In today's world of consumerism every person loves a great deal. One way to score significant savings for your purchases is through Tax Form For Federal Tax Rebate For Plug In Cars. They are a form of marketing that retailers and manufacturers use to provide customers with a partial reimbursement on their purchases following the time they've completed them. In this article, we will look into the world of Tax Form For Federal Tax Rebate For Plug In Cars. We'll discuss what they are and how they operate, and how you can maximise your savings through these efficient incentives.

Get Latest Tax Form For Federal Tax Rebate For Plug In Car Below

Tax Form For Federal Tax Rebate For Plug In Car

Tax Form For Federal Tax Rebate For Plug In Car -

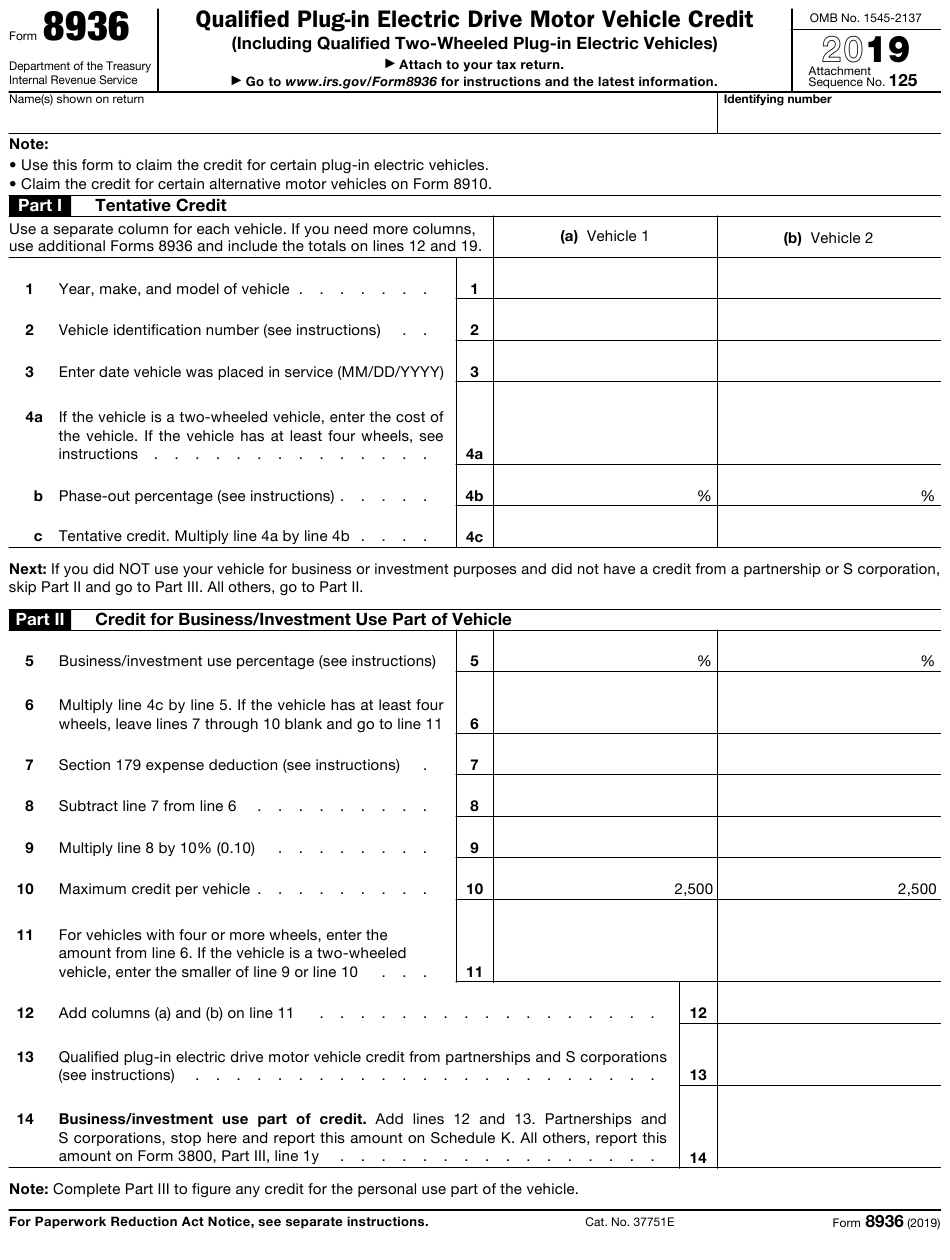

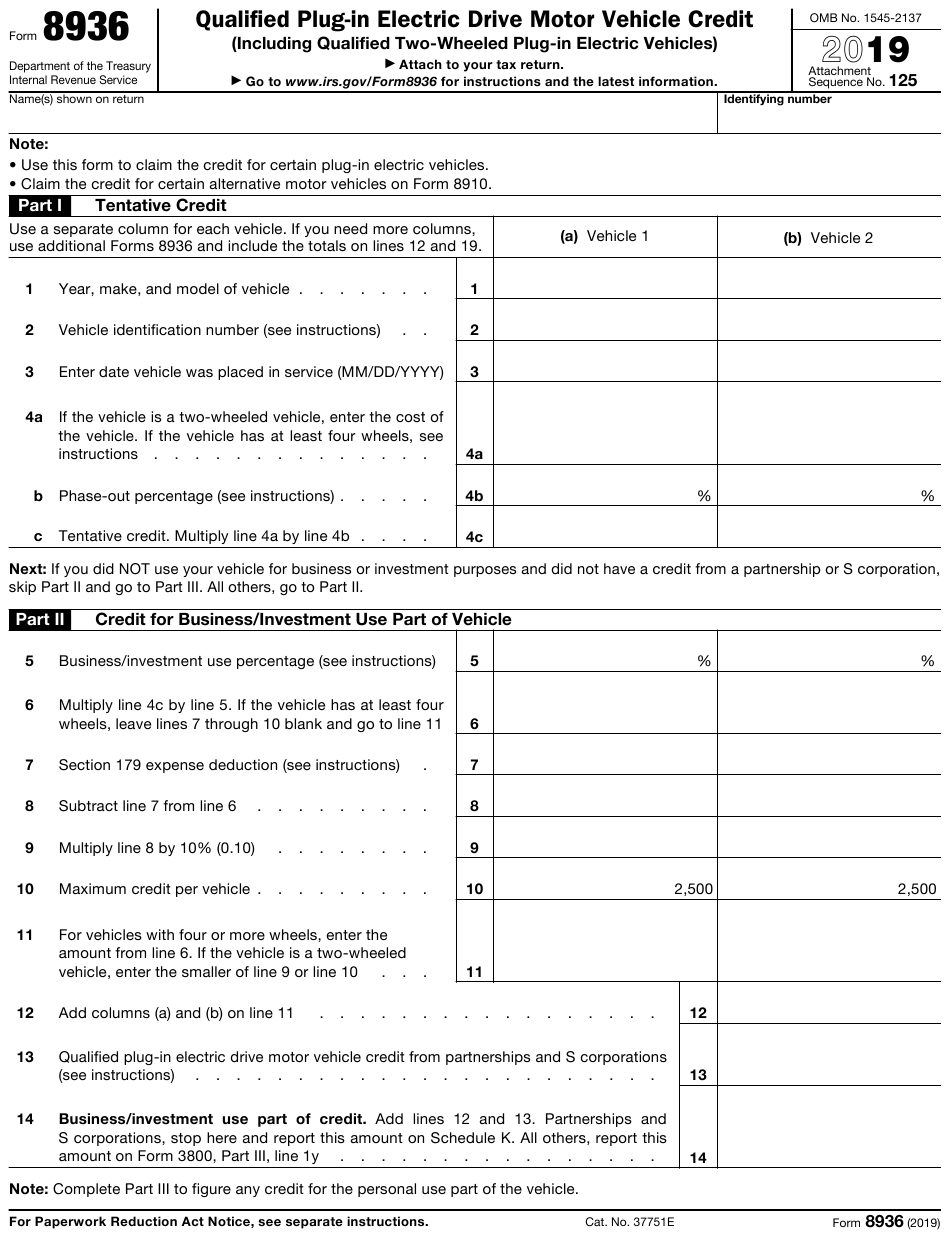

Web 25 f 233 vr 2023 nbsp 0183 32 Form 8936 is an IRS form for claiming the Qualified Plug in Electric Drive Motor Vehicle Credit on an individual s tax return Taxpayers may use Form 8936 provided the new plug in electric

