In this modern-day world of consumers everyone is looking for a great deal. One option to obtain significant savings on your purchases is by using Medical Loss Ratio Rebate Former Employeess. Medical Loss Ratio Rebate Former Employeess can be a way of marketing employed by retailers and manufacturers to offer customers a refund for their purchases after they've bought them. In this article, we'll take a look at the world that is Medical Loss Ratio Rebate Former Employeess, exploring the nature of them, how they work, and how you can maximize the value of these incentives.

Get Latest Medical Loss Ratio Rebate Former Employees Below

Medical Loss Ratio Rebate Former Employees

Medical Loss Ratio Rebate Former Employees -

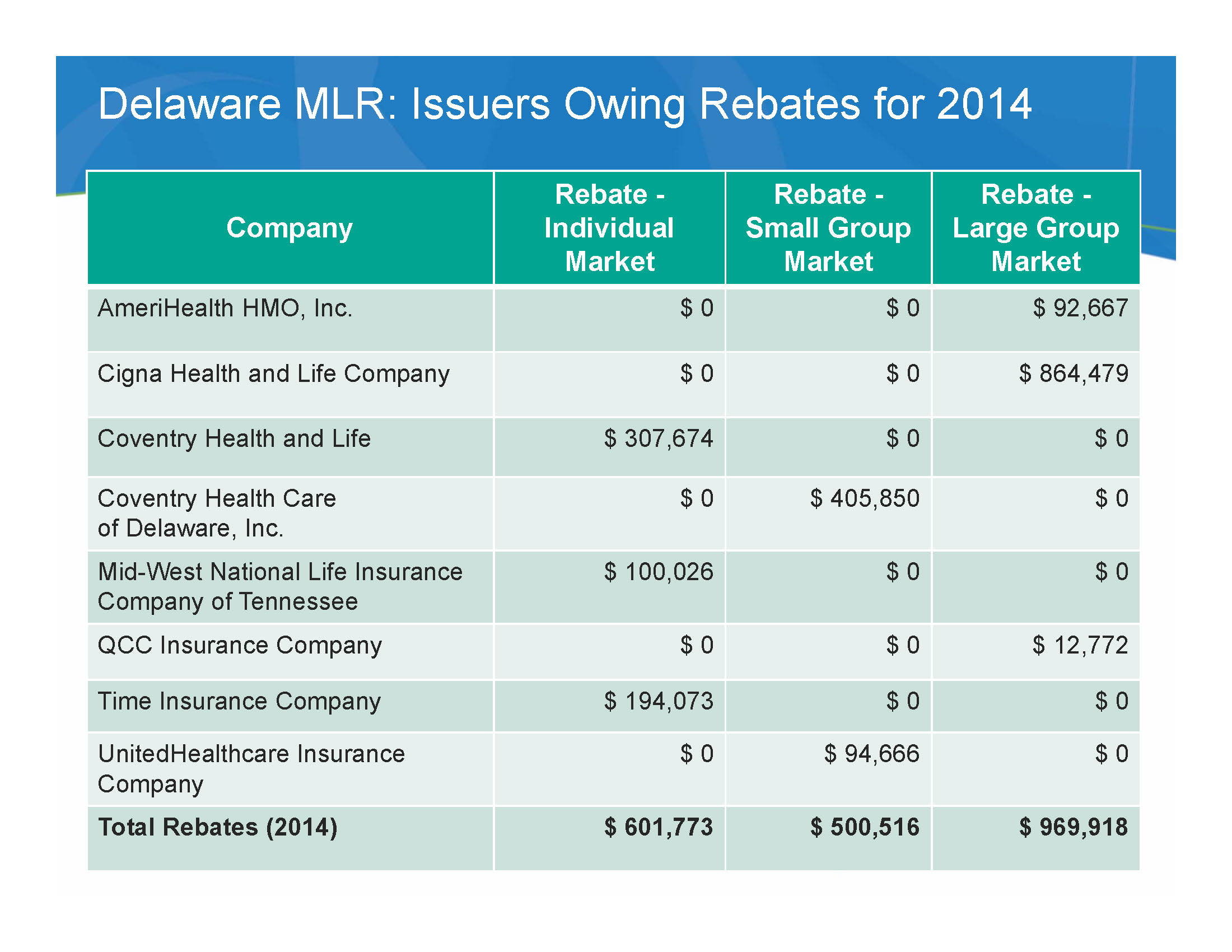

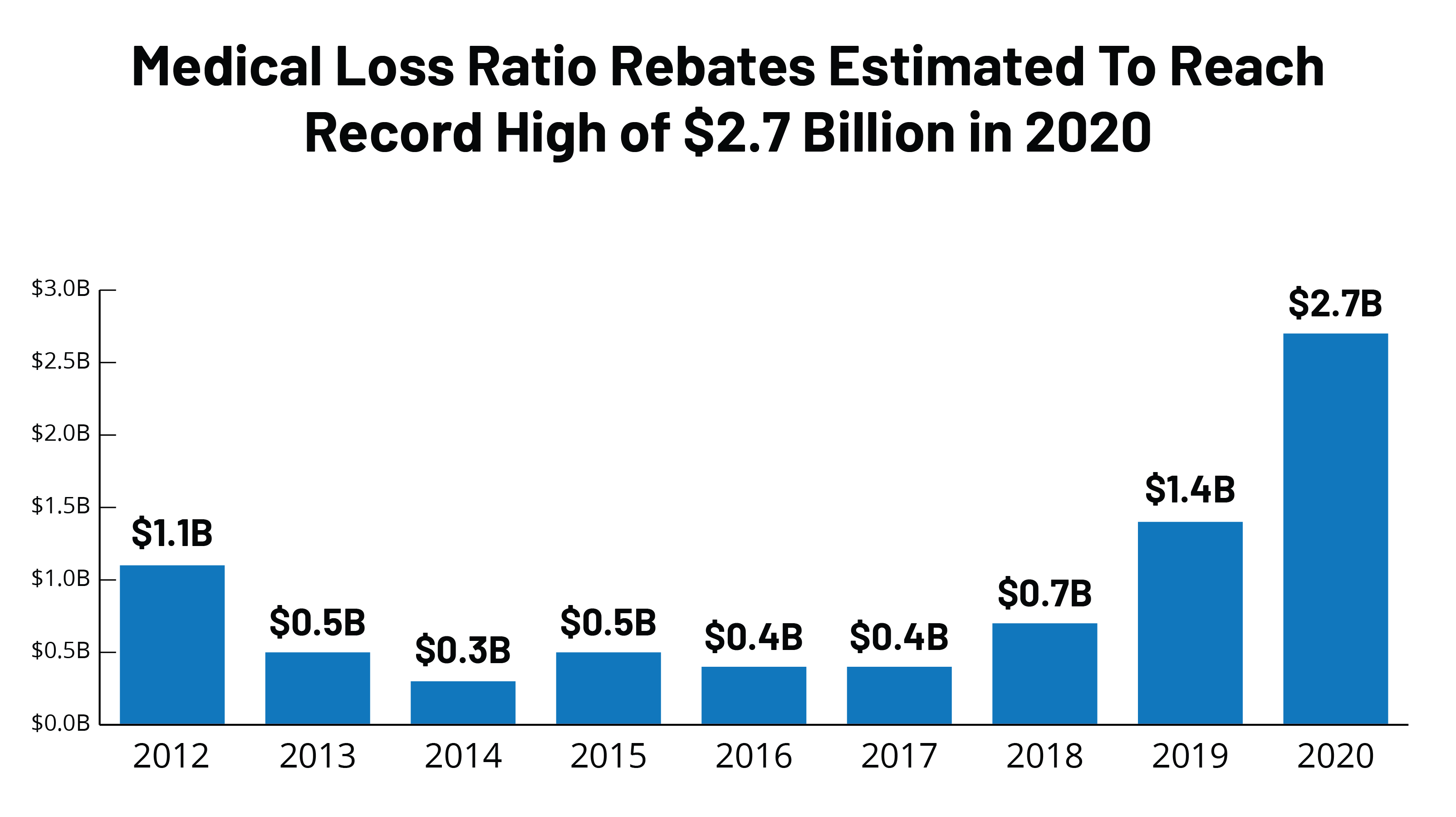

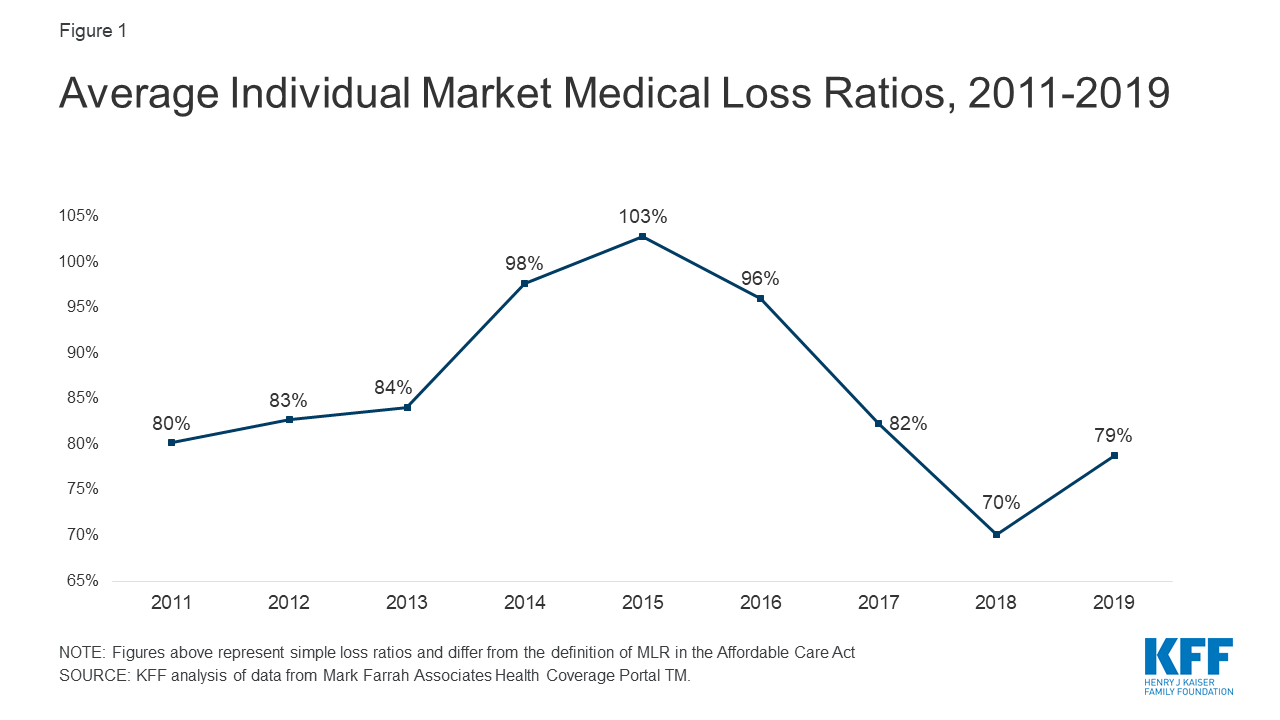

