In this modern-day world of consumers every person loves a great bargain. One way to gain substantial savings for your purchases is through Montana Property Tax Rebates. They are a form of marketing that retailers and manufacturers use for offering customers a percentage payment on their purchases, after they have bought them. In this post, we'll examine the subject of Montana Property Tax Rebates. We'll explore the nature of them what they are, how they function, and ways to maximize the value of these incentives.

Get Latest Montana Property Tax Rebate Below

Montana Property Tax Rebate

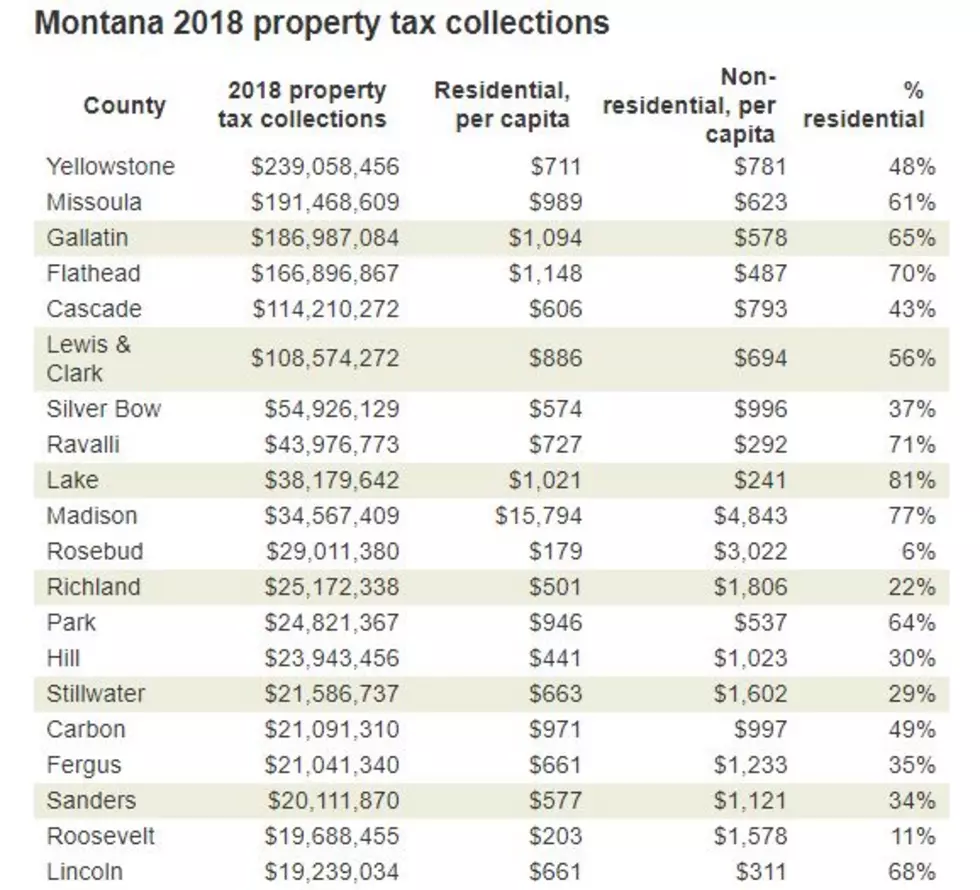

Montana Property Tax Rebate - Montana Property Tax Rebate, Montana Property Tax Rebate 2023, Montana Property Tax Rebate Status, Montana Property Tax Rebate Form, Montana Property Tax Rebate Deadline, Montana Property Tax Rebate 2022, Montana Property Tax Rebate 2021, Montana Property Tax Rebate Check Status, Montana Property Tax Rebate Application, How Are Property Taxes Calculated In Montana

