In this day and age of consuming every person loves a great deal. One way to make significant savings on your purchases is by using Irs Rebate Recovery Forms. The use of Irs Rebate Recovery Forms is a method that retailers and manufacturers use to give customers a part reimbursement on their purchases following the time they've completed them. In this article, we will look into the world of Irs Rebate Recovery Forms, looking at the nature of them and how they work and the best way to increase your savings through these efficient incentives.

Get Latest Irs Rebate Recovery Form Below

Irs Rebate Recovery Form

Irs Rebate Recovery Form - Irs Rebate Recovery Form, Irs Forms 2021 Recovery Rebate Credit Worksheet, What Is The Irs Recovery Rebate Credit

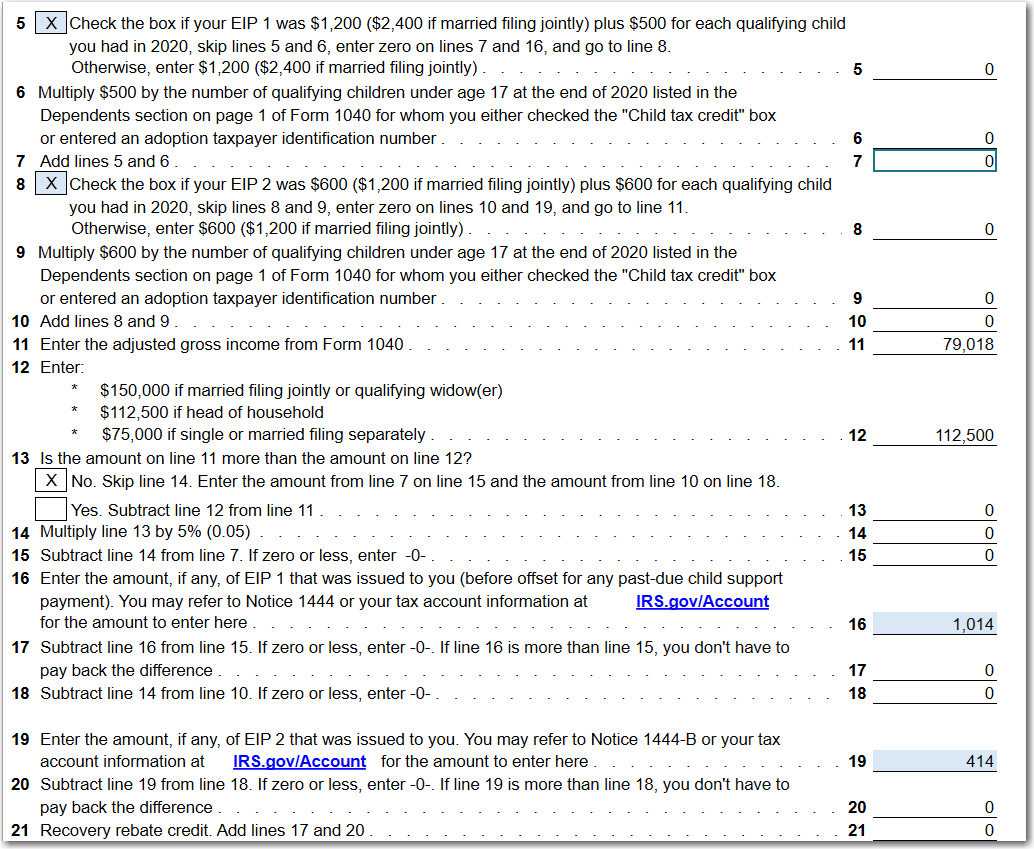

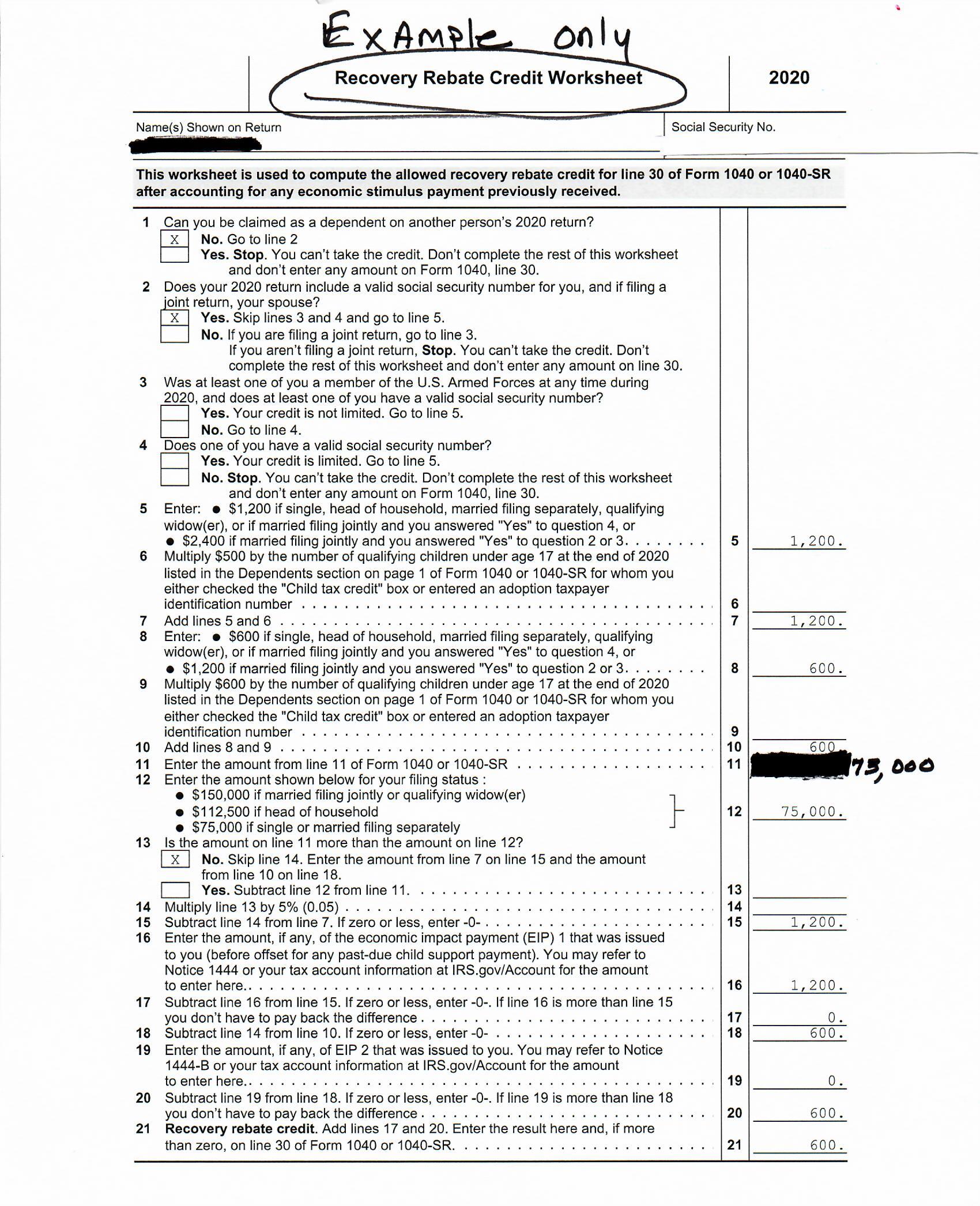

Web 10 Dez 2021 nbsp 0183 32 To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form

Web 13 Jan 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and

A Irs Rebate Recovery Form at its most basic description, is a refund offered to a customer after purchasing a certain product or service. It's an effective way that businesses use to draw customers, boost sales, and even promote certain products.

Types of Irs Rebate Recovery Form

IRS CP 12R Recovery Rebate Credit Overpayment

IRS CP 12R Recovery Rebate Credit Overpayment

Web 13 Jan 2022 nbsp 0183 32 Compute the 2021 Recovery Rebate Credit amount using tax preparation software or the line 30 worksheet found in 2021 Form 1040 and Form 1040 SR

Web 10 Dez 2021 nbsp 0183 32 You must file a 2020 tax return to claim a Recovery Rebate Credit even if you don t usually file a tax return The Recovery Rebate Credit Worksheet in the 2020

Cash Irs Rebate Recovery Form

Cash Irs Rebate Recovery Form are a simple type of Irs Rebate Recovery Form. The customer receives a particular amount of money back upon buying a product. These are typically applied to the most expensive products like electronics or appliances.

Mail-In Irs Rebate Recovery Form

Mail-in Irs Rebate Recovery Form require the customer to send in proof of purchase in order to receive their refund. They're more complicated, but they can provide substantial savings.

Instant Irs Rebate Recovery Form

Instant Irs Rebate Recovery Form are applied right at the point of sale, reducing the purchase price immediately. Customers don't need to wait for savings in this manner.

