Today, in a world that is driven by the consumer everyone appreciates a great deal. One way to score significant savings on your purchases can be achieved through Irs Recovery Rebate Credit Form 1040s. Irs Recovery Rebate Credit Form 1040s are an effective marketing tactic used by manufacturers and retailers to offer customers a return on their purchases once they've bought them. In this article, we will explore the world of Irs Recovery Rebate Credit Form 1040s. We'll look at the nature of them about, how they work, and how you can maximise the savings you can make by using these cost-effective incentives.

Get Latest Irs Recovery Rebate Credit Form 1040 Below

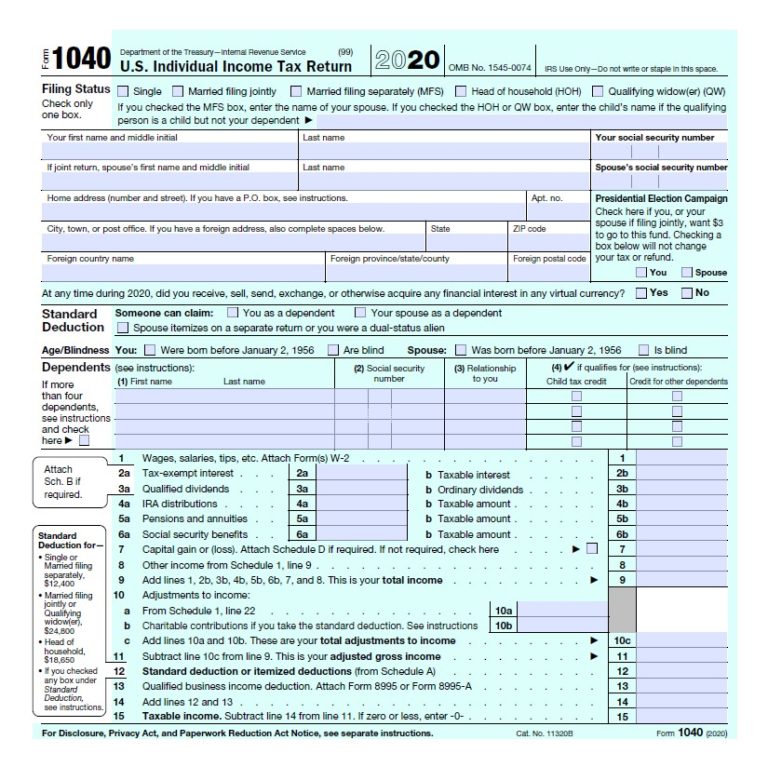

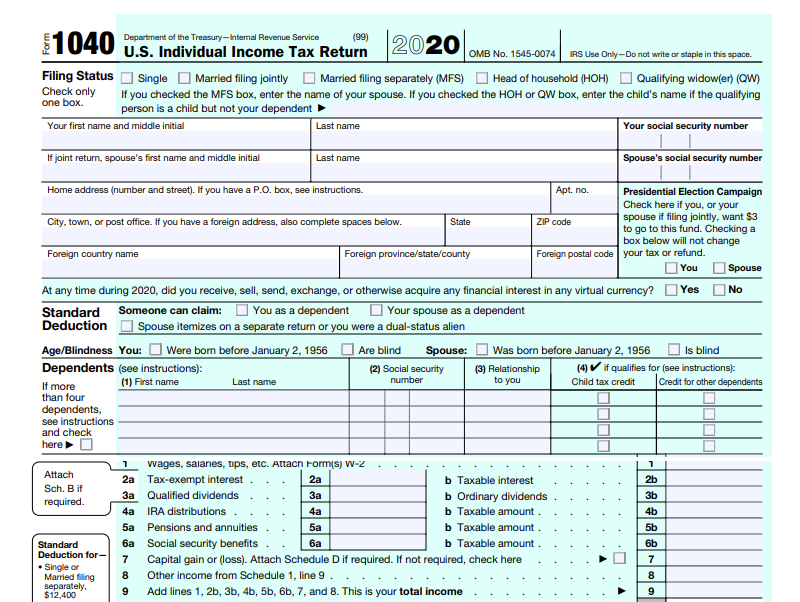

Irs Recovery Rebate Credit Form 1040

Irs Recovery Rebate Credit Form 1040 -

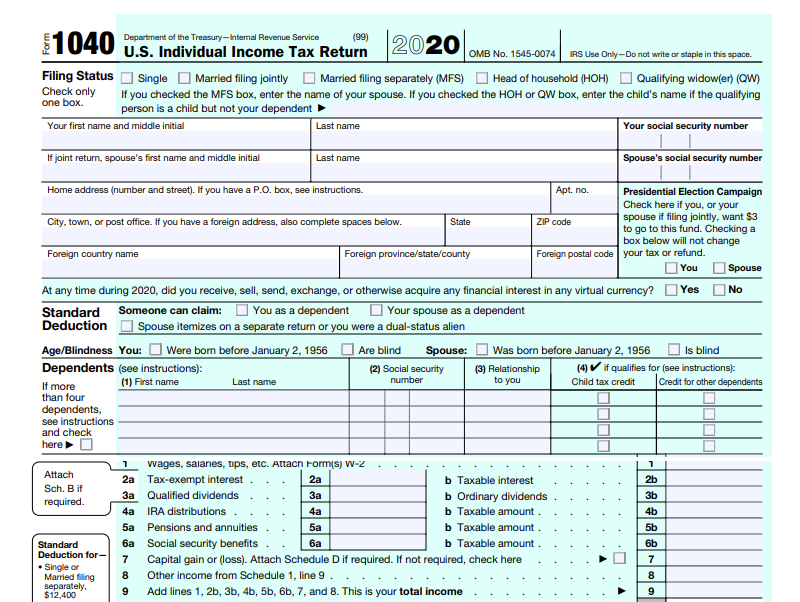

Verkko 10 jouluk 2021 nbsp 0183 32 A1 Yes if your 2020 has been processed and you didn t claim the credit on your original 2020 tax return you must file an Amended U S Individual

