In the modern world of consumerization every person loves a great bargain. One option to obtain significant savings on your purchases is to use Maine Property Tax Rebate Forms. Maine Property Tax Rebate Forms are marketing strategies that retailers and manufacturers use to provide customers with a portion of a refund on purchases made after they have purchased them. In this article, we will take a look at the world that is Maine Property Tax Rebate Forms. We'll look at the nature of them about, how they work, and how to maximize your savings through these cost-effective incentives.

Get Latest Maine Property Tax Rebate Form Below

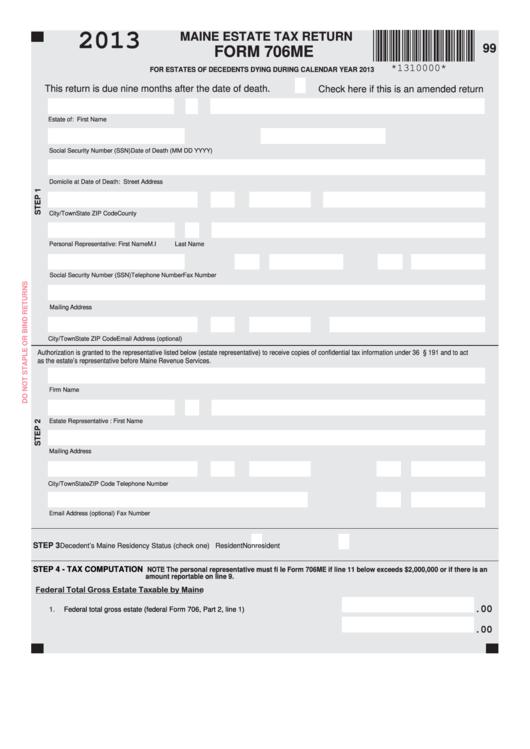

Maine Property Tax Rebate Form

Maine Property Tax Rebate Form -

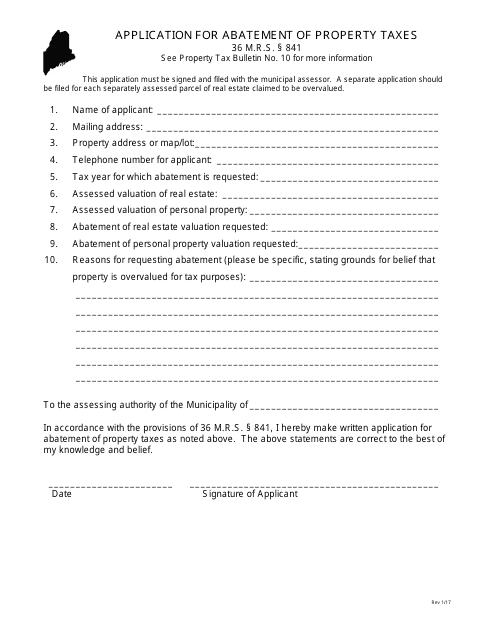

Web APPLICATION FOR ABATEMENT OF MUNICIPAL PROPERTY TAXES 36 M R S 167 167 841 849 and Property Tax Bulletin No 10 This application must be filed with your

Web Maine Revenue Services administers several programs aimed at providing eligible Maine taxpayers with tax relief Income Tax Credits Individual income tax credits provide a

A Maine Property Tax Rebate Form the simplest model, refers to a partial refund to a purchaser after they've bought a product or service. It is a powerful tool employed by companies to attract customers, increase sales, and market specific products.

Types of Maine Property Tax Rebate Form

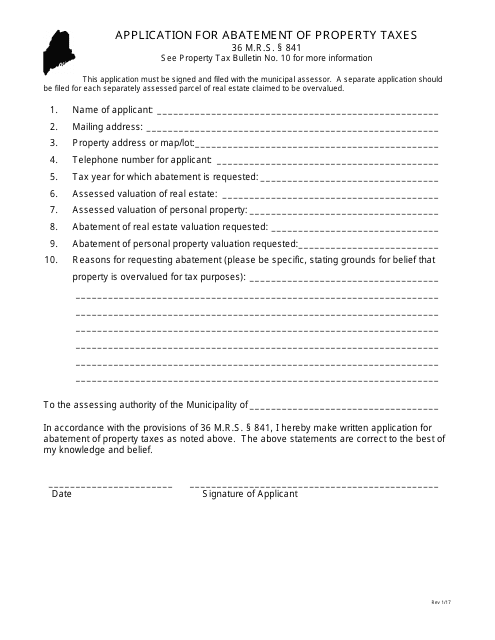

Maine Application For Abatement Of Property Taxes Download Fillable PDF

Maine Application For Abatement Of Property Taxes Download Fillable PDF

Web Maine Revenue Services Property Tax Division P O Box 9106 Augusta ME 04332 9106 Rev 03 22 INSTRUCTIONS Submit this application to MRS within 185 days of