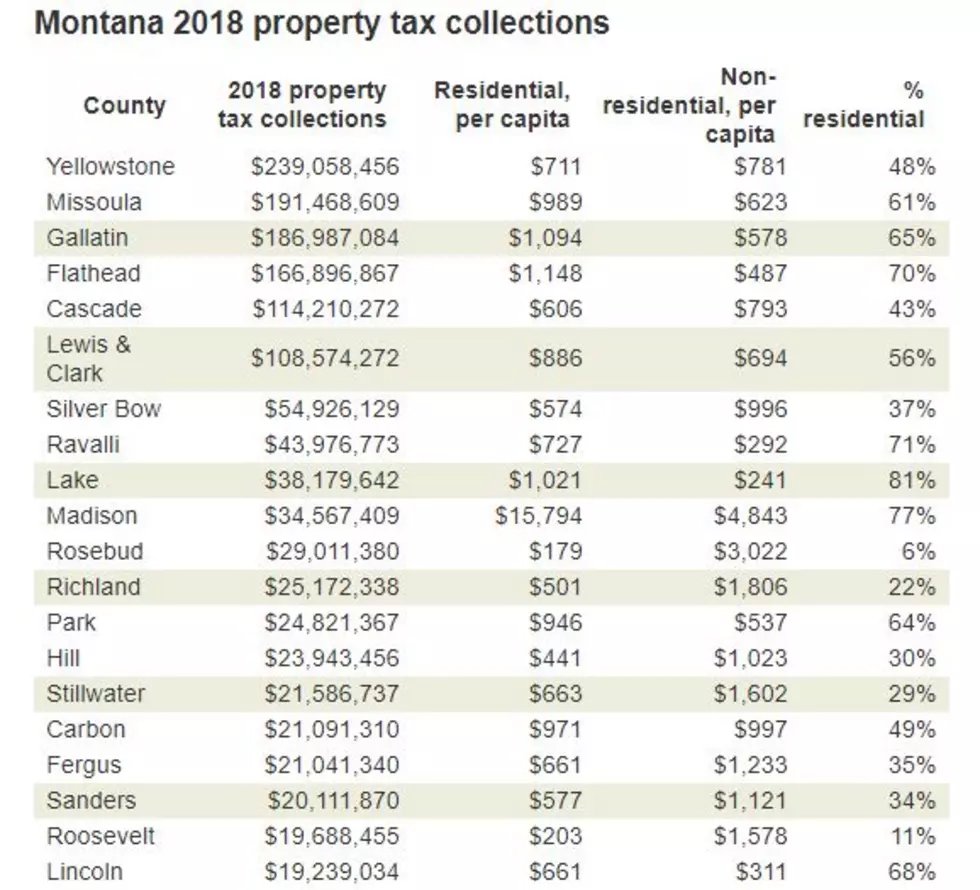

Web Governor Greg Gianforte in 2022 proposed a property tax rebate for Montanans for their primary residence and signed it into law in March 2023 The rebate provides Montanans

Web Check the status of your Individual Income Tax Rebate House Bill 192 Use surplus revenue for income tax and property tax refunds and payment of bonds House Bill 222 Provide rebates of property taxes paid on a

A Montana Property Tax Rebate as it is understood in its simplest definition, is a return to the customer after having purchased a item or service. This is a potent tool for businesses to entice buyers, increase sales and market specific products.

