In the modern world of consumerization everyone appreciates a great deal. One way to make substantial savings on your purchases is to use Mileage Tax Rebate Forms. Mileage Tax Rebate Forms can be a way of marketing used by manufacturers and retailers for offering customers a percentage payment on their purchases, after they've bought them. In this article, we'll delve into the world of Mileage Tax Rebate Forms. We will explore what they are and how they function, as well as ways to maximize your savings with these cost-effective incentives.

Get Latest Mileage Tax Rebate Form Below

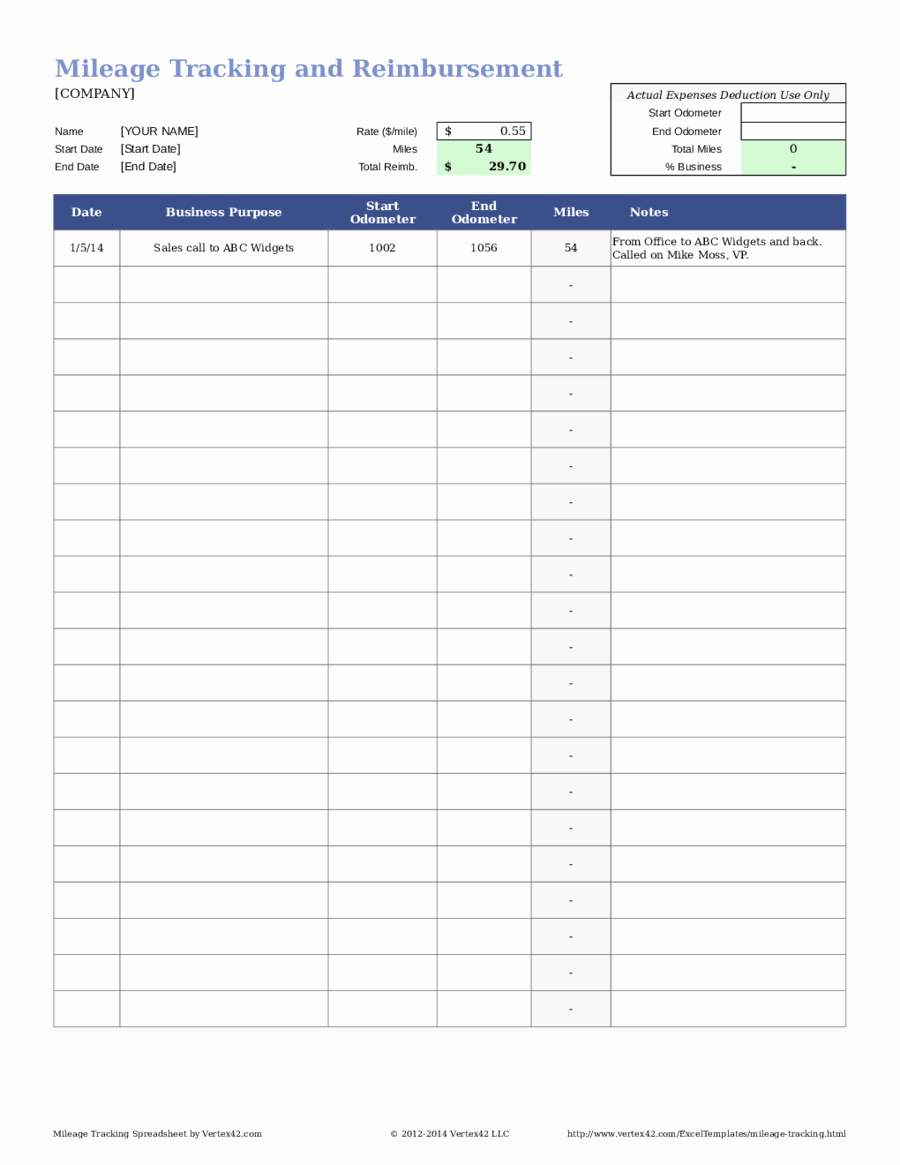

Mileage Tax Rebate Form

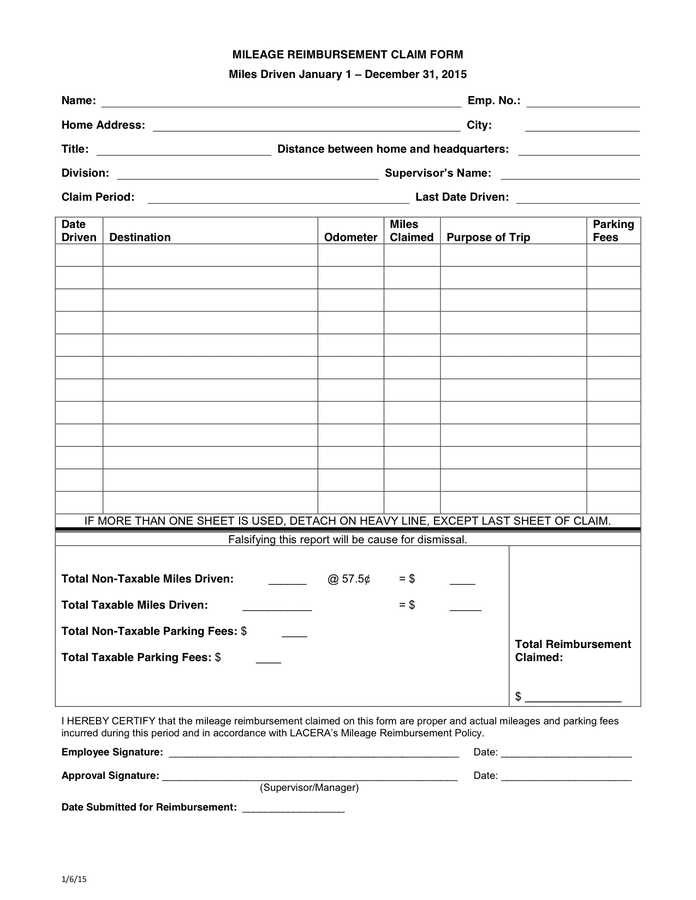

Mileage Tax Rebate Form -

Web 12 juil 2022 nbsp 0183 32 To get your approved mileage allowance payments you ll need to claim them from HMRC at the end of the tax year If you don t usually file a return meaning your employer pays your taxes through the

Web Government approved mileage allowance relief rates for the 2023 2024 tax year are Car van 163 0 45 per mile up to 10 000 miles 163 0 25 over 10 000 miles If you carry a

A Mileage Tax Rebate Form in its most basic version, is an ad-hoc reimbursement to a buyer after purchasing a certain product or service. It's a very effective technique that companies use to attract customers, boost sales, and market specific products.

Types of Mileage Tax Rebate Form

Mileage Form Pdf 2020 2022 Fill And Sign Printable Template Online

Mileage Form Pdf 2020 2022 Fill And Sign Printable Template Online

Web Tax rates per business mile Your employee travels 12 000 business miles in their car the approved amount for the year would be 163 5 000 10 000 x 45p plus 2 000 x 25p It does

Web Start your claim for free gt HMRC Mileage Claim Can you claim tax back for driving to work Things get complicated quickly when you claim mileage for work and not all your travel

Cash Mileage Tax Rebate Form

Cash Mileage Tax Rebate Form are by far the easiest type of Mileage Tax Rebate Form. Customers are given a certain amount of money in return for purchasing a item. These are usually used for more expensive items such electronics or appliances.

Mail-In Mileage Tax Rebate Form

Mail-in Mileage Tax Rebate Form require customers to submit evidence of purchase to get the refund. They're a little more complicated, but they can provide substantial savings.

Instant Mileage Tax Rebate Form

Instant Mileage Tax Rebate Form will be applied at point of sale, reducing prices immediately. Customers do not have to wait long for savings with this type.

How Mileage Tax Rebate Form Work

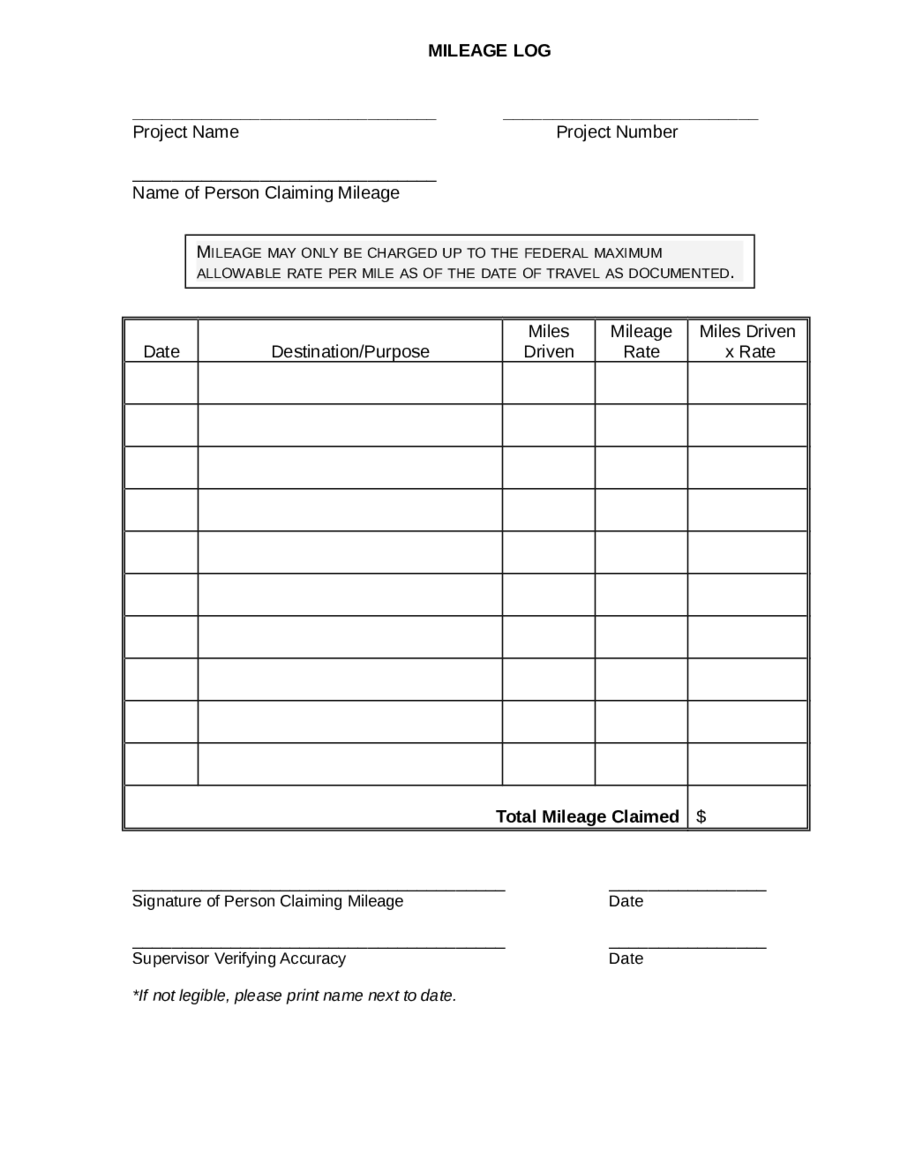

Mileage Log Template For Taxes New Mileage Spreadsheet For Taxes

Mileage Log Template For Taxes New Mileage Spreadsheet For Taxes

Web That means the mileage deduction in 2022 2021 rate is different from previous years It includes factors like gasoline prices wear and tear and more There s no limit to the

The Mileage Tax Rebate Form Process

The process typically involves few steps:

-

Purchase the product: Then, you buy the product in the same way you would normally.

-

Fill in your Mileage Tax Rebate Form forms: The Mileage Tax Rebate Form form will have to supply some details like your name, address, and the purchase details, in order to take advantage of your Mileage Tax Rebate Form.

-

You must submit the Mileage Tax Rebate Form Based on the kind of Mileage Tax Rebate Form there may be a requirement to mail a Mileage Tax Rebate Form form in or upload it online.

-

Wait for the company's approval: They will review your request to make sure that it's in accordance with the reimbursement's terms and condition.

-

Get your Mileage Tax Rebate Form Once you've received your approval, you'll receive your refund using a check or prepaid card, or by another method specified by the offer.

Pros and Cons of Mileage Tax Rebate Form

Advantages

-

Cost Savings Mileage Tax Rebate Form are a great way to lower the cost you pay for products.

-

Promotional Offers The aim is to encourage customers to try new items or brands.

-

Boost Sales Mileage Tax Rebate Form can enhance a company's sales and market share.

Disadvantages

-

Complexity Mileage Tax Rebate Form that are mail-in, in particular difficult and slow-going.

-

Days of expiration: Many Mileage Tax Rebate Form have deadlines for submission.

-

Risk of not receiving payment Some customers might not receive their refunds if they don't adhere to the requirements precisely.

Download Mileage Tax Rebate Form

Download Mileage Tax Rebate Form

FAQs

1. Are Mileage Tax Rebate Form the same as discounts? No, the Mileage Tax Rebate Form will be some form of refund following the purchase, whereas discounts reduce prices at moment of sale.

