In today's consumer-driven world every person loves a great deal. One of the ways to enjoy significant savings for your purchases is through Rebates In Accountings. They are a form of marketing used by manufacturers and retailers for offering customers a percentage reimbursement on their purchases following the time they have purchased them. In this article, we'll dive into the world Rebates In Accountings. We'll look at what they are and how they operate, and ways you can increase your savings with these cost-effective incentives.

Get Latest Rebates In Accounting Below

Rebates In Accounting

Rebates In Accounting -

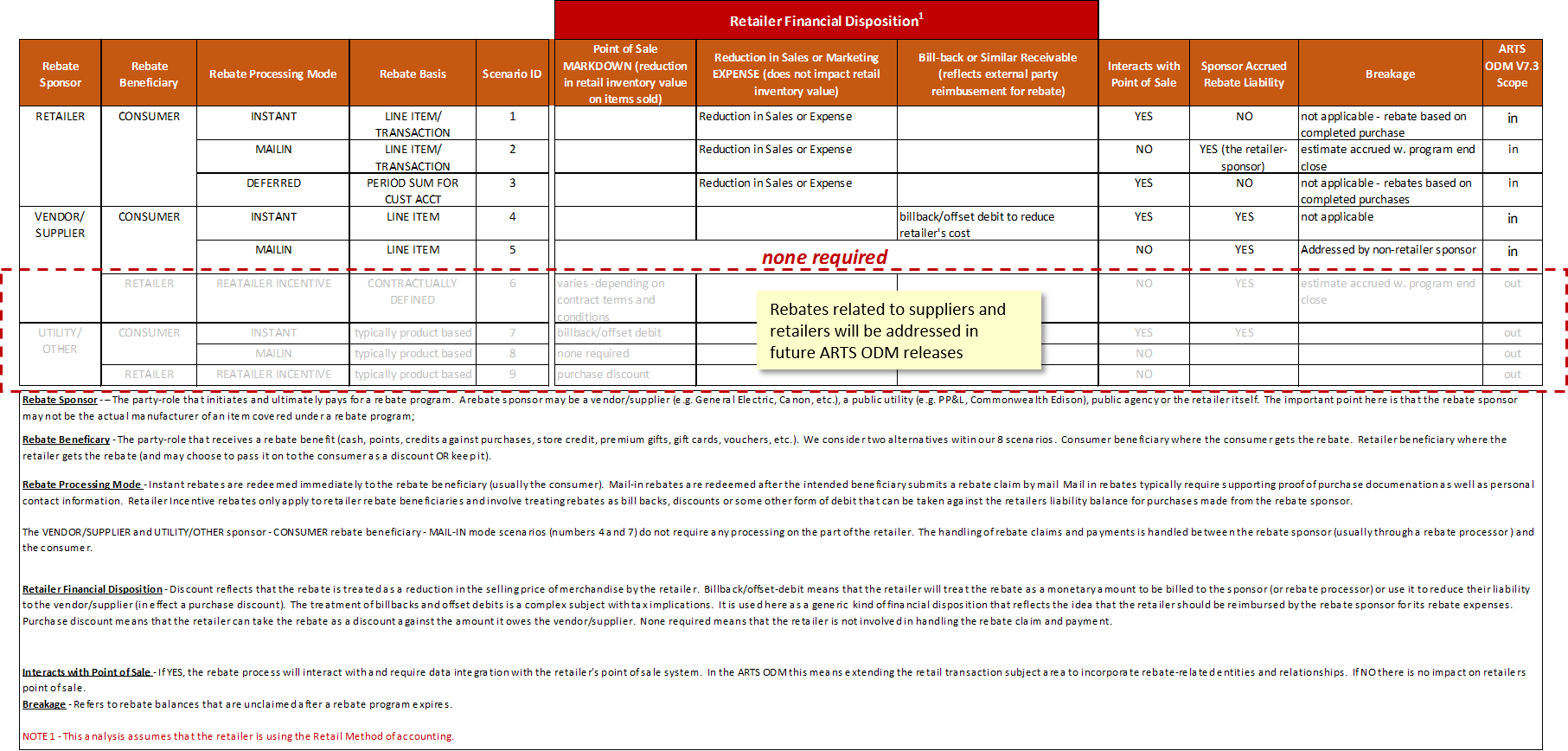

Verkko Accounting Tax Global IFRS Viewpoint Inventory discounts and rebates What s the issue Discounts and rebates can be offered to purchasers in a number of ways for

Verkko 7 hein 228 k 2022 nbsp 0183 32 A rebate is a payment back to a buyer of a portion of the full purchase price of a good or service This payment is typically triggered by the

A Rebates In Accounting or Rebates In Accounting, in its most basic version, is an ad-hoc refund to a purchaser after purchasing a certain product or service. This is a potent tool that businesses use to draw customers, boost sales, and market specific products.