Types of Montana Property Tax Rebate

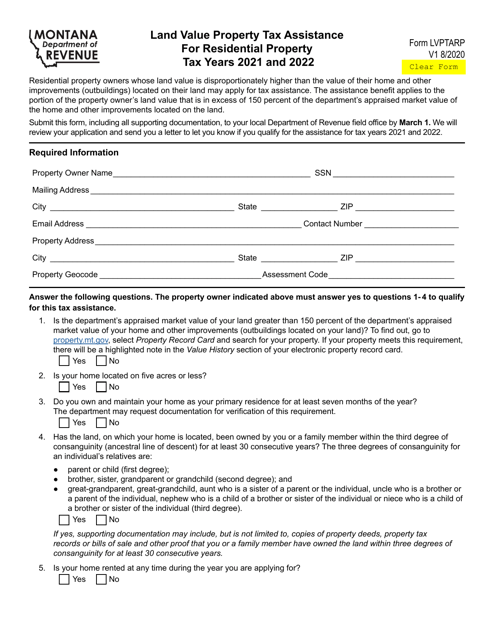

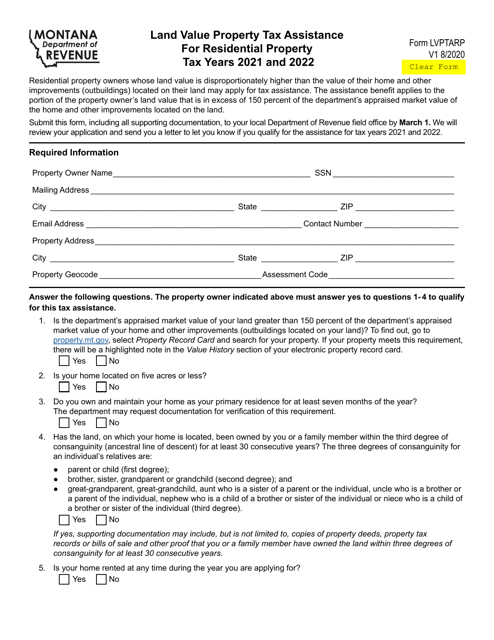

Form LVPTARP Download Fillable PDF Or Fill Online Land Value Property

Form LVPTARP Download Fillable PDF Or Fill Online Land Value Property

Web 16 ao 251 t 2023 nbsp 0183 32 The application period for Montana s new property tax rebate is open The refund is for up to 675 of taxes paid on a principal residence for the 2022 tax year C

Web Governor Greg Gianforte in 2022 proposed a property tax rebate for Montanans for their primary residence and signed it into law in March 2023 The rebate provides Montanans

Cash Montana Property Tax Rebate

Cash Montana Property Tax Rebate can be the simplest type of Montana Property Tax Rebate. Customers are offered a certain amount back in cash after purchasing a product. These are typically for products that are expensive, such as electronics or appliances.

Mail-In Montana Property Tax Rebate

Mail-in Montana Property Tax Rebate require the customer to send in the proof of purchase to be eligible for their money back. They're somewhat more complicated but could provide substantial savings.

Instant Montana Property Tax Rebate

Instant Montana Property Tax Rebate are made at the moment of sale, cutting the price of purchases immediately. Customers don't have to wait until they can save through this kind of offer.

