In our modern, consumer-driven society we all love a good deal. One way to score significant savings when you shop is with Rebates Accounting Entrys. Rebates Accounting Entrys are a strategy for marketing used by manufacturers and retailers to offer customers a partial return on their purchases once they've completed them. In this post, we'll take a look at the world that is Rebates Accounting Entrys. We'll discuss what they are what they are, how they function, and how you can maximise the value of these incentives.

Get Latest Rebates Accounting Entry Below

Rebates Accounting Entry

Rebates Accounting Entry - Rebates Accounting Entry, Rebates Journal Entry, Rebates Accounting Treatment, Rebates Accounting Treatment Ifrs, Rebate Journal Entry Class 11, Rebate Accounting Entries In Sap, Customer Rebates Accounting Entry, Vendor Rebates Accounting Entry, Rebate Accounting Journal Entry, Rebate Accrual Accounting Entry

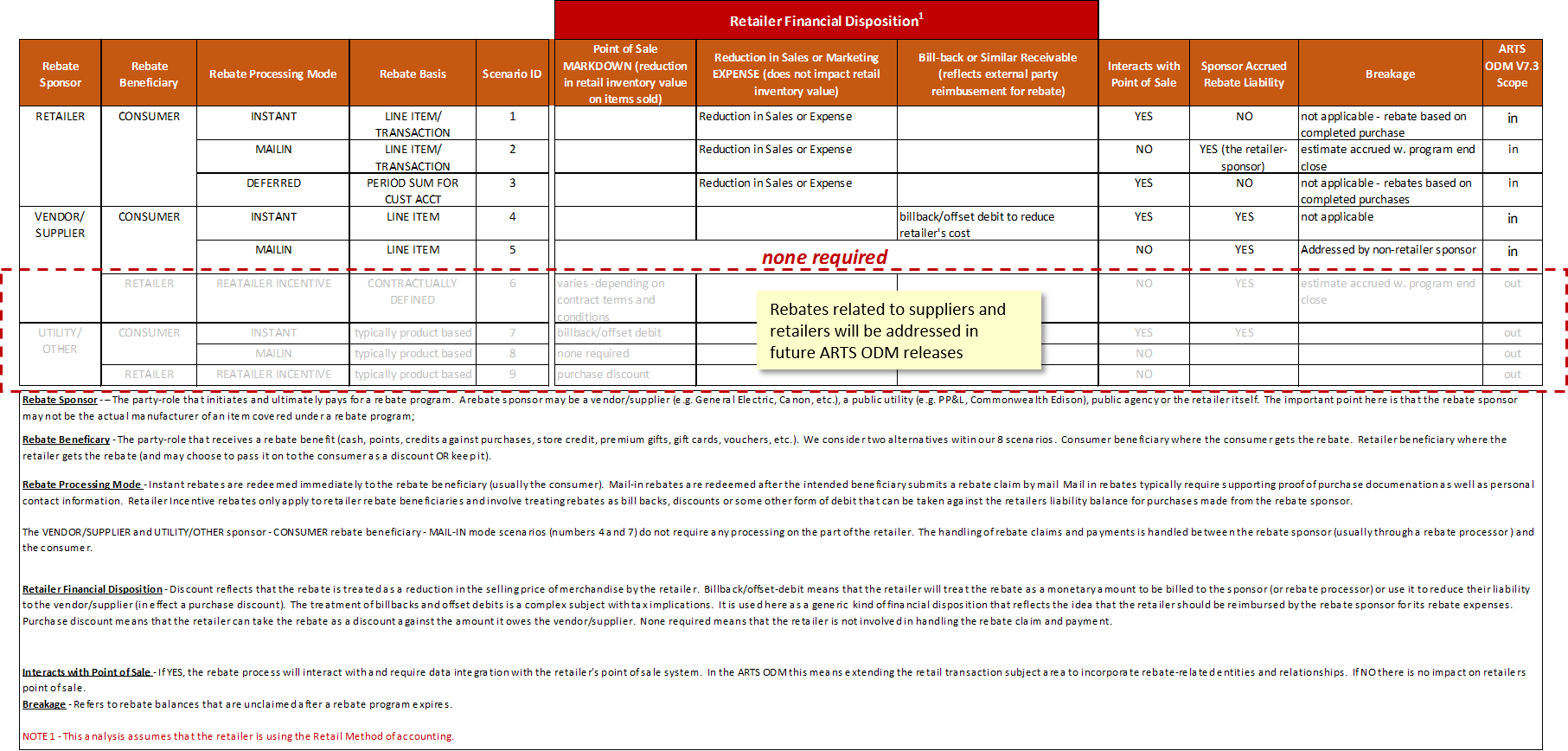

Web 1 sept 2023 nbsp 0183 32 While you re likely familiar with the concept of a rebate we are going to break down the different types of rebates to determine the proper accounting

Web 6 avr 2022 nbsp 0183 32 1 What is a Rebate 2 What are Supplier Rebates 3 What are the Types of Rebates 4 What is an Example of a Rebate 5 How to Account for Customer Rebates 6 How to Account for Vendor

A Rebates Accounting Entry in its simplest form, is a cash refund provided to customers following the purchase of a product or service. It's a powerful method utilized by businesses to attract buyers, increase sales and even promote certain products.

Types of Rebates Accounting Entry

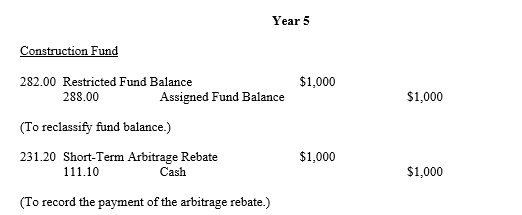

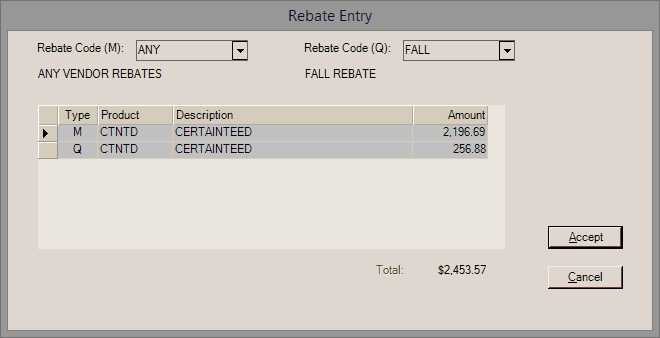

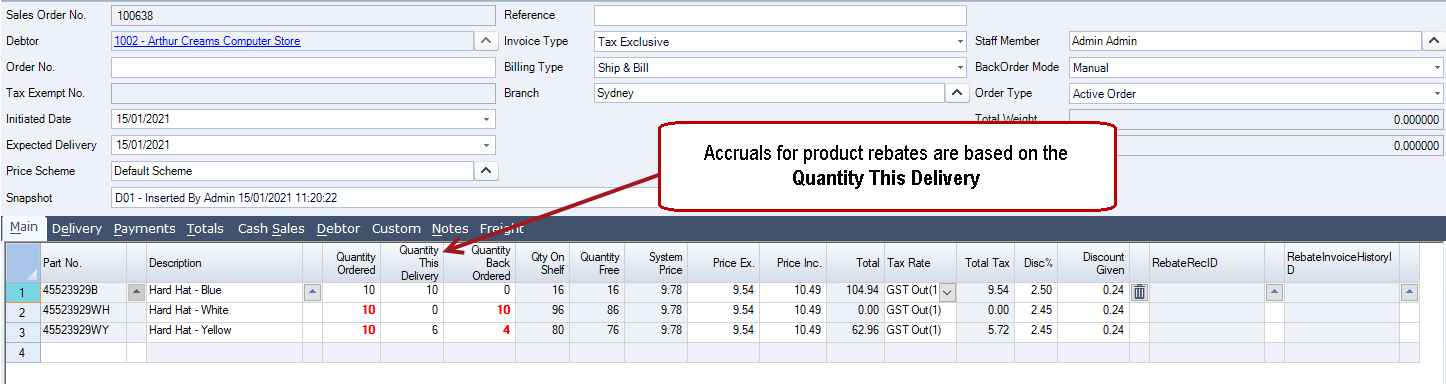

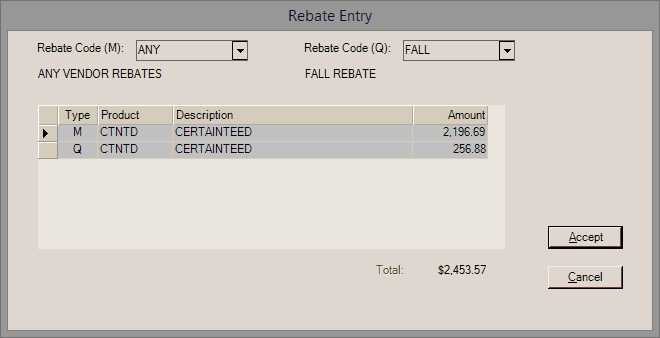

Rebates Rebate Accruals JIWA Training

Rebates Rebate Accruals JIWA Training

Web Discount A cash discount is recorded in the books of accounts while a trade discount is not Since the discount allowed is a clear expense for a business in order to earn revenue