Web 10 janv 2023 nbsp 0183 32 Use Form 8936 to figure your credit for qualified plug in electric drive motor vehicles you placed in service during your tax year Also use Form 8936 to figure your

A Tax Form For Federal Tax Rebate For Plug In Car as it is understood in its simplest definition, is a refund to a purchaser after they've bought a product or service. It's a very effective technique for businesses to entice customers, increase sales, or promote a specific product.

Types of Tax Form For Federal Tax Rebate For Plug In Car

Tax Form For Federal Tax Rebate For Plug in Car 2023 Carrebate

Tax Form For Federal Tax Rebate For Plug in Car 2023 Carrebate

Web Federal Tax Credits for Plug in Electric and Fuel Cell Electric Vehicles Purchased in 2023 or After Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell

Web 1 janv 2023 nbsp 0183 32 Federal Tax Credit Up To 4 000 Pre owned all electric plug in hybrid and fuel cell electric vehicles purchased on or after January 1 2023 may be eligible for a

Cash Tax Form For Federal Tax Rebate For Plug In Car

Cash Tax Form For Federal Tax Rebate For Plug In Car are the simplest type of Tax Form For Federal Tax Rebate For Plug In Car. Customers receive a certain amount of money when buying a product. These are often used for large-ticket items such as electronics and appliances.

Mail-In Tax Form For Federal Tax Rebate For Plug In Car

Mail-in Tax Form For Federal Tax Rebate For Plug In Car require the customer to provide an evidence of purchase for the refund. They're somewhat more involved but offer significant savings.

Instant Tax Form For Federal Tax Rebate For Plug In Car

Instant Tax Form For Federal Tax Rebate For Plug In Car are applied at place of purchase, reducing prices immediately. Customers don't need to wait long for savings by using this method.

How Tax Form For Federal Tax Rebate For Plug In Car Work

Claiming The 7 500 Electric Vehicle Tax Credit A Step by Step Guide

Claiming The 7 500 Electric Vehicle Tax Credit A Step by Step Guide

Web The amount equals 30 of purchased price with a maximum credit of 4 000 Other requirements apply New Plug in and Fuel Cell Electric Vehicles Purchased Before

The Tax Form For Federal Tax Rebate For Plug In Car Process

It usually consists of a couple of steps that are easy to follow:

-

Then, you purchase the product you purchase the product just like you normally would.

-

Complete your Tax Form For Federal Tax Rebate For Plug In Car forms: The Tax Form For Federal Tax Rebate For Plug In Car form will need to provide some data, such as your name, address and purchase information, to receive your Tax Form For Federal Tax Rebate For Plug In Car.

-

Make sure you submit the Tax Form For Federal Tax Rebate For Plug In Car It is dependent on the kind of Tax Form For Federal Tax Rebate For Plug In Car it is possible that you need to mail a Tax Form For Federal Tax Rebate For Plug In Car form in or send it via the internet.

-

Wait for approval: The company will go through your application and ensure that it's compliant with terms and conditions of the Tax Form For Federal Tax Rebate For Plug In Car.

-

You will receive your Tax Form For Federal Tax Rebate For Plug In Car Once it's approved, you'll receive the refund in the form of a check, prepaid card, or by another option that's specified in the offer.

Pros and Cons of Tax Form For Federal Tax Rebate For Plug In Car

Advantages

-

Cost Savings Rewards can drastically reduce the cost for an item.

-

Promotional Offers Incentivize customers in trying new products or brands.

-

Help to Increase Sales Tax Form For Federal Tax Rebate For Plug In Car are a great way to boost the company's sales as well as market share.

Disadvantages

-

Complexity The mail-in Tax Form For Federal Tax Rebate For Plug In Car in particular are often time-consuming and lengthy.

-

Expiration Dates A majority of Tax Form For Federal Tax Rebate For Plug In Car have specific deadlines for submission.

-

A risk of not being paid: Some customers may lose their Tax Form For Federal Tax Rebate For Plug In Car in the event that they don't comply with the rules precisely.

Download Tax Form For Federal Tax Rebate For Plug In Car

Download Tax Form For Federal Tax Rebate For Plug In Car

FAQs

1. Are Tax Form For Federal Tax Rebate For Plug In Car the same as discounts? Not necessarily, as Tax Form For Federal Tax Rebate For Plug In Car are a partial refund upon purchase, whereas discounts reduce the cost of purchase at point of sale.

2. Are there Tax Form For Federal Tax Rebate For Plug In Car that can be used on the same product It's dependent on the terms for the Tax Form For Federal Tax Rebate For Plug In Car offer and also the item's ability to qualify. Some companies may allow this, whereas others will not.

3. How long does it take to get the Tax Form For Federal Tax Rebate For Plug In Car? The length of time differs, but could last from a few weeks until a few months to receive your Tax Form For Federal Tax Rebate For Plug In Car.

4. Do I have to pay taxes upon Tax Form For Federal Tax Rebate For Plug In Car quantities? most cases, Tax Form For Federal Tax Rebate For Plug In Car amounts are not considered taxable income.

5. Should I be able to trust Tax Form For Federal Tax Rebate For Plug In Car deals from lesser-known brands Consider doing some research and ensure that the business offering the Tax Form For Federal Tax Rebate For Plug In Car is reputable prior to making the purchase.

