Today, in a world that is driven by the consumer everybody loves a good deal. One method of gaining significant savings on your purchases is to use Nyc Star Rebate Forms. Nyc Star Rebate Forms are marketing strategies that retailers and manufacturers use to offer customers a refund for their purchases after they've completed them. In this article, we will dive into the world Nyc Star Rebate Forms, exploring what they are about, how they work, and ways to maximize the savings you can make by using these cost-effective incentives.

Get Latest Nyc Star Rebate Form Below

Nyc Star Rebate Form

Nyc Star Rebate Form -

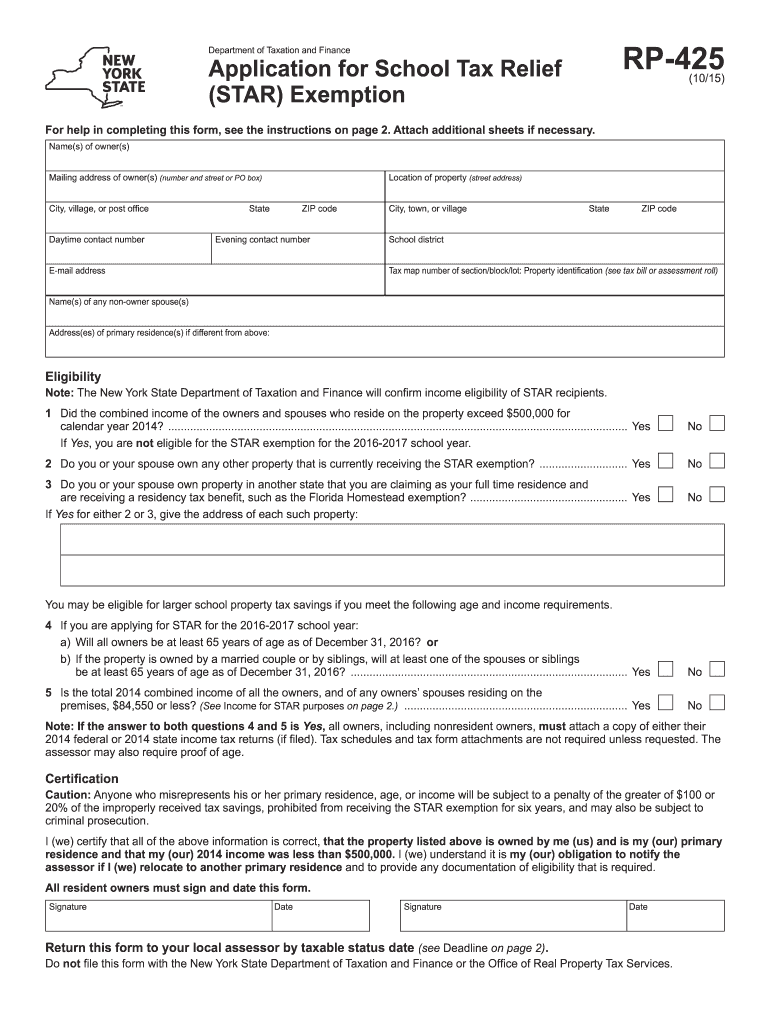

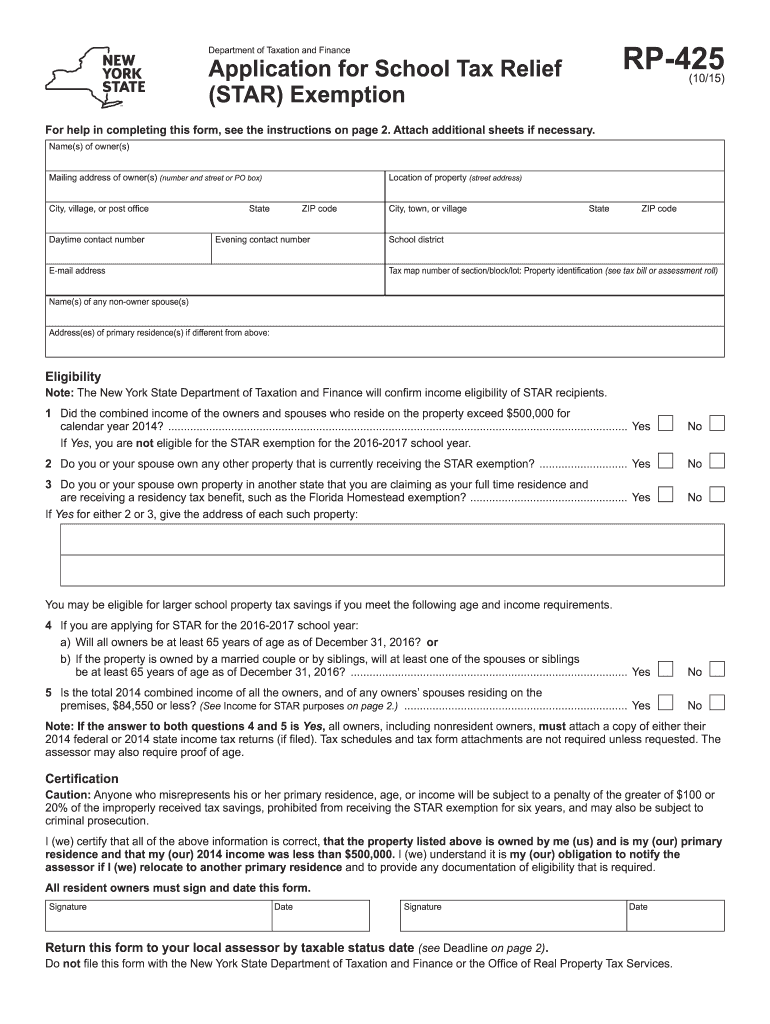

Web This form is primarily for use by property owners with Basic STAR exemptions who wish to apply and are eligible for the Enhanced STAR exemption If you are a new homeowner

Web You may apply for the Basic STAR or Enhanced STAR tax exemption with the NYC Department of Finance if You owned your property and received STAR in 2015 16 but

A Nyc Star Rebate Form as it is understood in its simplest form, is a refund given to a client following the purchase of a product or service. It's a very effective technique for businesses to entice clients, increase sales and advertise specific products.

Types of Nyc Star Rebate Form

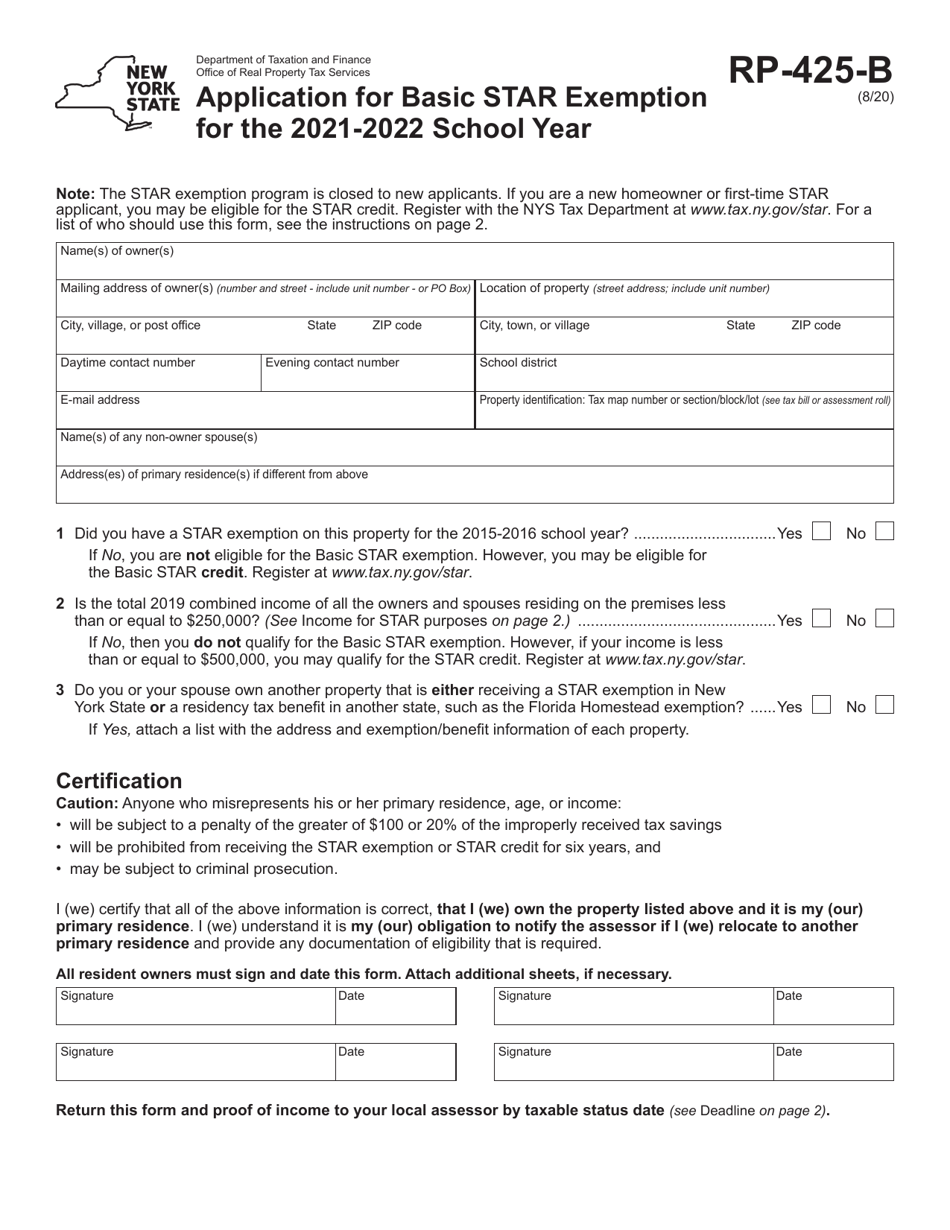

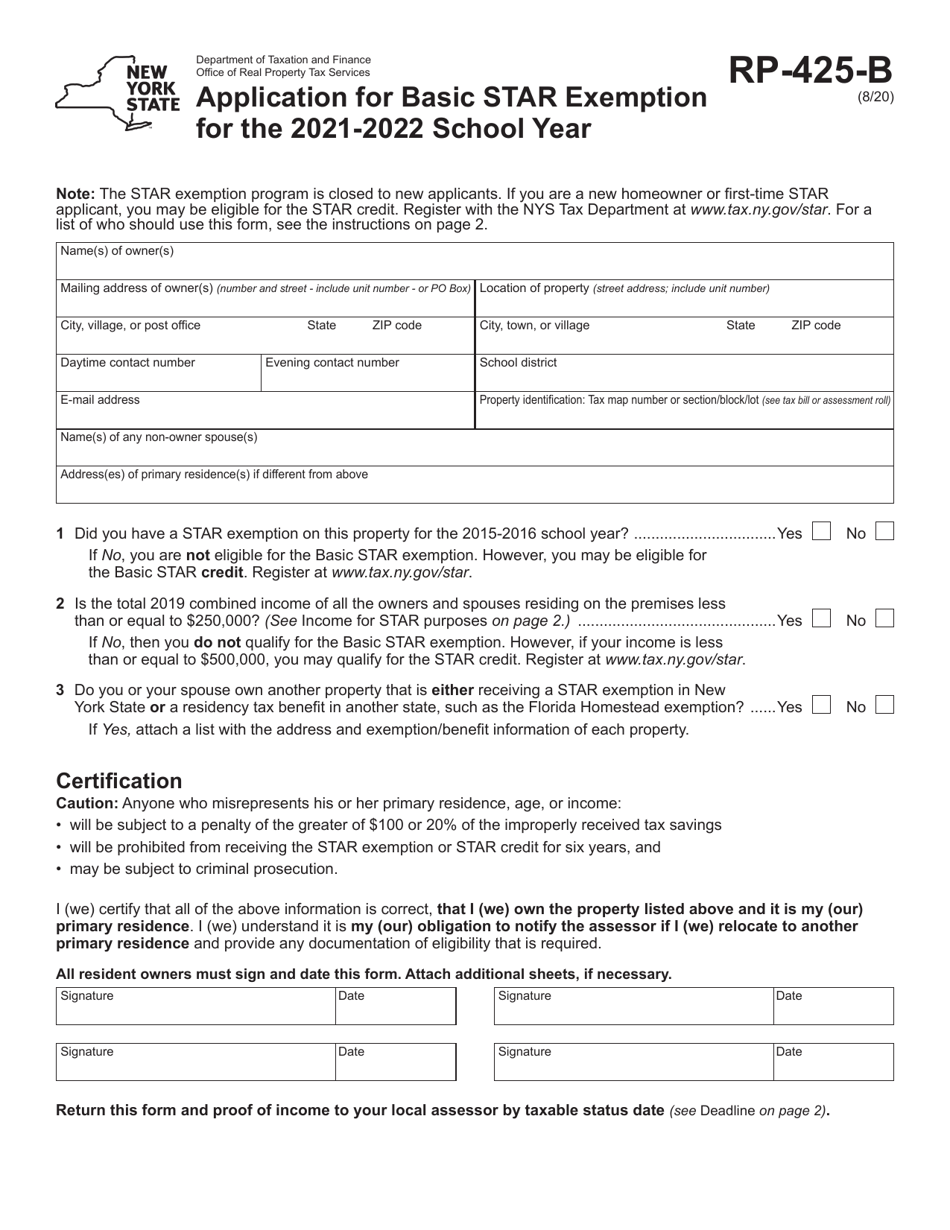

Form RP 425 B Download Fillable PDF Or Fill Online Application For

Form RP 425 B Download Fillable PDF Or Fill Online Application For

Web and you must have had a STAR exemption on the same property for the 2015 2016 school year If your income is more than 250 000 but less than or equal to 500 000 you may

Web If you want to restore your Basic STAR exemption If you got the Basic STAR exemption in 2015 16 but later lost the benefit you can restore it through NYC Department of Finance

Cash Nyc Star Rebate Form

Cash Nyc Star Rebate Form is the most basic type of Nyc Star Rebate Form. Customers are offered a certain amount back in cash after purchasing a item. These are typically for products that are expensive, such as electronics or appliances.

Mail-In Nyc Star Rebate Form

Mail-in Nyc Star Rebate Form require consumers to present documents of purchase to claim the money. They're more complicated, but they can provide significant savings.

Instant Nyc Star Rebate Form

Instant Nyc Star Rebate Form are credited at the moment of sale, cutting the purchase price immediately. Customers do not have to wait until they can save when they purchase this type of Nyc Star Rebate Form.

How Nyc Star Rebate Form Work

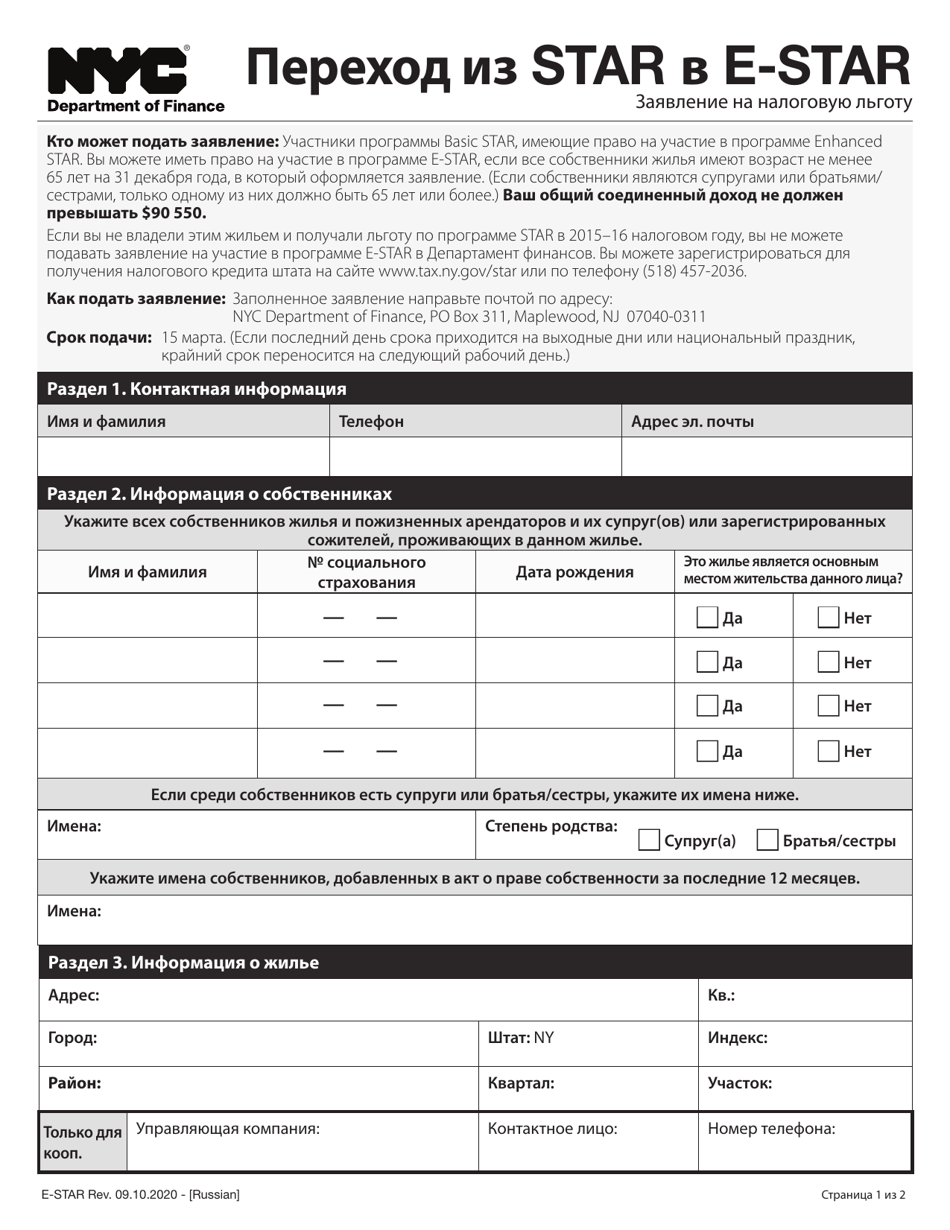

New York City Star To E Star Exemption Application Download Fillable

New York City Star To E Star Exemption Application Download Fillable

Web You can register for the state tax credit at www tax ny gov star or by calling 518 457 2036 How to apply Mail your completed application to NYC Department of Finance PO Box

The Nyc Star Rebate Form Process

The process typically comprises a few steps

-

Purchase the product: Then you buy the product the way you normally do.

-

Fill in your Nyc Star Rebate Form application: In order to claim your Nyc Star Rebate Form, you'll have to provide some data, such as your name, address and information about the purchase in order to submit your Nyc Star Rebate Form.

-

Complete the Nyc Star Rebate Form Based on the type of Nyc Star Rebate Form you will need to mail in a form or submit it online.

-

Wait for the company's approval: They will scrutinize your submission for compliance with reimbursement's terms and condition.

-

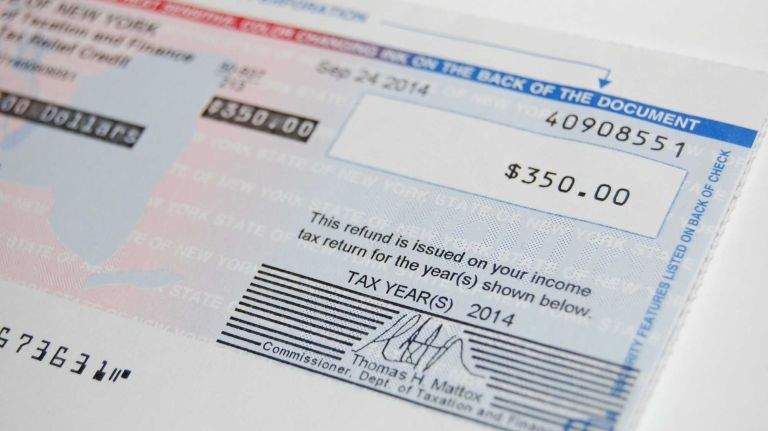

Redeem your Nyc Star Rebate Form: Once approved, you'll receive your money back, in the form of a check, prepaid card or another method as specified by the offer.

Pros and Cons of Nyc Star Rebate Form

Advantages

-

Cost savings Nyc Star Rebate Form can dramatically decrease the price for an item.

-

Promotional Deals Customers are enticed to explore new products or brands.

-

boost sales A Nyc Star Rebate Form program can boost companies' sales and market share.

Disadvantages

-

Complexity Nyc Star Rebate Form that are mail-in, in particular the case of HTML0, can be a hassle and time-consuming.

-

Day of Expiration Many Nyc Star Rebate Form have strict time limits for submission.

-

A risk of not being paid Certain customers could not be able to receive their Nyc Star Rebate Form if they don't comply with the rules exactly.

Download Nyc Star Rebate Form

FAQs

1. Are Nyc Star Rebate Form equivalent to discounts? No, Nyc Star Rebate Form offer one-third of the amount refunded following purchase, while discounts reduce the purchase price at time of sale.

2. Can I use multiple Nyc Star Rebate Form for the same product This is dependent on conditions applicable to Nyc Star Rebate Form offered and product's quality and eligibility. Certain companies may permit it, while others won't.

3. How long does it take to receive the Nyc Star Rebate Form? The length of time will differ, but can take several weeks to a few months before you receive your Nyc Star Rebate Form.

4. Do I need to pay tax of Nyc Star Rebate Form values? the majority of circumstances, Nyc Star Rebate Form amounts are not considered taxable income.

5. Do I have confidence in Nyc Star Rebate Form offers from lesser-known brands You must research and verify that the brand providing the Nyc Star Rebate Form is reputable prior to making an investment.

Westchester Pols Don t Like STAR Rebate Changes Yonkers Times

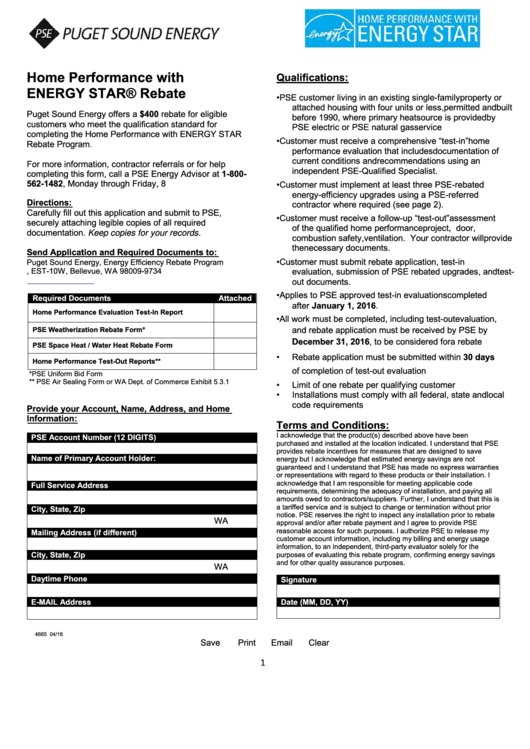

Top Pse Rebate Form Templates Free To Download In PDF Format

Check more sample of Nyc Star Rebate Form below

Nys Star Tax Rebate Checks 2022 StarRebate

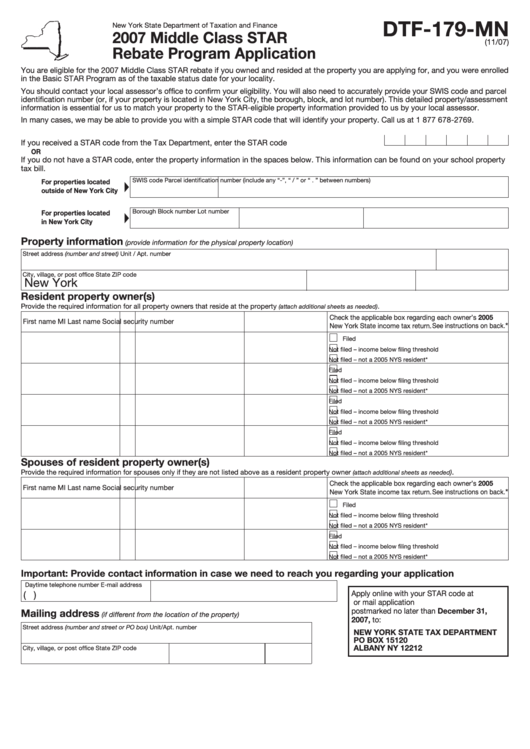

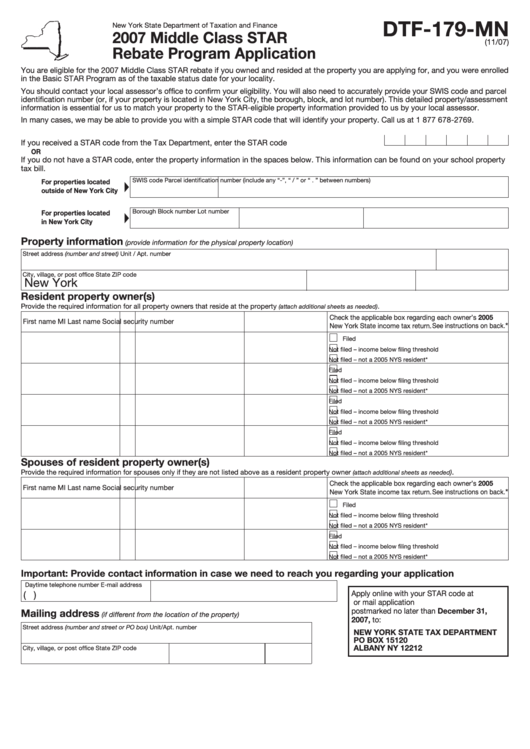

Form Dtf 179 Mn 2007 Middle Class Star Rebate Program Application

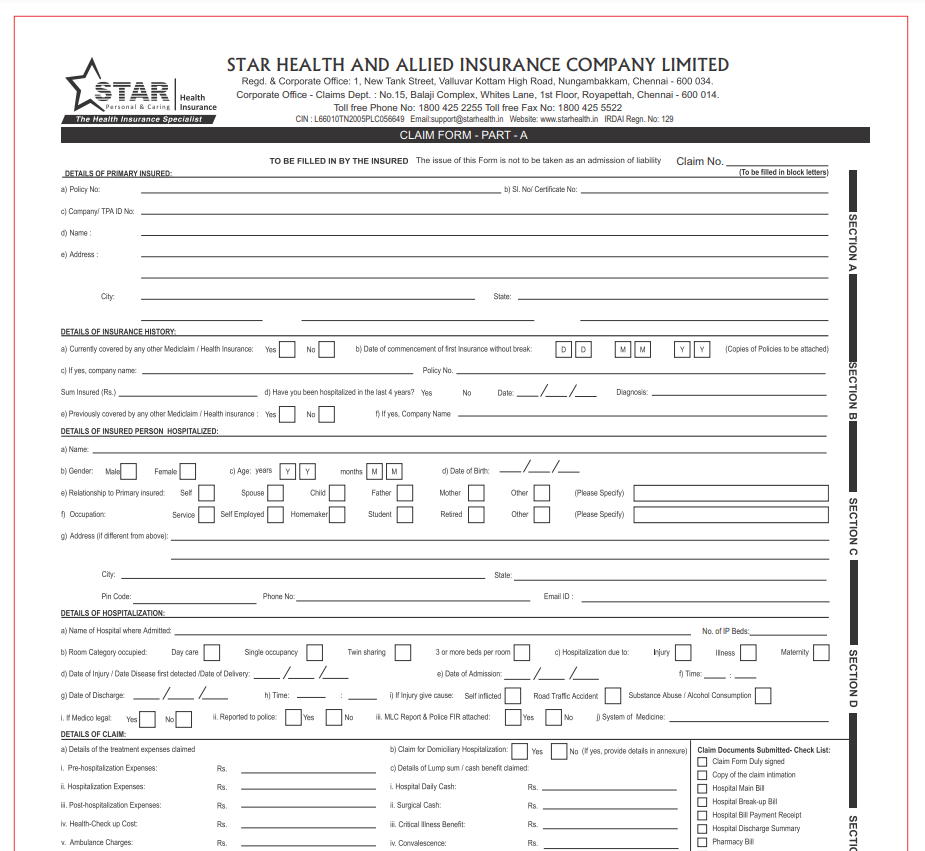

Reimbursement Process For Star Health Insurance Printable Rebate Form

Ouc Rebates Pdf Fill Online Printable Fillable Blank PdfFiller

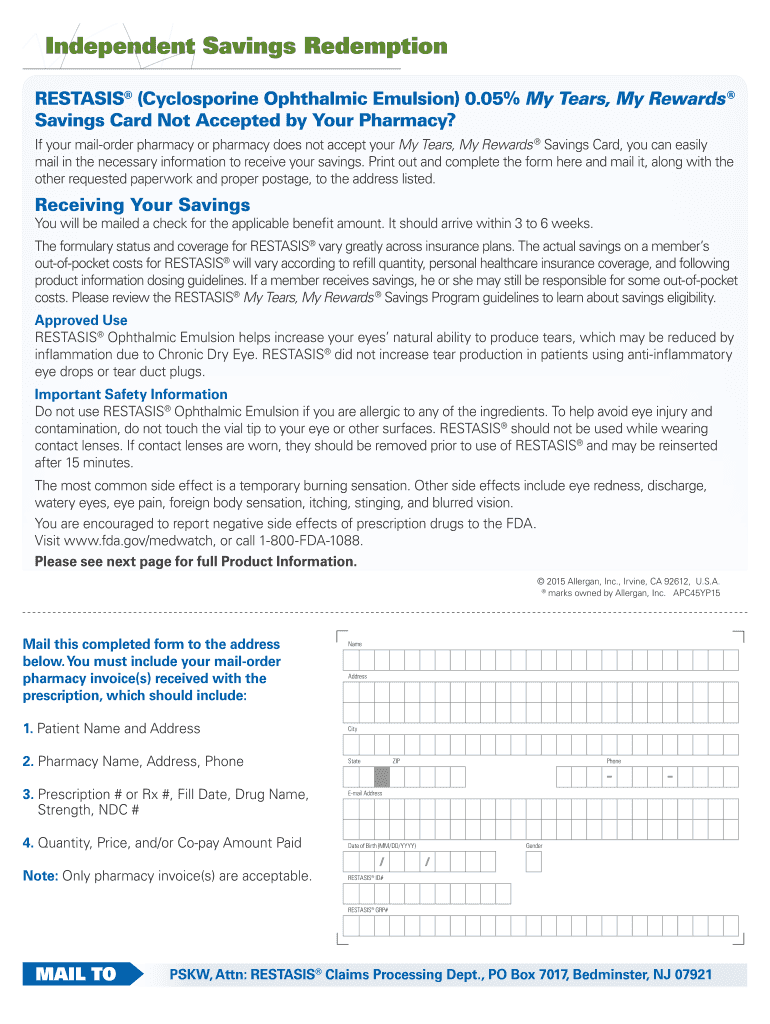

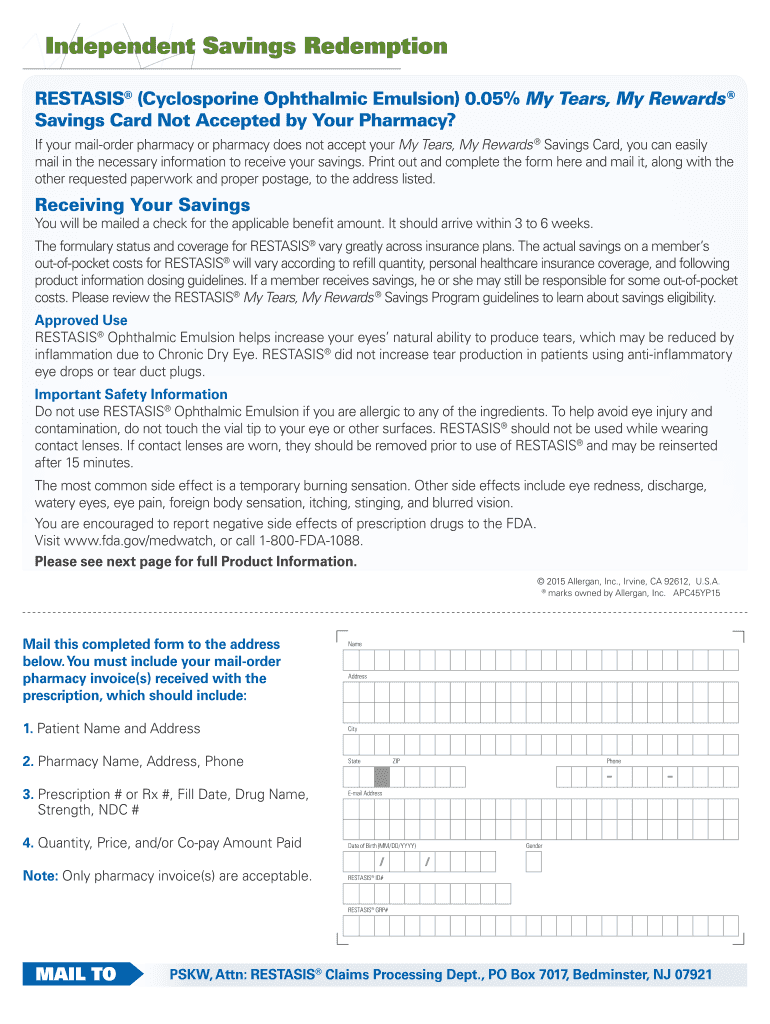

Restasis Claim Form Fill Online Printable Fillable Blank PdfFiller

Return Of STAR Rebate Check Sought New City NY Patch StarRebate

https://www.nyc.gov/site/finance/benefits/landlords-star.page

Web You may apply for the Basic STAR or Enhanced STAR tax exemption with the NYC Department of Finance if You owned your property and received STAR in 2015 16 but

https://www.nyc.gov/site/finance/taxes/property-tax-rebate.page

Web The fiscal year 2023 property tax rebate is for homeowners whose New York City property is their primary residence and whose combined income is 250 000 or less Most

Web You may apply for the Basic STAR or Enhanced STAR tax exemption with the NYC Department of Finance if You owned your property and received STAR in 2015 16 but

Web The fiscal year 2023 property tax rebate is for homeowners whose New York City property is their primary residence and whose combined income is 250 000 or less Most

Ouc Rebates Pdf Fill Online Printable Fillable Blank PdfFiller

Form Dtf 179 Mn 2007 Middle Class Star Rebate Program Application

Restasis Claim Form Fill Online Printable Fillable Blank PdfFiller

Return Of STAR Rebate Check Sought New City NY Patch StarRebate

Residential Rebates

All About Mail In Rebates Part 2 The Do s And Don ts Of Submitting

All About Mail In Rebates Part 2 The Do s And Don ts Of Submitting

2022 Rent Rebate Form Fillable Printable PDF Forms Handypdf