Web Property Tax Forms Property Tax Stabilization Guidance for Municipalities Stabilization Application 2022 application was due 12 1 22 To view PDF or Word documents you

Cash Maine Property Tax Rebate Form

Cash Maine Property Tax Rebate Form are probably the most simple type of Maine Property Tax Rebate Form. Customers are offered a certain amount back in cash after purchasing a particular item. These are typically for large-ticket items such as electronics and appliances.

Mail-In Maine Property Tax Rebate Form

Mail-in Maine Property Tax Rebate Form require the customer to submit their proof of purchase before receiving their reimbursement. They're somewhat more involved but can offer significant savings.

Instant Maine Property Tax Rebate Form

Instant Maine Property Tax Rebate Form are applied at points of sale. This reduces the purchase cost immediately. Customers do not have to wait for their savings when they purchase this type of Maine Property Tax Rebate Form.

How Maine Property Tax Rebate Form Work

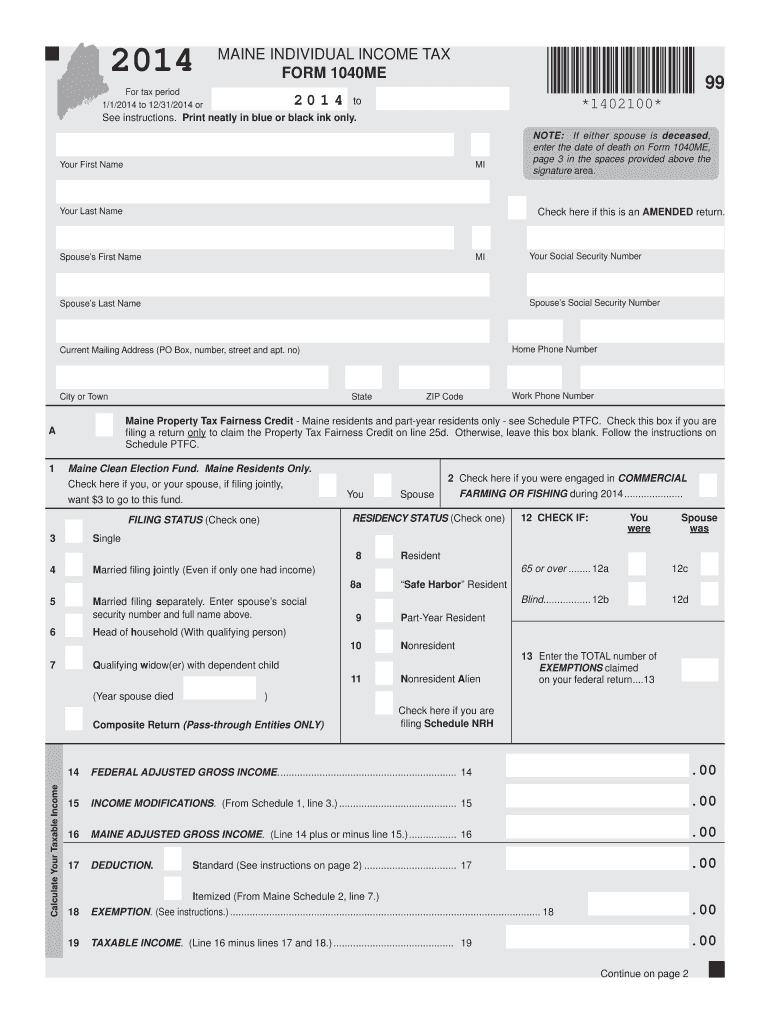

Maine Tax Forms Fill Out And Sign Printable PDF Template SignNow

Maine Tax Forms Fill Out And Sign Printable PDF Template SignNow

Web Real Estate Withholding REW Worksheets for Tax Credits Electronic Request Form to request individual income tax forms Tax Relief Business Equipment Tax

The Maine Property Tax Rebate Form Process

The process typically involves a handful of simple steps:

-

Purchase the item: First you purchase the item like you normally do.

-

Fill in your Maine Property Tax Rebate Form form: You'll have to provide some information including your name, address and purchase details, to make a claim for your Maine Property Tax Rebate Form.

