In this day and age of consuming people love a good deal. One way to earn significant savings when you shop is with Rebate Recovery Tax Forms. Rebate Recovery Tax Forms are a method of marketing employed by retailers and manufacturers to offer customers a refund for their purchases after they have done so. In this article, we will delve into the world of Rebate Recovery Tax Forms, examining the nature of them and how they work and ways you can increase your savings by taking advantage of these cost-effective incentives.

Get Latest Rebate Recovery Tax Form Below

Rebate Recovery Tax Form

Rebate Recovery Tax Form - Recovery Rebate Tax Form

Web 3 juin 2023 nbsp 0183 32 For 2021 Federal tax returns on income are eligible for the Recovery Rebate If you re a married couple who have two kids and are tax dependent taxpayer you can

Web 17 f 233 vr 2022 nbsp 0183 32 A1 You must file a 2021 tax return to claim a Recovery Rebate Credit even if you are otherwise not required to file a tax return Your 2021 Recovery Rebate Credit

A Rebate Recovery Tax Form in its most basic model, refers to a partial cash refund provided to customers following the purchase of a product or service. It's an effective method employed by companies to attract buyers, increase sales and market specific products.

Types of Rebate Recovery Tax Form

What Is The Recovery Rebate Credit CD Tax Financial

What Is The Recovery Rebate Credit CD Tax Financial

Web 23 mars 2023 nbsp 0183 32 The Recovery Rebate is available on federal income tax returns until 2021 Tax dependents who qualify could receive up to 1 400 married couples with two

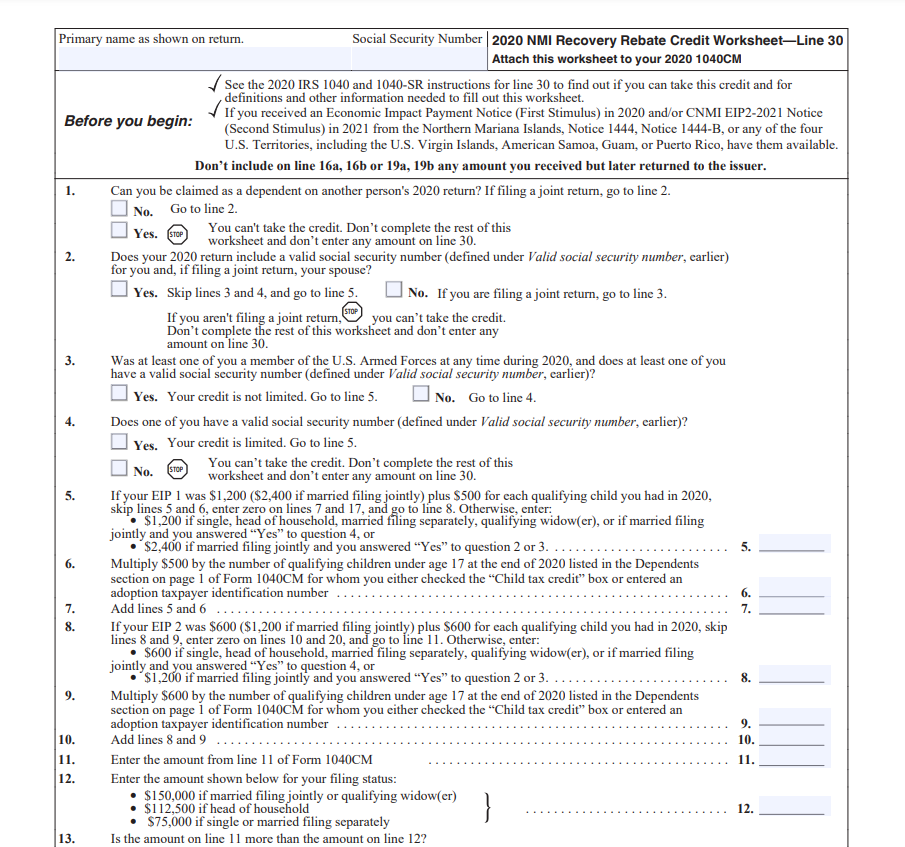

Web 10 d 233 c 2021 nbsp 0183 32 To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form

Cash Rebate Recovery Tax Form

Cash Rebate Recovery Tax Form are the simplest kind of Rebate Recovery Tax Form. Clients receive a predetermined amount of money back after purchasing a particular item. They are typically used to purchase costly items like electronics or appliances.

