In this modern-day world of consumers everyone appreciates a great bargain. One method to get significant savings for your purchases is through Solar Tax Incentivess. Solar Tax Incentivess are an effective marketing tactic used by manufacturers and retailers to give customers a part refund on purchases made after they have placed them. In this post, we'll dive into the world Solar Tax Incentivess, examining the nature of them what they are, how they function, as well as ways to maximize your savings through these efficient incentives.

Get Latest Solar Tax Incentives Below

Solar Tax Incentives

Solar Tax Incentives -

Web 23 Okt 2023 nbsp 0183 32 By transforming tax credits into fungible assets PTC transferability creates a ripple effect that extends far beyond the confines of balance sheets contributing to the

Web 14 M 228 rz 2023 nbsp 0183 32 The U S government offers a solar tax credit that can help you recoup up to 30 of the cost of installing a solar power system The residential clean energy credit also covers other types of

A Solar Tax Incentives in its most basic version, is an ad-hoc refund to a purchaser who has purchased a particular product or service. This is a potent tool used by businesses to attract customers, increase sales and market specific products.

Types of Solar Tax Incentives

Solar Financing New Star Solar

Solar Financing New Star Solar

Web 25 Okt 2023 nbsp 0183 32 Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in

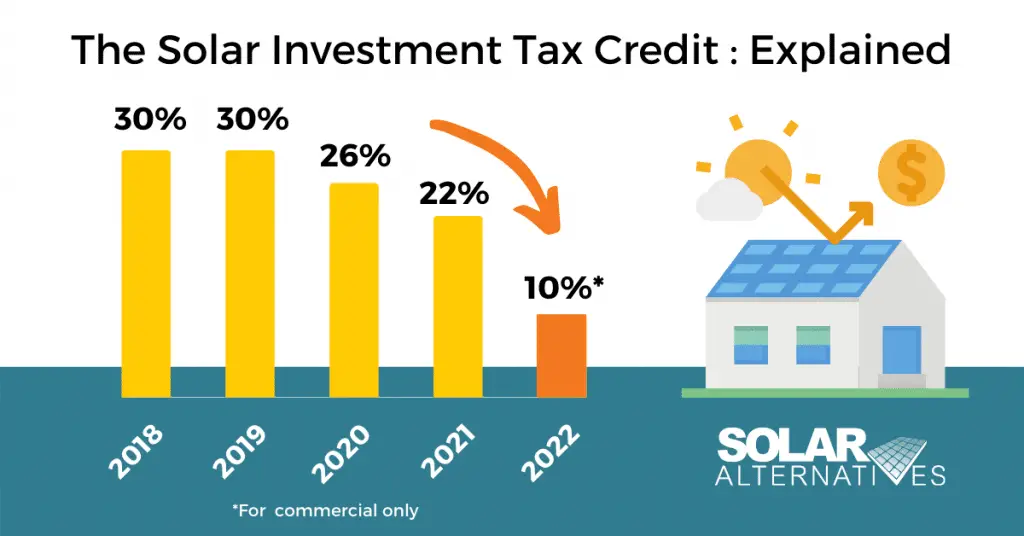

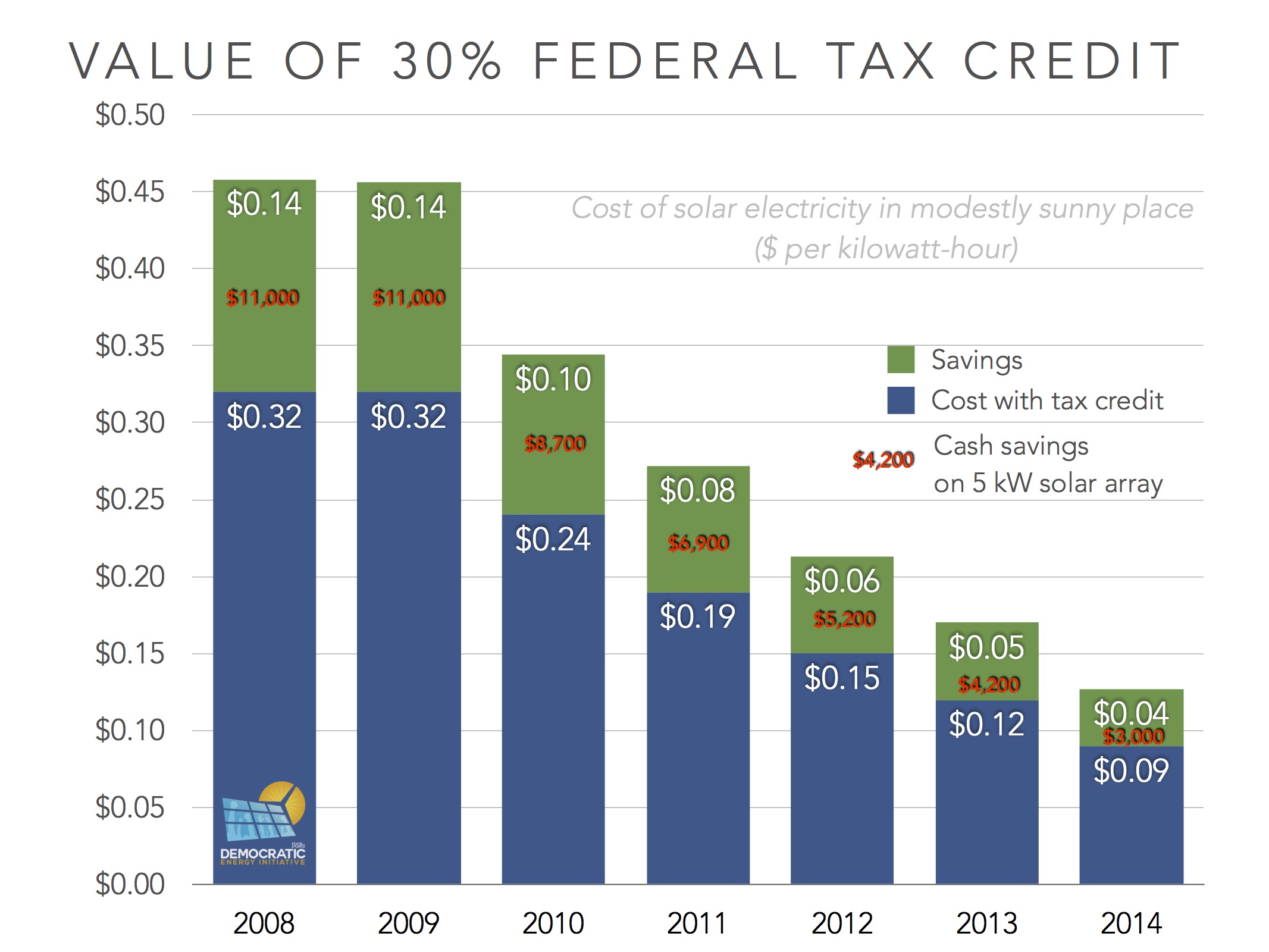

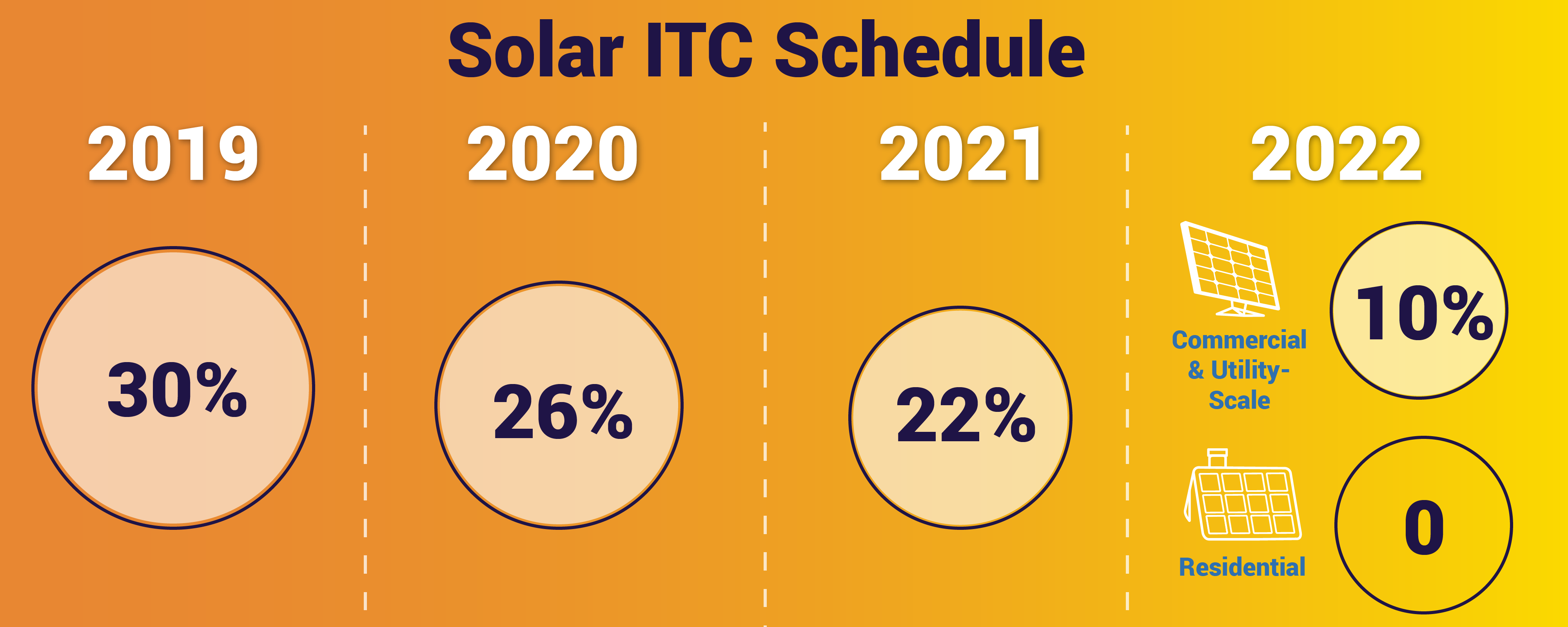

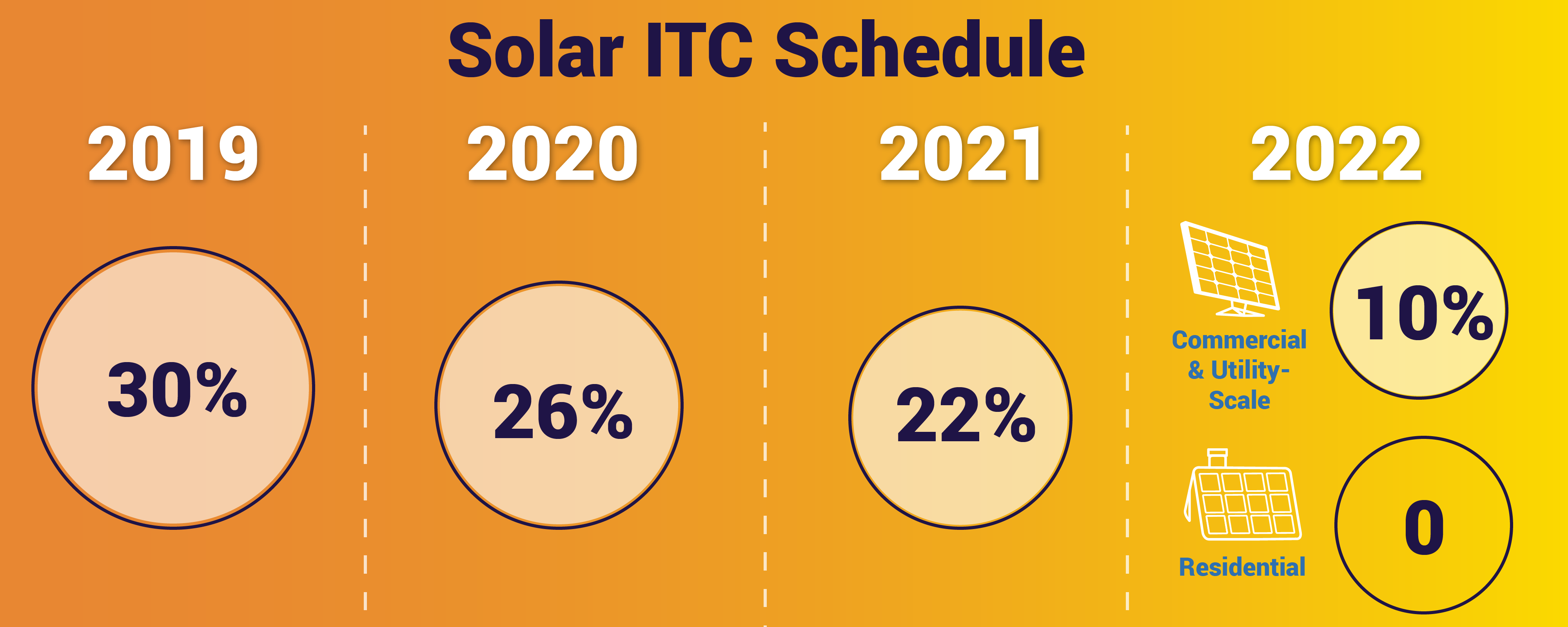

Web 4 Aug 2023 nbsp 0183 32 Here are the specifics 2016 2019 the energy tax credit remained at 30 of the cost of the system 2020 2021 owners of new residential and commercial solar

Cash Solar Tax Incentives

Cash Solar Tax Incentives are the most straightforward type of Solar Tax Incentives. Customers are offered a certain amount of money back after buying a product. These are typically for expensive items such as electronics or appliances.

