In our current world of high-end consumer goods every person loves a great bargain. One way to gain significant savings on your purchases is by using Saskatchewan Carbon Tax Rebate Forms. The use of Saskatchewan Carbon Tax Rebate Forms is a method used by manufacturers and retailers to give customers a part reimbursement on their purchases following the time they've completed them. In this article, we'll examine the subject of Saskatchewan Carbon Tax Rebate Forms and explore the nature of them and how they work and how you can maximise your savings through these efficient incentives.

Get Latest Saskatchewan Carbon Tax Rebate Form Below

Saskatchewan Carbon Tax Rebate Form

Saskatchewan Carbon Tax Rebate Form -

Web 15 juil 2022 nbsp 0183 32 1 079 in Alberta 1 101 in Saskatchewan 832 in Manitoba 745 in Ontario Residents of small and rural communities will receive an extra 10 per cent on

Web 15 juil 2022 nbsp 0183 32 For the 2021 base year the Saskatchewan program allows for an annual credit of 550 for an individual 275 for a spouse common law partner 138 per child under 19 and 275 for the first child

A Saskatchewan Carbon Tax Rebate Form in its most basic form, is a partial refund given to a client after purchasing a certain product or service. It's an effective method for businesses to entice customers, boost sales, and to promote certain products.

Types of Saskatchewan Carbon Tax Rebate Form

Saskatchewan s Carbon Tax Numbers Are In And The Answer Is Reporting

Saskatchewan s Carbon Tax Numbers Are In And The Answer Is Reporting

Web 3 avr 2023 nbsp 0183 32 Kirk Fraser CBC Saskatchewan residents will see an increase to the federal carbon tax as well as a corresponding jump in the federal rebate As of April 1 2023 Canada saw the largest

Web 2 janv 2023 nbsp 0183 32 A discussion paper from the provincial government back in February said the OBPS program will match the federal carbon pricing schedule which will start at 65 per tonne CO2e carbon dioxide

Cash Saskatchewan Carbon Tax Rebate Form

Cash Saskatchewan Carbon Tax Rebate Form are the most straightforward kind of Saskatchewan Carbon Tax Rebate Form. Customers are offered a certain amount of money back after purchasing a item. They are typically used to purchase big-ticket items, like electronics and appliances.

Mail-In Saskatchewan Carbon Tax Rebate Form

Mail-in Saskatchewan Carbon Tax Rebate Form require customers to send in their proof of purchase before receiving their money back. They're a little more involved but offer significant savings.

Instant Saskatchewan Carbon Tax Rebate Form

Instant Saskatchewan Carbon Tax Rebate Form apply at the point of sale, and can reduce prices immediately. Customers don't have to wait for their savings through this kind of offer.

How Saskatchewan Carbon Tax Rebate Form Work

Carbon Tax Rebates Coming To Provinces That Rejected Federal Plan

Carbon Tax Rebates Coming To Provinces That Rejected Federal Plan

Web 12 avr 2021 nbsp 0183 32 Canada s Parliamentary Budget Office PBO estimates that Saskatchewan will collect 659 million in carbon pricing revenues in 2021 22 and this doesn t include

The Saskatchewan Carbon Tax Rebate Form Process

The process typically comprises a couple of steps that are easy to follow:

-

Buy the product: At first you purchase the product exactly as you would normally.

-

Fill in your Saskatchewan Carbon Tax Rebate Form application: In order to claim your Saskatchewan Carbon Tax Rebate Form, you'll have to give some specific information including your name, address, along with the purchase details, to be eligible for a Saskatchewan Carbon Tax Rebate Form.

-

To submit the Saskatchewan Carbon Tax Rebate Form According to the nature of Saskatchewan Carbon Tax Rebate Form you will need to fill out a paper form or submit it online.

-

Wait for approval: The business will scrutinize your submission to determine if it's in compliance with the reimbursement's terms and condition.

-

Redeem your Saskatchewan Carbon Tax Rebate Form When it's approved you'll receive a refund either through check, prepaid card, or other option as per the terms of the offer.

Pros and Cons of Saskatchewan Carbon Tax Rebate Form

Advantages

-

Cost Savings A Saskatchewan Carbon Tax Rebate Form can significantly reduce the price you pay for products.

-

Promotional Deals These deals encourage customers in trying new products or brands.

-

Help to Increase Sales Saskatchewan Carbon Tax Rebate Form are a great way to boost companies' sales and market share.

Disadvantages

-

Complexity Saskatchewan Carbon Tax Rebate Form that are mail-in, in particular they can be time-consuming and lengthy.

-

The Expiration Dates A majority of Saskatchewan Carbon Tax Rebate Form have extremely strict deadlines to submit.

-

Risk of not receiving payment: Some customers may not receive their refunds if they don't comply with the rules exactly.

Download Saskatchewan Carbon Tax Rebate Form

Download Saskatchewan Carbon Tax Rebate Form

FAQs

1. Are Saskatchewan Carbon Tax Rebate Form equivalent to discounts? No, they are partial reimbursement after purchase, whereas discounts cut the cost of purchase at point of sale.

