In our modern, consumer-driven society we all love a good bargain. One of the ways to enjoy substantial savings on your purchases is through Solar Tax Rebate Forms. The use of Solar Tax Rebate Forms is a method that retailers and manufacturers use in order to offer customers a small refund on purchases made after they have done so. In this post, we'll investigate the world of Solar Tax Rebate Forms. We will explore what they are their purpose, how they function and how you can maximize the value of these incentives.

Get Latest Solar Tax Rebate Form Below

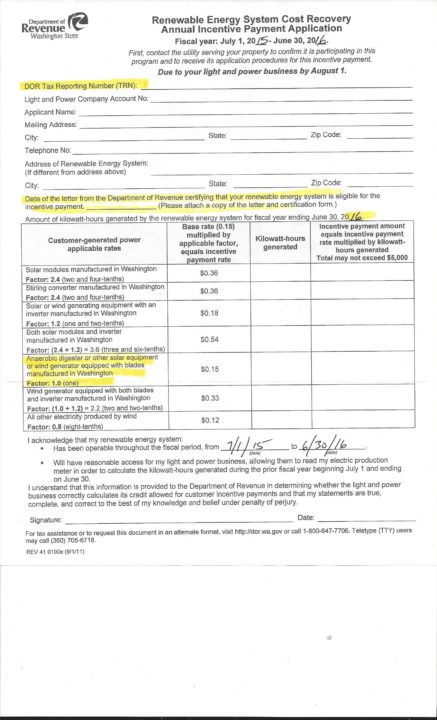

Solar Tax Rebate Form

Solar Tax Rebate Form -

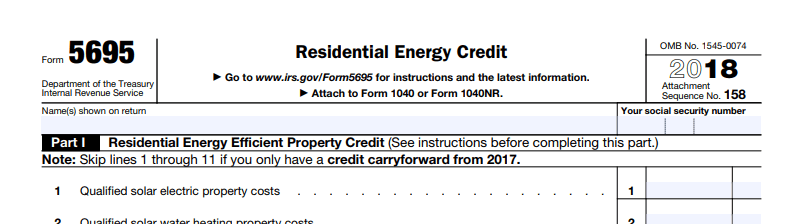

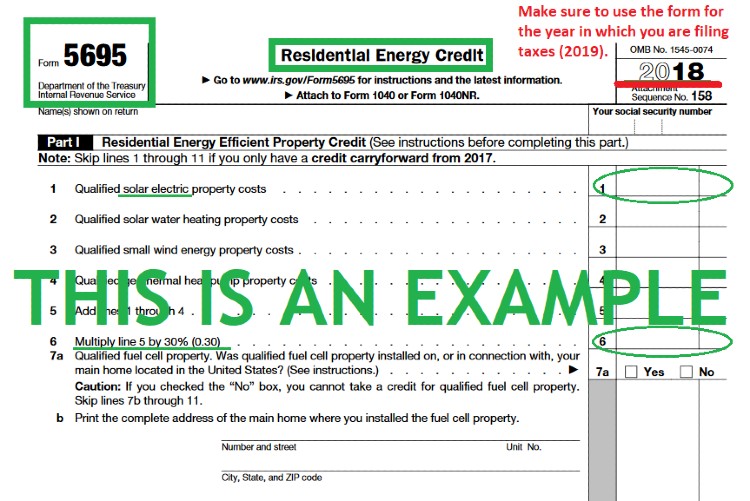

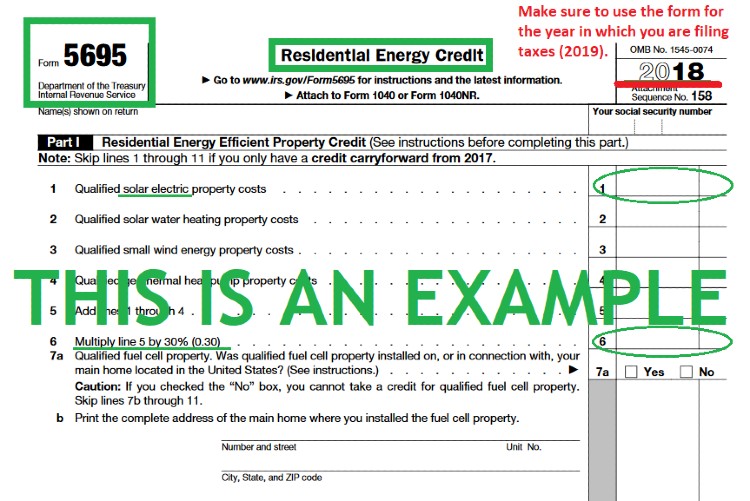

Web 8 oct 2021 nbsp 0183 32 The IRS has not yet released their revised Form 5695 so our example below uses 2021 s version and 26 tax credit amount One of the biggest immediate benefits of installing a solar electric system is that it