Types of Rebates In Accounting

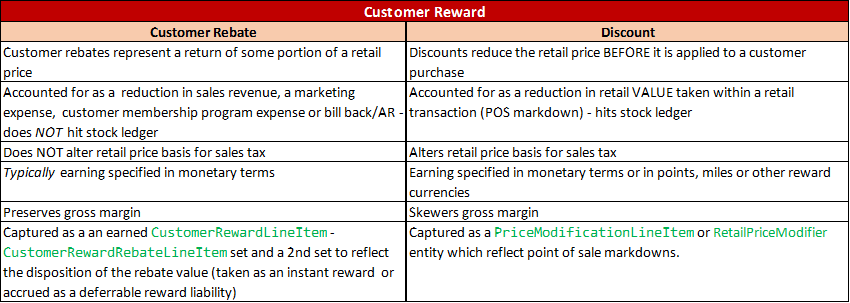

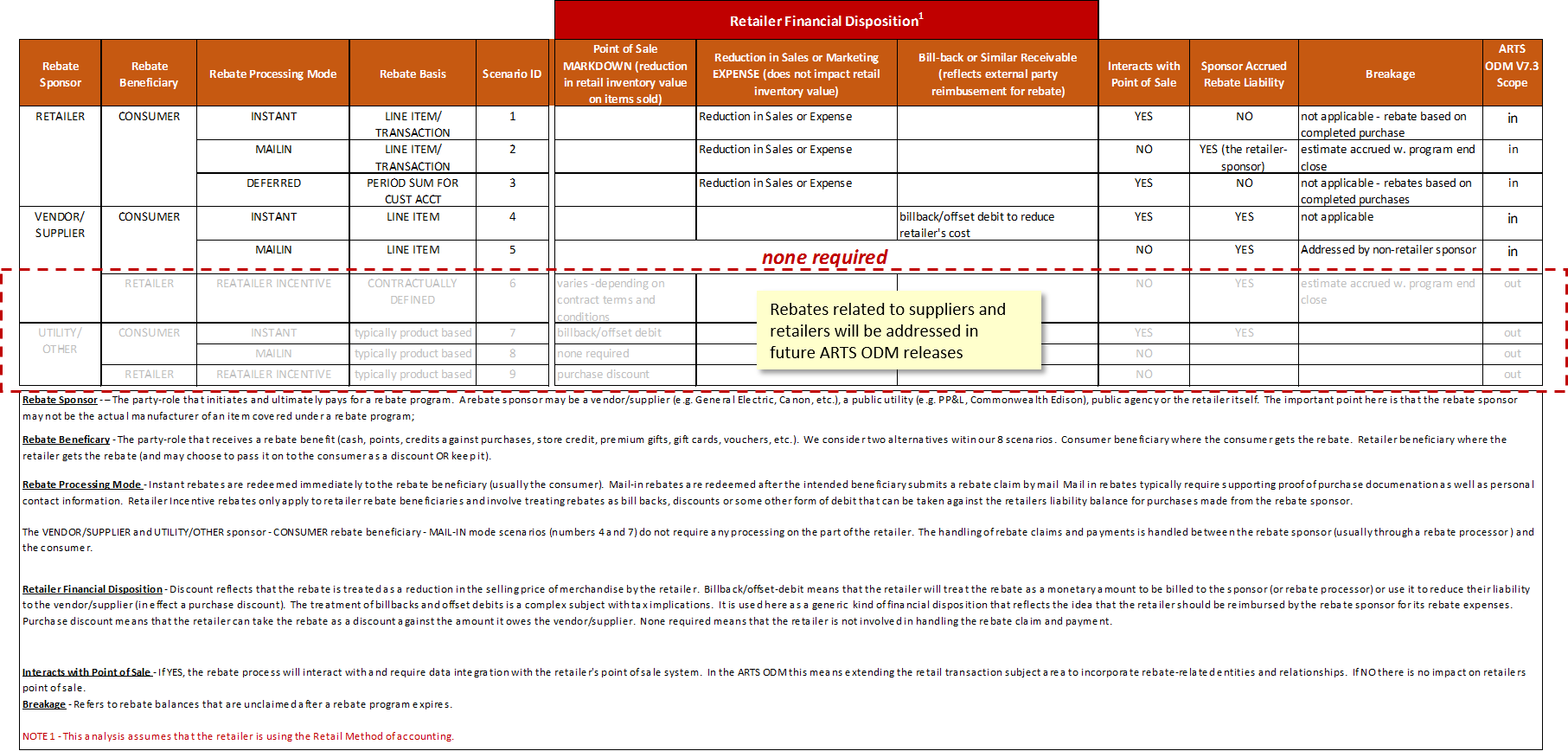

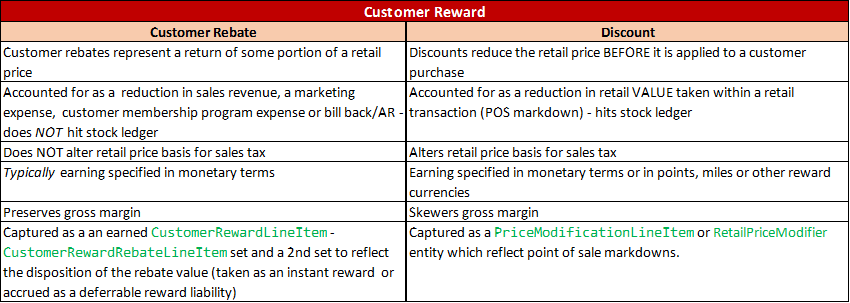

Understanding Customer Rebates

Understanding Customer Rebates

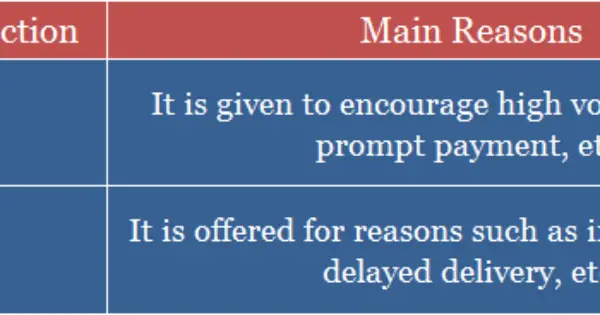

Verkko Rebates and discounts are distinct forms of price cuts that directly or indirectly promote the overall sales of a business Both the terms may sound similar however there is

Verkko What is Vendor Rebates Accounting Treatment Vendor rebates exist so that companies can better manage their supplier rebate programs The rebate will specify the terms in which the company qualifies

Cash Rebates In Accounting

Cash Rebates In Accounting are probably the most simple kind of Rebates In Accounting. Customers receive a specific amount of money back after purchasing a item. These are often used for big-ticket items, like electronics and appliances.

Mail-In Rebates In Accounting

Mail-in Rebates In Accounting need customers to send in their proof of purchase before receiving their money back. They are a bit more complicated but could provide substantial savings.

Instant Rebates In Accounting

Instant Rebates In Accounting will be applied at point of sale and reduce the purchase cost immediately. Customers do not have to wait until they can save in this manner.

How Rebates In Accounting Work

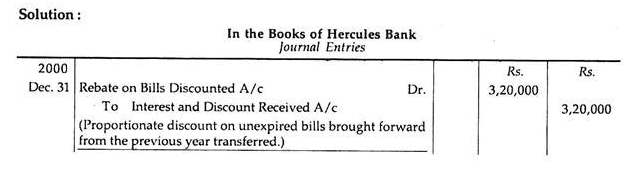

Rebate On Bills Discounted Banking Company Accounts Advanced

Rebate On Bills Discounted Banking Company Accounts Advanced

Verkko Rebates are a retrospective payment from a supplier to a customer that ultimately reduces the cost of a product at a later date Discounts are immediate rebates are delayed But like discounts rebates come in

The Rebates In Accounting Process

The process typically involves few simple steps:

-

Purchase the product: First purchase the product like you normally do.

-

Fill in your Rebates In Accounting application: In order to claim your Rebates In Accounting, you'll need to provide some data including your name, address, and details about your purchase, in order to submit your Rebates In Accounting.

-

Complete the Rebates In Accounting In accordance with the nature of Rebates In Accounting you will need to mail a Rebates In Accounting form in or make it available online.

-

Wait for approval: The company will go through your application and ensure that it's compliant with reimbursement's terms and condition.

-

Enjoy your Rebates In Accounting After being approved, you'll be able to receive your reimbursement, whether by check, prepaid card, or other method specified by the offer.

Pros and Cons of Rebates In Accounting

Advantages

-

Cost Savings A Rebates In Accounting can significantly reduce the price you pay for the product.

-

Promotional Offers Customers are enticed to explore new products or brands.

-

Enhance Sales Rebates In Accounting can help boost companies' sales and market share.

Disadvantages

-

Complexity Rebates In Accounting that are mail-in, in particular could be cumbersome and demanding.

-

Extension Dates A majority of Rebates In Accounting have rigid deadlines to submit.

-

A risk of not being paid: Some customers may not receive their Rebates In Accounting if they don't adhere to the rules precisely.

Download Rebates In Accounting

Download Rebates In Accounting

FAQs

1. Are Rebates In Accounting the same as discounts? No, Rebates In Accounting offer a partial refund after the purchase, whereas discounts cut the price of the purchase at the time of sale.

2. Are multiple Rebates In Accounting available on the same item This depends on the terms of the Rebates In Accounting offer and also the item's ability to qualify. Certain businesses may allow this, whereas others will not.

3. What is the time frame to get an Rebates In Accounting? The period varies, but it can be anywhere from a few weeks up to a several months to receive a Rebates In Accounting.

4. Do I need to pay tax when I receive Rebates In Accounting sums? the majority of situations, Rebates In Accounting amounts are not considered to be taxable income.

5. Can I trust Rebates In Accounting offers from brands that aren't well-known It's crucial to research to ensure that the name that is offering the Rebates In Accounting is reputable prior making an purchase.

