In today's world of consumerism everyone appreciates a great deal. One way to earn significant savings on your purchases can be achieved through Non Resident Gst Rebate Forms. The use of Non Resident Gst Rebate Forms is a method employed by retailers and manufacturers to provide customers with a portion of a refund on their purchases after they've purchased them. In this post, we'll delve into the world of Non Resident Gst Rebate Forms. We'll discuss the nature of them, how they work, and the best way to increase your savings via these cost-effective incentives.

Get Latest Non Resident Gst Rebate Form Below

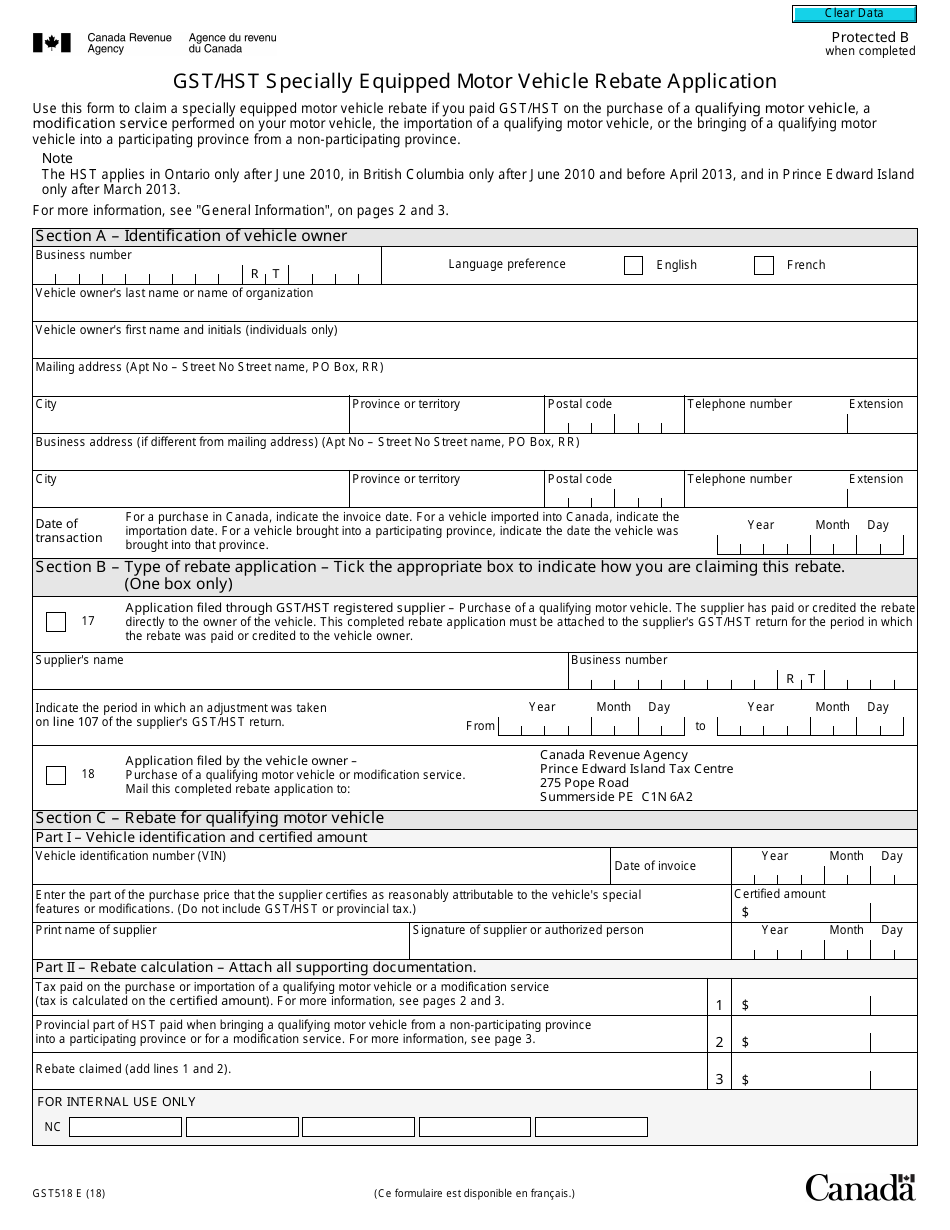

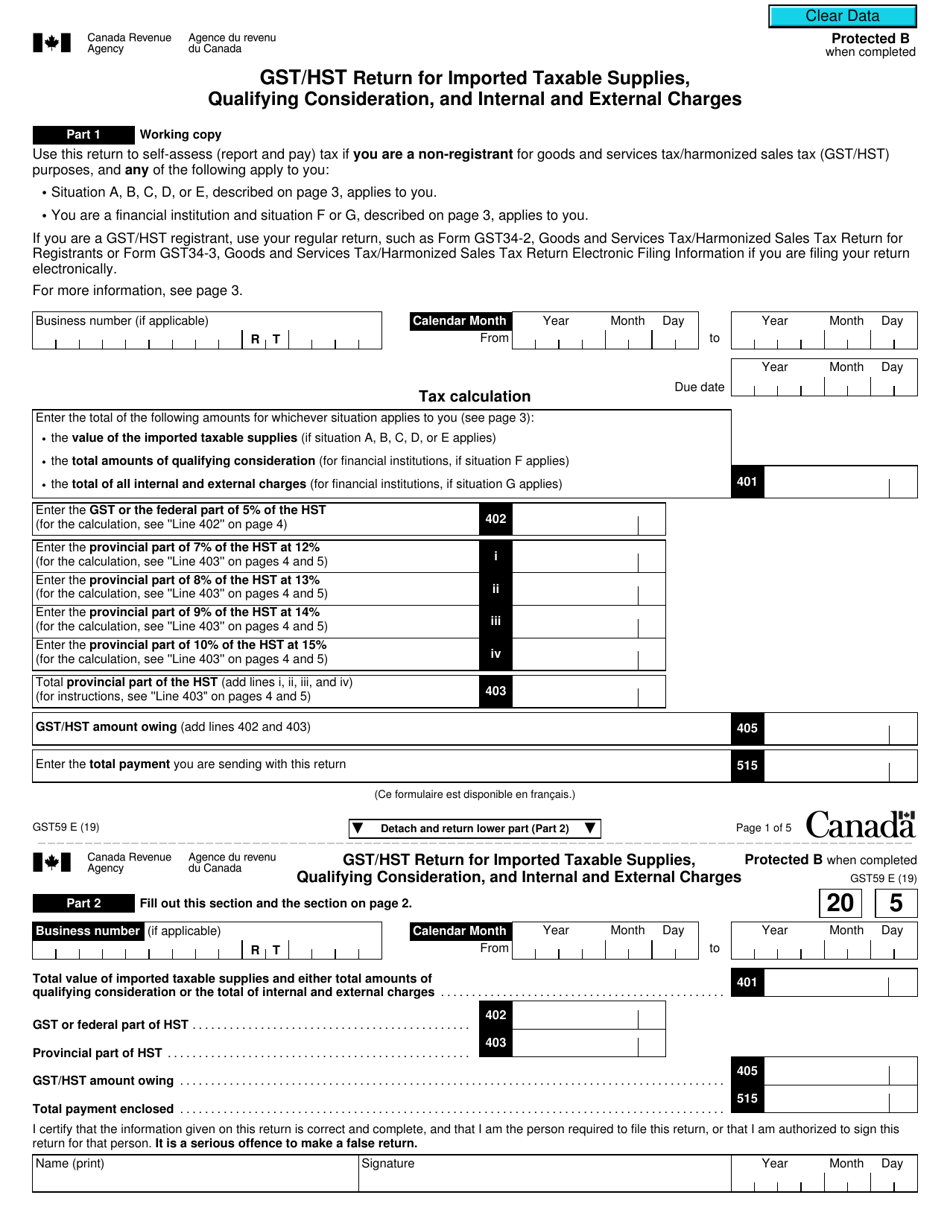

Non Resident Gst Rebate Form

Non Resident Gst Rebate Form -

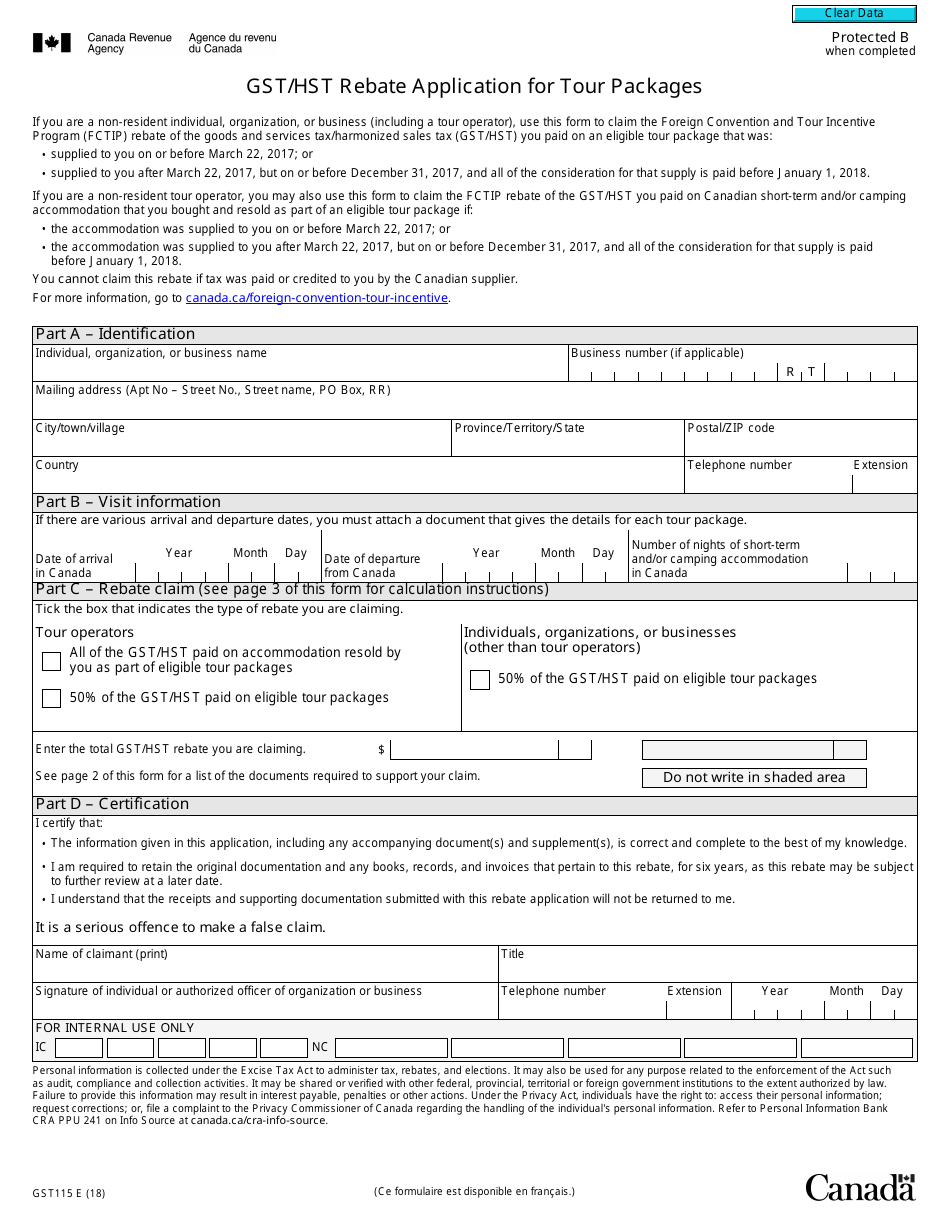

Web You are a non resident claiming a rebate of the GST HST paid on an eligible tour package or you are a non resident tour operator claiming a rebate for accommodation sold in eligible tour packages For more information see Foreign Convention and Tour Incentive Program

Web Non resident businesses that purchase goods for commercial export can receive a rebate of the GST HST they pay on goods they buy in Canada They can apply for the rebate using Form GST189 General Application for GST HST Rebates and Form GST288 Supplement to Forms GST189 and GST498

A Non Resident Gst Rebate Form as it is understood in its simplest form, is a partial refund that a client receives after they've purchased a good or service. This is a potent tool utilized by businesses to attract customers, increase sales, and advertise specific products.