-

Make sure you submit the Maine Property Tax Rebate Form Based on the kind of Maine Property Tax Rebate Form it is possible that you need to fill out a paper form or upload it online.

-

Wait for the company's approval: They is going to review your entry to determine if it's in compliance with the refund's conditions and terms.

-

Pay your Maine Property Tax Rebate Form Once you've received your approval, the amount you receive will be in the form of a check, prepaid card, or any other option specified by the offer.

Pros and Cons of Maine Property Tax Rebate Form

Advantages

-

Cost Savings The use of Maine Property Tax Rebate Form can greatly lower the cost you pay for an item.

-

Promotional Offers They encourage customers to experiment with new products, or brands.

-

Accelerate Sales Maine Property Tax Rebate Form are a great way to boost an organization's sales and market share.

Disadvantages

-

Complexity Maine Property Tax Rebate Form that are mail-in, particularly, can be cumbersome and demanding.

-

Extension Dates: Many Maine Property Tax Rebate Form have extremely strict deadlines to submit.

-

Risque of Non-Payment Customers may miss out on Maine Property Tax Rebate Form because they don't comply with the rules exactly.

Download Maine Property Tax Rebate Form

Download Maine Property Tax Rebate Form

FAQs

1. Are Maine Property Tax Rebate Form equivalent to discounts? No, Maine Property Tax Rebate Form are an amount of money that is refunded after the purchase, whereas discounts reduce the purchase price at the moment of sale.

2. Can I use multiple Maine Property Tax Rebate Form for the same product The answer is dependent on the conditions on the Maine Property Tax Rebate Form offer and also the item's qualification. Some companies may allow it, while other companies won't.

3. How long will it take to receive an Maine Property Tax Rebate Form? The amount of time is different, but it could last from a few weeks until a several months to receive a Maine Property Tax Rebate Form.

4. Do I need to pay tax in relation to Maine Property Tax Rebate Form funds? most cases, Maine Property Tax Rebate Form amounts are not considered taxable income.

5. Can I trust Maine Property Tax Rebate Form deals from lesser-known brands It is essential to investigate and ensure that the brand providing the Maine Property Tax Rebate Form is reputable prior to making an acquisition.

