In today's world of consumerism everybody loves a good deal. One way to gain substantial savings on your purchases is through Irs Rebate Recovery Formss. They are a form of marketing that retailers and manufacturers use to offer customers a discount on purchases they made after they've done so. In this article, we'll dive into the world Irs Rebate Recovery Formss. We'll explore the nature of them and how they operate, and how you can maximize the value of these incentives.

Get Latest Irs Rebate Recovery Forms Below

Irs Rebate Recovery Forms

Irs Rebate Recovery Forms - Irs Rebate Recovery Form, Irs Forms 2021 Recovery Rebate Credit Worksheet, What Is The Irs Recovery Rebate Credit

Verkko IRS gov rrc claiming the Recovery Rebate Credit if you aren t required to file a tax return claiming the Recovery Rebate Credit if you aren t required to file a tax return

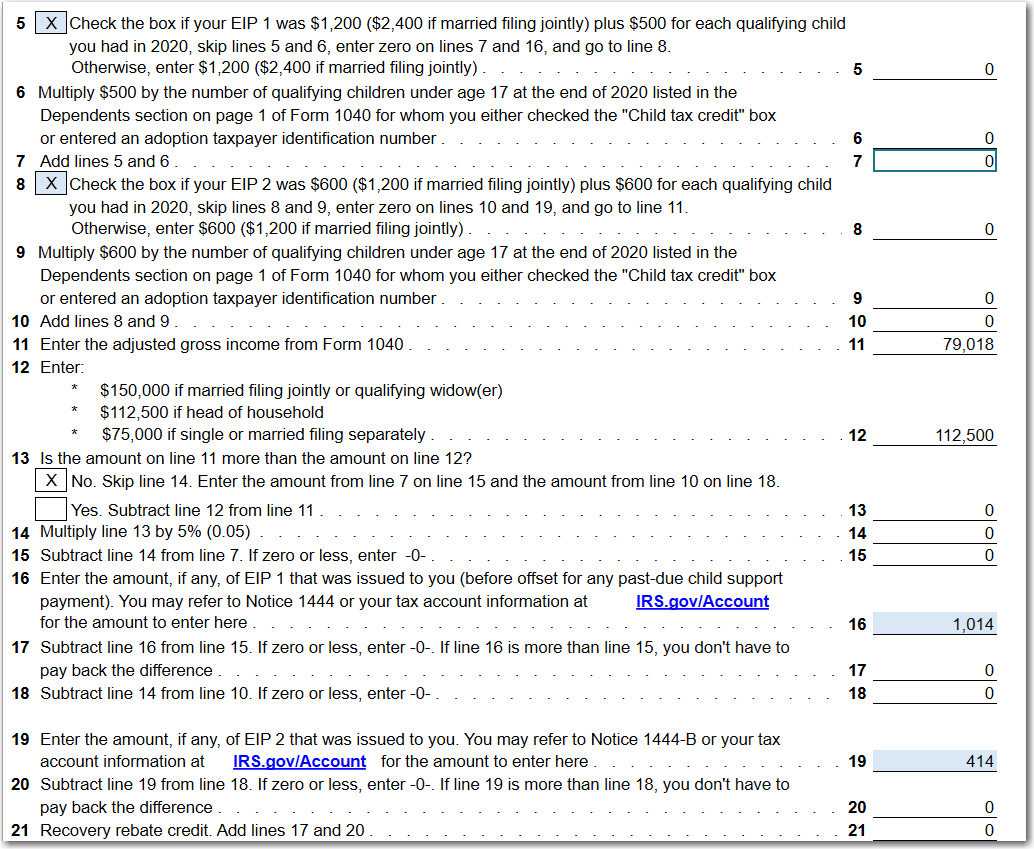

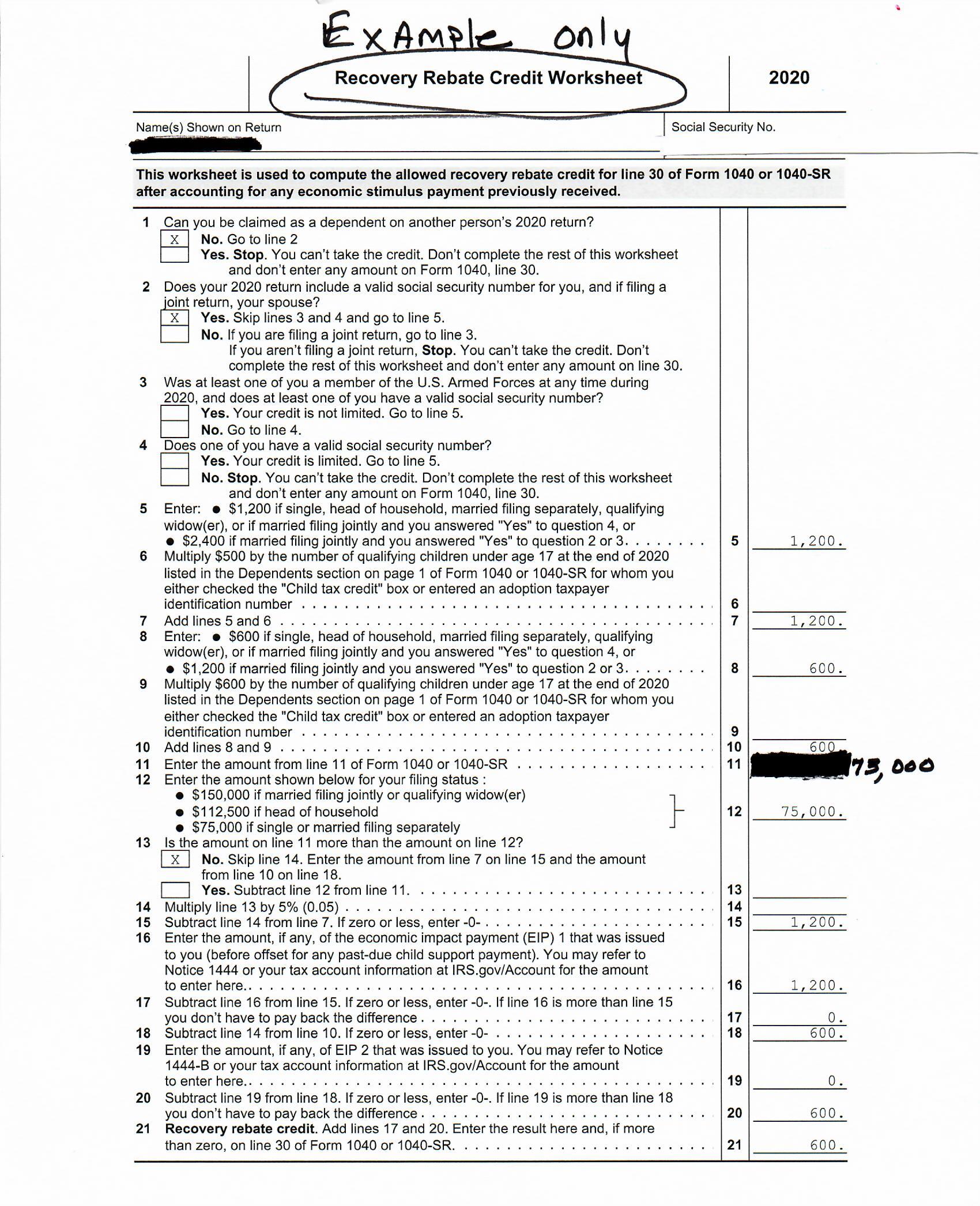

Verkko 13 tammik 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the

A Irs Rebate Recovery Forms the simplest form, is a cash refund provided to customers after they've bought a product or service. It's a highly effective tool that companies use to attract buyers, increase sales and advertise specific products.

