In our current world of high-end consumer goods people love a good deal. One way to gain significant savings for your purchases is through Seniors And Disability Irs Rebate Forms. Seniors And Disability Irs Rebate Forms are a marketing strategy employed by retailers and manufacturers to offer consumers a partial return on their purchases once they have bought them. In this article, we will investigate the world of Seniors And Disability Irs Rebate Forms. We'll discuss the nature of them, how they work, and how you can maximize your savings with these cost-effective incentives.

Get Latest Seniors And Disability Irs Rebate Form Below

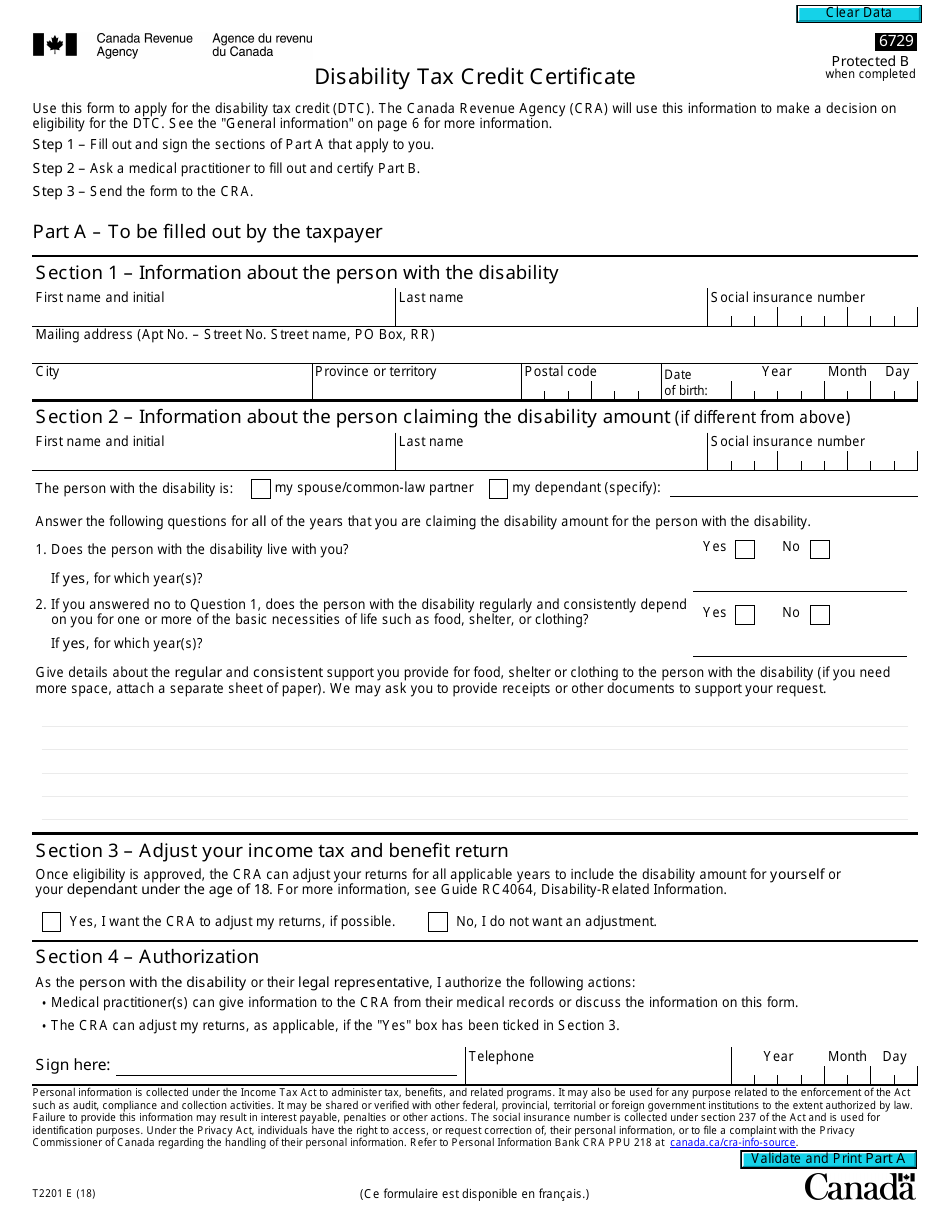

Seniors And Disability Irs Rebate Form

Seniors And Disability Irs Rebate Form -

Verkko 19 lokak 2023 nbsp 0183 32 This amount will include up to 7 500 of any taxable disability income you or your spouse received during the year Follow the form instructions to include

