In this modern-day world of consumers everyone appreciates a great bargain. One method of gaining significant savings from your purchases is via New Brunswick Property Tax Rebate Forms. New Brunswick Property Tax Rebate Forms are a method of marketing that retailers and manufacturers use to provide customers with a portion of a cash back on their purchases once they have completed them. In this article, we'll dive into the world New Brunswick Property Tax Rebate Forms, exploring the nature of them and how they function, and how you can make the most of your savings using these low-cost incentives.

Get Latest New Brunswick Property Tax Rebate Form Below

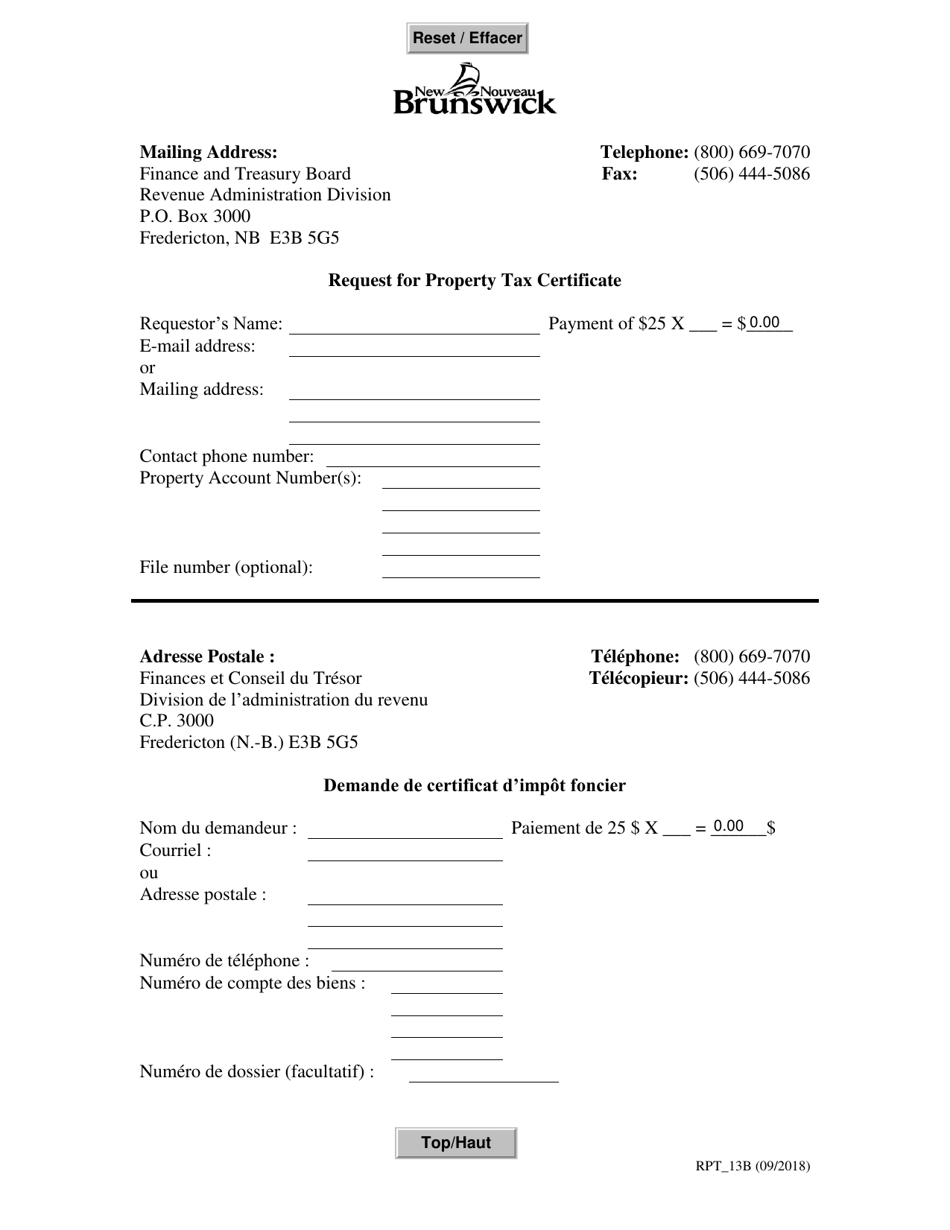

New Brunswick Property Tax Rebate Form

New Brunswick Property Tax Rebate Form -

Web 3 juin 2022 nbsp 0183 32 03 June 2022 FREDERICTON GNB The provincial government is providing property tax relief for owners of eligible residential rental properties four units or more

Web Description If you and your spouse have a combined taxable income of Less than 22 000 you are eligible for up to a 300 rebate Between 22 001 and 25 000 you

A New Brunswick Property Tax Rebate Form or New Brunswick Property Tax Rebate Form, in its most basic definition, is a refund given to a client who has purchased a particular product or service. It's a highly effective tool used by businesses to attract buyers, increase sales or promote a specific product.