Types of Irs Rebate Recovery Forms

IRS CP 12R Recovery Rebate Credit Overpayment

IRS CP 12R Recovery Rebate Credit Overpayment

Verkko IR 2021 15 January 15 2021 IRS Free File online tax preparation products available at no charge launched today giving taxpayers an early opportunity to claim credits

Verkko 17 marrask 2023 nbsp 0183 32 2020 Recovery Rebate Credit file a tax return by May 17 2024 2021 Recovery Rebate Credit file a tax return by April 15 2025 Get free help

Cash Irs Rebate Recovery Forms

Cash Irs Rebate Recovery Forms are the simplest type of Irs Rebate Recovery Forms. Customers get a set amount of cash back after purchasing a item. These are typically for the most expensive products like electronics or appliances.

Mail-In Irs Rebate Recovery Forms

Mail-in Irs Rebate Recovery Forms are based on the requirement that customers present the proof of purchase in order to receive the money. They are a bit more involved but offer huge savings.

Instant Irs Rebate Recovery Forms

Instant Irs Rebate Recovery Forms will be applied at moment of sale, cutting your purchase cost instantly. Customers don't have to wait until they can save by using this method.

How Irs Rebate Recovery Forms Work

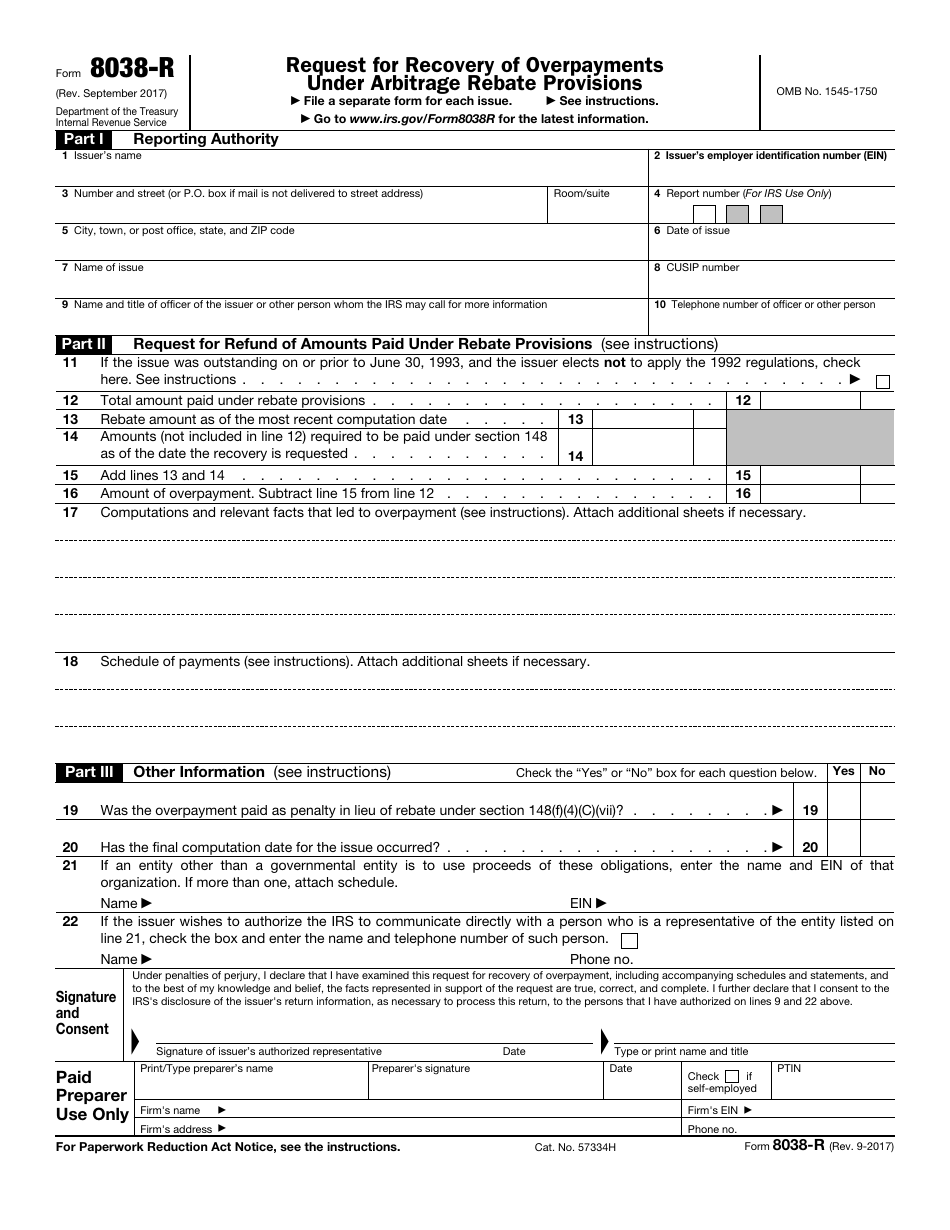

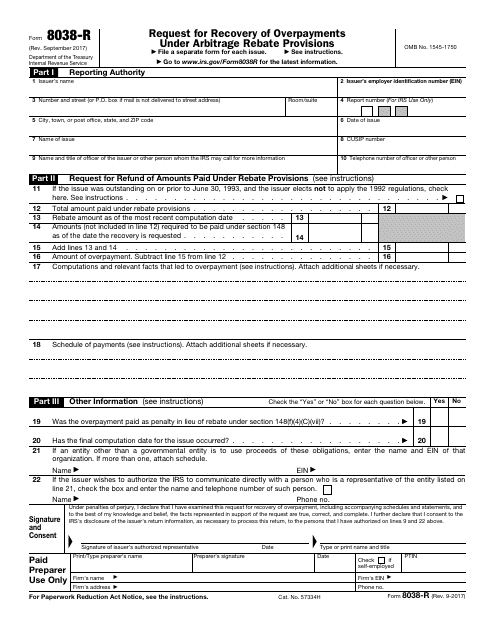

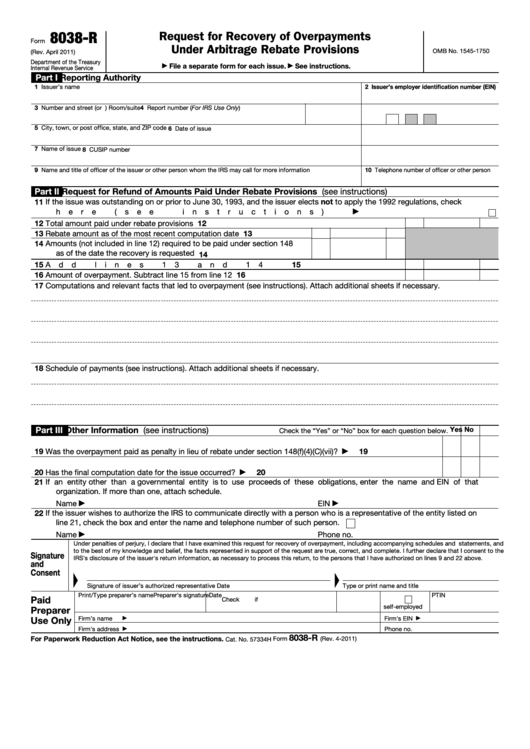

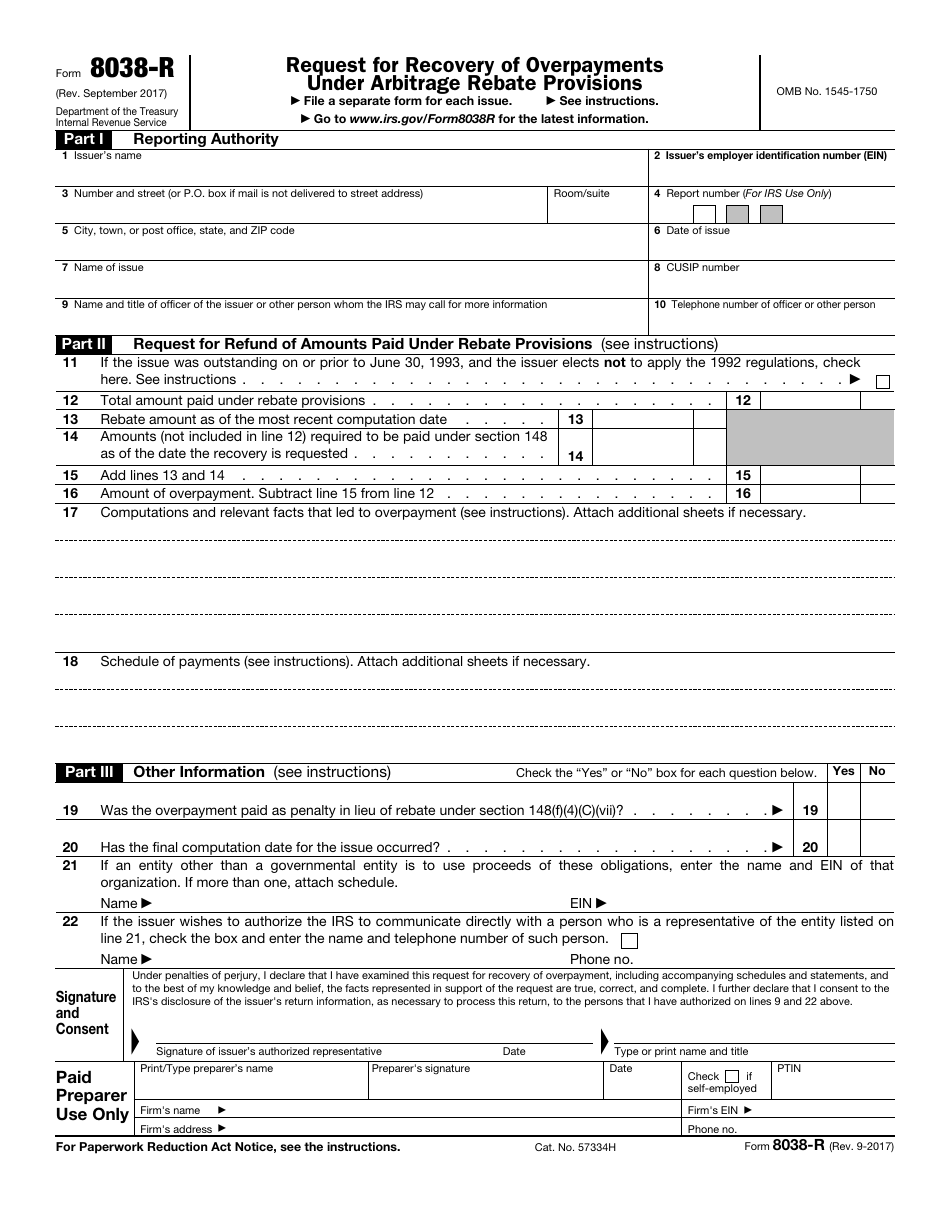

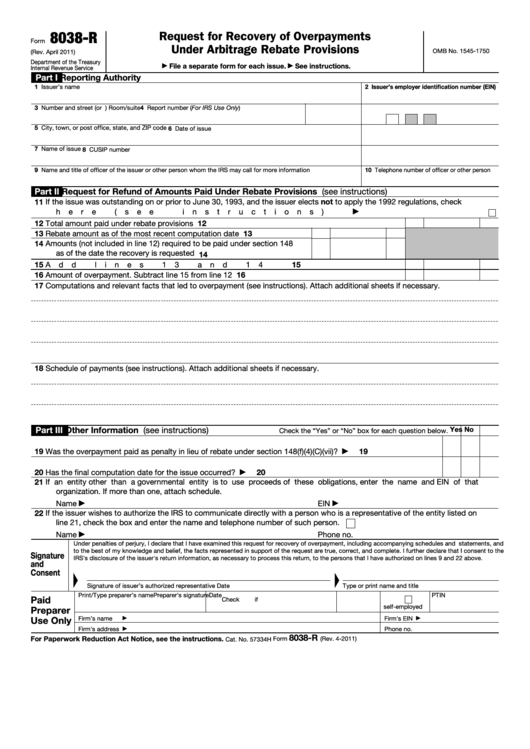