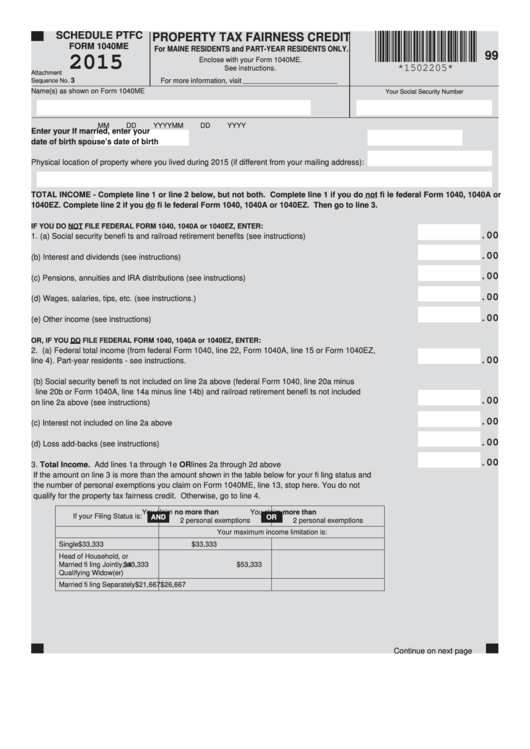

Schedule Ptfc Form 1040me Maine Property Tax Fairness Credit 2015

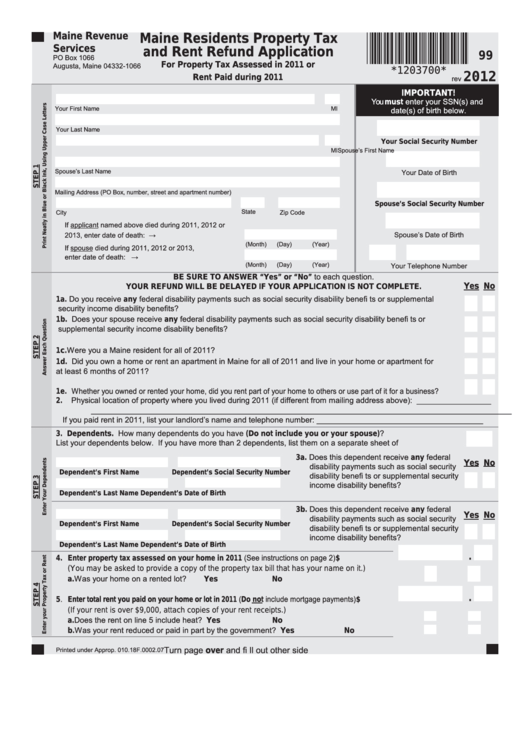

Form 99 Maine Residents Property Tax And Rent Refund Application

Check more sample of Maine Property Tax Rebate Form below

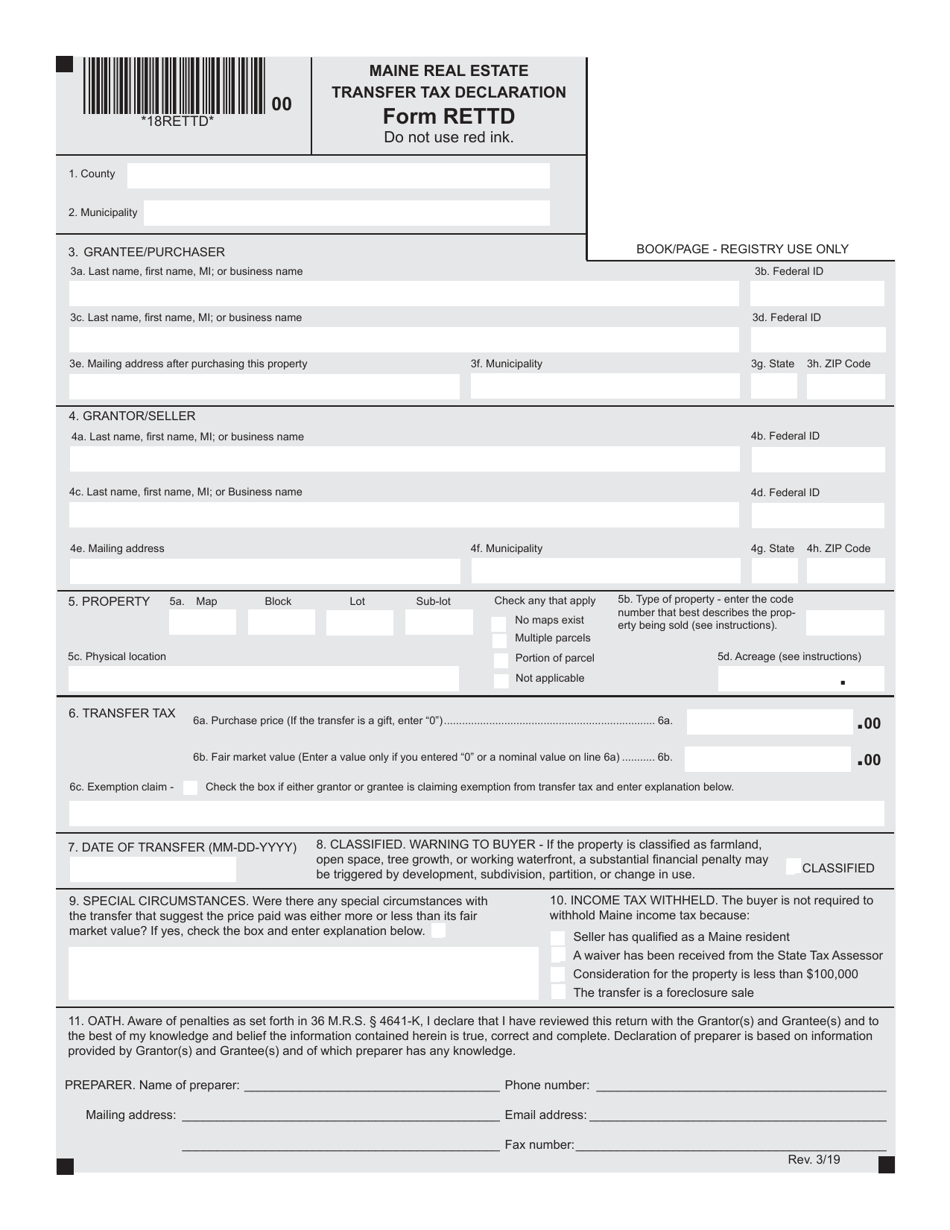

Form RETTD Download Fillable PDF Or Fill Online Maine Real Estate

