In the modern world of consumerization everyone is looking for a great bargain. One method to get significant savings on your purchases is to use Mchenry County Tax Rebate Forms. Mchenry County Tax Rebate Forms are a marketing strategy employed by retailers and manufacturers to offer consumers a partial cash back on their purchases once they have bought them. In this article, we'll delve into the world of Mchenry County Tax Rebate Forms, exploring the nature of them and how they function, and how you can maximize your savings by taking advantage of these cost-effective incentives.

Get Latest Mchenry County Tax Rebate Form Below

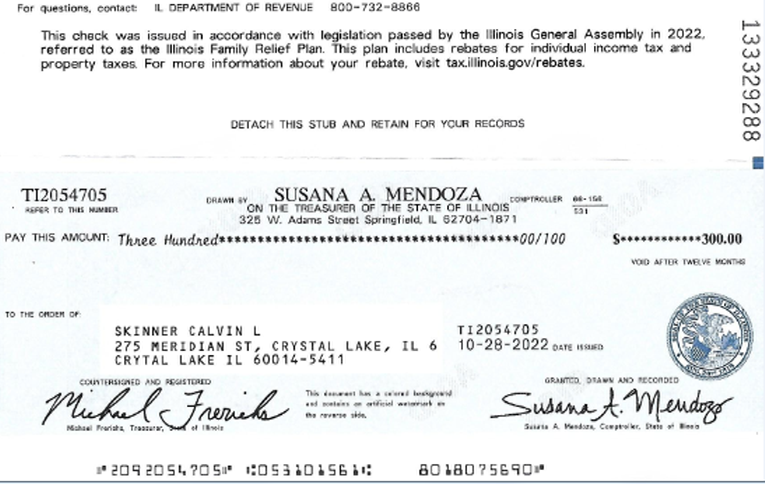

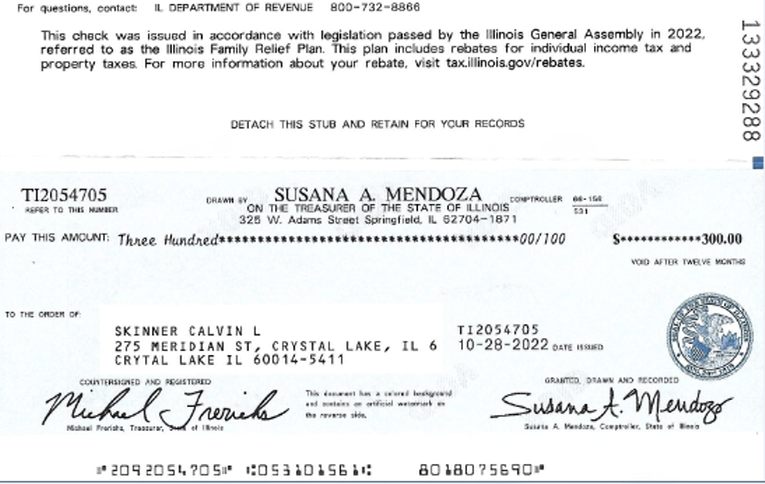

Mchenry County Tax Rebate Form

Mchenry County Tax Rebate Form -

Web You are required to bring your original tax bill or a duplicate copy of your tax bill Banks are able to provide you with a receipt Please check with your local bank for their payment

Web 7 ao 251 t 2022 nbsp 0183 32 You may be eligible for a one time individual income and property tax rebate available to taxpayers who meet certain requirements Rebates are expected to be

A Mchenry County Tax Rebate Form as it is understood in its simplest version, is an ad-hoc reimbursement to a buyer after purchasing a certain product or service. It's a very effective technique used by companies to attract customers, increase sales, and market specific products.