Form 8038 R Request For Recovery Of Overpayments Under Arbitrage

Form 8038 R Request For Recovery Of Overpayments Under Arbitrage

Verkko The 2020 Recovery Rebate Credit RRC is established under the CARES Act If you didn t receive the full amount of the recovery rebate credit as EIPs you may be able

The Irs Rebate Recovery Forms Process

The procedure typically consists of a handful of simple steps:

-

Purchase the item: First you purchase the product in the same way you would normally.

-

Fill in the Irs Rebate Recovery Forms form: You'll need to supply some details including your address, name, as well as the details of your purchase to take advantage of your Irs Rebate Recovery Forms.

-

Complete the Irs Rebate Recovery Forms The Irs Rebate Recovery Forms must be submitted in accordance with the kind of Irs Rebate Recovery Forms you might need to send in a form, or upload it online.

-

Wait for the company's approval: They will scrutinize your submission to make sure it is in line with the guidelines and conditions of the Irs Rebate Recovery Forms.

-

Accept your Irs Rebate Recovery Forms: Once approved, you'll receive your refund either through check, prepaid card, or a different method as specified by the offer.

Pros and Cons of Irs Rebate Recovery Forms

Advantages

-

Cost Savings Irs Rebate Recovery Forms can substantially cut the price you pay for products.

-