Types of New Brunswick Property Tax Rebate Form

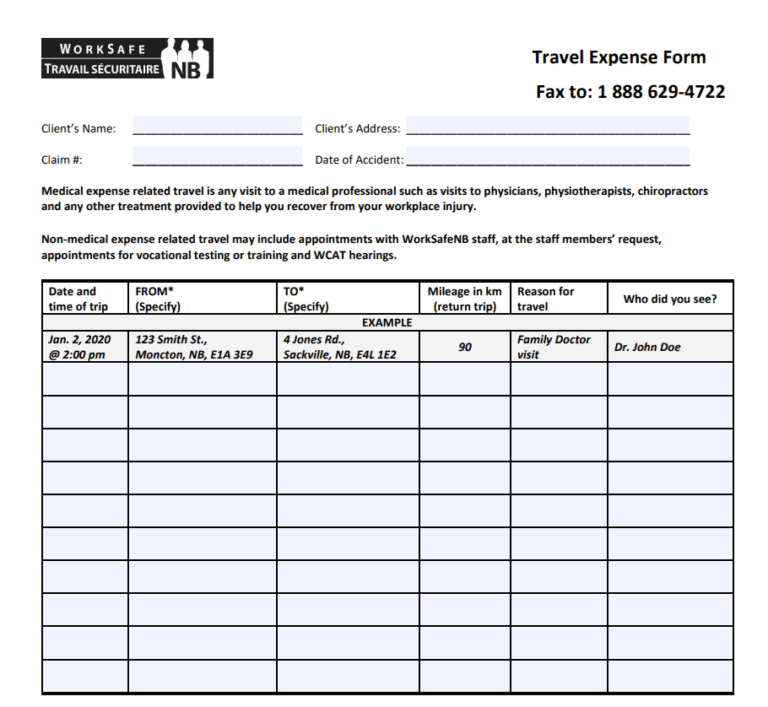

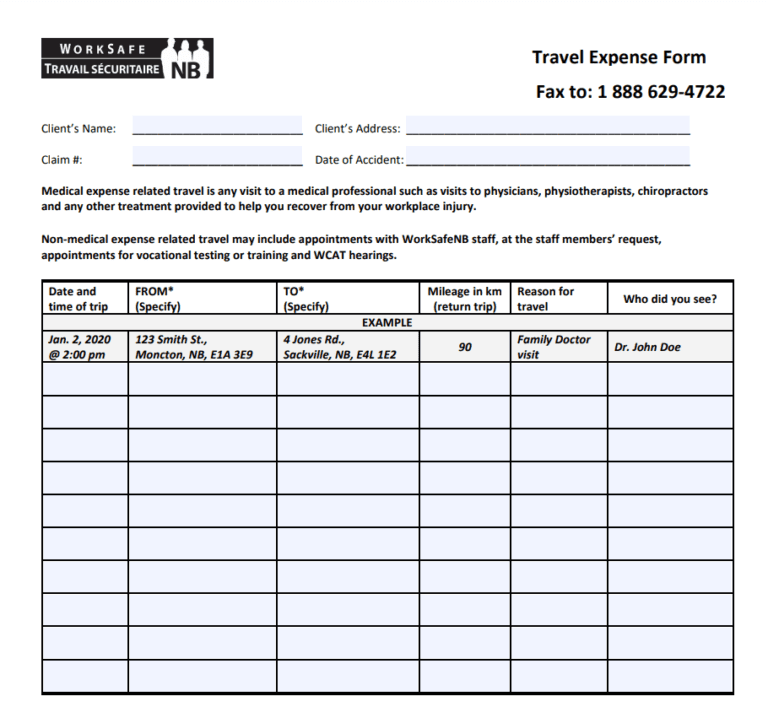

New Brunswick Travel Requirements Printable Rebate Form

New Brunswick Travel Requirements Printable Rebate Form

Web less than 22 000 you are eligible for up to a 300 rebate Between 22 001 and 25 000 you are eligible for up to a 200 rebate Between 25 001 and 30 000 you are eligible

