In our modern, consumer-driven society every person loves a great bargain. One option to obtain significant savings on your purchases can be achieved through Stimulus Tax Rebate Forms. Stimulus Tax Rebate Forms are a strategy for marketing used by manufacturers and retailers to provide customers with a partial return on their purchases once they have bought them. In this article, we'll investigate the world of Stimulus Tax Rebate Forms. We'll explore the nature of them what they are, how they function, and how you can maximize your savings using these low-cost incentives.

Get Latest Stimulus Tax Rebate Form Below

Stimulus Tax Rebate Form

Stimulus Tax Rebate Form -

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 15 mars 2023 nbsp 0183 32 Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the total amount of their third Economic

A Stimulus Tax Rebate Form at its most basic format, is a refund offered to a customer who has purchased a particular product or service. It's a powerful instrument that businesses use to draw buyers, increase sales and also to advertise certain products.

Types of Stimulus Tax Rebate Form

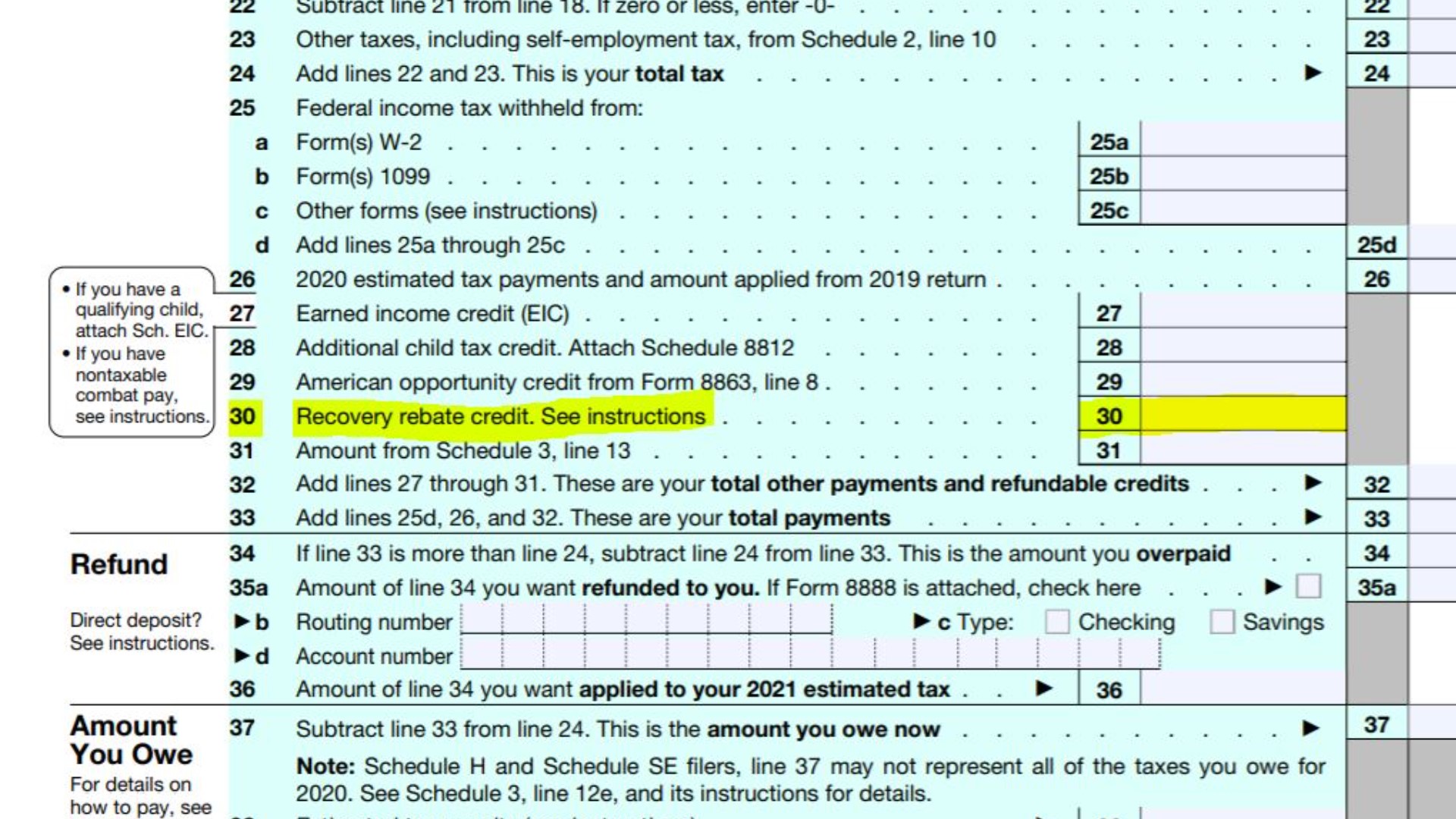

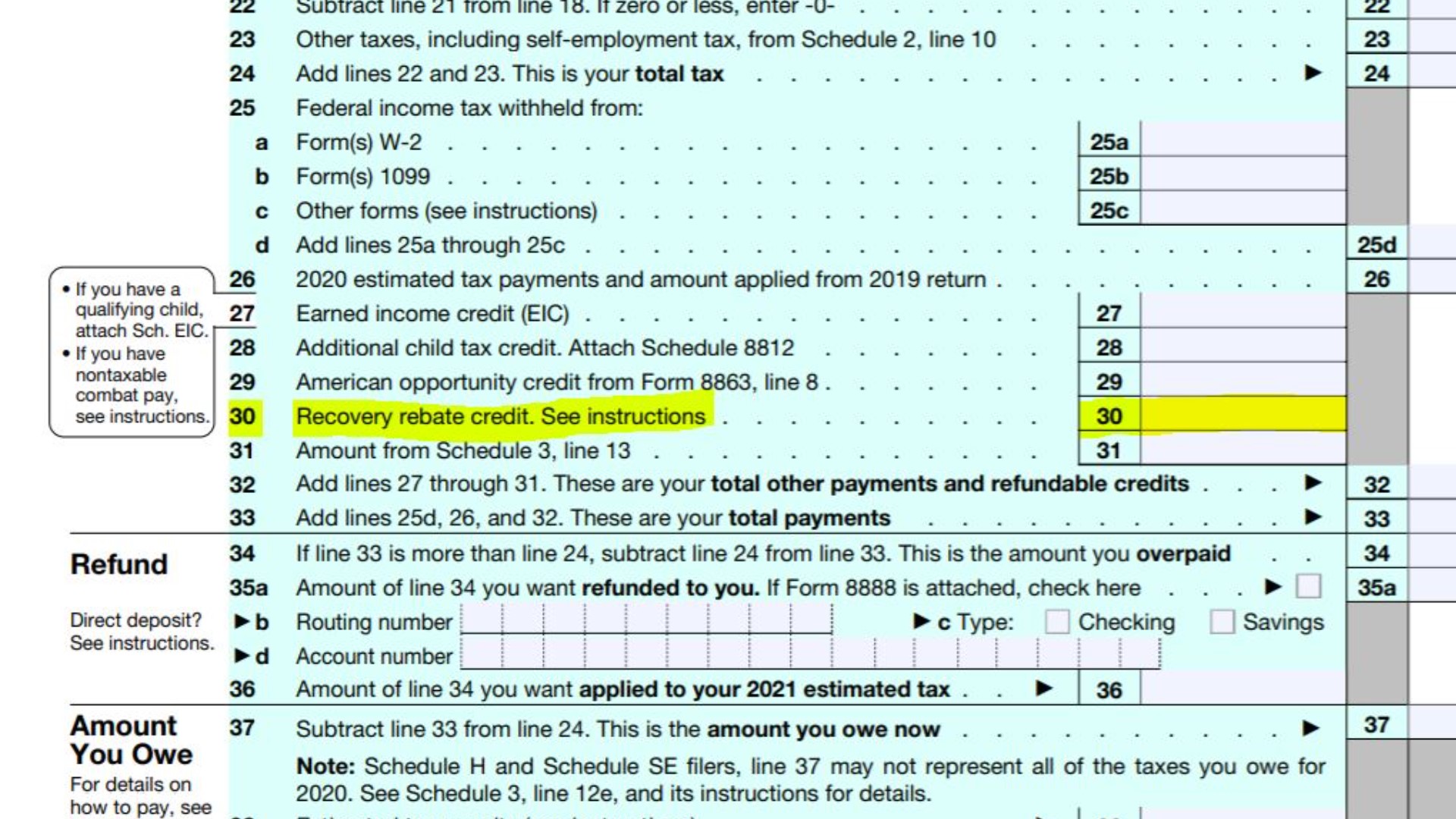

10 Recovery Rebate Credit Worksheet

10 Recovery Rebate Credit Worksheet

Web 13 avr 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible for the credit Your 2021

Web 10 d 233 c 2021 nbsp 0183 32 To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form

Cash Stimulus Tax Rebate Form

Cash Stimulus Tax Rebate Form are a simple kind of Stimulus Tax Rebate Form. Customers are given a certain amount of cash back after buying a product. These are typically for big-ticket items, like electronics and appliances.

Mail-In Stimulus Tax Rebate Form

Mail-in Stimulus Tax Rebate Form require consumers to submit an evidence of purchase for their refund. They're somewhat more involved, but offer substantial savings.

Instant Stimulus Tax Rebate Form

Instant Stimulus Tax Rebate Form are made at the point of sale and reduce the purchase cost immediately. Customers don't need to wait long for savings when they purchase this type of Stimulus Tax Rebate Form.