How Montana Property Tax Rebate Work

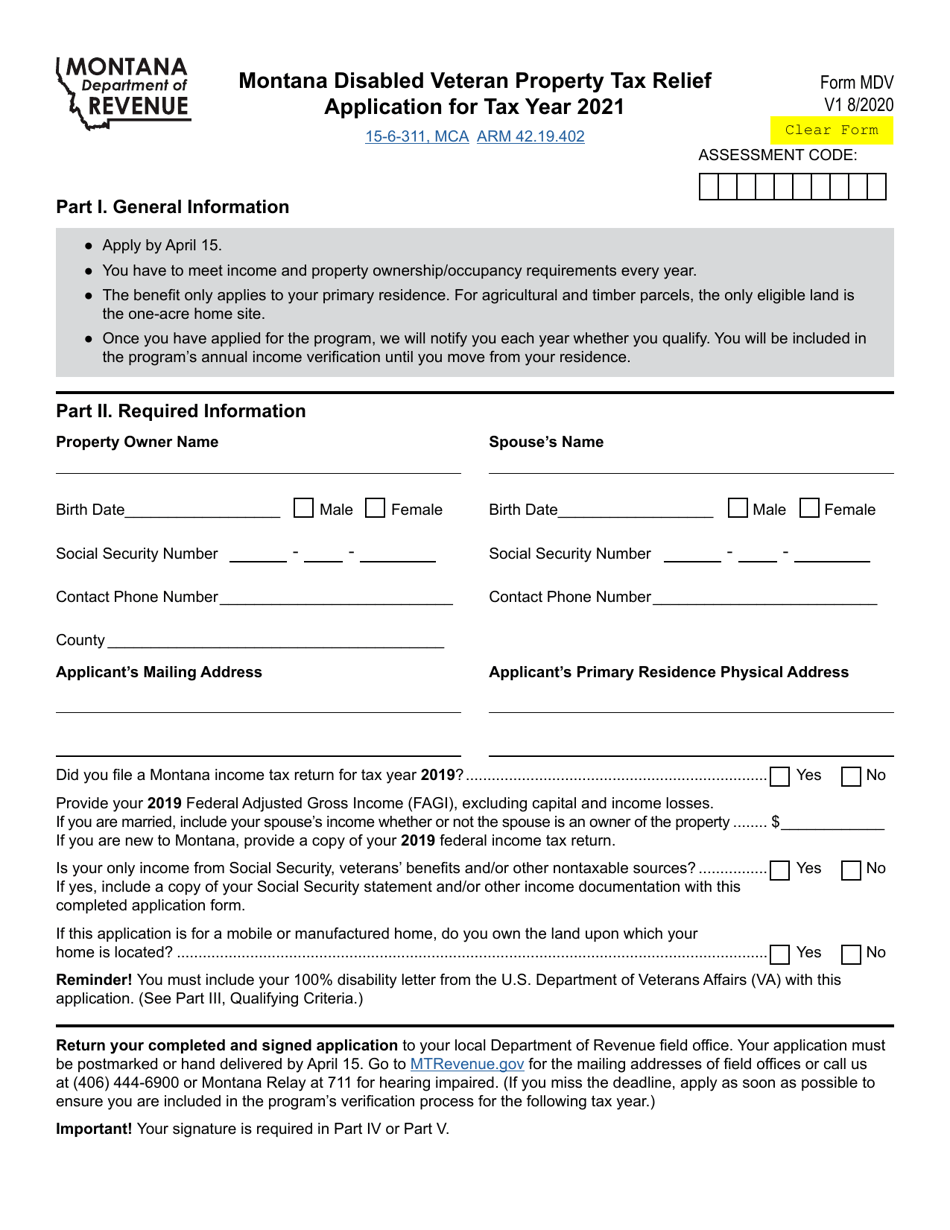

Form MDV Download Fillable PDF Or Fill Online Montana Disabled Veteran

Form MDV Download Fillable PDF Or Fill Online Montana Disabled Veteran

Web 14 ao 251 t 2023 nbsp 0183 32 Montana homeowners will be eligible for a second property tax rebate up to 675 in 2024 for property taxes paid on a principal residence for 2023 Last November

The Montana Property Tax Rebate Process

The process typically involves few simple steps

-

Purchase the item: First, you buy the product the way you normally do.

-

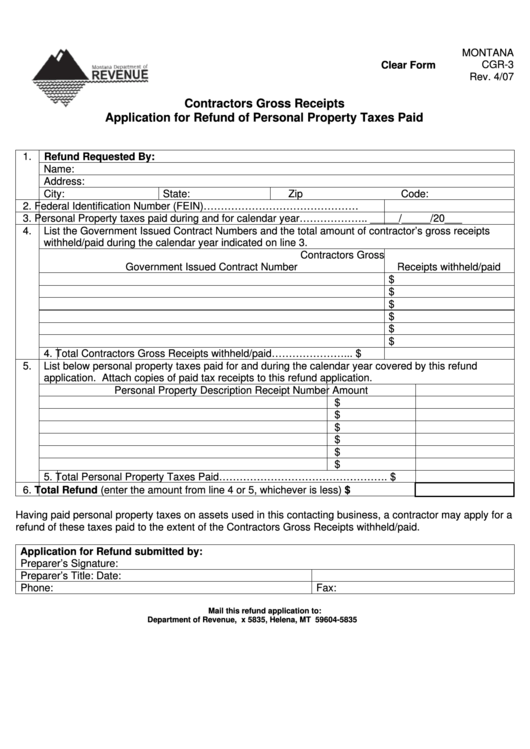

Fill in the Montana Property Tax Rebate form: You'll need provide certain information like your name, address, and the purchase details, in order in order to be eligible for a Montana Property Tax Rebate.

-

Complete the Montana Property Tax Rebate In accordance with the nature of Montana Property Tax Rebate there may be a requirement to mail in a form or make it available online.

-

Wait for the company's approval: They will examine your application to verify that it is compliant with the requirements of the Montana Property Tax Rebate.

-

Redeem your Montana Property Tax Rebate After you've been approved, you'll be able to receive your reimbursement, through a check, or a prepaid card or another procedure specified by the deal.

Pros and Cons of Montana Property Tax Rebate

Advantages

-

Cost Savings Rewards can drastically lower the cost you pay for the item.

-

Promotional Deals they encourage their customers to try out new products or brands.

-

boost sales Reward programs can boost companies' sales and market share.

Disadvantages

-

Complexity: Mail-in Montana Property Tax Rebate, in particular the case of HTML0, can be a hassle and tedious.

-

The Expiration Dates Many Montana Property Tax Rebate impose specific deadlines for submission.

