In today's consumer-driven world everyone is looking for a great deal. One way to gain significant savings on your purchases can be achieved through Obama S Rebate Forms. Obama S Rebate Forms are a strategy for marketing employed by retailers and manufacturers to provide customers with a portion of a refund for their purchases after they have completed them. In this post, we'll delve into the world of Obama S Rebate Forms. We'll look at the nature of them and how they function, and how you can make the most of your savings using these low-cost incentives.

Get Latest Obama S Rebate Form Below

Obama S Rebate Form

Obama S Rebate Form -

Web 18 juil 2013 nbsp 0183 32 WASHINGTON July 18 2013 An estimated 8 5 million Americans will receive rebates from their health insurers this summer thanks to the Affordable Care Act

Tax rebates that were created by the law were paid to individual U S taxpayers during 2008 Most taxpayers below the income limit received a rebate of at least 300 per person 600 for married couples filing jointly Eligible taxpayers received along with their individual payment 300 per dependent child under the age of 17 The payment was equal to the payer s net income tax liability but could not exceed 600 for a single person or 1200 married couple filing jointly

A Obama S Rebate Form as it is understood in its simplest definition, is a reimbursement to a buyer after they've bought a product or service. It's an effective way used by businesses to attract buyers, increase sales and also to advertise certain products.

Types of Obama S Rebate Form

Obama Health Insurance Rebate Checks Are In The Mail McClatchy DC

Obama Health Insurance Rebate Checks Are In The Mail McClatchy DC

In his New Energy For America plan Obama proposes to reduce overall U S oil consumption by at least 35 or 10 million barrels per day by 2030 in order to offset imports from OPEC nations And by 2011 the United States was said to be quot awash with domestic oil and increasingly divorced and less reliant on foreign imports quot

Web 26 f 233 vr 2009 nbsp 0183 32 The US stimulus bill recently signed into law by US President Barack Obama includes a 300 million provision to fund the Energy Efficient Appliance Rebate Program

Cash Obama S Rebate Form

Cash Obama S Rebate Form are the most basic kind of Obama S Rebate Form. Customers get a set amount of money back upon buying a product. These are typically applied to the most expensive products like electronics or appliances.

