In this modern-day world of consumers we all love a good bargain. One way to make significant savings on your purchases is through New York Homeowner Tax Rebates. They are a form of marketing used by manufacturers and retailers to provide customers with a portion of a refund for their purchases after they have made them. In this article, we will take a look at the world that is New York Homeowner Tax Rebates. We will explore what they are what they are, how they function, and how you can maximise your savings through these efficient incentives.

Get Latest New York Homeowner Tax Rebate Below

New York Homeowner Tax Rebate

New York Homeowner Tax Rebate -

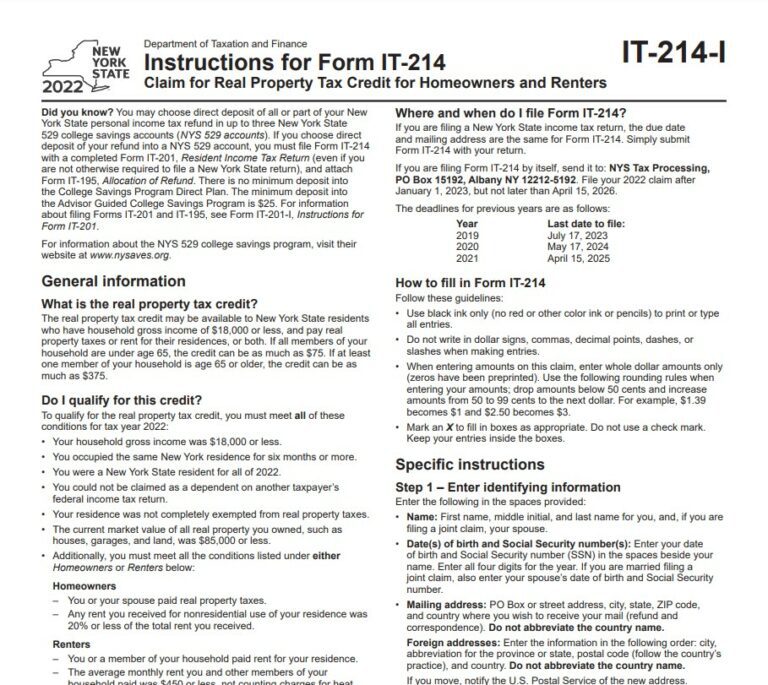