Web 5 avr 2023 nbsp 0183 32 Step by step instructions for using IRS Form 5695 to claim the federal solar tax credit For installations completed until 2023 the tax

A Solar Tax Rebate Form, in its simplest form, is a return to the customer after having purchased a item or service. It's a highly effective tool that companies use to attract customers, increase sales, or promote a specific product.

Types of Solar Tax Rebate Form

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

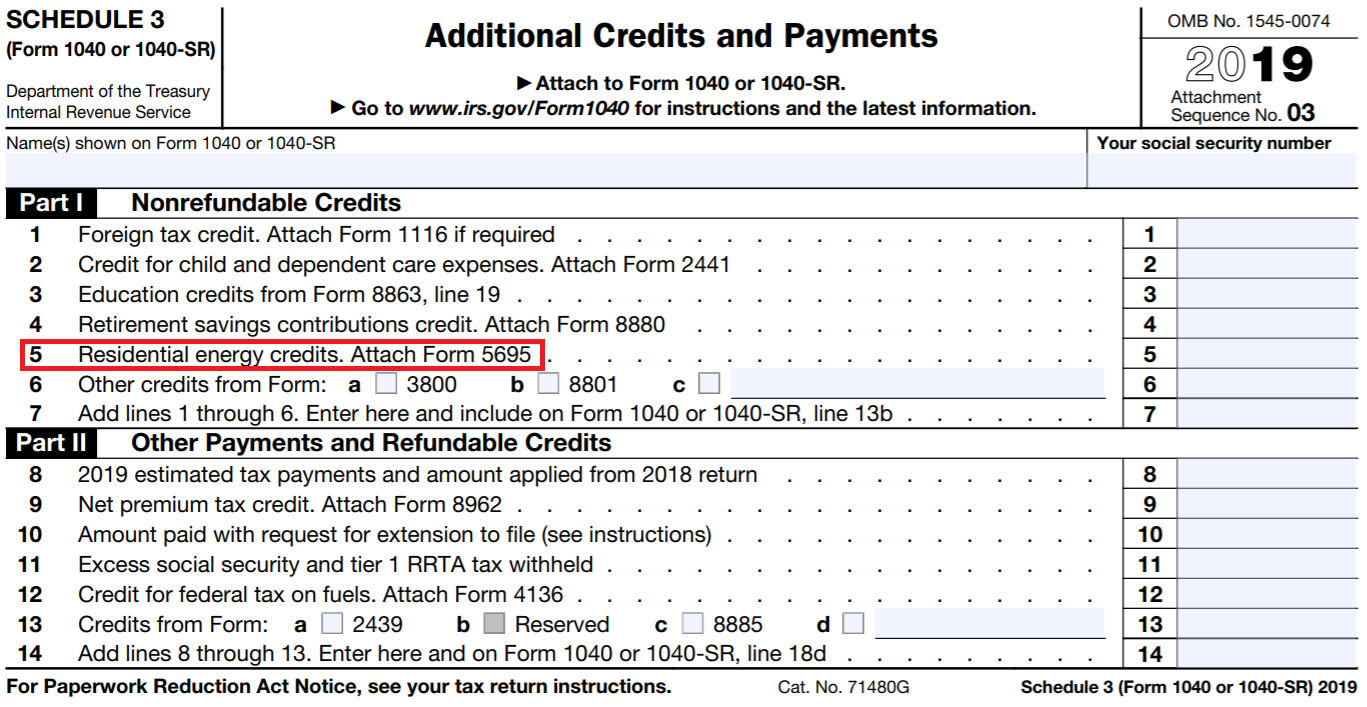

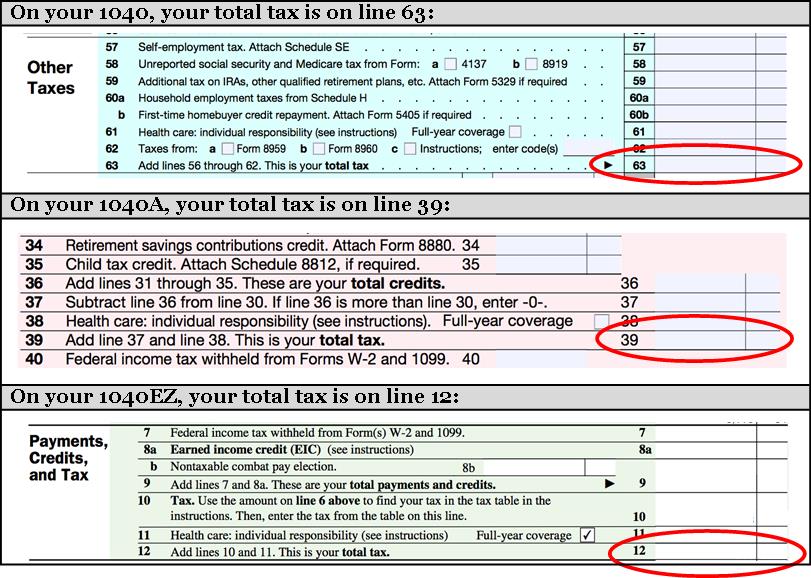

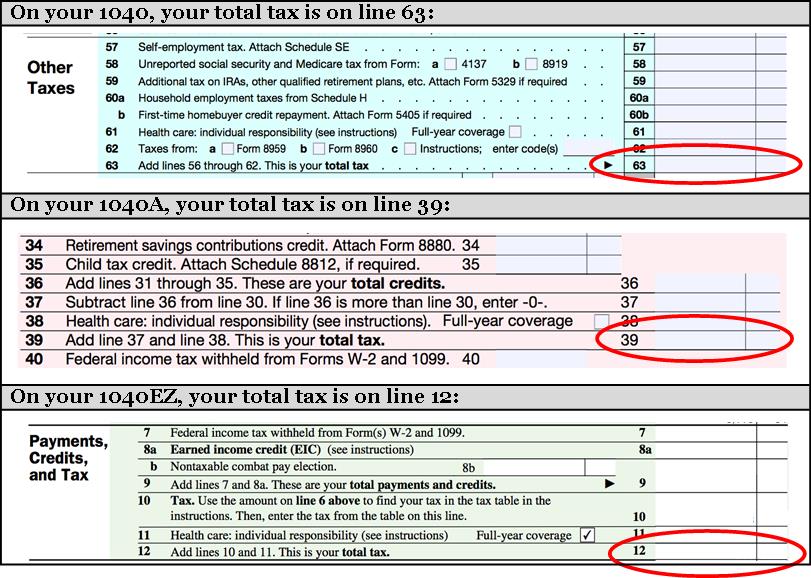

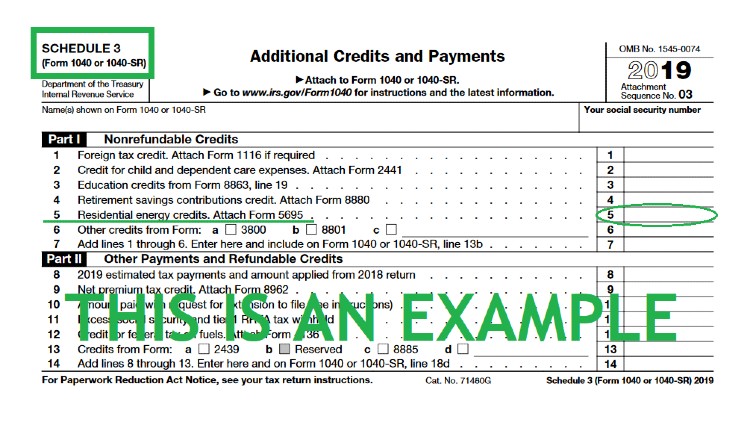

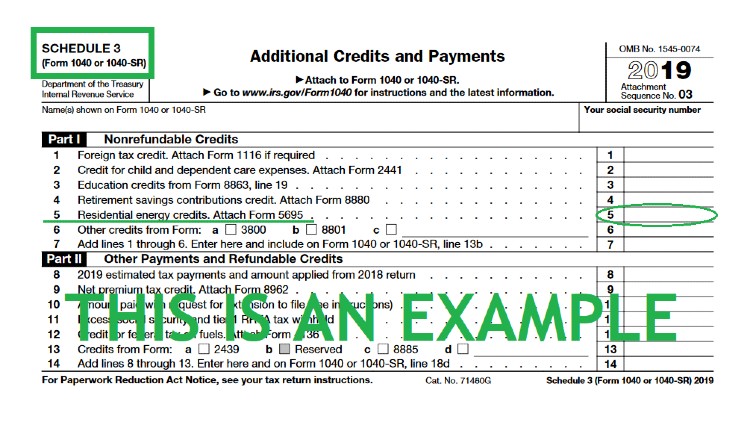

Web 26 avr 2023 nbsp 0183 32 You will need four IRS tax forms to file for your solar tax credit Form 1040 Schedule 3 Form 1040 Form 5695 Instructions for Form 5695 latest version You ll also need Receipts from your solar

Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of

Cash Solar Tax Rebate Form

Cash Solar Tax Rebate Form is the most basic kind of Solar Tax Rebate Form. Customers get a set amount of money when purchasing a particular item. These are usually used for big-ticket items, like electronics and appliances.

Mail-In Solar Tax Rebate Form

Mail-in Solar Tax Rebate Form demand that customers send in evidence of purchase to get the refund. They're a little more complicated but could provide substantial savings.

Instant Solar Tax Rebate Form

Instant Solar Tax Rebate Form can be applied at the point of sale. They reduce the purchase cost immediately. Customers do not have to wait for savings by using this method.

How Solar Tax Rebate Form Work

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

Web 8 sept 2022 nbsp 0183 32 Federal Solar Tax Credit Resources The U S Department of Energy DOE Solar Energy Technologies Office SETO developed three resources to help Americans navigate changes to the federal solar

The Solar Tax Rebate Form Process

The process typically comprises a few simple steps:

-

Purchase the product: First you purchase the item like you would normally.

-

Fill in this Solar Tax Rebate Form application: In order to claim your Solar Tax Rebate Form, you'll need to supply some details, such as your address, name, as well as the details of your purchase in order to receive your Solar Tax Rebate Form.

-

Submit the Solar Tax Rebate Form The Solar Tax Rebate Form must be submitted in accordance with the kind of Solar Tax Rebate Form you may have to mail a Solar Tax Rebate Form form in or make it available online.

-

Wait for approval: The business is going to review your entry to confirm that it complies with the reimbursement's terms and condition.

-

Enjoy your Solar Tax Rebate Form Once you've received your approval, the amount you receive will be either by check, prepaid card or through a different option that's specified in the offer.

Pros and Cons of Solar Tax Rebate Form

Advantages

-

Cost savings Solar Tax Rebate Form are a great way to reduce the cost for the item.

-

Promotional Offers Incentivize customers to explore new products or brands.

-

Enhance Sales Solar Tax Rebate Form can increase a company's sales and market share.

Disadvantages

-

Complexity In particular, mail-in Solar Tax Rebate Form in particular the case of HTML0, can be a hassle and lengthy.

-

Day of Expiration Many Solar Tax Rebate Form are subject to very strict deadlines for filing.

-

Risk of not receiving payment Some customers might not be able to receive their Solar Tax Rebate Form if they don't adhere to the requirements precisely.

Download Solar Tax Rebate Form

Download Solar Tax Rebate Form

FAQs

1. Are Solar Tax Rebate Form equivalent to discounts? No, Solar Tax Rebate Form offer an amount of money that is refunded after the purchase, while discounts lower your purchase cost at moment of sale.

2. Can I get multiple Solar Tax Rebate Form for the same product The answer is dependent on the conditions in the Solar Tax Rebate Form offers and the product's suitability. Certain companies might permit it, but some will not.

3. How long does it take to receive the Solar Tax Rebate Form What is the timeframe? is different, but it could range from several weeks to few months to receive your Solar Tax Rebate Form.

4. Do I have to pay tax on Solar Tax Rebate Form values? most situations, Solar Tax Rebate Form amounts are not considered to be taxable income.

5. Should I be able to trust Solar Tax Rebate Form offers from lesser-known brands Consider doing some research and confirm that the company offering the Solar Tax Rebate Form is legitimate prior to making an purchase.