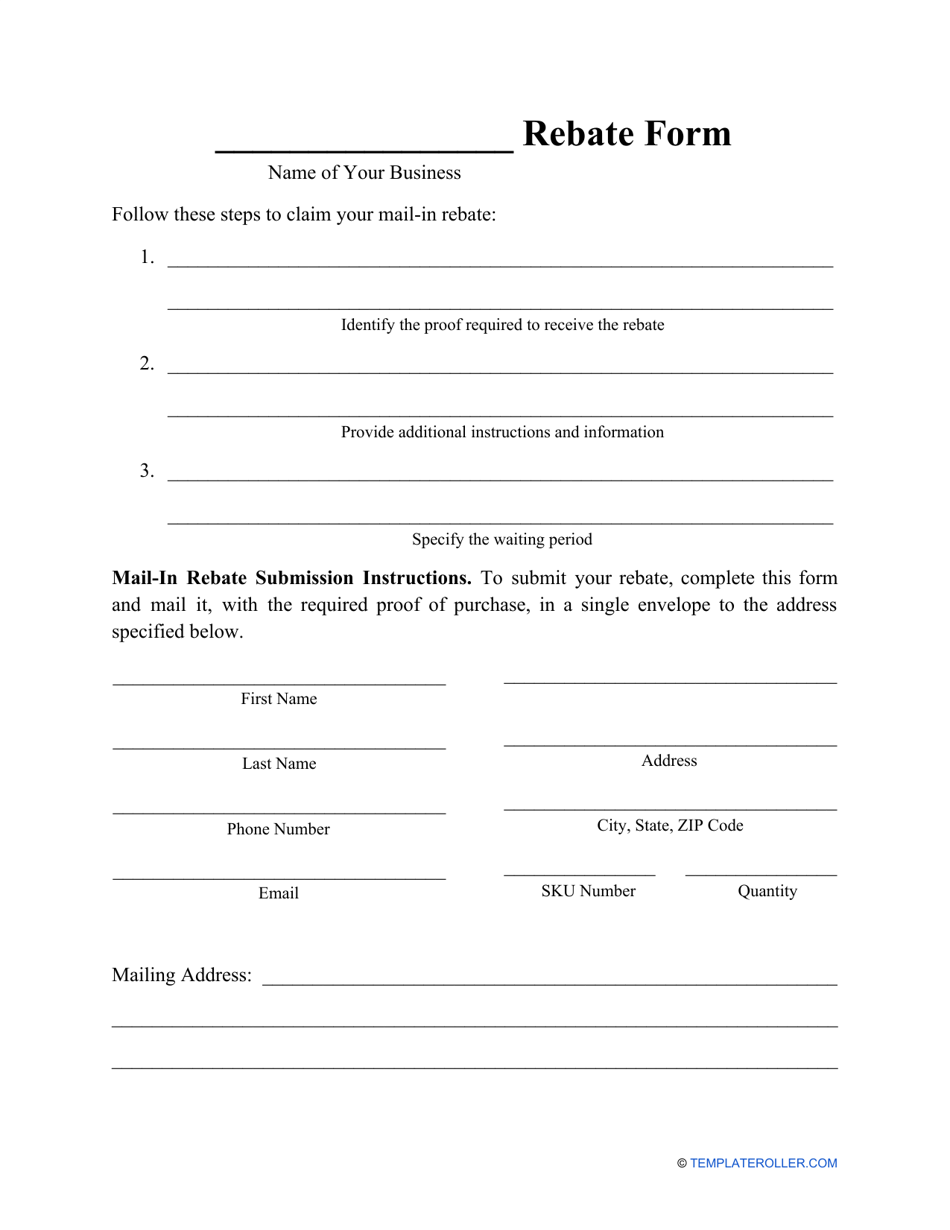

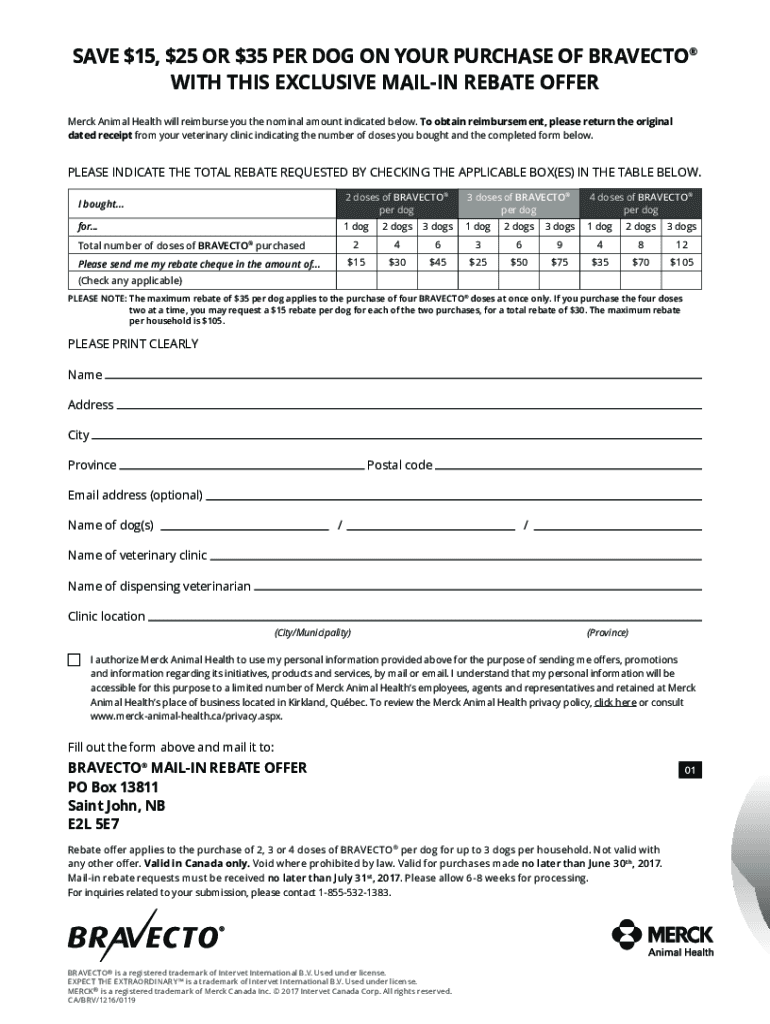

Mail-In Rebate Recovery Tax Form

Mail-in Rebate Recovery Tax Form require consumers to present the proof of purchase in order to receive their refund. They're a bit more involved but can offer huge savings.

Instant Rebate Recovery Tax Form

Instant Rebate Recovery Tax Form apply at the points of sale. This reduces the price instantly. Customers do not have to wait for savings through this kind of offer.

How Rebate Recovery Tax Form Work

Recovery Rebate Credit Form Printable Rebate Form

Recovery Rebate Credit Form Printable Rebate Form

Web If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form 1040 U S Individual Income Tax

The Rebate Recovery Tax Form Process

The process typically involves a couple of steps that are easy to follow:

-

Purchase the product: Then, you buy the product the way you normally do.

-

Complete your Rebate Recovery Tax Form form: You'll need to fill in some information like your name, address along with the purchase details, in order to submit your Rebate Recovery Tax Form.

