In our modern, consumer-driven society every person loves a great deal. One way to earn substantial savings when you shop is with Recovery Rebate Instructions Form 1040s. The use of Recovery Rebate Instructions Form 1040s is a method that retailers and manufacturers use to offer consumers a partial payment on their purchases, after they have bought them. In this article, we will go deeper into the realm of Recovery Rebate Instructions Form 1040s, exploring the nature of them, how they work, and how you can maximise your savings by taking advantage of these cost-effective incentives.

Get Latest Recovery Rebate Instructions Form 1040 Below

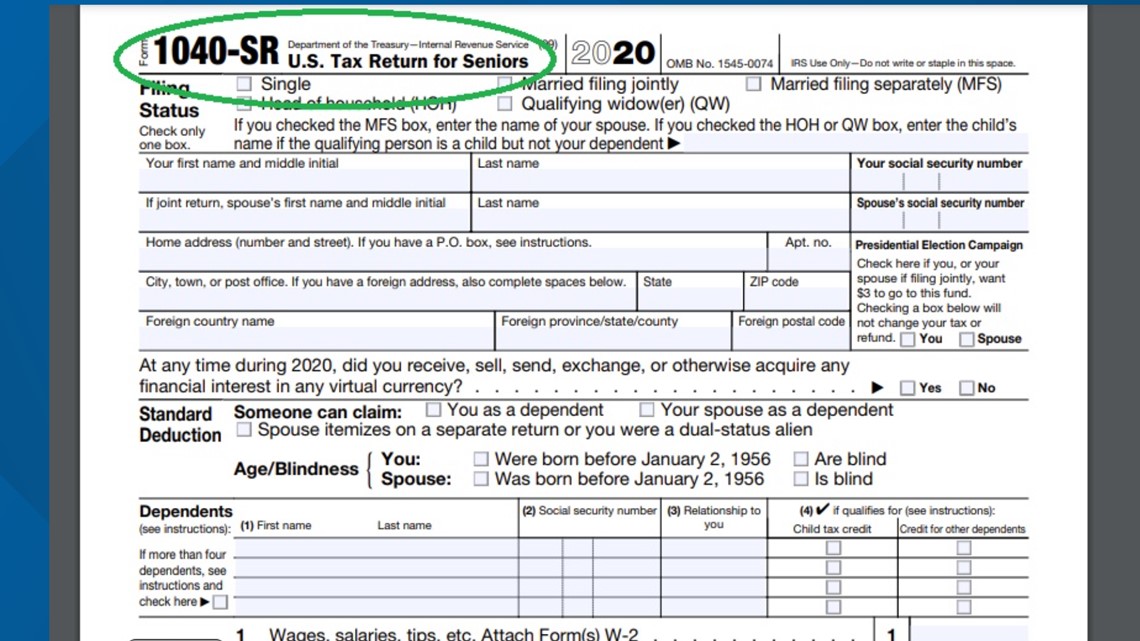

Recovery Rebate Instructions Form 1040

Recovery Rebate Instructions Form 1040 -

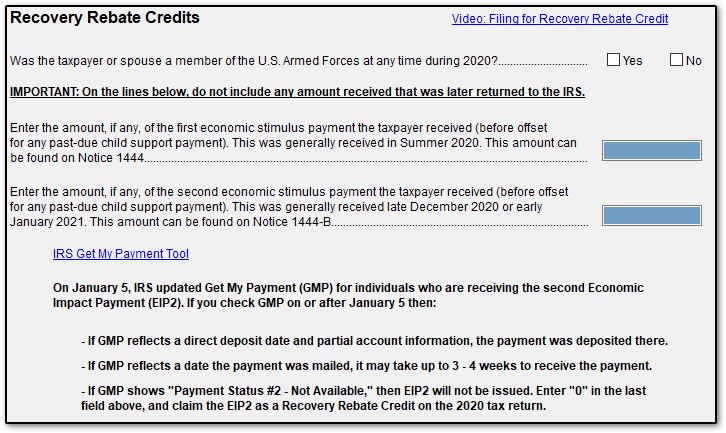

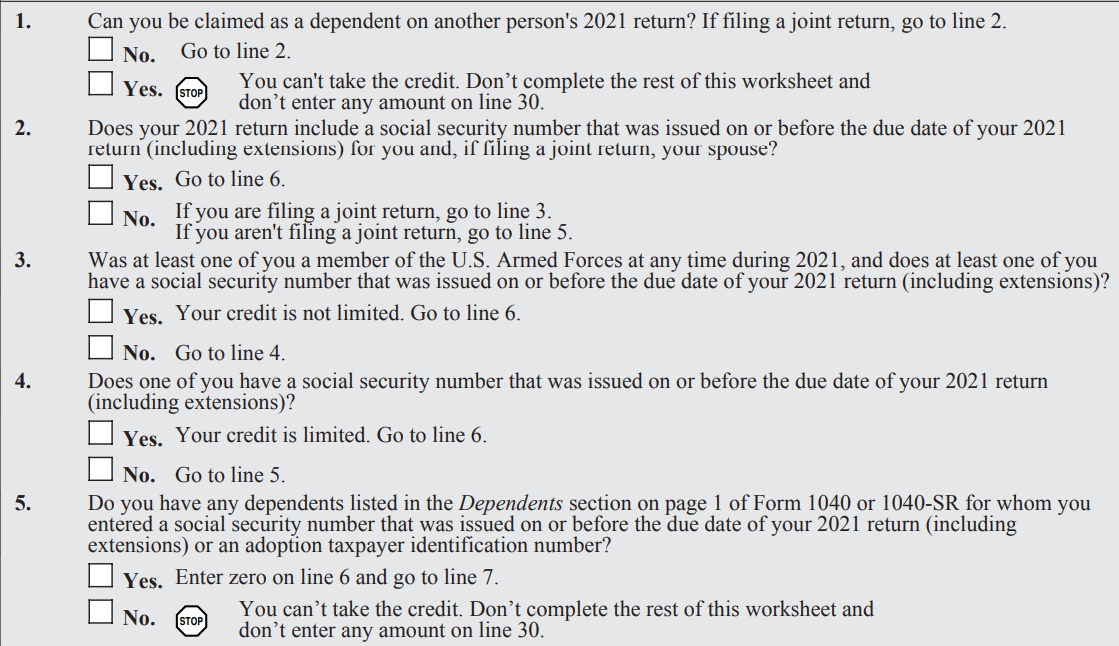

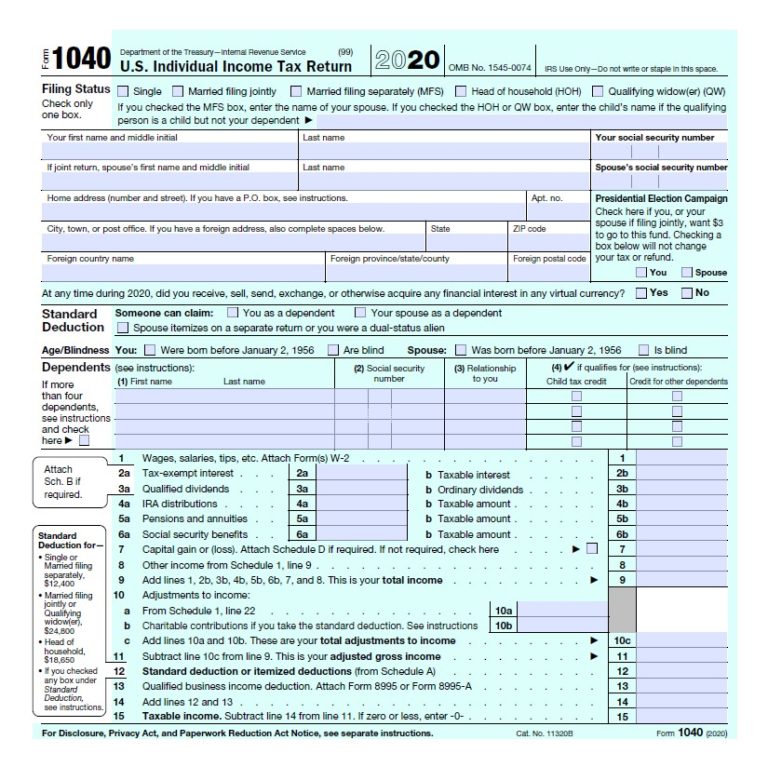

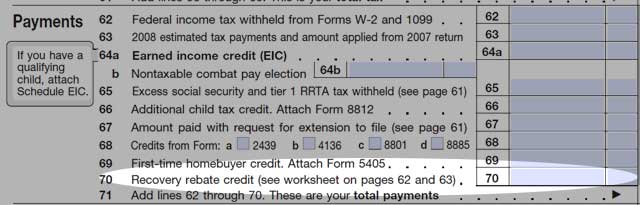

Web 10 Dez 2021 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the Form 1040 and Form 1040 SR instructions PDF can help determine if you are eligible for the credit The

Web 20 Dez 2022 nbsp 0183 32 IRS Statements and Announcements Page Last Reviewed or Updated 20 Dec 2022 Eligible individuals can claim the Recovery Rebate Credit on their Form 1040

A Recovery Rebate Instructions Form 1040 is, in its most basic description, is a refund that a client receives after they've purchased a good or service. It is a powerful tool that businesses use to draw customers, boost sales, and even promote certain products.

Types of Recovery Rebate Instructions Form 1040

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

Web 1040 1040A or 1040EZ The instructions for forms 1040 1040A and 1040EZ all include a worksheet for this purpose In order to calculate the Recovery Rebate Credit a person

Web 10 Dez 2021 nbsp 0183 32 To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form

Cash Recovery Rebate Instructions Form 1040

Cash Recovery Rebate Instructions Form 1040 are the most straightforward type of Recovery Rebate Instructions Form 1040. Customers get a set amount of money back upon purchasing a particular item. These are typically applied to the most expensive products like electronics or appliances.

Mail-In Recovery Rebate Instructions Form 1040

Customers who want to receive mail-in Recovery Rebate Instructions Form 1040 must present evidence of purchase to get their money back. They're a little more involved but can offer huge savings.

Instant Recovery Rebate Instructions Form 1040

Instant Recovery Rebate Instructions Form 1040 will be applied at point of sale, which reduces the price instantly. Customers do not have to wait until they can save in this manner.

How Recovery Rebate Instructions Form 1040 Work

1040 EF Message 0006 Recovery Rebate Credit Drake20

1040 EF Message 0006 Recovery Rebate Credit Drake20

Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021

The Recovery Rebate Instructions Form 1040 Process

The procedure usually involves a handful of simple steps:

-