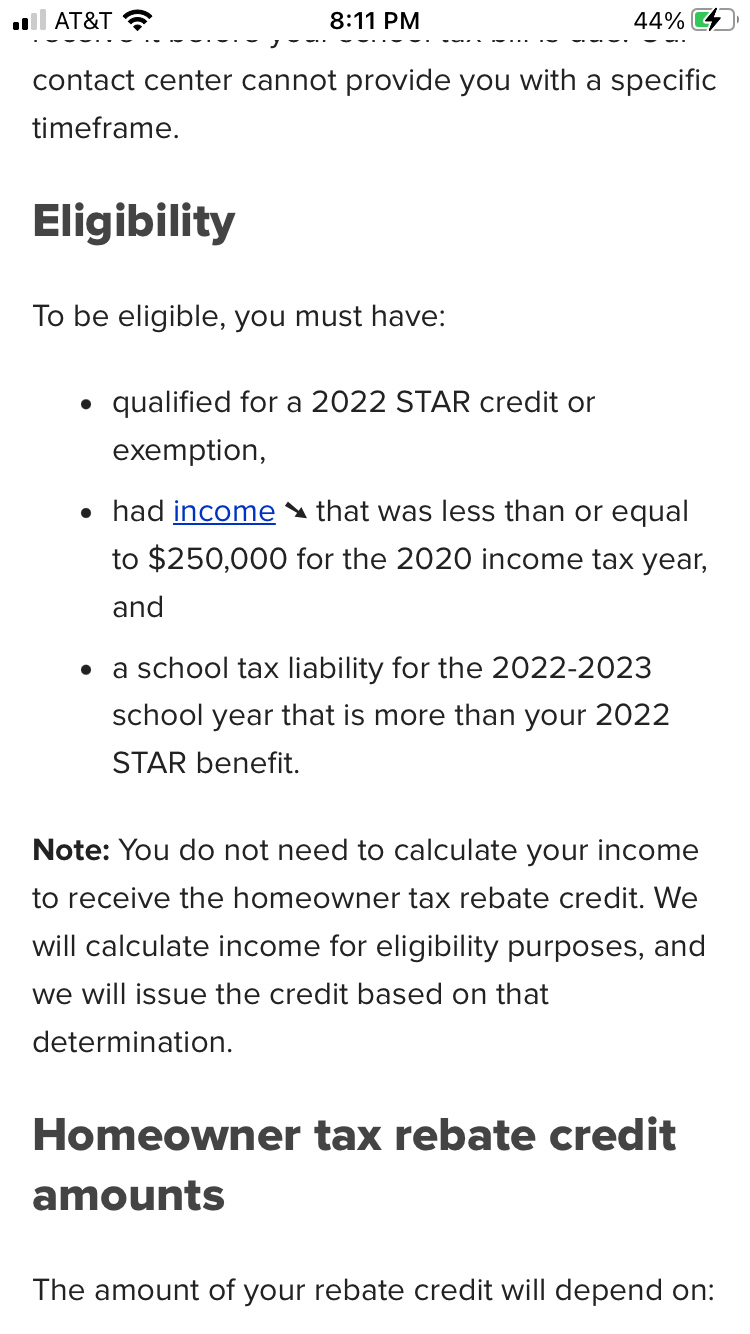

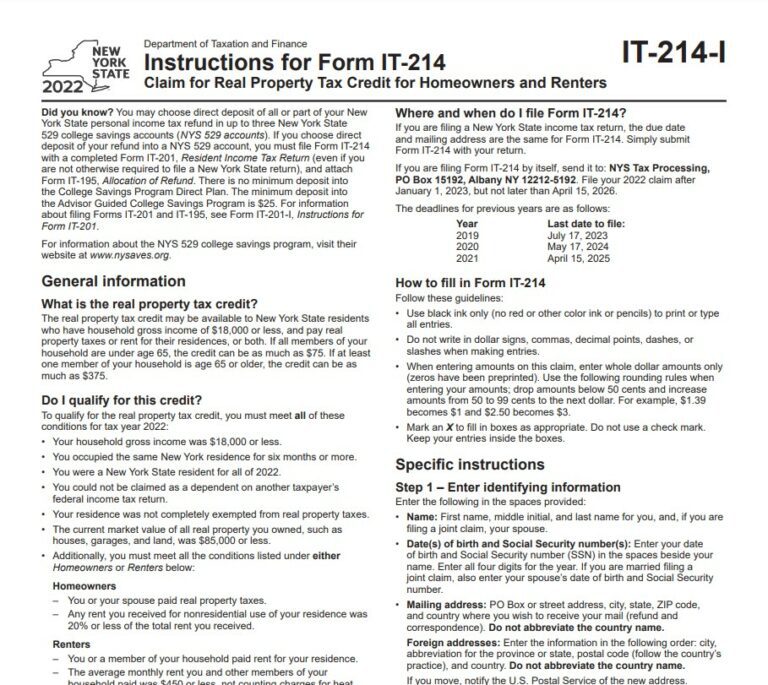

Web 17 ao 251 t 2022 nbsp 0183 32 Homeowner tax rebate credit registration If you received a letter Form RP 5303 requesting that you register for the homeowner tax rebate credit please follow

Web 14 mars 2023 nbsp 0183 32 Learn about the homeowner tax rebate credit The homeowner tax rebate credit is a one year program providing direct property tax relief to nearly three million

A New York Homeowner Tax Rebate in its most basic form, is a reimbursement to a buyer following the purchase of a product or service. It's a highly effective tool that companies use to attract buyers, increase sales and promote specific products.