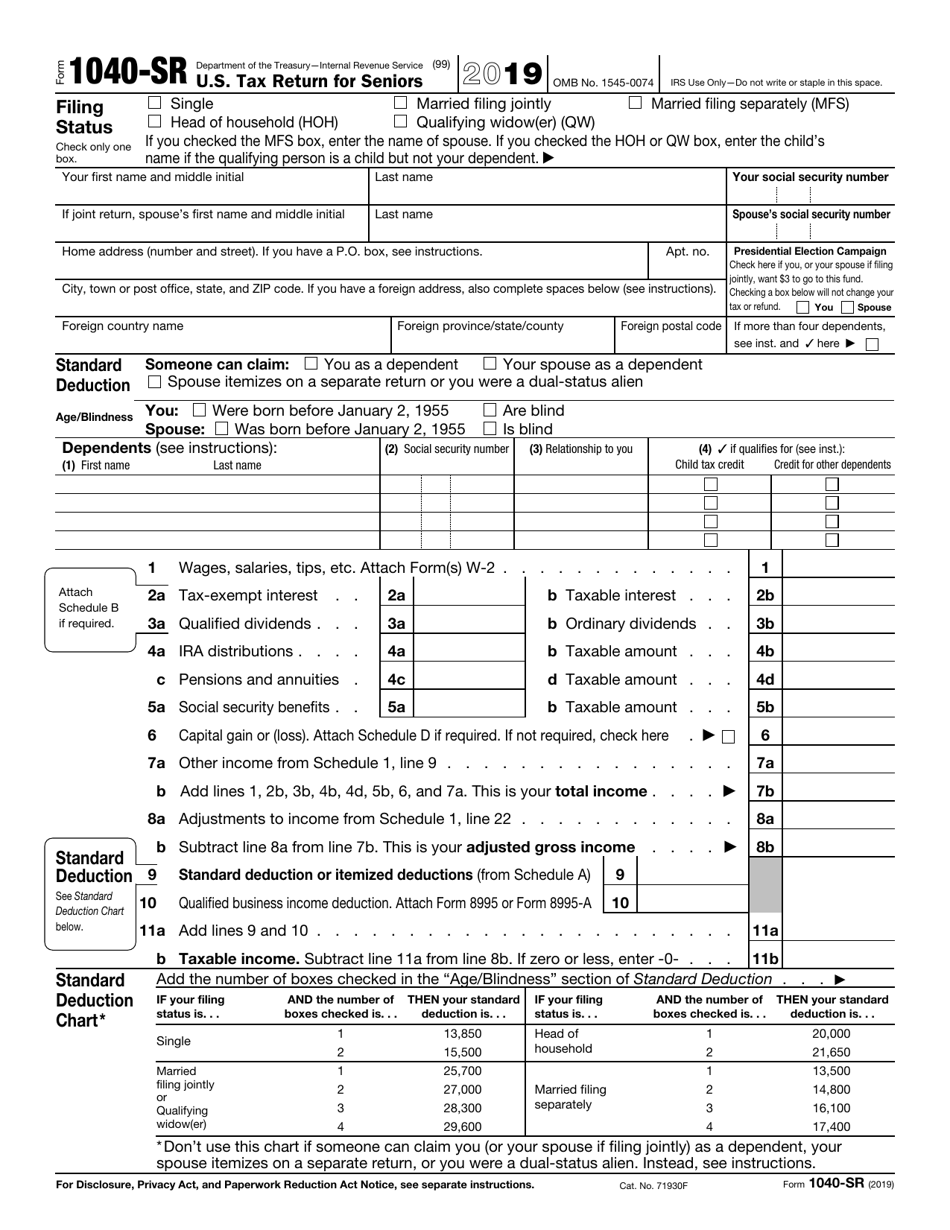

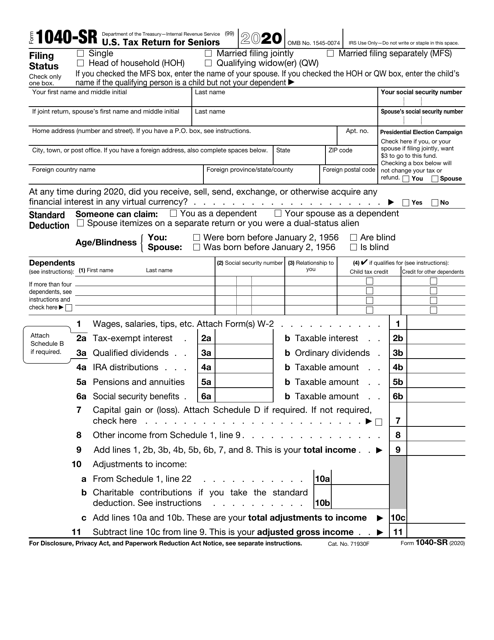

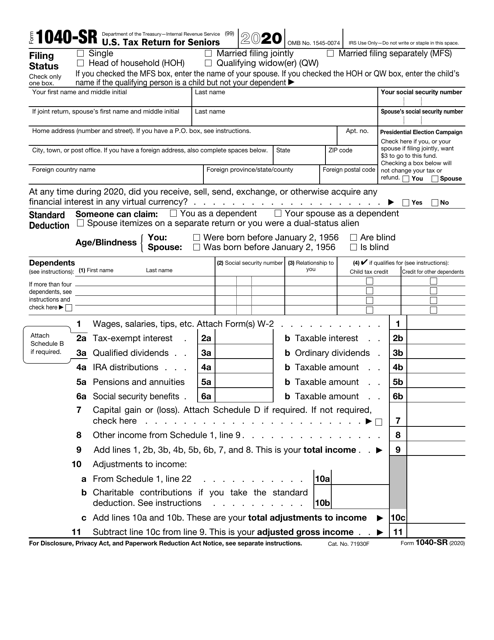

Verkko 17 elok 2023 nbsp 0183 32 People 65 and older may choose to use Form 1040 SR U S Tax Return for Seniors Do I Qualify for the Credit for the Elderly or Disabled Senior taxpayers

A Seniors And Disability Irs Rebate Form the simplest form, is a partial return to the customer following the purchase of a product or service. It's a highly effective tool that businesses use to draw customers, increase sales, as well as promote particular products.