State Of Maine Rew 5 Form Fill Out Sign Online DocHub

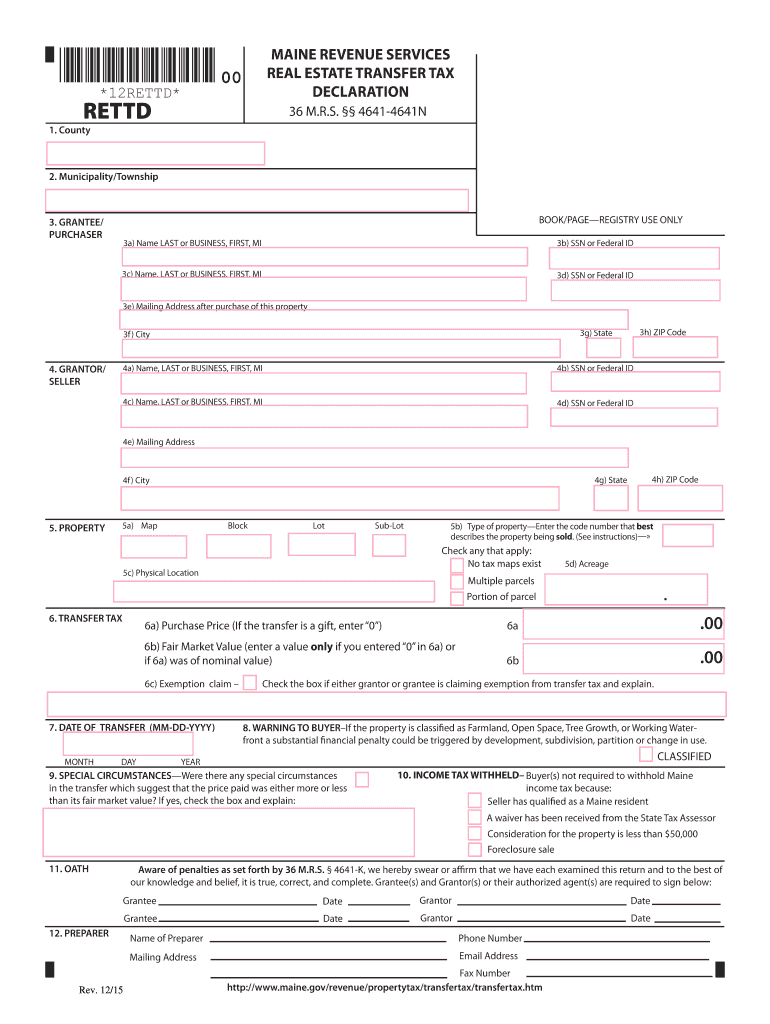

12rettd Maine Gov Fill Out And Sign Printable PDF Template SignNow

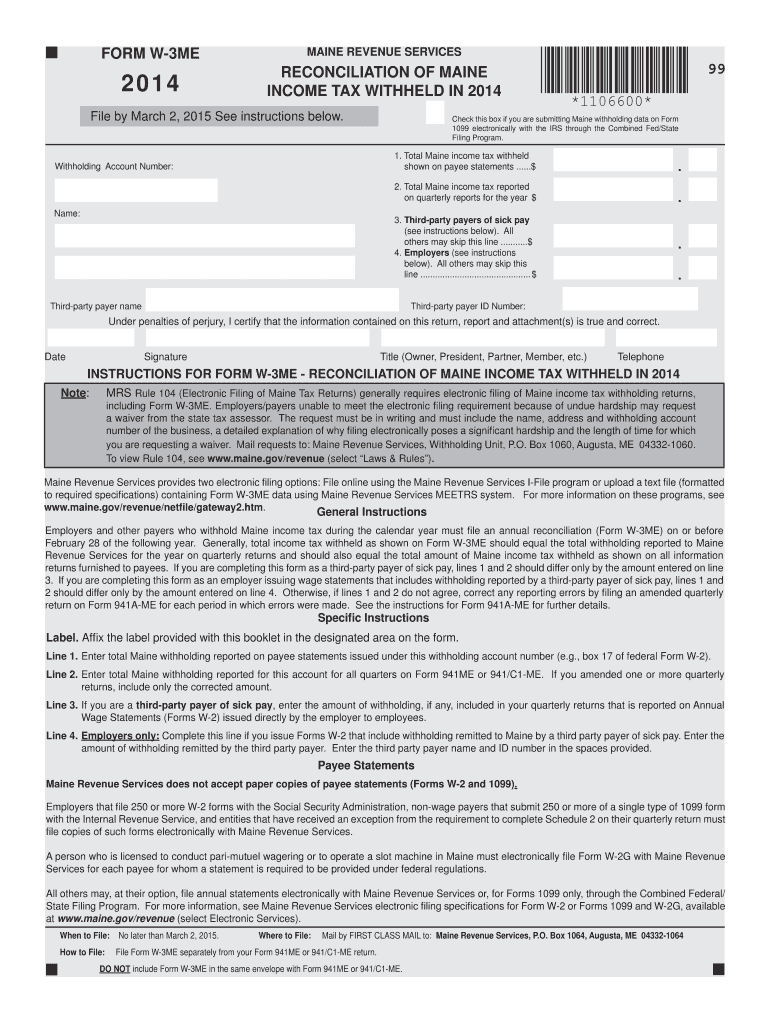

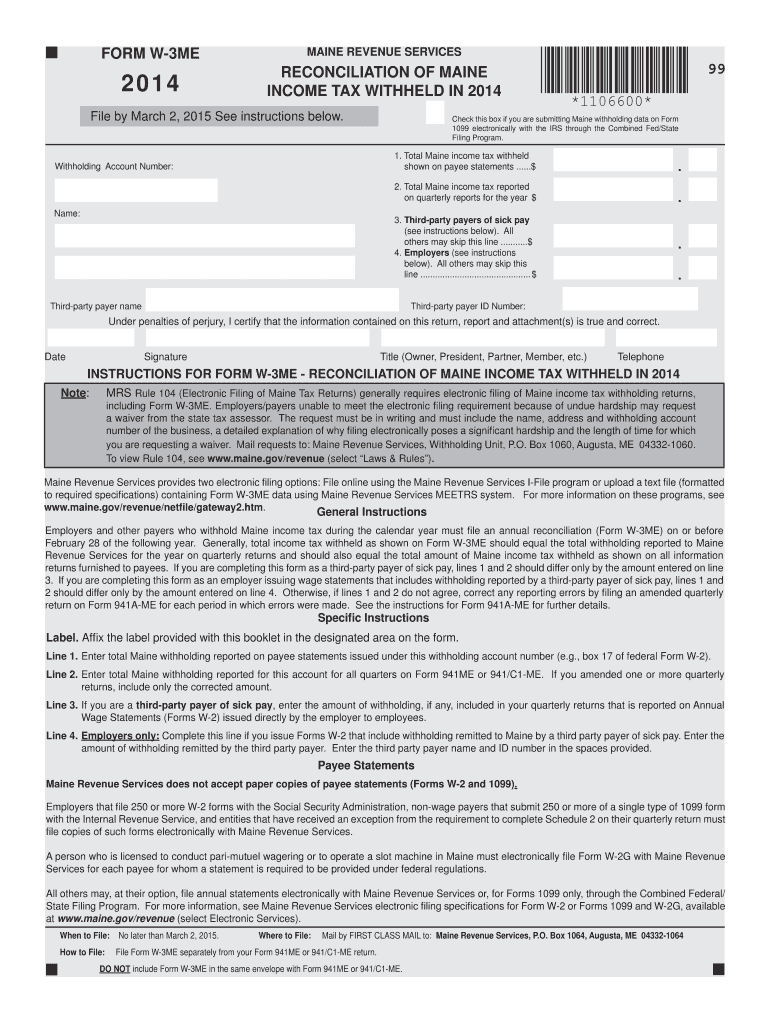

Maine Form Fill Out And Sign Printable PDF Template SignNow

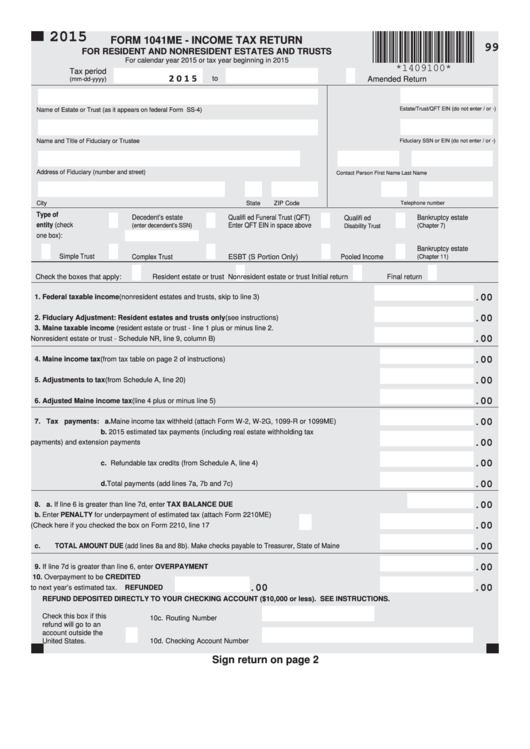

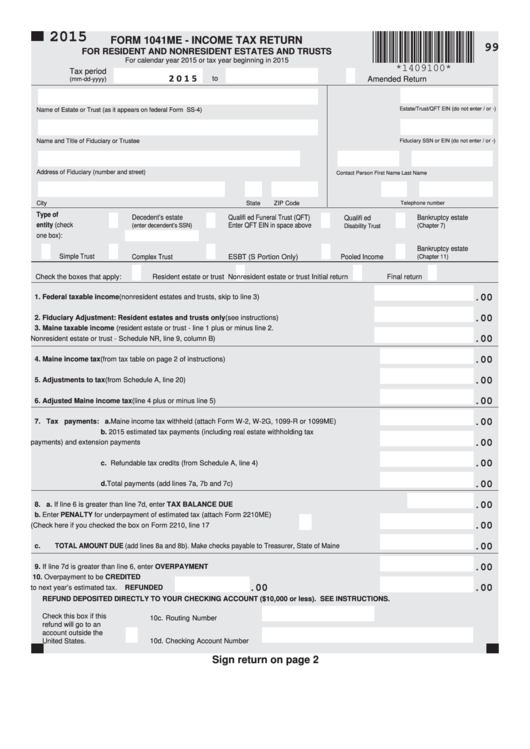