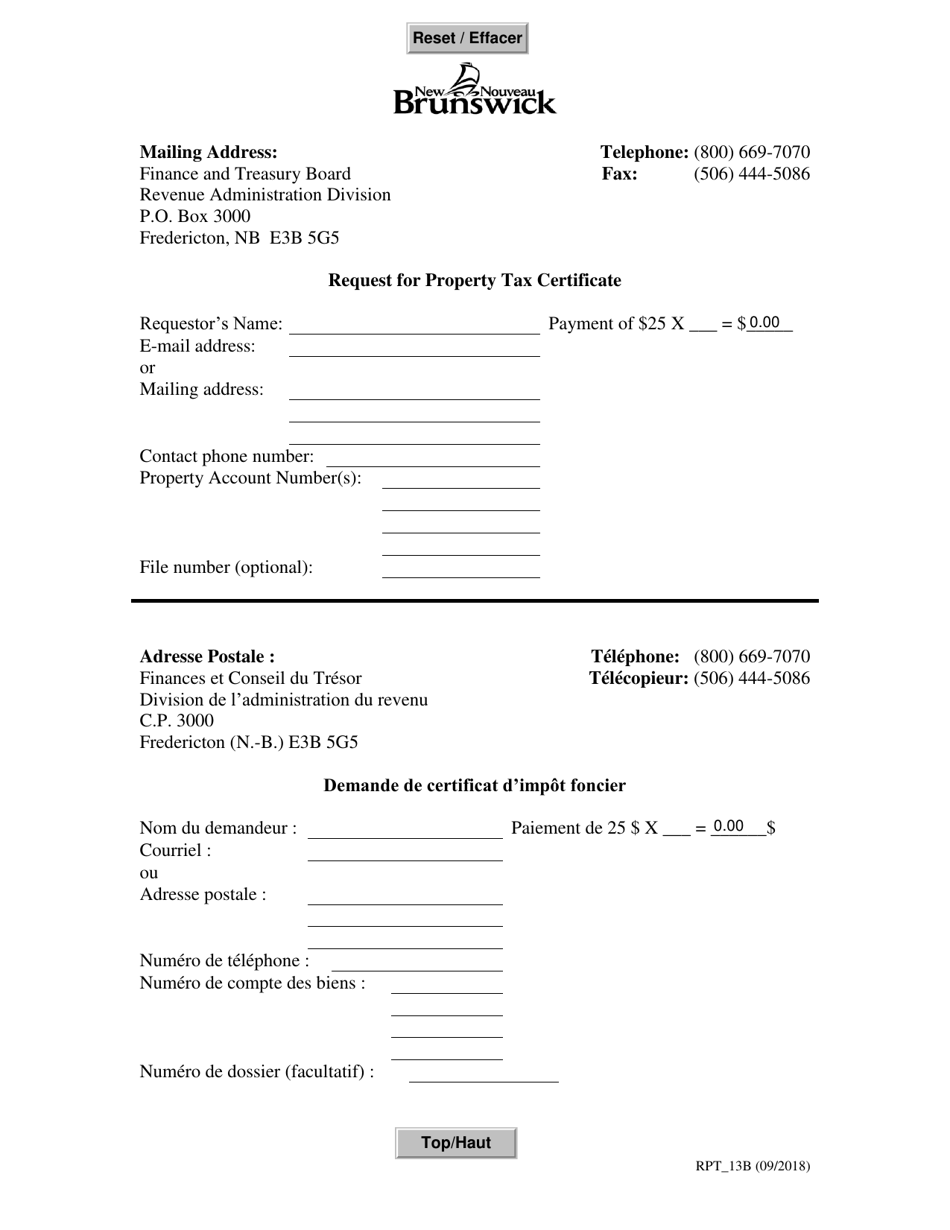

Web Submit a completed application form along with a void cheque to the Finance and Treasury Board or at any Service New Brunswick Center To access the application click here

Cash New Brunswick Property Tax Rebate Form

Cash New Brunswick Property Tax Rebate Form are the simplest kind of New Brunswick Property Tax Rebate Form. Customers get a set amount of money after buying a product. These are typically for the most expensive products like electronics or appliances.

Mail-In New Brunswick Property Tax Rebate Form

Mail-in New Brunswick Property Tax Rebate Form require customers to send in evidence of purchase to get their cash back. They're a little more complicated, but they can provide huge savings.

Instant New Brunswick Property Tax Rebate Form

Instant New Brunswick Property Tax Rebate Form apply at the point of sale, and can reduce your purchase cost instantly. Customers don't have to wait long for savings in this manner.

How New Brunswick Property Tax Rebate Form Work

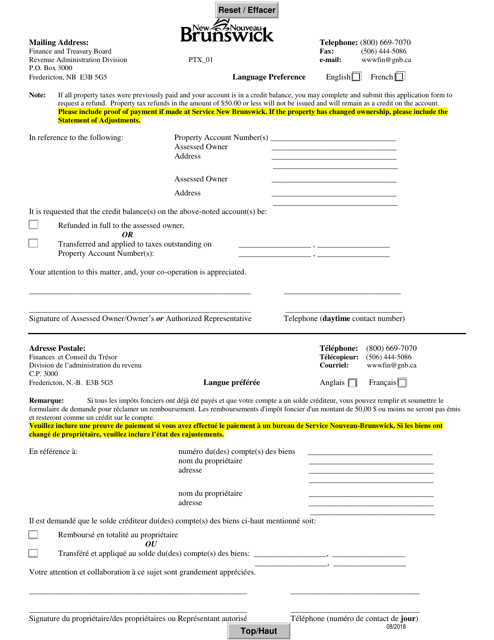

Form PTX 01 Download Fillable PDF Or Fill Online Application For

Form PTX 01 Download Fillable PDF Or Fill Online Application For

Web Description The Property Tax Allowance gives a tax break to low income property owners If you and your spouse have a combined taxable income of less than 22 000 you are

The New Brunswick Property Tax Rebate Form Process

The process typically involves few easy steps:

-

Buy the product: Firstly you purchase the product as you normally would.