Types of Non Resident Gst Rebate Form

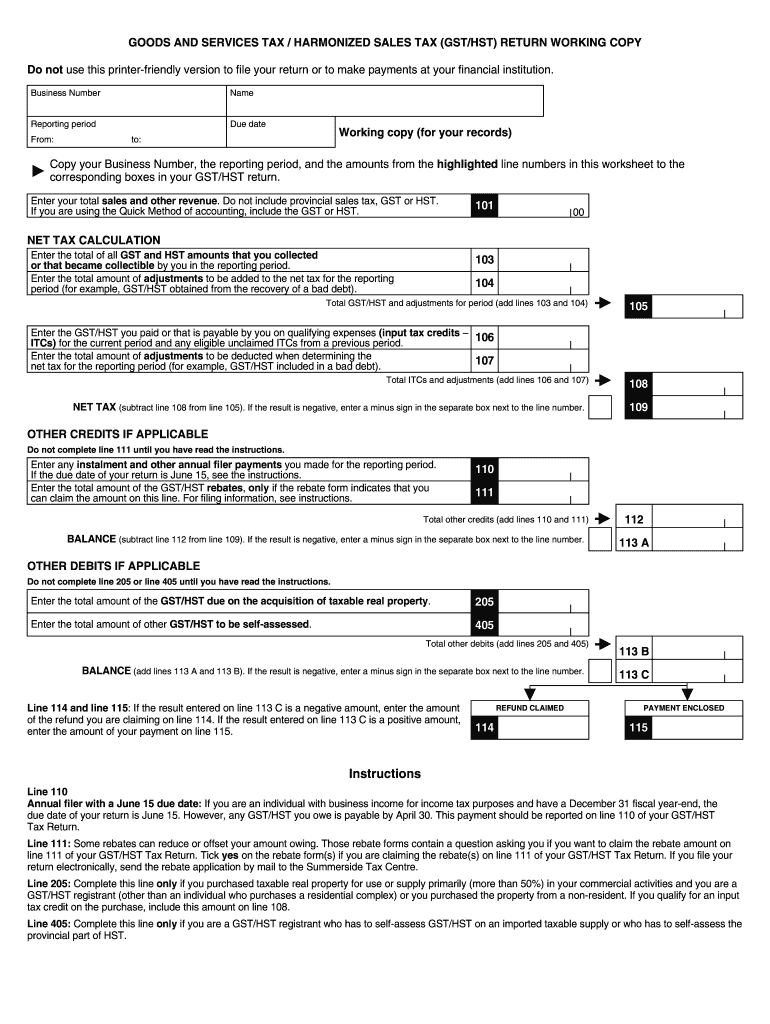

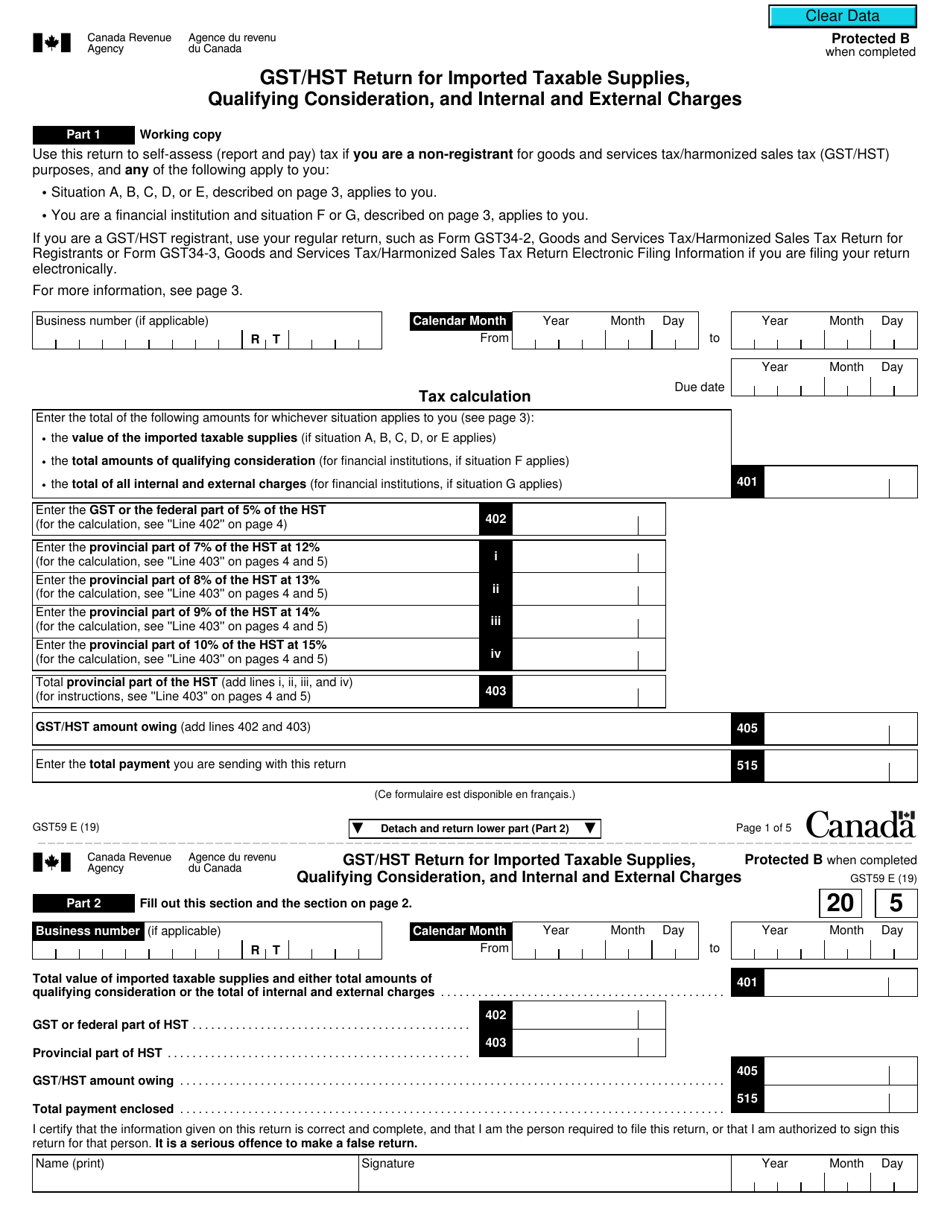

Tax Gst Return Fill Online Printable Fillable Blank PdfFiller

Tax Gst Return Fill Online Printable Fillable Blank PdfFiller

Web If all of the above noted conditions are met the non resident exporter is entitled to a rebate of GST HST and the Minister of Revenue is required to pay a tax rebate to the non resident exporter equal to the amount of GST HST paid on the goods Application for Rebate of GST HST Evidence

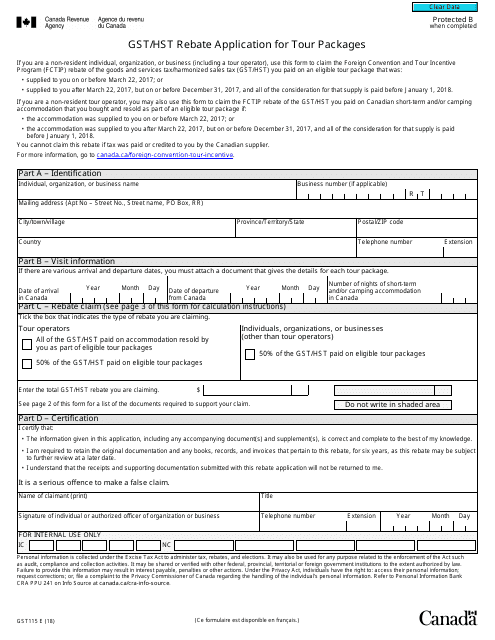

Web Use this form to claim a rebate of the goods and services tax harmonized sales tax GST HST if you are a tour operator and you paid GST HST on an eligible tour package or you paid GST HST on short term and or camping accommodation that you purchased and sold as part of an eligible tour package

Cash Non Resident Gst Rebate Form

Cash Non Resident Gst Rebate Form are by far the easiest kind of Non Resident Gst Rebate Form. Customers receive a certain amount of money after purchasing a particular item. This is often for high-ticket items like electronics or appliances.

