In today's world of consumerism everyone enjoys a good bargain. One option to obtain significant savings on your purchases is to use Section 87a Rebates. Section 87a Rebates are a method of marketing employed by retailers and manufacturers to offer consumers a partial reimbursement on their purchases following the time they have done so. In this article, we'll explore the world of Section 87a Rebates, exploring the nature of them about, how they work, and how to maximize your savings via these cost-effective incentives.

Get Latest Section 87a Rebate Below

Section 87a Rebate

Section 87a Rebate - Section 87a Rebate For Fy 2023-24, Section 87a Rebate For Senior Citizens, Section 87a Rebate In Hindi, Section 87a Rebate For Ay 2022-23, Sec 87a Rebate For Ay 2024-25, Sec 87a Rebate For Ay 2021-22, What Is Rebate Section 87a, Who Is Eligible For 87a Rebate, How Is Section 87a Rebate Calculated, How Much Rebate Under Section 87a

Web 3 f 233 vr 2023 nbsp 0183 32 How is Section 87a Rebate calculated Let s take a few examples of how the Section 87A Rebate will make income of Rs 7 lakh tax free under the new tax regime As a reminder of the new tax slab

Web 3 f 233 vr 2023 nbsp 0183 32 Section 87A allows an individual to claim tax rebate if their taxable income does not increase the specified level The rebate is up to Rs 25 000 for

A Section 87a Rebate the simplest definition, is a refund to a purchaser who has purchased a particular product or service. It's a very effective technique employed by companies to attract customers, boost sales, and market specific products.

Types of Section 87a Rebate

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Web Any individual whose annual net income does not exceed Rs 5 Lakh qualifies to claim tax rebate under Section 87a of the Income Tax Act 1961 This implies an individual can

Web Individuals can enjoy a tax rebate under Section 87A when they earn a net taxable income within 5 00 000 in a given financial year Eligible candidates can claim a tax rebate of

Cash Section 87a Rebate

Cash Section 87a Rebate are the simplest kind of Section 87a Rebate. The customer receives a particular amount back in cash after purchasing a product. These are typically for more expensive items such electronics or appliances.

Mail-In Section 87a Rebate

Customers who want to receive mail-in Section 87a Rebate must send in proof of purchase to receive their money back. They're somewhat more involved, but offer significant savings.

Instant Section 87a Rebate

Instant Section 87a Rebate are applied at the point of sale. They reduce the price of your purchase instantly. Customers don't need to wait for their savings in this manner.

How Section 87a Rebate Work

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Web 6 f 233 vr 2023 nbsp 0183 32 Income Tax Rebate u s 87A By Anjana Dhand Updated on 6 Feb 2023 The tax rebate u s 87A allows a taxpayer to reduce his her tax liability marginally depending on the net total income In this article we

The Section 87a Rebate Process

It usually consists of a couple of steps that are easy to follow:

-

Purchase the product: First make sure you purchase the product as you normally would.

-

Fill out the Section 87a Rebate questionnaire: you'll have submit some information including your name, address and information about the purchase in order to receive your Section 87a Rebate.

-

You must submit the Section 87a Rebate It is dependent on the type of Section 87a Rebate you may have to submit a form by mail or submit it online.

-

Wait for approval: The company will review your submission to determine if it's in compliance with the reimbursement's terms and condition.

-

Accept your Section 87a Rebate After you've been approved, you'll receive your cash back either by check, prepaid card or another method as specified by the offer.

Pros and Cons of Section 87a Rebate

Advantages

-

Cost Savings Rewards can drastically cut the price you pay for an item.

-

Promotional Offers They encourage customers to try new items or brands.

-

Enhance Sales The benefits of a Section 87a Rebate can improve the company's sales as well as market share.

Disadvantages

-

Complexity Mail-in Section 87a Rebate in particular may be lengthy and take a long time to complete.

-

Time Limits for Section 87a Rebate A lot of Section 87a Rebate have extremely strict deadlines to submit.

-

Risque of Non-Payment Customers may miss out on Section 87a Rebate because they don't comply with the rules precisely.

Download Section 87a Rebate

FAQs

1. Are Section 87a Rebate equivalent to discounts? No, Section 87a Rebate require some form of refund following the purchase whereas discounts will reduce prices at time of sale.

2. Are there multiple Section 87a Rebate I can get on the same product It's contingent upon the terms for the Section 87a Rebate deals and product's acceptance. Certain companies might allow it, and some don't.

3. What is the time frame to receive a Section 87a Rebate? The period differs, but it can take anywhere from a couple of weeks to a couple of months before you get your Section 87a Rebate.

4. Do I need to pay taxes for Section 87a Rebate the amount? the majority of instances, Section 87a Rebate amounts are not considered taxable income.