2. Are there any Mileage Tax Rebate Form that I can use for the same product It is contingent on the terms of Mileage Tax Rebate Form is offered as well as the merchandise's potential eligibility. Certain companies may allow it, but some will not.

3. How long does it take to receive the Mileage Tax Rebate Form? The length of time is variable, however it can be from several weeks to couple of months before you get your Mileage Tax Rebate Form.

4. Do I need to pay taxes on Mileage Tax Rebate Form amount? most situations, Mileage Tax Rebate Form amounts are not considered to be taxable income.

5. Can I trust Mileage Tax Rebate Form offers from lesser-known brands It's important to do your research and ensure that the business providing the Mileage Tax Rebate Form is reliable prior to making an purchase.

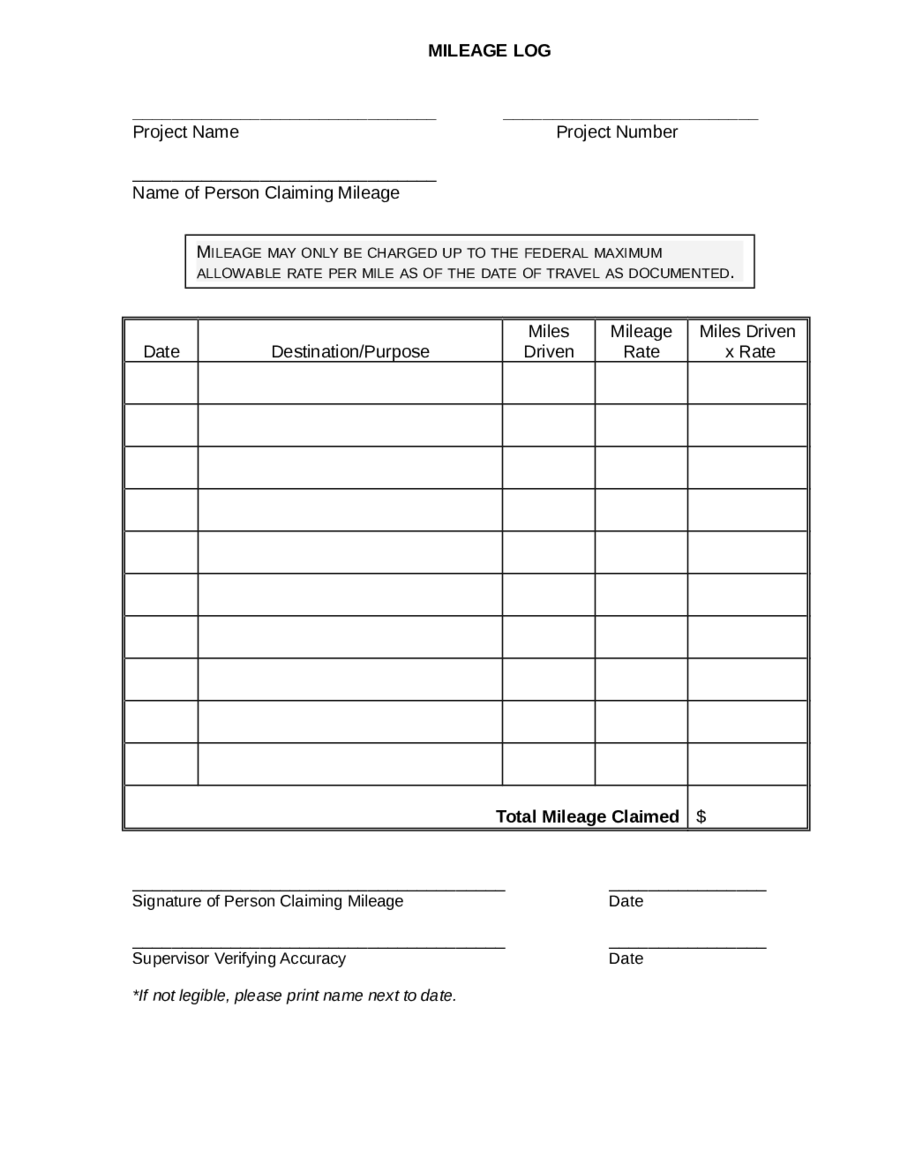

Reimbursement Form Printable Printable Forms Free Online

50 Mileage Log Form For Taxes Ufreeonline Template

