In this day and age of consuming every person loves a great deal. One way to make substantial savings for your purchases is through Nj Homestead Rebate On The Federal Tax Forms. Nj Homestead Rebate On The Federal Tax Forms are a method of marketing used by manufacturers and retailers for offering customers a percentage refund on purchases made after they have completed them. In this article, we'll investigate the world of Nj Homestead Rebate On The Federal Tax Forms. We'll explore the nature of them and how they work and ways you can increase your savings with these cost-effective incentives.

Get Latest Nj Homestead Rebate On The Federal Tax Form Below

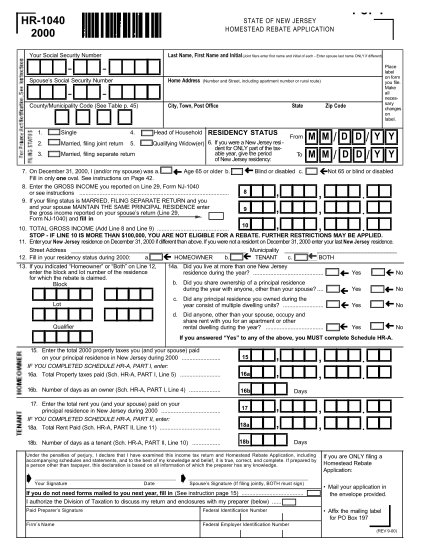

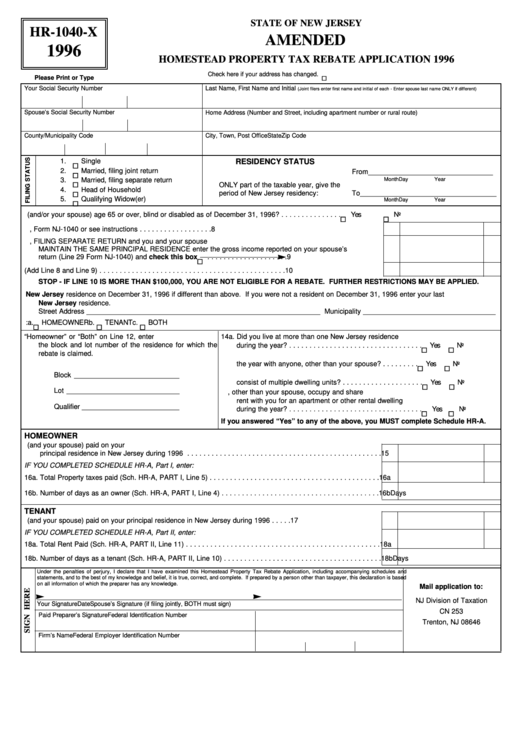

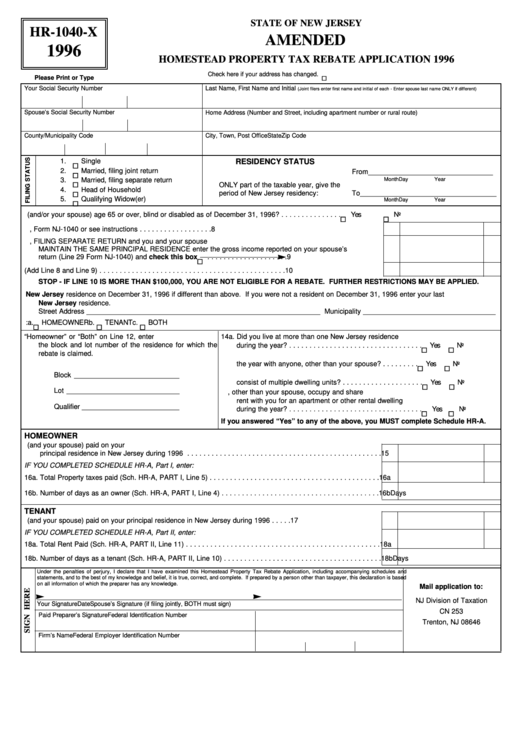

Nj Homestead Rebate On The Federal Tax Form

Nj Homestead Rebate On The Federal Tax Form -

Web required to file a 2018 New Jersey tax return we will include your property tax credit with your Homestead Benefit How Homestead Benefits Are Paid We will issue your benefit