Web 22 janv 2014 nbsp 0183 32 I am looking for Customer rebate accounting entries From the existing postings i found 2 different entries 1 Accrued Expense a c Dr Accrued Liability a c

Cash Rebates Accounting Entry

Cash Rebates Accounting Entry can be the simplest type of Rebates Accounting Entry. Clients receive a predetermined amount back in cash after purchasing a particular item. This is often for costly items like electronics or appliances.

Mail-In Rebates Accounting Entry

Mail-in Rebates Accounting Entry need customers to send in evidence of purchase to get the refund. They're a bit longer-lasting, however they offer huge savings.

Instant Rebates Accounting Entry

Instant Rebates Accounting Entry are applied right at the moment of sale, cutting prices immediately. Customers don't need to wait long for savings with this type.

How Rebates Accounting Entry Work

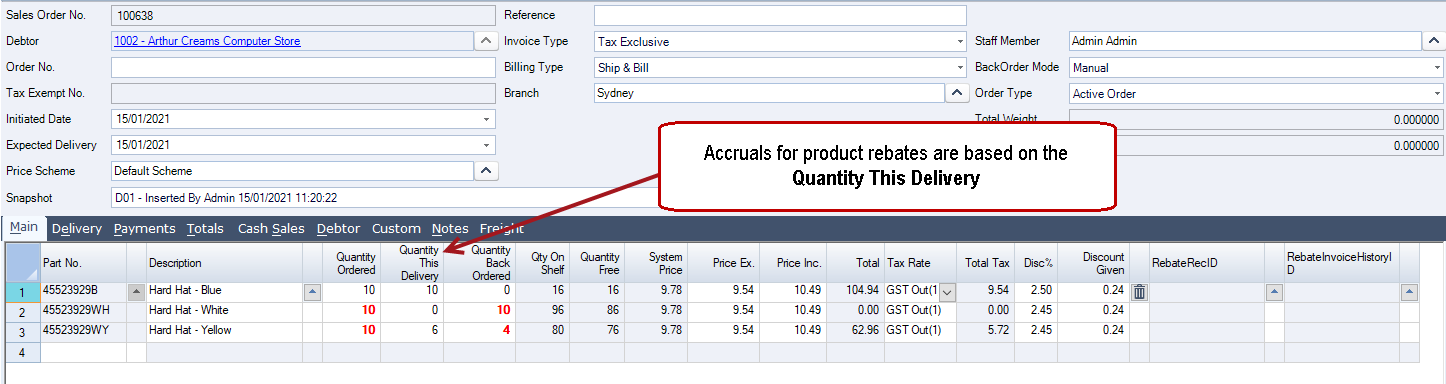

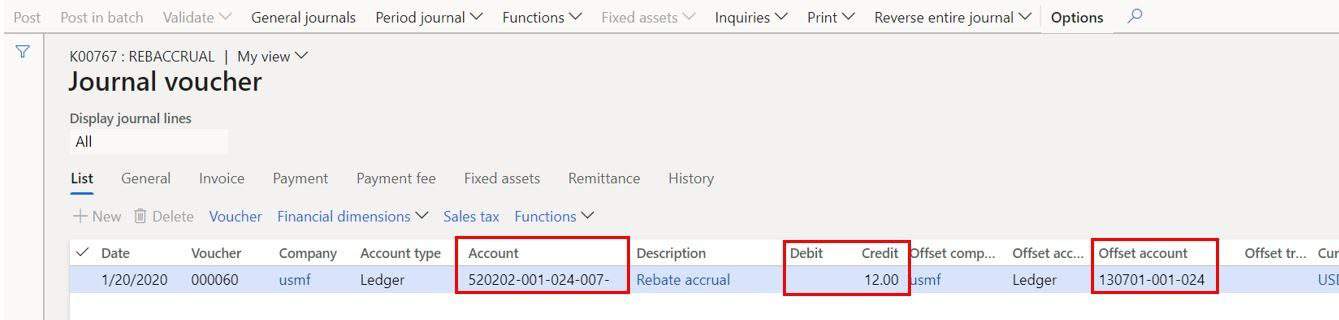

Managing Rebates In Dynamics 365 For Operations AXSource

Managing Rebates In Dynamics 365 For Operations AXSource

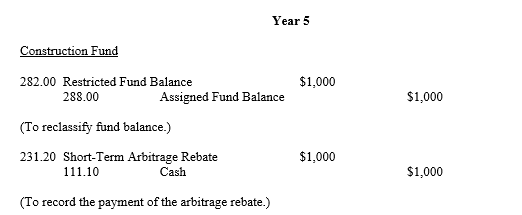

Web Journal entries for rebates are straightforward if the purpose of the accounting entry is considered A rebate is an amount repaid to a customer who has made a certain quantity or value of purchases

The Rebates Accounting Entry Process

The process typically involves a few simple steps:

-

Purchase the product: First then, you buy the item like you would normally.

-

Complete this Rebates Accounting Entry questionnaire: you'll need to fill in some information like your name, address, as well as the details of your purchase to apply for your Rebates Accounting Entry.

-

To submit the Rebates Accounting Entry Based on the nature of Rebates Accounting Entry the recipient may be required to mail in a form or make it available online.

-

Wait for the company's approval: They will examine your application to confirm that it complies with the requirements of the Rebates Accounting Entry.

-

Enjoy your Rebates Accounting Entry When it's approved you'll receive the refund via check, prepaid card, or by another option that's specified in the offer.

Pros and Cons of Rebates Accounting Entry

Advantages

-