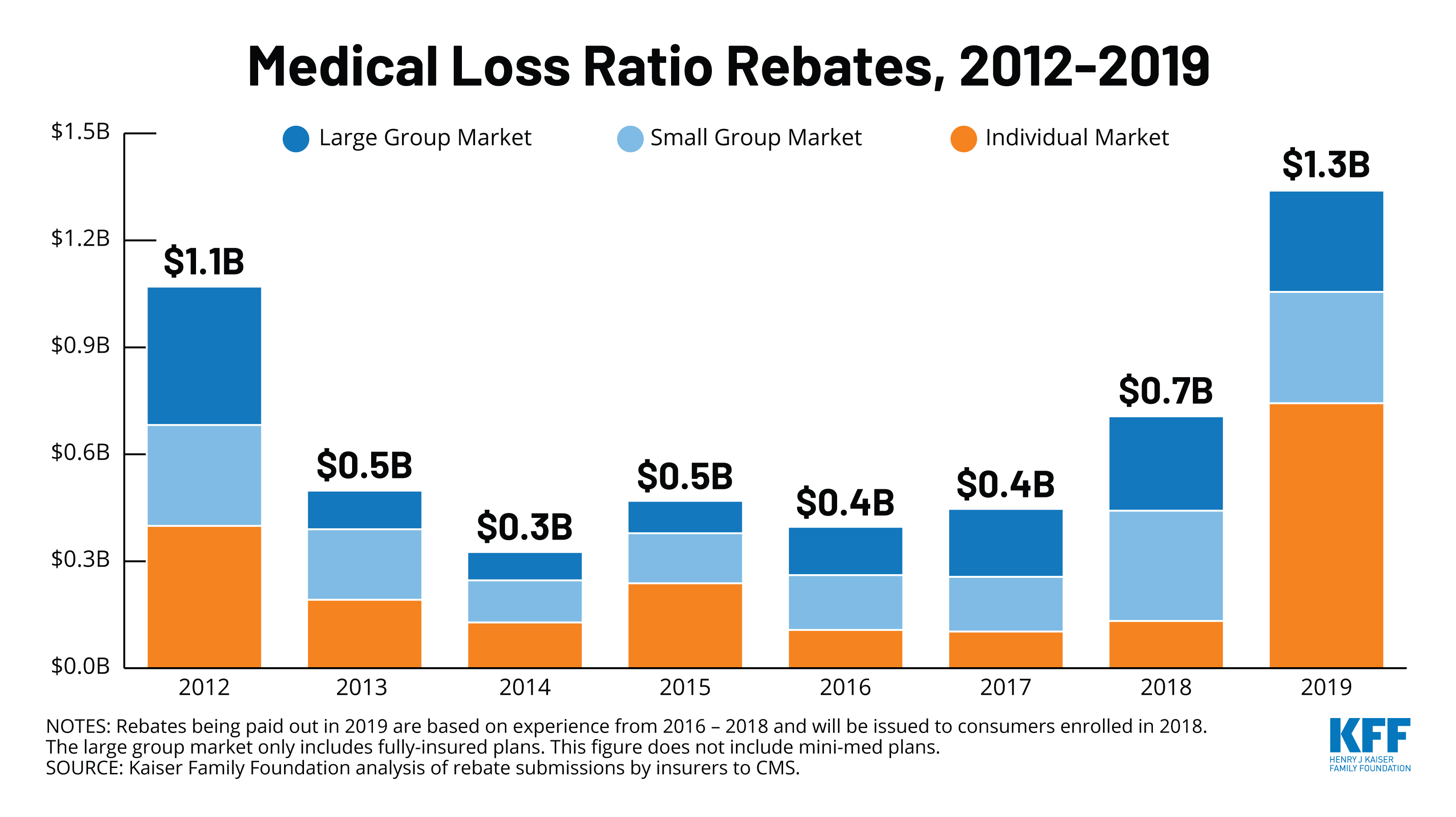

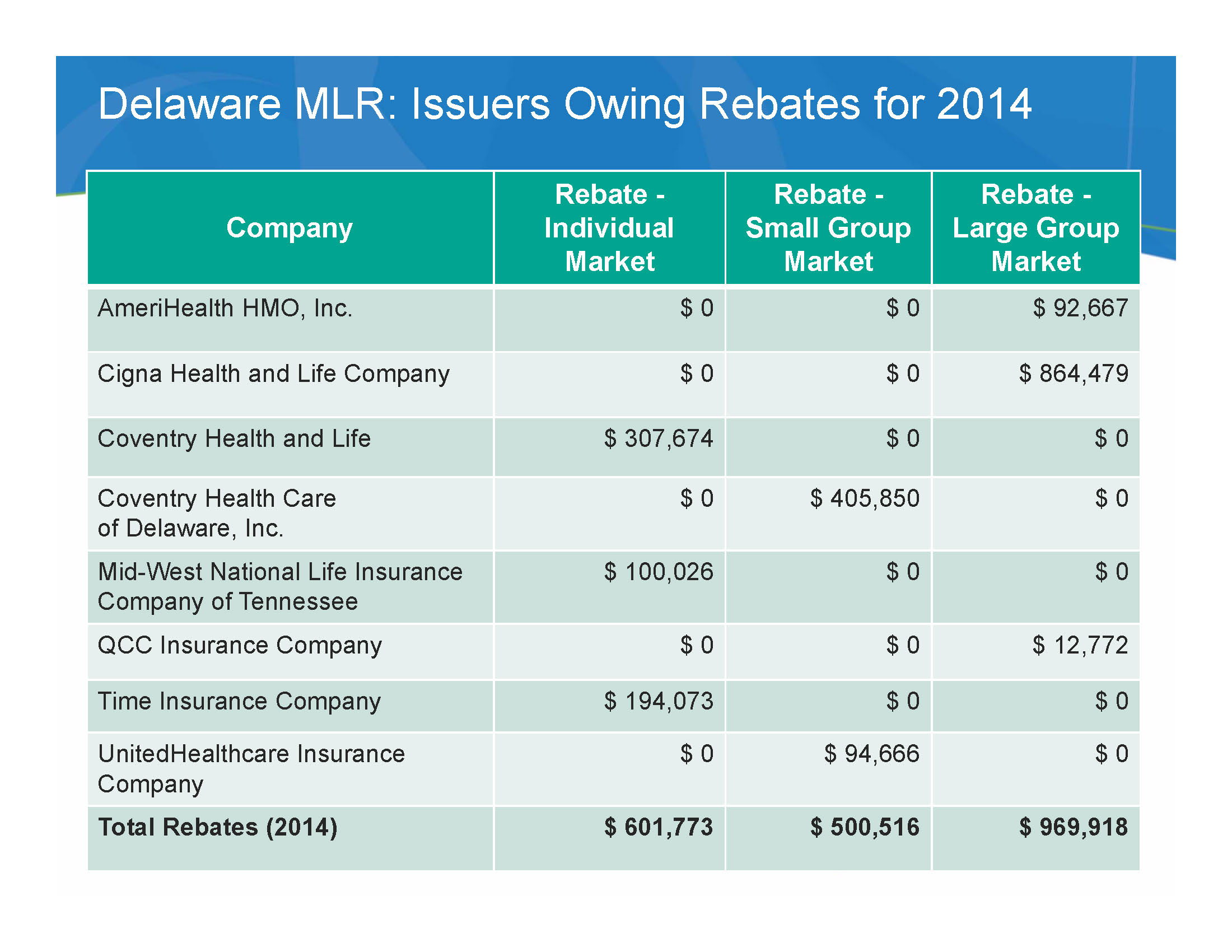

Web 17 mai 2023 nbsp 0183 32 In the individual market the 2022 average rebate per person was 205 while the average rebates per person for the small group market and the large group market were 169 and 110 respectively