Types of Seniors And Disability Irs Rebate Form

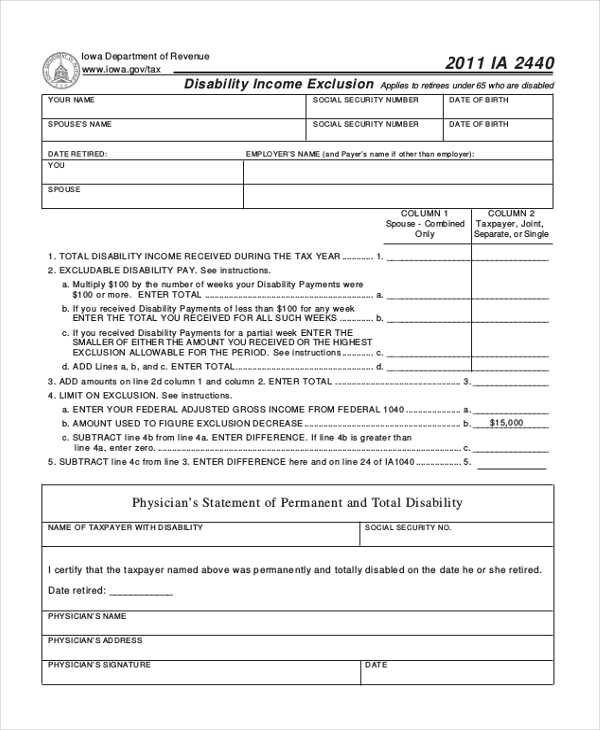

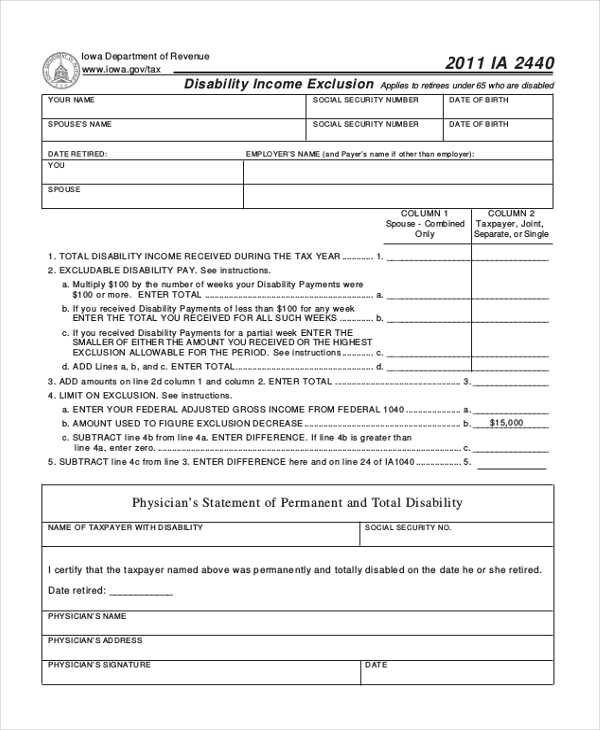

FREE 51 Disability Forms In PDF MS Word

FREE 51 Disability Forms In PDF MS Word

Verkko 20 jouluk 2022 nbsp 0183 32 File your 2021 tax return electronically and the tax software will help you figure your 2021 Recovery Rebate Credit Your Recovery Rebate Credit will reduce