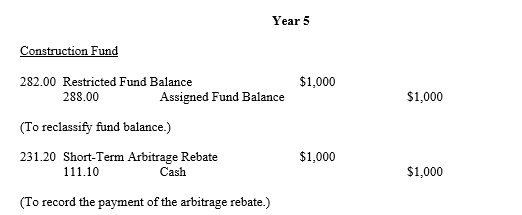

Arbitrage Rebates Office Of The Washington State Auditor

Difference Between Discount And Rebate with Example

Check more sample of Rebates In Accounting below

Retiring A Bill Of Exchange Under Rebate Journal Entries Finance

Understanding Customer Rebates

Rebate Calculator Accounts Flow

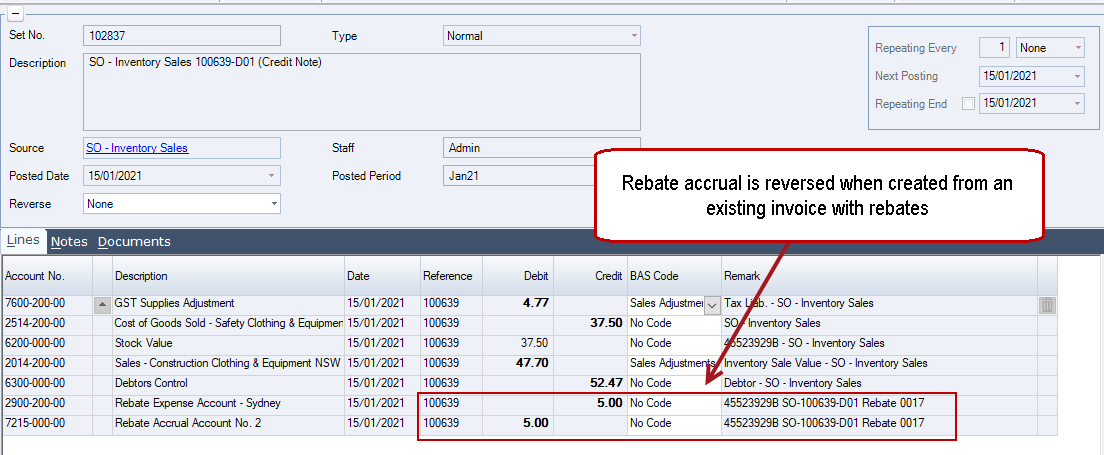

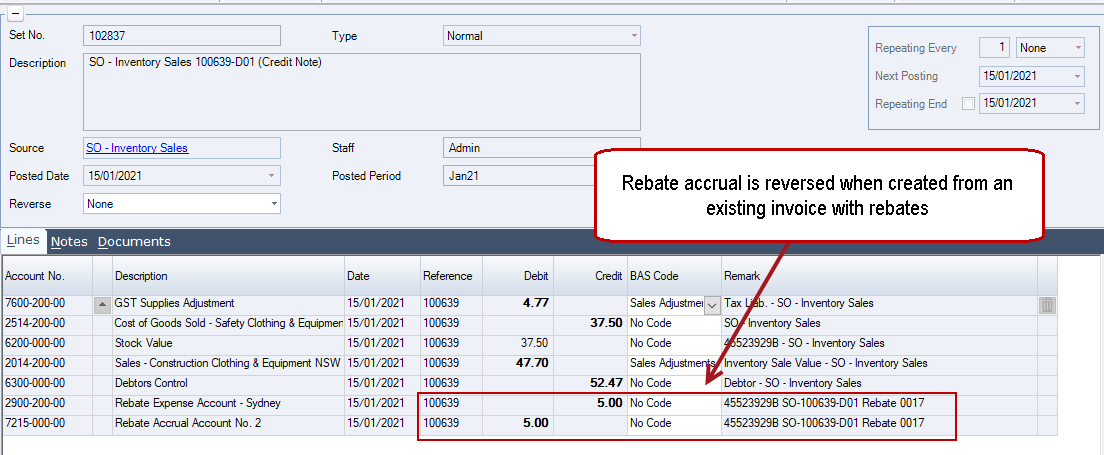

Rebates Rebate Accruals JIWA Training

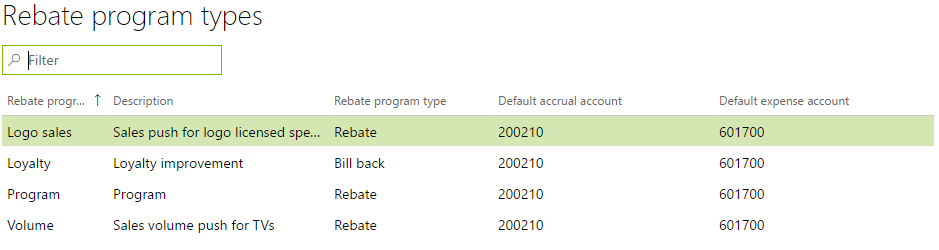

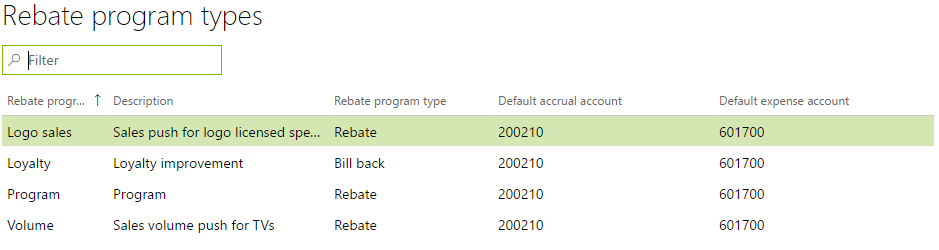

Rebate In MM SAP Blogs

7 Common Problems With Accounting For Rebates Enable

https://www.timesmojo.com/how-are-rebates-recorded-in-accounting

Verkko 7 hein 228 k 2022 nbsp 0183 32 A rebate is a payment back to a buyer of a portion of the full purchase price of a good or service This payment is typically triggered by the

https://www.solvexia.com/blog/rebate-accoun…

Verkko 6 huhtik 2022 nbsp 0183 32 A rebate is a retroactive payment back to a buyer of a good or service After the sale has been made the rebate lowers the full purchase price by returning either a lump sum or percentage of the

Verkko 7 hein 228 k 2022 nbsp 0183 32 A rebate is a payment back to a buyer of a portion of the full purchase price of a good or service This payment is typically triggered by the

Verkko 6 huhtik 2022 nbsp 0183 32 A rebate is a retroactive payment back to a buyer of a good or service After the sale has been made the rebate lowers the full purchase price by returning either a lump sum or percentage of the

Rebates Rebate Accruals JIWA Training

Understanding Customer Rebates

Rebate In MM SAP Blogs

7 Common Problems With Accounting For Rebates Enable

Rebate Accounting 10 Reasons Why Rebates Are Not Always Claimed Enable

Managing Rebates In Dynamics 365 For Operations AXSource

Managing Rebates In Dynamics 365 For Operations AXSource

Rebate Accounting Entries pdf Rebate Marketing Debits And Credits