How Irs Rebate Recovery Form Work

How Do I Claim The Recovery Rebate Credit On My Ta

How Do I Claim The Recovery Rebate Credit On My Ta

Web IR 2021 15 January 15 2021 WASHINGTON IRS Free File online tax preparation products available at no charge launched today giving taxpayers an early opportunity

The Irs Rebate Recovery Form Process

The process typically involves few simple steps:

-

Buy the product: At first, you purchase the item as you normally would.

-

Complete this Irs Rebate Recovery Form forms: The Irs Rebate Recovery Form form will need provide certain information, such as your address, name, and details about your purchase, in order in order to apply for your Irs Rebate Recovery Form.

-

Complete the Irs Rebate Recovery Form In accordance with the type of Irs Rebate Recovery Form the recipient may be required to send in a form, or submit it online.

-

Wait for approval: The company will look over your submission to ensure it meets the guidelines and conditions of the Irs Rebate Recovery Form.

-

Pay your Irs Rebate Recovery Form Once you've received your approval, you'll receive your cash back either through check, prepaid card, or by another method specified by the offer.

Pros and Cons of Irs Rebate Recovery Form

Advantages

-

Cost savings Irs Rebate Recovery Form are a great way to lower the cost you pay for an item.

-

Promotional Offers The aim is to encourage customers to explore new products or brands.

-

boost sales A Irs Rebate Recovery Form program can boost a company's sales and market share.

Disadvantages

-

Complexity: Mail-in Irs Rebate Recovery Form, in particular the case of HTML0, can be a hassle and long-winded.

-

Deadlines for Expiration A lot of Irs Rebate Recovery Form have certain deadlines for submitting.

-

Risque of Non-Payment Certain customers could not be able to receive their Irs Rebate Recovery Form if they do not adhere to the guidelines exactly.

Download Irs Rebate Recovery Form

Download Irs Rebate Recovery Form

FAQs

1. Are Irs Rebate Recovery Form the same as discounts? No, Irs Rebate Recovery Form require partial reimbursement after purchase, whereas discounts reduce your purchase cost at time of sale.

2. Are there any Irs Rebate Recovery Form that I can use on the same item It's dependent on the terms of the Irs Rebate Recovery Form deals and product's eligibility. Some companies will allow the use of multiple Irs Rebate Recovery Form, whereas other won't.

3. What is the time frame to get a Irs Rebate Recovery Form? The amount of time varies, but it can be from several weeks to few months to receive your Irs Rebate Recovery Form.

4. Do I need to pay taxes for Irs Rebate Recovery Form sums? the majority of circumstances, Irs Rebate Recovery Form amounts are not considered taxable income.

5. Can I trust Irs Rebate Recovery Form offers from lesser-known brands It is essential to investigate and verify that the brand giving the Irs Rebate Recovery Form is trustworthy prior to making any purchase.