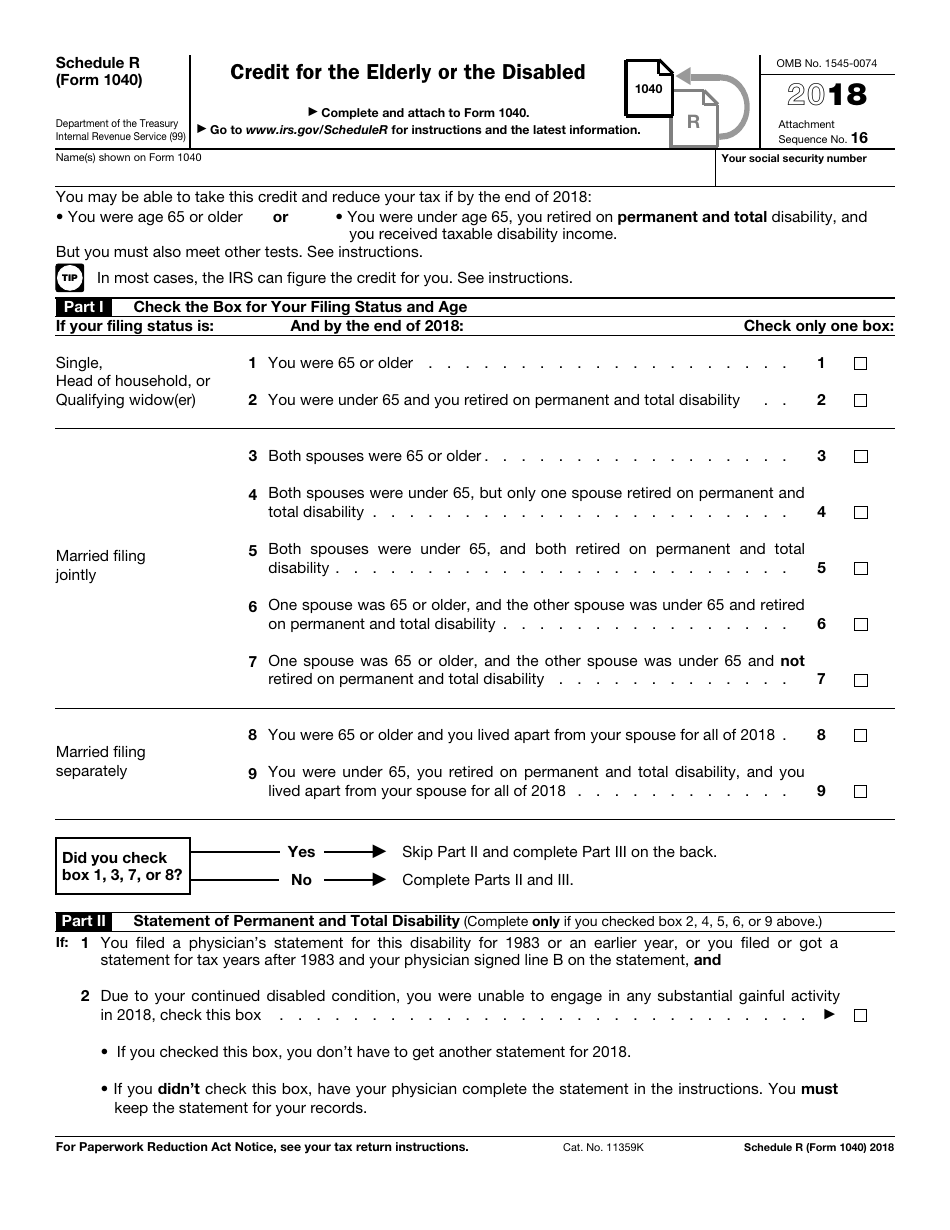

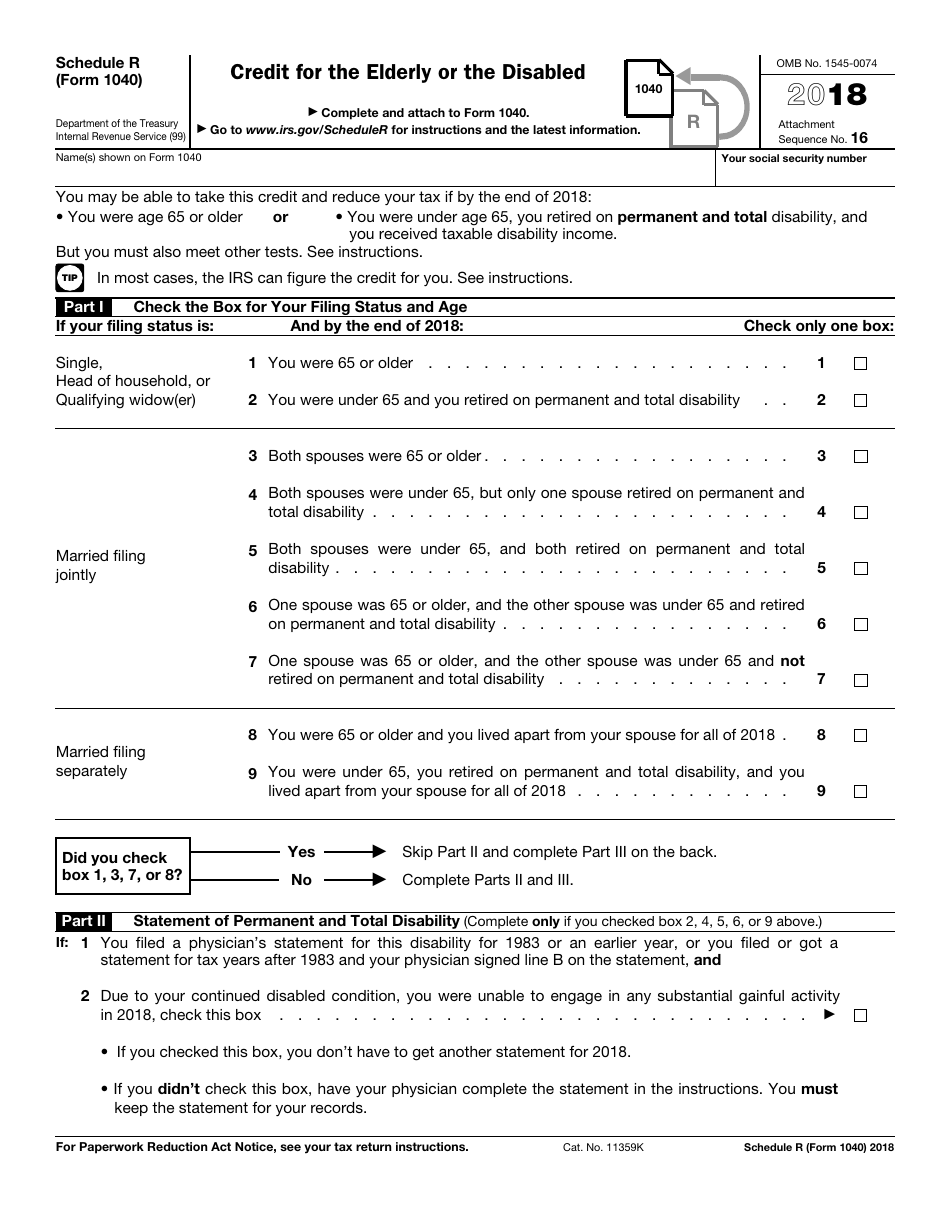

Verkko Elderly or the Disabled Use Schedule R Form 1040 to figure the credit for the elderly or the disa bled Future developments For the latest information about developments

Cash Seniors And Disability Irs Rebate Form

Cash Seniors And Disability Irs Rebate Form are the most basic type of Seniors And Disability Irs Rebate Form. Customers receive a specific amount of money when purchasing a item. This is often for more expensive items such electronics or appliances.

Mail-In Seniors And Disability Irs Rebate Form

Mail-in Seniors And Disability Irs Rebate Form require consumers to send in evidence of purchase to get their cash back. They're somewhat more involved, but can result in huge savings.

Instant Seniors And Disability Irs Rebate Form

Instant Seniors And Disability Irs Rebate Form will be applied at point of sale. They reduce the price of your purchase instantly. Customers do not have to wait until they can save with this type.

How Seniors And Disability Irs Rebate Form Work

Rebate Form Download Printable PDF Templateroller

Rebate Form Download Printable PDF Templateroller

Verkko 7 marrask 2022 nbsp 0183 32 Who Qualifies for Schedule R Schedule R Form 1040 can help you figure the credit for the elderly or the disabled To qualify you must be a U S citizen or resident alien who Reached age

The Seniors And Disability Irs Rebate Form Process

The process typically comprises a few simple steps

-

Buy the product: At first you purchase the item in the same way you would normally.