Cost savings Rebates Accounting Entry could significantly decrease the price for an item.

-

Promotional Deals Customers are enticed to try out new products or brands.

-

Help to Increase Sales The benefits of a Rebates Accounting Entry can improve an organization's sales and market share.

Disadvantages

-

Complexity: Mail-in Rebates Accounting Entry, in particular are often time-consuming and time-consuming.

-

The Expiration Dates Many Rebates Accounting Entry have deadlines for submission.

-

Risk of Non-Payment: Some customers may not get their Rebates Accounting Entry if they do not adhere to the guidelines exactly.

Download Rebates Accounting Entry

Download Rebates Accounting Entry

FAQs

1. Are Rebates Accounting Entry the same as discounts? Not necessarily, as Rebates Accounting Entry are one-third of the amount refunded following purchase, whereas discounts decrease their price at point of sale.

2. Are multiple Rebates Accounting Entry available on the same item It's contingent upon the terms for the Rebates Accounting Entry promotions and on the products acceptance. Certain companies might allow it, while other companies won't.

3. What is the time frame to receive the Rebates Accounting Entry? The period is different, but it could take anywhere from a few weeks to a few months before you receive your Rebates Accounting Entry.

4. Do I need to pay tax regarding Rebates Accounting Entry quantities? most situations, Rebates Accounting Entry amounts are not considered to be taxable income.

5. Do I have confidence in Rebates Accounting Entry deals from lesser-known brands it is crucial to conduct research and make sure that the company that is offering the Rebates Accounting Entry is reputable prior to making an purchase.

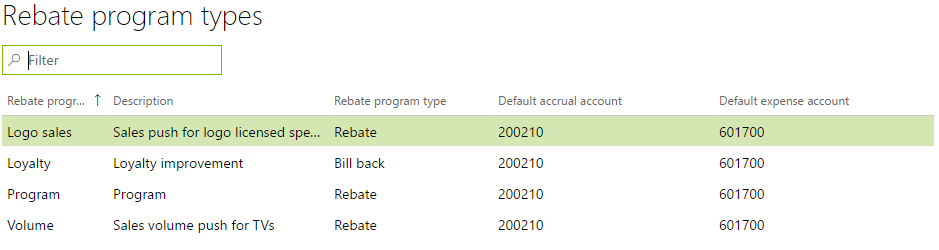

Volume Rebate Agreement Template

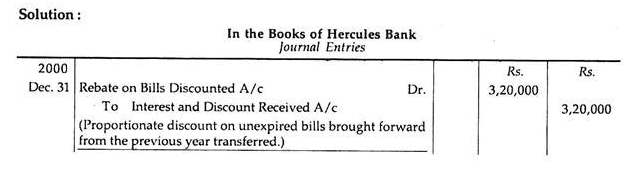

Rebate On Bills Discounted Banking Company Accounts Advanced

Check more sample of Rebates Accounting Entry below

Process Vendor Rebates Dynamics 365 Finance And Operations Dynamics Tips

Rebate Accounting Product

Inventory Rebate Accounting

Accounting Entries Accounting Entries Purchases

Application Areas Purchasing Receipts Functions

Rebate Accounting Product

![]()