Mail-In Non Resident Gst Rebate Form

Mail-in Non Resident Gst Rebate Form require consumers to send in an evidence of purchase for their cash back. They're a bit more complicated but could provide substantial savings.

Instant Non Resident Gst Rebate Form

Instant Non Resident Gst Rebate Form are applied right at the point of sale. They reduce the price of your purchase instantly. Customers don't need to wait around for savings when they purchase this type of Non Resident Gst Rebate Form.

How Non Resident Gst Rebate Form Work

Form GST115 Fill Out Sign Online And Download Fillable PDF Canada

Form GST115 Fill Out Sign Online And Download Fillable PDF Canada

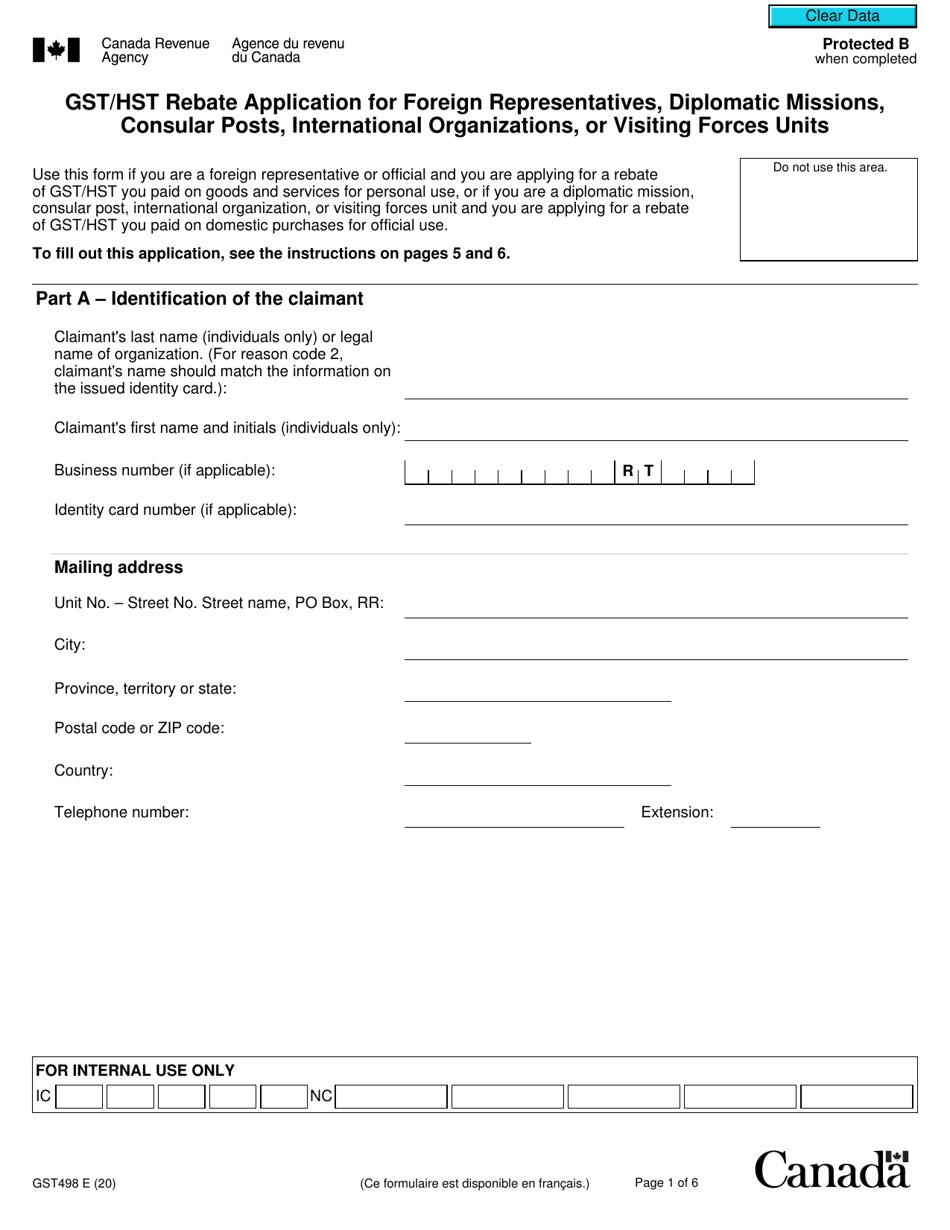

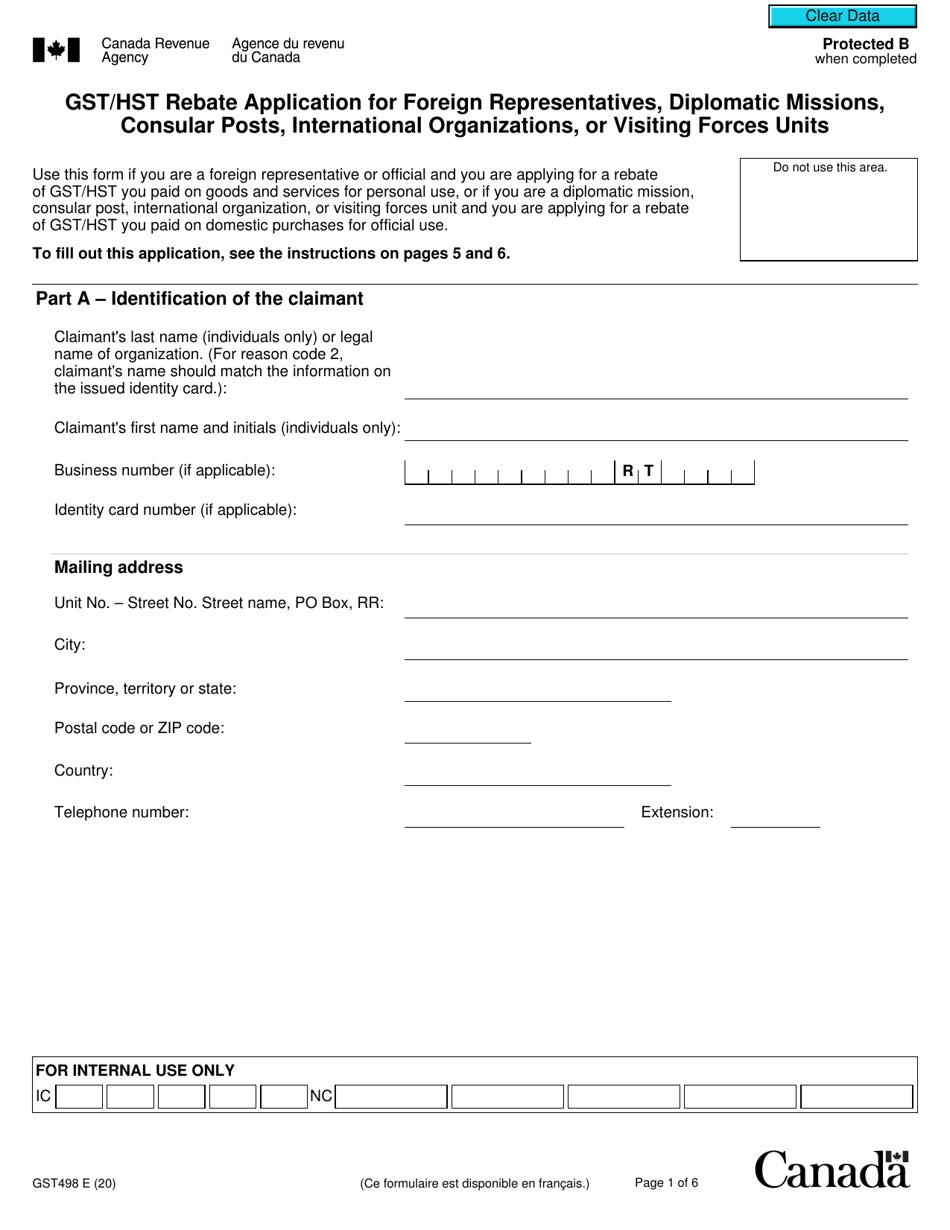

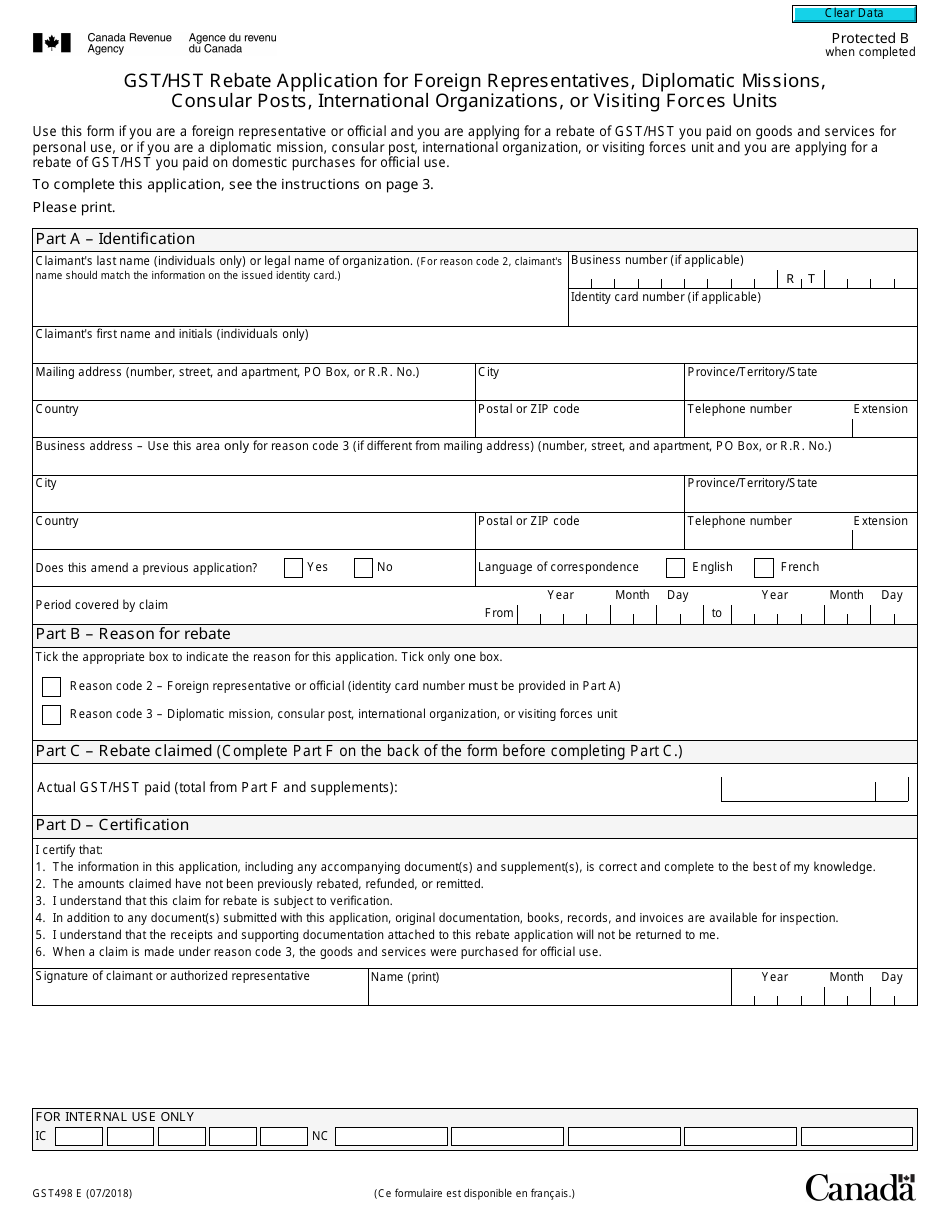

Web GST HST Rebate Application for Foreign Representatives Diplomatic Missions Consular Posts International Organizations or Visiting Forces Units Use this form if you are a foreign representative or official and you are applying for a rebate Do not use this area

The Non Resident Gst Rebate Form Process

The procedure typically consists of a few simple steps:

-

You purchase the item: First purchase the product like you would normally.

-

Fill out the Non Resident Gst Rebate Form form: You'll need to provide some information, such as your name, address and information about the purchase in order to submit your Non Resident Gst Rebate Form.

-

Make sure you submit the Non Resident Gst Rebate Form depending on the type of Non Resident Gst Rebate Form you might need to mail in a form or upload it online.