-

Complete the Seniors And Disability Irs Rebate Form form: You'll need to provide some data like your name, address along with the purchase details, to submit your Seniors And Disability Irs Rebate Form.

-

Complete the Seniors And Disability Irs Rebate Form If you want to submit the Seniors And Disability Irs Rebate Form, based on the type of Seniors And Disability Irs Rebate Form you could be required to send in a form, or make it available online.

-

Wait for approval: The business will examine your application to make sure that it's in accordance with the Seniors And Disability Irs Rebate Form's terms and conditions.

-

Enjoy your Seniors And Disability Irs Rebate Form After being approved, you'll get your refund, either by check, prepaid card, or by another method as specified by the offer.

Pros and Cons of Seniors And Disability Irs Rebate Form

Advantages

-

Cost Savings A Seniors And Disability Irs Rebate Form can significantly reduce the price you pay for the product.

-

Promotional Offers They encourage customers to try out new products or brands.

-

Improve Sales The benefits of a Seniors And Disability Irs Rebate Form can improve an organization's sales and market share.

Disadvantages

-

Complexity Seniors And Disability Irs Rebate Form that are mail-in, particularly are often time-consuming and costly.

-

Expiration Dates Some Seniors And Disability Irs Rebate Form have strict time limits for submission.

-

Risk of Not Being Paid Customers may not get their Seniors And Disability Irs Rebate Form if they do not follow the rules precisely.

Download Seniors And Disability Irs Rebate Form

Download Seniors And Disability Irs Rebate Form

FAQs

1. Are Seniors And Disability Irs Rebate Form equivalent to discounts? No, Seniors And Disability Irs Rebate Form offer a partial refund after the purchase, whereas discounts decrease the cost of purchase at time of sale.

2. Are there Seniors And Disability Irs Rebate Form that can be used on the same product This is dependent on conditions of Seniors And Disability Irs Rebate Form is offered as well as the merchandise's eligibility. Some companies may allow it, but some will not.

3. How long will it take to receive an Seniors And Disability Irs Rebate Form What is the timeframe? will differ, but can take several weeks to a few months for you to receive your Seniors And Disability Irs Rebate Form.

4. Do I have to pay taxes of Seniors And Disability Irs Rebate Form sums? the majority of cases, Seniors And Disability Irs Rebate Form amounts are not considered taxable income.

5. Do I have confidence in Seniors And Disability Irs Rebate Form offers from lesser-known brands it is crucial to conduct research and verify that the organization giving the Seniors And Disability Irs Rebate Form is credible prior to making a purchase.