Check more sample of Mileage Tax Rebate Form below

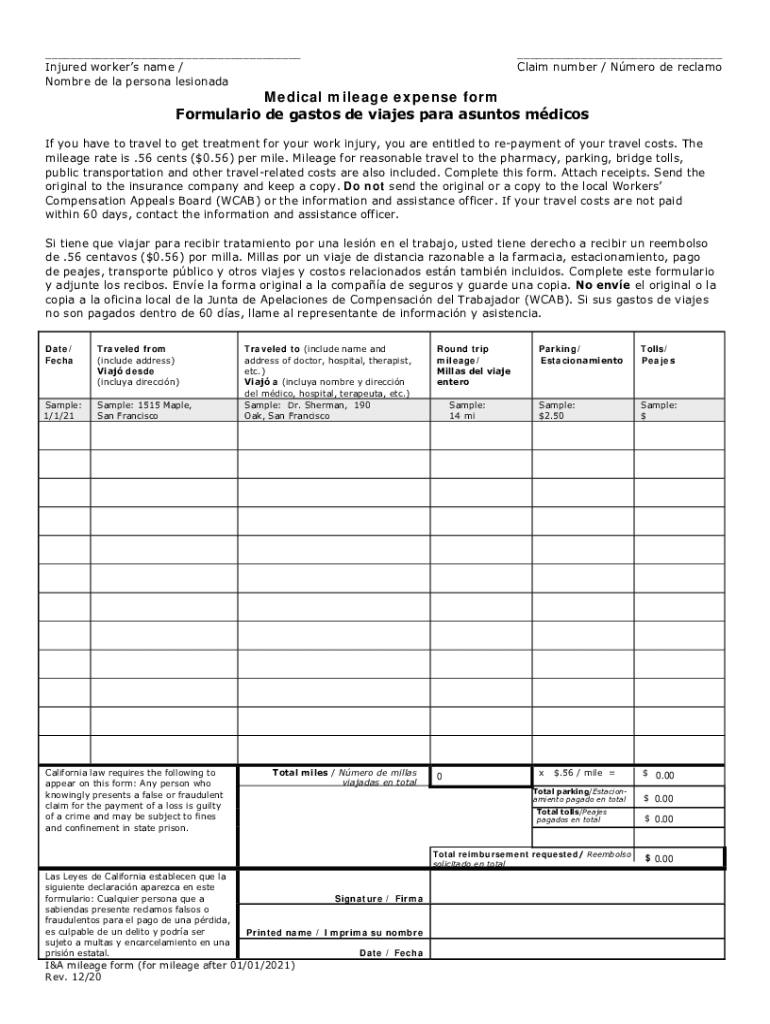

2014 Form OR 735 9002 Fill Online Printable Fillable Blank PdfFiller

Printable Mileage Form Printable Forms Free Online

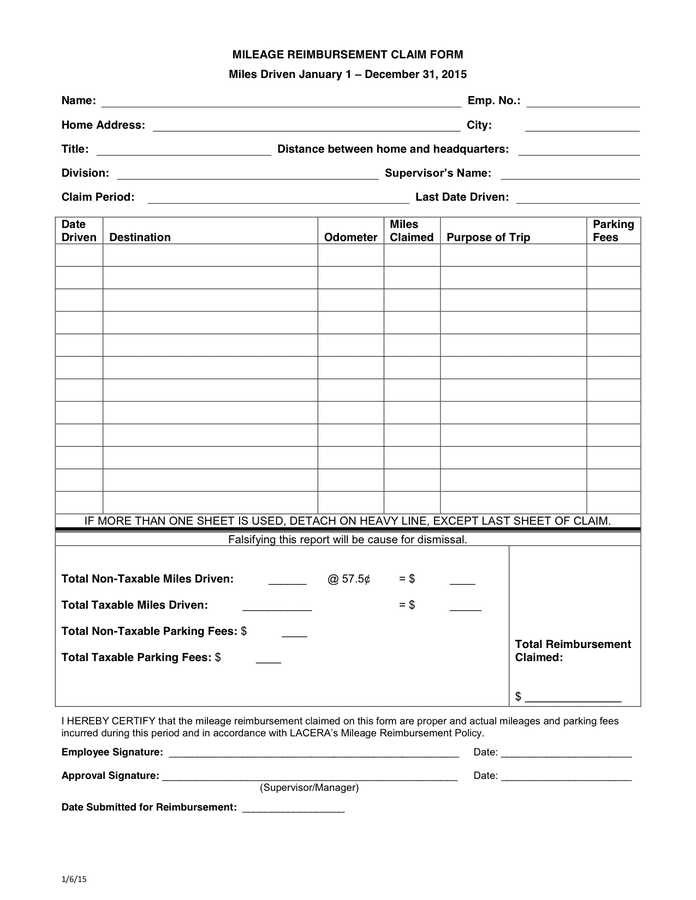

Printable Mileage Reimbursement Form Printable Form 2022

Mileage Reimbursement Claim Form In Word And Pdf Formats

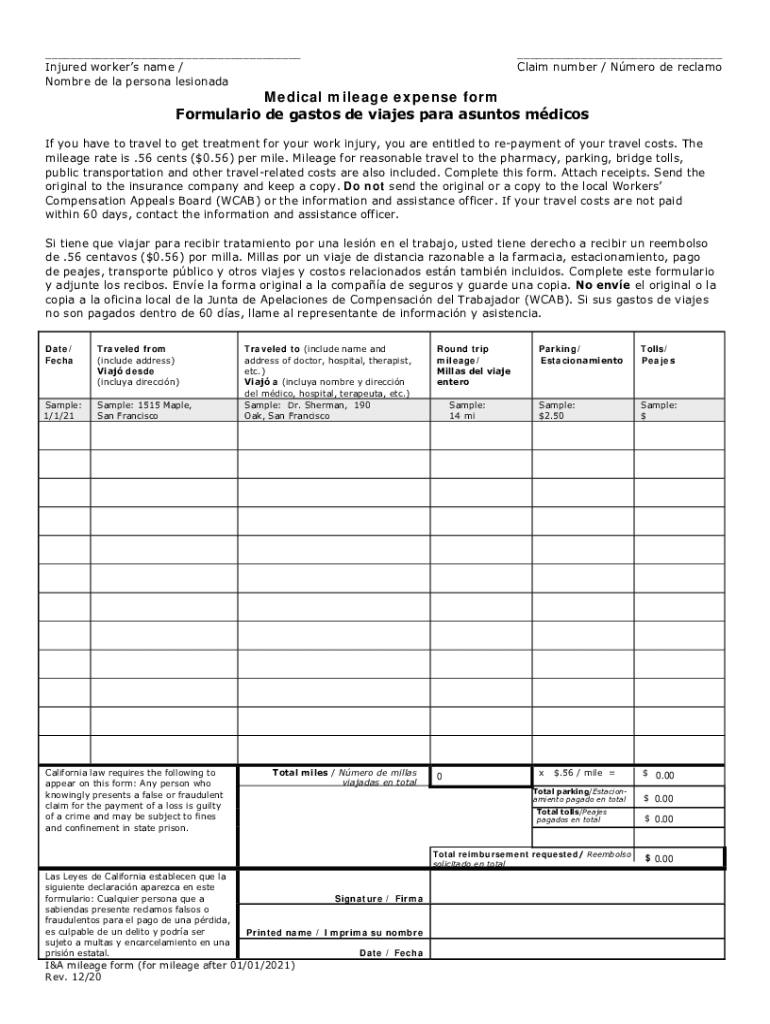

2019 Wcab Mileage Fill And Sign Printable Template Online US Legal

Printable Mileage Log 2022 Printable World Holiday

https://www.taxrebateservices.co.uk/tax-guides/mileage-allowance...

Web Government approved mileage allowance relief rates for the 2023 2024 tax year are Car van 163 0 45 per mile up to 10 000 miles 163 0 25 over 10 000 miles If you carry a

https://money.usnews.com/money/personal-finance/taxes/articles/...

Web 21 mars 2023 nbsp 0183 32 Taxpayers may want to calculate which option will result in the higher deduction but for most deducting mileage is easier and will result in greater tax savings

Web Government approved mileage allowance relief rates for the 2023 2024 tax year are Car van 163 0 45 per mile up to 10 000 miles 163 0 25 over 10 000 miles If you carry a

Web 21 mars 2023 nbsp 0183 32 Taxpayers may want to calculate which option will result in the higher deduction but for most deducting mileage is easier and will result in greater tax savings

Mileage Reimbursement Claim Form In Word And Pdf Formats

Printable Mileage Form Printable Forms Free Online

2019 Wcab Mileage Fill And Sign Printable Template Online US Legal

Printable Mileage Log 2022 Printable World Holiday

Mileage Log With Reimbursement Form MS Excel Excel Templates Excel

Mileage Log Template For Taxes Inspirational 2019 Mileage Log Fillable

Mileage Log Template For Taxes Inspirational 2019 Mileage Log Fillable

Mileage Log Reimbursement Form Templates 10 Free Xlsx Docs PDF