-

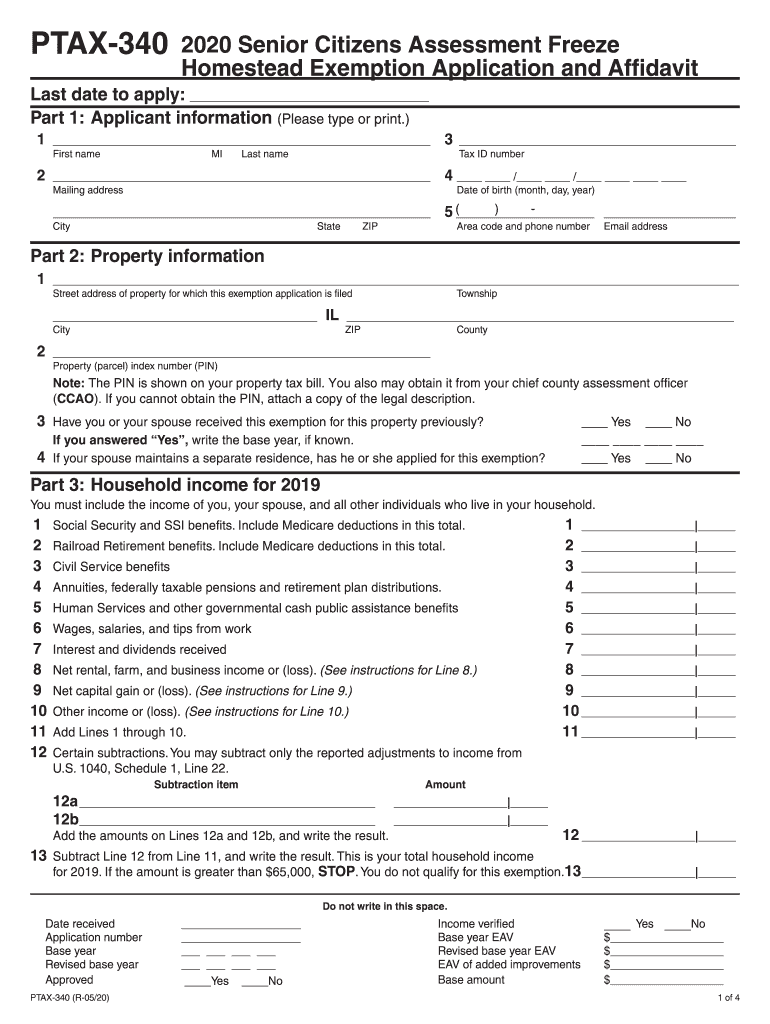

Complete the New Brunswick Property Tax Rebate Form forms: The New Brunswick Property Tax Rebate Form form will need be able to provide a few details including your address, name, and purchase information, to apply for your New Brunswick Property Tax Rebate Form.

-

In order to submit the New Brunswick Property Tax Rebate Form According to the type of New Brunswick Property Tax Rebate Form you may have to mail in a form or upload it online.

-

Wait for approval: The company will evaluate your claim for compliance with requirements of the New Brunswick Property Tax Rebate Form.

-

Enjoy your New Brunswick Property Tax Rebate Form If it is approved, you'll receive your money back, through a check, or a prepaid card, or a different method specified by the offer.

Pros and Cons of New Brunswick Property Tax Rebate Form

Advantages

-

Cost savings: New Brunswick Property Tax Rebate Form can significantly decrease the price for the product.

-

Promotional Deals: They encourage customers to try new products or brands.

-

Accelerate Sales Reward programs can boost the sales of a business and increase its market share.

Disadvantages

-

Complexity mail-in New Brunswick Property Tax Rebate Form particularly they can be time-consuming and costly.

-

Time Limits for New Brunswick Property Tax Rebate Form A lot of New Brunswick Property Tax Rebate Form have certain deadlines for submitting.

-

Risk of not receiving payment Some customers might not receive New Brunswick Property Tax Rebate Form if they don't follow the regulations precisely.

Download New Brunswick Property Tax Rebate Form

Download New Brunswick Property Tax Rebate Form

FAQs

1. Are New Brunswick Property Tax Rebate Form the same as discounts? No, they are some form of refund following the purchase, while discounts lower costs at moment of sale.

2. Are multiple New Brunswick Property Tax Rebate Form available on the same product The answer is dependent on the conditions for the New Brunswick Property Tax Rebate Form offered and product's ability to qualify. Certain companies may permit it, while others won't.

3. How long does it take to get the New Brunswick Property Tax Rebate Form? The time frame will vary, but it may take anywhere from a couple of weeks to a couple of months for you to receive your New Brunswick Property Tax Rebate Form.

4. Do I need to pay taxes regarding New Brunswick Property Tax Rebate Form quantities? most circumstances, New Brunswick Property Tax Rebate Form amounts are not considered to be taxable income.

5. Do I have confidence in New Brunswick Property Tax Rebate Form deals from lesser-known brands it is crucial to conduct research and ensure that the brand which is providing the New Brunswick Property Tax Rebate Form is trustworthy prior to making an investment.

