In the modern world of consumerization everybody loves a good deal. One way to gain substantial savings for your purchases is through Philadelphia Real Estate Tax Rebate Forms. Philadelphia Real Estate Tax Rebate Forms can be a way of marketing used by manufacturers and retailers to provide customers with a portion of a discount on purchases they made after they've done so. In this article, we'll dive into the world Philadelphia Real Estate Tax Rebate Forms, looking at what they are as well as how they work and how you can maximize your savings by taking advantage of these cost-effective incentives.

Get Latest Philadelphia Real Estate Tax Rebate Form Below

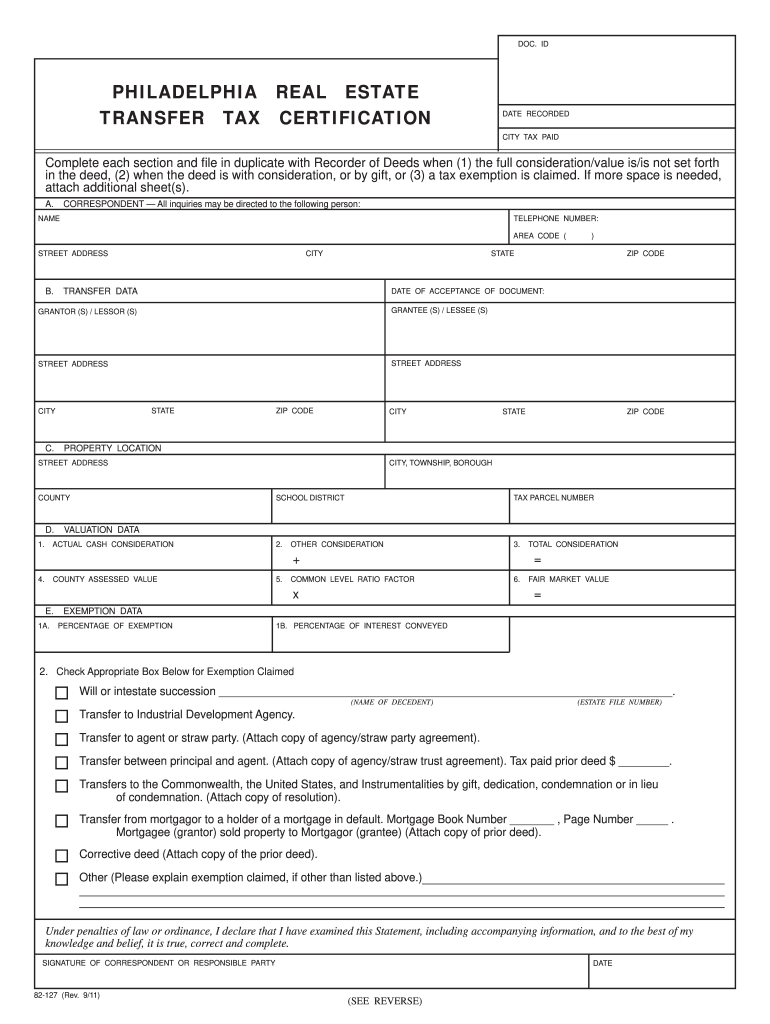

Philadelphia Real Estate Tax Rebate Form

Philadelphia Real Estate Tax Rebate Form -

Web 30 juin 2023 nbsp 0183 32 PHILADELPHIA RESIDENTS Please read the special filing instructions on Page 11 OWNER RENTER You are eligible for a Property Tax Rent Rebate for claim

Web 2022 Property Tax Rent Rebate applications must be postmarked by December 31 2023 to be considered myPATH allows claimants of the Property Tax Rent Rebate Program to

A Philadelphia Real Estate Tax Rebate Form in its most basic version, is an ad-hoc refund offered to a customer after they've purchased a good or service. It is a powerful tool employed by companies to draw buyers, increase sales and advertise specific products.