How Stimulus Tax Rebate Form Work

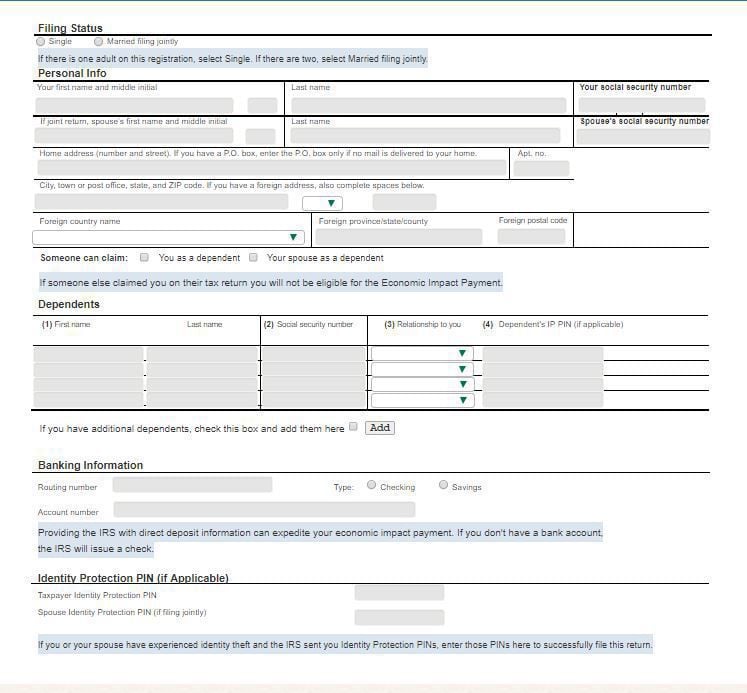

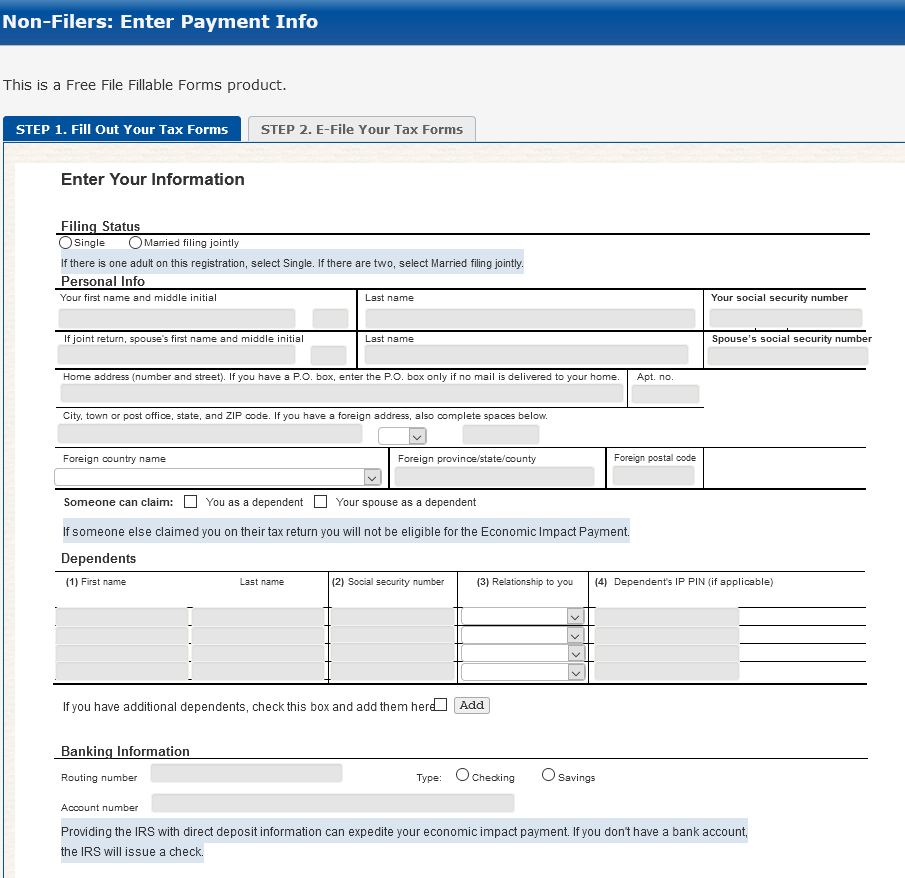

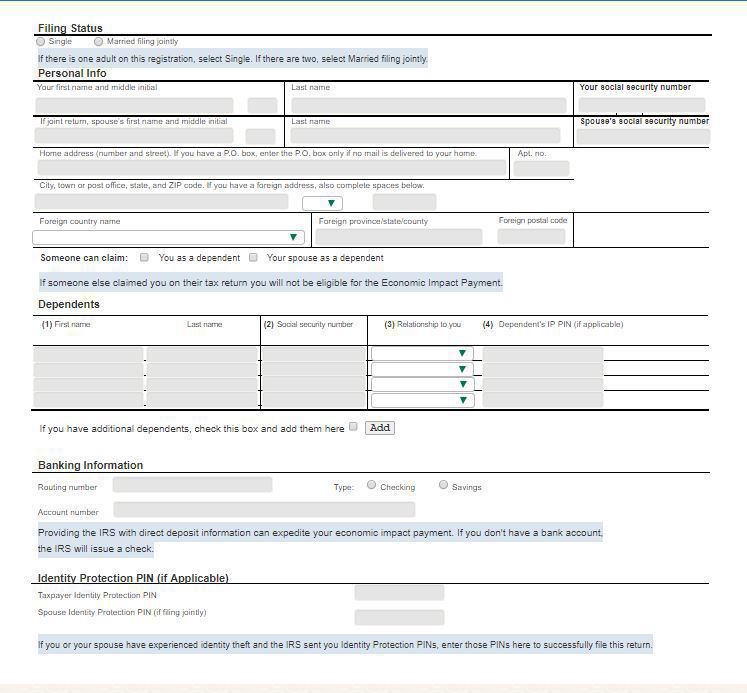

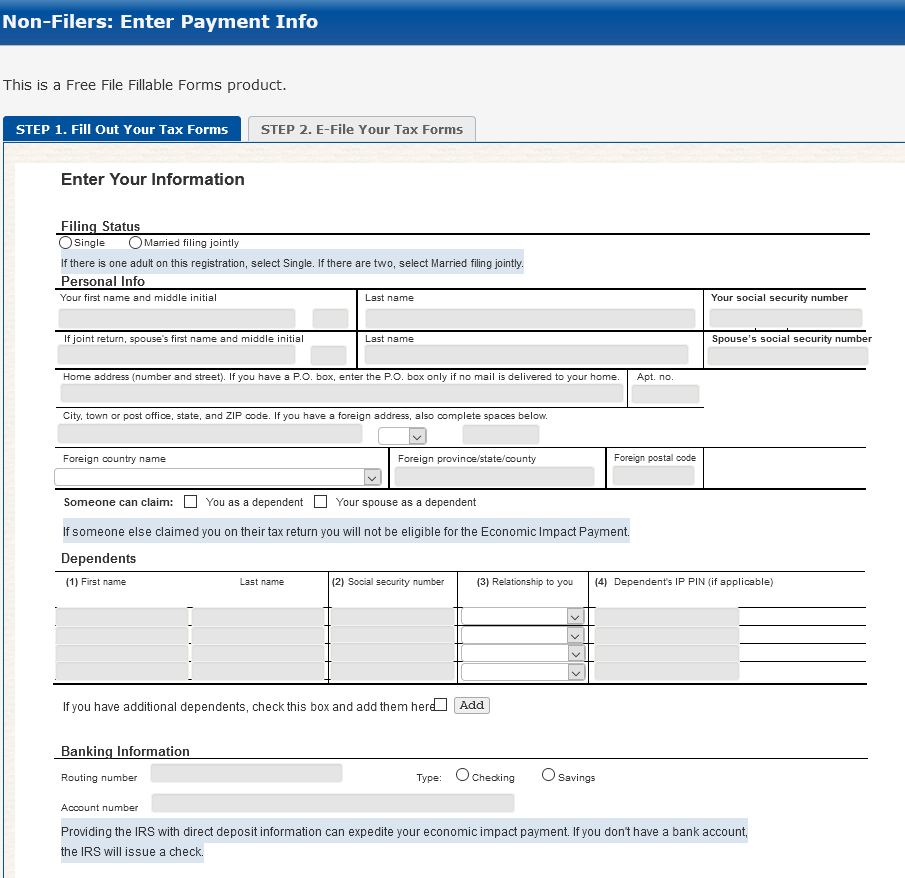

Stimulus Check Fillable Form Printable Forms Free Online

Stimulus Check Fillable Form Printable Forms Free Online

Web 1 f 233 vr 2022 nbsp 0183 32 The maximum Recovery Rebate Credit on 2021 returns amounts to 1 400 per person including all qualifying dependents claimed on a tax return A married couple with no dependents for example

The Stimulus Tax Rebate Form Process

It usually consists of a few steps:

-

Purchase the product: Then purchase the product the way you normally do.

-

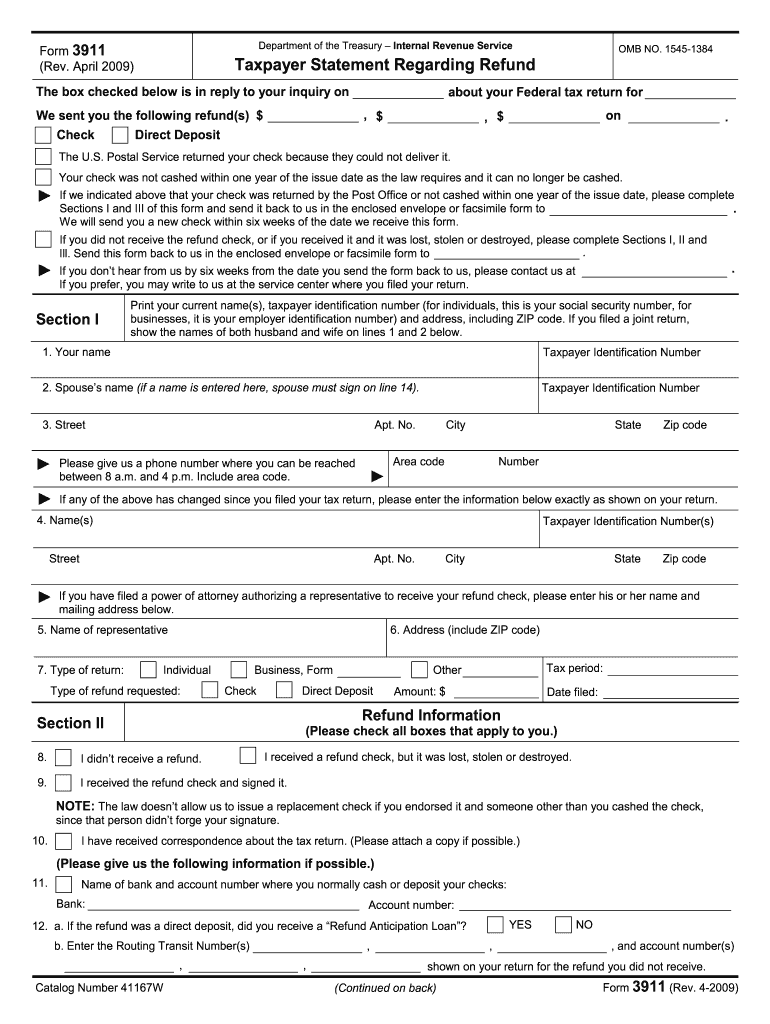

Fill in the Stimulus Tax Rebate Form questionnaire: you'll need provide certain information like your name, address and information about the purchase in order to make a claim for your Stimulus Tax Rebate Form.

-

To submit the Stimulus Tax Rebate Form If you want to submit the Stimulus Tax Rebate Form, based on the type of Stimulus Tax Rebate Form you will need to mail in a form or upload it online.

-

Wait for approval: The business will go through your application to make sure it is in line with the requirements of the Stimulus Tax Rebate Form.

-

Get your Stimulus Tax Rebate Form When it's approved you'll get your refund, via check, prepaid card, or another procedure specified by the deal.

Pros and Cons of Stimulus Tax Rebate Form

Advantages

-

Cost savings A Stimulus Tax Rebate Form can significantly lower the cost you pay for an item.

-

Promotional Offers The aim is to encourage customers to try new items or brands.

-

Boost Sales Stimulus Tax Rebate Form can increase companies' sales and market share.

Disadvantages

-

Complexity Stimulus Tax Rebate Form that are mail-in, in particular the case of HTML0, can be a hassle and long-winded.

-

Days of expiration A lot of Stimulus Tax Rebate Form have deadlines for submission.

-

Risk of Non-Payment Certain customers could have their Stimulus Tax Rebate Form delayed if they don't observe the rules exactly.

Download Stimulus Tax Rebate Form

Download Stimulus Tax Rebate Form

FAQs

1. Are Stimulus Tax Rebate Form equivalent to discounts? Not at all, Stimulus Tax Rebate Form provide some form of refund following the purchase, whereas discounts decrease their price at moment of sale.

2. Can I use multiple Stimulus Tax Rebate Form on the same item? It depends on the conditions of Stimulus Tax Rebate Form deals and product's eligibility. Certain businesses may allow it, while some won't.

