In this day and age of consuming, everyone loves a good bargain. One method to get substantial savings on your purchases can be achieved through Leaving Uk Tax Rebate Forms. Leaving Uk Tax Rebate Forms are a method of marketing used by manufacturers and retailers for offering customers a percentage cash back on their purchases once they've purchased them. In this post, we'll dive into the world Leaving Uk Tax Rebate Forms. We will explore what they are and how they operate, and how you can maximize the value of these incentives.

Get Latest Leaving Uk Tax Rebate Form Below

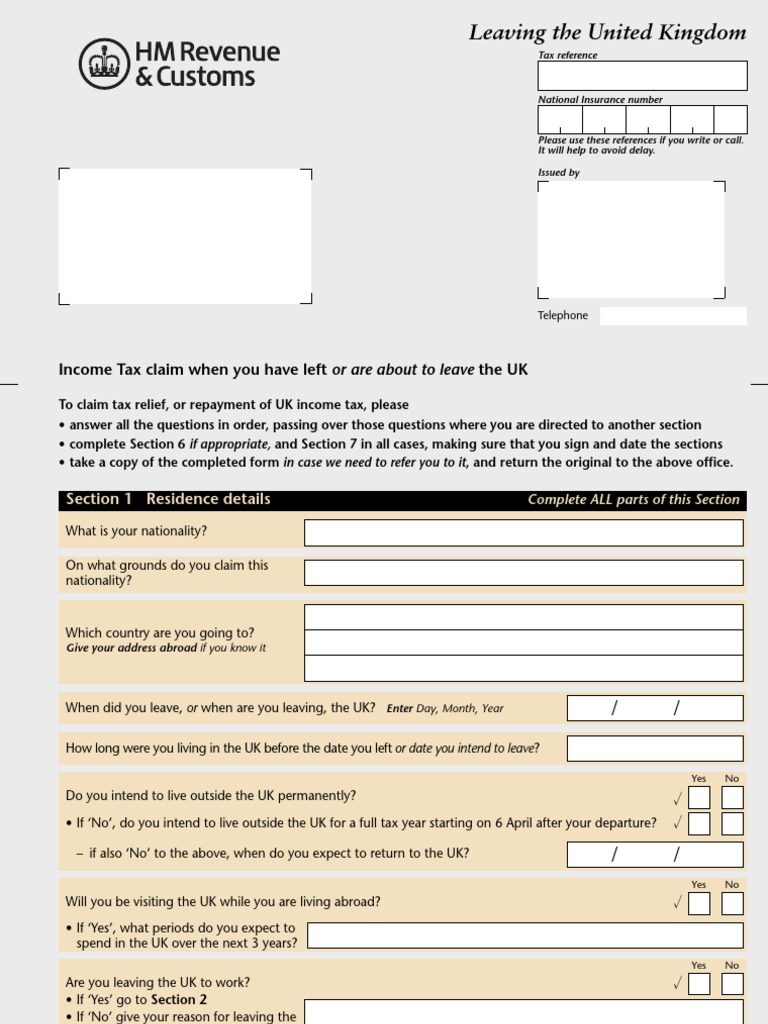

Leaving Uk Tax Rebate Form

Leaving Uk Tax Rebate Form -

Web 1 juin 2015 nbsp 0183 32 Most people that leave the UK part way through the tax year can get a rebate because they wouldn t have used all of their personal allowance But as you are leaving

Web Tax credits if you leave or move to the UK Work in an EU country Show 2 more Tax on your UK income if you live abroad and Claiming benefits if you live move or travel abroad

A Leaving Uk Tax Rebate Form in its most basic form, is a partial payment to a consumer after they've purchased a good or service. It's an effective way used by companies to attract customers, increase sales, and to promote certain products.

Types of Leaving Uk Tax Rebate Form

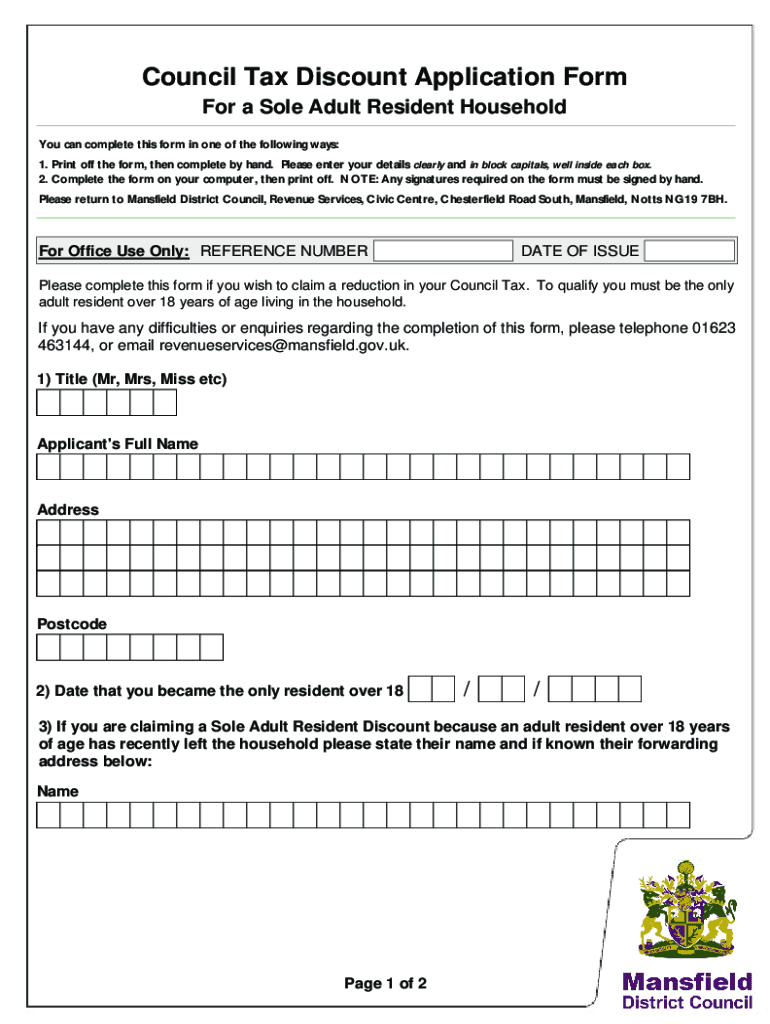

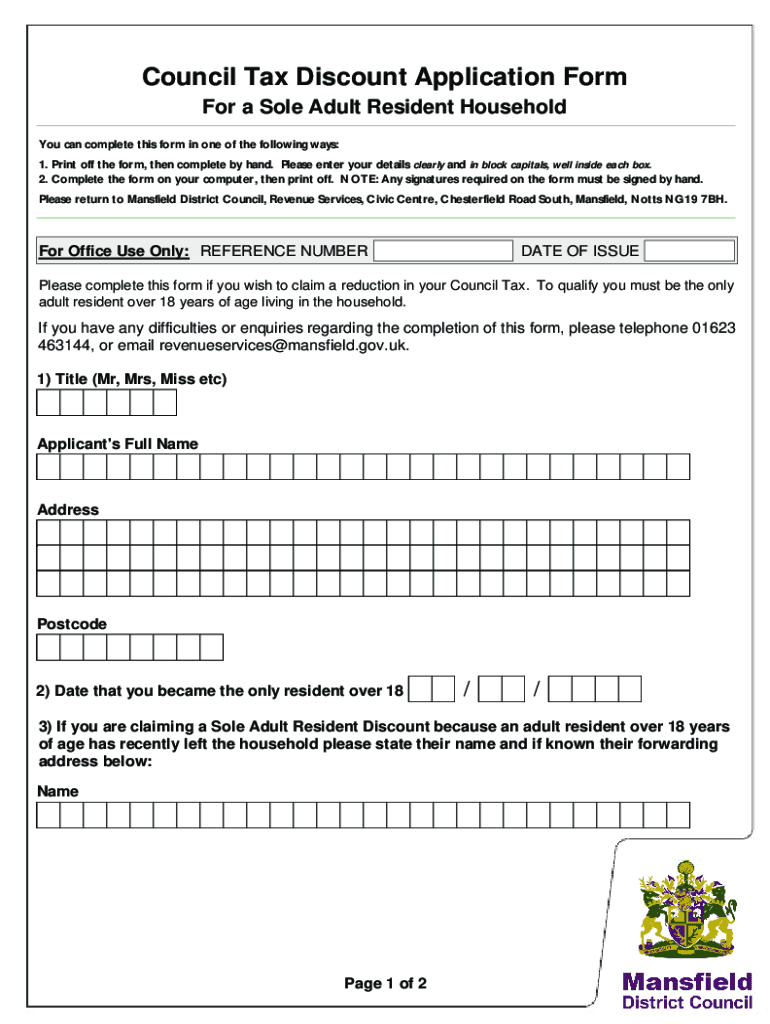

P85 Form Hmrc Leaving The Uk Insurance Pension Free 30 day

P85 Form Hmrc Leaving The Uk Insurance Pension Free 30 day

Web 6 avr 2014 nbsp 0183 32 Details You can either use the online form service sign in to or set up a Government Gateway account print the postal form fill it in by hand and post it to HM

Web 6 avr 2023 nbsp 0183 32 If you leave the UK to live or work abroad you may be able to claim back some of the income tax that you have paid When you leave the UK you must usually send form P85 Leaving the UK getting your tax

Cash Leaving Uk Tax Rebate Form

Cash Leaving Uk Tax Rebate Form are probably the most simple kind of Leaving Uk Tax Rebate Form. Customers receive a specified amount of money back upon purchasing a particular item. They are typically used to purchase products that are expensive, such as electronics or appliances.

Mail-In Leaving Uk Tax Rebate Form

Mail-in Leaving Uk Tax Rebate Form require consumers to provide documents of purchase to claim their refund. They're a bit more involved, however they can yield substantial savings.

Instant Leaving Uk Tax Rebate Form

Instant Leaving Uk Tax Rebate Form can be applied at the point of sale, which reduces the price of purchases immediately. Customers don't have to wait until they can save by using this method.

How Leaving Uk Tax Rebate Form Work

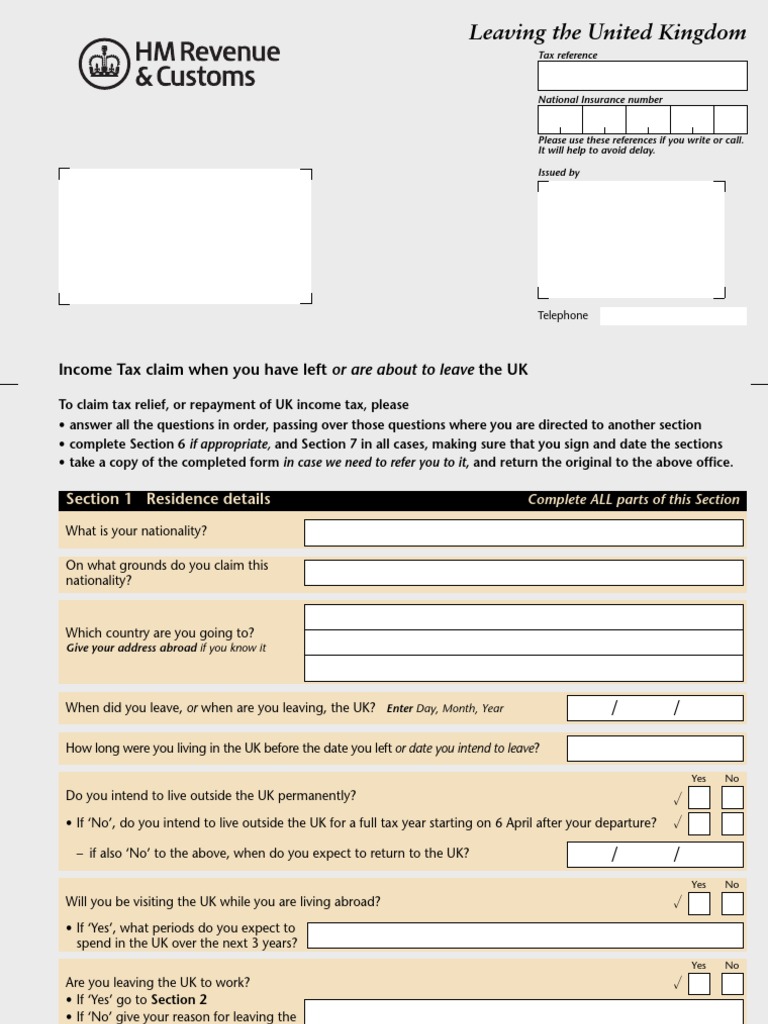

2013 2022 Form UK HMRC P85 Fill Online Printable Fillable Blank

2013 2022 Form UK HMRC P85 Fill Online Printable Fillable Blank

Web There are a couple of crucial forms you need to support a UK tax back claim A P85 contains the date you left the UK your UK residency status and your employment

The Leaving Uk Tax Rebate Form Process

The procedure usually involves a few steps:

-

Purchase the item: First, you buy the product as you normally would.

-

Fill in this Leaving Uk Tax Rebate Form questionnaire: you'll need to provide some information, such as your name, address, and purchase details in order to apply for your Leaving Uk Tax Rebate Form.

-

To submit the Leaving Uk Tax Rebate Form In accordance with the kind of Leaving Uk Tax Rebate Form there may be a requirement to fill out a form and mail it in or submit it online.

-

Wait for approval: The company is going to review your entry to confirm that it complies with the rules and regulations of the Leaving Uk Tax Rebate Form.

-

Enjoy your Leaving Uk Tax Rebate Form After you've been approved, you'll get your refund, through a check, or a prepaid card, or a different method as specified by the offer.

Pros and Cons of Leaving Uk Tax Rebate Form

Advantages

-

Cost savings Leaving Uk Tax Rebate Form are a great way to lower the cost you pay for the item.

-

Promotional Deals They encourage customers to try new products or brands.

-

Boost Sales Leaving Uk Tax Rebate Form can help boost the sales of a business and increase its market share.

Disadvantages

-

Complexity In particular, mail-in Leaving Uk Tax Rebate Form particularly the case of HTML0, can be a hassle and tedious.

-

End Dates A majority of Leaving Uk Tax Rebate Form have strict time limits for submission.

-

Risk of not receiving payment Some customers might have their Leaving Uk Tax Rebate Form delayed if they don't adhere to the requirements precisely.

Download Leaving Uk Tax Rebate Form

Download Leaving Uk Tax Rebate Form

FAQs

1. Are Leaving Uk Tax Rebate Form equivalent to discounts? Not necessarily, as Leaving Uk Tax Rebate Form are a partial refund after purchase, and discounts are a reduction of their price at time of sale.

2. Can I use multiple Leaving Uk Tax Rebate Form on the same product This depends on the conditions for the Leaving Uk Tax Rebate Form offered and product's suitability. Certain companies might allow it, and some don't.

3. How long does it take to receive an Leaving Uk Tax Rebate Form? The timing will vary, but it may range from several weeks to couple of months before you get your Leaving Uk Tax Rebate Form.

4. Do I have to pay taxes upon Leaving Uk Tax Rebate Form funds? the majority of cases, Leaving Uk Tax Rebate Form amounts are not considered to be taxable income.

5. Can I trust Leaving Uk Tax Rebate Form offers from brands that aren't well-known You must research and ensure that the business offering the Leaving Uk Tax Rebate Form is legitimate prior to making a purchase.

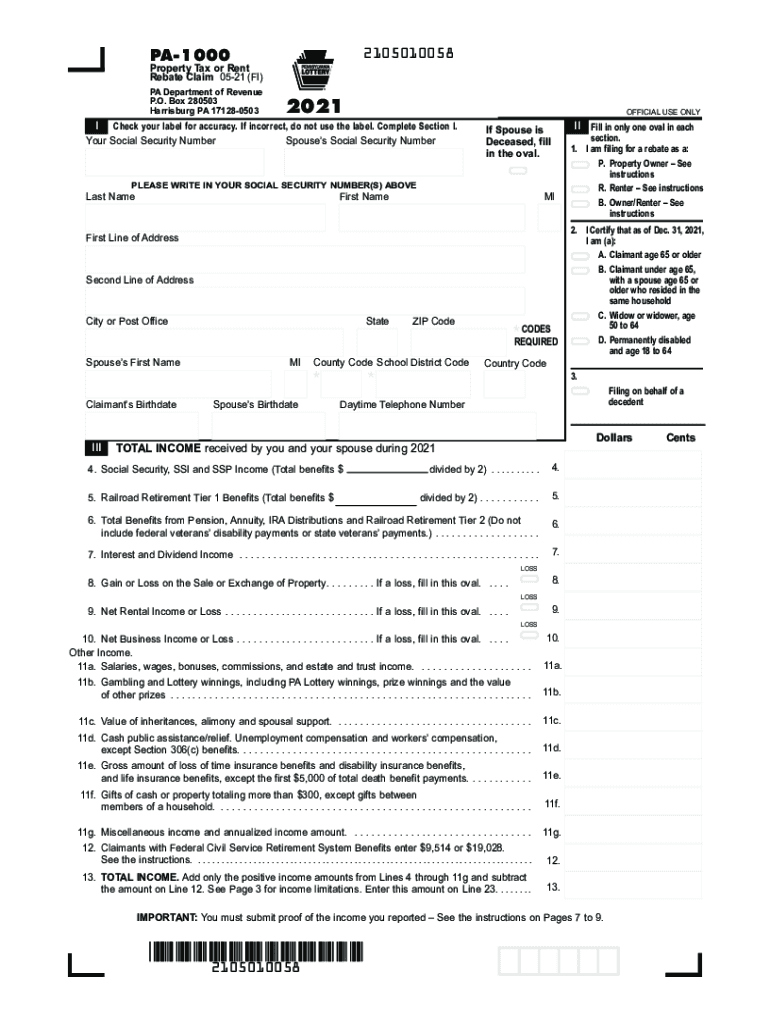

Rebate Form Download Printable PDF Templateroller

1000 Tax Printable Fill Out Sign Online DocHub

Check more sample of Leaving Uk Tax Rebate Form below

All About Mail In Rebates Part 2 The Do s And Don ts Of Submitting

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

Free Printable Menards Coupons 2020 Semashow

2022 Rent Rebate Form Fillable Printable PDF Forms Handypdf

Fillable Rebate Form 4448 Menards Printable Forms Free Online

PA Property Tax Rebate Forms Printable Rebate Form

https://www.gov.uk/tax-right-retire-abroad-return-to-uk

Web Tax credits if you leave or move to the UK Work in an EU country Show 2 more Tax on your UK income if you live abroad and Claiming benefits if you live move or travel abroad

https://www.gov.uk/guidance/claim-personal-allowances-and-tax-refunds...

Web 6 juin 2023 nbsp 0183 32 How to claim a refund on tax and personal allowances on UK income if you re not resident in the UK on form R43

Web Tax credits if you leave or move to the UK Work in an EU country Show 2 more Tax on your UK income if you live abroad and Claiming benefits if you live move or travel abroad

Web 6 juin 2023 nbsp 0183 32 How to claim a refund on tax and personal allowances on UK income if you re not resident in the UK on form R43

2022 Rent Rebate Form Fillable Printable PDF Forms Handypdf

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

Fillable Rebate Form 4448 Menards Printable Forms Free Online

PA Property Tax Rebate Forms Printable Rebate Form

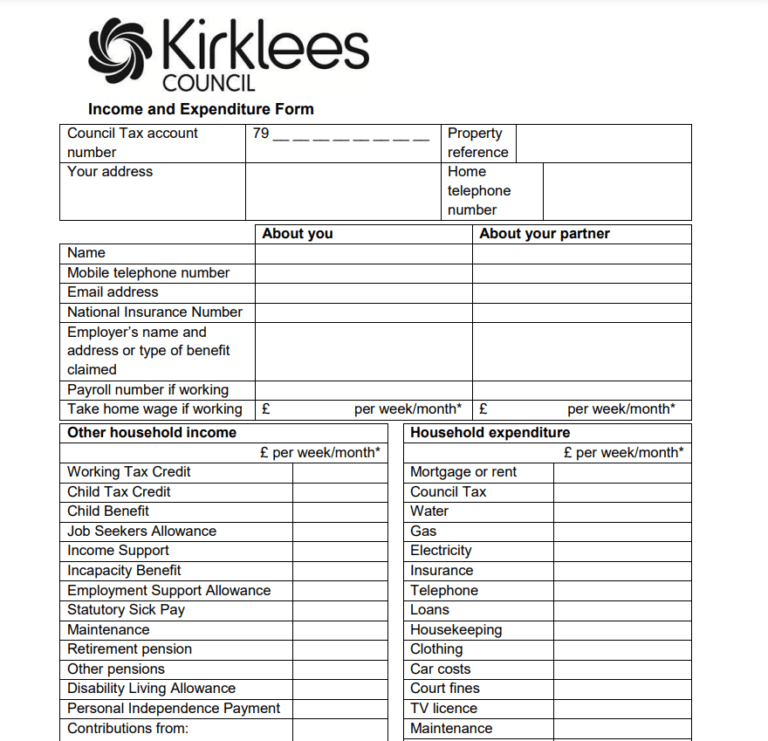

Council Tax Rebate Form Kirklees By Touch Printable Rebate Form

Scottish Council Tax Rebates Fill Online Printable Fillable Blank

Scottish Council Tax Rebates Fill Online Printable Fillable Blank

P G And E Ev Rebate Printable Rebate Form