In the modern world of consumerization everyone appreciates a great deal. One option to obtain substantial savings for your purchases is through Rebate Tax Credit Form 2023s. The use of Rebate Tax Credit Form 2023s is a method employed by retailers and manufacturers to offer customers a partial reimbursement on their purchases following the time they have created them. In this article, we'll delve into the world of Rebate Tax Credit Form 2023s and explore the nature of them, how they work, and ways you can increase your savings using these low-cost incentives.

Get Latest Rebate Tax Credit Form 2023 Below

Rebate Tax Credit Form 2023

Rebate Tax Credit Form 2023 -

Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit 2034 22 no annual maximum or lifetime limit

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

A Rebate Tax Credit Form 2023 is, in its most basic type, is a refund given to a client after having purchased a item or service. It's a highly effective tool employed by companies to draw clients, increase sales and also to advertise certain products.

Types of Rebate Tax Credit Form 2023

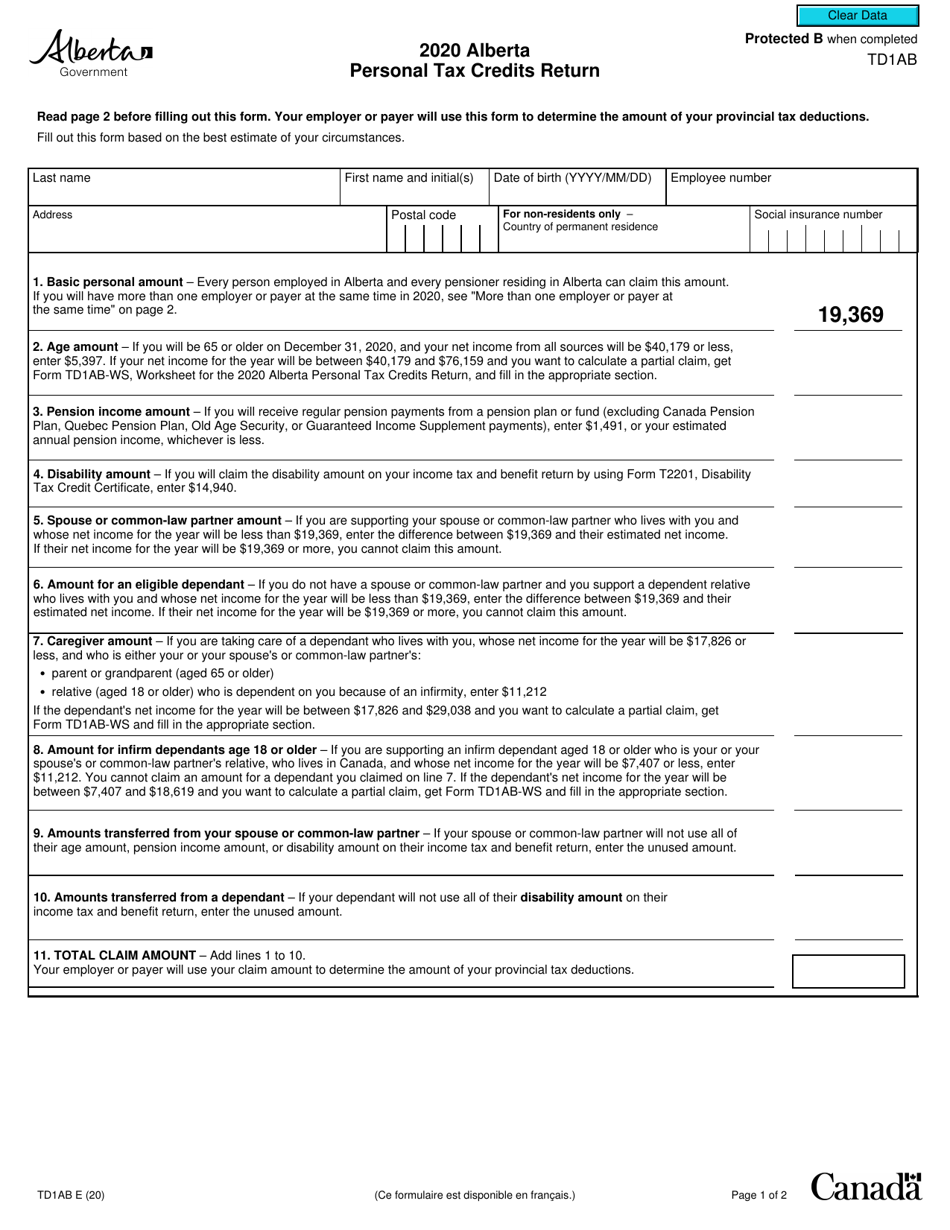

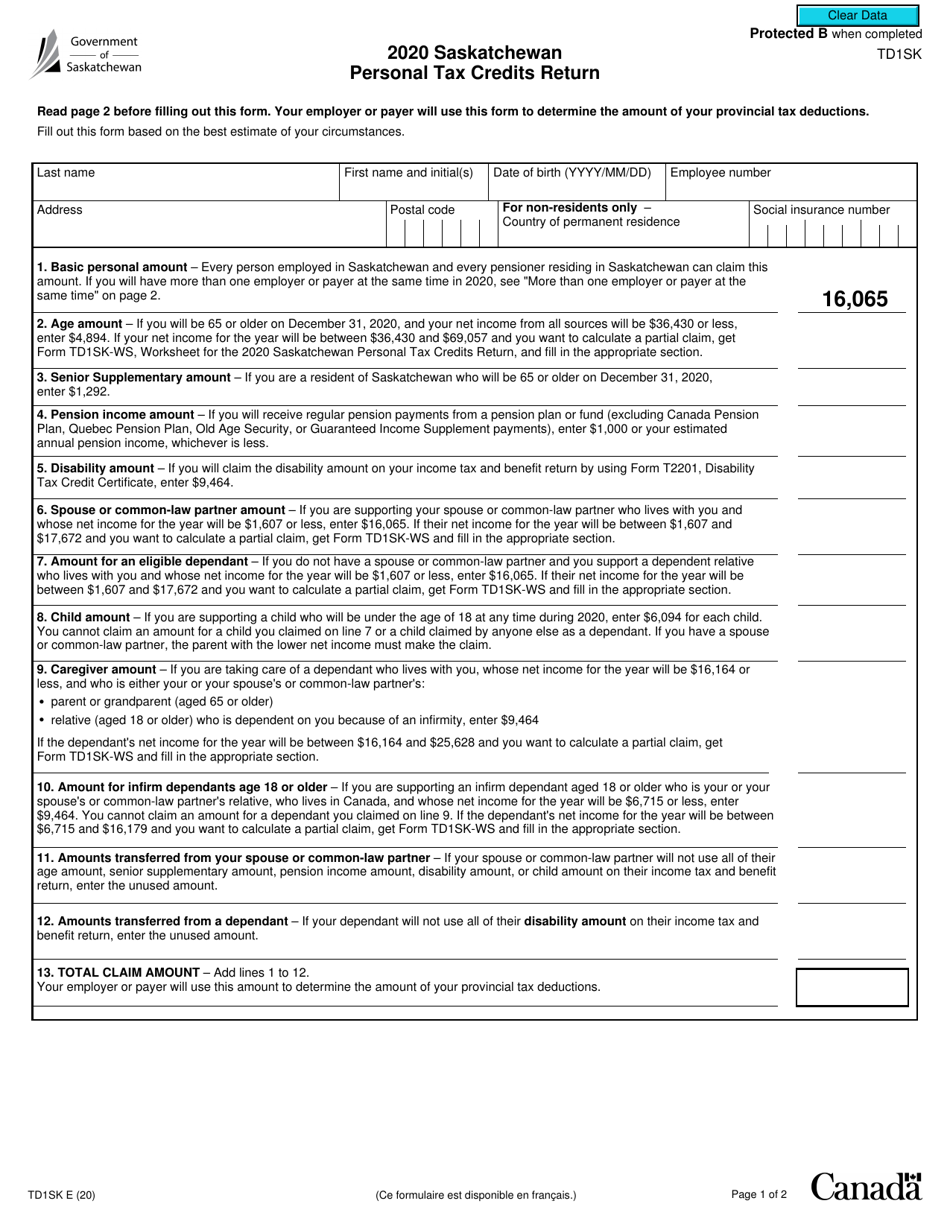

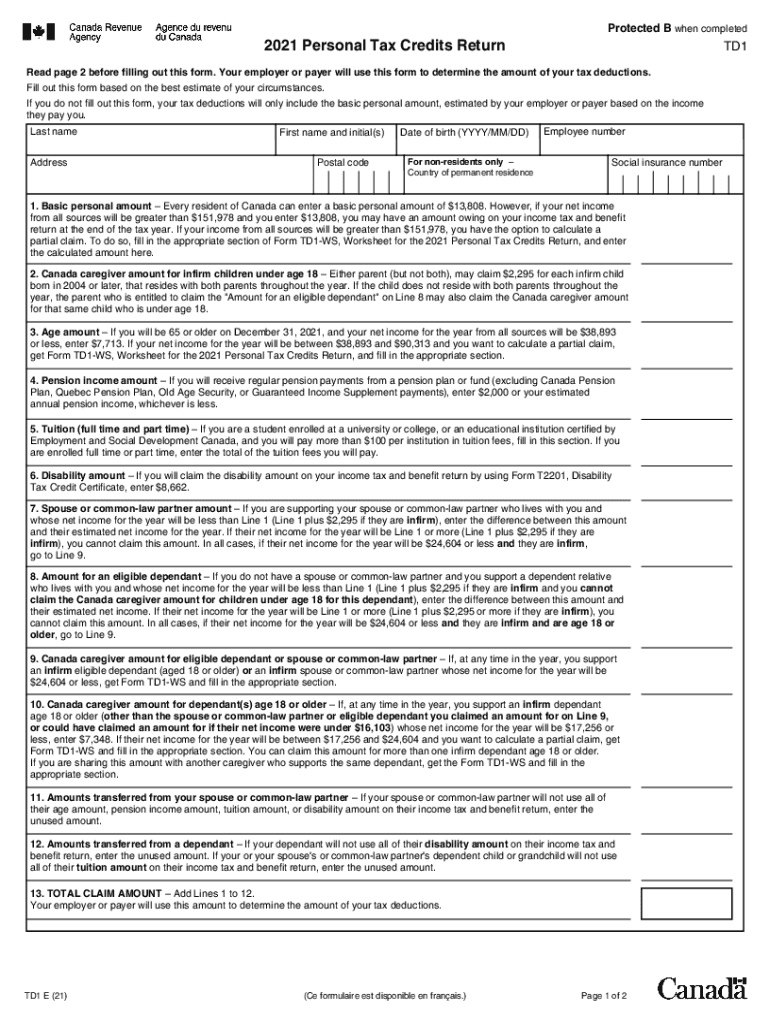

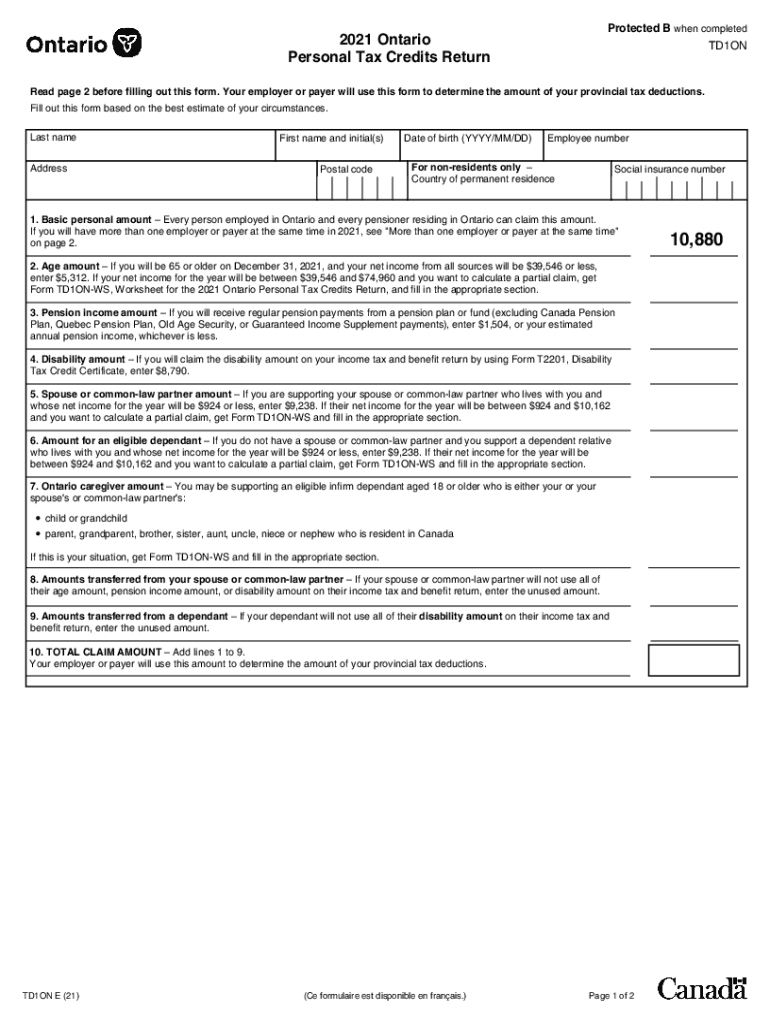

Td1 Fill Out Sign Online DocHub