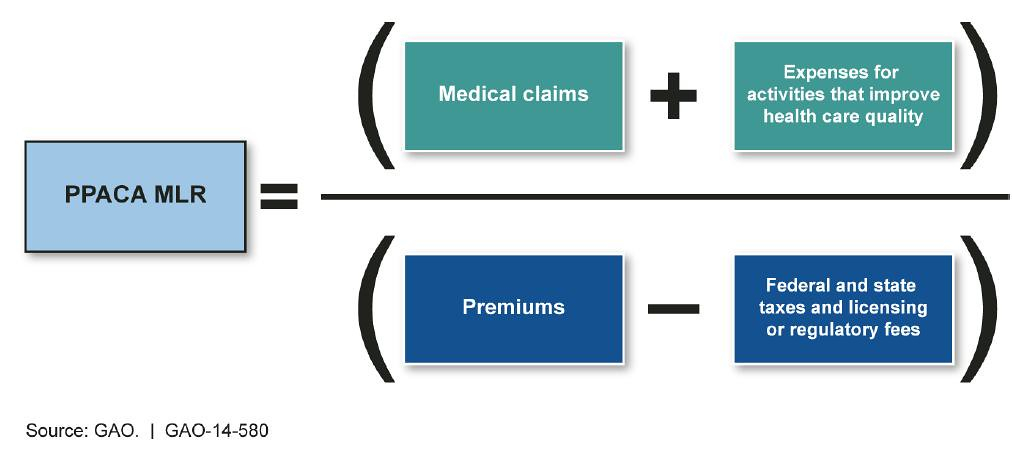

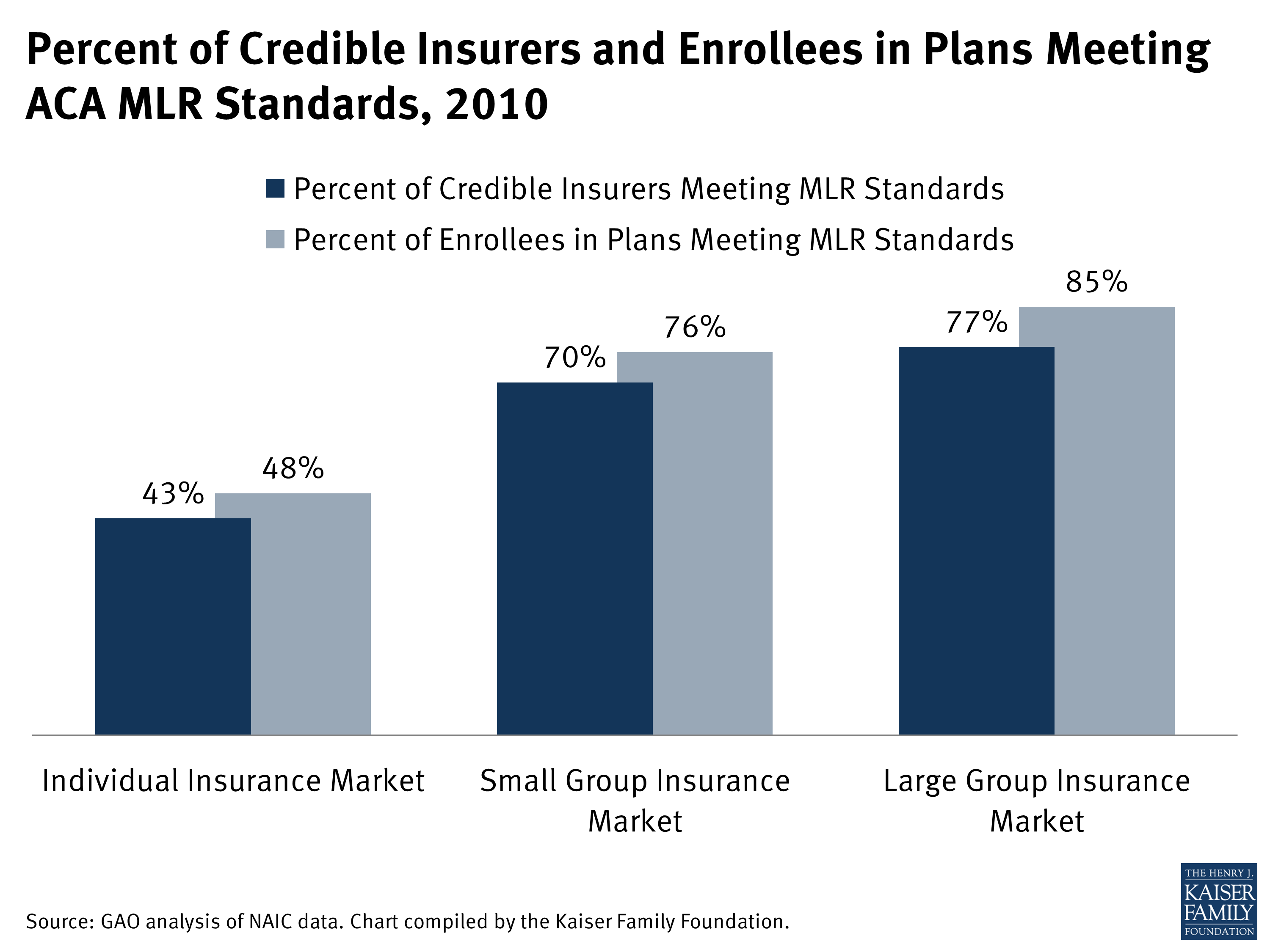

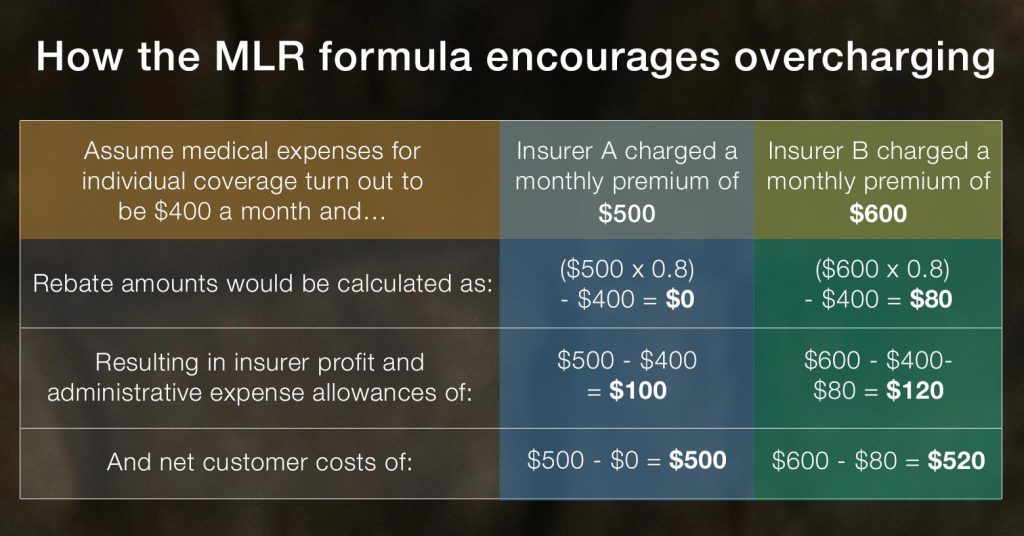

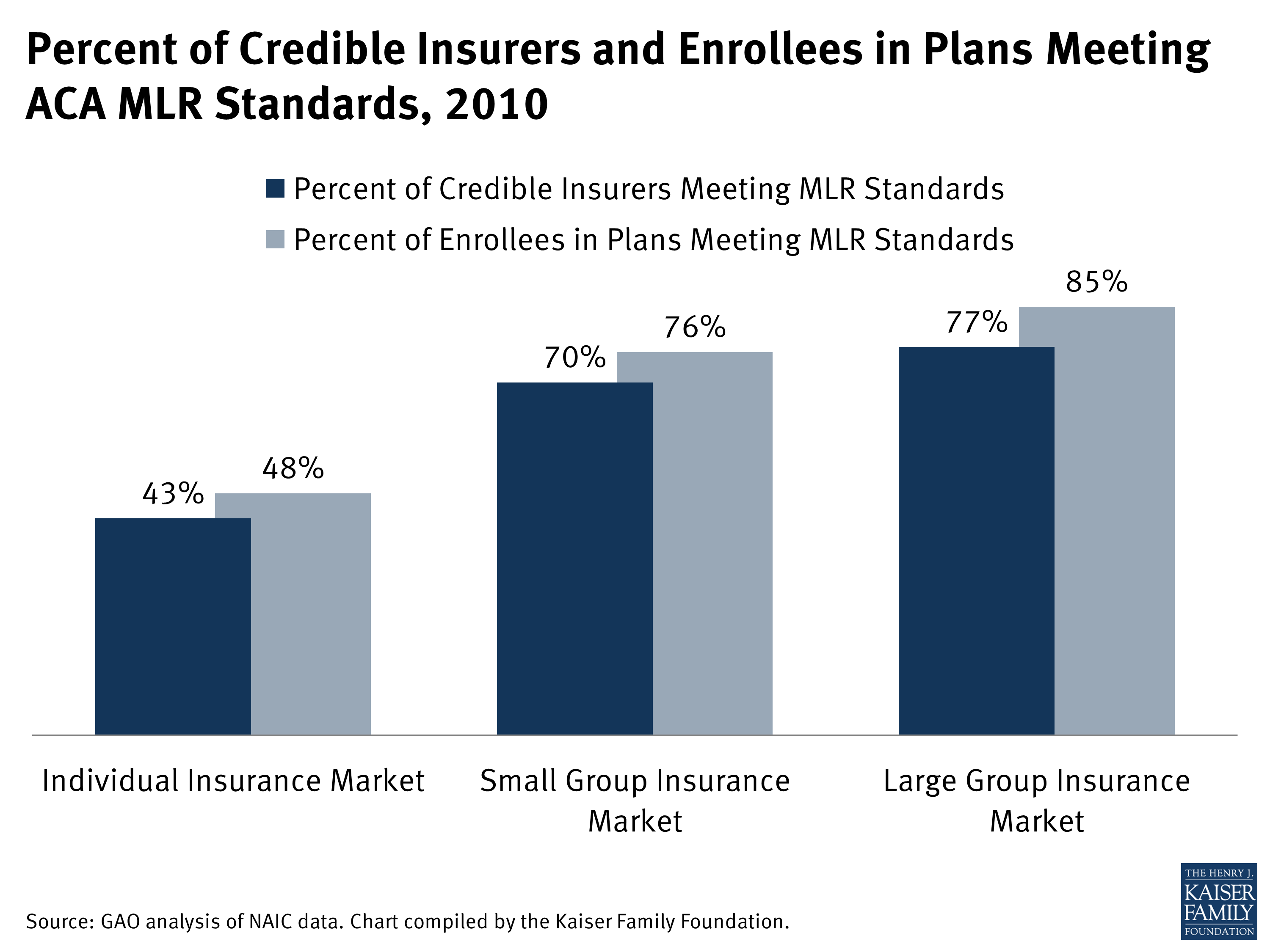

Web INTRODUCTION The ACA requires medical insurance companies quot Insurer quot or quot Insurers quot to pay annual Medical Loss Ratio MLR rebates to policyholders by each September

A Medical Loss Ratio Rebate Former Employees is, in its most basic definition, is a payment to a consumer after having purchased a item or service. It's an effective way employed by companies to draw customers, increase sales or promote a specific product.