Types of Mchenry County Tax Rebate Form

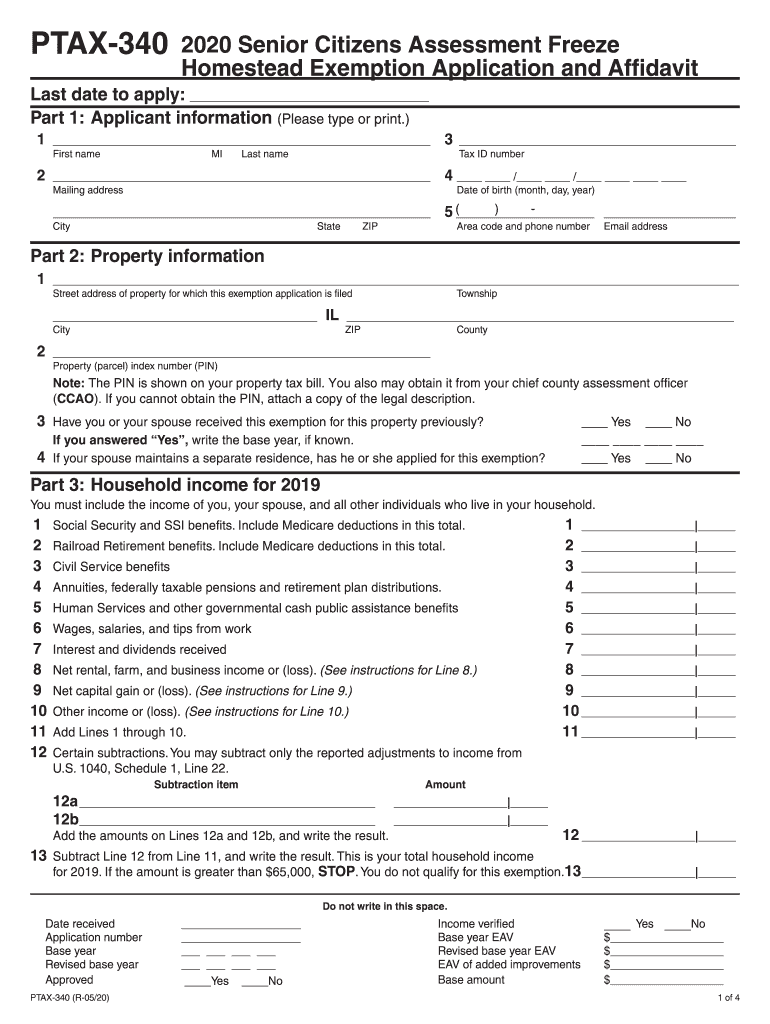

Illinois Property Tax Freeze Form Mchenry County CountyForms

Illinois Property Tax Freeze Form Mchenry County CountyForms

Web In addition to assessments the County Tax Director is or responsible on administering property tax exemptions homestead charge credit for senior citizens BELEG TAX

Web VOUCHER TAX REBATE PROGRAM FOR LANDLORDS Application are now being accepted for the Voucher Tax Rebate Program Please see application information

Cash Mchenry County Tax Rebate Form

Cash Mchenry County Tax Rebate Form are by far the easiest type of Mchenry County Tax Rebate Form. Clients receive a predetermined amount of money back after purchasing a item. These are typically applied to products that are expensive, such as electronics or appliances.

Mail-In Mchenry County Tax Rebate Form

Mail-in Mchenry County Tax Rebate Form need customers to present their proof of purchase before receiving their reimbursement. They're longer-lasting, however they offer huge savings.

Instant Mchenry County Tax Rebate Form

Instant Mchenry County Tax Rebate Form are credited at the point of sale and reduce the cost of purchase immediately. Customers do not have to wait for savings by using this method.

How Mchenry County Tax Rebate Form Work

Illinois Quitclaim Deed Form 2020 2021 Fill And Sign Printable Gambaran

Illinois Quitclaim Deed Form 2020 2021 Fill And Sign Printable Gambaran

Web Mchenry County Tax Rebate Form Find informational on how to contact an resident post bond sendung commissary funds and register for our VINE help

The Mchenry County Tax Rebate Form Process

The process usually involves a few simple steps

-

Purchase the product: First purchase the product in the same way you would normally.

-

Complete the Mchenry County Tax Rebate Form questionnaire: you'll need provide certain information, such as your name, address and the purchase details, in order to get your Mchenry County Tax Rebate Form.

-

To submit the Mchenry County Tax Rebate Form: Depending on the kind of Mchenry County Tax Rebate Form you could be required to mail a Mchenry County Tax Rebate Form form in or submit it online.

-

Wait for approval: The business will go through your application to determine if it's in compliance with the Mchenry County Tax Rebate Form's terms and conditions.

-

You will receive your Mchenry County Tax Rebate Form Once you've received your approval, you'll receive your cash back through a check, or a prepaid card or another method as specified by the offer.

Pros and Cons of Mchenry County Tax Rebate Form

Advantages

-

Cost Savings Rewards can drastically lower the cost you pay for the product.

-

Promotional Offers They encourage customers to test new products or brands.

-

Increase Sales Reward programs can boost the sales of a company as well as its market share.

Disadvantages

-

Complexity Mail-in Mchenry County Tax Rebate Form in particular are often time-consuming and time-consuming.

-

Time Limits for Mchenry County Tax Rebate Form Many Mchenry County Tax Rebate Form impose the strictest deadlines for submission.

-

Risk of not receiving payment Certain customers could not receive their Mchenry County Tax Rebate Form if they don't adhere to the requirements exactly.

Download Mchenry County Tax Rebate Form

Download Mchenry County Tax Rebate Form

FAQs

1. Are Mchenry County Tax Rebate Form similar to discounts? No, Mchenry County Tax Rebate Form involve a partial refund after the purchase, but discounts can reduce the price of the purchase at the point of sale.

2. Are there multiple Mchenry County Tax Rebate Form I can get for the same product? It depends on the conditions that apply to the Mchenry County Tax Rebate Form offers and the product's qualification. Certain companies allow it, while other companies won't.

3. How long does it take to get the Mchenry County Tax Rebate Form What is the timeframe? is variable, however it can range from several weeks to few months for you to receive your Mchenry County Tax Rebate Form.

4. Do I need to pay tax of Mchenry County Tax Rebate Form montants? the majority of cases, Mchenry County Tax Rebate Form amounts are not considered to be taxable income.

5. Should I be able to trust Mchenry County Tax Rebate Form offers from lesser-known brands Do I need to conduct a thorough research and confirm that the company which is providing the Mchenry County Tax Rebate Form is credible prior to making an investment.