IRS Form 1040 SR 2019 Fill Out Sign Online And Download Fillable

Renters Rebate Sample Form Edit Fill Sign Online Handypdf

Check more sample of Seniors And Disability Irs Rebate Form below

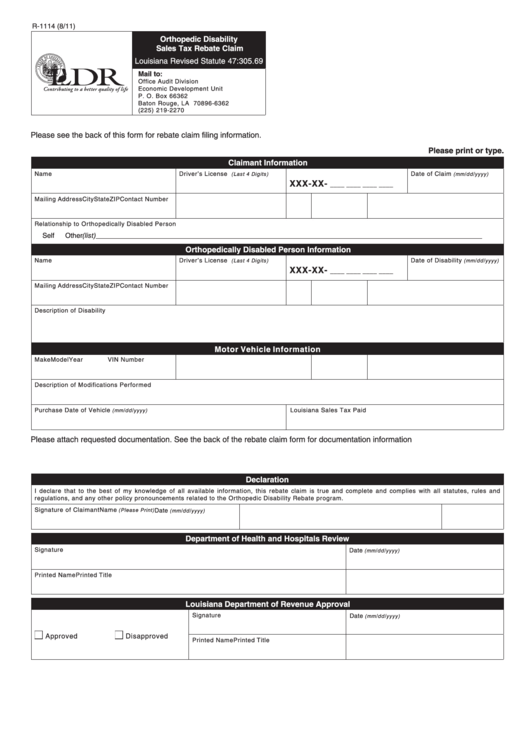

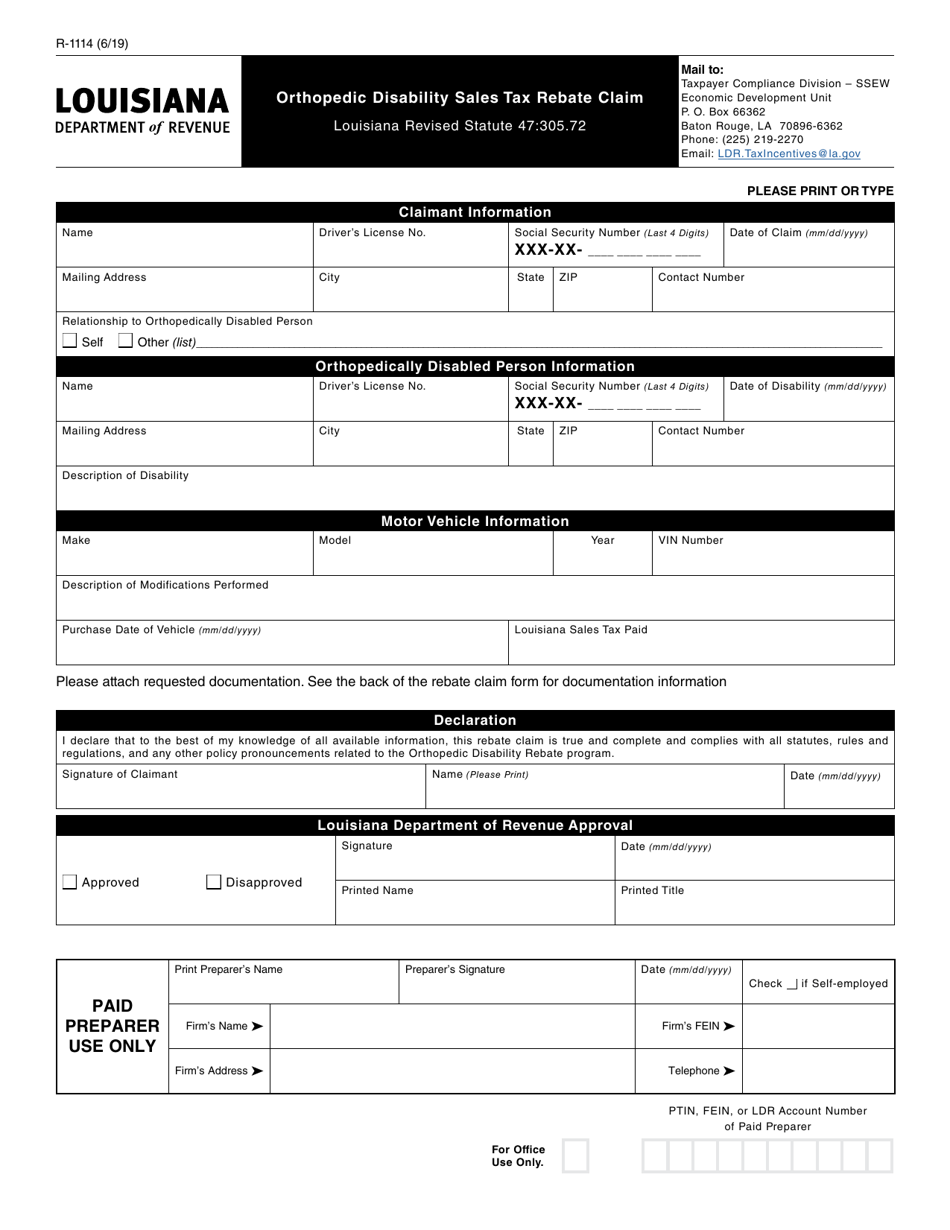

Fillable Form R 1114 Orthopedic Disability Sales Tax Rebate Claim

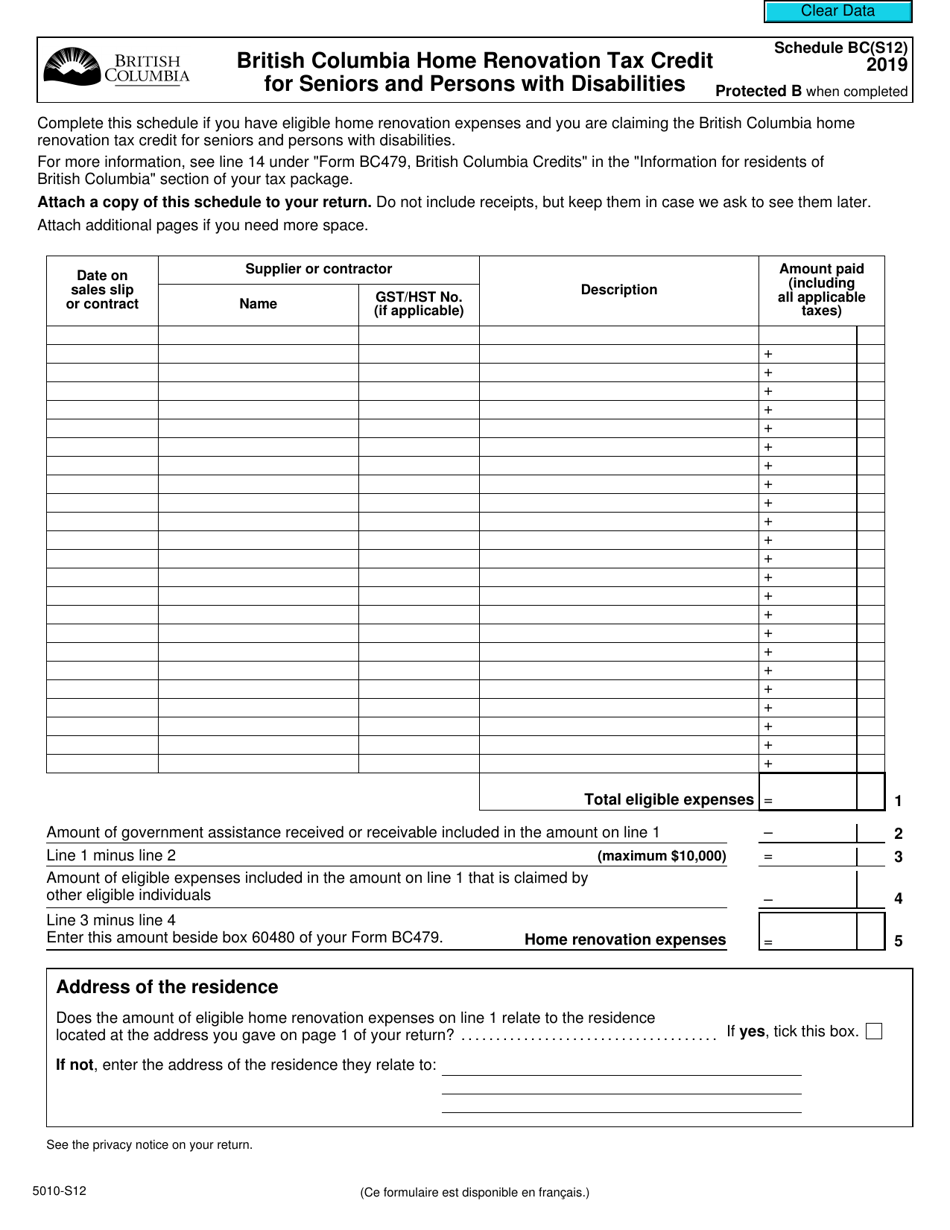

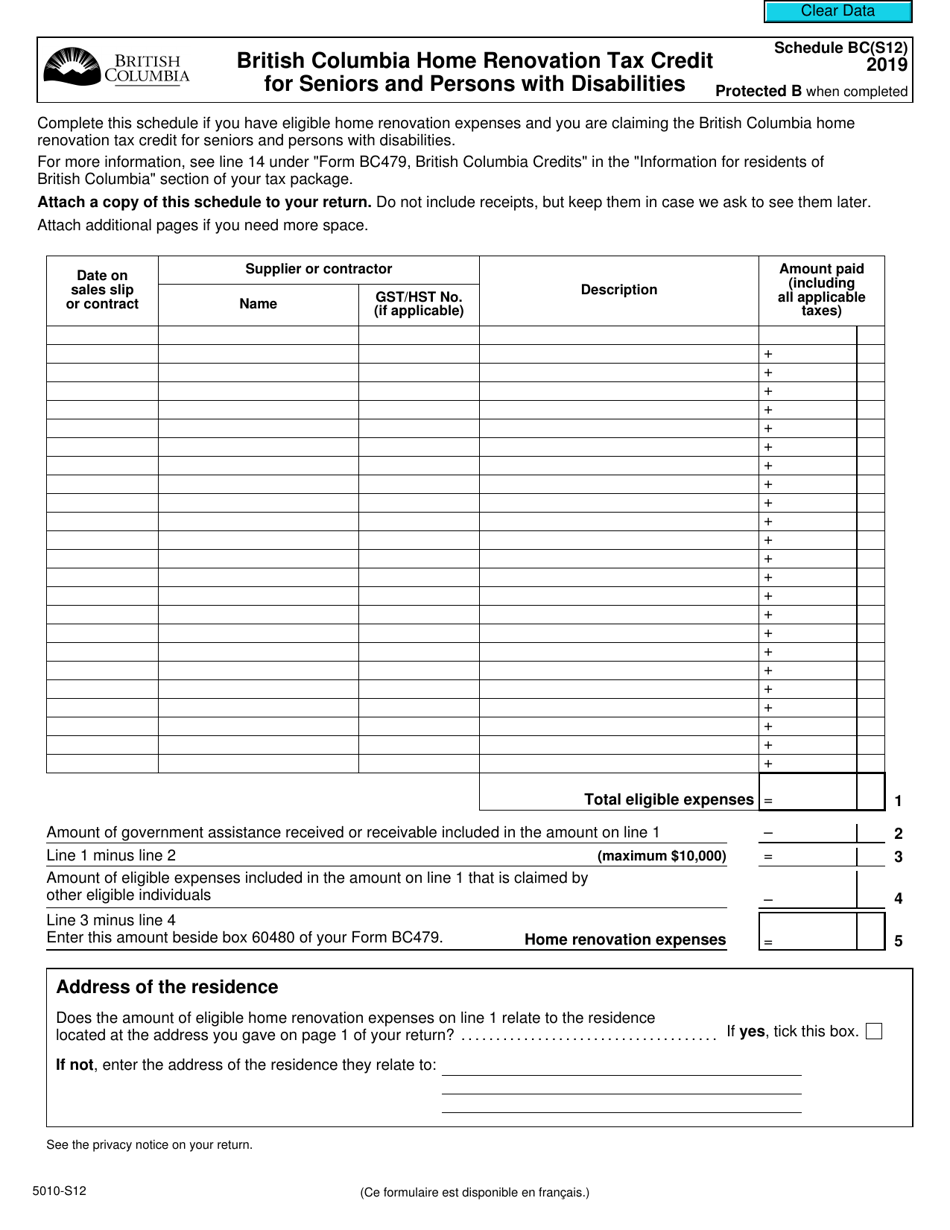

Form 5010 S12 Schedule BC S12 Download Fillable PDF Or Fill Online

Form R 1114 Download Fillable PDF Or Fill Online Orthopedic Disability

IRS Form 1040 SR Download Fillable PDF Or Fill Online U S Tax Return

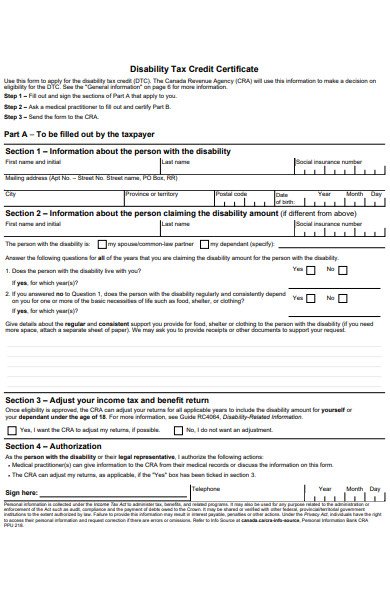

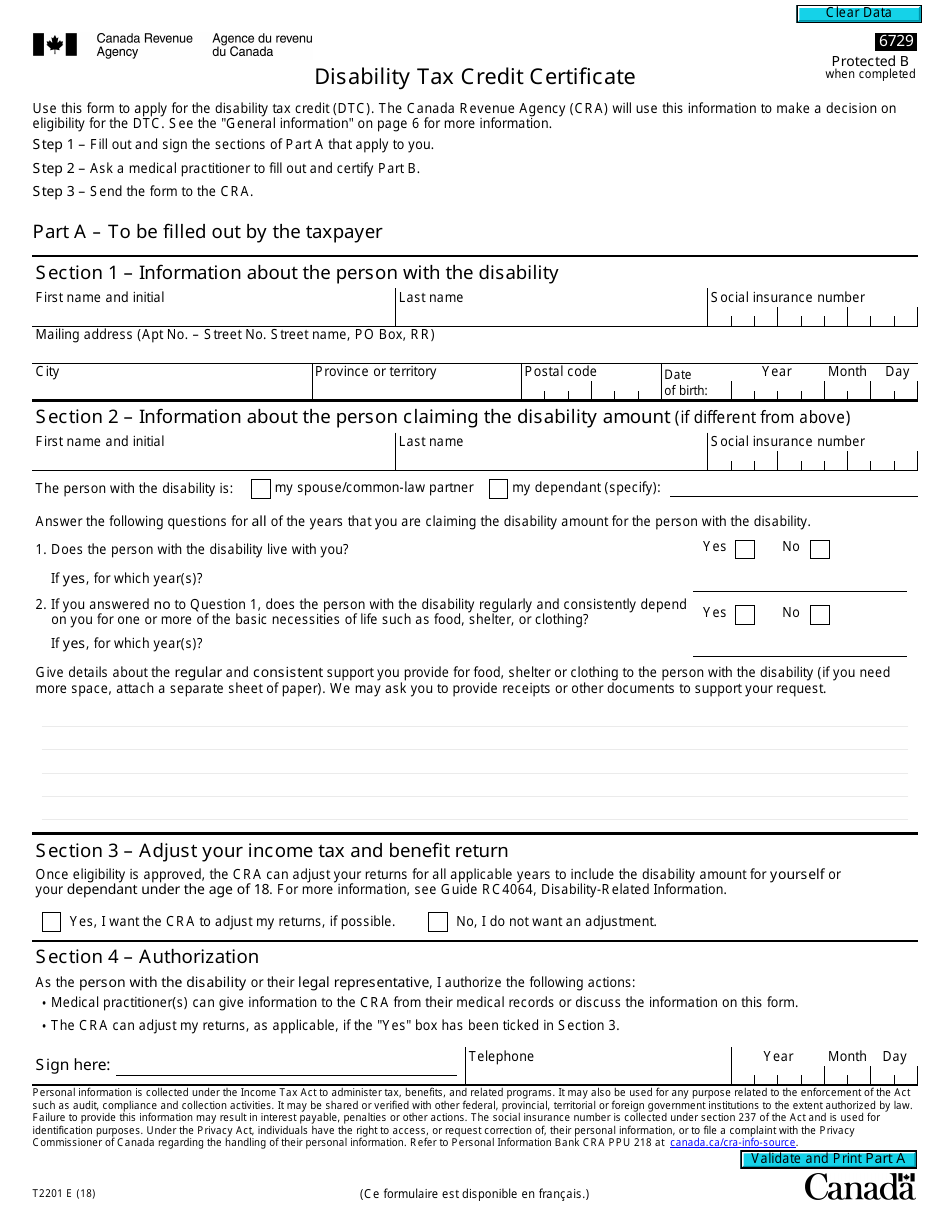