5. Do I have confidence in Section 87a Rebate offers from lesser-known brands You must research and confirm that the brand which is providing the Section 87a Rebate has a good reputation prior to making an investment.

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

How To Solve For Income Tax Amy Fleishman s Math Problems

Check more sample of Section 87a Rebate below

All You Need To Know About Section 87A At TaxHelpdesk TaxHelpdesk

Section 87A Tax Rebate Under Section 87A Rebates Financial

Rebate Of Income Tax Under Section 87A YouTube

Everything You Need To Know About 87a Rebate Ay 2023 20 And How To Use

Income Tax Rebate U s 87A For The Financial Year 2022 23

Income Tax Return TaxHelpdesk

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 f 233 vr 2023 nbsp 0183 32 Section 87A allows an individual to claim tax rebate if their taxable income does not increase the specified level The rebate is up to Rs 25 000 for

https://tax2win.in/guide/section-87a

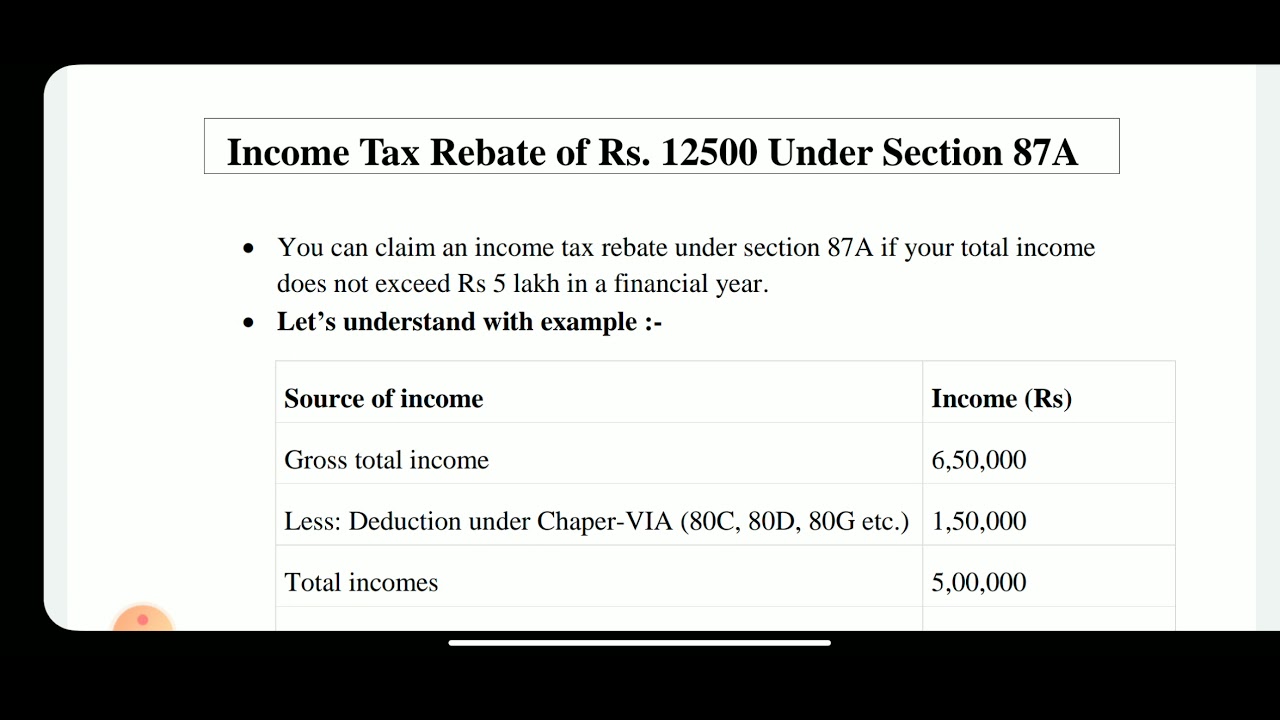

Web 14 sept 2019 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under

Web 3 f 233 vr 2023 nbsp 0183 32 Section 87A allows an individual to claim tax rebate if their taxable income does not increase the specified level The rebate is up to Rs 25 000 for

Web 14 sept 2019 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under

Everything You Need To Know About 87a Rebate Ay 2023 20 And How To Use

Section 87A Tax Rebate Under Section 87A Rebates Financial

Income Tax Rebate U s 87A For The Financial Year 2022 23

Income Tax Return TaxHelpdesk

Rebate Under Section 87A Of Rs 12 500 Under Income Tax Important

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Pol cia Tis c Bal k How To Calculate Rebate Ob iansky V a ok Vlastn k