Ptax 340 Fill Out Sign Online DocHub

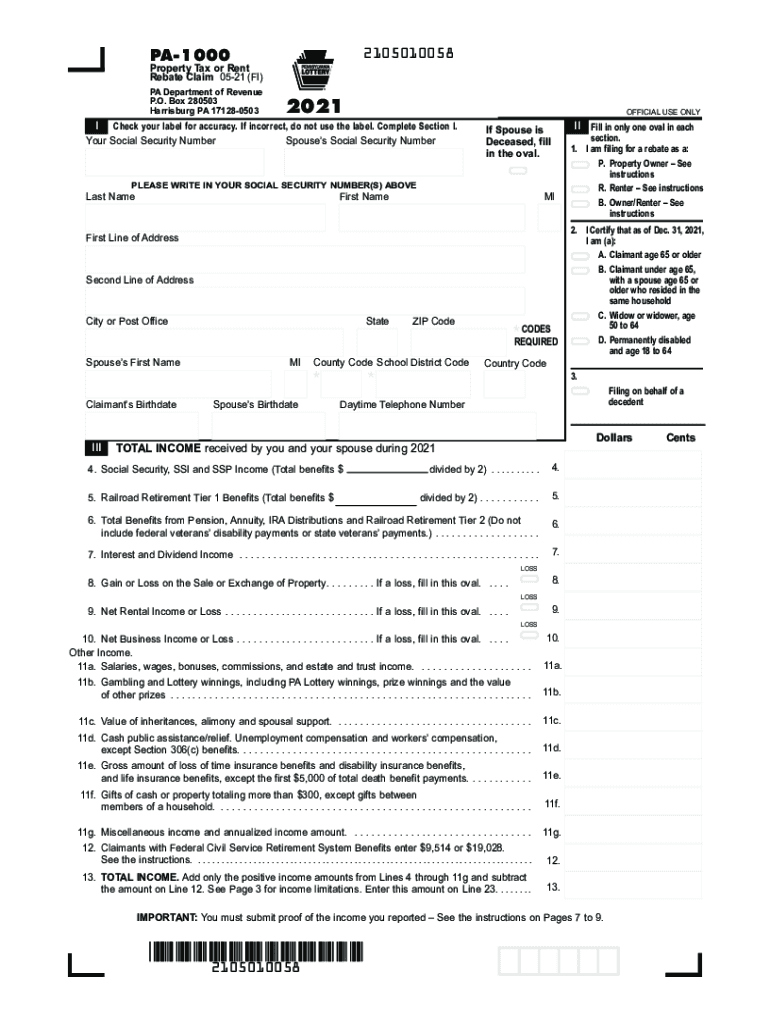

1000 Tax Printable Fill Out Sign Online DocHub

Check more sample of Mchenry County Tax Rebate Form below

PA Property Tax Rebate Forms Printable Rebate Form

Top 47 Imagen Cook County Senior Citizen Exemption Ecover mx

McHenry County Valley Hi Tax Rebate Program Miller Verchota CPAs

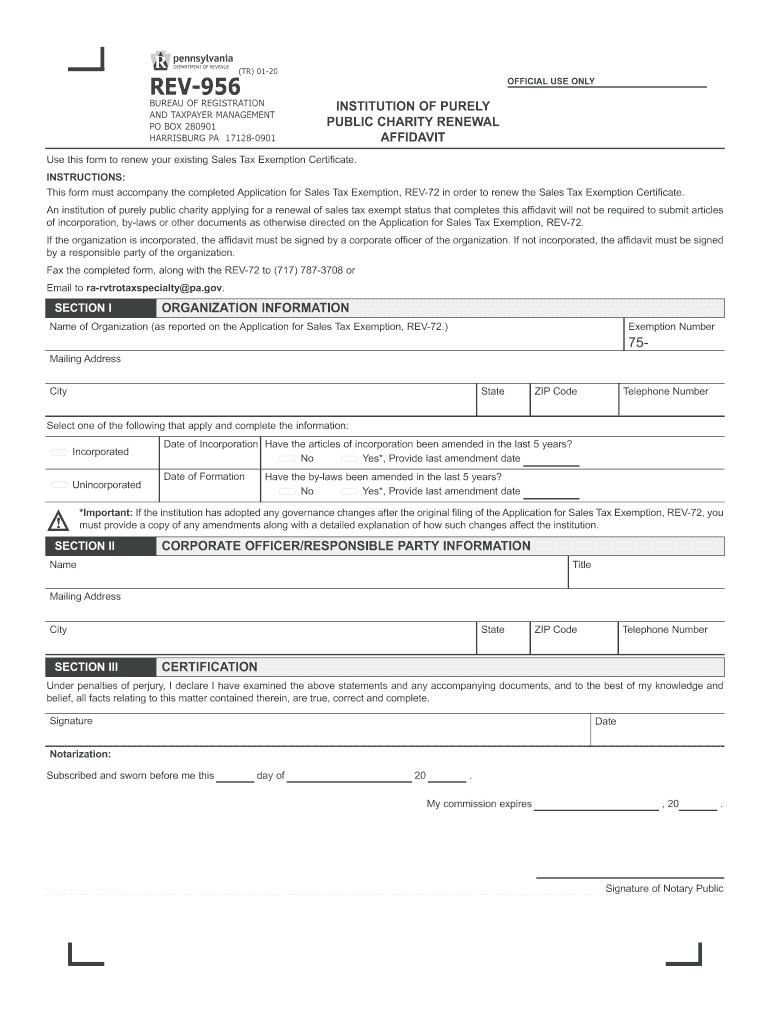

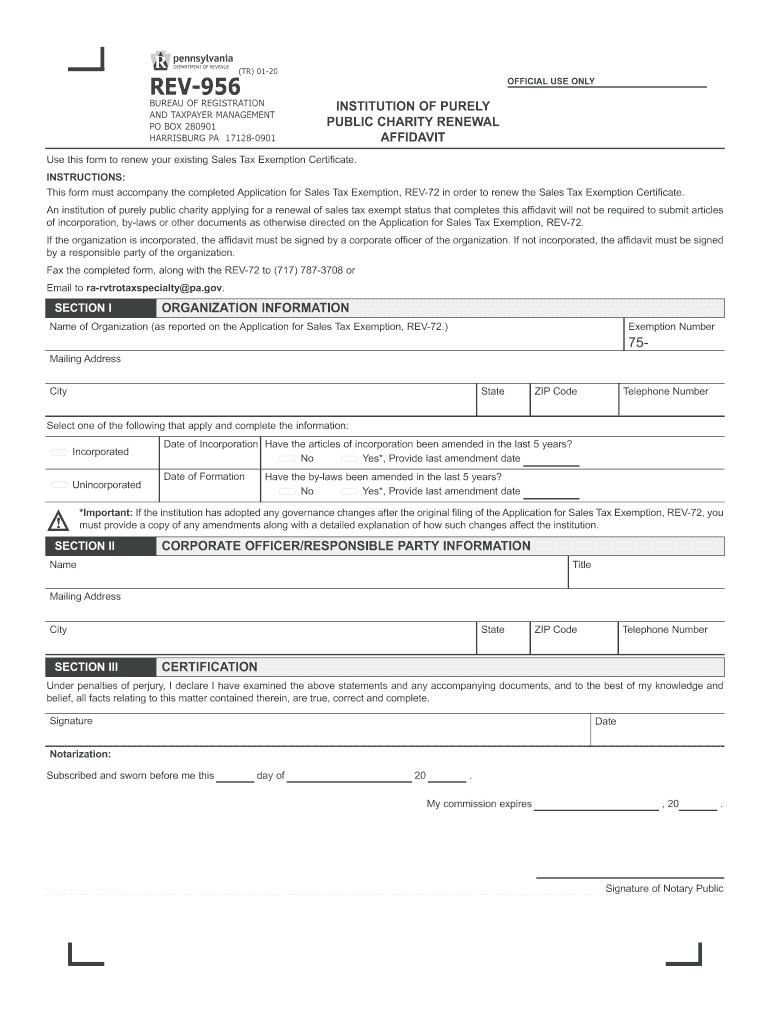

2020 2023 Form PA REV 956 Fill Online Printable Fillable Blank

Farms Business Cut Out Of Jack Franks Valley Hi Property Tax Rebate

Pat Quinn Cuts Seniors Circuit Breaker Property Tax Relief Program In

https://mchenrycountyblog.com/2022/08/07/find-out-if-you-are-eligible...

Web 7 ao 251 t 2022 nbsp 0183 32 You may be eligible for a one time individual income and property tax rebate available to taxpayers who meet certain requirements Rebates are expected to be

https://www.mchenrycountyil.gov/county-government/departments-j-z/...

Web Look Up Pay Your Tax Bill Tax Bill Email Notifications Applying for Your Passport Advance Tax Senior Deferral Treasurer and Distribution Reports FOIA Tax Sale Meet

Web 7 ao 251 t 2022 nbsp 0183 32 You may be eligible for a one time individual income and property tax rebate available to taxpayers who meet certain requirements Rebates are expected to be

Web Look Up Pay Your Tax Bill Tax Bill Email Notifications Applying for Your Passport Advance Tax Senior Deferral Treasurer and Distribution Reports FOIA Tax Sale Meet