Mail-In Solar Tax Incentives

Mail-in Solar Tax Incentives require that customers send in an evidence of purchase for the money. They're a bit more involved, but can result in huge savings.

Instant Solar Tax Incentives

Instant Solar Tax Incentives will be applied at place of purchase, reducing the purchase cost immediately. Customers don't have to wait around for savings with this type.

How Solar Tax Incentives Work

Solar Tax Credit Everything A Homeowner Needs To Know Credible

Solar Tax Credit Everything A Homeowner Needs To Know Credible

Web 17 Apr 2023 nbsp 0183 32 However some key uncertainties remain One is the share of EVs eligible for tax incentives Another is the level of onshoring that will take place for battery and solar

The Solar Tax Incentives Process

The process typically comprises a handful of simple steps:

-

Buy the product: At first then, you buy the item just like you normally would.

-

Complete this Solar Tax Incentives template: You'll need to provide some data, such as your address, name, as well as the details of your purchase to claim your Solar Tax Incentives.

-

In order to submit the Solar Tax Incentives It is dependent on the kind of Solar Tax Incentives you will need to mail in a form or make it available online.

-

Wait until the company approves: The company will evaluate your claim to make sure it is in line with the guidelines and conditions of the Solar Tax Incentives.

-

Accept your Solar Tax Incentives When it's approved you'll receive a refund through a check, or a prepaid card, or through another method specified by the offer.

Pros and Cons of Solar Tax Incentives

Advantages

-

Cost savings Solar Tax Incentives can substantially cut the price you pay for a product.

-

Promotional Offers they encourage their customers to test new products or brands.

-

Boost Sales Solar Tax Incentives are a great way to boost the sales of a company as well as its market share.