-

Risk of Not Being Paid: Some customers may not receive Montana Property Tax Rebate if they don't comply with the rules exactly.

Download Montana Property Tax Rebate

Download Montana Property Tax Rebate

FAQs

1. Are Montana Property Tax Rebate the same as discounts? No, Montana Property Tax Rebate involve one-third of the amount refunded following purchase, whereas discounts reduce their price at moment of sale.

2. Are there any Montana Property Tax Rebate that I can use on the same item? It depends on the terms and conditions of Montana Property Tax Rebate offer and also the item's ability to qualify. Some companies will allow it, but others won't.

3. How long does it take to get a Montana Property Tax Rebate? The period is variable, however it can be anywhere from a few weeks up to a several months to receive a Montana Property Tax Rebate.

4. Do I need to pay taxes upon Montana Property Tax Rebate values? most cases, Montana Property Tax Rebate amounts are not considered taxable income.

5. Should I be able to trust Montana Property Tax Rebate deals from lesser-known brands Consider doing some research and ensure that the brand that is offering the Montana Property Tax Rebate is reputable prior to making any purchase.

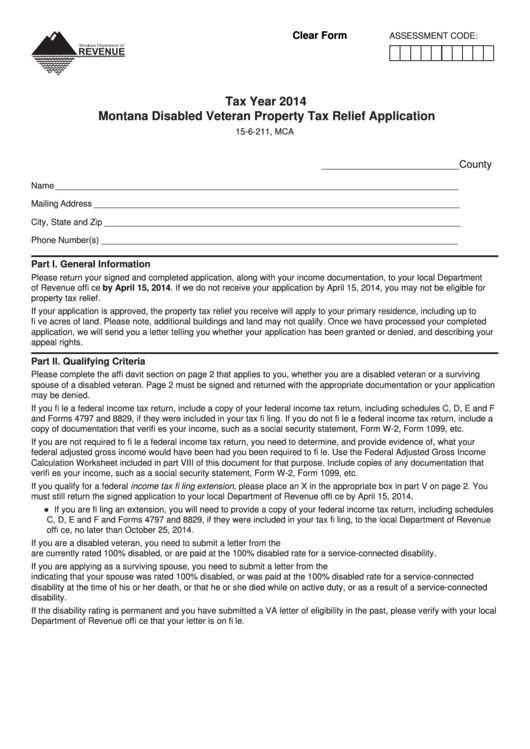

Fillable Montana Disabled Veteran Property Tax Relief Application

Fillable Application Form For Refund Of Personal Property Taxes Paid

Check more sample of Montana Property Tax Rebate below

What To Know About Montana s New Income And Property Tax Rebates

Update On Montana Tax rebates Bill

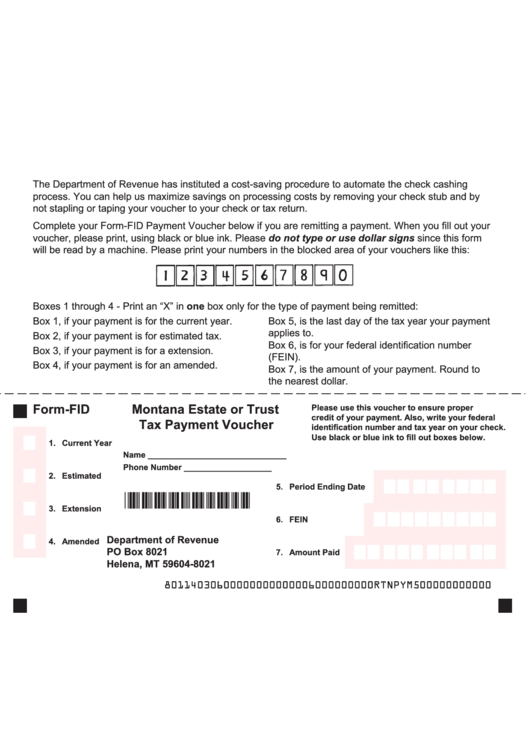

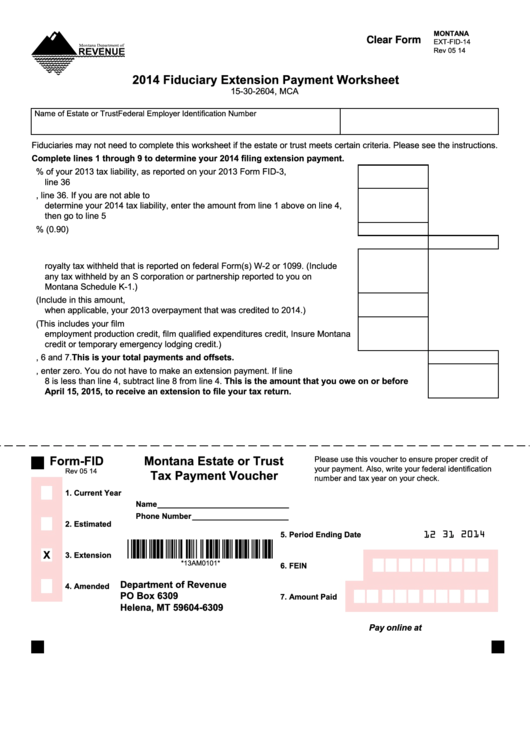

Fillable Form Fid Montana Estate Or Trust Tax Payment Voucher montana