Electric Car Tax Rebate California ElectricCarTalk

Ptr Tax Rebate Libracha

Check more sample of Tax Form For Federal Tax Rebate For Plug In Car below

T1159 Fill Out Sign Online DocHub

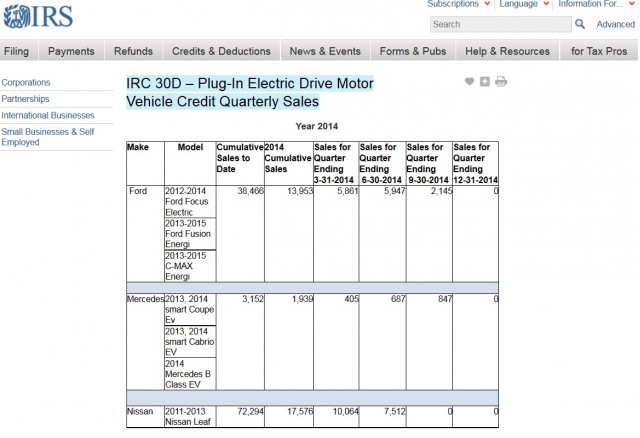

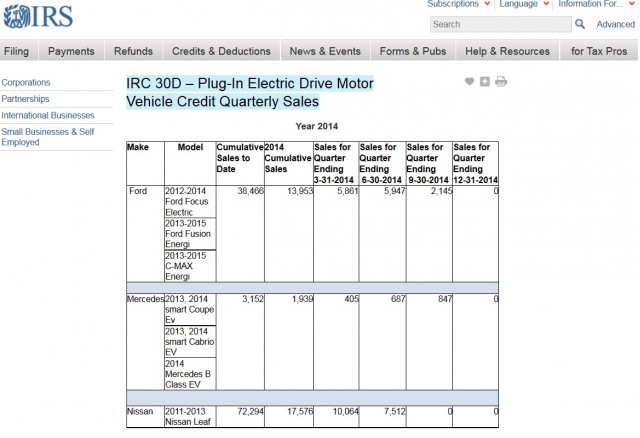

IRS Electric Car Tax Credits Reporting Discrepancies Remain

Delaware Electric Car Tax Rebate Printable Rebate Form

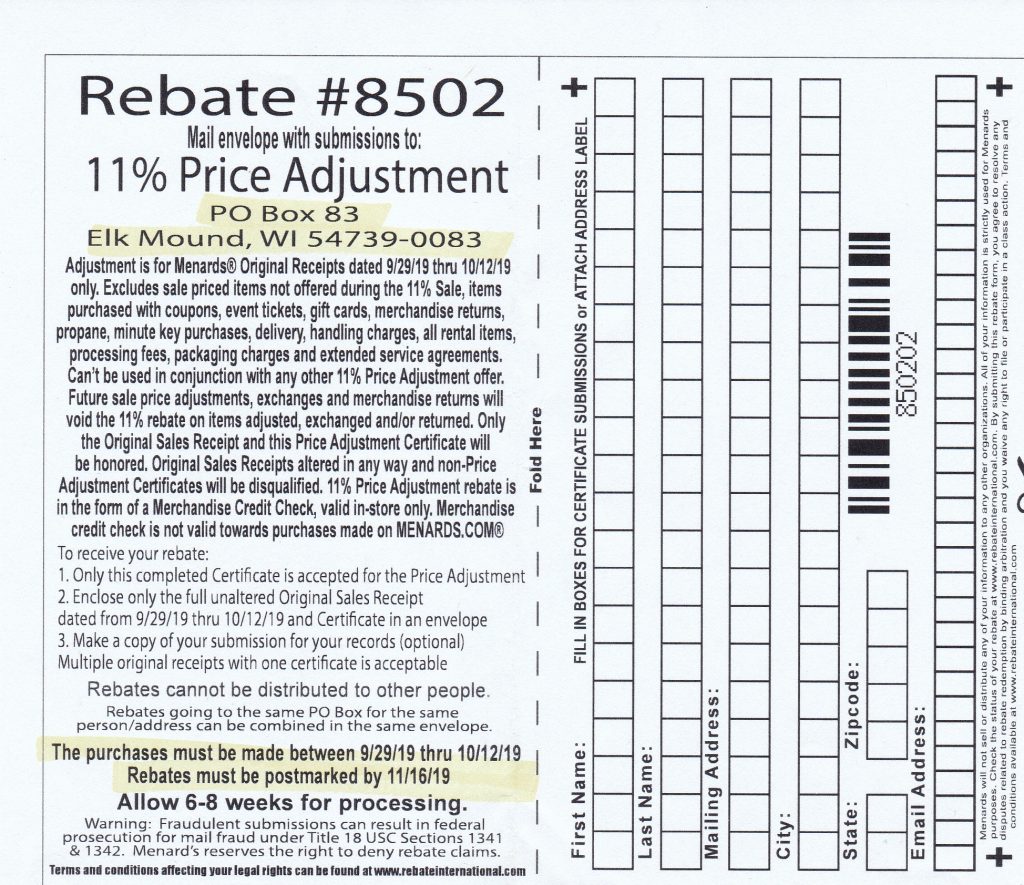

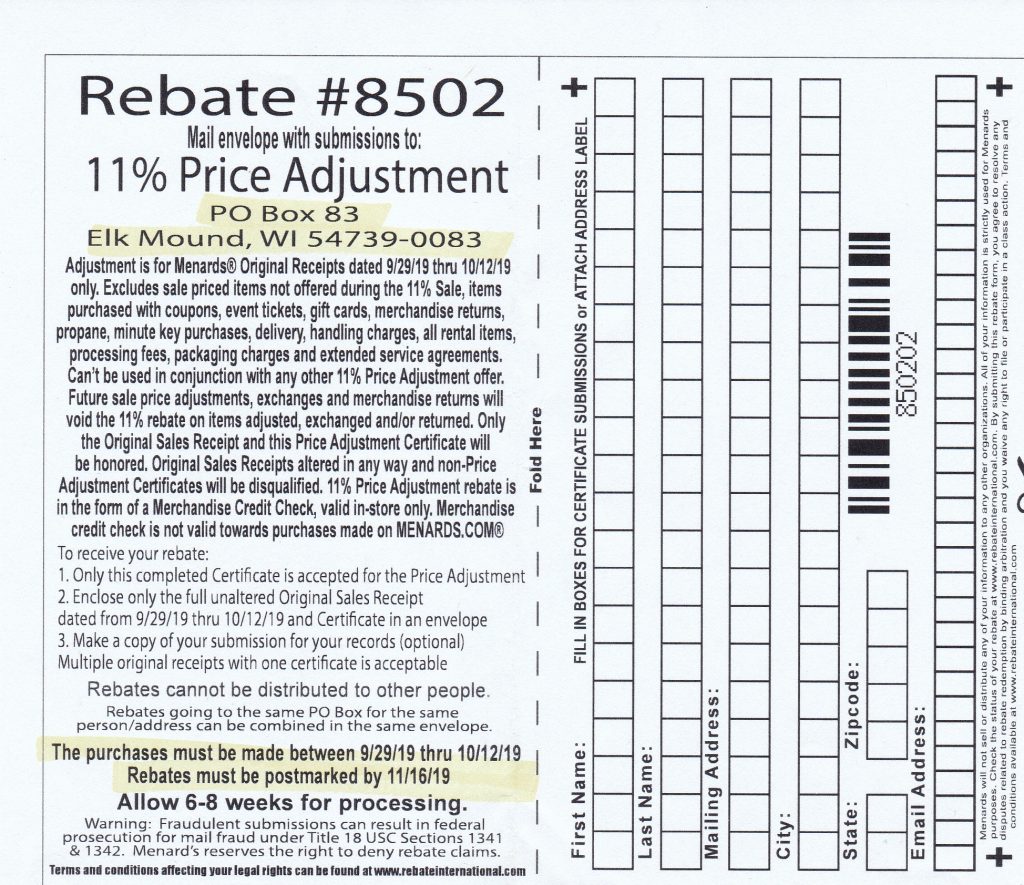

Menards 11 Price Adjustment Rebate 8502 Purchases 9 29 19 10 12 19

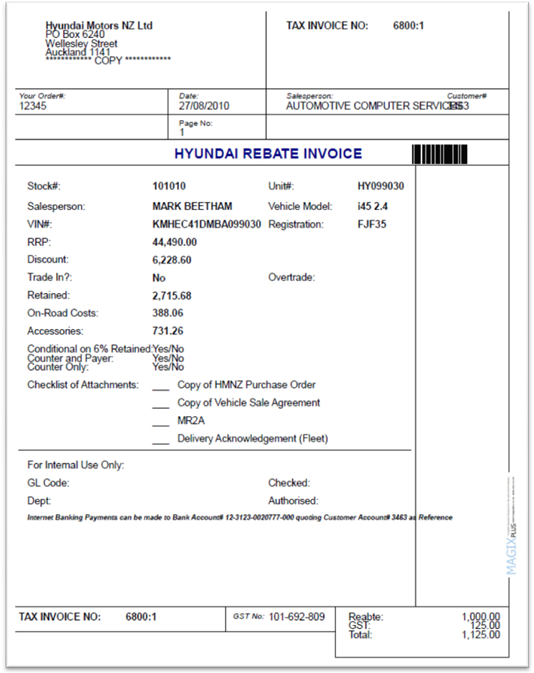

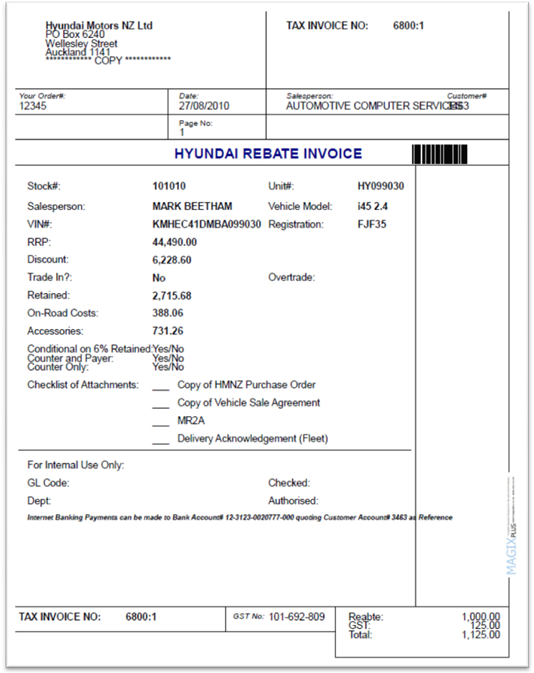

Hyundai Rebate Invoices

Ev Car Tax Rebate Calculator 2022 Carrebate

https://www.irs.gov/forms-pubs/about-form-8936

Web 10 janv 2023 nbsp 0183 32 Use Form 8936 to figure your credit for qualified plug in electric drive motor vehicles you placed in service during your tax year Also use Form 8936 to figure your

https://turbotax.intuit.com/tax-tips/going-green/filing-tax-for…

Web 26 juin 2023 nbsp 0183 32 If you purchased a qualifying vehicle and are looking to claim the Qualified Plug In Electric Motor Vehicle Credit or Clean Vehicle Credit you ll use Form 8936 with your tax return TABLE OF CONTENTS What