https://www.solvexia.com/blog/rebate-accoun…

Web 6 avr 2022 nbsp 0183 32 1 What is a Rebate 2 What are Supplier Rebates 3 What are the Types of Rebates 4 What is an Example of a Rebate 5 How to Account for Customer Rebates 6 How to Account for Vendor

https://www.solvexia.com/blog/accounting-fo…

Web 1 What is a Rebate 2 What are Supplier and Vendor Rebates 3 How to Account for Vendor Rebates 4 How to Account for Customer Rebates 5 What is Vendor Rebates Accounting Treatment 6 What are

Web 6 avr 2022 nbsp 0183 32 1 What is a Rebate 2 What are Supplier Rebates 3 What are the Types of Rebates 4 What is an Example of a Rebate 5 How to Account for Customer Rebates 6 How to Account for Vendor

Web 1 What is a Rebate 2 What are Supplier and Vendor Rebates 3 How to Account for Vendor Rebates 4 How to Account for Customer Rebates 5 What is Vendor Rebates Accounting Treatment 6 What are

Accounting Entries Accounting Entries Purchases

Rebate Accounting Product

Application Areas Purchasing Receipts Functions

Rebate Accounting Product

Inventory Rebate Accounting

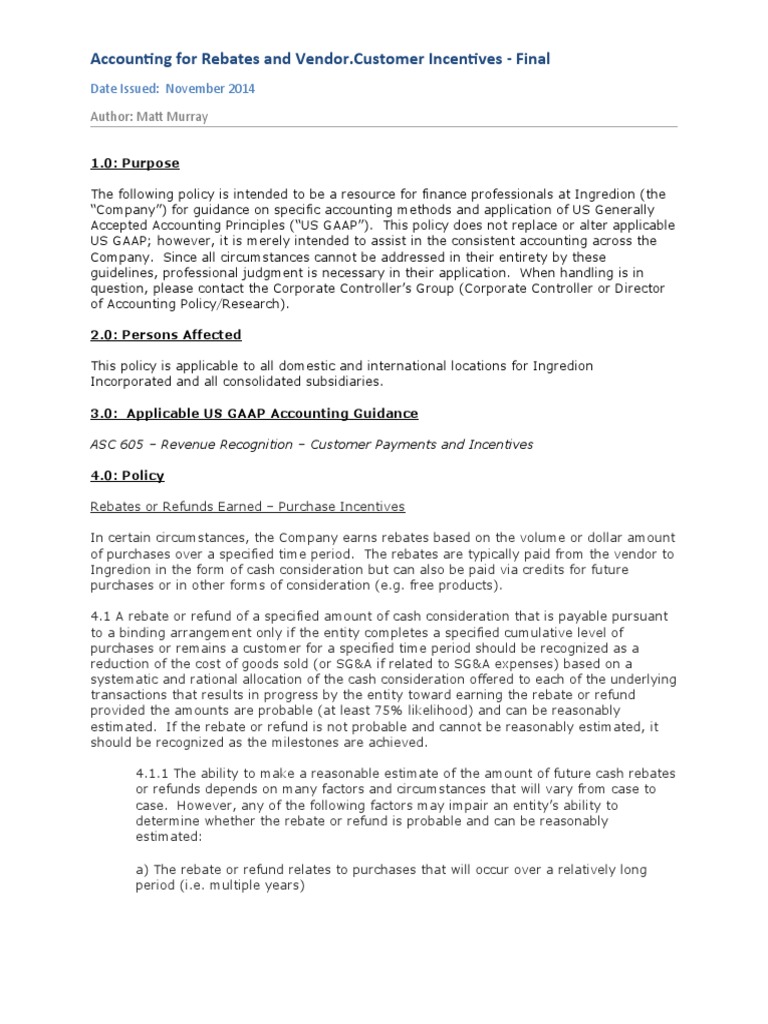

Accounting For Rebates And Vendor Customer Incentives Final PDF

Accounting For Rebates And Vendor Customer Incentives Final PDF

Rebate Accounting Product