How To Claim The Solar Investment Tax Credit YSG Solar YSG Solar

New York Solar Tax Credit Explained EnergySage

Check more sample of Solar Tax Rebate Form below

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

The Declining Federal Solar Tax Credit And Top Things To Know For 2019

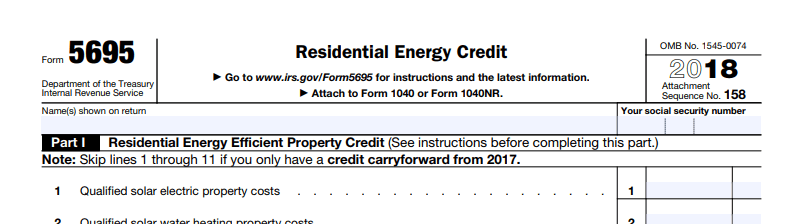

How To Claim The Solar Tax Credit Using IRS Form 5695

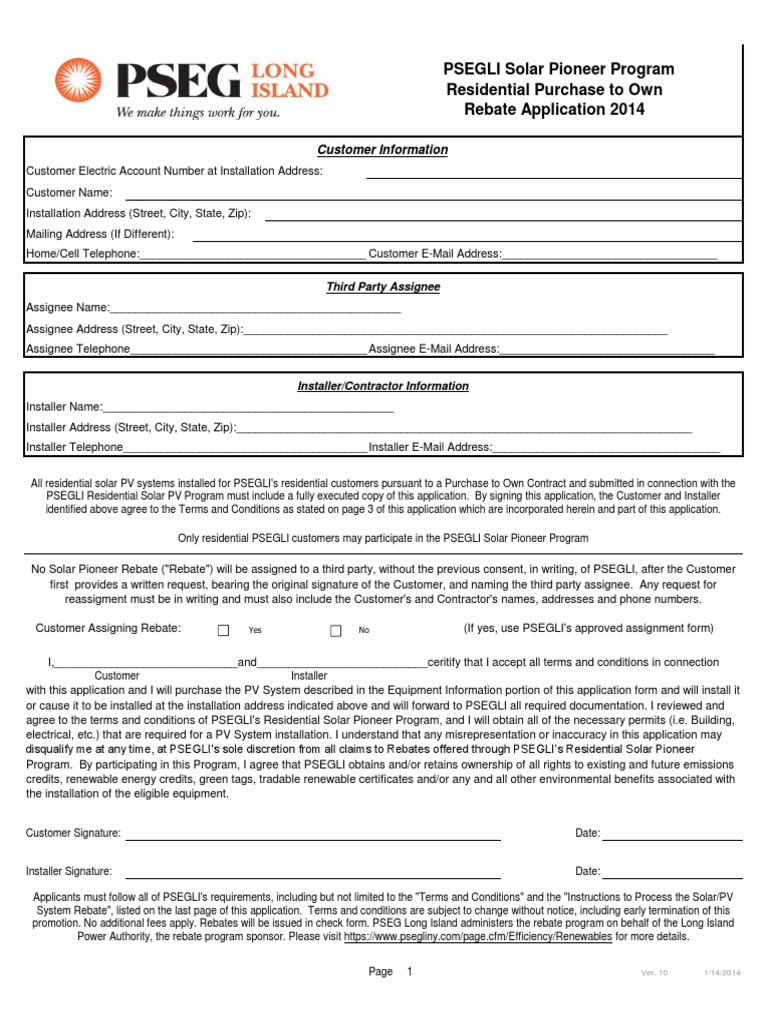

PSEG Long Island PSEGLI Solar Pioneer Program Residential

Filing For The Solar Tax Credit Wells Solar

Can You Use The 30 Federal Tax Credit For Solar The Energy Miser

https://www.solarreviews.com/blog/guide-to-cl…

Web 5 avr 2023 nbsp 0183 32 Step by step instructions for using IRS Form 5695 to claim the federal solar tax credit For installations completed until 2023 the tax

https://news.energysage.com/how-do-i-claim-the-solar-tax-credit

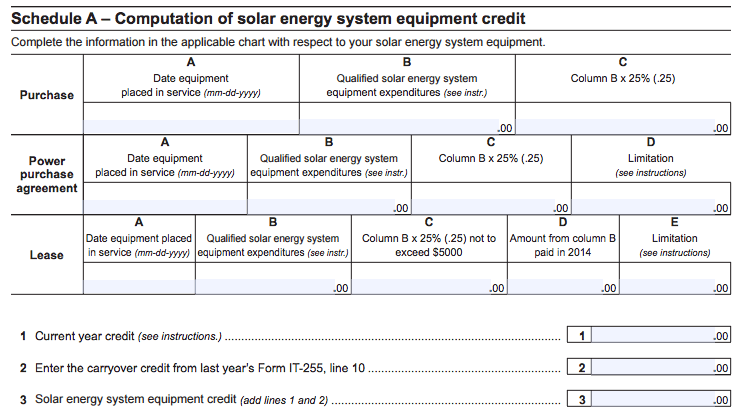

Web 22 sept 2022 nbsp 0183 32 Form 5695 calculates tax credits for a variety of qualified residential energy improvements including geothermal heat pumps solar panels solar water heating