Web 10 janv 2023 nbsp 0183 32 Use Form 8936 to figure your credit for qualified plug in electric drive motor vehicles you placed in service during your tax year Also use Form 8936 to figure your

Web 26 juin 2023 nbsp 0183 32 If you purchased a qualifying vehicle and are looking to claim the Qualified Plug In Electric Motor Vehicle Credit or Clean Vehicle Credit you ll use Form 8936 with your tax return TABLE OF CONTENTS What

Menards 11 Price Adjustment Rebate 8502 Purchases 9 29 19 10 12 19

IRS Electric Car Tax Credits Reporting Discrepancies Remain

Hyundai Rebate Invoices

Ev Car Tax Rebate Calculator 2022 Carrebate

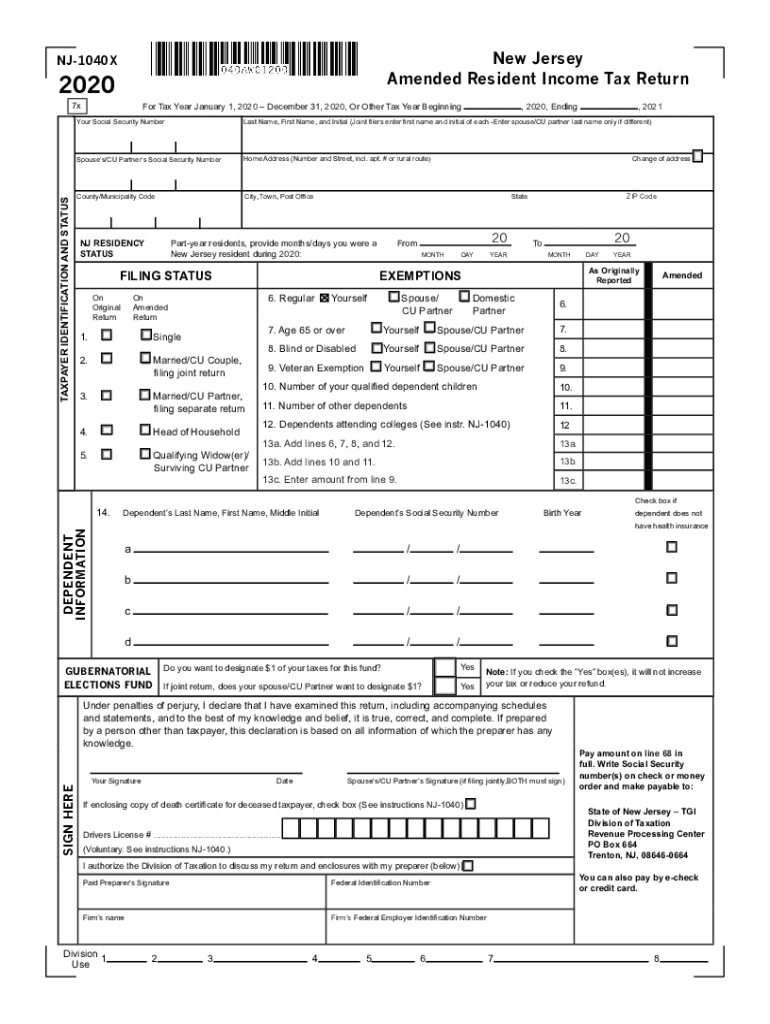

2020 Form NJ DoT NJ 1040x Fill Online Printable Fillable Blank

Federal Tax Rebate For Electric Cars 2022 2023 Carrebate

Federal Tax Rebate For Electric Cars 2022 2023 Carrebate

Illinois Unemployment 941x Fill Out Sign Online DocHub