Web Eligibility requirements You owned and occupied a home in New Jersey that was your principal residence main home on October 1 2020 and Your 2020 New Jersey gross

A Nj Homestead Rebate On The Federal Tax Form the simplest description, is a refund that a client receives after purchasing a certain product or service. It's a very effective technique utilized by businesses to attract customers, increase sales and advertise specific products.

Types of Nj Homestead Rebate On The Federal Tax Form

2018 New Jersey Homestead Rebate Application Fill Out Sign Online

2018 New Jersey Homestead Rebate Application Fill Out Sign Online

Web In recent years however New Jersey has provided the Homestead Rebate in the form of a credit against the property taxes due in May of the current year Wolfe said In this

Web 18 juil 2022 nbsp 0183 32 In late June with the June 30 budget adoption deadline approaching the governor announced an expansion of the ANCHOR program proposal with tax rebates of

Cash Nj Homestead Rebate On The Federal Tax Form

Cash Nj Homestead Rebate On The Federal Tax Form are the most straightforward kind of Nj Homestead Rebate On The Federal Tax Form. Customers get a set amount of money in return for buying a product. These are often used for more expensive items such electronics or appliances.

Mail-In Nj Homestead Rebate On The Federal Tax Form

Mail-in Nj Homestead Rebate On The Federal Tax Form demand that customers present the proof of purchase to be eligible for their cash back. They're a bit more complicated, but they can provide huge savings.

Instant Nj Homestead Rebate On The Federal Tax Form

Instant Nj Homestead Rebate On The Federal Tax Form are made at the points of sale. This reduces the price of purchases immediately. Customers don't need to wait for savings by using this method.

