In today's consumer-driven world we all love a good bargain. One method of gaining substantial savings on your purchases can be achieved through Recovery Rebate Credit Irs Forms. They are a form of marketing employed by retailers and manufacturers in order to offer customers a small refund on their purchases after they've created them. In this article, we'll look into the world of Recovery Rebate Credit Irs Forms, examining the nature of them, how they work, and how you can maximise your savings through these cost-effective incentives.

Get Latest Recovery Rebate Credit Irs Form Below

Recovery Rebate Credit Irs Form

Recovery Rebate Credit Irs Form - Recovery Rebate Credit Irs Form, Irs Forms 2021 Recovery Rebate Credit Worksheet, What Is Irs Recovery Rebate Credit

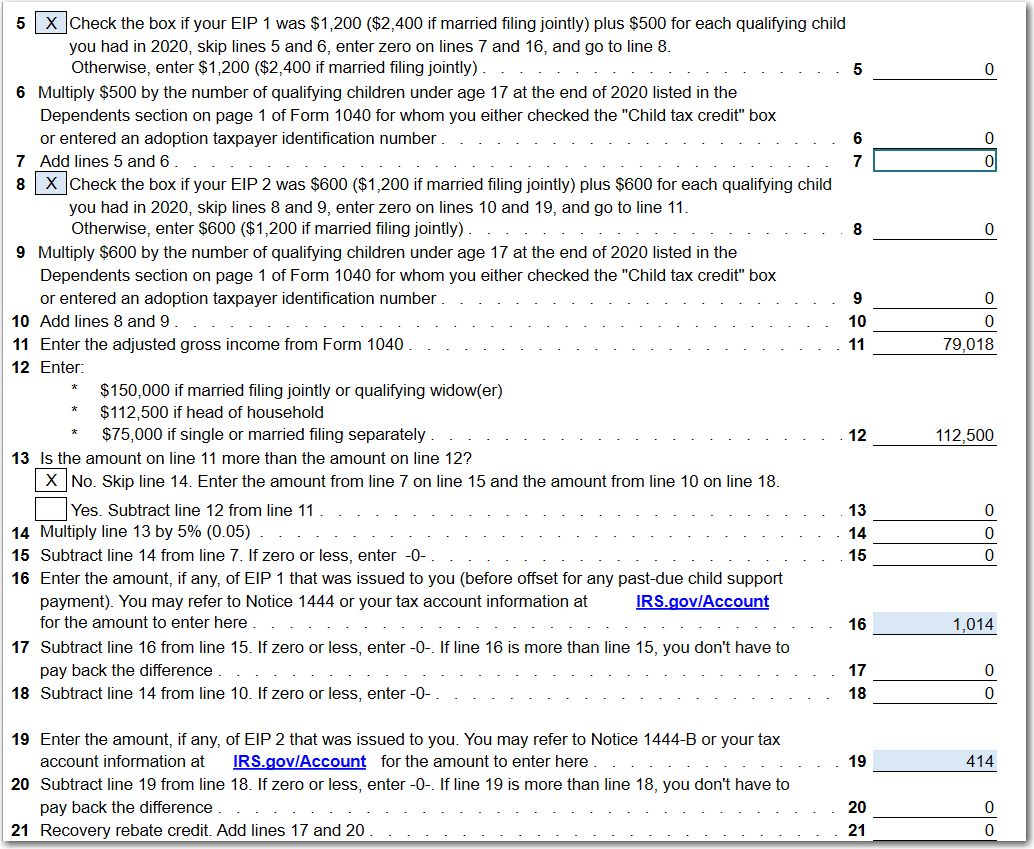

To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form 1040 and Form 1040 SR Instructions PDF Enter the computed amount from the worksheet onto line 30 Recovery Rebate Credit of your 2020 Form 1040 or 2020

The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit Your 2021 Recovery Rebate Credit will reduce any tax

A Recovery Rebate Credit Irs Form as it is understood in its simplest model, refers to a partial return to the customer after purchasing a certain product or service. It's an effective way utilized by businesses to attract customers, boost sales, as well as promote particular products.

