In this modern-day world of consumers everyone is looking for a great deal. One option to obtain substantial savings from your purchases is via Self Employed Tax Rebate Forms. Self Employed Tax Rebate Forms can be a way of marketing used by manufacturers and retailers for offering customers a percentage return on their purchases once they have placed them. In this post, we'll go deeper into the realm of Self Employed Tax Rebate Forms. We will explore what they are about, how they work, and how you can make the most of your savings with these cost-effective incentives.

Get Latest Self Employed Tax Rebate Form Below

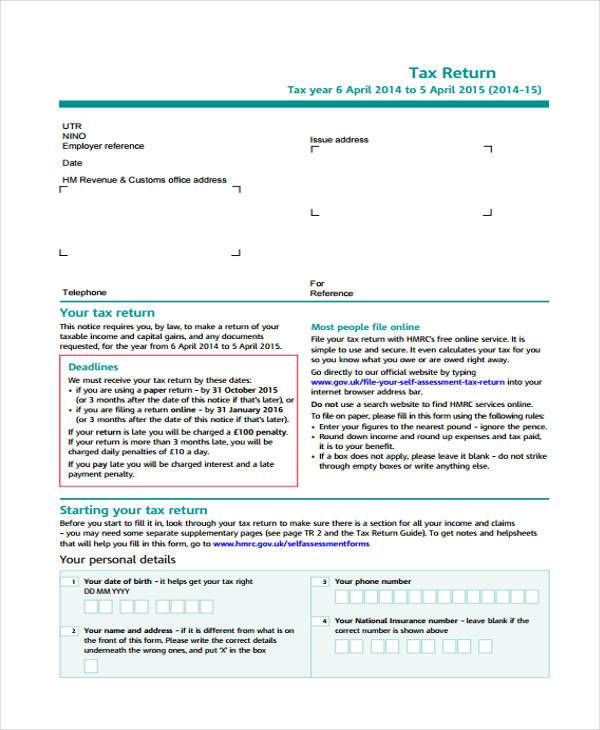

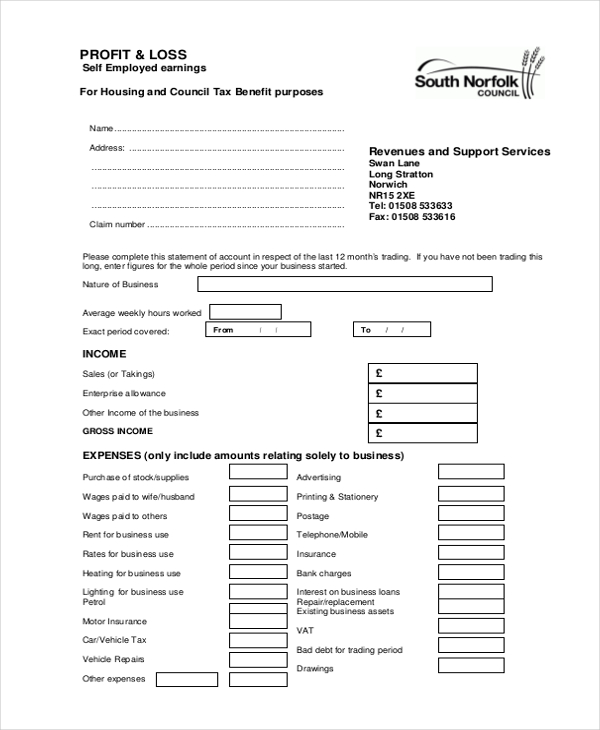

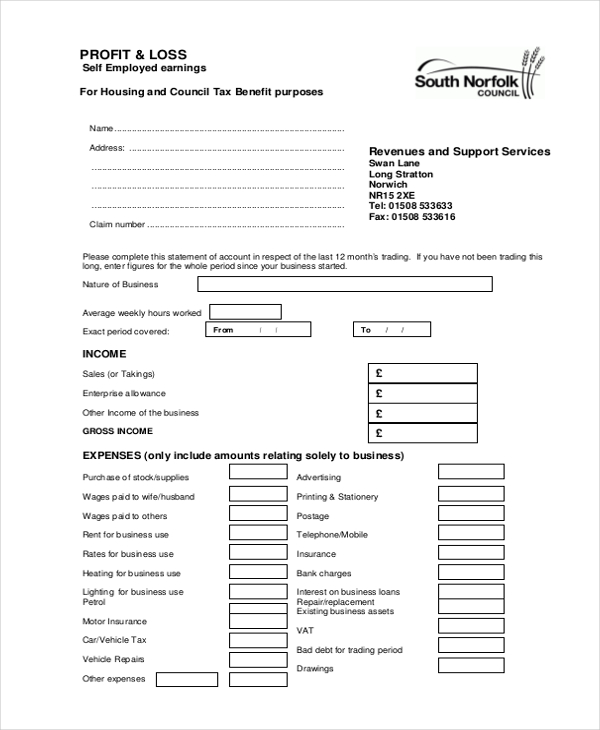

Self Employed Tax Rebate Form

Self Employed Tax Rebate Form -

Web 5 janv 2023 nbsp 0183 32 What is an HMRC tax rebate If you ve paid too much tax you could be eligible for a refund from HMRC This is known as a tax rebate The average tax rebate in the UK is around 163 3 000 and