Form 1041me Maine Income Tax Return For Resident And Nonresident

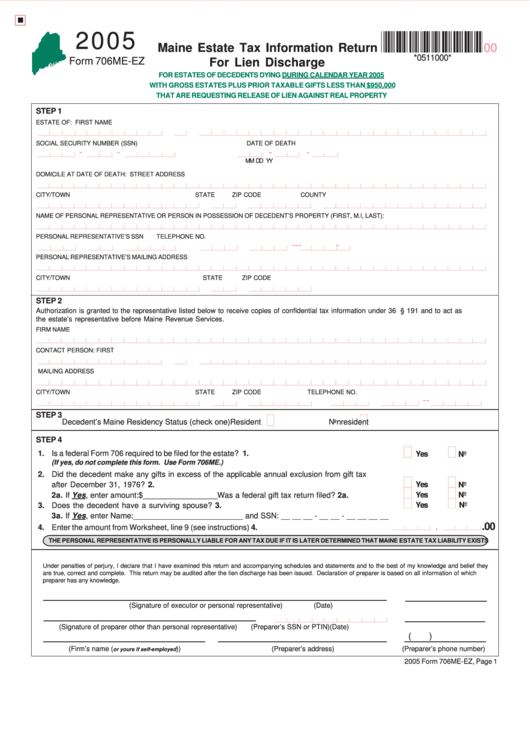

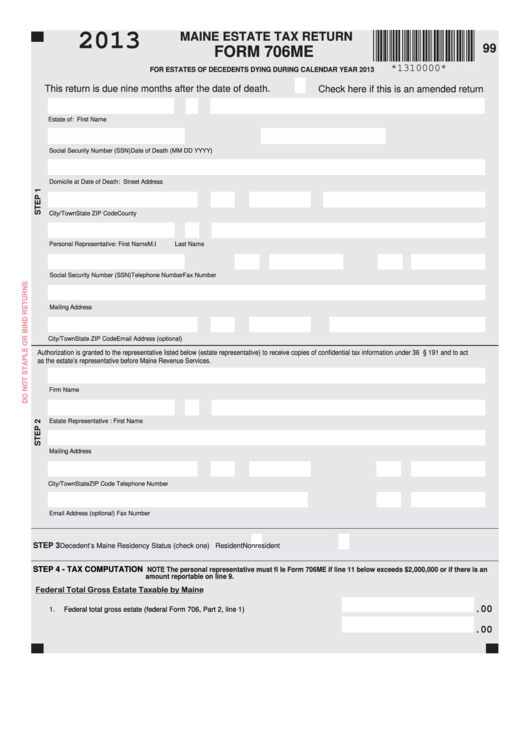

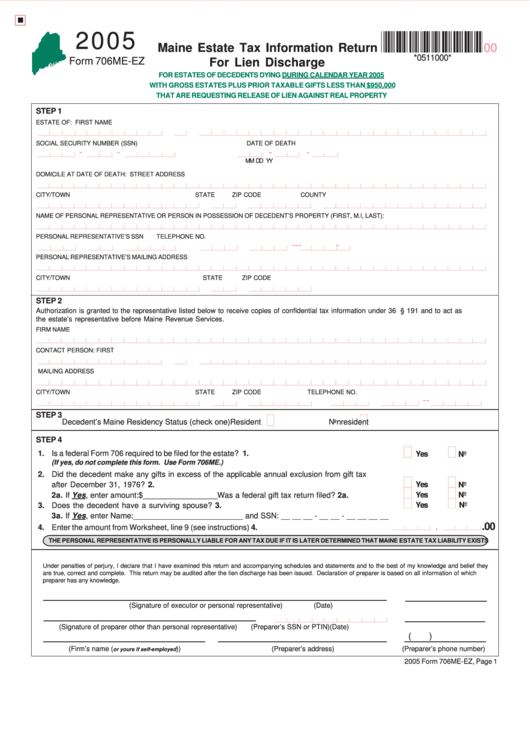

Form 706me Ez Maine Estate Tax Information Return For Lien Discharge

https://www.maine.gov/revenue/taxes/tax-relief-credits-programs

Web Maine Revenue Services administers several programs aimed at providing eligible Maine taxpayers with tax relief Income Tax Credits Individual income tax credits provide a

Web Maine Revenue Services administers several programs aimed at providing eligible Maine taxpayers with tax relief Income Tax Credits Individual income tax credits provide a

Web Maine

Maine Form Fill Out And Sign Printable PDF Template SignNow

State Of Maine Rew 5 Form Fill Out Sign Online DocHub

Form 1041me Maine Income Tax Return For Resident And Nonresident

Form 706me Ez Maine Estate Tax Information Return For Lien Discharge

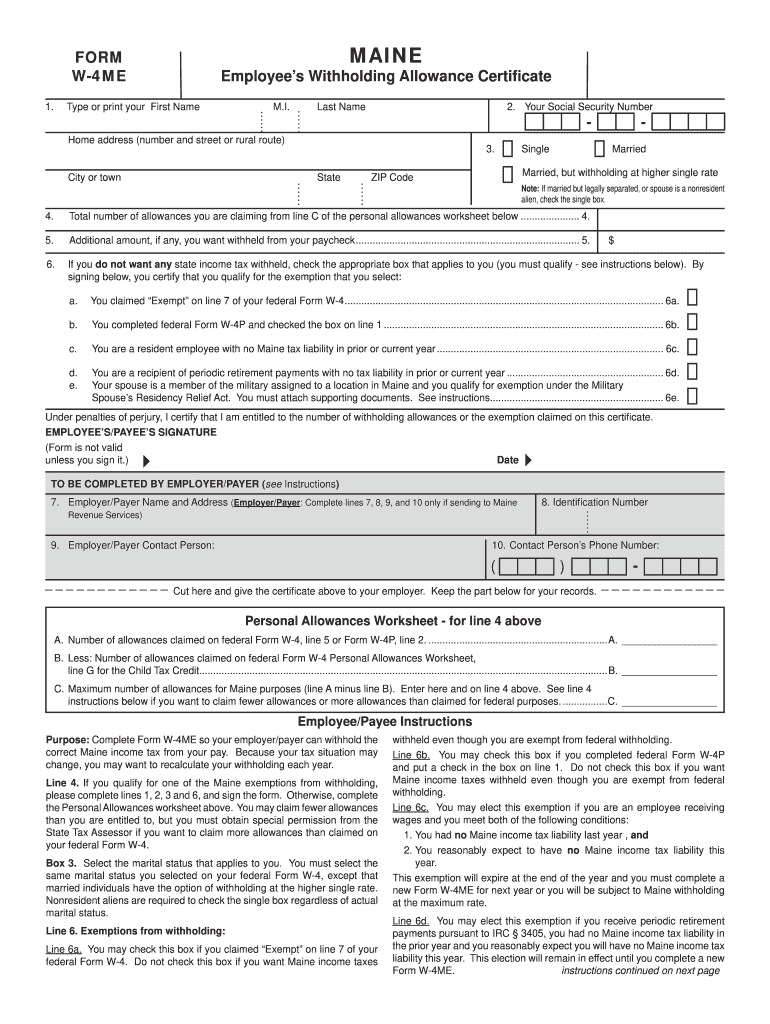

W4me Fill Out Sign Online DocHub

Fill Free Fillable Efficiency Maine PDF Forms PumpRebate

Fill Free Fillable Efficiency Maine PDF Forms PumpRebate

Maine Tax Forms And Instructions For 2021 Form 1040ME