In the modern world of consumerization people love a good deal. One way to score significant savings from your purchases is via Rebate In Accountings. The use of Rebate In Accountings is a method used by manufacturers and retailers for offering customers a percentage return on their purchases once they've purchased them. In this post, we'll examine the subject of Rebate In Accountings, examining the nature of them, how they work, and ways to maximize the savings you can make by using these cost-effective incentives.

Get Latest Rebate In Accounting Below

Rebate In Accounting

Rebate In Accounting - Rebate In Accounting, Rebate In Accounting Meaning, Rebate In Accounting Definition, Rebate Entry In Accounting, Rebate Meaning In Accounting Class 11, Explain Rebate In Accounting, Deferred Rebate In Accounting, Rebate Accounting Treatment Ifrs, Rebate Accounting Journal Entry, Rebate Accounting Us Gaap

Verkko Definition A rebate is a fraction of a sale transaction that is returned to the customer after the operation is closed It is a sales incentive that rewards a client with a certain portion of the transaction value What Does Rebate Mean Rebates are a marketing strategy employed to create an incentive to keep purchasing

Verkko 2 syysk 2023 nbsp 0183 32 A rebate is a payment back to a buyer of a portion of the full purchase price of a good or service This payment is typically triggered by the cumulative amount of purchases made within a certain period of time Rebates are generally designed to increase the volume of purchases made by customers

A Rebate In Accounting as it is understood in its simplest format, is a refund to a purchaser after having purchased a item or service. It's a powerful method that companies use to attract customers, increase sales, and even promote certain products.