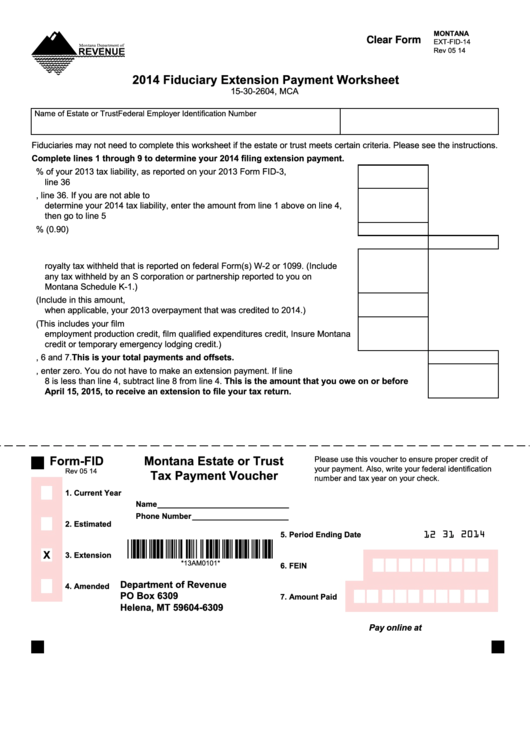

Fillable Montana Form Ext Fid 14 Fiduciary Extension Payment

Montana Homeowners Could Receive Property Tax Rebates Of Up To 1 000

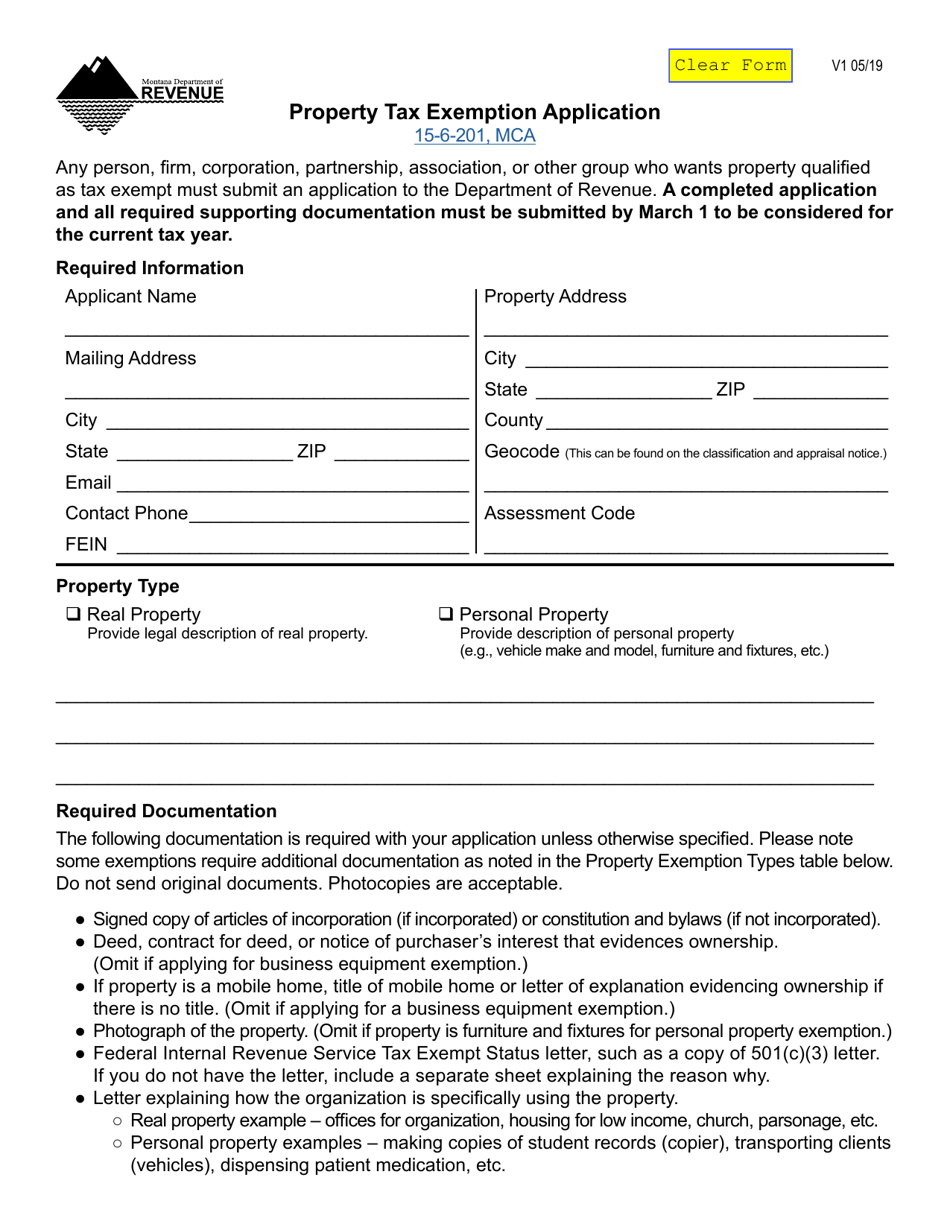

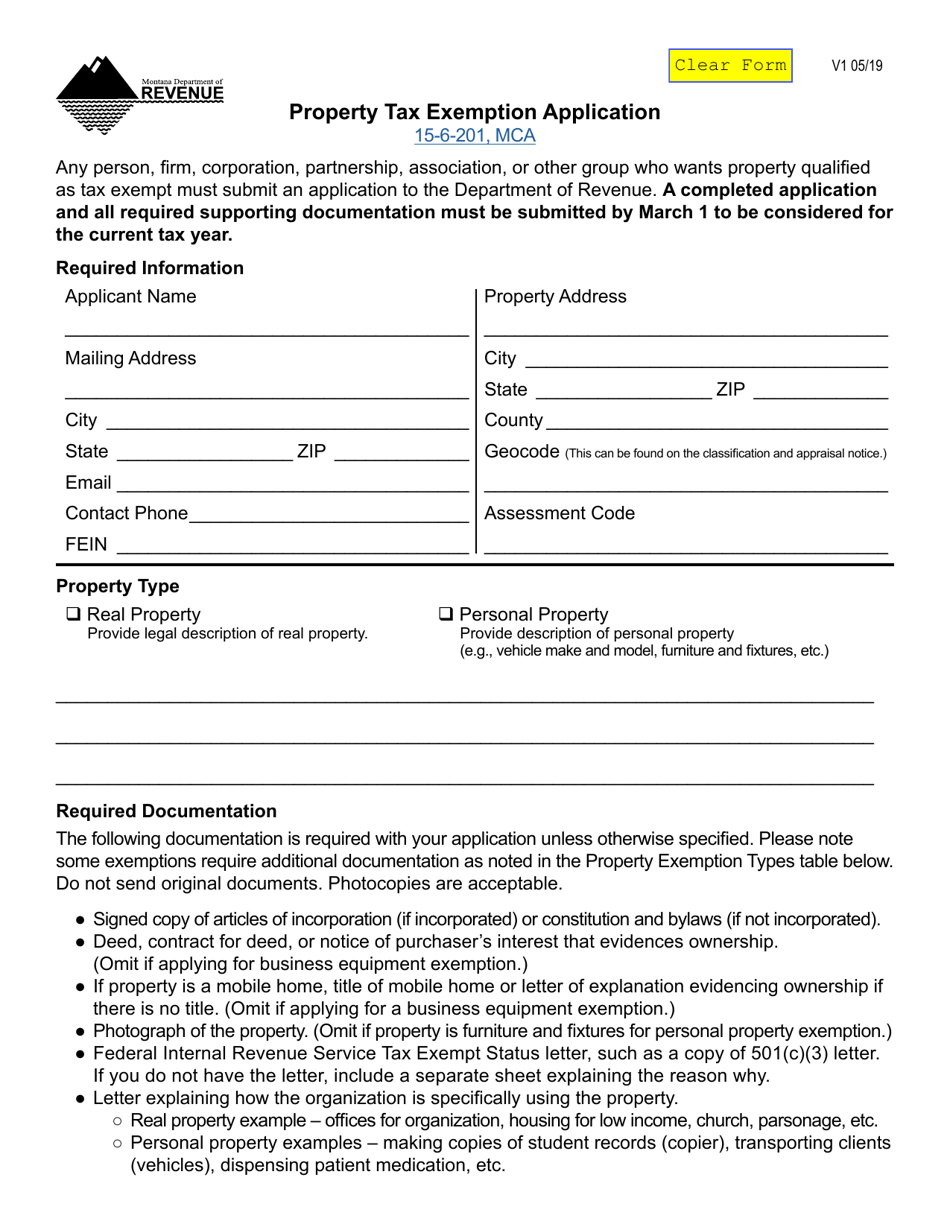

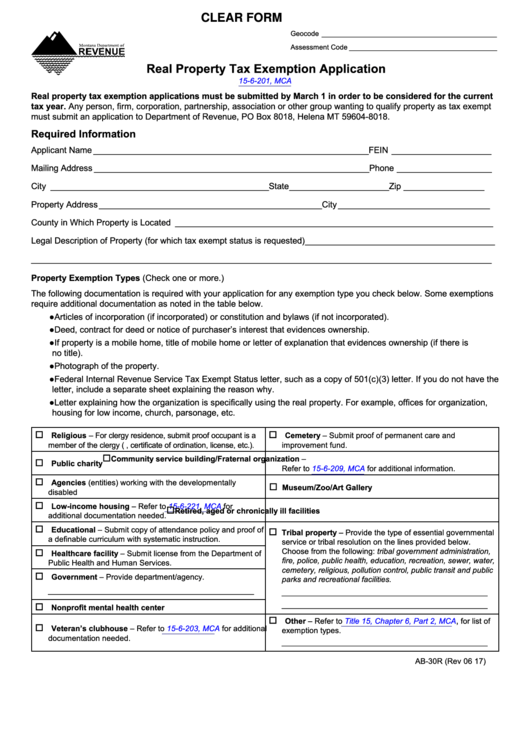

Montana Property Tax Exemption Application Download Fillable PDF

https://mtrevenue.gov/taxes/montana-tax-reb…

Web Check the status of your Individual Income Tax Rebate House Bill 192 Use surplus revenue for income tax and property tax refunds and payment of bonds House Bill 222 Provide rebates of property taxes paid on a

https://mtrevenue.gov/all-montana-property-tax-rebates-will-be-sent-by...

Web 24 ao 251 t 2023 nbsp 0183 32 The Montana Property Tax Rebate provides qualifying Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 The

Web Check the status of your Individual Income Tax Rebate House Bill 192 Use surplus revenue for income tax and property tax refunds and payment of bonds House Bill 222 Provide rebates of property taxes paid on a

Web 24 ao 251 t 2023 nbsp 0183 32 The Montana Property Tax Rebate provides qualifying Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 The

Fillable Montana Form Ext Fid 14 Fiduciary Extension Payment

Update On Montana Tax rebates Bill

Montana Homeowners Could Receive Property Tax Rebates Of Up To 1 000

Montana Property Tax Exemption Application Download Fillable PDF

Fillable Real Property Tax Exemption Application Form Montana Printable

This US States Property Tax Rebate For Residents How To Qualify

This US States Property Tax Rebate For Residents How To Qualify

Montana Personal Property Tax PROPERTY BSI