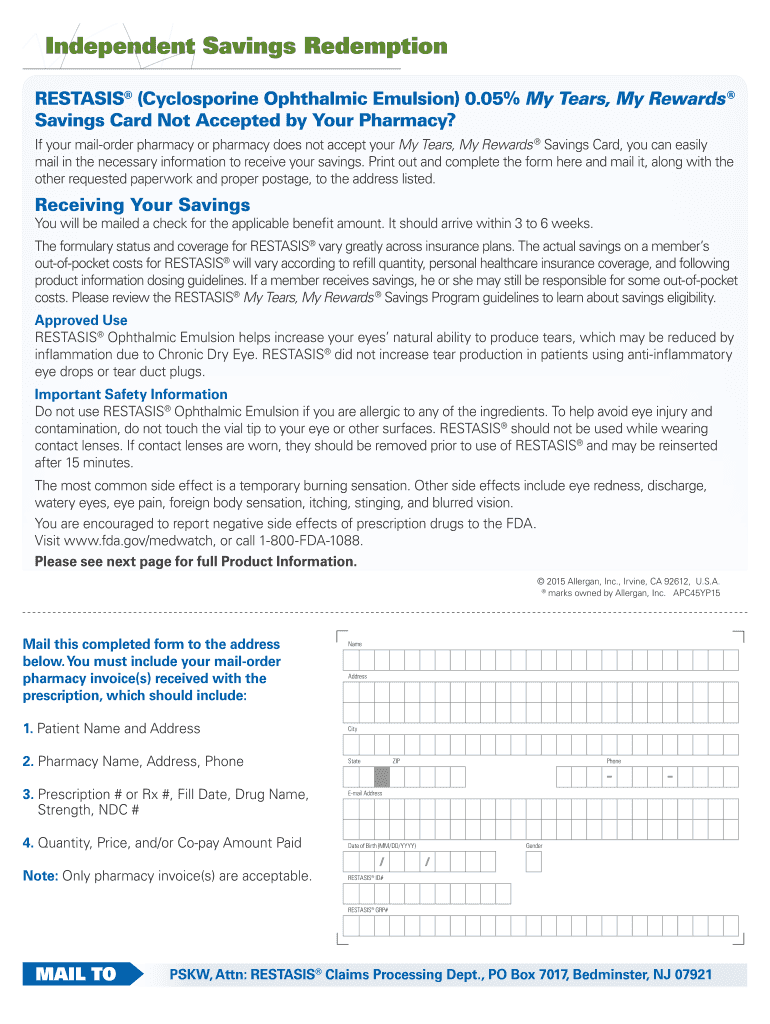

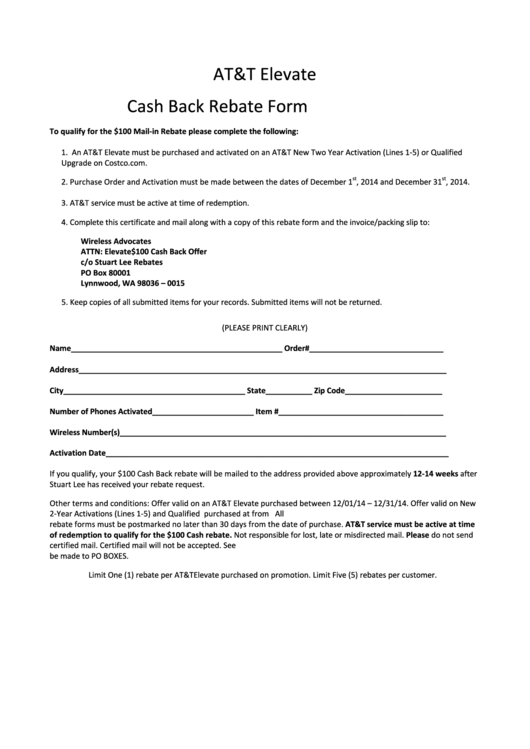

Mail-In Obama S Rebate Form

Mail-in Obama S Rebate Form demand that customers send in their proof of purchase before receiving their cash back. They're more involved but offer huge savings.

Instant Obama S Rebate Form

Instant Obama S Rebate Form are credited at the moment of sale, cutting the price of your purchase instantly. Customers do not have to wait long for savings by using this method.