Types of New York Homeowner Tax Rebate

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks

Web How will I know if I am eligible for the property tax rebate The property tax rebate is for homeowners whose New York City property is their primary residence and whose

Web 24 ao 251 t 2022 nbsp 0183 32 NEW YORK New York City Mayor Eric Adams today signed legislation to provide a one time property tax rebate of up to 150 to hundreds of thousands of eligible

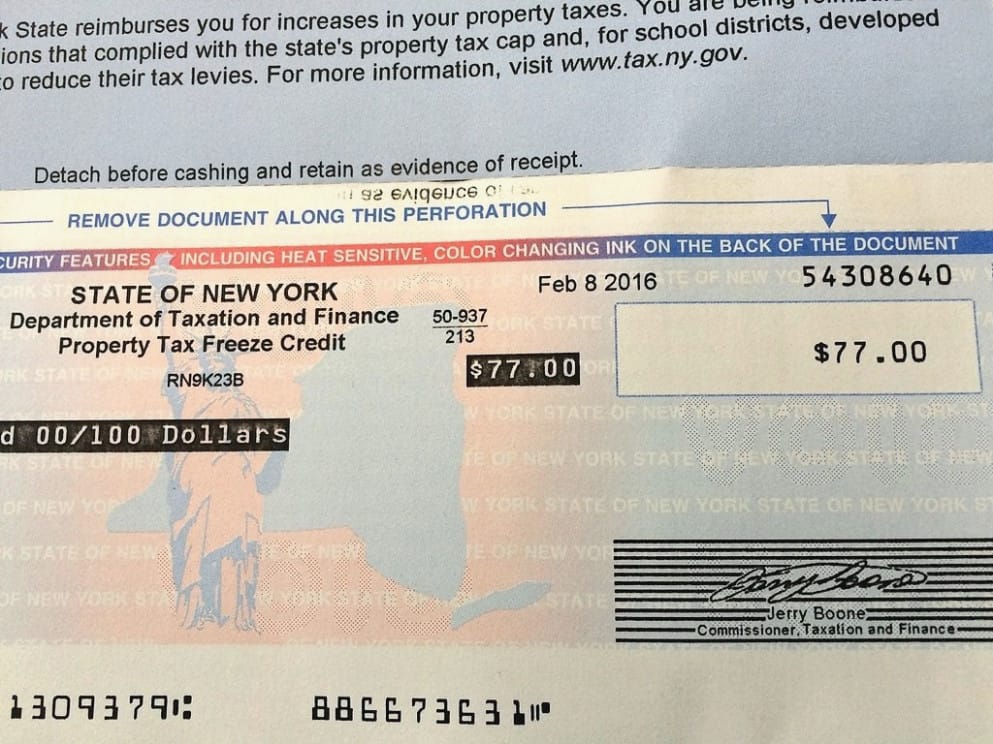

Cash New York Homeowner Tax Rebate

Cash New York Homeowner Tax Rebate are the most straightforward type of New York Homeowner Tax Rebate. The customer receives a particular sum of money back when purchasing a item. They are typically used to purchase big-ticket items, like electronics and appliances.

Mail-In New York Homeowner Tax Rebate

Customers who want to receive mail-in New York Homeowner Tax Rebate must present documents of purchase to claim their money back. They're a little more involved, but offer significant savings.

Instant New York Homeowner Tax Rebate

Instant New York Homeowner Tax Rebate apply at the point of sale. They reduce the price instantly. Customers don't need to wait until they can save by using this method.