Web If you re self employed have relatively simple tax affairs and your annual business turnover was below 163 85 000 use the SA103S 2022 short version of the Self employment

A Self Employed Tax Rebate Form as it is understood in its simplest definition, is a cash refund provided to customers when they purchase a product or service. It's an effective method employed by companies to attract customers, increase sales, and advertise specific products.

Types of Self Employed Tax Rebate Form

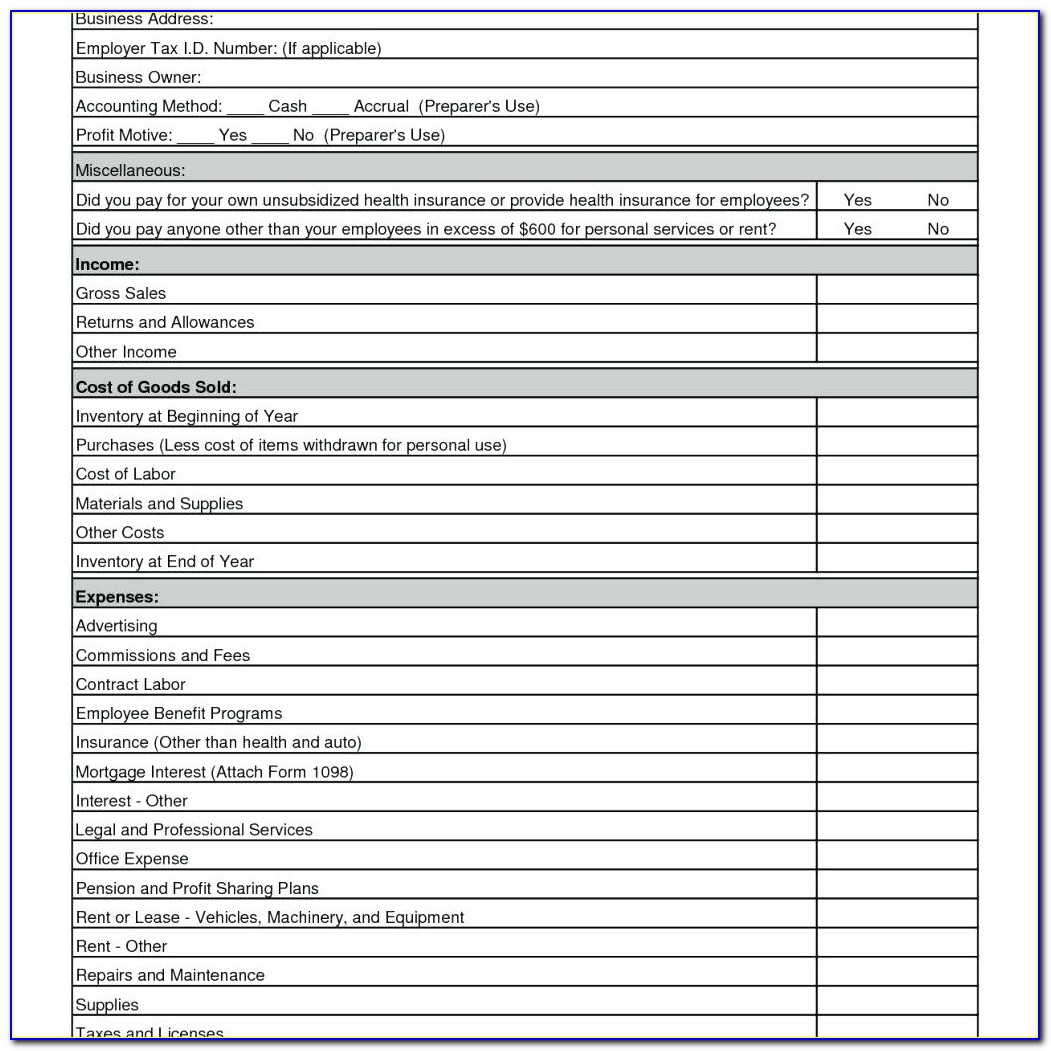

FREE 9 Self Assessment Forms In PDF MS Word Excel

FREE 9 Self Assessment Forms In PDF MS Word Excel

Web 4 avr 2014 nbsp 0183 32 Details If you re a self employed subcontractor use the online form to make a claim for repayment of pay deductions in the current tax year Use your tax return