Types of Medical Loss Ratio Rebate Former Employees

Data Note 2020 Medical Loss Ratio Rebates Methods 9346 02 KFF

Data Note 2020 Medical Loss Ratio Rebates Methods 9346 02 KFF

Web 14 sept 2021 nbsp 0183 32 Compliance Medical Loss Ratio MLR Rebate Checks In 2021 September 14 2021 The Affordable Care Act ACA requires group health plans to spend a

Web 1 nov 2021 nbsp 0183 32 Former participants refers to previous plan year participants not current COBRA participants or former employees not covered by the current plan DOL

Cash Medical Loss Ratio Rebate Former Employees

Cash Medical Loss Ratio Rebate Former Employees can be the simplest kind of Medical Loss Ratio Rebate Former Employees. Customers are given a certain amount of money back upon purchasing a particular item. These are usually used for products that are expensive, such as electronics or appliances.

Mail-In Medical Loss Ratio Rebate Former Employees

Mail-in Medical Loss Ratio Rebate Former Employees require customers to send in documents of purchase to claim their money back. They're a little more involved, but offer huge savings.

Instant Medical Loss Ratio Rebate Former Employees

Instant Medical Loss Ratio Rebate Former Employees are made at the place of purchase, reducing the cost of purchase immediately. Customers don't need to wait until they can save with this type.

How Medical Loss Ratio Rebate Former Employees Work

Data Note 2020 Medical Loss Ratio Rebates KFF

Data Note 2020 Medical Loss Ratio Rebates KFF

Web 17 ao 251 t 2020 nbsp 0183 32 Employers who sponsor a fully insured group health plan may be receiving a Medical Loss Ratio MLR rebate from their insurers Self insured medical benefit

The Medical Loss Ratio Rebate Former Employees Process

The process usually involves a handful of simple steps:

-

Then, you purchase the product make sure you purchase the product like you would normally.

-

Complete the Medical Loss Ratio Rebate Former Employees questionnaire: you'll need to provide some information, such as your name, address, as well as the details of your purchase to apply for your Medical Loss Ratio Rebate Former Employees.

-

Submit the Medical Loss Ratio Rebate Former Employees If you want to submit the Medical Loss Ratio Rebate Former Employees, based on the kind of Medical Loss Ratio Rebate Former Employees, you may need to mail a Medical Loss Ratio Rebate Former Employees form in or submit it online.

-

Wait for the company's approval: They will examine your application to determine if it's in compliance with the reimbursement's terms and condition.

-

Accept your Medical Loss Ratio Rebate Former Employees When it's approved you'll receive a refund in the form of a check, prepaid card, or other way specified in the offer.

Pros and Cons of Medical Loss Ratio Rebate Former Employees

Advantages

-

Cost Savings The use of Medical Loss Ratio Rebate Former Employees can greatly reduce the cost for an item.

-

Promotional Deals The aim is to encourage customers to explore new products or brands.

-

Improve Sales A Medical Loss Ratio Rebate Former Employees program can boost sales for a company and also increase market share.

Disadvantages

-

Complexity Medical Loss Ratio Rebate Former Employees that are mail-in, particularly difficult and take a long time to complete.

-

Deadlines for Expiration Most Medical Loss Ratio Rebate Former Employees come with deadlines for submission.

-

Risk of Not Being Paid: Some customers may not get their Medical Loss Ratio Rebate Former Employees if they don't observe the rules exactly.

Download Medical Loss Ratio Rebate Former Employees

Download Medical Loss Ratio Rebate Former Employees

FAQs

1. Are Medical Loss Ratio Rebate Former Employees the same as discounts? No, Medical Loss Ratio Rebate Former Employees involve partial reimbursement after purchase, whereas discounts decrease the price of the purchase at the time of sale.

2. Are there any Medical Loss Ratio Rebate Former Employees that I can use on the same product This is dependent on conditions for the Medical Loss Ratio Rebate Former Employees provides and the particular product's suitability. Certain businesses may allow it, and some don't.

3. How long does it take to receive an Medical Loss Ratio Rebate Former Employees What is the timeframe? differs, but it can take anywhere from a couple of weeks to a couple of months before you get your Medical Loss Ratio Rebate Former Employees.

4. Do I have to pay tax in relation to Medical Loss Ratio Rebate Former Employees funds? the majority of instances, Medical Loss Ratio Rebate Former Employees amounts are not considered to be taxable income.