Td1 Fill Out Sign Online DocHub

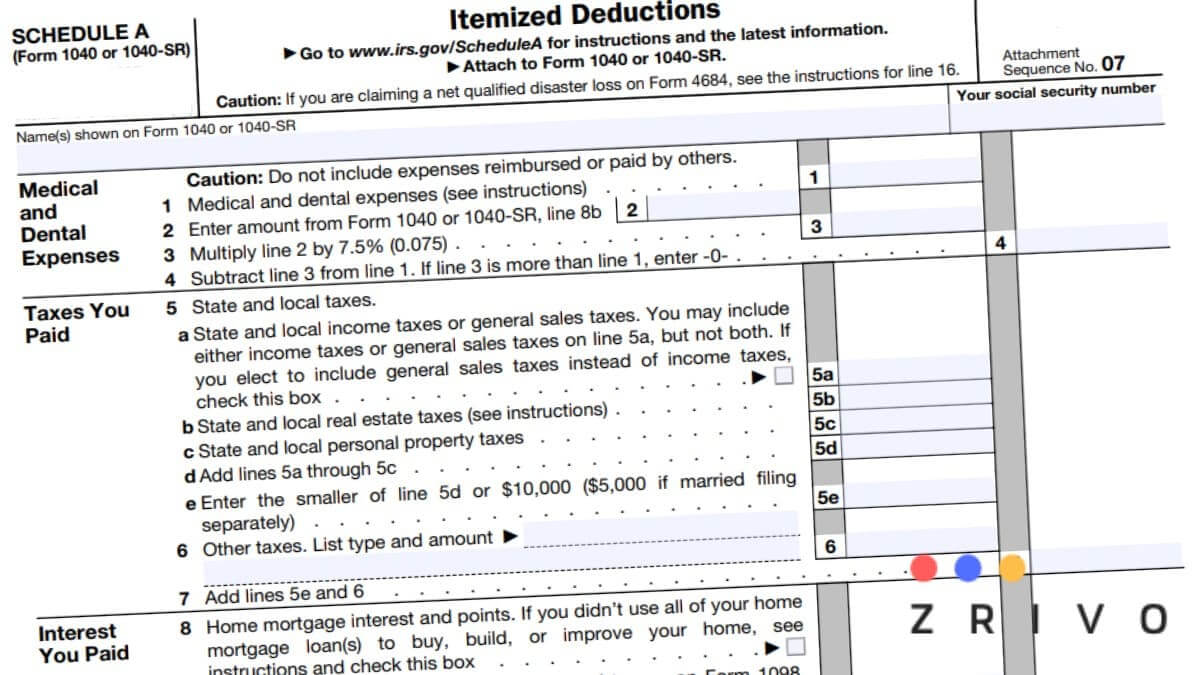

For 2023 taxes filed in 2024 the credit maxes out at 15 950 The credit is phased out at MAGI of 279 230 or more 7 Earned income tax credit Key IRS Tax Forms Schedules Publications

About Form 5695 Residential Energy Credits Instructions for Form 5695 2022 Page Last Reviewed or Updated 28 Aug 2023 If you invest in renewable energy for your home such as solar wind geothermal biomass fuel cells or battery storage you may qualify for a tax credit

Cash Rebate Tax Credit Form 2023

Cash Rebate Tax Credit Form 2023 can be the simplest kind of Rebate Tax Credit Form 2023. Customers are given a certain sum of money back when purchasing a particular item. These are typically applied to expensive items such as electronics or appliances.

Mail-In Rebate Tax Credit Form 2023

Customers who want to receive mail-in Rebate Tax Credit Form 2023 must present documents of purchase to claim the money. They are a bit more involved, but can result in substantial savings.

Instant Rebate Tax Credit Form 2023

Instant Rebate Tax Credit Form 2023 are made at the point of sale, which reduces the price of purchases immediately. Customers do not have to wait until they can save when they purchase this type of Rebate Tax Credit Form 2023.