How New York Homeowner Tax Rebate Work

Check Yourself Gov Hochul Reminds Voters Who Provided Them A Rebate

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/tronc/CEH7XCAU3RGZRIFZ3QD7EA46X4.jpg)

Check Yourself Gov Hochul Reminds Voters Who Provided Them A Rebate

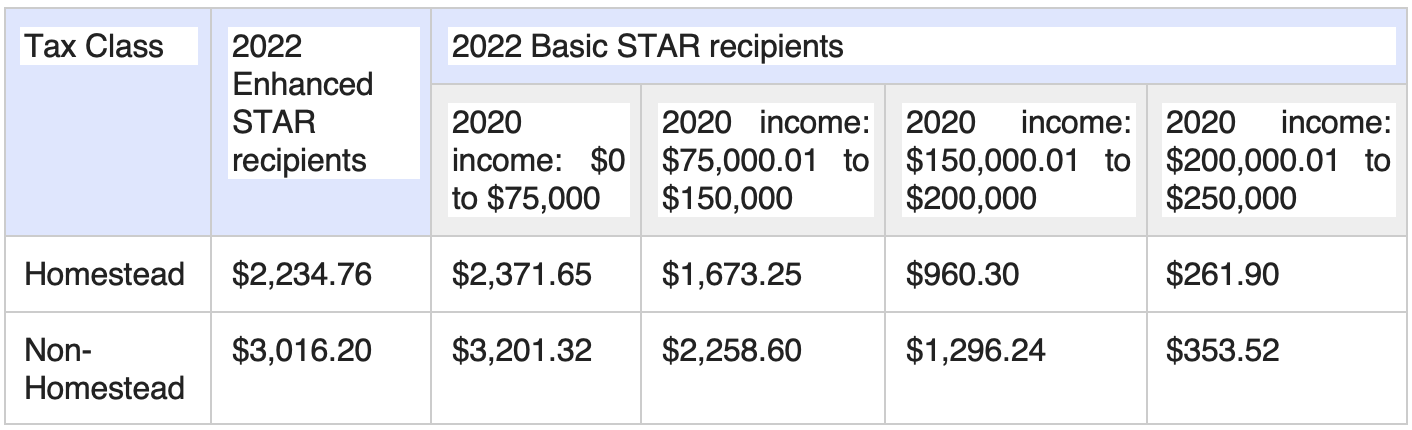

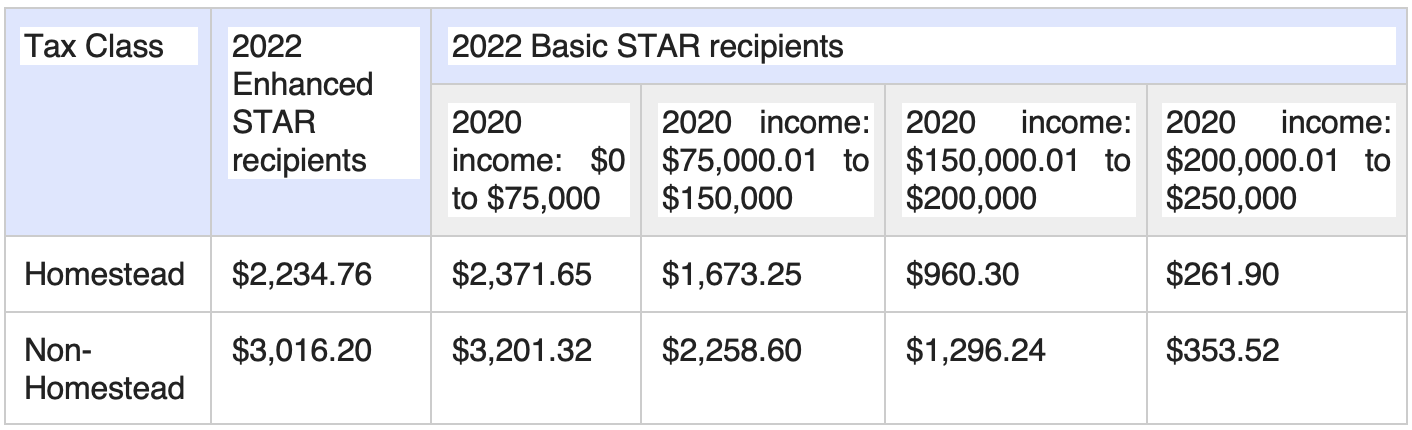

Web 13 juin 2022 nbsp 0183 32 NEW YORK CITY Check your mailboxes New York City homeowners The checks for the 2022 Homeowner Tax Rebate Credit are part of a budget deal

The New York Homeowner Tax Rebate Process

The process typically involves couple of steps that are easy to follow:

-

Then, you purchase the product make sure you purchase the product exactly as you would normally.