Types of Philadelphia Real Estate Tax Rebate Form

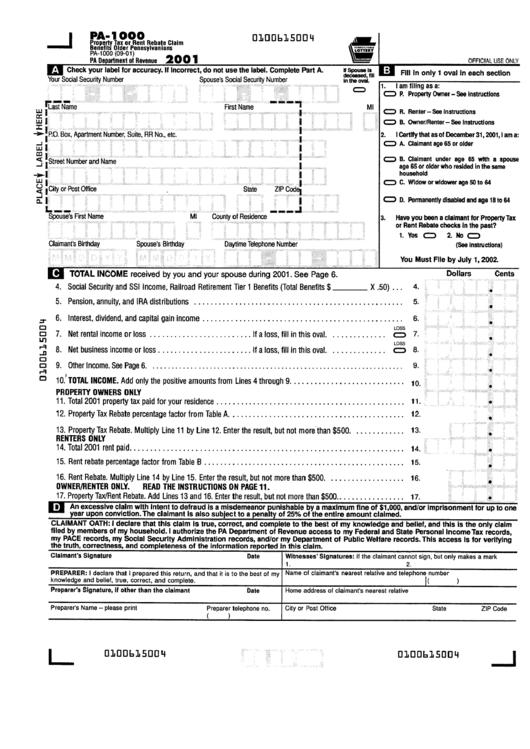

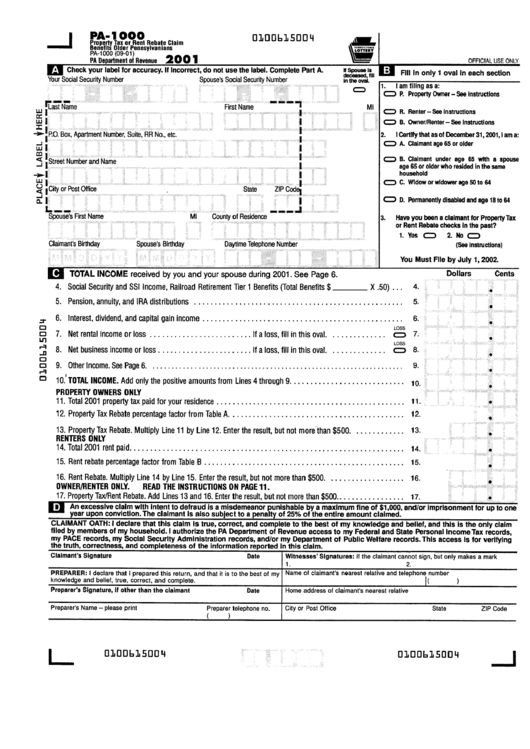

Form Pa 1000 Property Tax Or Rent Rebate Claim Benefits Older

Form Pa 1000 Property Tax Or Rent Rebate Claim Benefits Older

Web Learn more about the new online filing features for the Property Tax Rent Rebate Program by visiting myPATH Visit the Property Tax Rent Rebate Program page on the

Web 13 juil 2022 nbsp 0183 32 The Homestead Exemption offers Real Estate Tax savings to all Philadelphia homeowners by reducing the taxable assessment of their primary

Cash Philadelphia Real Estate Tax Rebate Form

Cash Philadelphia Real Estate Tax Rebate Form are the most basic type of Philadelphia Real Estate Tax Rebate Form. Clients receive a predetermined amount of cash back after purchasing a particular item. They are typically used to purchase the most expensive products like electronics or appliances.

Mail-In Philadelphia Real Estate Tax Rebate Form

Mail-in Philadelphia Real Estate Tax Rebate Form require consumers to provide their proof of purchase before receiving their cash back. They're a bit more involved but offer significant savings.

Instant Philadelphia Real Estate Tax Rebate Form

Instant Philadelphia Real Estate Tax Rebate Form can be applied at the point of sale. They reduce your purchase cost instantly. Customers do not have to wait until they can save with this type.

How Philadelphia Real Estate Tax Rebate Form Work

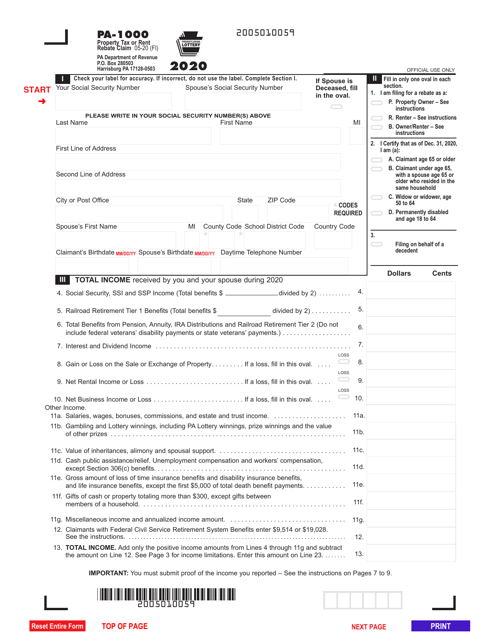

Form PA 1000 Download Fillable PDF Or Fill Online Property Tax Or Rent

Form PA 1000 Download Fillable PDF Or Fill Online Property Tax Or Rent

Web 25 mai 2023 nbsp 0183 32 This program reduces the taxable portion of your property assessment by 80 000 in effect for 2023 Real Estate Tax bills and future years The exemption for tax

The Philadelphia Real Estate Tax Rebate Form Process

The process typically involves few easy steps:

-

Purchase the product: First you purchase the item like you would normally.

-

Complete the Philadelphia Real Estate Tax Rebate Form forms: The Philadelphia Real Estate Tax Rebate Form form will need to supply some details like your name, address as well as the details of your purchase to be eligible for a Philadelphia Real Estate Tax Rebate Form.

-

You must submit the Philadelphia Real Estate Tax Rebate Form In accordance with the type of Philadelphia Real Estate Tax Rebate Form there may be a requirement to fill out a form and mail it in or submit it online.

-

Wait for approval: The company will scrutinize your submission for compliance with terms and conditions of the Philadelphia Real Estate Tax Rebate Form.

-

Enjoy your Philadelphia Real Estate Tax Rebate Form After approval, you'll be able to receive your reimbursement, either through check, prepaid card or through a different procedure specified by the deal.

Pros and Cons of Philadelphia Real Estate Tax Rebate Form

Advantages

-

Cost savings Philadelphia Real Estate Tax Rebate Form can substantially decrease the price for a product.

-

Promotional Offers they encourage their customers to experiment with new products, or brands.

-

Increase Sales Philadelphia Real Estate Tax Rebate Form can help boost sales for a company and also increase market share.

Disadvantages

-

Complexity In particular, mail-in Philadelphia Real Estate Tax Rebate Form in particular may be lengthy and time-consuming.

-

The Expiration Dates Some Philadelphia Real Estate Tax Rebate Form have strict time limits for submission.

-

Risk of not receiving payment Some customers might miss out on Philadelphia Real Estate Tax Rebate Form because they don't adhere to the requirements precisely.

Download Philadelphia Real Estate Tax Rebate Form

Download Philadelphia Real Estate Tax Rebate Form

FAQs

1. Are Philadelphia Real Estate Tax Rebate Form similar to discounts? No, they are an amount of money that is refunded after the purchase, while discounts lower the purchase price at time of sale.

2. Are there Philadelphia Real Estate Tax Rebate Form that can be used for the same product The answer is dependent on the conditions of the Philadelphia Real Estate Tax Rebate Form offer and also the item's qualification. Certain companies allow it, but some will not.

3. What is the time frame to receive a Philadelphia Real Estate Tax Rebate Form? The length of time can vary, but typically it will take anywhere from a few weeks to a few months to receive your Philadelphia Real Estate Tax Rebate Form.

4. Do I have to pay taxes with respect to Philadelphia Real Estate Tax Rebate Form sums? most cases, Philadelphia Real Estate Tax Rebate Form amounts are not considered taxable income.

5. Do I have confidence in Philadelphia Real Estate Tax Rebate Form offers from brands that aren't well-known Do I need to conduct a thorough research and confirm that the brand providing the Philadelphia Real Estate Tax Rebate Form is trustworthy prior to making an purchase.

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

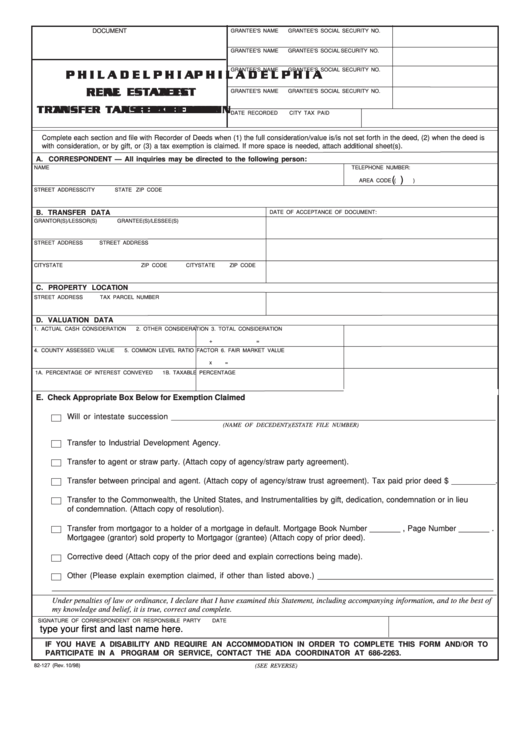

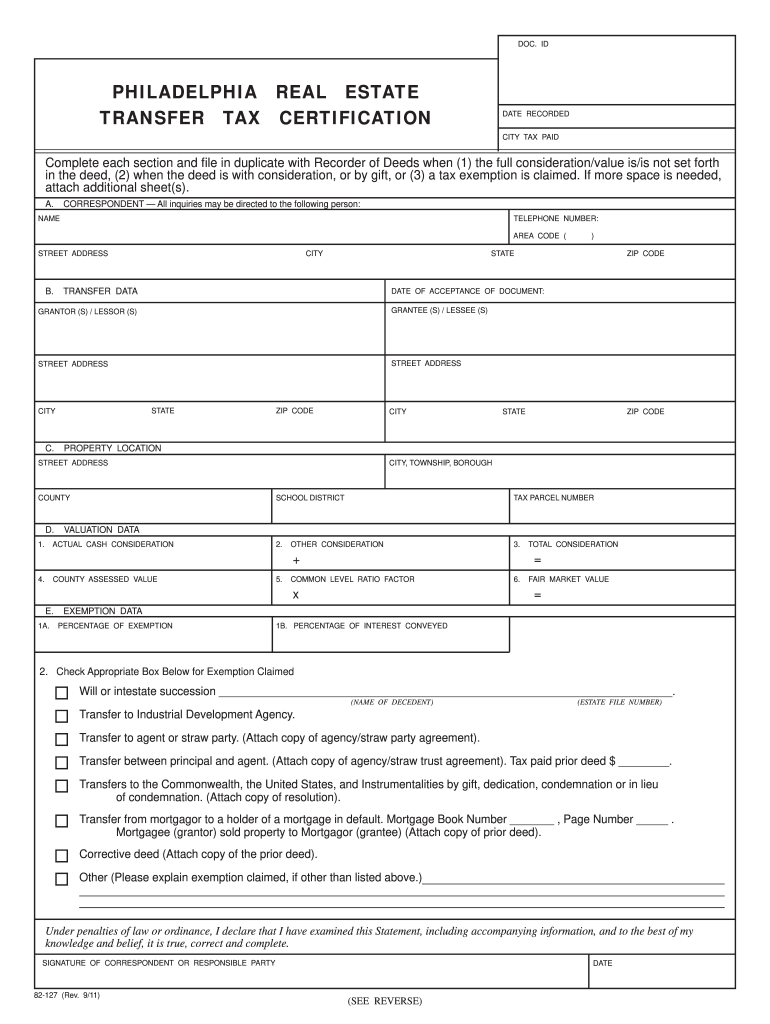

Fillable Form 82 127 Philadelphia Real Estate Transfer Tax

Check more sample of Philadelphia Real Estate Tax Rebate Form below

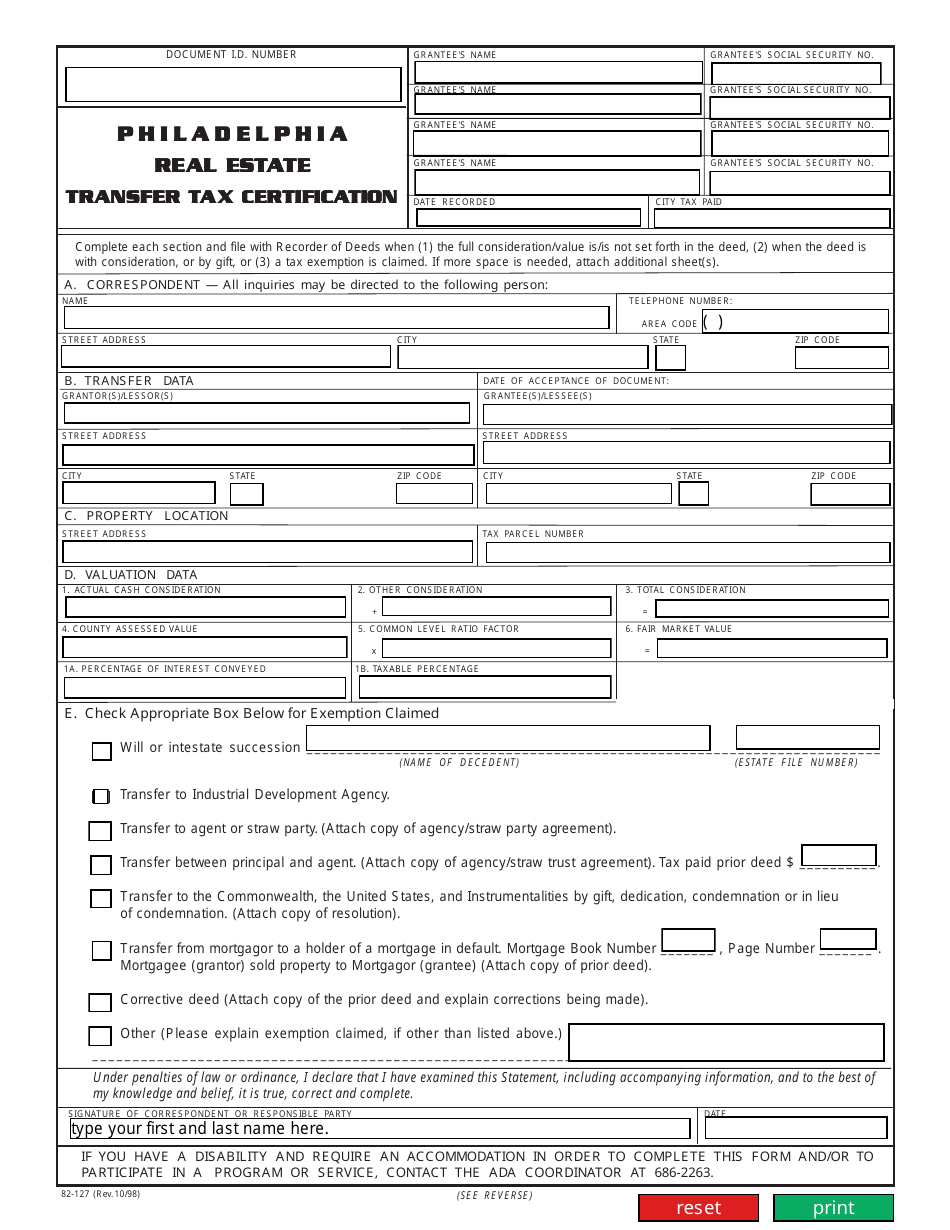

Form 82 127 Download Fillable PDF Or Fill Online Real Estate Transfer

Rev 1220 As 9 08 I Fill Online Printable Fillable Blank PdfFiller

2021 PA Form PA 40 ES I Fill Online Printable Fillable Blank

PA Property Tax Rebate Forms Printable Rebate Form

Philadelphia Deed Transfer Form Fill Out And Sign Printable PDF

T1159 Fill Out Sign Online DocHub

https://www.revenue.pa.gov/FormsandPublications/FormsforIndividuals/P…

Web 2022 Property Tax Rent Rebate applications must be postmarked by December 31 2023 to be considered myPATH allows claimants of the Property Tax Rent Rebate Program to

https://www.phila.gov/documents/homestead-exemption-application

Web 11 lignes nbsp 0183 32 Department of Revenue PO Box 52817 Philadelphia PA 19115 You must

Web 2022 Property Tax Rent Rebate applications must be postmarked by December 31 2023 to be considered myPATH allows claimants of the Property Tax Rent Rebate Program to

Web 11 lignes nbsp 0183 32 Department of Revenue PO Box 52817 Philadelphia PA 19115 You must

PA Property Tax Rebate Forms Printable Rebate Form

Rev 1220 As 9 08 I Fill Online Printable Fillable Blank PdfFiller

Philadelphia Deed Transfer Form Fill Out And Sign Printable PDF

T1159 Fill Out Sign Online DocHub

P G Printable Rebate Form

Property Tax Rebate Application Printable Pdf Download

Property Tax Rebate Application Printable Pdf Download

Ptr Tax Rebate Libracha