Web 5 avr 2023 nbsp 0183 32 Step by step instructions for using IRS Form 5695 to claim the federal solar tax credit For installations completed until 2023 the tax

Web 22 sept 2022 nbsp 0183 32 Form 5695 calculates tax credits for a variety of qualified residential energy improvements including geothermal heat pumps solar panels solar water heating

PSEG Long Island PSEGLI Solar Pioneer Program Residential

The Declining Federal Solar Tax Credit And Top Things To Know For 2019

Filing For The Solar Tax Credit Wells Solar

Can You Use The 30 Federal Tax Credit For Solar The Energy Miser

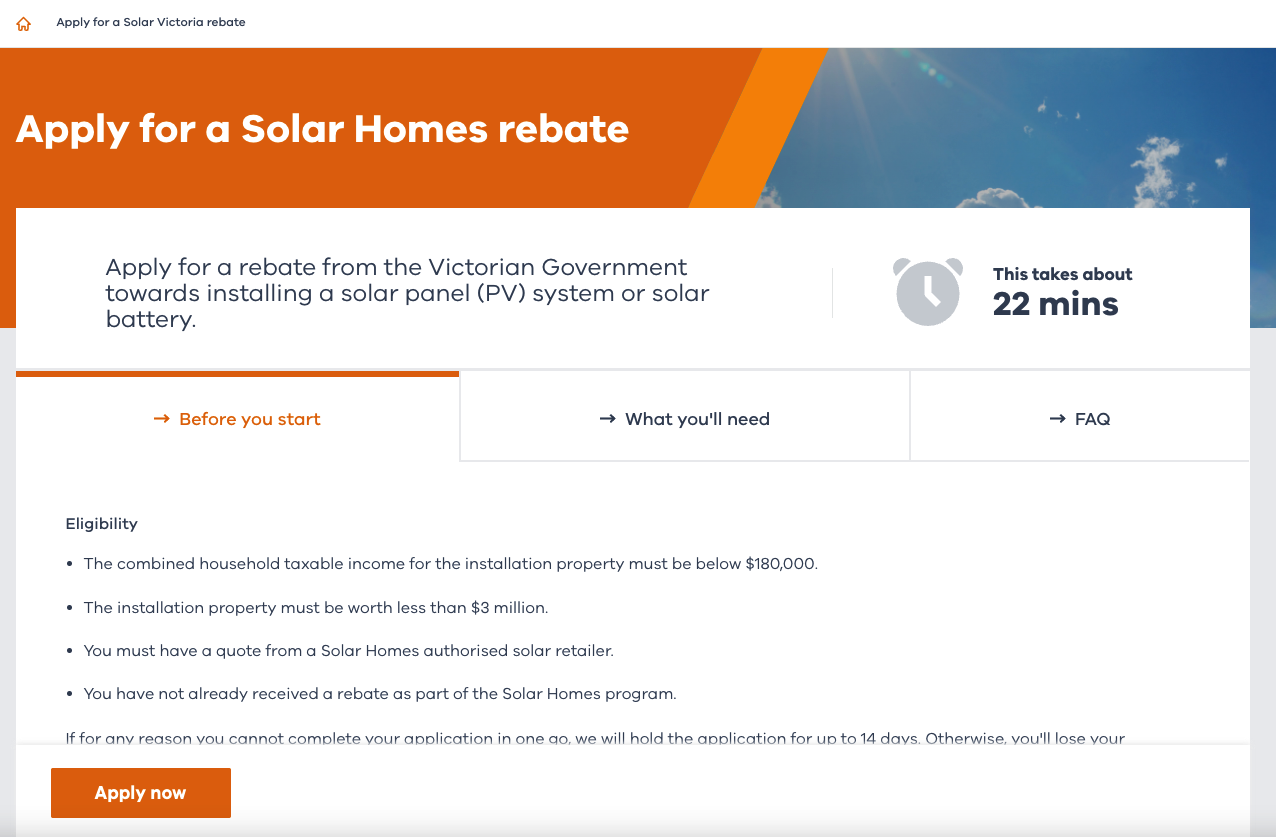

Solar Rebate Victoria 2022 Printable Rebate Form

Filing For The Solar Tax Credit Wells Solar

Filing For The Solar Tax Credit Wells Solar

For All Solar Homeowners Remember The June 30th Production Meter