How Nj Homestead Rebate On The Federal Tax Form Work

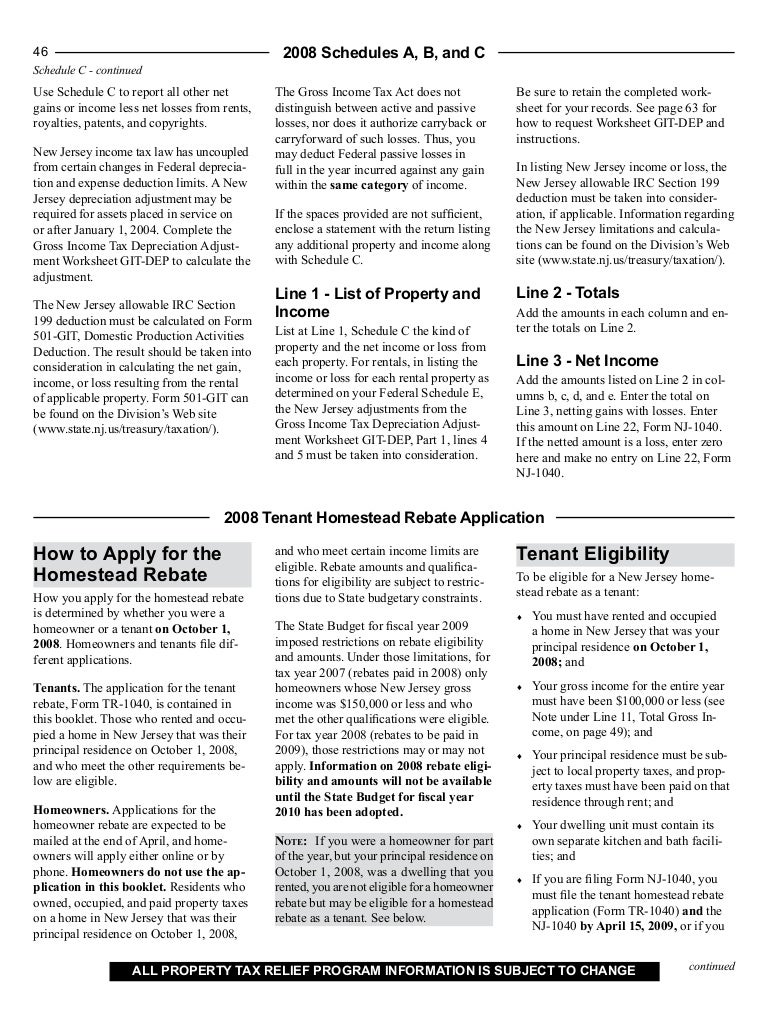

Tenant Homestead Rebate Instructions

Tenant Homestead Rebate Instructions

Web Form NJ 1040 and fill in 10 TOTAL GROSS INCOME Add Line 8 and Line 9 STOP IF LINE 10 IS MORE THAN 100 000 YOU ARE NOT ELIGIBLE FOR A REBATE

The Nj Homestead Rebate On The Federal Tax Form Process

The process typically involves a couple of steps that are easy to follow:

-

Purchase the product: First, you purchase the item the way you normally do.

-

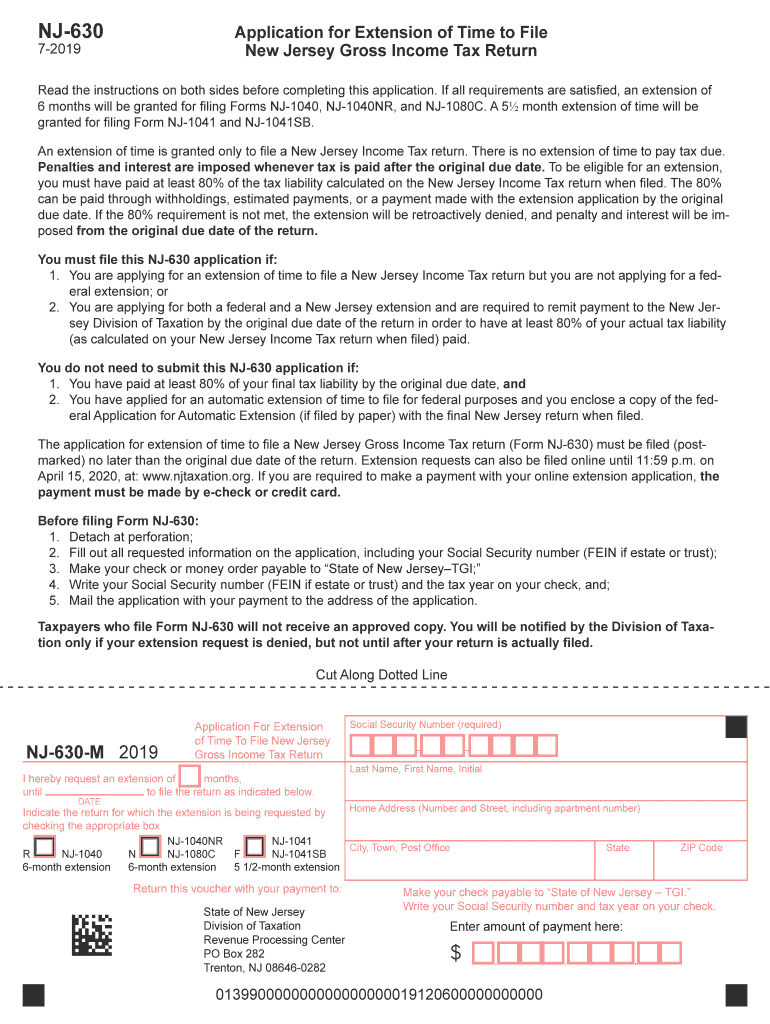

Fill out this Nj Homestead Rebate On The Federal Tax Form forms: The Nj Homestead Rebate On The Federal Tax Form form will have be able to provide a few details including your name, address and details about your purchase, in order to get your Nj Homestead Rebate On The Federal Tax Form.