Types of Recovery Rebate Credit Irs Form

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

No matter how you file you will need to do the following to claim the 2021 Recovery Rebate Credit Compute the 2021 Recovery Rebate Credit amount using tax preparation software or the line 30 worksheet found in 2021 Form 1040 and Form 1040 SR Instructions

Recovery Rebate Credit on a 2020 Tax Return Most people who are eligible for the 2020 Recovery Rebate Credit have already received it in advance in the first two rounds of Economic Impact Payments Missing first and second payments may only be claimed on a 2020 tax return

Cash Recovery Rebate Credit Irs Form

Cash Recovery Rebate Credit Irs Form are probably the most simple type of Recovery Rebate Credit Irs Form. Customers get a set sum of money back when purchasing a particular item. They are typically used to purchase high-ticket items like electronics or appliances.

Mail-In Recovery Rebate Credit Irs Form

Mail-in Recovery Rebate Credit Irs Form need customers to present the proof of purchase in order to receive their money back. They're a bit more complicated, but they can provide significant savings.

Instant Recovery Rebate Credit Irs Form

Instant Recovery Rebate Credit Irs Form are applied at the points of sale. This reduces the price of purchases immediately. Customers don't have to wait for their savings when they purchase this type of Recovery Rebate Credit Irs Form.

How Recovery Rebate Credit Irs Form Work

How Do I Claim The Recovery Rebate Credit On My Ta

How Do I Claim The Recovery Rebate Credit On My Ta

2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form 1040 U S Individual Income Tax Return or Form 1040 SR

The Recovery Rebate Credit Irs Form Process

The process usually involves a few steps:

-

Buy the product: At first you purchase the item just as you would ordinarily.

-

Fill in your Recovery Rebate Credit Irs Form forms: The Recovery Rebate Credit Irs Form form will need to fill in some information, such as your name, address and the purchase details, in order to submit your Recovery Rebate Credit Irs Form.

-

Submit the Recovery Rebate Credit Irs Form: Depending on the type of Recovery Rebate Credit Irs Form, you may need to mail a Recovery Rebate Credit Irs Form form in or upload it online.

-

Wait for approval: The company will look over your submission for compliance with Recovery Rebate Credit Irs Form's terms and conditions.

-

Get your Recovery Rebate Credit Irs Form Once it's approved, you'll receive the refund via check, prepaid card or through a different method specified by the offer.

Pros and Cons of Recovery Rebate Credit Irs Form

Advantages

-

Cost savings Recovery Rebate Credit Irs Form can dramatically cut the price you pay for the product.

-

Promotional Offers Customers are enticed to try new products or brands.

-

Improve Sales Recovery Rebate Credit Irs Form can increase companies' sales and market share.

Disadvantages

-

Complexity Reward mail-ins particularly may be lengthy and long-winded.

-

Time Limits for Recovery Rebate Credit Irs Form A majority of Recovery Rebate Credit Irs Form have certain deadlines for submitting.

-

Risque of Non-Payment Some customers might miss out on Recovery Rebate Credit Irs Form because they don't follow the regulations precisely.

Download Recovery Rebate Credit Irs Form

Download Recovery Rebate Credit Irs Form

FAQs

1. Are Recovery Rebate Credit Irs Form the same as discounts? No, Recovery Rebate Credit Irs Form offer partial reimbursement after purchase whereas discounts will reduce the purchase price at time of sale.

2. Can I make use of multiple Recovery Rebate Credit Irs Form on the same product What is the best way to do it? It's contingent on conditions and conditions of Recovery Rebate Credit Irs Form promotions and on the products acceptance. Certain companies might permit it, while others won't.

3. How long does it take to get an Recovery Rebate Credit Irs Form? The time frame differs, but could take anywhere from a couple of weeks to a few months for you to receive your Recovery Rebate Credit Irs Form.

4. Do I have to pay tax in relation to Recovery Rebate Credit Irs Form amounts? In the majority of circumstances, Recovery Rebate Credit Irs Form amounts are not considered taxable income.

5. Can I trust Recovery Rebate Credit Irs Form offers from brands that aren't well-known It is essential to investigate and confirm that the company offering the Recovery Rebate Credit Irs Form is reputable before making a purchase.

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Check more sample of Recovery Rebate Credit Irs Form below

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

Recovery Rebate Credit Worksheet ATX Line 30 COVID 19 ATX Community

1040 EF Message 0006 Recovery Rebate Credit Drake20

Tax Time Guide Didn t Get Economic Impact Payments Check Eligibility

Recovery Rebate Credit Irs Form Recovery Rebate

https://www.irs.gov/newsroom/2021-recovery-rebate...

The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit Your 2021 Recovery Rebate Credit will reduce any tax

https://www.irs.gov/newsroom/2021-recovery-rebate...