How Rebate Tax Credit Form 2023 Work

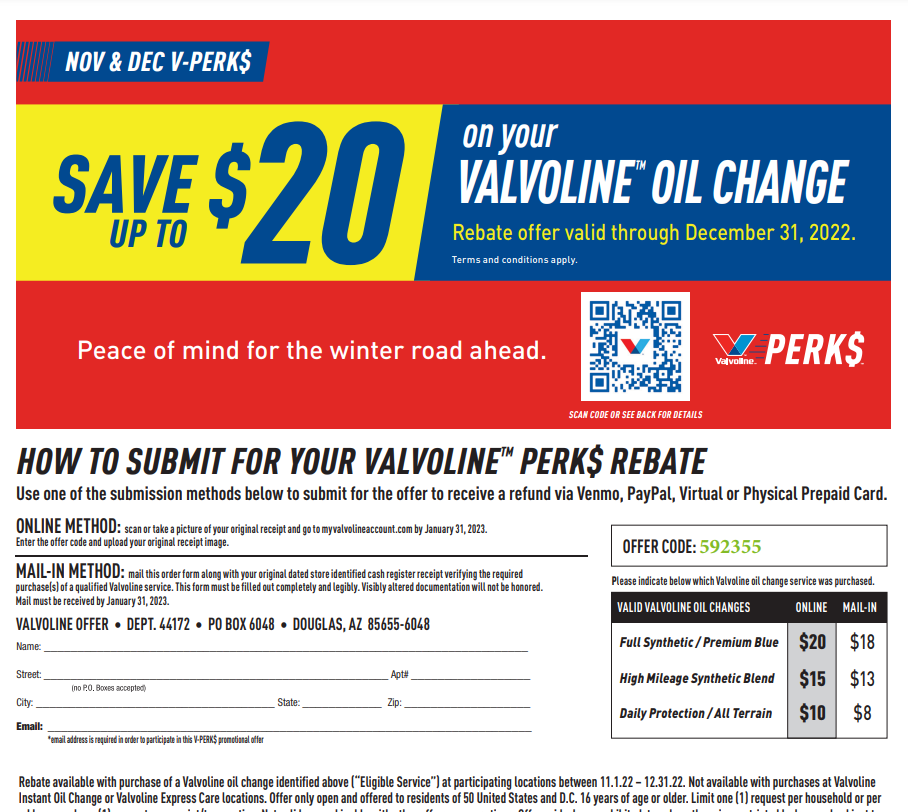

Valvoline Rebate Forms Printable Rebate Form

Valvoline Rebate Forms Printable Rebate Form

During the 2023 tax season taxpayers are eligible for a credit of 30 of the hardware and installation costs for EV chargers installed at their homes in 2022 It s a one time nonrefundable tax

The Rebate Tax Credit Form 2023 Process

The process typically comprises a handful of simple steps:

-

Buy the product: At first you purchase the product just like you normally would.

-

Complete this Rebate Tax Credit Form 2023 paper: You'll have provide certain information, such as your address, name, along with the purchase details, to be eligible for a Rebate Tax Credit Form 2023.

-

Submit the Rebate Tax Credit Form 2023: Depending on the kind of Rebate Tax Credit Form 2023 you will need to submit a claim form to the bank or upload it online.

-

Wait for approval: The company will examine your application and ensure that it's compliant with requirements of the Rebate Tax Credit Form 2023.

-

Get your Rebate Tax Credit Form 2023 After being approved, you'll be able to receive your reimbursement, using a check or prepaid card, or a different method that is specified in the offer.

Pros and Cons of Rebate Tax Credit Form 2023

Advantages

-

Cost Savings The use of Rebate Tax Credit Form 2023 can greatly decrease the price for the item.

-

Promotional Deals: They encourage customers to explore new products or brands.

-

Boost Sales The benefits of a Rebate Tax Credit Form 2023 can improve a company's sales and market share.

Disadvantages

-

Complexity The mail-in Rebate Tax Credit Form 2023 in particular could be cumbersome and slow-going.

-

Extension Dates Many Rebate Tax Credit Form 2023 impose extremely strict deadlines to submit.

-

Risk of Not Being Paid Certain customers could not receive their refunds if they don't adhere to the requirements exactly.

Download Rebate Tax Credit Form 2023

Download Rebate Tax Credit Form 2023

FAQs

1. Are Rebate Tax Credit Form 2023 equivalent to discounts? No, Rebate Tax Credit Form 2023 are a partial refund upon purchase, but discounts can reduce your purchase cost at point of sale.

2. Can I make use of multiple Rebate Tax Credit Form 2023 for the same product What is the best way to do it? It's contingent on terms that apply to the Rebate Tax Credit Form 2023 deals and product's quality and eligibility. Certain companies might allow the use of multiple Rebate Tax Credit Form 2023, whereas other won't.