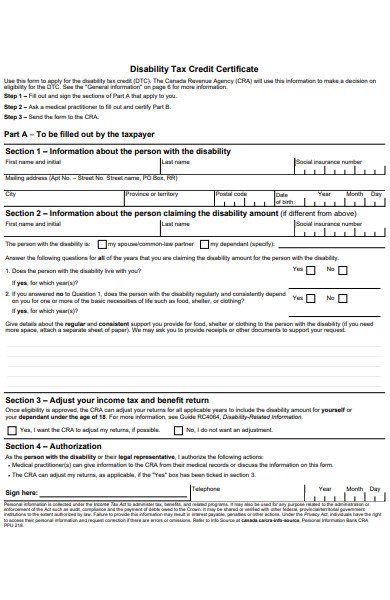

Form T2201 Download Fillable PDF Or Fill Online Disability Tax Credit

1040 SR The New Tax Return Form For Seniors The Balance Berks

https://www.irs.gov/individuals/seniors-retirees

Verkko 17 elok 2023 nbsp 0183 32 People 65 and older may choose to use Form 1040 SR U S Tax Return for Seniors Do I Qualify for the Credit for the Elderly or Disabled Senior taxpayers

https://www.irs.gov/pub/irs-pdf/i1040sr.pdf

Verkko Department of the Treasury Internal Revenue Service 2022 Instructions for Schedule R Credit for the Use Schedule R Form 1040 to figure the credit for the elderly or the

Verkko 17 elok 2023 nbsp 0183 32 People 65 and older may choose to use Form 1040 SR U S Tax Return for Seniors Do I Qualify for the Credit for the Elderly or Disabled Senior taxpayers

Verkko Department of the Treasury Internal Revenue Service 2022 Instructions for Schedule R Credit for the Use Schedule R Form 1040 to figure the credit for the elderly or the

IRS Form 1040 SR Download Fillable PDF Or Fill Online U S Tax Return

Form 5010 S12 Schedule BC S12 Download Fillable PDF Or Fill Online

Form T2201 Download Fillable PDF Or Fill Online Disability Tax Credit

1040 SR The New Tax Return Form For Seniors The Balance Berks

Fuel Tax Disability Application Form

FREE 9 Sample Social Security Disability Forms In PDF Word

FREE 9 Sample Social Security Disability Forms In PDF Word

Rebates Exemptions And Deferrals For Senior Citizens Persons With