-

Make sure you submit the Nj Homestead Rebate On The Federal Tax Form If you want to submit the Nj Homestead Rebate On The Federal Tax Form, based on the kind of Nj Homestead Rebate On The Federal Tax Form, you may need to fill out a form and mail it in or submit it online.

-

Wait for approval: The business will scrutinize your submission for compliance with Nj Homestead Rebate On The Federal Tax Form's terms and conditions.

-

Enjoy your Nj Homestead Rebate On The Federal Tax Form If it is approved, the amount you receive will be either by check, prepaid card or another procedure specified by the deal.

Pros and Cons of Nj Homestead Rebate On The Federal Tax Form

Advantages

-

Cost savings Nj Homestead Rebate On The Federal Tax Form are a great way to reduce the price you pay for products.

-

Promotional Offers These promotions encourage consumers to experiment with new products, or brands.

-

Increase Sales Nj Homestead Rebate On The Federal Tax Form can help boost the sales of a company as well as its market share.

Disadvantages

-

Complexity The mail-in Nj Homestead Rebate On The Federal Tax Form in particular they can be time-consuming and lengthy.

-

End Dates: Many Nj Homestead Rebate On The Federal Tax Form have certain deadlines for submitting.

-

Risk of Non-Payment Certain customers could not receive their refunds if they don't adhere to the rules exactly.

Download Nj Homestead Rebate On The Federal Tax Form

Download Nj Homestead Rebate On The Federal Tax Form

FAQs

1. Are Nj Homestead Rebate On The Federal Tax Form similar to discounts? No, Nj Homestead Rebate On The Federal Tax Form are only a partial reimbursement following the purchase whereas discounts will reduce the purchase price at moment of sale.

2. Do I have to use multiple Nj Homestead Rebate On The Federal Tax Form on the same item This is dependent on terms of the Nj Homestead Rebate On The Federal Tax Form offers and the product's suitability. Certain companies might permit it, and some don't.

3. What is the time frame to receive a Nj Homestead Rebate On The Federal Tax Form? The timing will differ, but can take anywhere from a couple of weeks to a few months before you receive your Nj Homestead Rebate On The Federal Tax Form.

4. Do I need to pay tax when I receive Nj Homestead Rebate On The Federal Tax Form montants? the majority of cases, Nj Homestead Rebate On The Federal Tax Form amounts are not considered to be taxable income.

5. Should I be able to trust Nj Homestead Rebate On The Federal Tax Form offers from brands that aren't well-known It's important to do your research to ensure that the name that is offering the Nj Homestead Rebate On The Federal Tax Form has a good reputation prior to making a purchase.