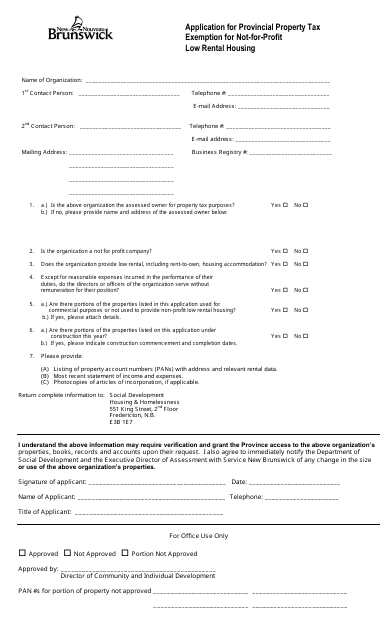

New Brunswick Canada Application For Provincial Property Tax Exemption

Ptax 340 Fill Out Sign Online DocHub

Check more sample of New Brunswick Property Tax Rebate Form below

Property Tax Rebate Application Printable Pdf Download

New Brunswick Residential Tenancies Act 2020 2022 Fill And Sign

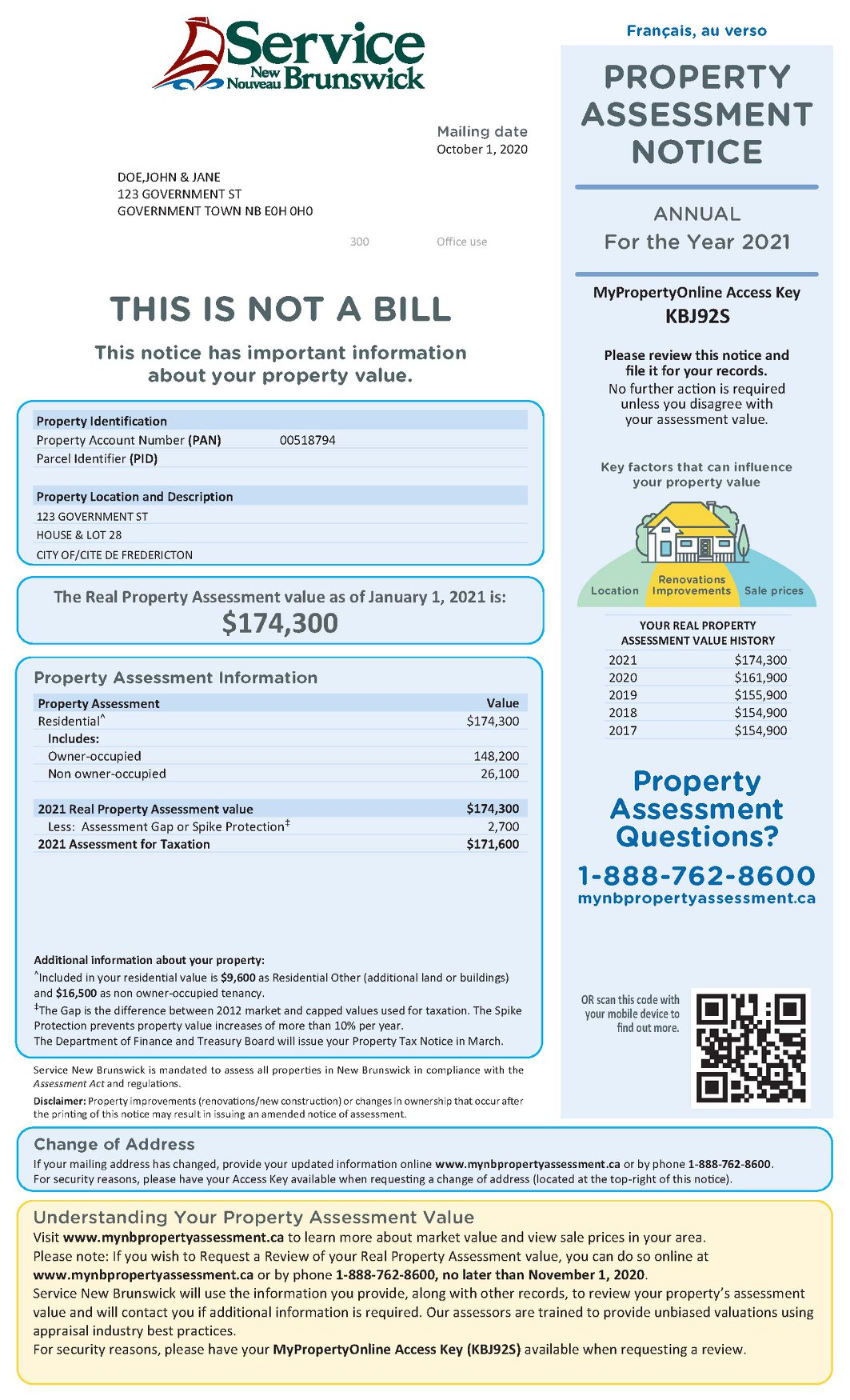

Some New Brunswick Residents Shocked By Large Property Tax Assessment

Rebate Form Download Printable PDF Templateroller