3. How long does it take to receive a Rebate Tax Credit Form 2023? The amount of time is different, but it could take several weeks to a couple of months before you get your Rebate Tax Credit Form 2023.

4. Do I need to pay tax in relation to Rebate Tax Credit Form 2023 the amount? most cases, Rebate Tax Credit Form 2023 amounts are not considered to be taxable income.

5. Should I be able to trust Rebate Tax Credit Form 2023 offers from lesser-known brands Consider doing some research to ensure that the name giving the Rebate Tax Credit Form 2023 is credible prior to making the purchase.

Mo Crp Form 2018 Fill Out Sign Online DocHub

2022 Rent Rebate Form Fillable Printable PDF Forms Handypdf

Check more sample of Rebate Tax Credit Form 2023 below

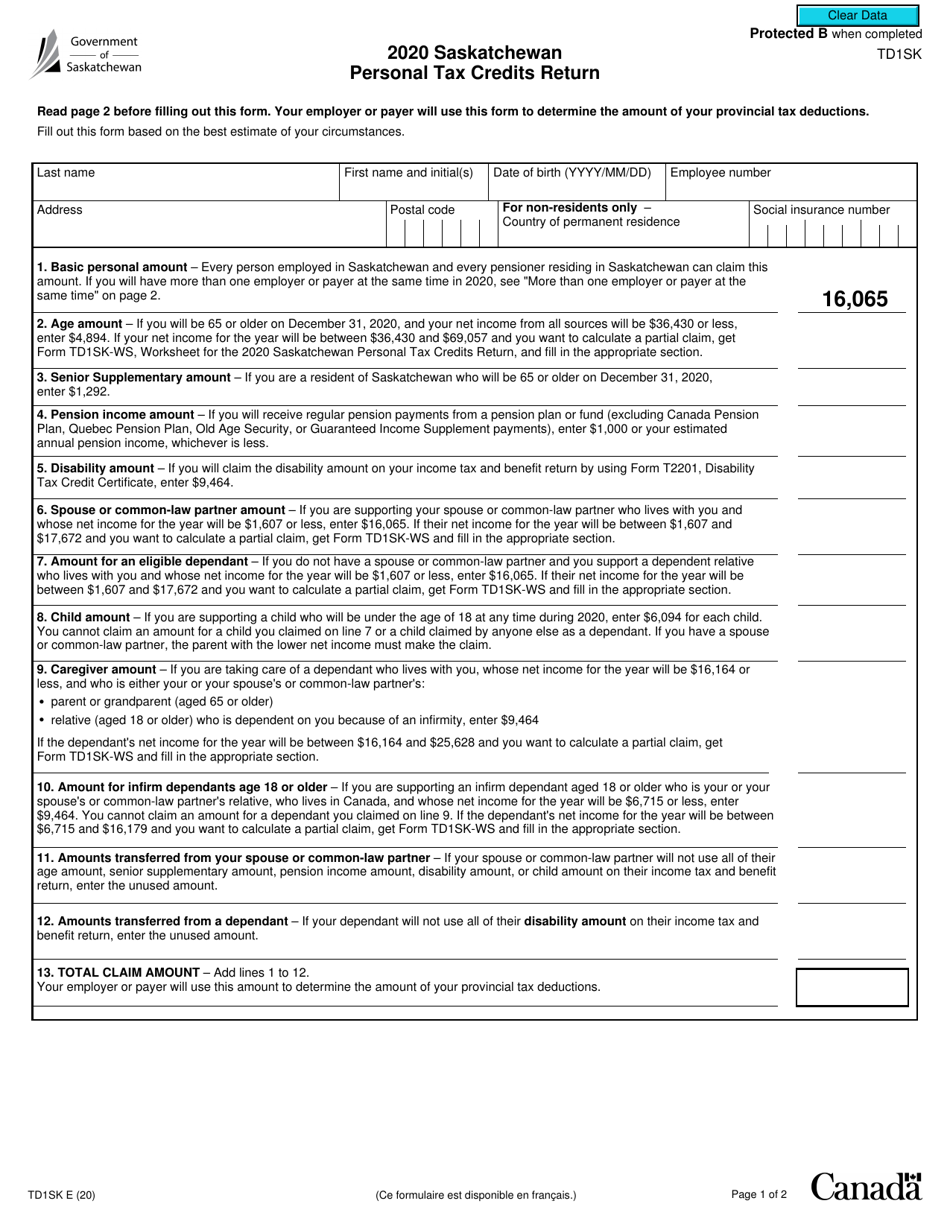

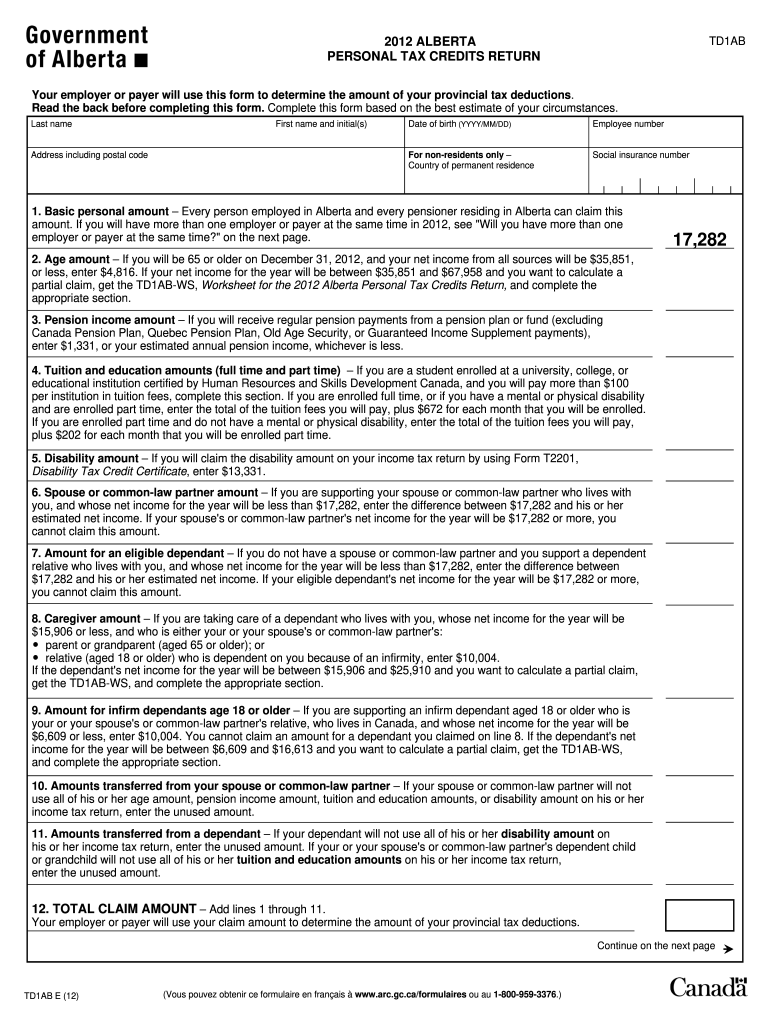

Form TD1AB Download Fillable PDF Or Fill Online Personal Tax Credits

Child Tax Credit 2020 Changes Canada Claiming The Child Tax Credit

Irs Calendar 2023 Recette 2023

Certificate Of Rent Paid 2014 Eligibility Requirements And Refund

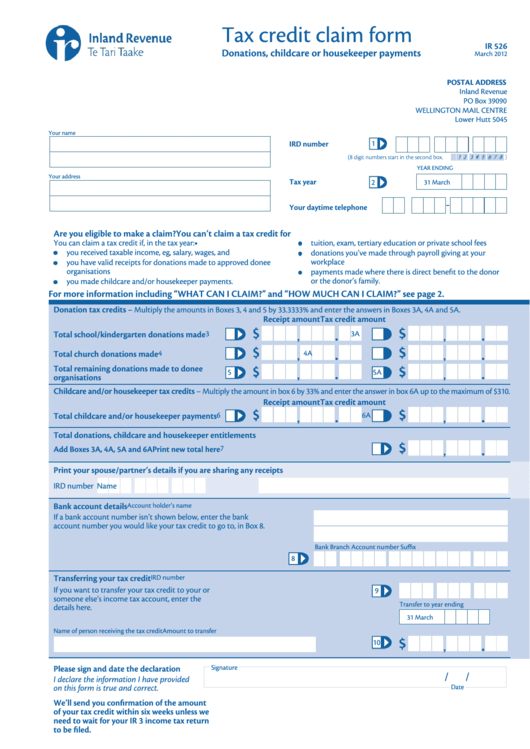

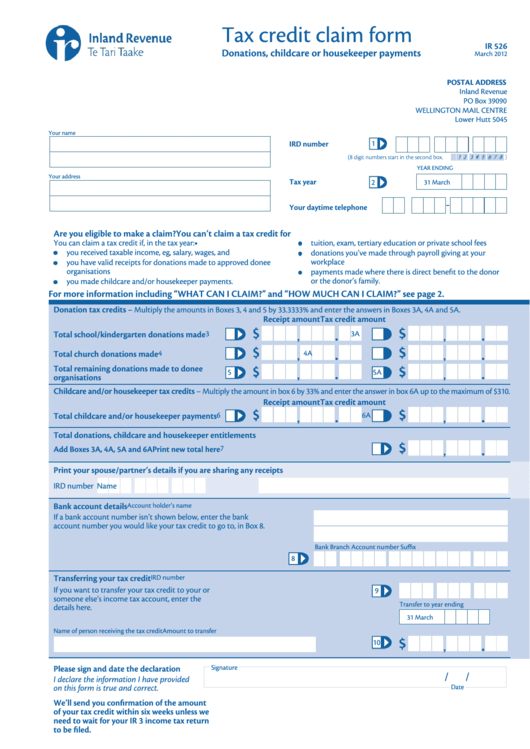

Fillable Form Ir526 Tax Credit Claim Form Printable Pdf Download Gambaran

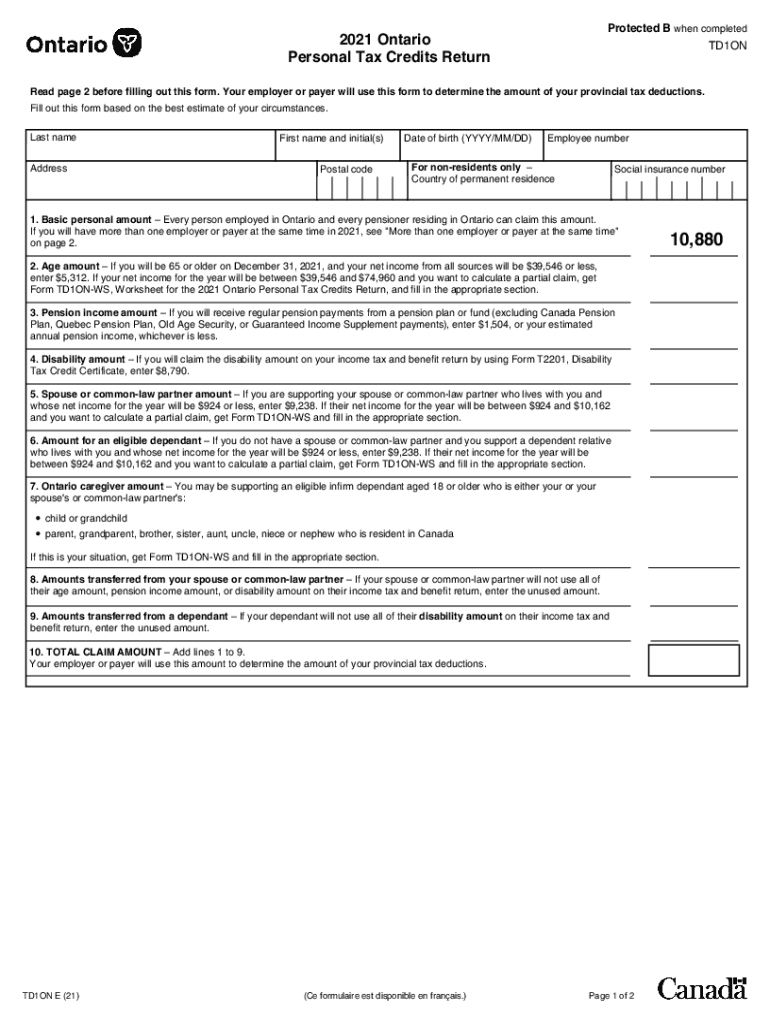

2021 2023 Form Canada TD1ON Fill Online Printable Fillable Blank

https://www.irs.gov/credits-deductions/home-energy-tax-credits

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

Certificate Of Rent Paid 2014 Eligibility Requirements And Refund

Child Tax Credit 2020 Changes Canada Claiming The Child Tax Credit

Fillable Form Ir526 Tax Credit Claim Form Printable Pdf Download Gambaran

2021 2023 Form Canada TD1ON Fill Online Printable Fillable Blank

Td1ab Fillable Form Fill Out Sign Online DocHub

2019 2022 Form Canada T3 RET E Fill Online Printable Fillable Blank

2019 2022 Form Canada T3 RET E Fill Online Printable Fillable Blank

T1213 Tax Form Fill Out Sign Online DocHub