In our modern, consumer-driven society we all love a good bargain. One method of gaining significant savings when you shop is with Mlr Rebate Former Employeess. Mlr Rebate Former Employeess are an effective marketing tactic employed by retailers and manufacturers to offer customers a partial discount on purchases they made after they've created them. In this post, we'll look into the world of Mlr Rebate Former Employeess. We'll look at what they are their purpose, how they function and how you can maximise your savings via these cost-effective incentives.

Get Latest Mlr Rebate Former Employees Below

Mlr Rebate Former Employees

Mlr Rebate Former Employees -

Web 9 ao 251 t 2022 nbsp 0183 32 ERISA and tax considerations for MLR rebates Options available to employers that receive MLR rebates Medical Loss Ratio MLR rebate season is quickly

Web 1 nov 2021 nbsp 0183 32 A current year s MLR rebate is based on premiums paid to the insurer for the previous year Upon receipt of an MLR rebate the employer should calculate the

A Mlr Rebate Former Employees in its simplest description, is a refund offered to a customer who has purchased a particular product or service. It's a powerful instrument that companies use to attract customers, increase sales as well as promote particular products.

Types of Mlr Rebate Former Employees

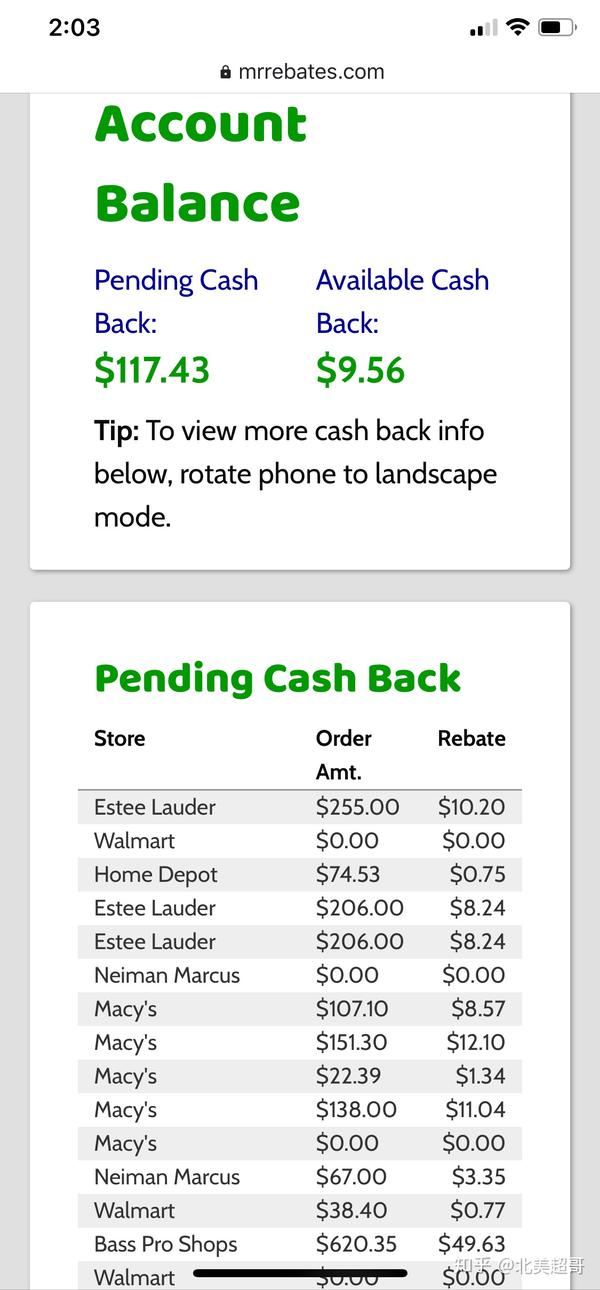

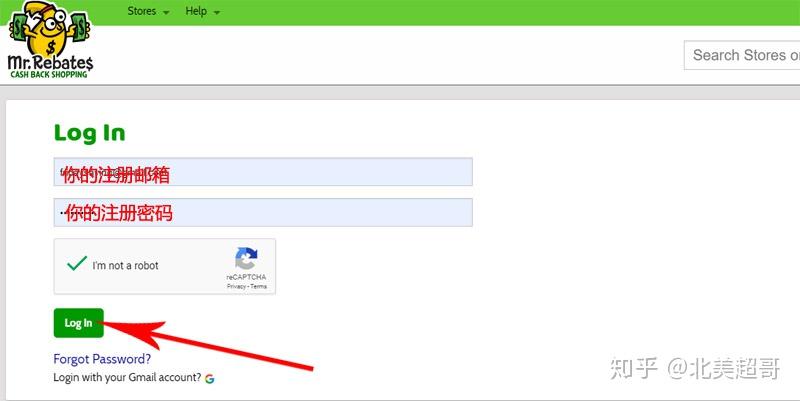

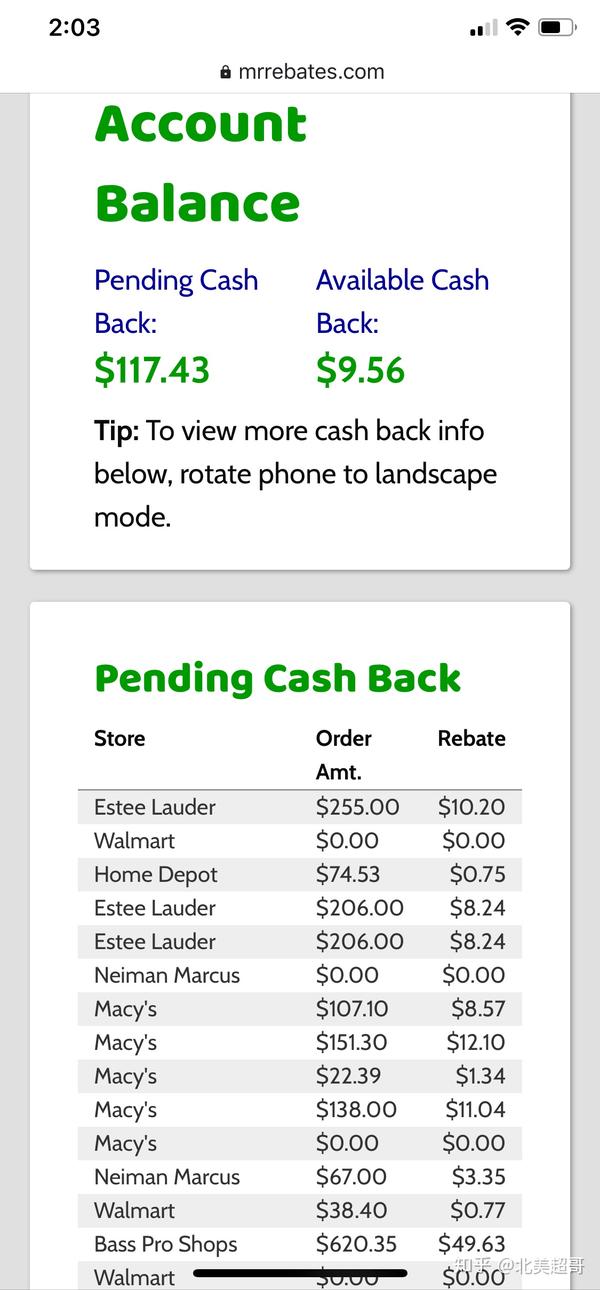

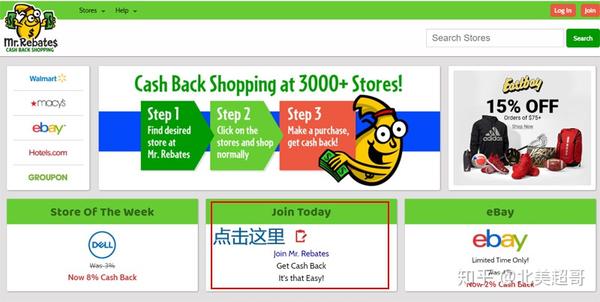

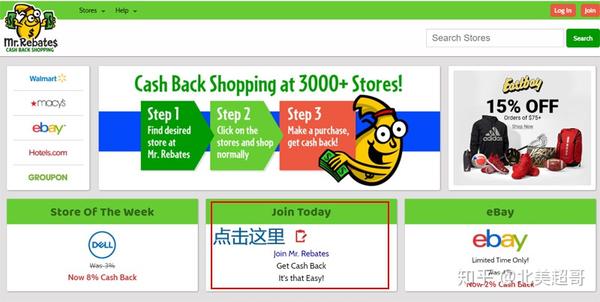

Mr Rebates Mrrebates

Mr Rebates Mrrebates

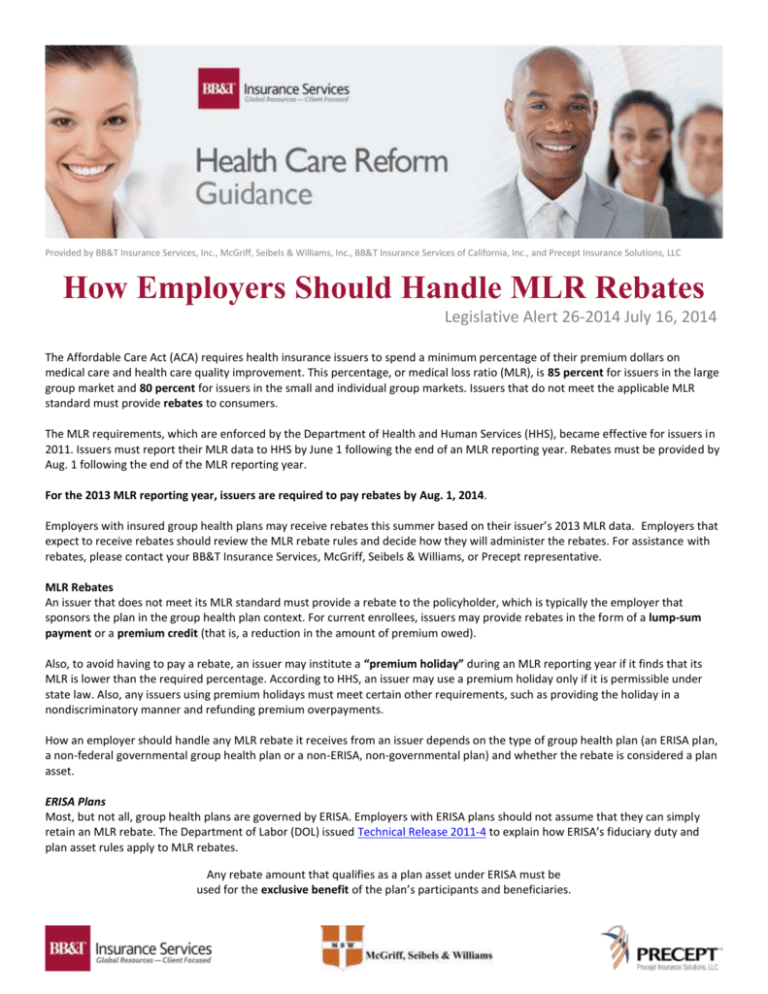

Web 14 sept 2021 nbsp 0183 32 The law does not require employers to track down former employees for MLR rebates but COBRA participants must be included in any premium rebates if

Web Employer groups may choose whether to distribute MLR rebate checks to former employees They are not required to track down former employees If it is determined

Cash Mlr Rebate Former Employees

Cash Mlr Rebate Former Employees are the most basic type of Mlr Rebate Former Employees. Customers are offered a certain amount of money back after purchasing a particular item. These are often used for more expensive items such electronics or appliances.

Mail-In Mlr Rebate Former Employees

Customers who want to receive mail-in Mlr Rebate Former Employees must submit proof of purchase in order to receive their money back. They're a bit more involved, but offer significant savings.

Instant Mlr Rebate Former Employees

Instant Mlr Rebate Former Employees are applied at point of sale, and can reduce the cost of purchase immediately. Customers don't have to wait around for savings through this kind of offer.

How Mlr Rebate Former Employees Work

Splitting Your MLR Rebate With Your Employees

Splitting Your MLR Rebate With Your Employees

Web 9 juin 2022 nbsp 0183 32 If a plan offers multiple benefit options under separate policies the participants and beneficiaries covered under the specific policy the rebate applies to should receive

The Mlr Rebate Former Employees Process

The process typically involves a couple of steps that are easy to follow:

-

When you buy the product you purchase the product in the same way you would normally.

-

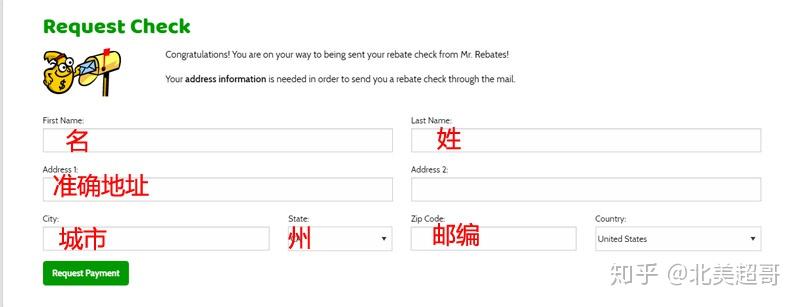

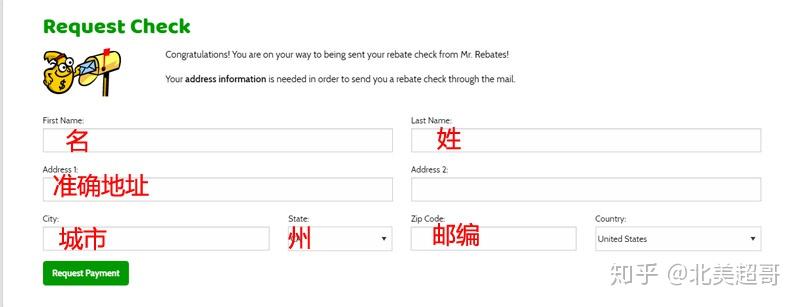

Complete this Mlr Rebate Former Employees request form. You'll have provide certain information like your name, address and purchase details, to claim your Mlr Rebate Former Employees.

-

To submit the Mlr Rebate Former Employees It is dependent on the nature of Mlr Rebate Former Employees there may be a requirement to fill out a paper form or submit it online.

-

Wait until the company approves: The company will evaluate your claim to make sure it is in line with the Mlr Rebate Former Employees's terms and conditions.

-

Accept your Mlr Rebate Former Employees If it is approved, you'll receive a refund via check, prepaid card, or a different method specified by the offer.

Pros and Cons of Mlr Rebate Former Employees

Advantages

-

Cost Savings Rewards can drastically reduce the price you pay for products.

-

Promotional Deals They encourage customers to try new items or brands.

-

Boost Sales Mlr Rebate Former Employees can enhance sales for a company and also increase market share.

Disadvantages

-

Complexity Reward mail-ins particularly may be lengthy and tedious.

-

The Expiration Dates A lot of Mlr Rebate Former Employees have the strictest deadlines for submission.

-

The risk of non-payment Customers may have their Mlr Rebate Former Employees delayed if they do not follow the rules exactly.

Download Mlr Rebate Former Employees

Download Mlr Rebate Former Employees

FAQs

1. Are Mlr Rebate Former Employees equivalent to discounts? No, Mlr Rebate Former Employees require a partial refund upon purchase whereas discounts will reduce costs at time of sale.

2. Can I make use of multiple Mlr Rebate Former Employees on the same product What is the best way to do it? It's contingent on conditions applicable to Mlr Rebate Former Employees is offered as well as the merchandise's admissibility. Certain companies might allow it, while others won't.

3. How long does it take to receive a Mlr Rebate Former Employees? The duration is variable, however it can range from several weeks to several months to receive a Mlr Rebate Former Employees.

4. Do I have to pay tax of Mlr Rebate Former Employees amount? the majority of cases, Mlr Rebate Former Employees amounts are not considered to be taxable income.

5. Can I trust Mlr Rebate Former Employees offers from lesser-known brands Do I need to conduct a thorough research to ensure that the name which is providing the Mlr Rebate Former Employees is reputable prior to making a purchase.

How Employers Should Handle MLR Rebates Central PA Benefit Solutions

Ask The Experts Medical Loss Ratio MLR Rebates ThinkHR

Check more sample of Mlr Rebate Former Employees below

Mr Rebates Mrrebates

Mr Rebates Mrrebates

Handling MLR Rebates

2022 MLR Rebate Checks To Be Issued Soon To Fully Insured Plans

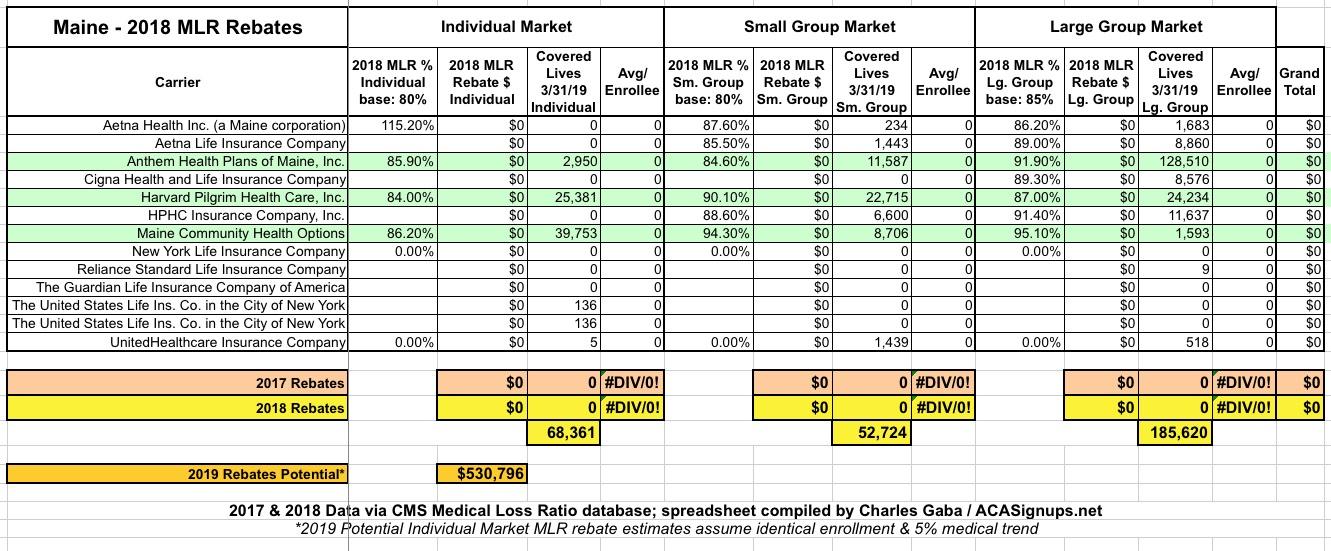

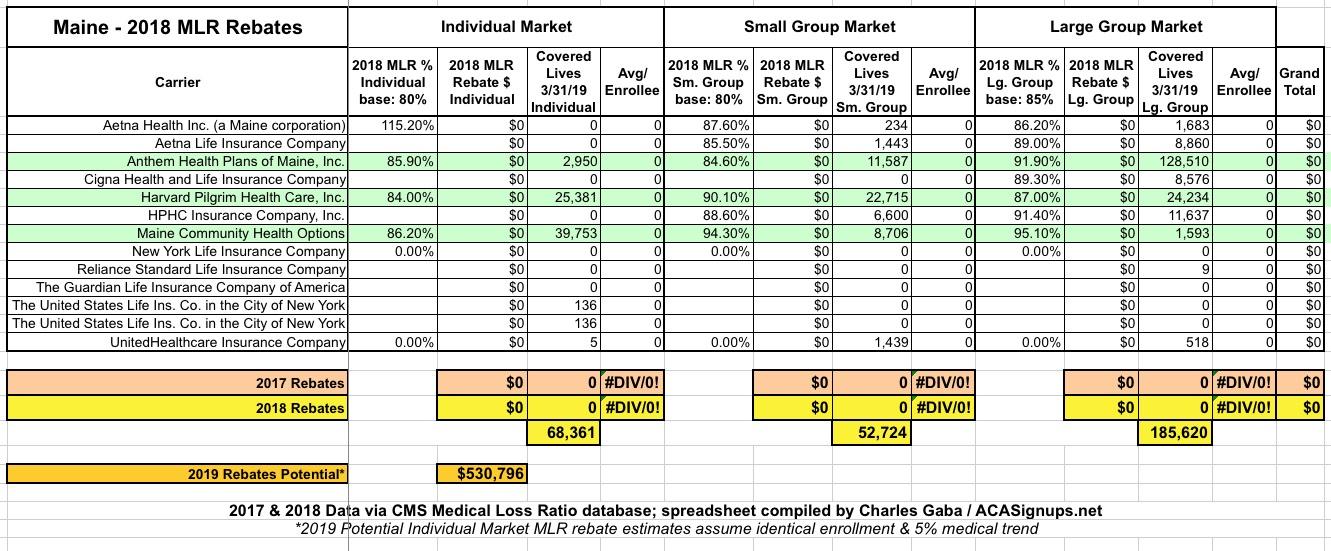

Maine The Most Boring MLR Rebate Table For At Least Two Years Running

2020 Medical Loss Ratio MLR Rebate FAQ

https://www.epicbrokers.com/insights/medical-loss-ratio-rebates-what...

Web 1 nov 2021 nbsp 0183 32 A current year s MLR rebate is based on premiums paid to the insurer for the previous year Upon receipt of an MLR rebate the employer should calculate the

https://www.amwinsconnect.com/news/how-employers-should-handle-…

Web 17 ao 251 t 2020 nbsp 0183 32 Returning the rebate to individuals who participated in the plan both in the year in which the rebate is received 2020 in this case and in the year used to

Web 1 nov 2021 nbsp 0183 32 A current year s MLR rebate is based on premiums paid to the insurer for the previous year Upon receipt of an MLR rebate the employer should calculate the

Web 17 ao 251 t 2020 nbsp 0183 32 Returning the rebate to individuals who participated in the plan both in the year in which the rebate is received 2020 in this case and in the year used to

2022 MLR Rebate Checks To Be Issued Soon To Fully Insured Plans

Mr Rebates Mrrebates

Maine The Most Boring MLR Rebate Table For At Least Two Years Running

2020 Medical Loss Ratio MLR Rebate FAQ

Mr Rebates Mrrebates

Mr Rebates Mrrebates

Mr Rebates Mrrebates

Mr Rebates Quick Cash Button Chrome