Purchase the product: First you purchase the item the way you normally do.

-

Complete your Recovery Rebate Instructions Form 1040 paper: You'll have to supply some details, such as your name, address, and the purchase details, in order in order to get your Recovery Rebate Instructions Form 1040.

-

Complete the Recovery Rebate Instructions Form 1040 depending on the nature of Recovery Rebate Instructions Form 1040 you may have to send in a form, or submit it online.

-

Wait until the company approves: The company will review your submission for compliance with refund's conditions and terms.

-

Accept your Recovery Rebate Instructions Form 1040 Once you've received your approval, you'll receive a refund in the form of a check, prepaid card, or any other way specified in the offer.

Pros and Cons of Recovery Rebate Instructions Form 1040

Advantages

-

Cost savings The use of Recovery Rebate Instructions Form 1040 can greatly cut the price you pay for products.

-

Promotional Deals These deals encourage customers in trying new products or brands.

-

Enhance Sales Reward programs can boost an organization's sales and market share.

Disadvantages

-

Complexity: Mail-in Recovery Rebate Instructions Form 1040, in particular are often time-consuming and lengthy.

-

Deadlines for Expiration Many Recovery Rebate Instructions Form 1040 impose extremely strict deadlines to submit.

-

A risk of not being paid Customers may have their Recovery Rebate Instructions Form 1040 delayed if they don't follow the regulations exactly.