-

Fill in your New York Homeowner Tax Rebate request form. You'll need provide certain information, such as your address, name, and information about the purchase in order to take advantage of your New York Homeowner Tax Rebate.

-

In order to submit the New York Homeowner Tax Rebate According to the type of New York Homeowner Tax Rebate you will need to mail a New York Homeowner Tax Rebate form in or upload it online.

-

Wait for the company's approval: They is going to review your entry to verify that it is compliant with the refund's conditions and terms.

-

Receive your New York Homeowner Tax Rebate After approval, the amount you receive will be either by check, prepaid card or through a different method that is specified in the offer.

Pros and Cons of New York Homeowner Tax Rebate

Advantages

-

Cost Savings New York Homeowner Tax Rebate could significantly reduce the cost for an item.

-

Promotional Deals These promotions encourage consumers to test new products or brands.

-

Enhance Sales The benefits of a New York Homeowner Tax Rebate can improve companies' sales and market share.

Disadvantages

-

Complexity mail-in New York Homeowner Tax Rebate particularly could be cumbersome and costly.

-

Time Limits for New York Homeowner Tax Rebate Many New York Homeowner Tax Rebate impose the strictest deadlines for submission.

-

Risque of Non-Payment: Some customers may have their New York Homeowner Tax Rebate delayed if they don't adhere to the requirements exactly.

Download New York Homeowner Tax Rebate

Download New York Homeowner Tax Rebate

FAQs

1. Are New York Homeowner Tax Rebate equivalent to discounts? No, New York Homeowner Tax Rebate offer only a partial reimbursement following the purchase, whereas discounts decrease costs at time of sale.

2. Are there New York Homeowner Tax Rebate that can be used for the same product What is the best way to do it? It's contingent on terms applicable to New York Homeowner Tax Rebate offered and product's quality and eligibility. Some companies may allow it, while others won't.

3. What is the time frame to receive an New York Homeowner Tax Rebate? The amount of time differs, but could take anywhere from a couple of weeks to a few months before you receive your New York Homeowner Tax Rebate.

4. Do I have to pay taxes for New York Homeowner Tax Rebate quantities? most cases, New York Homeowner Tax Rebate amounts are not considered taxable income.

5. Should I be able to trust New York Homeowner Tax Rebate offers from brands that aren't well-known It is essential to investigate and verify that the brand giving the New York Homeowner Tax Rebate is reputable prior to making an investment.