The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible for the credit If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit Your 2021 Recovery Rebate Credit will reduce any tax

The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible for the credit If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

1040 EF Message 0006 Recovery Rebate Credit Drake20

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

Tax Time Guide Didn t Get Economic Impact Payments Check Eligibility

Recovery Rebate Credit Irs Form Recovery Rebate

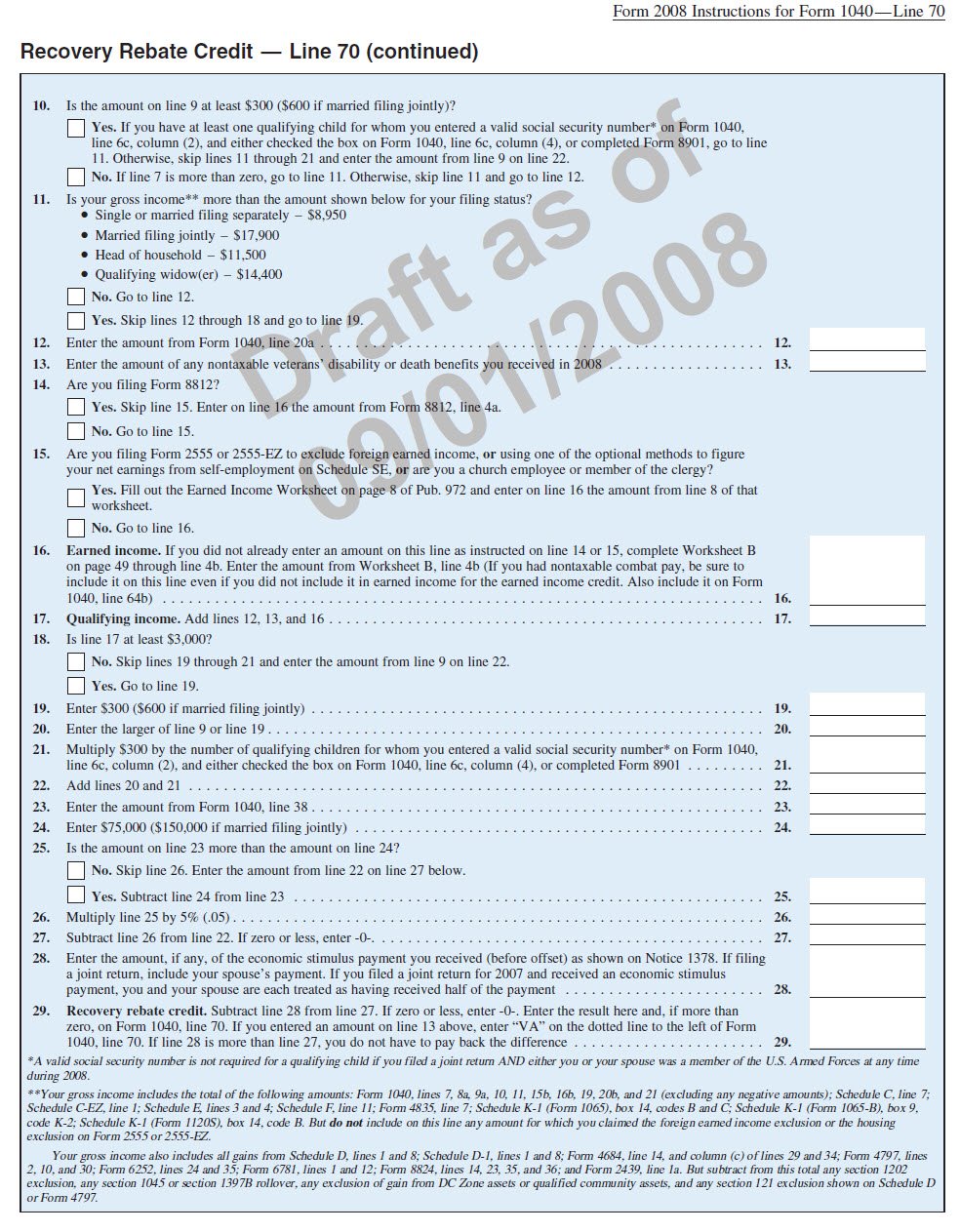

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

Free File 1040 Form 2021 Recovery Rebate

Free File 1040 Form 2021 Recovery Rebate

What Is The Recovery Rebate Credit CD Tax Financial