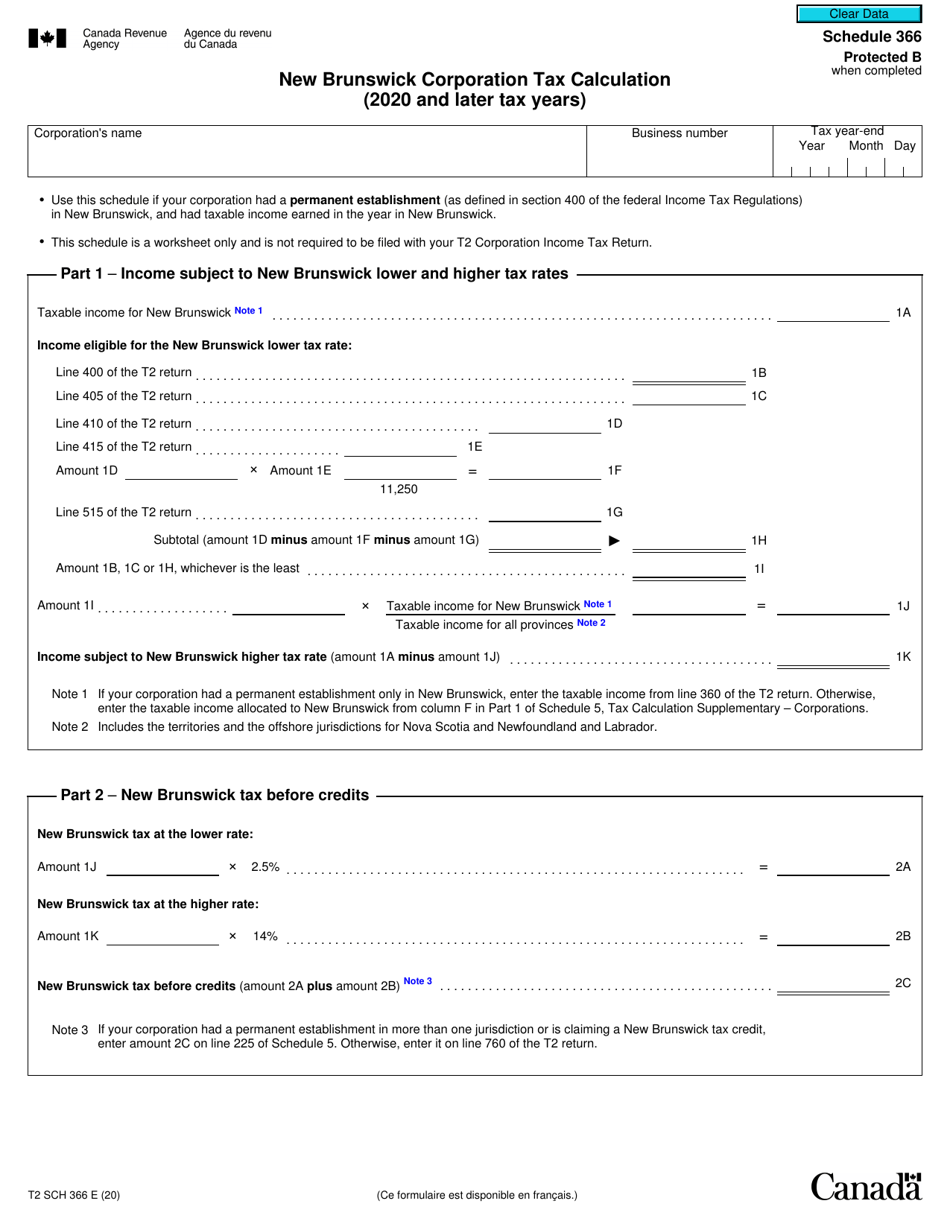

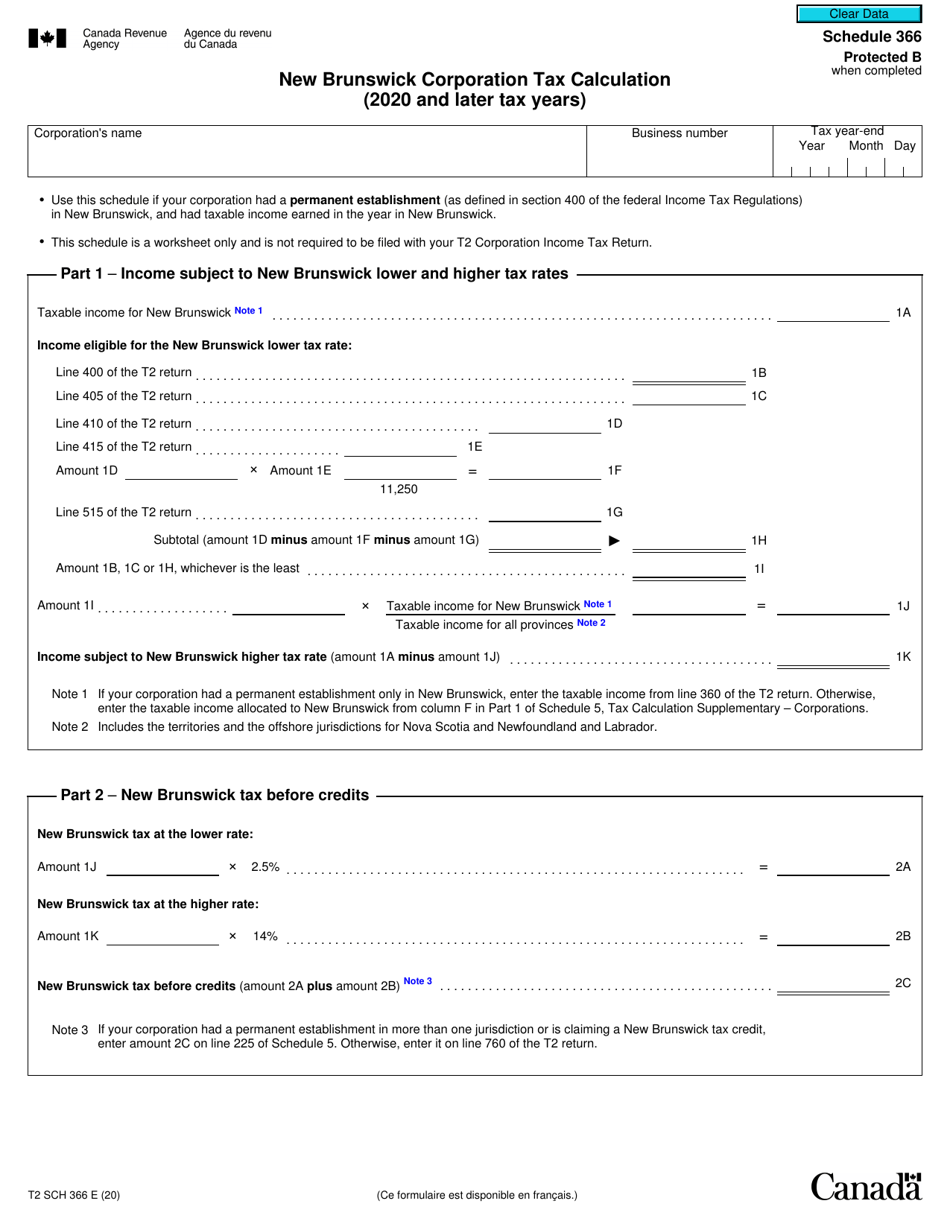

Form T2 Schedule 366 Download Fillable PDF Or Fill Online New Brunswick

Download New Brunswick Offer To Lease Form For Free FormTemplate

https://www2.snb.ca/content/snb/en/services/services_renderer.12815...

Web Description If you and your spouse have a combined taxable income of Less than 22 000 you are eligible for up to a 300 rebate Between 22 001 and 25 000 you

https://www2.gnb.ca/content/snb/en/sites/property-assessment/apply.html

Web For a principal residence Property Tax Allowance For low income property owners For Farmers Farm Land Identification Program To defer taxes on farm property For

Web Description If you and your spouse have a combined taxable income of Less than 22 000 you are eligible for up to a 300 rebate Between 22 001 and 25 000 you

Web For a principal residence Property Tax Allowance For low income property owners For Farmers Farm Land Identification Program To defer taxes on farm property For