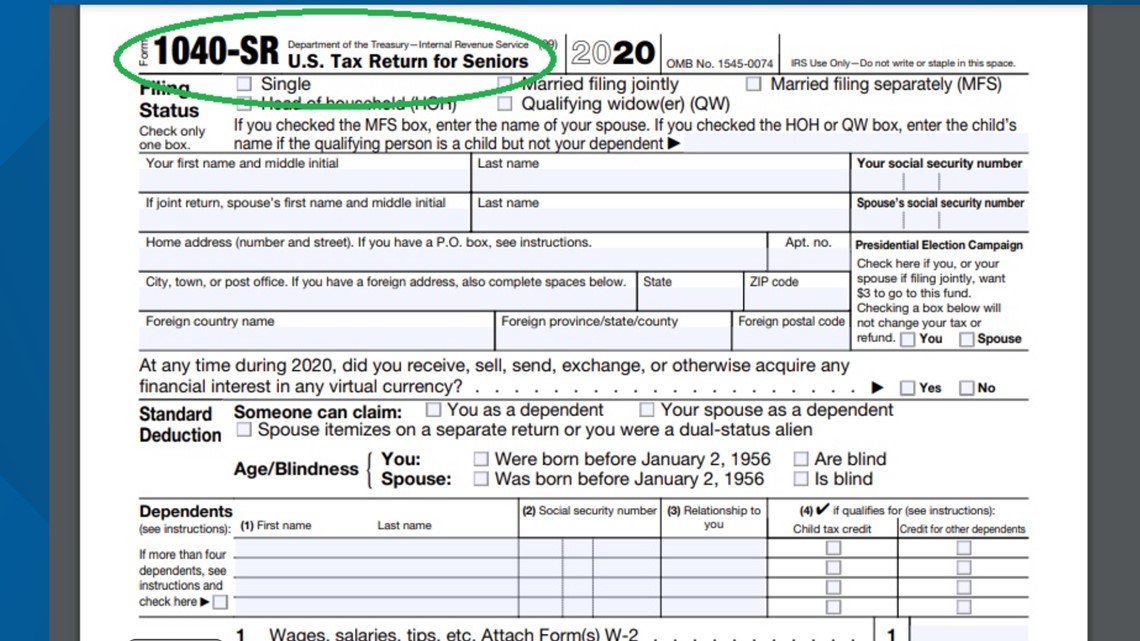

Verkko 13 tammik 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the

A Irs Recovery Rebate Credit Form 1040 as it is understood in its simplest version, is an ad-hoc payment to a consumer after purchasing a certain product or service. It's an effective method that businesses use to draw customers, boost sales, and to promote certain products.

Types of Irs Recovery Rebate Credit Form 1040

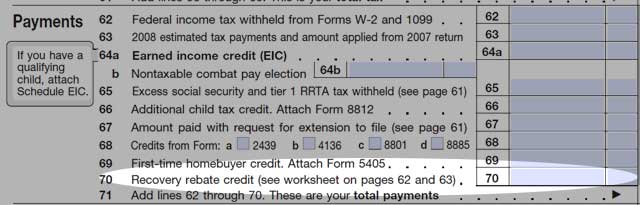

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

Verkko 17 marrask 2023 nbsp 0183 32 2020 Recovery Rebate Credit file a tax return by May 17 2024 2021 Recovery Rebate Credit file a tax return by April 15 2025 Get free help

Verkko 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021

Cash Irs Recovery Rebate Credit Form 1040

Cash Irs Recovery Rebate Credit Form 1040 can be the simplest type of Irs Recovery Rebate Credit Form 1040. Customers get a set amount of cash back after purchasing a item. These are often used for the most expensive products like electronics or appliances.

Mail-In Irs Recovery Rebate Credit Form 1040

Mail-in Irs Recovery Rebate Credit Form 1040 require consumers to send in an evidence of purchase for the money. They are a bit more complicated, but they can provide significant savings.

Instant Irs Recovery Rebate Credit Form 1040

Instant Irs Recovery Rebate Credit Form 1040 apply at the place of purchase, reducing the purchase cost immediately. Customers do not have to wait until they can save when they purchase this type of Irs Recovery Rebate Credit Form 1040.

How Irs Recovery Rebate Credit Form 1040 Work

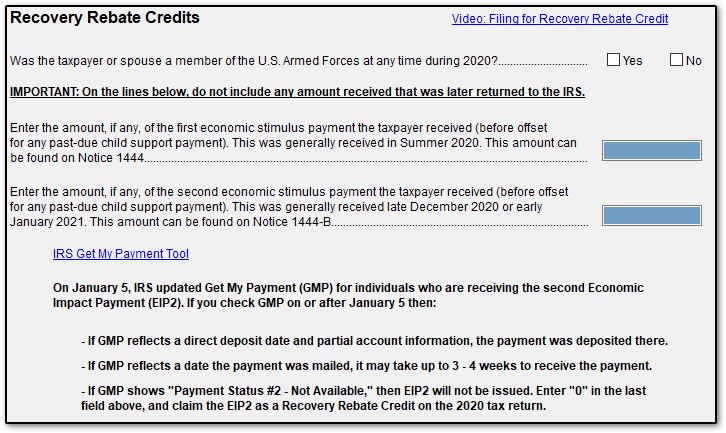

1040 EF Message 0006 Recovery Rebate Credit Drake20

1040 EF Message 0006 Recovery Rebate Credit Drake20

Verkko 2021 Recovery Rebate Credit If you do not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021

The Irs Recovery Rebate Credit Form 1040 Process

The process typically involves handful of simple steps:

-

When you buy the product, you purchase the item exactly as you would normally.

-

Fill in this Irs Recovery Rebate Credit Form 1040 Form: To claim the Irs Recovery Rebate Credit Form 1040 you'll have submit some information, such as your name, address and the purchase details, in order in order to get your Irs Recovery Rebate Credit Form 1040.