How Obama S Rebate Form Work

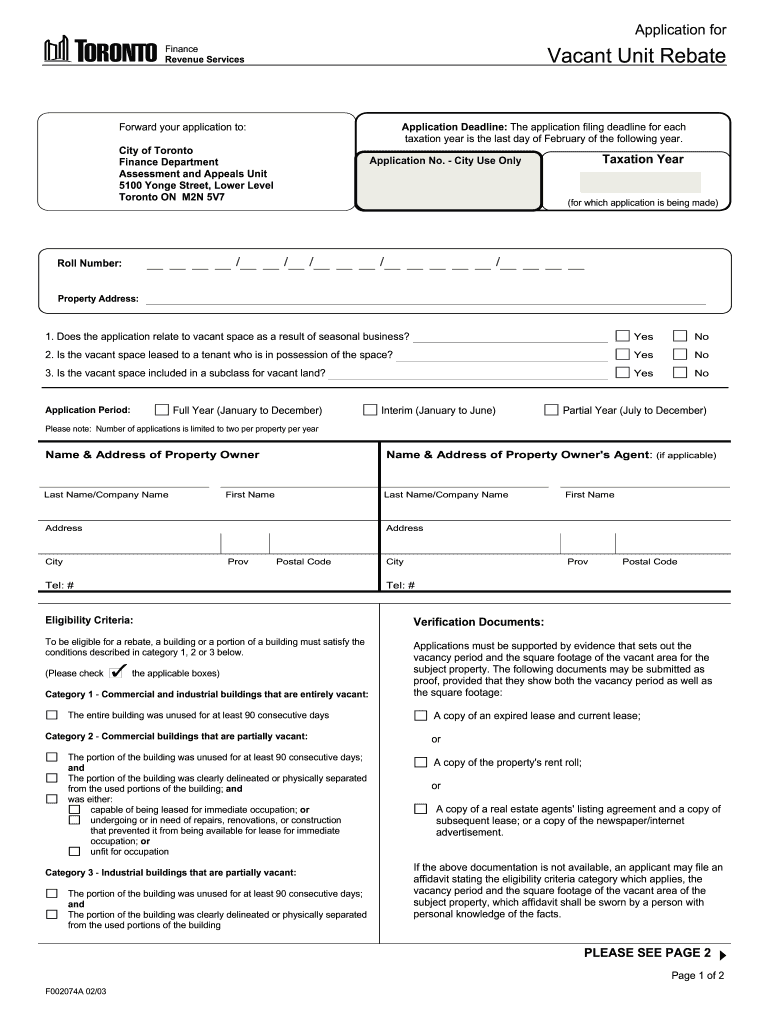

Rebate Form Template Fill Out And Sign Printable PDF Template SignNow

Rebate Form Template Fill Out And Sign Printable PDF Template SignNow

Web 27 juil 2023 nbsp 0183 32 Find out about Rebate Programs to maximize your rebate savings start by researching available rebates in your area These include state local and federal

The Obama S Rebate Form Process

The procedure typically consists of a few simple steps

-

Buy the product: At first purchase the product exactly as you would normally.

-

Complete the Obama S Rebate Form questionnaire: you'll have to give some specific information like your name, address and the purchase details, in order to be eligible for a Obama S Rebate Form.

-

In order to submit the Obama S Rebate Form: Depending on the nature of Obama S Rebate Form it is possible that you need to submit a form by mail or submit it online.

-

Wait for the company's approval: They will scrutinize your submission for compliance with guidelines and conditions of the Obama S Rebate Form.

-

Enjoy your Obama S Rebate Form When it's approved the amount you receive will be through a check, or a prepaid card, or any other procedure specified by the deal.

Pros and Cons of Obama S Rebate Form

Advantages

-

Cost savings Rewards can drastically lower the cost you pay for a product.

-

Promotional Deals These promotions encourage consumers to try new products or brands.

-

Improve Sales Reward programs can boost companies' sales and market share.

Disadvantages

-

Complexity Obama S Rebate Form that are mail-in, particularly is a time-consuming process and time-consuming.

-

Deadlines for Expiration Many Obama S Rebate Form impose certain deadlines for submitting.

-

Risk of Not Being Paid: Some customers may not receive their Obama S Rebate Form if they don't comply with the rules precisely.

Download Obama S Rebate Form

FAQs

1. Are Obama S Rebate Form similar to discounts? No, the Obama S Rebate Form will be only a partial reimbursement following the purchase, while discounts reduce the purchase price at the moment of sale.

2. Are there Obama S Rebate Form that can be used on the same product It's dependent on the conditions of the Obama S Rebate Form provides and the particular product's suitability. Certain companies might permit it, but others won't.

3. How long will it take to get a Obama S Rebate Form What is the timeframe? varies, but it can take anywhere from a couple of weeks to a couple of months for you to receive your Obama S Rebate Form.

4. Do I have to pay taxes for Obama S Rebate Form amounts? In most instances, Obama S Rebate Form amounts are not considered taxable income.

5. Can I trust Obama S Rebate Form deals from lesser-known brands It's crucial to research and ensure that the brand giving the Obama S Rebate Form is reputable prior to making a purchase.

1 Un

Rebate Form Fill And Sign Printable Template Online US Legal Forms

Check more sample of Obama S Rebate Form below

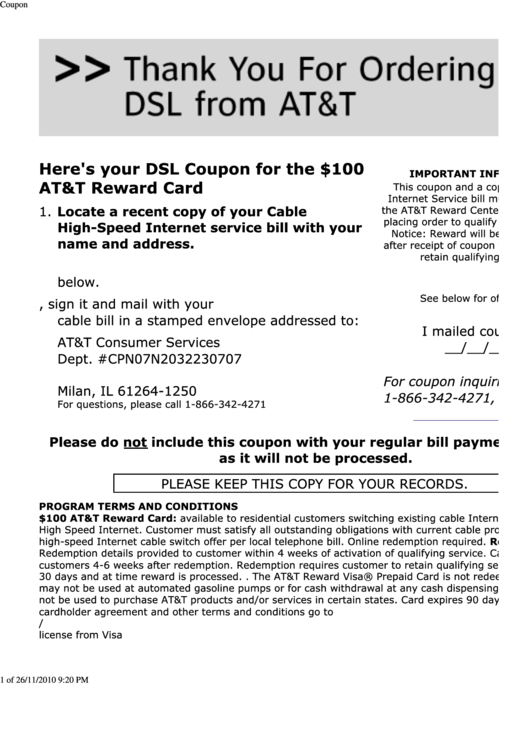

At t Elevate Cash Back Rebate Form Printable Pdf Download

Printable Old Style Rebate Form Printable Forms Free Online

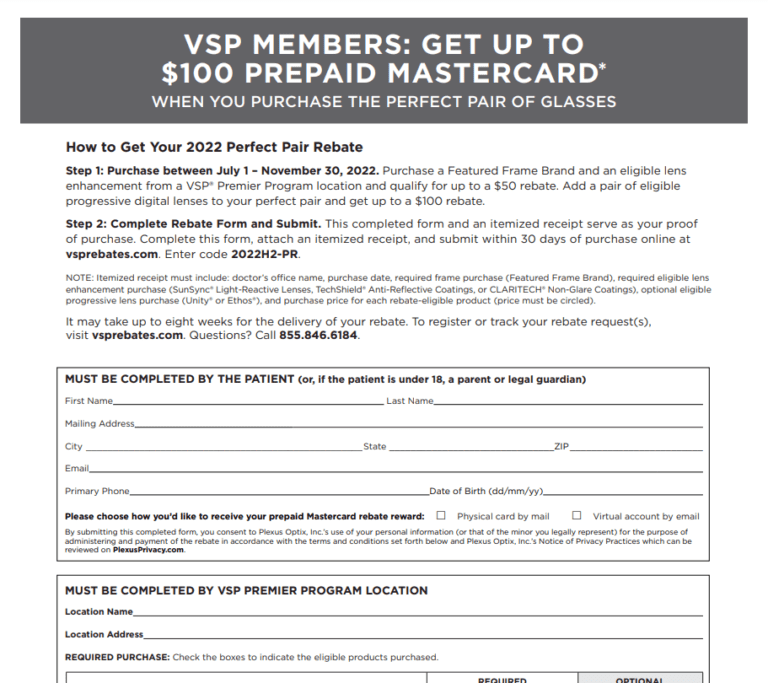

Vsp Glasses Rebate Form Printable Rebate Form

PPL Rebates Printable Rebate Form

Obama Orders 2350 Dollar Tax Rebate In November Obama Rebates Dollar

Maryland Renters Rebate 2023 Printable Rebate Form

https://en.wikipedia.org/wiki/Economic_Stimulus_Act_of_2008

Tax rebates that were created by the law were paid to individual U S taxpayers during 2008 Most taxpayers below the income limit received a rebate of at least 300 per person 600 for married couples filing jointly Eligible taxpayers received along with their individual payment 300 per dependent child under the age of 17 The payment was equal to the payer s net income tax liability but could not exceed 600 for a single person or 1200 married couple filing jointly

https://www.thebalancemoney.com/what-was-obama-s-stimulus-package …

Web 31 d 233 c 2021 nbsp 0183 32 President Barack Obama signed the American Recovery and Reinvestment Act ARRA on February 17 2009 The Congressional Budget Office estimated it would

Tax rebates that were created by the law were paid to individual U S taxpayers during 2008 Most taxpayers below the income limit received a rebate of at least 300 per person 600 for married couples filing jointly Eligible taxpayers received along with their individual payment 300 per dependent child under the age of 17 The payment was equal to the payer s net income tax liability but could not exceed 600 for a single person or 1200 married couple filing jointly

Web 31 d 233 c 2021 nbsp 0183 32 President Barack Obama signed the American Recovery and Reinvestment Act ARRA on February 17 2009 The Congressional Budget Office estimated it would

PPL Rebates Printable Rebate Form

Printable Old Style Rebate Form Printable Forms Free Online

Obama Orders 2350 Dollar Tax Rebate In November Obama Rebates Dollar

Maryland Renters Rebate 2023 Printable Rebate Form

Menards 11 Off Everything Purchases 3 22 20 3 28 20

Printable Rebate Form 6119 Printable Forms Free Online

Printable Rebate Form 6119 Printable Forms Free Online

85 SAMPLE PRINTABLE LEASE AGREEMENT SamplePrintable2