New York State Homeowner Tax Rebate Credit HTRC Sciarabba Walker

New York Property Owners Getting Rebate Checks Months Early

Check more sample of New York Homeowner Tax Rebate below

Tax Rebate Checks Come Early This Year Yonkers Times

New York State Agrees To Waive Fines For Businesses That Miss Sales Tax

New York Homeowner Tax Credits Rebates Savings Home

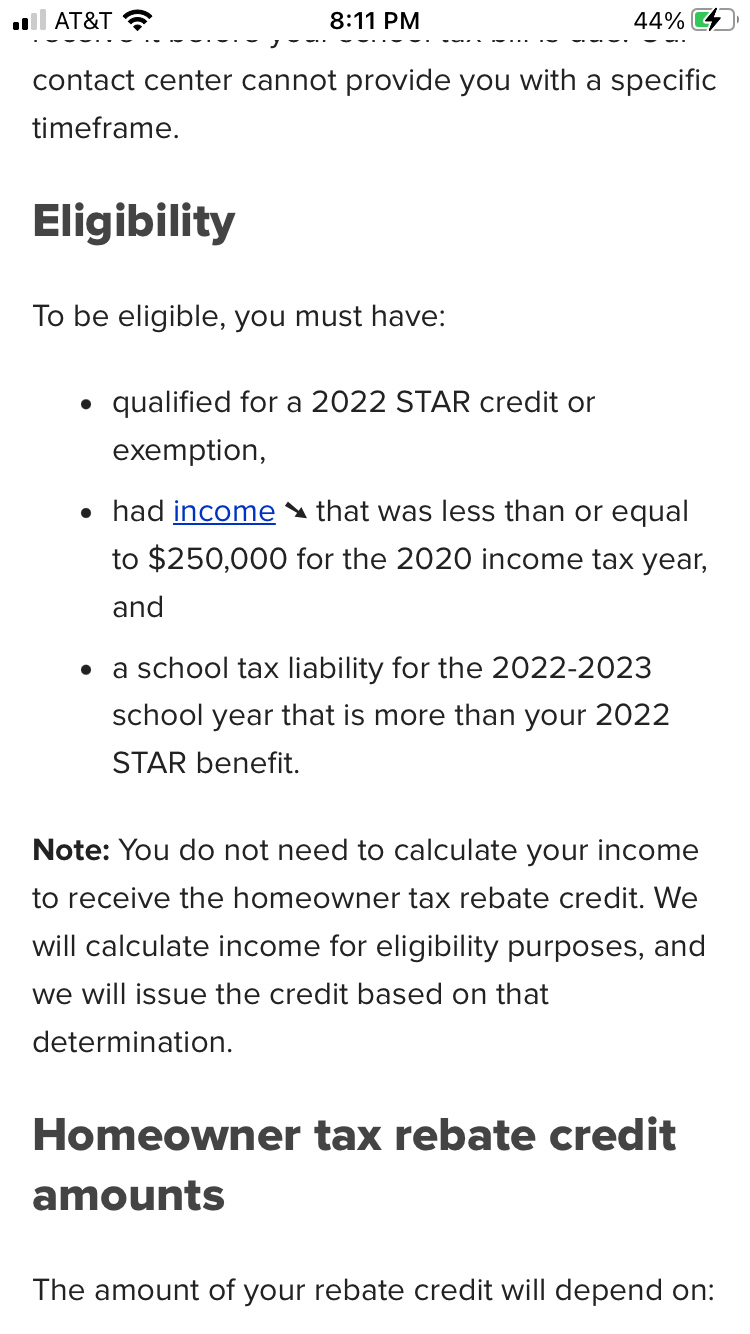

Can Someone Help Me Understand The NY 2022 Homeowner Rebate General

Property Tax Rebate New York State Printable Rebate Form

City Of Watertown New York NYS Homeowner Tax Rebate Credit

https://www.tax.ny.gov/pit/property/htrc/lookup.htm

Web 14 mars 2023 nbsp 0183 32 Learn about the homeowner tax rebate credit The homeowner tax rebate credit is a one year program providing direct property tax relief to nearly three million

https://www.tax.ny.gov/pit/property/property-tax-relief.htm

Web 5 juil 2023 nbsp 0183 32 If you re looking for information about the 2022 homeowner tax rebate credit see homeowner tax rebate credit The property tax relief credit directly reduced your

Web 14 mars 2023 nbsp 0183 32 Learn about the homeowner tax rebate credit The homeowner tax rebate credit is a one year program providing direct property tax relief to nearly three million

Web 5 juil 2023 nbsp 0183 32 If you re looking for information about the 2022 homeowner tax rebate credit see homeowner tax rebate credit The property tax relief credit directly reduced your

Can Someone Help Me Understand The NY 2022 Homeowner Rebate General

New York State Agrees To Waive Fines For Businesses That Miss Sales Tax

Property Tax Rebate New York State Printable Rebate Form

City Of Watertown New York NYS Homeowner Tax Rebate Credit

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks

Town Of Pelham Assessor State Begins Sending One year Homeowner Tax

Town Of Pelham Assessor State Begins Sending One year Homeowner Tax

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks