In today's consumer-driven world we all love a good bargain. One way to make substantial savings on your purchases can be achieved through Ontario Carbon Tax Rebate Forms. They are a form of marketing employed by retailers and manufacturers to offer consumers a partial refund for their purchases after they have taken them. In this article, we will delve into the world of Ontario Carbon Tax Rebate Forms. We'll discuss what they are their purpose, how they function and how you can maximise your savings with these cost-effective incentives.

Get Latest Ontario Carbon Tax Rebate Form Below

Ontario Carbon Tax Rebate Form

Ontario Carbon Tax Rebate Form -

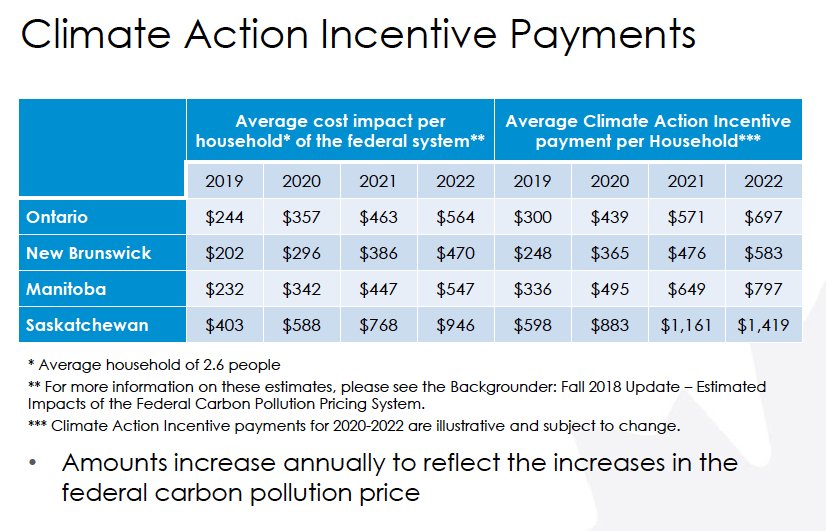

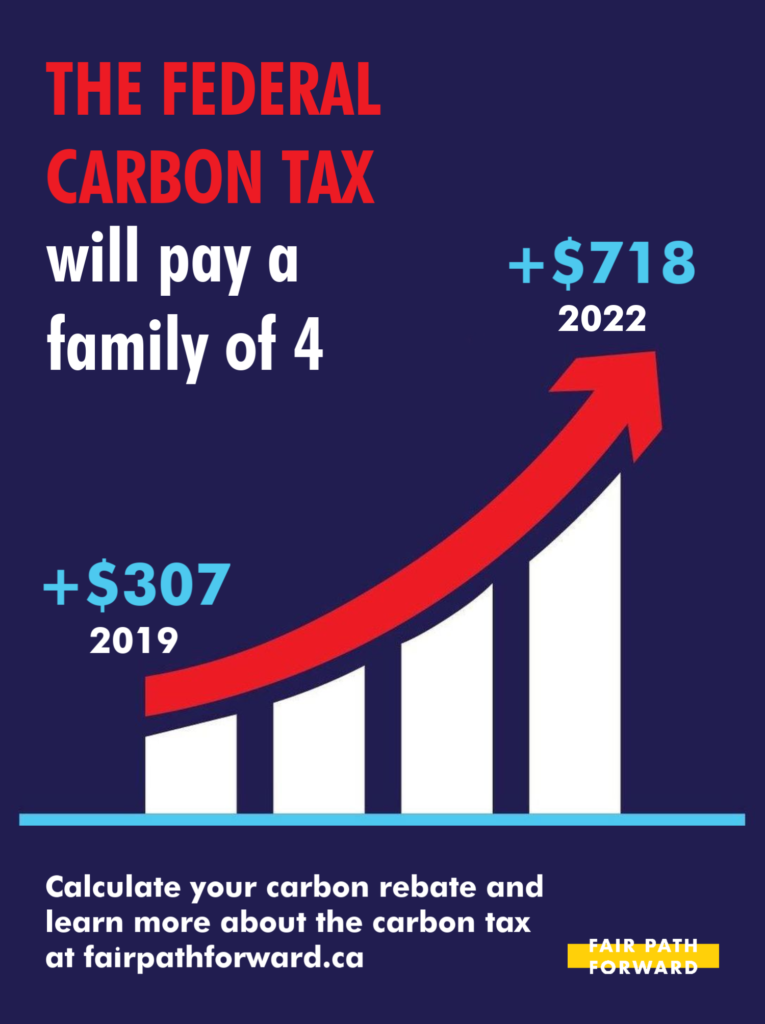

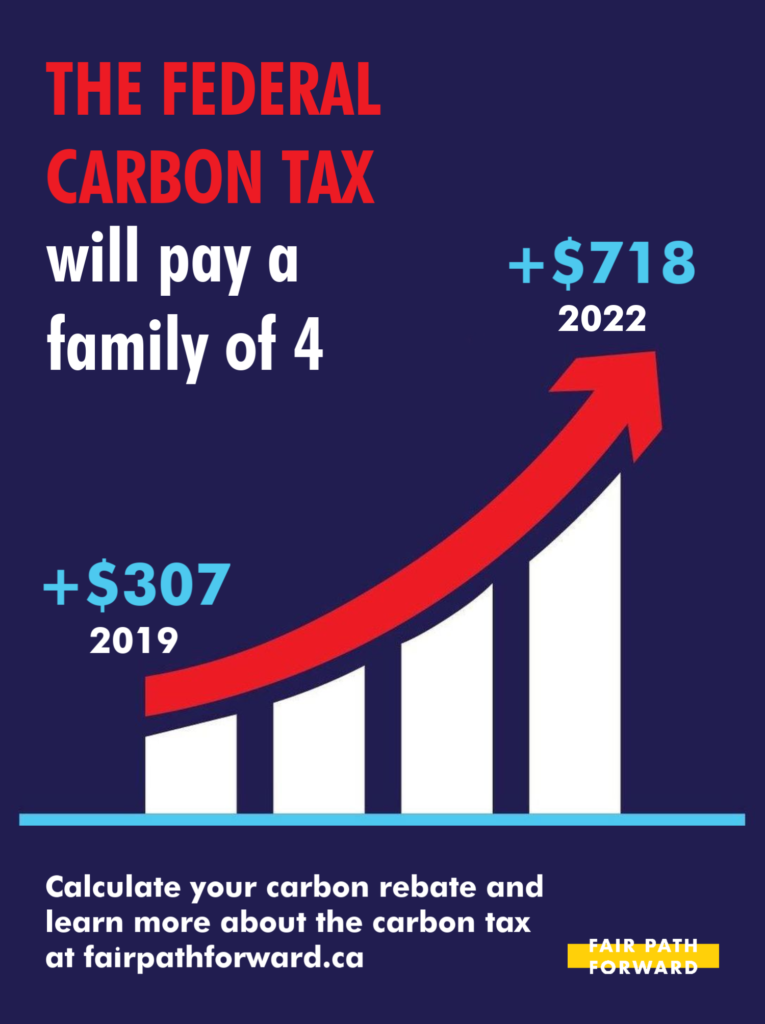

Web 23 mars 2022 nbsp 0183 32 No funds collected are retained by the federal government In 2022 23 the increased CAI payments announced today mean a family of four will receive 745 in

Web 22 nov 2022 nbsp 0183 32 CAI payments for 2023 24 will be disbursed as follows Residents of Alberta Manitoba Ontario and Saskatchewan will receive four equal quarterly payments April

A Ontario Carbon Tax Rebate Form at its most basic form, is a refund that a client receives who has purchased a particular product or service. It's a powerful method that companies use to attract customers, increase sales and to promote certain products.

Types of Ontario Carbon Tax Rebate Form

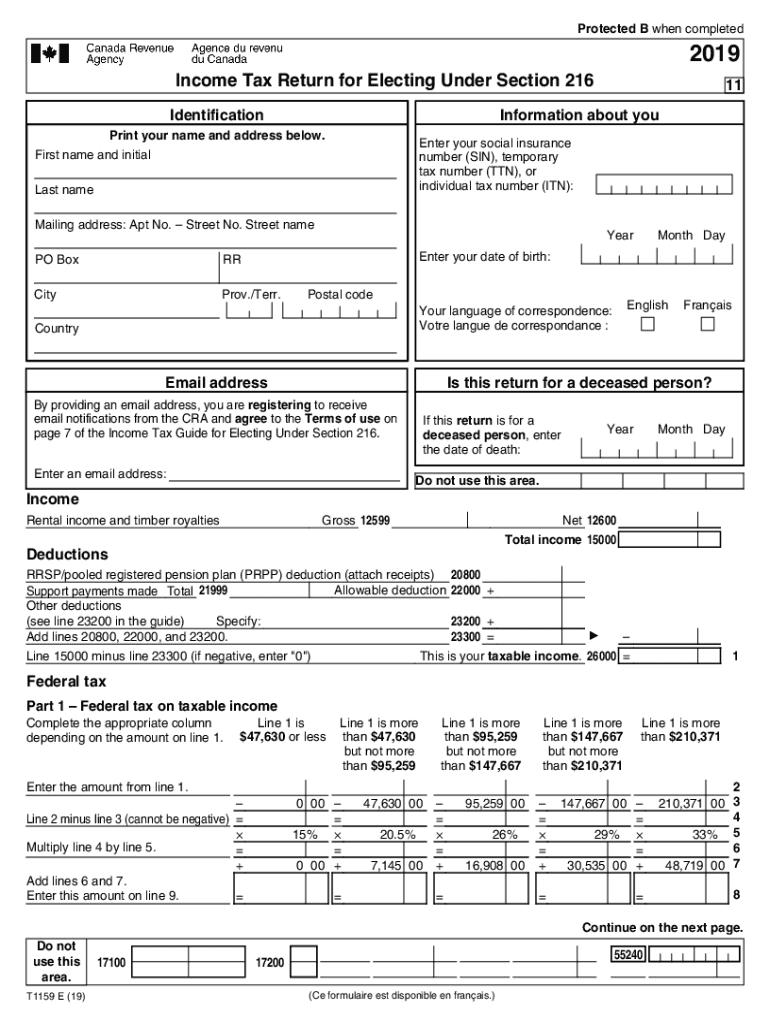

T1159 Fill Out Sign Online DocHub

T1159 Fill Out Sign Online DocHub

Web 13 avr 2023 nbsp 0183 32 264 in Manitoba 340 in Saskatchewan 386 in Alberta With payments every three months a family of four will be eligible to receive a yearly 2023 2024 total of

Web 11 juil 2023 nbsp 0183 32 Who is eligible for the carbon tax rebate The CAIP is already available to residents of Alberta Saskatchewan Manitoba and Ontario This month the federal

Cash Ontario Carbon Tax Rebate Form

Cash Ontario Carbon Tax Rebate Form is the most basic kind of Ontario Carbon Tax Rebate Form. Customers receive a specific amount of money in return for purchasing a particular item. These are usually used for expensive items such as electronics or appliances.

Mail-In Ontario Carbon Tax Rebate Form

Customers who want to receive mail-in Ontario Carbon Tax Rebate Form must present the proof of purchase in order to receive the money. They are a bit more involved but offer substantial savings.

Instant Ontario Carbon Tax Rebate Form

Instant Ontario Carbon Tax Rebate Form are made at the point of sale and reduce the purchase cost immediately. Customers don't need to wait long for savings when they purchase this type of Ontario Carbon Tax Rebate Form.

How Ontario Carbon Tax Rebate Form Work

Ontario Climate Action Incentive And Carbon Rebate Use Survey HALLBAR ORG

Ontario Climate Action Incentive And Carbon Rebate Use Survey HALLBAR ORG

Web 15 juil 2022 nbsp 0183 32 1 079 in Alberta 1 101 in Saskatchewan 832 in Manitoba 745 in Ontario Residents of small and rural communities will receive an extra 10 per cent on

The Ontario Carbon Tax Rebate Form Process

The procedure usually involves a handful of simple steps:

-

When you buy the product you purchase the item in the same way you would normally.

-

Complete your Ontario Carbon Tax Rebate Form template: You'll have be able to provide a few details like your name, address, and information about the purchase in order to get your Ontario Carbon Tax Rebate Form.

-

You must submit the Ontario Carbon Tax Rebate Form depending on the nature of Ontario Carbon Tax Rebate Form you could be required to fill out a form and mail it in or send it via the internet.

-

Wait until the company approves: The company will evaluate your claim to make sure that it's in accordance with the refund's conditions and terms.

-

Redeem your Ontario Carbon Tax Rebate Form When it's approved you'll receive a refund either through check, prepaid card, or a different option that's specified in the offer.

Pros and Cons of Ontario Carbon Tax Rebate Form

Advantages

-

Cost Savings A Ontario Carbon Tax Rebate Form can significantly cut the price you pay for a product.

-

Promotional Deals These deals encourage customers to try new items or brands.

-

boost sales Ontario Carbon Tax Rebate Form are a great way to boost sales for a company and also increase market share.

Disadvantages

-

Complexity mail-in Ontario Carbon Tax Rebate Form particularly is a time-consuming process and time-consuming.

-

Deadlines for Expiration A majority of Ontario Carbon Tax Rebate Form have strict time limits for submission.

-

Risk of Non-Payment Customers may not receive Ontario Carbon Tax Rebate Form if they don't adhere to the rules exactly.

Download Ontario Carbon Tax Rebate Form

Download Ontario Carbon Tax Rebate Form

FAQs

1. Are Ontario Carbon Tax Rebate Form the same as discounts? Not necessarily, as Ontario Carbon Tax Rebate Form are a partial refund upon purchase, whereas discounts cut the purchase price at moment of sale.

2. Are there Ontario Carbon Tax Rebate Form that can be used for the same product What is the best way to do it? It's contingent on conditions that apply to the Ontario Carbon Tax Rebate Form deals and product's admissibility. Certain companies might permit it, but some will not.

3. How long will it take to receive a Ontario Carbon Tax Rebate Form What is the timeframe? is variable, however it can range from several weeks to few months before you receive your Ontario Carbon Tax Rebate Form.

4. Do I need to pay taxes upon Ontario Carbon Tax Rebate Form quantities? most situations, Ontario Carbon Tax Rebate Form amounts are not considered taxable income.

5. Can I trust Ontario Carbon Tax Rebate Form deals from lesser-known brands Do I need to conduct a thorough research and make sure that the company offering the Ontario Carbon Tax Rebate Form is reputable prior to making purchases.

Carbon Tax Rebates Coming To Provinces That Rejected Federal Plan

Carbon Policy BC Carbon Tax Link To The World

Check more sample of Ontario Carbon Tax Rebate Form below

A Tale Of 2 Taxes How Carbon Pricing And Revenue Rolls Out In Alberta

What You Need To Know Federal Carbon Tax Takes Effect In Ont

Alberta Budget 2016 How Much Is This Carbon Tax Going To Cost Me

TOPS Tops Business Forms W 3 Tax Form 2 Pt Form With Carbons 10 PK

Confused About Carbon Taxes And Rebates Here s What You Need To Know

Edmonton Grandmother Told To Return Portion Of Carbon Tax Rebate Cheque

https://www.canada.ca/en/department-finance/news/2022/11/climate...

Web 22 nov 2022 nbsp 0183 32 CAI payments for 2023 24 will be disbursed as follows Residents of Alberta Manitoba Ontario and Saskatchewan will receive four equal quarterly payments April

https://www.canada.ca/en/revenue-agency/campaigns/cai-payment.html

Web That s why the Government of Canada has put a price on carbon pollution The Government of Canada has introduced the new climate action incentive CAI payment If you are a

Web 22 nov 2022 nbsp 0183 32 CAI payments for 2023 24 will be disbursed as follows Residents of Alberta Manitoba Ontario and Saskatchewan will receive four equal quarterly payments April

Web That s why the Government of Canada has put a price on carbon pollution The Government of Canada has introduced the new climate action incentive CAI payment If you are a

TOPS Tops Business Forms W 3 Tax Form 2 Pt Form With Carbons 10 PK

What You Need To Know Federal Carbon Tax Takes Effect In Ont

Confused About Carbon Taxes And Rebates Here s What You Need To Know

Edmonton Grandmother Told To Return Portion Of Carbon Tax Rebate Cheque

Are 2020 s Tax Changes significant Or a Wash CBC News

Clean Prosperity Releases Its Own Carbon Tax Sticker For Ontario

Clean Prosperity Releases Its Own Carbon Tax Sticker For Ontario

Taxing Canadians Patience Corporations Need To Pay Their Fair Share