Tenant Homestead Rebate Instructions

Tenant Homestead Rebate Instructions

Check more sample of Nj Homestead Rebate On The Federal Tax Form below

New Jersey Homestead Rebate 2023 Rebate2022

Nj Homestead Rebate 2023 Rebate2022

New Jersey Rent Rebate Printable Rebate Form

NJ Homestead Rebate Due 11 30 2018 YouTube

Fillable Form Hr 1040 X Amended Homestead Property Tax Rebate

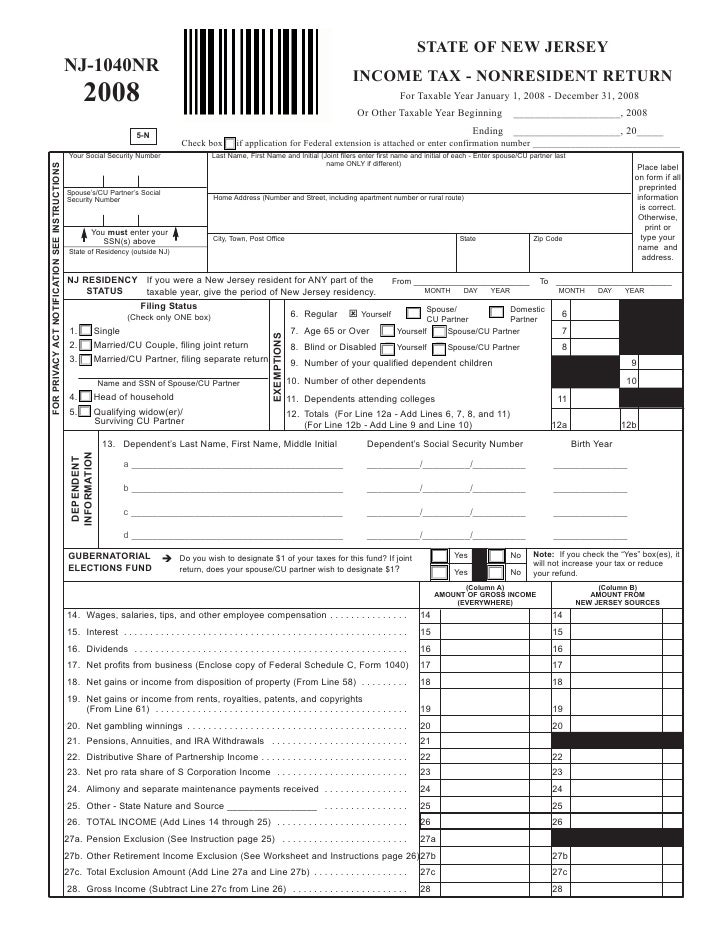

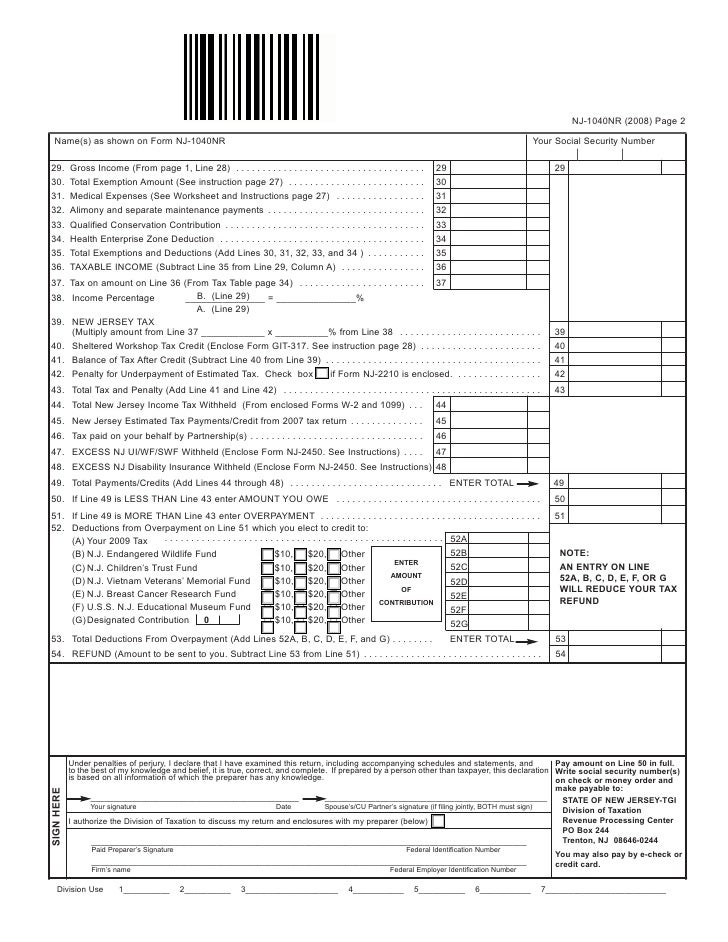

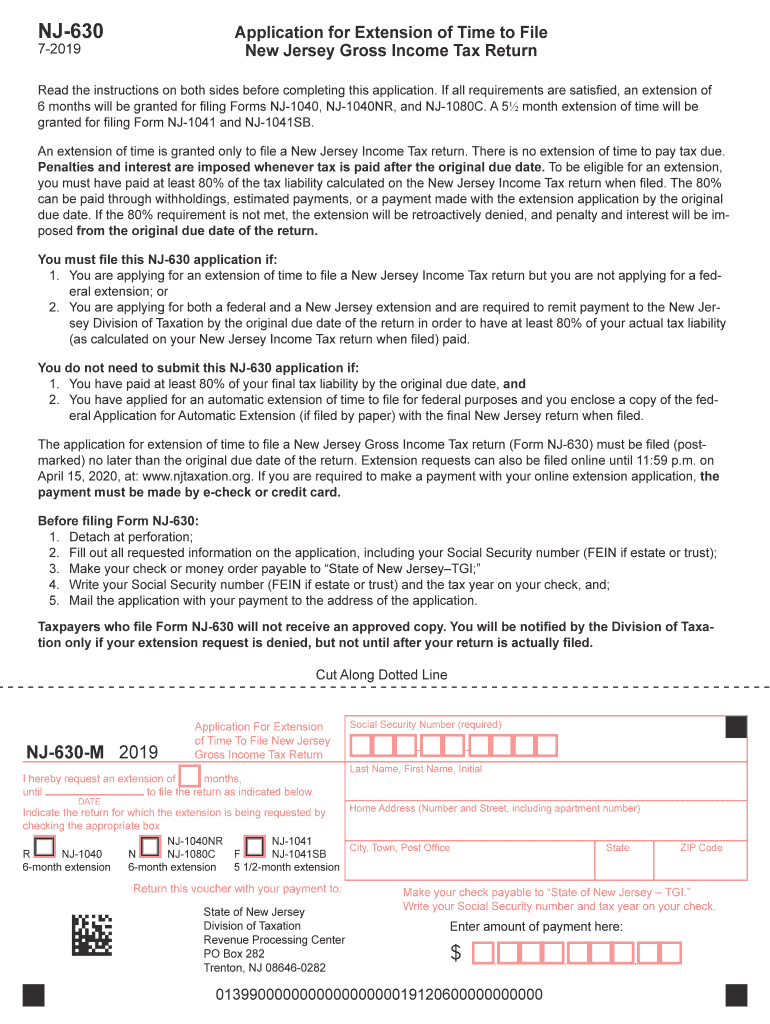

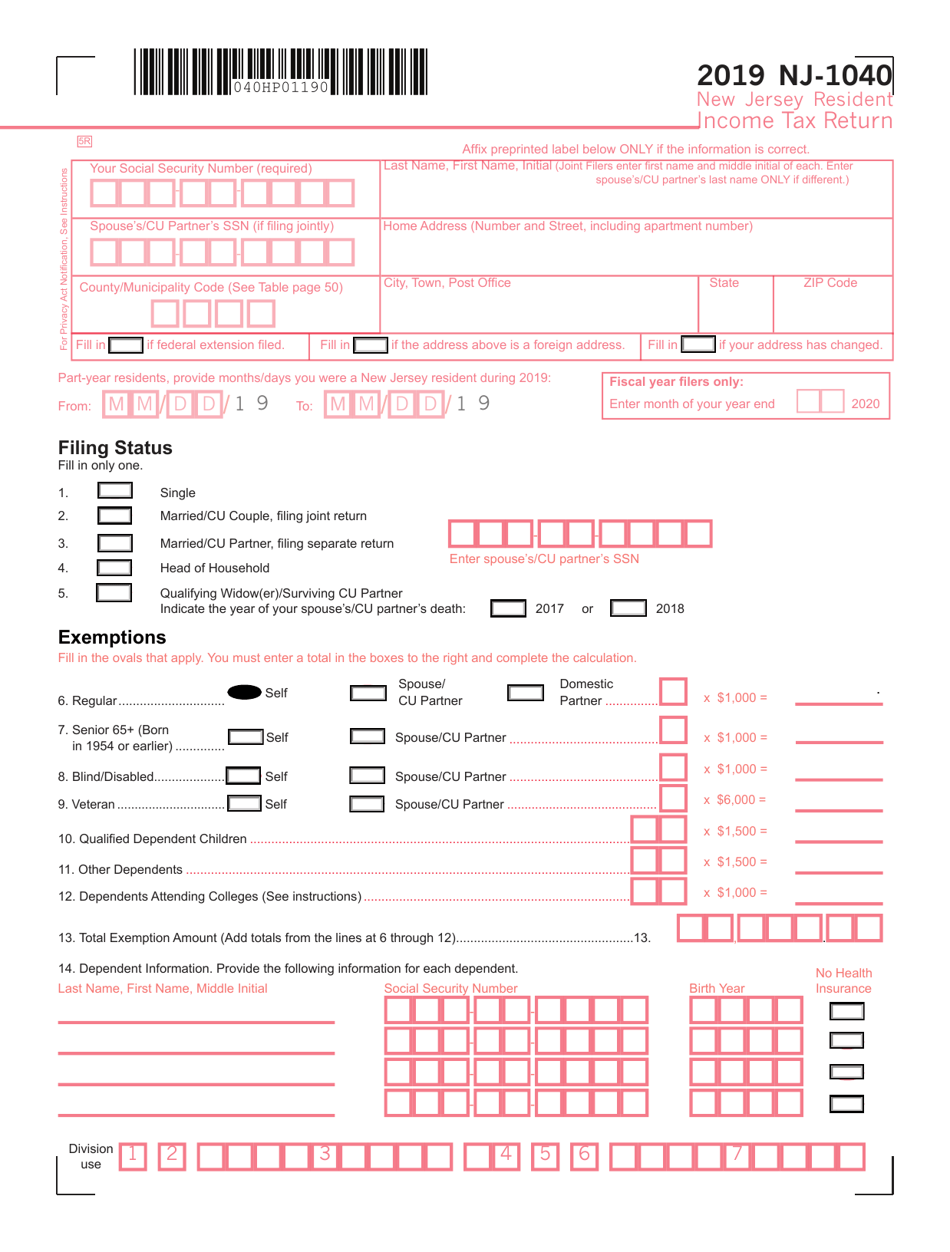

NJ Resident Income Tax Return

https://www.state.nj.us/treasury/taxation/anchor/home.shtml

Web Eligibility requirements You owned and occupied a home in New Jersey that was your principal residence main home on October 1 2020 and Your 2020 New Jersey gross

https://www.nj.gov/treasury/taxation/homestead/geninf.shtml

Web 14 juil 2023 nbsp 0183 32 Homestead Benefit Program The filing deadline for the 2018 Homestead Benefit was November 30 2021 The Affordable New Jersey Communities for

Web Eligibility requirements You owned and occupied a home in New Jersey that was your principal residence main home on October 1 2020 and Your 2020 New Jersey gross

Web 14 juil 2023 nbsp 0183 32 Homestead Benefit Program The filing deadline for the 2018 Homestead Benefit was November 30 2021 The Affordable New Jersey Communities for

NJ Homestead Rebate Due 11 30 2018 YouTube

Nj Homestead Rebate 2023 Rebate2022

Fillable Form Hr 1040 X Amended Homestead Property Tax Rebate

NJ Resident Income Tax Return

Homestead Rebate Application For Tenants Only

Homestead Rebate Application For Tenants Only

Homestead Rebate Application For Tenants Only

Nj 1040 Printable Form Printable Forms Free Online