-

Wait for the company's approval: They will look over your submission to determine if it's in compliance with the refund's conditions and terms.

-

You will receive your Non Resident Gst Rebate Form Once it's approved, you'll receive your refund either by check, prepaid card, or a different procedure specified by the deal.

Pros and Cons of Non Resident Gst Rebate Form

Advantages

-

Cost savings Non Resident Gst Rebate Form are a great way to decrease the price for a product.

-

Promotional Offers: They encourage customers in trying new products or brands.

-

Help to Increase Sales A Non Resident Gst Rebate Form program can boost an organization's sales and market share.

Disadvantages

-

Complexity: Mail-in Non Resident Gst Rebate Form, particularly the case of HTML0, can be a hassle and costly.

-

Days of expiration A majority of Non Resident Gst Rebate Form have certain deadlines for submitting.

-

Risk of Not Being Paid Certain customers could not be able to receive their Non Resident Gst Rebate Form if they do not follow the rules precisely.

Download Non Resident Gst Rebate Form

Download Non Resident Gst Rebate Form

FAQs

1. Are Non Resident Gst Rebate Form similar to discounts? No, Non Resident Gst Rebate Form are an amount of money that is refunded after the purchase, and discounts are a reduction of the price of the purchase at the point of sale.

2. Do I have to use multiple Non Resident Gst Rebate Form on the same item This is dependent on conditions of Non Resident Gst Rebate Form is offered as well as the merchandise's admissibility. Certain companies might allow the use of multiple Non Resident Gst Rebate Form, whereas other won't.

3. How long will it take to receive a Non Resident Gst Rebate Form What is the timeframe? can vary, but typically it will take a couple of weeks or a couple of months before you get your Non Resident Gst Rebate Form.

4. Do I need to pay tax in relation to Non Resident Gst Rebate Form funds? most cases, Non Resident Gst Rebate Form amounts are not considered to be taxable income.

5. Should I be able to trust Non Resident Gst Rebate Form deals from lesser-known brands It is essential to investigate and verify that the organization offering the Non Resident Gst Rebate Form is credible prior to making an purchase.

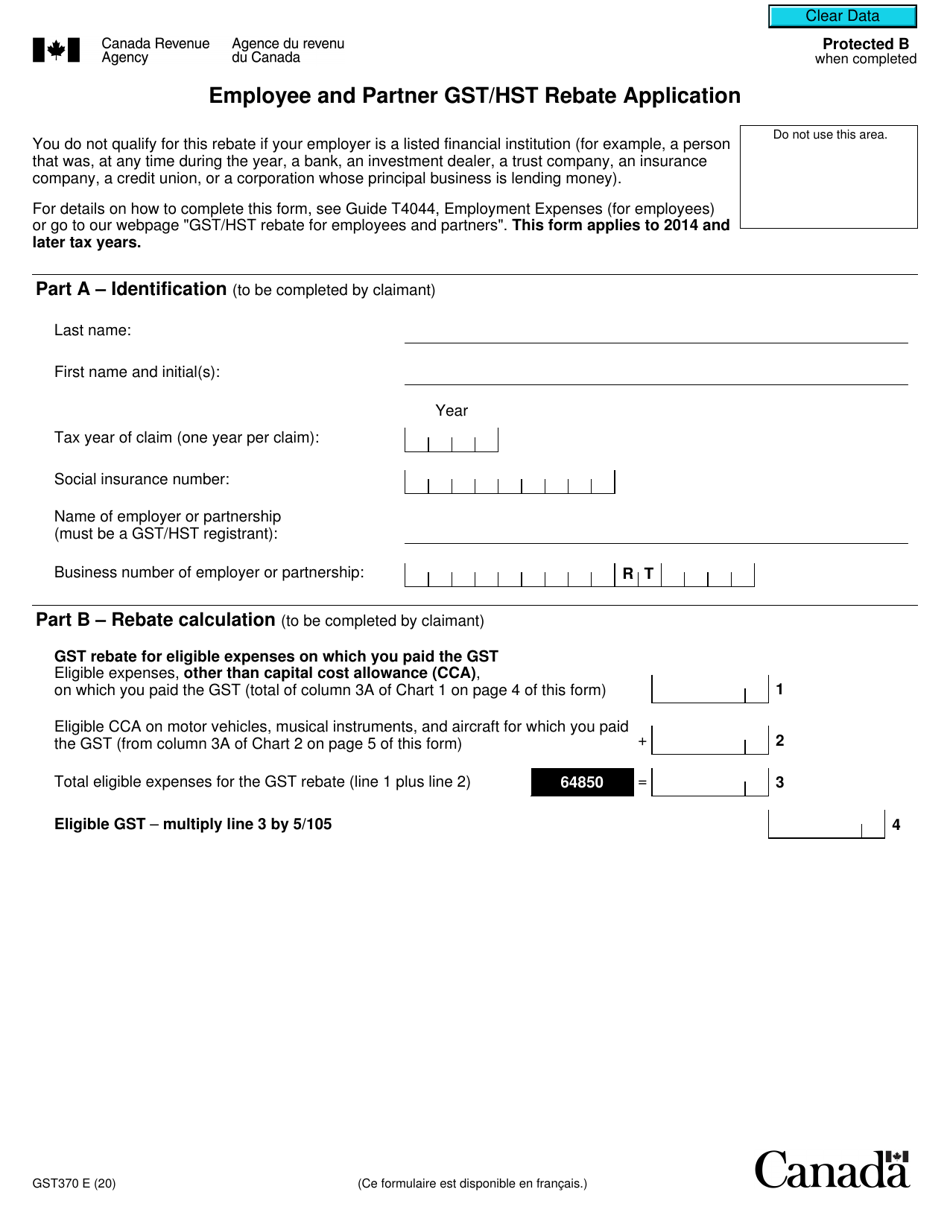

Form GST370 Download Fillable PDF Or Fill Online Employee And Partner

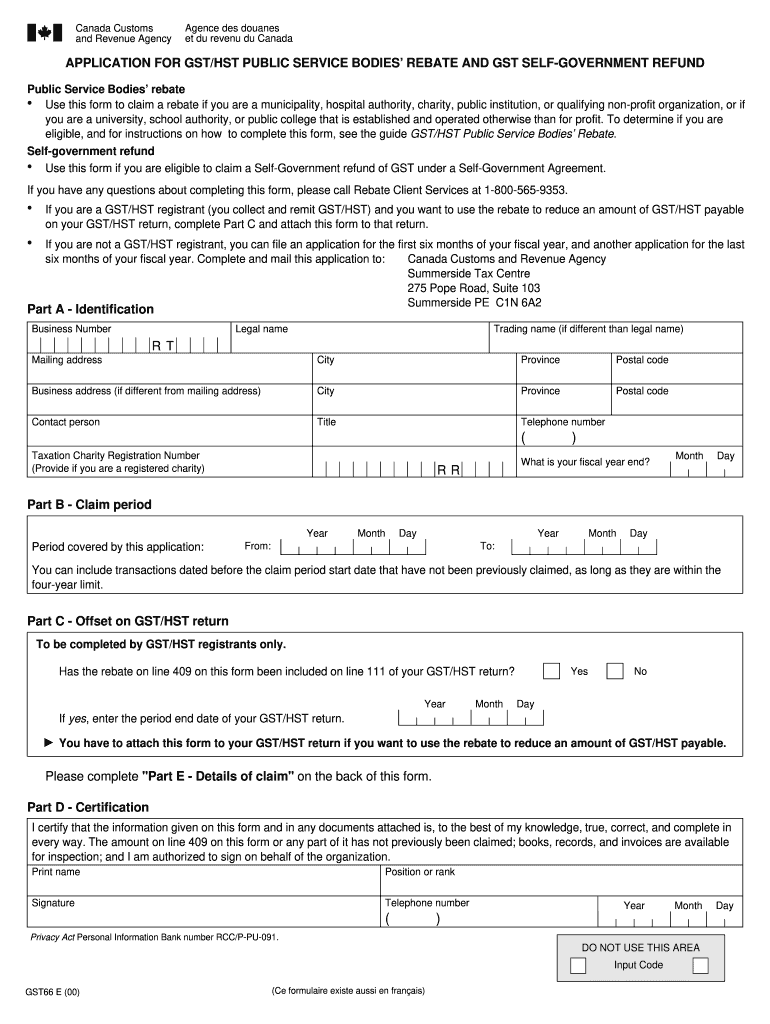

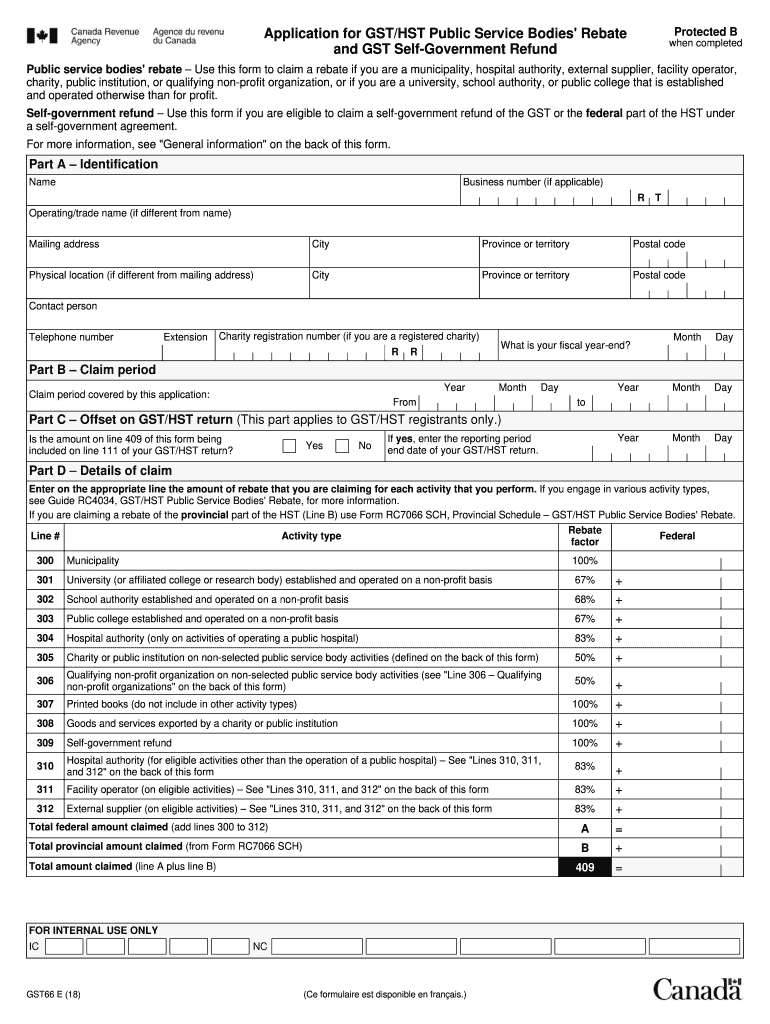

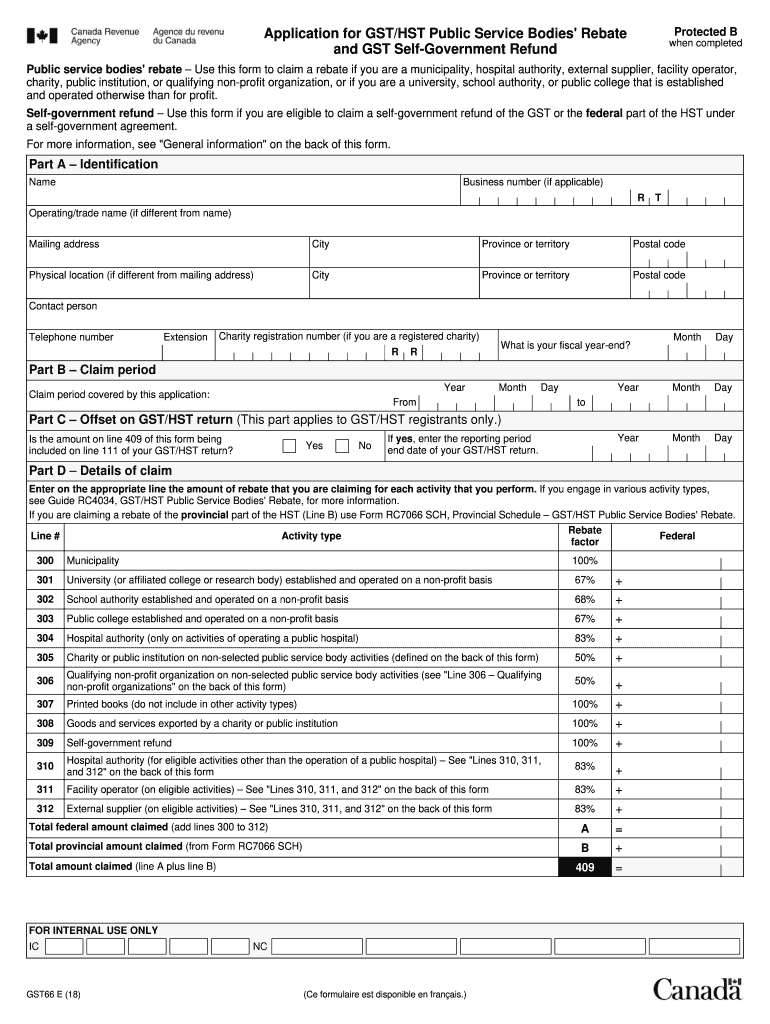

2000 Form Canada GST66 E Fill Online Printable Fillable Blank

Check more sample of Non Resident Gst Rebate Form below

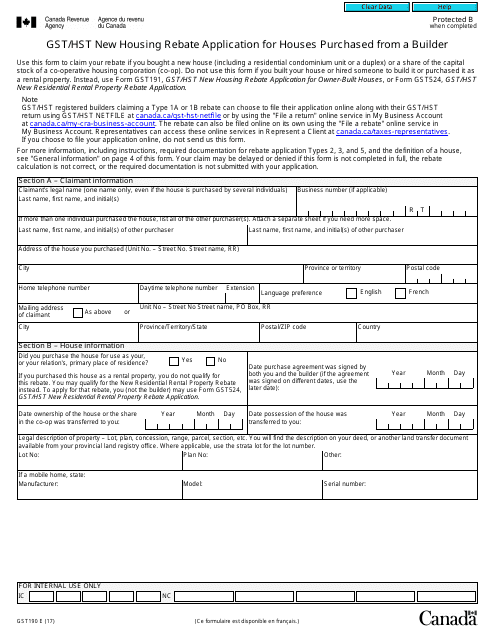

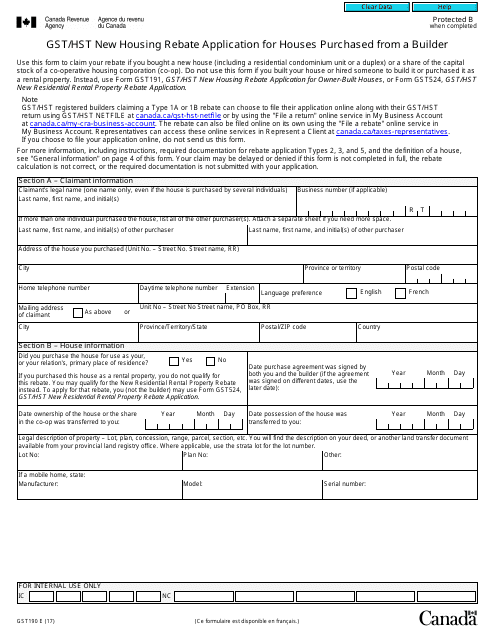

Gst191 Fillable Form Printable Forms Free Online

Gst66 E Fill Out Sign Online DocHub

Gst Fillable Form Printable Forms Free Online

Form GST190 Download Fillable PDF Or Fill Online Gst Hst New Housing

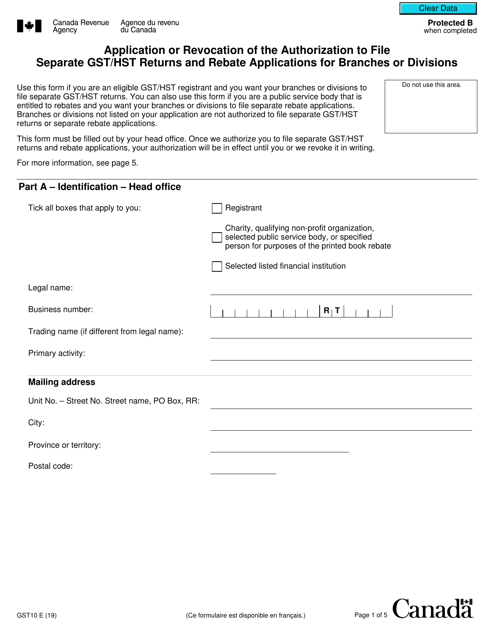

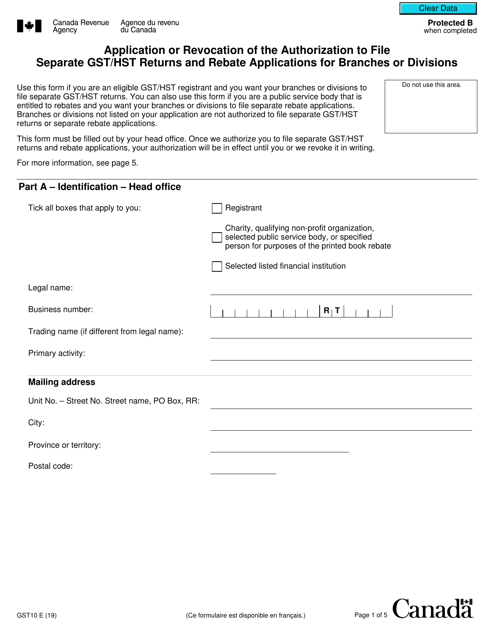

Form GST10 Download Fillable PDF Or Fill Online Application Or

Form GST498 Download Fillable PDF Or Fill Online Gst Hst Rebate

https://www.canada.ca/en/revenue-agency/services/forms-publications/...

Web Non resident businesses that purchase goods for commercial export can receive a rebate of the GST HST they pay on goods they buy in Canada They can apply for the rebate using Form GST189 General Application for GST HST Rebates and Form GST288 Supplement to Forms GST189 and GST498

https://ryan.com/contentassets/cc9f155973a2479db9141fd6…

Web Form GST498 GST HST Rebate Application for Foreign Representatives Diplomatic Missions Consular Posts International Organizations or Visiting Forces Units you are a non resident claiming a rebate of GST HST paid on an eligible tour package or you are a non resident tour

Web Non resident businesses that purchase goods for commercial export can receive a rebate of the GST HST they pay on goods they buy in Canada They can apply for the rebate using Form GST189 General Application for GST HST Rebates and Form GST288 Supplement to Forms GST189 and GST498

Web Form GST498 GST HST Rebate Application for Foreign Representatives Diplomatic Missions Consular Posts International Organizations or Visiting Forces Units you are a non resident claiming a rebate of GST HST paid on an eligible tour package or you are a non resident tour

Form GST190 Download Fillable PDF Or Fill Online Gst Hst New Housing

Gst66 E Fill Out Sign Online DocHub

Form GST10 Download Fillable PDF Or Fill Online Application Or

Form GST498 Download Fillable PDF Or Fill Online Gst Hst Rebate

Form GST498 Download Fillable PDF Or Fill Online Gst Hst Rebate

Gst Fillable Form Printable Forms Free Online

Gst Fillable Form Printable Forms Free Online

Gst Fillable Form Printable Forms Free Online