Download Recovery Rebate Instructions Form 1040

Download Recovery Rebate Instructions Form 1040

FAQs

1. Are Recovery Rebate Instructions Form 1040 similar to discounts? No, Recovery Rebate Instructions Form 1040 are only a partial reimbursement following the purchase, but discounts can reduce the cost of purchase at moment of sale.

2. Are there any Recovery Rebate Instructions Form 1040 that I can use on the same item The answer is dependent on the conditions of the Recovery Rebate Instructions Form 1040 is offered as well as the merchandise's potential eligibility. Certain companies may allow it, but others won't.

3. What is the time frame to receive a Recovery Rebate Instructions Form 1040? The time frame differs, but it can take anywhere from a couple of weeks to a couple of months before you get your Recovery Rebate Instructions Form 1040.

4. Do I need to pay taxes regarding Recovery Rebate Instructions Form 1040 funds? most cases, Recovery Rebate Instructions Form 1040 amounts are not considered taxable income.

5. Should I be able to trust Recovery Rebate Instructions Form 1040 deals from lesser-known brands It's important to do your research and confirm that the company giving the Recovery Rebate Instructions Form 1040 is reliable prior to making the purchase.

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

Check more sample of Recovery Rebate Instructions Form 1040 below

Solved Recovery Rebate Credit Error On 1040 Instructions

How Do I Claim The Recovery Rebate Credit On My Ta

1040 Recovery Rebate Credit Worksheet

1040 Recovery Rebate Credit Drake20

