In this day and age of consuming every person loves a great deal. One way to gain significant savings in your purchase is through Pst Rebate Form For Charitiess. Pst Rebate Form For Charitiess are a strategy for marketing that retailers and manufacturers use in order to offer customers a small cash back on their purchases once they've completed them. In this article, we'll go deeper into the realm of Pst Rebate Form For Charitiess. We'll explore what they are as well as how they work and the best way to increase your savings through these cost-effective incentives.

Get Latest Pst Rebate Form For Charities Below

Pst Rebate Form For Charities

Pst Rebate Form For Charities -

Web 1 juil 2010 nbsp 0183 32 A charity claiming a PSB rebate for the provincial part of the HST must complete and file Form RC7066 SCH Provincial Schedule GST HST Public Service

Web To apply for the rebate use Form GST189 General Application for Rebate of GST HST The form describes the documentation that is required to support your rebate claim For

A Pst Rebate Form For Charities at its most basic version, is an ad-hoc reimbursement to a buyer after having purchased a item or service. It's an effective way for businesses to entice customers, increase sales and promote specific products.

Types of Pst Rebate Form For Charities

BC PST Rebate Select Machinery And Equipment Avisar CPA

BC PST Rebate Select Machinery And Equipment Avisar CPA

Web You may be able to claim a PSB rebate for GST HST paid or payable in respect of eligible purchases or expenses for a particular claim period in a rebate application for a later

Web If a charity that is a registrant wants to use its PSB rebate to reduce any amount it owes on a GST HST return or to increase any refund it must file its PSB rebate application along

Cash Pst Rebate Form For Charities

Cash Pst Rebate Form For Charities can be the simplest type of Pst Rebate Form For Charities. Customers receive a certain amount of money when buying a product. These are usually used for costly items like electronics or appliances.

Mail-In Pst Rebate Form For Charities

Mail-in Pst Rebate Form For Charities require customers to submit documents of purchase to claim their cash back. They're a bit longer-lasting, however they offer substantial savings.

Instant Pst Rebate Form For Charities

Instant Pst Rebate Form For Charities will be applied at point of sale and reduce the price instantly. Customers do not have to wait until they can save by using this method.

How Pst Rebate Form For Charities Work

British Columbia PST Rebate On Select Machinery And Equipment Extended

British Columbia PST Rebate On Select Machinery And Equipment Extended

Web charity claiming a PSB rebate for the provincial part of the HST must complete and file Form RC7066 SCH Provincial Schedule GST HST Public Service Bodies Rebate or

The Pst Rebate Form For Charities Process

The process typically involves a number of easy steps:

-

Buy the product: Firstly make sure you purchase the product as you normally would.

-

Complete your Pst Rebate Form For Charities questionnaire: you'll have to provide some data, such as your address, name, and details about your purchase, in order to receive your Pst Rebate Form For Charities.

-

Submit the Pst Rebate Form For Charities It is dependent on the kind of Pst Rebate Form For Charities you might need to fill out a paper form or upload it online.

-

Wait for approval: The business is going to review your entry to make sure that it's in accordance with the terms and conditions of the Pst Rebate Form For Charities.

-

You will receive your Pst Rebate Form For Charities: Once approved, you'll receive your cash back through a check, or a prepaid card or another method as specified by the offer.

Pros and Cons of Pst Rebate Form For Charities

Advantages

-

Cost savings Pst Rebate Form For Charities can substantially decrease the price for an item.

-

Promotional Offers These promotions encourage consumers in trying new products or brands.

-

Help to Increase Sales The benefits of a Pst Rebate Form For Charities can improve sales for a company and also increase market share.

Disadvantages

-

Complexity mail-in Pst Rebate Form For Charities particularly could be cumbersome and lengthy.

-

The Expiration Dates A lot of Pst Rebate Form For Charities have certain deadlines for submitting.

-

The risk of non-payment Certain customers could lose their Pst Rebate Form For Charities in the event that they don't adhere to the rules precisely.

Download Pst Rebate Form For Charities

Download Pst Rebate Form For Charities

FAQs

1. Are Pst Rebate Form For Charities the same as discounts? No, Pst Rebate Form For Charities offer partial reimbursement after purchase, while discounts lower the cost of purchase at point of sale.

2. Can I get multiple Pst Rebate Form For Charities on the same product What is the best way to do it? It's contingent on conditions applicable to Pst Rebate Form For Charities is offered as well as the merchandise's admissibility. Some companies will allow the use of multiple Pst Rebate Form For Charities, whereas other won't.

3. How long will it take to get an Pst Rebate Form For Charities? The length of time will vary, but it may take several weeks to a couple of months before you get your Pst Rebate Form For Charities.

4. Do I have to pay taxes regarding Pst Rebate Form For Charities funds? the majority of instances, Pst Rebate Form For Charities amounts are not considered to be taxable income.

5. Can I trust Pst Rebate Form For Charities offers from lesser-known brands Consider doing some research and verify that the brand that is offering the Pst Rebate Form For Charities is reputable prior to making a purchase.

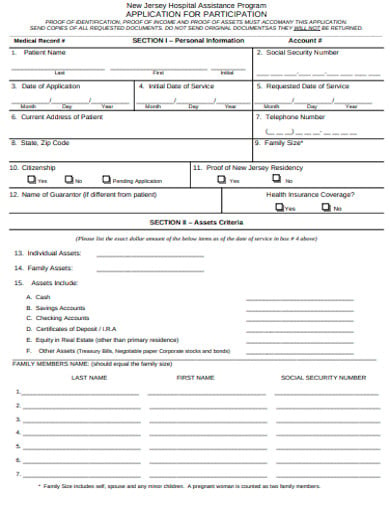

10 Charity Care Application Form Templates In PDF

BC s PST Rebate On Select Machinery And Equipment YouTube

Check more sample of Pst Rebate Form For Charities below

BC PST Rebate On Select Machinery And Equipment Grant Thornton

The B C PST Rebate On Select Machinery And Equipment Blog Avalon

PST Rebate On Select Machinery And Equipment Business Bookkeeping

BC PST Rebate On Select Machinery And Equipment Grant Thornton

The B C PST Rebate On Select Machinery And Equipment Blog Avalon

The B C PST Rebate On Select Machinery And Equipment Blog Avalon

https://www.canada.ca/en/revenue-agency/services/forms-publications/...

Web To apply for the rebate use Form GST189 General Application for Rebate of GST HST The form describes the documentation that is required to support your rebate claim For

https://www.canada.ca/en/revenue-agency/services/forms-publications/...

Web The GST rebate factor for charities is 50 Therefore the public service bodies rebate of the non creditable GST charged is 400 800 215 50 Step 2 Calculate the rebate of

Web To apply for the rebate use Form GST189 General Application for Rebate of GST HST The form describes the documentation that is required to support your rebate claim For

Web The GST rebate factor for charities is 50 Therefore the public service bodies rebate of the non creditable GST charged is 400 800 215 50 Step 2 Calculate the rebate of

BC PST Rebate On Select Machinery And Equipment Grant Thornton

The B C PST Rebate On Select Machinery And Equipment Blog Avalon

The B C PST Rebate On Select Machinery And Equipment Blog Avalon

The B C PST Rebate On Select Machinery And Equipment Blog Avalon

Federal And Provincial Tax Incentives For Heavy Equipment Information

New 3 Year PST Rebate Program Announced

New 3 Year PST Rebate Program Announced

B C PST Rebate For Incorporated Entities Crowe MacKay