Web You have to file an income tax return if your net earnings from self employment were 400 or more If your net earnings from self employment were less than 400 you still have

Cash Self Employed Tax Rebate Form

Cash Self Employed Tax Rebate Form are by far the easiest kind of Self Employed Tax Rebate Form. Customers get a set amount of cash back after purchasing a product. These are usually used for big-ticket items, like electronics and appliances.

Mail-In Self Employed Tax Rebate Form

Mail-in Self Employed Tax Rebate Form require the customer to present an evidence of purchase for the refund. They're somewhat more involved, but offer huge savings.

Instant Self Employed Tax Rebate Form

Instant Self Employed Tax Rebate Form are applied right at the point of sale and reduce the price instantly. Customers don't need to wait around for savings in this manner.

How Self Employed Tax Rebate Form Work

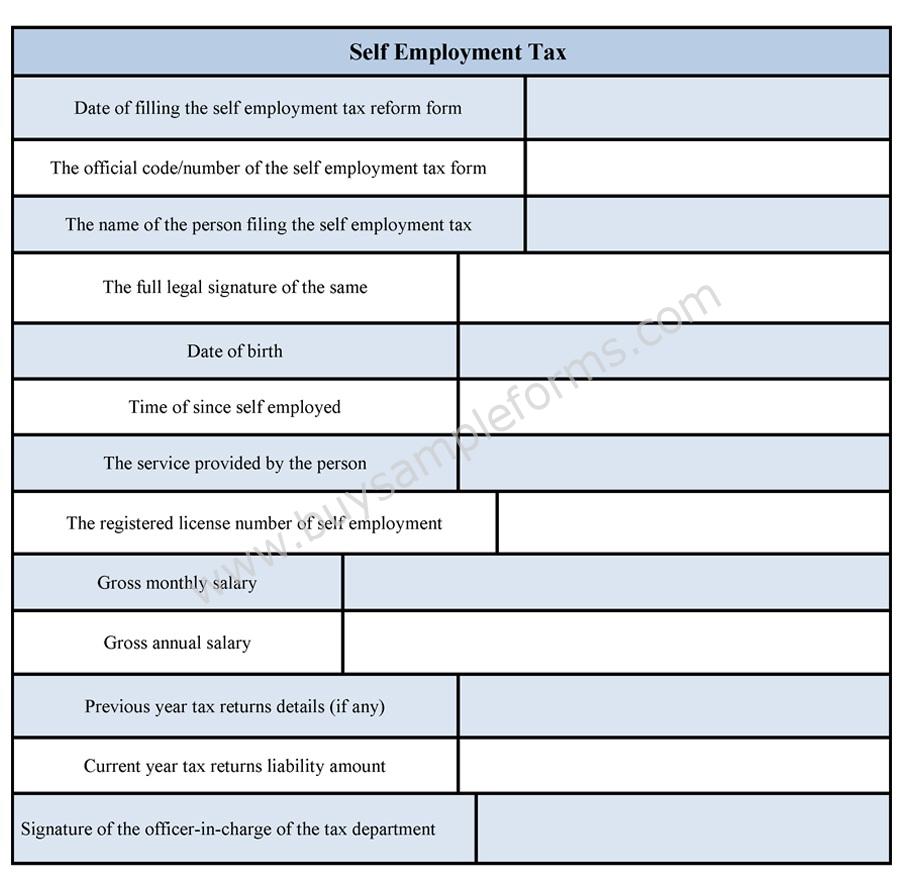

Self Employment Tax Form

Self Employment Tax Form

Web 3 mars 2016 nbsp 0183 32 complete Self Assessment tax returns except current year claims are claiming for expenses over 163 2 500 are claiming for more than 5 different jobs When you

The Self Employed Tax Rebate Form Process

The process usually involves a few steps

-

Purchase the product: Then make sure you purchase the product like you normally do.

-

Fill in this Self Employed Tax Rebate Form paper: You'll need to give some specific information, such as your name, address, and information about the purchase in order to take advantage of your Self Employed Tax Rebate Form.