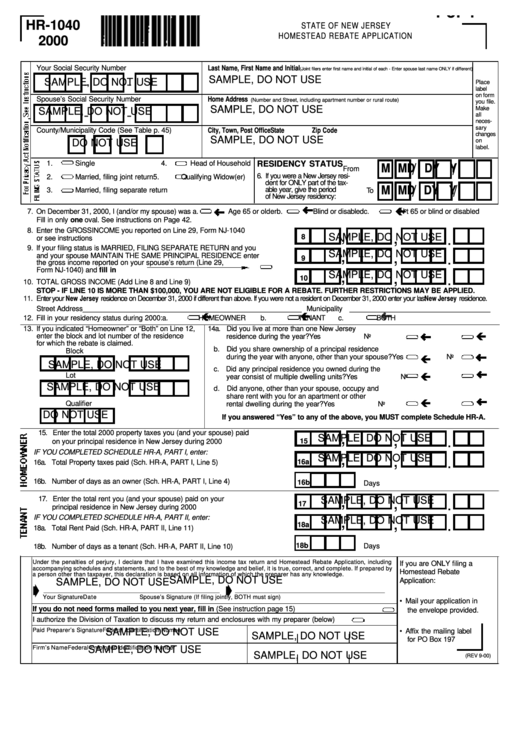

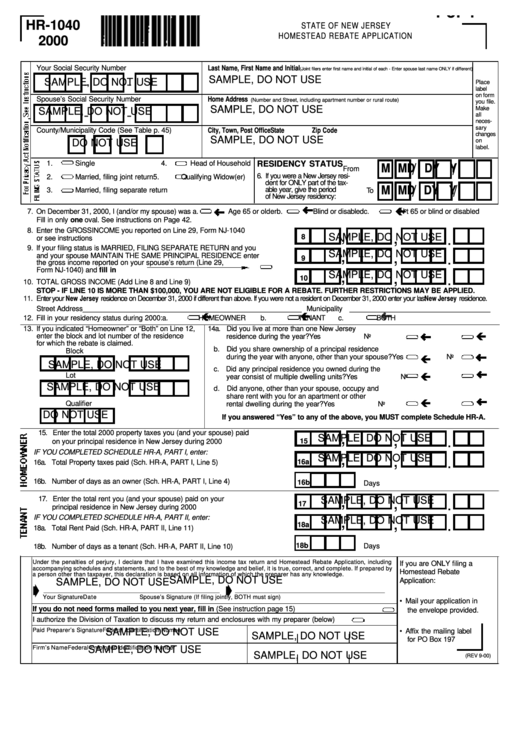

Form Hr 1040 Sample Homestead Rebate Application 2000 Printable Pdf

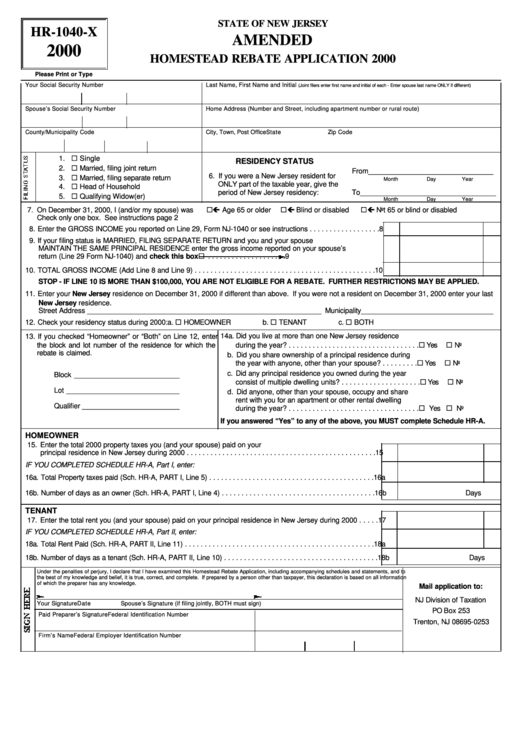

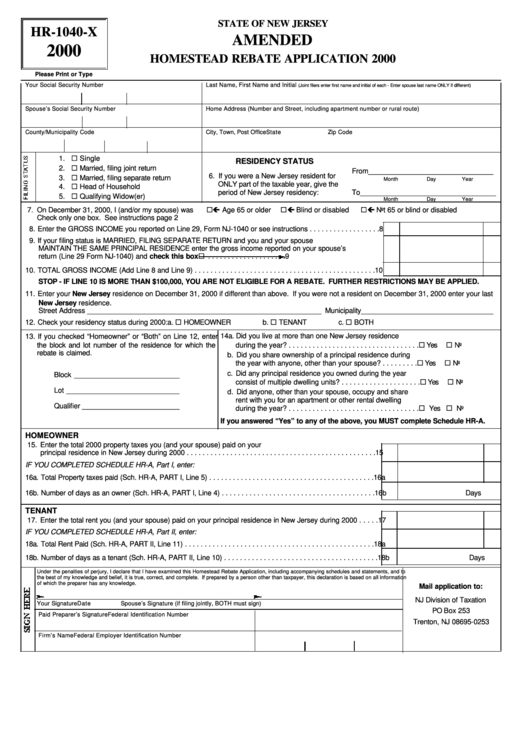

Fillable Form Hr 1040 X Amended Homestead Rebate Application 2000

https://www.irs.gov/newsroom/recovery-rebate-credit

Web 20 Dez 2022 nbsp 0183 32 IRS Statements and Announcements Page Last Reviewed or Updated 20 Dec 2022 Eligible individuals can claim the Recovery Rebate Credit on their Form 1040

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-c...

Web 10 Dez 2021 nbsp 0183 32 A3 You must file a 2020 tax return to claim a Recovery Rebate Credit even if you don t usually file a tax return The Recovery Rebate Credit Worksheet in the

Web 20 Dez 2022 nbsp 0183 32 IRS Statements and Announcements Page Last Reviewed or Updated 20 Dec 2022 Eligible individuals can claim the Recovery Rebate Credit on their Form 1040

Web 10 Dez 2021 nbsp 0183 32 A3 You must file a 2020 tax return to claim a Recovery Rebate Credit even if you don t usually file a tax return The Recovery Rebate Credit Worksheet in the

1040 Recovery Rebate Credit Drake20

How Do I Claim The Recovery Rebate Credit On My Ta

Form Hr 1040 Sample Homestead Rebate Application 2000 Printable Pdf

Fillable Form Hr 1040 X Amended Homestead Rebate Application 2000

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

Free File 1040 Form 2021 Recovery Rebate

Free File 1040 Form 2021 Recovery Rebate

How To Claim The Stimulus Money On Your Tax Return Wltx