-

Complete the Rebate Recovery Tax Form If you want to submit the Rebate Recovery Tax Form, based on the kind of Rebate Recovery Tax Form you could be required to submit a form by mail or make it available online.

-

Wait for approval: The business will go through your application to determine if it's in compliance with the terms and conditions of the Rebate Recovery Tax Form.

-

Receive your Rebate Recovery Tax Form Once it's approved, the amount you receive will be in the form of a check, prepaid card, or another option specified by the offer.

Pros and Cons of Rebate Recovery Tax Form

Advantages

-

Cost Savings The use of Rebate Recovery Tax Form can greatly cut the price you pay for the item.

-

Promotional Offers These promotions encourage consumers in trying new products or brands.

-

Accelerate Sales Rebate Recovery Tax Form can increase the company's sales as well as market share.

Disadvantages

-

Complexity The mail-in Rebate Recovery Tax Form particularly the case of HTML0, can be a hassle and take a long time to complete.

-

Deadlines for Expiration Many Rebate Recovery Tax Form are subject to certain deadlines for submitting.

-

Risque of Non-Payment Certain customers could not receive Rebate Recovery Tax Form if they do not adhere to the guidelines precisely.

Download Rebate Recovery Tax Form

Download Rebate Recovery Tax Form

FAQs

1. Are Rebate Recovery Tax Form the same as discounts? No, Rebate Recovery Tax Form involve only a partial reimbursement following the purchase whereas discounts will reduce the purchase price at time of sale.

2. Are there any Rebate Recovery Tax Form that I can use for the same product What is the best way to do it? It's contingent on terms of the Rebate Recovery Tax Form offers and the product's acceptance. Some companies will allow this, whereas others will not.

3. How long will it take to get an Rebate Recovery Tax Form? The time frame will differ, but can be from several weeks to couple of months before you get your Rebate Recovery Tax Form.

4. Do I need to pay taxes regarding Rebate Recovery Tax Form amounts? In most instances, Rebate Recovery Tax Form amounts are not considered taxable income.

5. Do I have confidence in Rebate Recovery Tax Form deals from lesser-known brands You must research to ensure that the name that is offering the Rebate Recovery Tax Form is reputable prior to making a purchase.

IRS CP 12R Recovery Rebate Credit Overpayment

What Does The Recovery Rebate Form Look Like Bears Printable Rebate Form

Check more sample of Rebate Recovery Tax Form below

IRS CP 11R Recovery Rebate Credit Balance Due

Recovery Rebate Credit Worksheet 2020 Ideas 2022

Printable Old Style Rebate Form Printable Forms Free Online

How To Calculate Recovery Rebate Credit 2022 Rebate2022 Recovery Rebate

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-d...

Web 17 f 233 vr 2022 nbsp 0183 32 A1 You must file a 2021 tax return to claim a Recovery Rebate Credit even if you are otherwise not required to file a tax return Your 2021 Recovery Rebate Credit

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-b...

Web 13 janv 2022 nbsp 0183 32 Compute the 2021 Recovery Rebate Credit amount using tax preparation software or the line 30 worksheet found in 2021 Form 1040 and Form 1040 SR

Web 17 f 233 vr 2022 nbsp 0183 32 A1 You must file a 2021 tax return to claim a Recovery Rebate Credit even if you are otherwise not required to file a tax return Your 2021 Recovery Rebate Credit

Web 13 janv 2022 nbsp 0183 32 Compute the 2021 Recovery Rebate Credit amount using tax preparation software or the line 30 worksheet found in 2021 Form 1040 and Form 1040 SR

How To Calculate Recovery Rebate Credit 2022 Rebate2022 Recovery Rebate

Recovery Rebate Credit Worksheet 2020 Ideas 2022

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

1040 Line 30 Recovery Rebate Credit Recovery Rebate

Form 8038 R Request For Recovery Of Overpayments Under Arbitrage

Form 8038 R Request For Recovery Of Overpayments Under Arbitrage

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021