5. Should I be able to trust Medical Loss Ratio Rebate Former Employees deals from lesser-known brands It is essential to investigate to ensure that the name offering the Medical Loss Ratio Rebate Former Employees is reliable prior to making an investment.

Medical Loss Ratio MLR Questionnaire Rebate2022

Medical Loss Ratio Rebates

Check more sample of Medical Loss Ratio Rebate Former Employees below

TWITTER Medical Loss Ratio Rebates 1 KFF

Explaining Health Care Reform Medical Loss Ratio MLR KFF

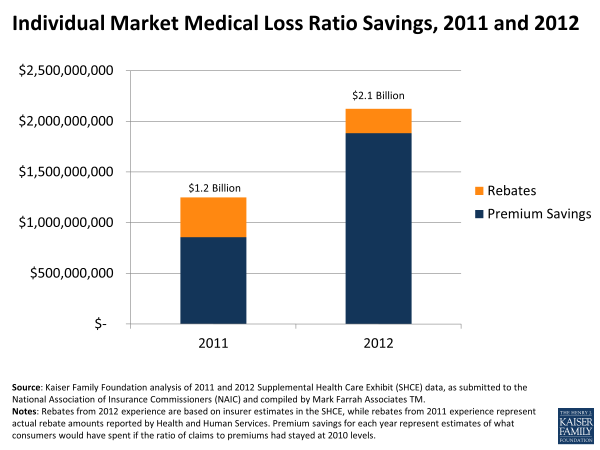

Beyond Rebates How Much Are Consumers Saving From The ACA s Medical

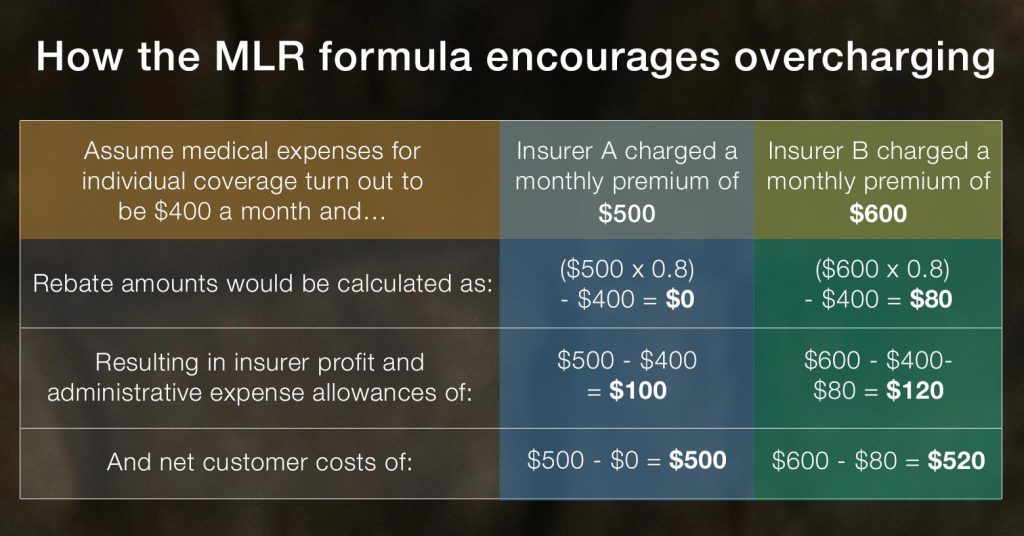

One Way To Ease ACA Rate Hikes Fix The Rebate Formula

The Medical Loss Ratio s Mixed Record Modern Healthcare

.png)

Data Note 2022 Medical Loss Ratio Rebates California Partnership For

https://www.ppibenefits.com/docs/MLR-Rebates-Guide.pdf

Web INTRODUCTION The ACA requires medical insurance companies quot Insurer quot or quot Insurers quot to pay annual Medical Loss Ratio MLR rebates to policyholders by each September

https://www.dol.gov/.../resource-center/faqs/mlr-insurance-re…

Web MLRquestions cms hhs gov If you are covered by a plan for federal government employees please visit the OPM website at https www opm gov Frequently asked

Web INTRODUCTION The ACA requires medical insurance companies quot Insurer quot or quot Insurers quot to pay annual Medical Loss Ratio MLR rebates to policyholders by each September

Web MLRquestions cms hhs gov If you are covered by a plan for federal government employees please visit the OPM website at https www opm gov Frequently asked

One Way To Ease ACA Rate Hikes Fix The Rebate Formula

Explaining Health Care Reform Medical Loss Ratio MLR KFF

.png)

The Medical Loss Ratio s Mixed Record Modern Healthcare

Data Note 2022 Medical Loss Ratio Rebates California Partnership For

Anthem Releases Medical Loss Ratio Rebate Information Hometown

Medical Loss Ratio Definition DEFINITION KLW

Medical Loss Ratio Definition DEFINITION KLW

Ask The Experts Medical Loss Ratio MLR Rebates ThinkHR