-

Complete the Self Employed Tax Rebate Form depending on the nature of Self Employed Tax Rebate Form it is possible that you need to submit a claim form to the bank or make it available online.

-

Wait for approval: The company will review your submission to verify that it is compliant with the Self Employed Tax Rebate Form's terms and conditions.

-

Accept your Self Employed Tax Rebate Form When it's approved you'll receive a refund through a check, or a prepaid card, or another method that is specified in the offer.

Pros and Cons of Self Employed Tax Rebate Form

Advantages

-

Cost Savings Rewards can drastically decrease the price for a product.

-

Promotional Deals they encourage their customers to test new products or brands.

-

Improve Sales Self Employed Tax Rebate Form can increase sales for a company and also increase market share.

Disadvantages

-

Complexity In particular, mail-in Self Employed Tax Rebate Form in particular difficult and take a long time to complete.

-

Days of expiration Most Self Employed Tax Rebate Form come with specific deadlines for submission.

-

Risk of Non-Payment Certain customers could not receive their refunds if they don't adhere to the requirements precisely.

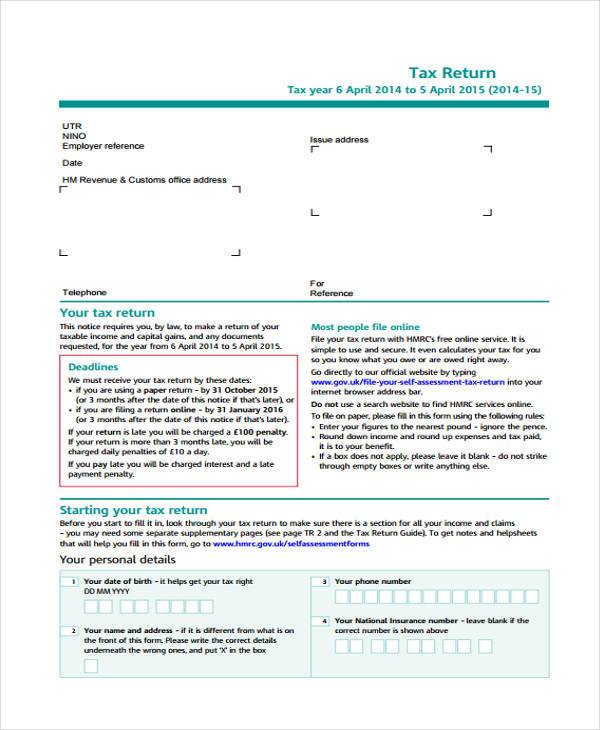

Download Self Employed Tax Rebate Form

Download Self Employed Tax Rebate Form

FAQs

1. Are Self Employed Tax Rebate Form similar to discounts? No, they are only a partial reimbursement following the purchase, but discounts can reduce the purchase price at point of sale.

2. Can I use multiple Self Employed Tax Rebate Form on the same product This is dependent on conditions in the Self Employed Tax Rebate Form offered and product's admissibility. Certain companies might allow the use of multiple Self Employed Tax Rebate Form, whereas other won't.

3. What is the time frame to get an Self Employed Tax Rebate Form? The time frame is different, but it could range from several weeks to several months to receive a Self Employed Tax Rebate Form.

4. Do I need to pay tax of Self Employed Tax Rebate Form values? the majority of cases, Self Employed Tax Rebate Form amounts are not considered taxable income.

5. Do I have confidence in Self Employed Tax Rebate Form offers from lesser-known brands Consider doing some research and verify that the brand providing the Self Employed Tax Rebate Form has a good reputation prior to making a purchase.