Promotional Offers They encourage customers in trying new products or brands.

-

Accelerate Sales Irs Rebate Recovery Forms can increase companies' sales and market share.

Disadvantages

-

Complexity The mail-in Irs Rebate Recovery Forms particularly are often time-consuming and tedious.

-

Day of Expiration Many Irs Rebate Recovery Forms are subject to deadlines for submission.

-

A risk of not being paid Certain customers could have their Irs Rebate Recovery Forms delayed if they don't observe the rules exactly.

Download Irs Rebate Recovery Forms

Download Irs Rebate Recovery Forms

FAQs

1. Are Irs Rebate Recovery Forms similar to discounts? No, the Irs Rebate Recovery Forms will be only a partial reimbursement following the purchase whereas discounts will reduce the price of the purchase at the moment of sale.

2. Are there multiple Irs Rebate Recovery Forms I can get on the same product What is the best way to do it? It's contingent on conditions in the Irs Rebate Recovery Forms deals and product's admissibility. Certain companies may permit it, but some will not.

3. How long does it take to receive an Irs Rebate Recovery Forms? The amount of time differs, but it can last from a few weeks until a few months to receive your Irs Rebate Recovery Forms.

4. Do I have to pay taxes with respect to Irs Rebate Recovery Forms sums? the majority of circumstances, Irs Rebate Recovery Forms amounts are not considered taxable income.

5. Should I be able to trust Irs Rebate Recovery Forms offers from brands that aren't well-known Consider doing some research and ensure that the business offering the Irs Rebate Recovery Forms is legitimate prior to making an purchase.

How Do I Claim The Recovery Rebate Credit On My Ta

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Check more sample of Irs Rebate Recovery Forms below

2022 Irs Recovery Rebate Credit Worksheet Rebate2022

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

IRS Form 8038 R Download Fillable PDF Or Fill Online Request For

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

1040 EF Message 0006 Recovery Rebate Credit Drake20

Fillable Form 8038 R Request For Recovery Of Overpayments Under

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Verkko 13 tammik 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-d...

Verkko 17 helmik 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible for the credit If

Verkko 13 tammik 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the

Verkko 17 helmik 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible for the credit If

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

1040 EF Message 0006 Recovery Rebate Credit Drake20

Fillable Form 8038 R Request For Recovery Of Overpayments Under

Who could Qualify For 2nd Stimulus

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial