In today's world of consumerism everyone is looking for a great bargain. One method to get substantial savings in your purchase is through Irs Solar Rebate Forms. Irs Solar Rebate Forms are a method of marketing used by manufacturers and retailers to offer customers a partial refund for their purchases after they've made them. In this post, we'll investigate the world of Irs Solar Rebate Forms, looking at the nature of them about, how they work, as well as ways to maximize your savings with these cost-effective incentives.

Get Latest Irs Solar Rebate Form Below

Irs Solar Rebate Form

Irs Solar Rebate Form - Irs Solar Rebate Form, Irs Solar Credit Form, Irs Solar Tax Credit Form Instructions, Federal Tax Rebates For Solar, Federal Tax Credit For Solar Form, How To Claim Federal Solar Rebate, Solar Rebate Explained

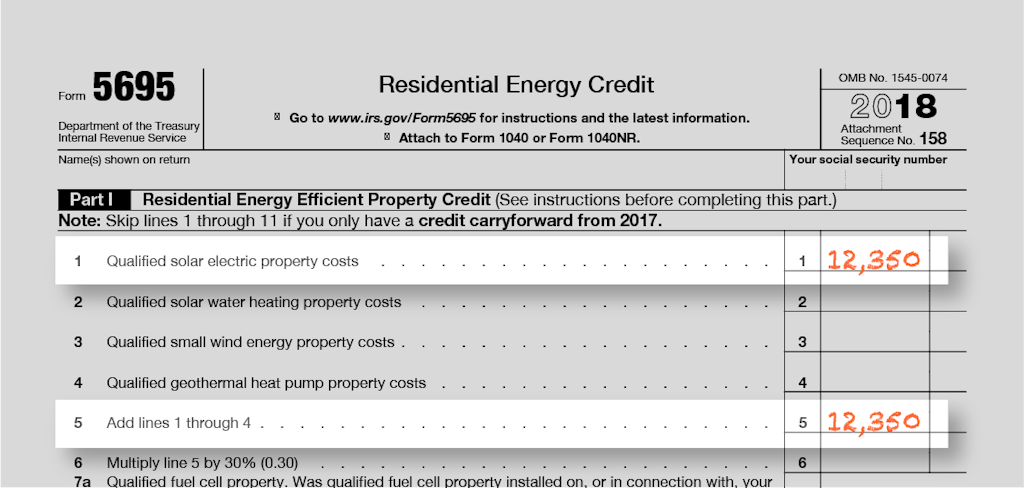

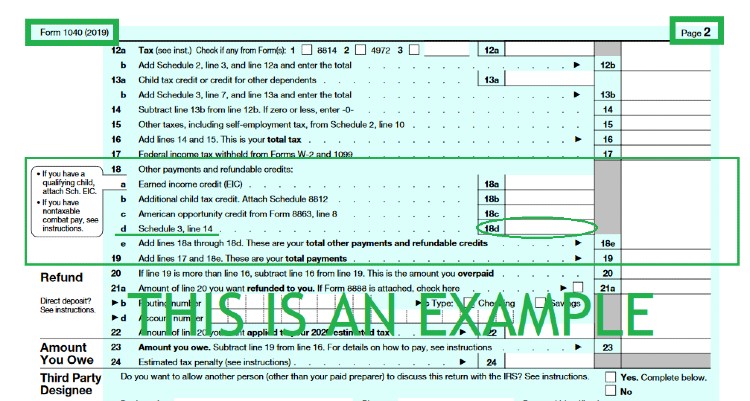

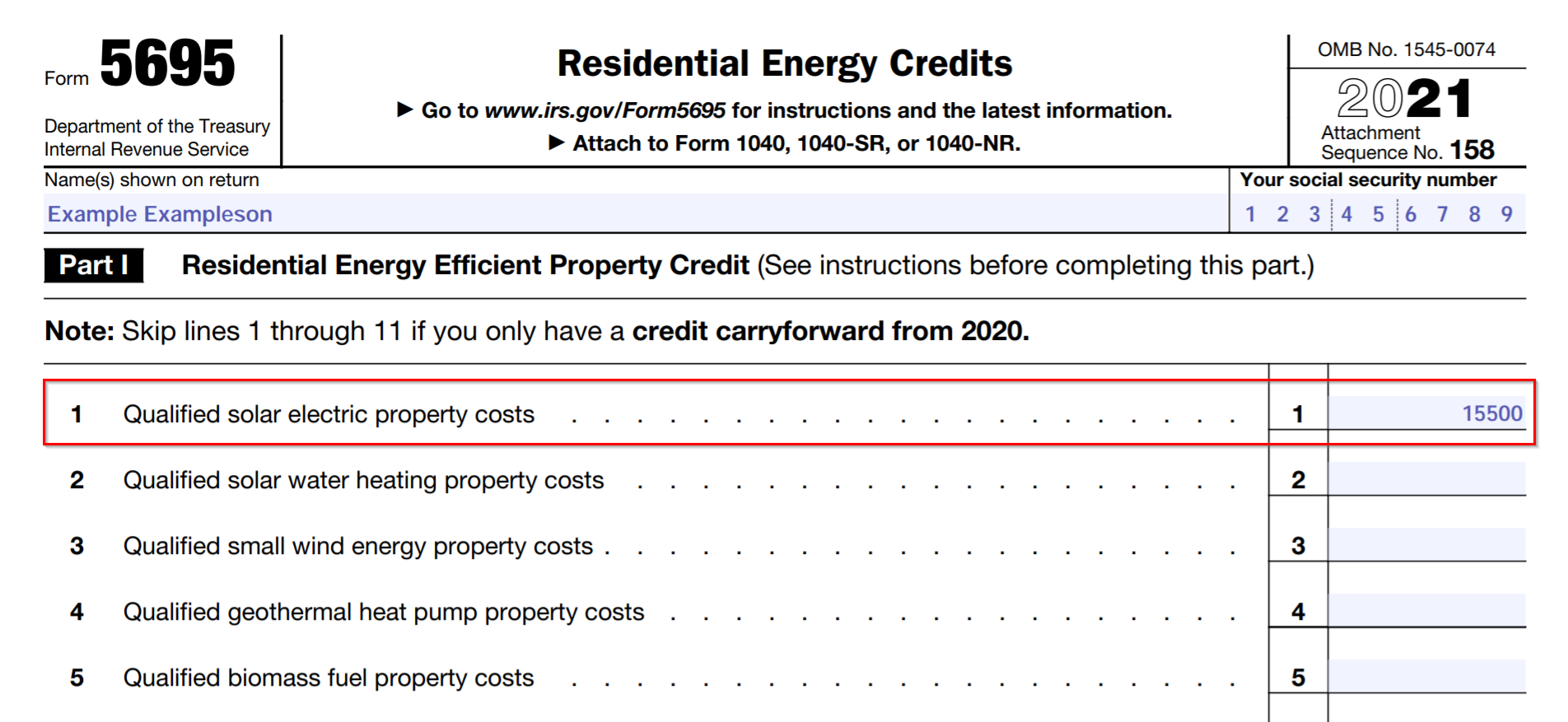

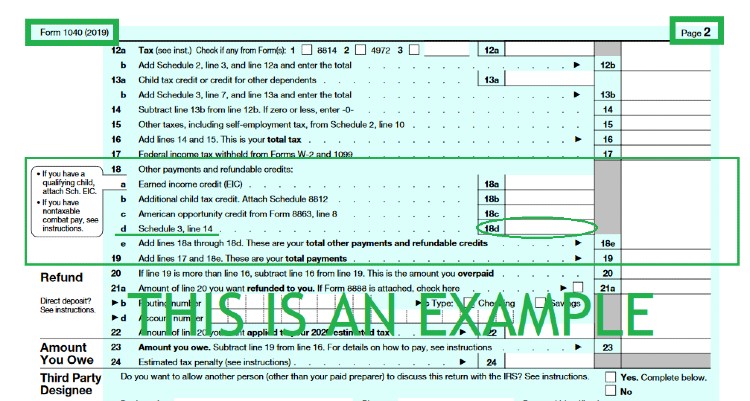

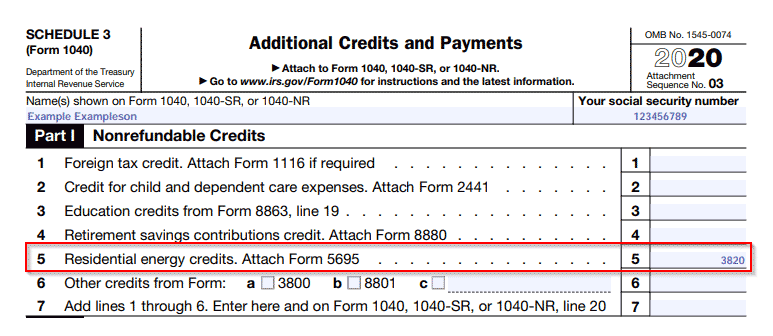

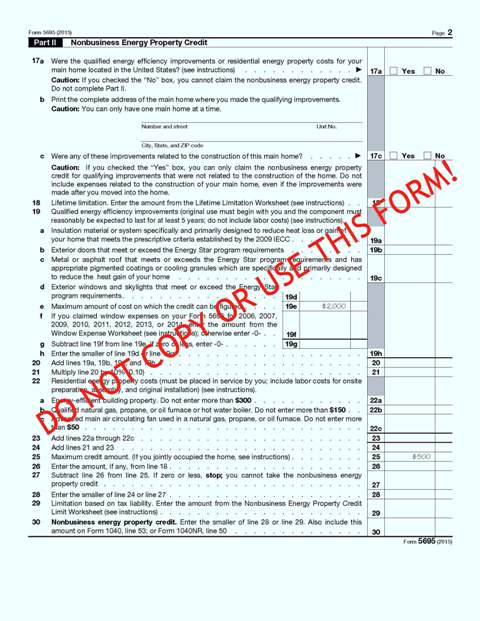

How do I claim the federal solar tax credit After seeking professional tax advice and ensuring you are eligible for the credit you can complete and attach IRS Form 5695 to your federal tax return Form 1040 or Form

Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022 If you

A Irs Solar Rebate Form is, in its most basic format, is a cash refund provided to customers after having purchased a item or service. It's an effective way used by companies to attract clients, increase sales and also to advertise certain products.

Types of Irs Solar Rebate Form

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

To claim the solar tax credit you ll have to fill out IRS Form 5695 You can claim the tax credit if you receive other clean energy incentives for the same project although this might

Form 5695 is the official IRS tax form you must use to claim the federal solar tax credit when you file your taxes You can download a copy of Form 5695 PDF on

Cash Irs Solar Rebate Form

Cash Irs Solar Rebate Form are the most straightforward type of Irs Solar Rebate Form. Clients receive a predetermined amount of money back after buying a product. These are typically for more expensive items such electronics or appliances.

Mail-In Irs Solar Rebate Form

Mail-in Irs Solar Rebate Form require that customers submit the proof of purchase to be eligible for their refund. They're more complicated but could provide significant savings.

Instant Irs Solar Rebate Form

Instant Irs Solar Rebate Form are applied right at the moment of sale, cutting your purchase cost instantly. Customers do not have to wait for their savings when they purchase this type of Irs Solar Rebate Form.

How Irs Solar Rebate Form Work

How To File The IRS Form 5695 ITC Solar Tax Credit A M Sun Solar

How To File The IRS Form 5695 ITC Solar Tax Credit A M Sun Solar

Step 01 Step 02 My electric bill is 290 mo Calculate My Savings What is IRS Form 5695 Form 5695 is the document you submit to get a credit on your tax

The Irs Solar Rebate Form Process

The procedure typically consists of a few steps:

-

You purchase the item: First make sure you purchase the product exactly as you would normally.

-

Complete your Irs Solar Rebate Form questionnaire: you'll have to fill in some information including your address, name, and purchase information, in order to take advantage of your Irs Solar Rebate Form.

-

Make sure you submit the Irs Solar Rebate Form Based on the kind of Irs Solar Rebate Form you will need to fill out a paper form or submit it online.

-

Wait for approval: The company will review your request to ensure it meets the reimbursement's terms and condition.

-

Pay your Irs Solar Rebate Form After being approved, you'll be able to receive your reimbursement, whether by check, prepaid card, or another method that is specified in the offer.

Pros and Cons of Irs Solar Rebate Form

Advantages

-

Cost savings Rewards can drastically lower the cost you pay for the item.

-

Promotional Deals: They encourage customers to test new products or brands.

-

Accelerate Sales Irs Solar Rebate Form are a great way to boost the company's sales as well as market share.

Disadvantages

-

Complexity Irs Solar Rebate Form that are mail-in, in particular may be lengthy and tedious.

-

Extension Dates Many Irs Solar Rebate Form have deadlines for submission.

-

Risk of Non-Payment: Some customers may not get their Irs Solar Rebate Form if they don't adhere to the requirements precisely.

Download Irs Solar Rebate Form

Download Irs Solar Rebate Form

FAQs

1. Are Irs Solar Rebate Form equivalent to discounts? No, Irs Solar Rebate Form offer only a partial reimbursement following the purchase, whereas discounts cut their price at moment of sale.

2. Can I get multiple Irs Solar Rebate Form on the same product It's contingent upon the conditions on the Irs Solar Rebate Form provides and the particular product's ability to qualify. Some companies may allow it, but some will not.

3. What is the time frame to get an Irs Solar Rebate Form? The duration differs, but could take a couple of weeks or a couple of months to receive your Irs Solar Rebate Form.

4. Do I have to pay tax regarding Irs Solar Rebate Form montants? most circumstances, Irs Solar Rebate Form amounts are not considered to be taxable income.

5. Do I have confidence in Irs Solar Rebate Form offers from brands that aren't well-known It's important to do your research and ensure that the brand giving the Irs Solar Rebate Form is legitimate prior to making any purchase.

Filing For The Solar Tax Credit Wells Solar

How To Claim The Solar Investment Tax Credit YSG Solar YSG Solar

Check more sample of Irs Solar Rebate Form below

IRS Form 5695 Lines 1 4 Irs Forms Irs Tax Credits

How To Claim The Federal Solar Tax Credit SAVKAT Inc

How To File IRS Form 5695 To Claim Your Renewable Energy Credits

Filing For The Solar Tax Credit Wells Solar

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Solar Tax Credit And Your Boat

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022 If you

https://www.solar.com/learn/how-to-file-t…

You will need four IRS tax forms to file for your solar tax credit Form 1040 Schedule 3 Form 1040 Form 5695 Instructions for Form 5695 latest version You ll also need Receipts from your solar

Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022 If you

You will need four IRS tax forms to file for your solar tax credit Form 1040 Schedule 3 Form 1040 Form 5695 Instructions for Form 5695 latest version You ll also need Receipts from your solar

Filing For The Solar Tax Credit Wells Solar

How To Claim The Federal Solar Tax Credit SAVKAT Inc

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Solar Tax Credit And Your Boat

How To Claim The Solar Tax Credit Using IRS Form 5695

Solar Tax Credit And Your Boat

Solar Tax Credit And Your Boat

How To File IRS Form 5695 To Claim Your Renewable Energy Credits