Rebate Form Download Printable PDF Templateroller

New Brunswick Residential Tenancies Act 2020 2022 Fill And Sign

Form T2 Schedule 366 Download Fillable PDF Or Fill Online New Brunswick

Download New Brunswick Offer To Lease Form For Free FormTemplate

New Brunswick Property Assessments Are Here Blog 103 9 MAX FM

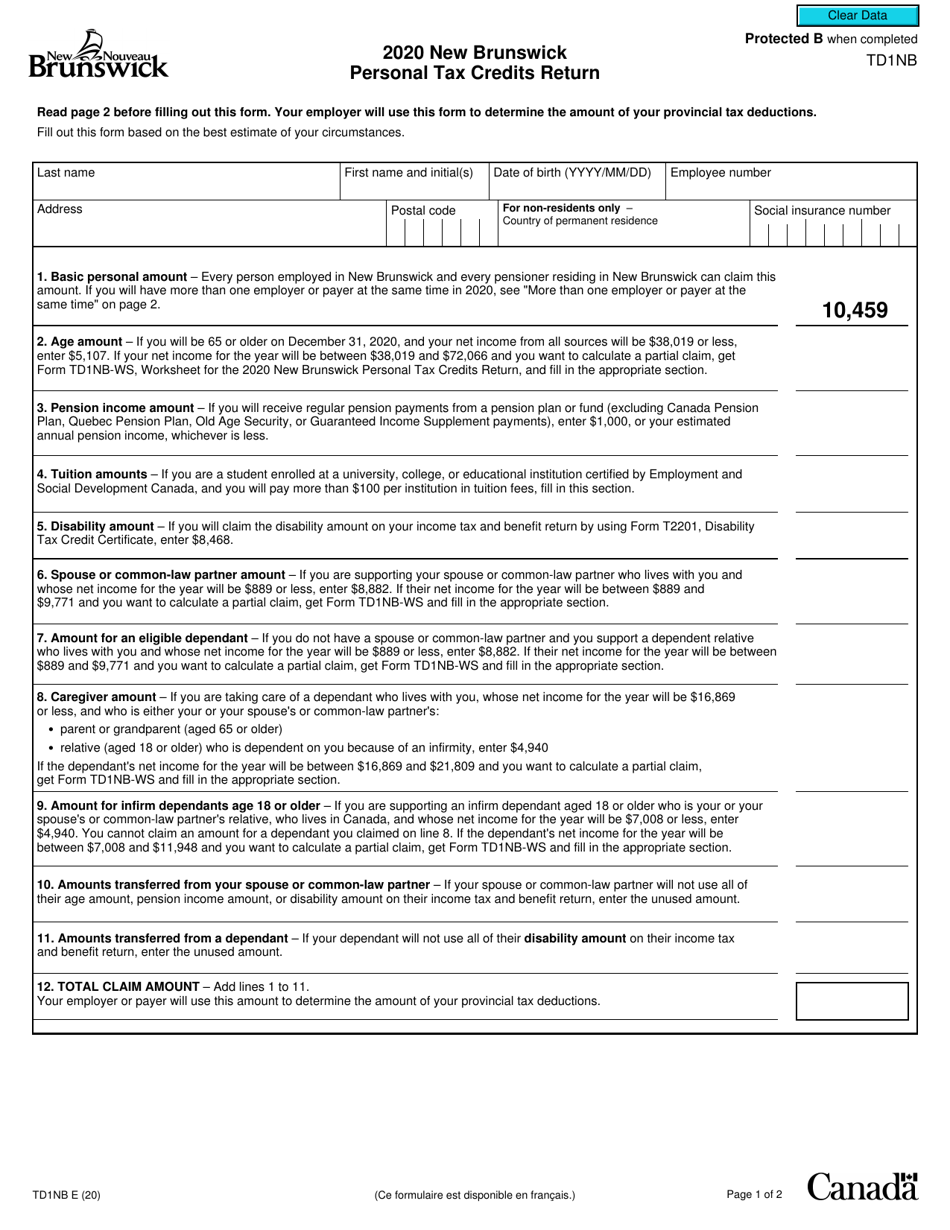

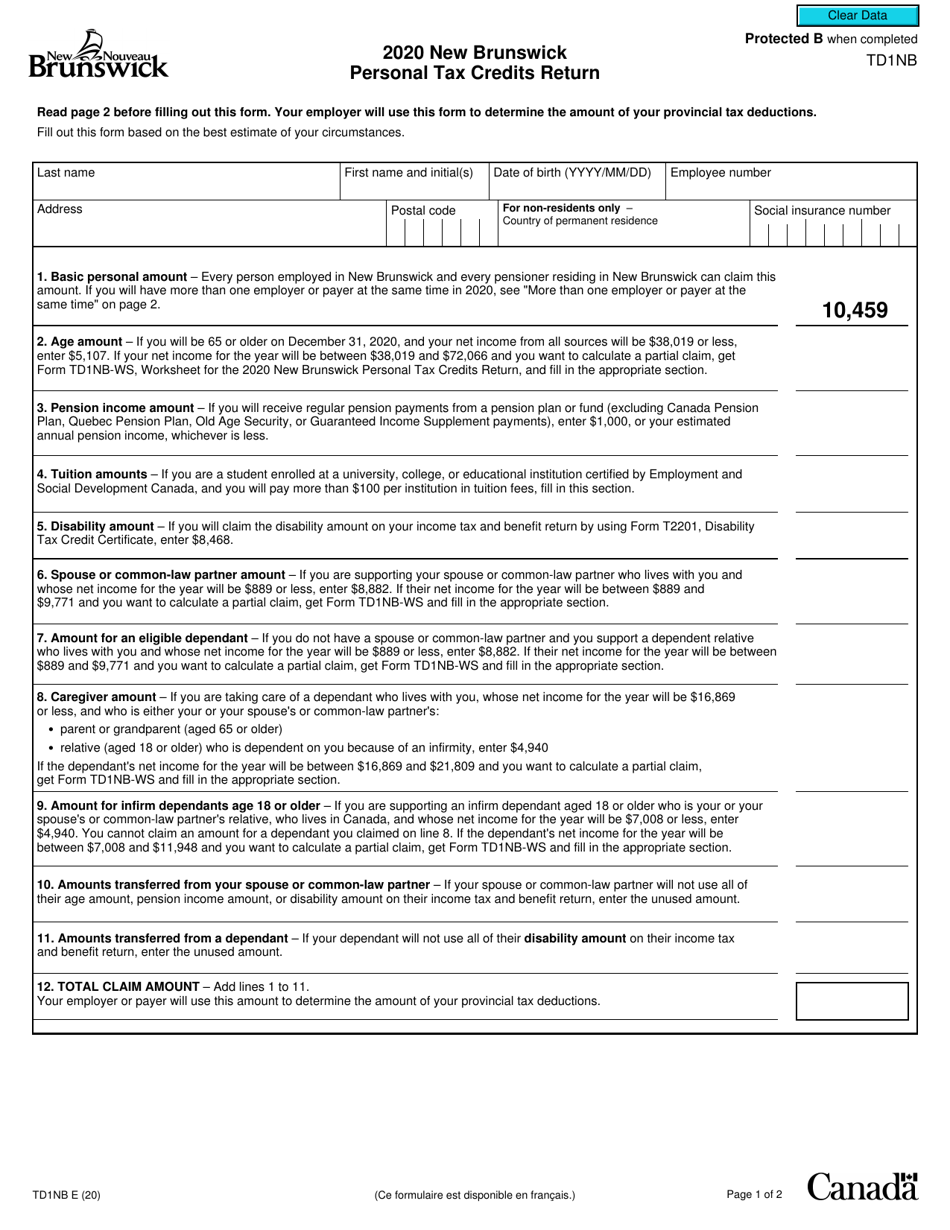

Form TD1NB Download Fillable PDF Or Fill Online New Brunswick Personal

Form TD1NB Download Fillable PDF Or Fill Online New Brunswick Personal

Form It 2023 Income Allocation And Apportionment Printable Pdf Download