Types of Rebate In Accounting

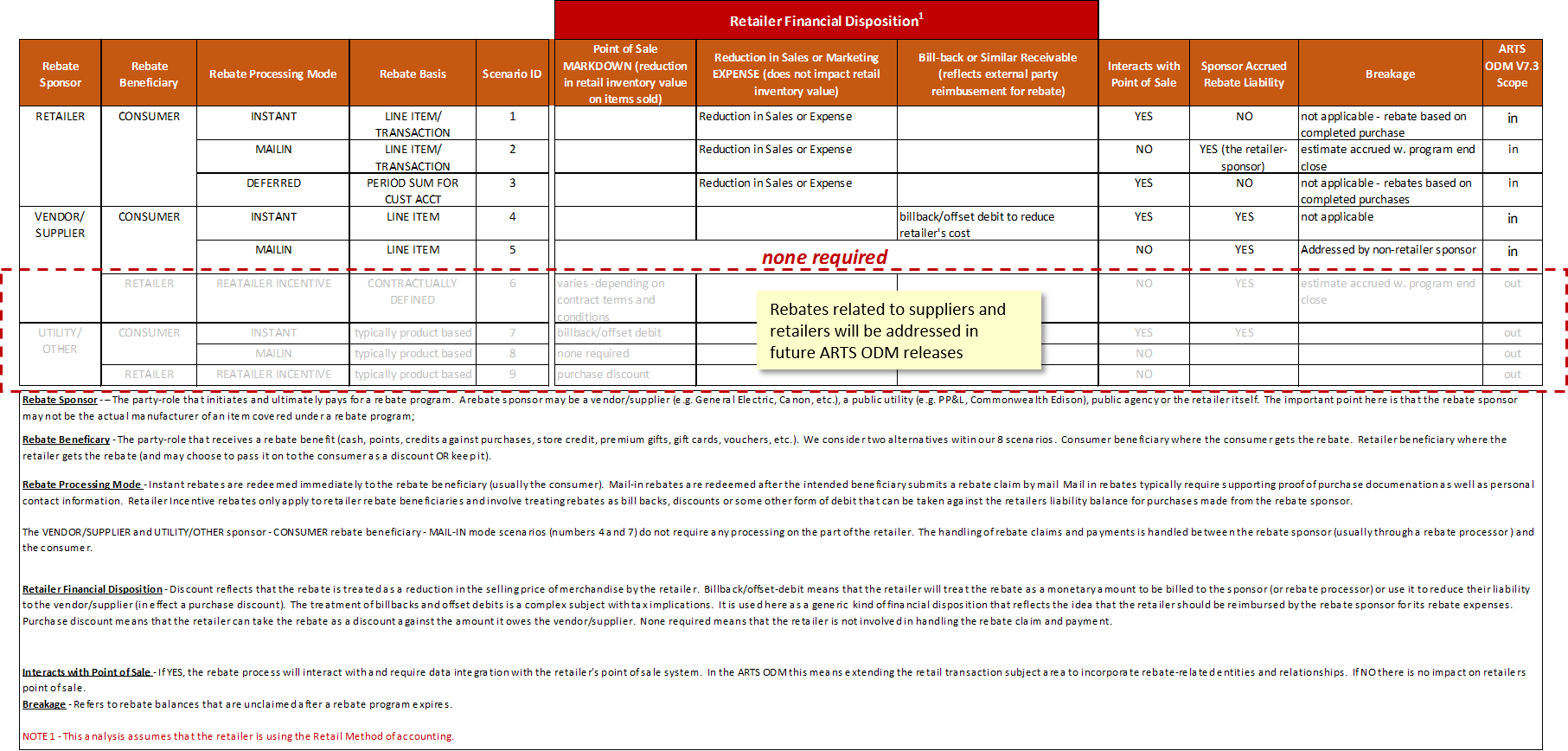

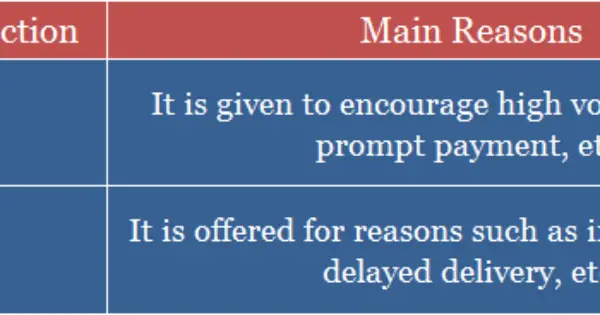

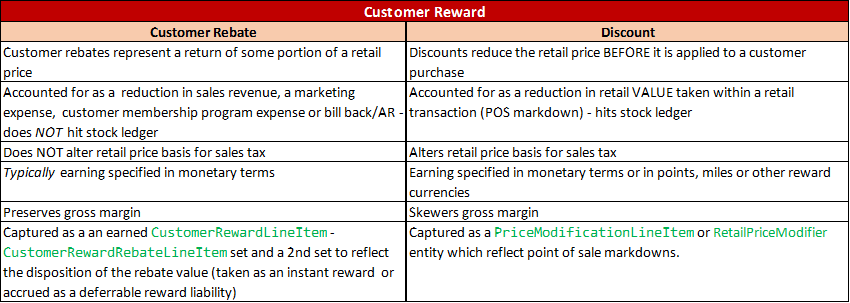

Concorrenti Integrazione Apertura Della Confezione Customer Rebate

Concorrenti Integrazione Apertura Della Confezione Customer Rebate

Verkko 6 huhtik 2022 nbsp 0183 32 A rebate is a retroactive payment back to a buyer of a good or service After the sale has been made the rebate lowers the full purchase price by returning either a lump sum or percentage of the sales price back to the buyer In some instances rebates are offered only when a certain purchase volume has been met

Verkko What s the issue Discounts and rebates can be offered to purchasers in a number of ways for example trade discounts settlement discounts volume based rebates and other rebates Accounting for these reductions will vary depending on

Cash Rebate In Accounting

Cash Rebate In Accounting are the most straightforward kind of Rebate In Accounting. Customers get a set amount of money when purchasing a item. This is often for expensive items such as electronics or appliances.

Mail-In Rebate In Accounting

Mail-in Rebate In Accounting are based on the requirement that customers present evidence of purchase to get their money back. They're somewhat more complicated, but they can provide substantial savings.