Disadvantages

-

Complexity The mail-in Solar Tax Incentives particularly are often time-consuming and take a long time to complete.

-

The Expiration Dates: Many Solar Tax Incentives have the strictest deadlines for submission.

-

Risk of Not Being Paid: Some customers may not receive their Solar Tax Incentives if they don't follow the regulations exactly.

Download Solar Tax Incentives

FAQs

1. Are Solar Tax Incentives equivalent to discounts? Not at all, Solar Tax Incentives provide an amount of money that is refunded after the purchase, whereas discounts cut the purchase price at point of sale.

2. Are multiple Solar Tax Incentives available on the same item This is dependent on conditions of Solar Tax Incentives deals and product's ability to qualify. Certain companies may permit it, but some will not.

3. What is the time frame to receive an Solar Tax Incentives? The length of time will differ, but can take anywhere from a few weeks to a couple of months before you get your Solar Tax Incentives.

4. Do I need to pay tax with respect to Solar Tax Incentives montants? the majority of instances, Solar Tax Incentives amounts are not considered taxable income.

5. Can I trust Solar Tax Incentives offers from brands that aren't well-known Consider doing some research and make sure that the company offering the Solar Tax Incentives is credible prior to making purchases.

Itc Solar Tax Credit 2022 SolarProGuide

The Federal Solar Tax Credit Can Save You Thousands Green Ridge Solar

Check more sample of Solar Tax Incentives below

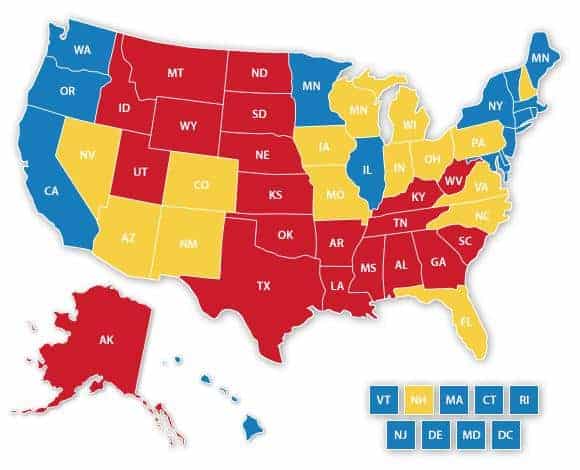

Property Tax Incentives For Solar By State

Solar Tax Incentives Act Before December 31

Learn About Solar Yongyang Solaroof Solar Energy Roofing Malaysia

Solar Tax Incentives Act Before December 31

Solar Tax Incentives In South Africa Archives Resergent Energy

Solar In California Ultimate Guide Solar Panels In California How You

https://www.nerdwallet.com/article/taxes/sola…

Web 14 M 228 rz 2023 nbsp 0183 32 The U S government offers a solar tax credit that can help you recoup up to 30 of the cost of installing a solar power system The residential clean energy credit also covers other types of

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

Web 28 Aug 2023 nbsp 0183 32 About Form 5695 Residential Energy Credits Instructions for Form 5695 2022 Page Last Reviewed or Updated 28 Aug 2023 If you invest in renewable

Web 14 M 228 rz 2023 nbsp 0183 32 The U S government offers a solar tax credit that can help you recoup up to 30 of the cost of installing a solar power system The residential clean energy credit also covers other types of

Web 28 Aug 2023 nbsp 0183 32 About Form 5695 Residential Energy Credits Instructions for Form 5695 2022 Page Last Reviewed or Updated 28 Aug 2023 If you invest in renewable

Solar Tax Incentives Act Before December 31

Solar Tax Incentives Act Before December 31

Solar Tax Incentives In South Africa Archives Resergent Energy

Solar In California Ultimate Guide Solar Panels In California How You

How To Get Solar Incentives And Rebates Suntrica

Solar Investment Tax Credit ITC SEIA

Solar Investment Tax Credit ITC SEIA

Solar Incentives Solar Tax Incentives By State