2018 Form UK SA103S Fill Online Printable Fillable Blank PdfFiller

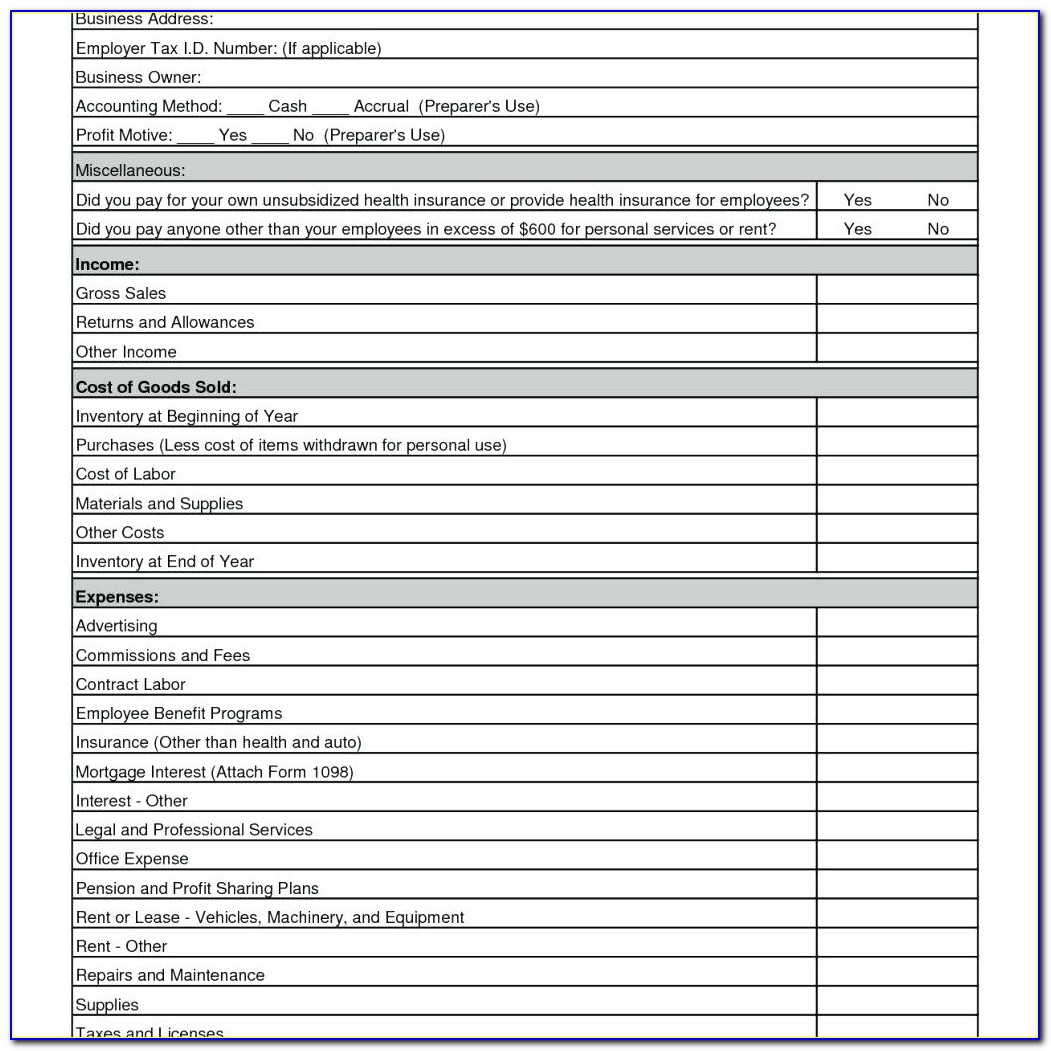

Self Employed Expense Worksheet

Check more sample of Self Employed Tax Rebate Form below

P55 Tax Rebate Form Business Printable Rebate Form

Tulsa Sales Tax Rebate Form Fill Out Sign Online DocHub

How To File Self Employment Taxes Step By Step Your Guide

P G Printable Rebate Form

Printable Self Employed Tax Deductions Worksheet Ideas Gealena

Ez Form For Taxes 2017 Form Resume Examples GEOGNQW5Vr

https://assets.publishing.service.gov.uk/government/uploads/…

Web If you re self employed have relatively simple tax affairs and your annual business turnover was below 163 85 000 use the SA103S 2022 short version of the Self employment

https://www.gov.uk/government/publications/income-tax-tax-claim-r38

Web 15 ao 251 t 2014 nbsp 0183 32 Form Claim an Income Tax refund Claim a tax refund if you ve overpaid tax You can also use this form to authorise a representative to get the payment on your

Web If you re self employed have relatively simple tax affairs and your annual business turnover was below 163 85 000 use the SA103S 2022 short version of the Self employment

Web 15 ao 251 t 2014 nbsp 0183 32 Form Claim an Income Tax refund Claim a tax refund if you ve overpaid tax You can also use this form to authorise a representative to get the payment on your

P G Printable Rebate Form

Tulsa Sales Tax Rebate Form Fill Out Sign Online DocHub

Printable Self Employed Tax Deductions Worksheet Ideas Gealena

Ez Form For Taxes 2017 Form Resume Examples GEOGNQW5Vr

Property Tax Rebate Application Printable Pdf Download

Income Tax Forms Income Tax Forms For Self Employed

Income Tax Forms Income Tax Forms For Self Employed

Self employment Tax Form Pdf 2022 Employment Form