2. Are there any Saskatchewan Carbon Tax Rebate Form that I can use on the same product What is the best way to do it? It's contingent on terms of the Saskatchewan Carbon Tax Rebate Form offered and product's ability to qualify. Some companies may allow this, whereas others will not.

3. What is the time frame to receive an Saskatchewan Carbon Tax Rebate Form? The timing will vary, but it may take several weeks to a few months to get your Saskatchewan Carbon Tax Rebate Form.

4. Do I need to pay tax with respect to Saskatchewan Carbon Tax Rebate Form sums? the majority of situations, Saskatchewan Carbon Tax Rebate Form amounts are not considered to be taxable income.

5. Should I be able to trust Saskatchewan Carbon Tax Rebate Form offers from lesser-known brands It's crucial to research and make sure that the company that is offering the Saskatchewan Carbon Tax Rebate Form is trustworthy prior to making purchases.

How To Get Money Back For Carbon Pricing On Your 2018 Taxes CBC News

What You Need To Know Federal Carbon Tax Takes Effect In Ont

Check more sample of Saskatchewan Carbon Tax Rebate Form below

Murray Mandryk Federal Initiatives Turn Saskatchewan Into An Island

Premier Scott Moe Tells Trudeau Sask Farmers need An Answer On Cash

Confused About Carbon Taxes And Rebates Here s What You Need To Know

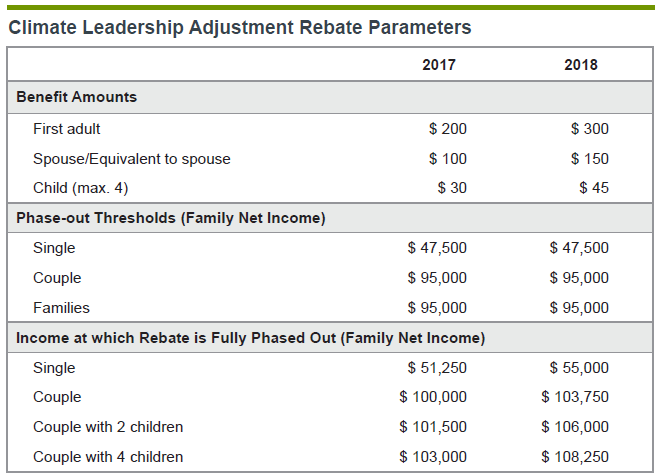

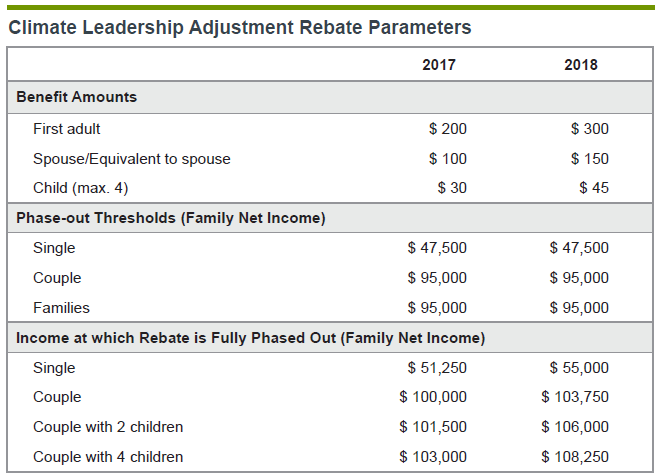

Alberta Budget 2016 How Much Is This Carbon Tax Going To Cost Me

TOPS Tops Business Forms W 3 Tax Form 2 Pt Form With Carbons 10 PK

Taxing Canadians Patience Corporations Need To Pay Their Fair Share

https://globalnews.ca/news/8993878/saskatc…

Web 15 juil 2022 nbsp 0183 32 For the 2021 base year the Saskatchewan program allows for an annual credit of 550 for an individual 275 for a spouse common law partner 138 per child under 19 and 275 for the first child

https://www.canada.ca/en/revenue-agency/campaigns/cai-payment.html

Web The Government of Canada has introduced the new climate action incentive CAI payment If you are a resident of Saskatchewan Manitoba Ontario or Alberta you can claim it

Web 15 juil 2022 nbsp 0183 32 For the 2021 base year the Saskatchewan program allows for an annual credit of 550 for an individual 275 for a spouse common law partner 138 per child under 19 and 275 for the first child

Web The Government of Canada has introduced the new climate action incentive CAI payment If you are a resident of Saskatchewan Manitoba Ontario or Alberta you can claim it

Alberta Budget 2016 How Much Is This Carbon Tax Going To Cost Me

Premier Scott Moe Tells Trudeau Sask Farmers need An Answer On Cash

TOPS Tops Business Forms W 3 Tax Form 2 Pt Form With Carbons 10 PK

Taxing Canadians Patience Corporations Need To Pay Their Fair Share

Edmonton Grandmother Told To Return Portion Of Carbon Tax Rebate Cheque

Provincial Government To Temporarily Cut Fuel Tax Offers Rebates

Provincial Government To Temporarily Cut Fuel Tax Offers Rebates

Duke Energy Bill Template Form The Form In Seconds Fill Out And Sign