Instant Rebate In Accounting

Instant Rebate In Accounting will be applied at points of sale. This reduces the purchase price immediately. Customers don't have to wait long for savings by using this method.

How Rebate In Accounting Work

Understanding Customer Rebates

Understanding Customer Rebates

Verkko Rebate management systems can significantly improve your rebate accounting processes by providing a fully visible audit trail and ensuring the mistakes that are often made in manual rebate management systems are entirely avoided 5 Systematize complex trading agreements Any complex trading agreement for rebate accounting

The Rebate In Accounting Process

The procedure typically consists of a couple of steps that are easy to follow:

-

When you buy the product purchase the product in the same way you would normally.

-

Fill out the Rebate In Accounting template: You'll need provide certain information, such as your name, address, and information about the purchase to receive your Rebate In Accounting.

-

To submit the Rebate In Accounting depending on the kind of Rebate In Accounting you might need to mail a Rebate In Accounting form in or upload it online.

-

Wait for the company's approval: They will evaluate your claim to determine if it's in compliance with the terms and conditions of the Rebate In Accounting.

-

Redeem your Rebate In Accounting After approval, the amount you receive will be in the form of a check, prepaid card or another method that is specified in the offer.

Pros and Cons of Rebate In Accounting

Advantages

-

Cost savings Rebate In Accounting can substantially decrease the price for the product.

-

Promotional Offers The aim is to encourage customers to test new products or brands.

-

increase sales The benefits of a Rebate In Accounting can improve a company's sales and market share.

Disadvantages

-

Complexity In particular, mail-in Rebate In Accounting in particular the case of HTML0, can be a hassle and long-winded.

-

The Expiration Dates Many Rebate In Accounting impose strict time limits for submission.

-

Risk of not receiving payment Certain customers could not be able to receive their Rebate In Accounting if they don't adhere to the requirements exactly.

Download Rebate In Accounting

FAQs

1. Are Rebate In Accounting equivalent to discounts? No, Rebate In Accounting offer one-third of the amount refunded following purchase, whereas discounts cut the purchase price at the moment of sale.

2. Can I make use of multiple Rebate In Accounting for the same product This depends on the terms of Rebate In Accounting provides and the particular product's eligibility. Certain businesses may allow it, and some don't.

3. How long does it take to get the Rebate In Accounting? The amount of time varies, but it can last from a few weeks until a few months before you receive your Rebate In Accounting.

4. Do I need to pay taxes in relation to Rebate In Accounting montants? the majority of cases, Rebate In Accounting amounts are not considered taxable income.

5. Should I be able to trust Rebate In Accounting deals from lesser-known brands It is essential to investigate and verify that the brand that is offering the Rebate In Accounting is reputable before making the purchase.

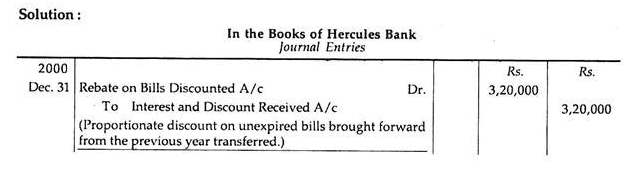

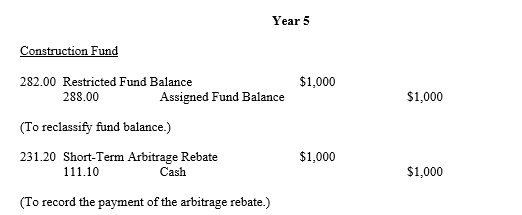

Arbitrage Rebates Office Of The Washington State Auditor

Rebate Calculator Accounts Flow

Check more sample of Rebate In Accounting below

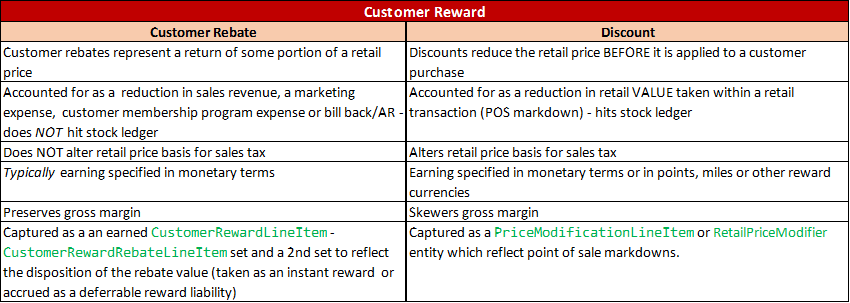

Difference Between Discount And Rebate with Example

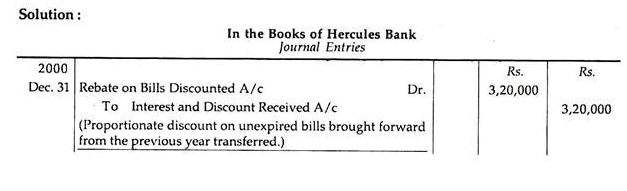

Retiring A Bill Of Exchange Under Rebate Journal Entries Finance

Rebate In MM SAP Blogs

Rebate Accounting 10 Reasons Why Rebates Are Not Always Claimed Enable

Understanding Customer Rebates

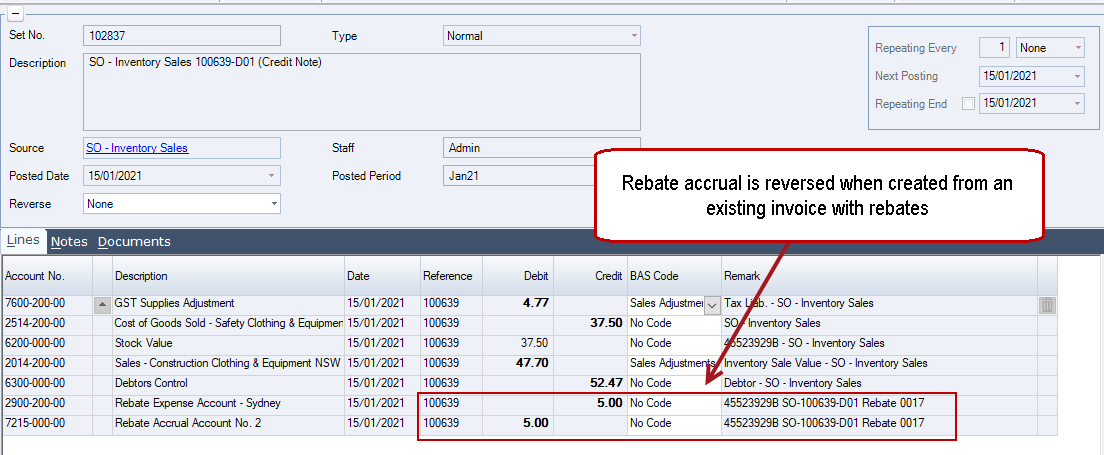

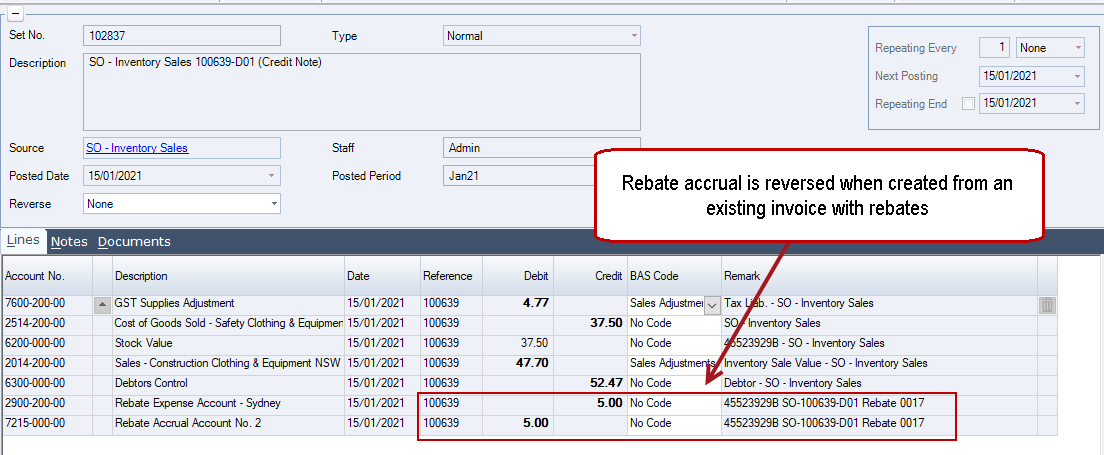

Rebates Rebate Accruals JIWA Training

https://www.accountingtools.com/articles/rebate

Verkko 2 syysk 2023 nbsp 0183 32 A rebate is a payment back to a buyer of a portion of the full purchase price of a good or service This payment is typically triggered by the cumulative amount of purchases made within a certain period of time Rebates are generally designed to increase the volume of purchases made by customers

https://www.accountingcapital.com/differences-and-comparisons/...

Verkko Discount is the reduction offered by a seller to the buyer from the purchase price of goods or services Rebate is refund or return of currency value that a seller of goods provides to the buyer for various different reasons Reasons To promote high quantity purchases receive timely payments and increased sales

Verkko 2 syysk 2023 nbsp 0183 32 A rebate is a payment back to a buyer of a portion of the full purchase price of a good or service This payment is typically triggered by the cumulative amount of purchases made within a certain period of time Rebates are generally designed to increase the volume of purchases made by customers

Verkko Discount is the reduction offered by a seller to the buyer from the purchase price of goods or services Rebate is refund or return of currency value that a seller of goods provides to the buyer for various different reasons Reasons To promote high quantity purchases receive timely payments and increased sales

Rebate Accounting 10 Reasons Why Rebates Are Not Always Claimed Enable

Retiring A Bill Of Exchange Under Rebate Journal Entries Finance

Understanding Customer Rebates

Rebates Rebate Accruals JIWA Training

Rebate Accounting Entries pdf Rebate Marketing Debits And Credits

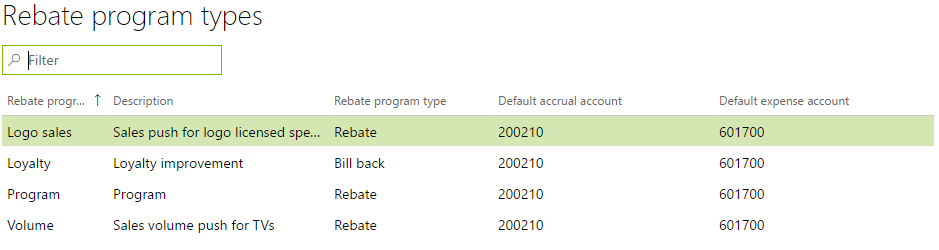

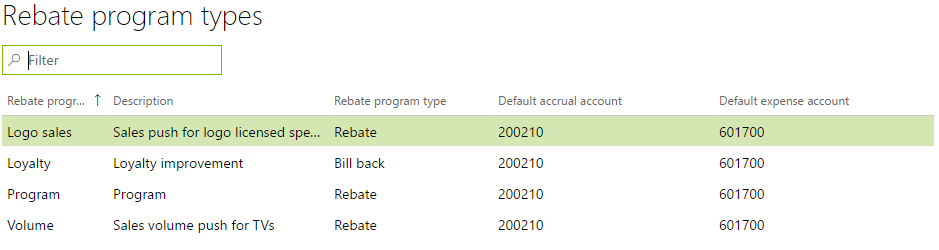

Managing Rebates In Dynamics 365 For Operations AXSource

Managing Rebates In Dynamics 365 For Operations AXSource

Rebate Accounting Product