-

Send in the Irs Recovery Rebate Credit Form 1040 In accordance with the type of Irs Recovery Rebate Credit Form 1040 it is possible that you need to send in a form, or upload it online.

-

Wait for approval: The company will go through your application to determine if it's in compliance with the guidelines and conditions of the Irs Recovery Rebate Credit Form 1040.

-

Redeem your Irs Recovery Rebate Credit Form 1040 After being approved, the amount you receive will be either by check, prepaid card, or a different option as per the terms of the offer.

Pros and Cons of Irs Recovery Rebate Credit Form 1040

Advantages

-

Cost savings Irs Recovery Rebate Credit Form 1040 could significantly reduce the price you pay for an item.

-

Promotional Deals They encourage customers to test new products or brands.

-

Accelerate Sales Irs Recovery Rebate Credit Form 1040 can help boost an organization's sales and market share.

Disadvantages

-

Complexity Reward mail-ins in particular difficult and slow-going.

-

Deadlines for Expiration A lot of Irs Recovery Rebate Credit Form 1040 have rigid deadlines to submit.

-

Risk of Non-Payment Customers may miss out on Irs Recovery Rebate Credit Form 1040 because they don't observe the rules exactly.

Download Irs Recovery Rebate Credit Form 1040

Download Irs Recovery Rebate Credit Form 1040

FAQs

1. Are Irs Recovery Rebate Credit Form 1040 similar to discounts? Not necessarily, as Irs Recovery Rebate Credit Form 1040 are an amount of money that is refunded after the purchase, and discounts are a reduction of the cost of purchase at moment of sale.

2. Are multiple Irs Recovery Rebate Credit Form 1040 available on the same item The answer is dependent on the terms and conditions of Irs Recovery Rebate Credit Form 1040 incentives and the specific product's quality and eligibility. Certain companies might allow it, while some won't.

3. How long does it take to get a Irs Recovery Rebate Credit Form 1040 What is the timeframe? will differ, but can be from several weeks to couple of months for you to receive your Irs Recovery Rebate Credit Form 1040.

4. Do I have to pay taxes regarding Irs Recovery Rebate Credit Form 1040 amounts? In the majority of cases, Irs Recovery Rebate Credit Form 1040 amounts are not considered taxable income.

5. Can I trust Irs Recovery Rebate Credit Form 1040 deals from lesser-known brands It's crucial to research to ensure that the name offering the Irs Recovery Rebate Credit Form 1040 is credible prior to making purchases.

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

How To Claim The Stimulus Money On Your Tax Return 13newsnow

Check more sample of Irs Recovery Rebate Credit Form 1040 below

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

What Is The Recovery Rebate Credit CD Tax Financial

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Tax Time Guide Didn t Get Economic Impact Payments Check Eligibility

Free File 1040 Form 2021 Recovery Rebate

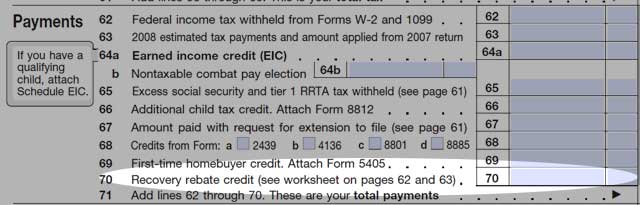

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Verkko 13 tammik 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-questions-an…

Verkko 13 huhtik 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file

Verkko 13 tammik 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the

Verkko 13 huhtik 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file

Tax Time Guide Didn t Get Economic Impact Payments Check Eligibility

What Is The Recovery Rebate Credit CD Tax Financial

Free File 1040 Form 2021 Recovery Rebate

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

IRS CP 11R Recovery Rebate Credit Balance Due

1040 Recovery Rebate Credit Drake20

1040 Recovery Rebate Credit Drake20

Did Not Get A Stimulus Check Check For A Recovery Rebate Credit