3. How long will it take to receive an Stimulus Tax Rebate Form? The length of time varies, but it can take a couple of weeks or a several months to receive a Stimulus Tax Rebate Form.

4. Do I have to pay tax with respect to Stimulus Tax Rebate Form sums? the majority of situations, Stimulus Tax Rebate Form amounts are not considered to be taxable income.

5. Can I trust Stimulus Tax Rebate Form offers from lesser-known brands It is essential to investigate to ensure that the name that is offering the Stimulus Tax Rebate Form is legitimate prior to making an investment.

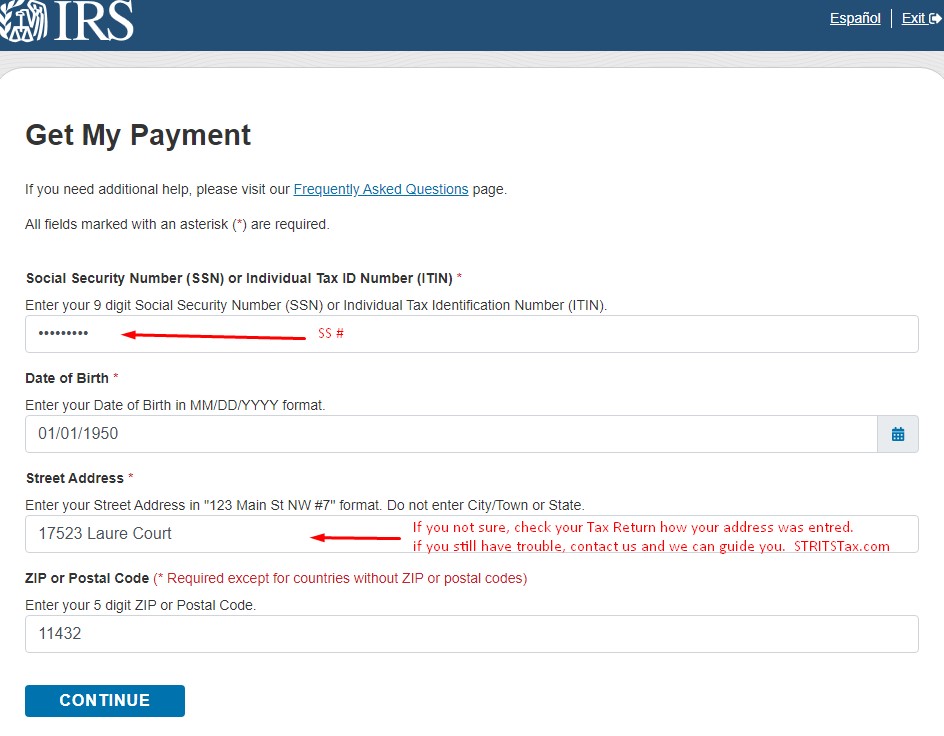

How Do I Claim The 600 Stimulus Payment For My Child That Was Born In 2020

Ouc Rebates Pdf Fill Online Printable Fillable Blank PdfFiller

Check more sample of Stimulus Tax Rebate Form below

For H1840 Fill Out And Sign Printable PDF Template SignNow

Legal Structure Free Fillable Forms Stimulus Check

Legal Structure Free Fillable Forms Stimulus Check

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

Irs Non Filers Printable Stimulus Form

https://www.irs.gov/coronavirus/economic-im…

Web 15 mars 2023 nbsp 0183 32 Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the total amount of their third Economic

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 15 mars 2023 nbsp 0183 32 Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the total amount of their third Economic

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

Legal Structure Free Fillable Forms Stimulus Check

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

Irs Non Filers Printable Stimulus Form

Recovery Rebate Credit stimulus Checks On Draft 1040

Didn t Get Your Stimulus Check Claim It As An Income Tax Credit

Didn t Get Your Stimulus Check Claim It As An Income Tax Credit

Stimulus Check Finder Income Tax Preparation Services STRITSTax