2020 2023 Form PA REV 956 Fill Online Printable Fillable Blank

Top 47 Imagen Cook County Senior Citizen Exemption Ecover mx

Farms Business Cut Out Of Jack Franks Valley Hi Property Tax Rebate

Pat Quinn Cuts Seniors Circuit Breaker Property Tax Relief Program In

2021 PA Form PA 40 ES I Fill Online Printable Fillable Blank

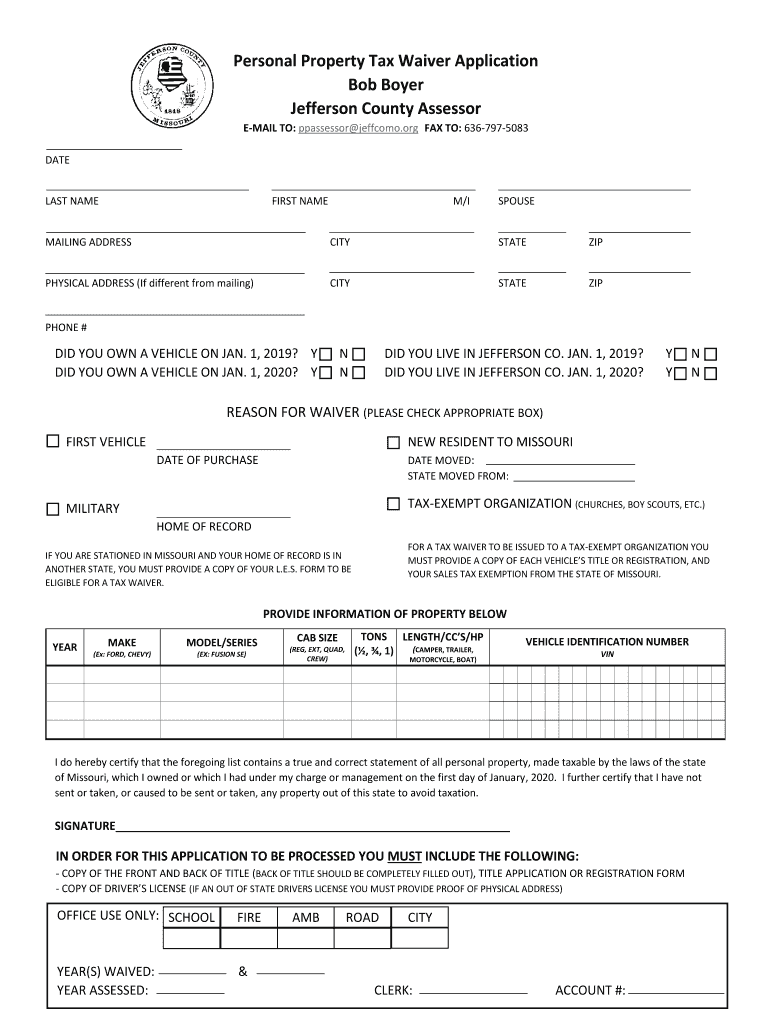

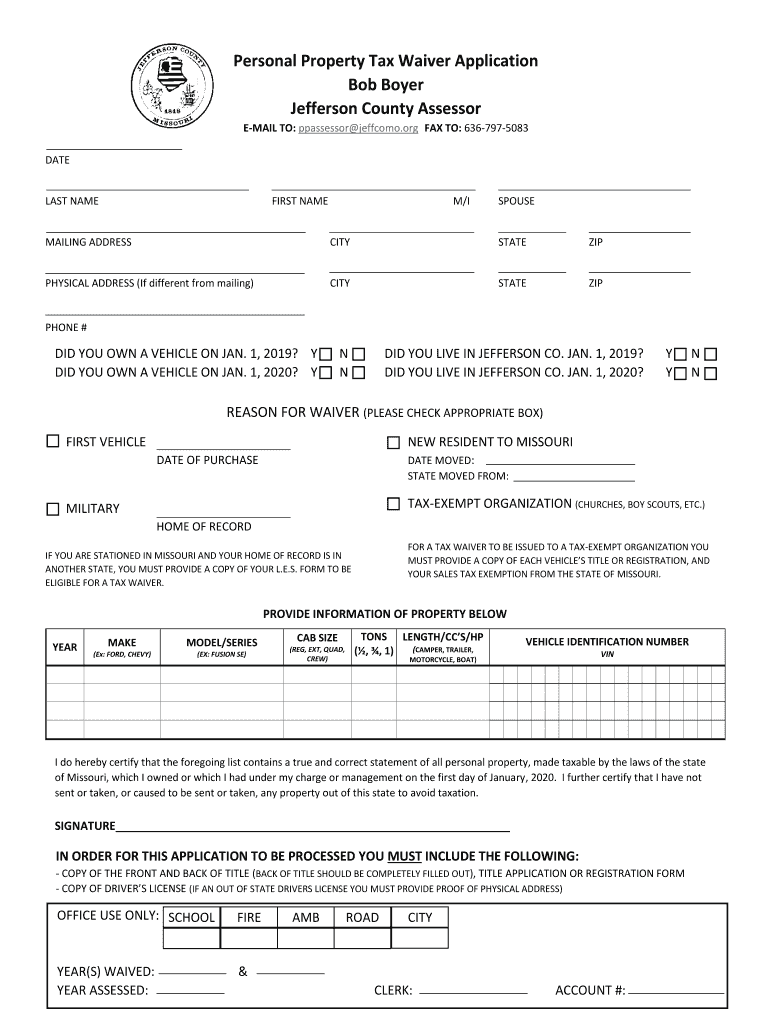

Personal Property Jefferson County Mo Fill Out Sign Online DocHub

Personal Property Jefferson County Mo Fill Out Sign Online DocHub

Form Pa 1000 Property Tax Or Rent Rebate Claim Benefits Older