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

Check more sample of Irs Rebate Recovery Form below

2022 Irs Recovery Rebate Credit Worksheet Rebate2022

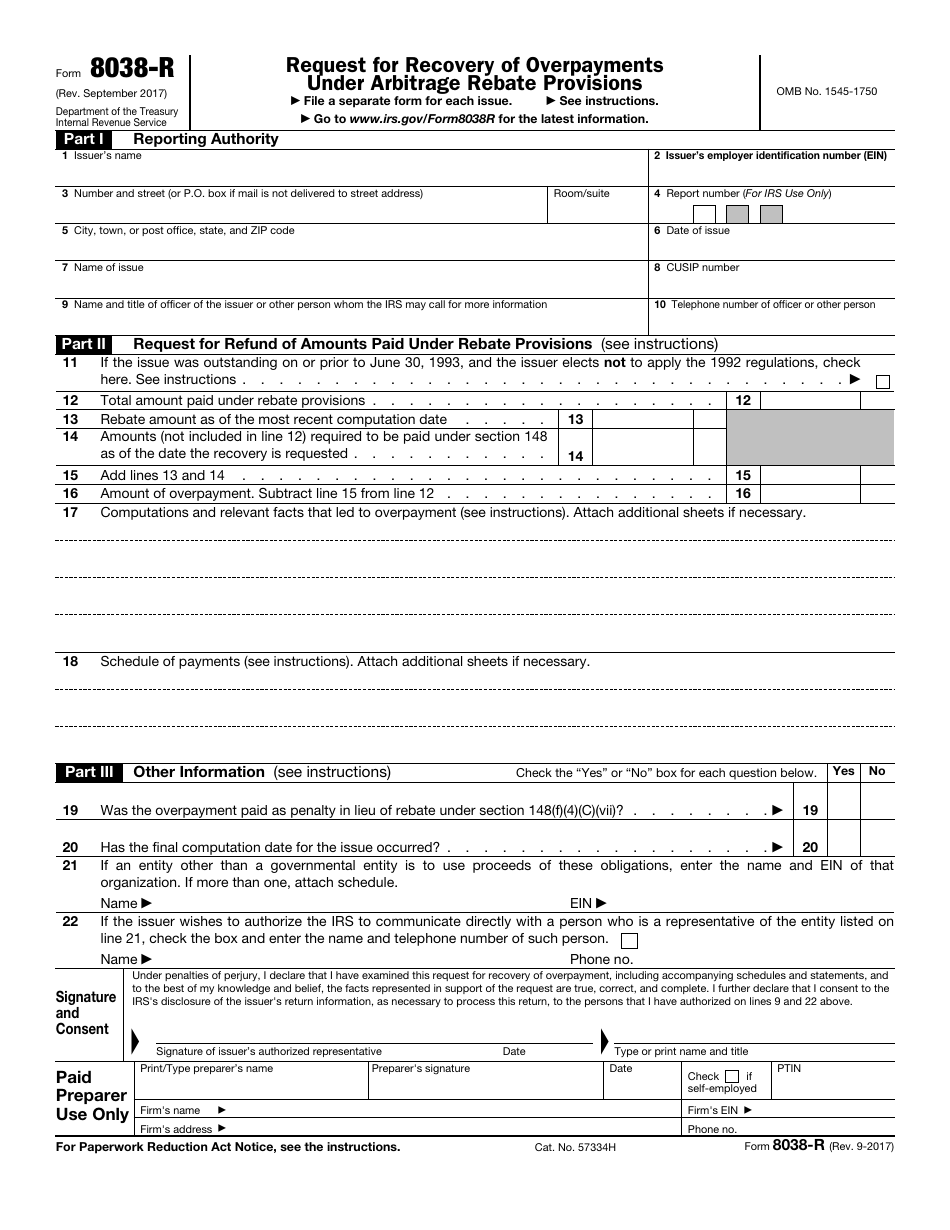

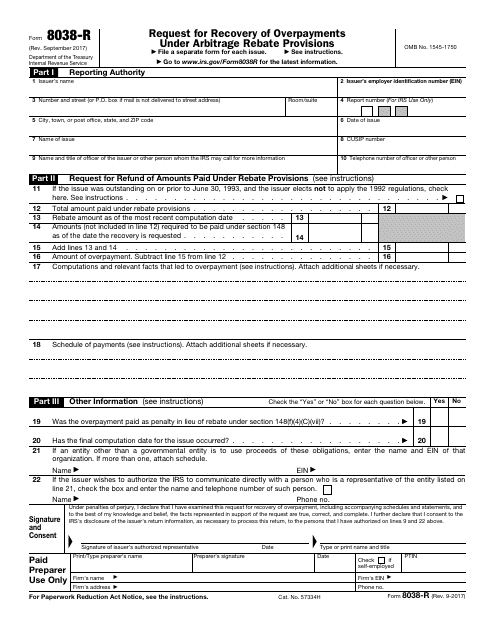

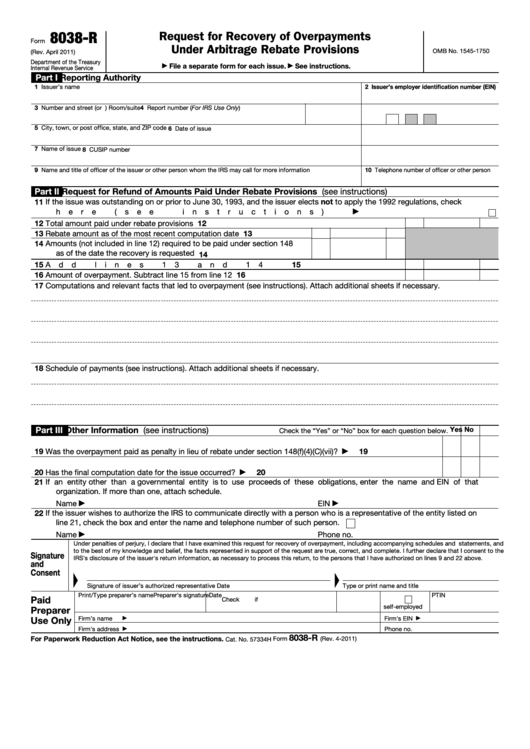

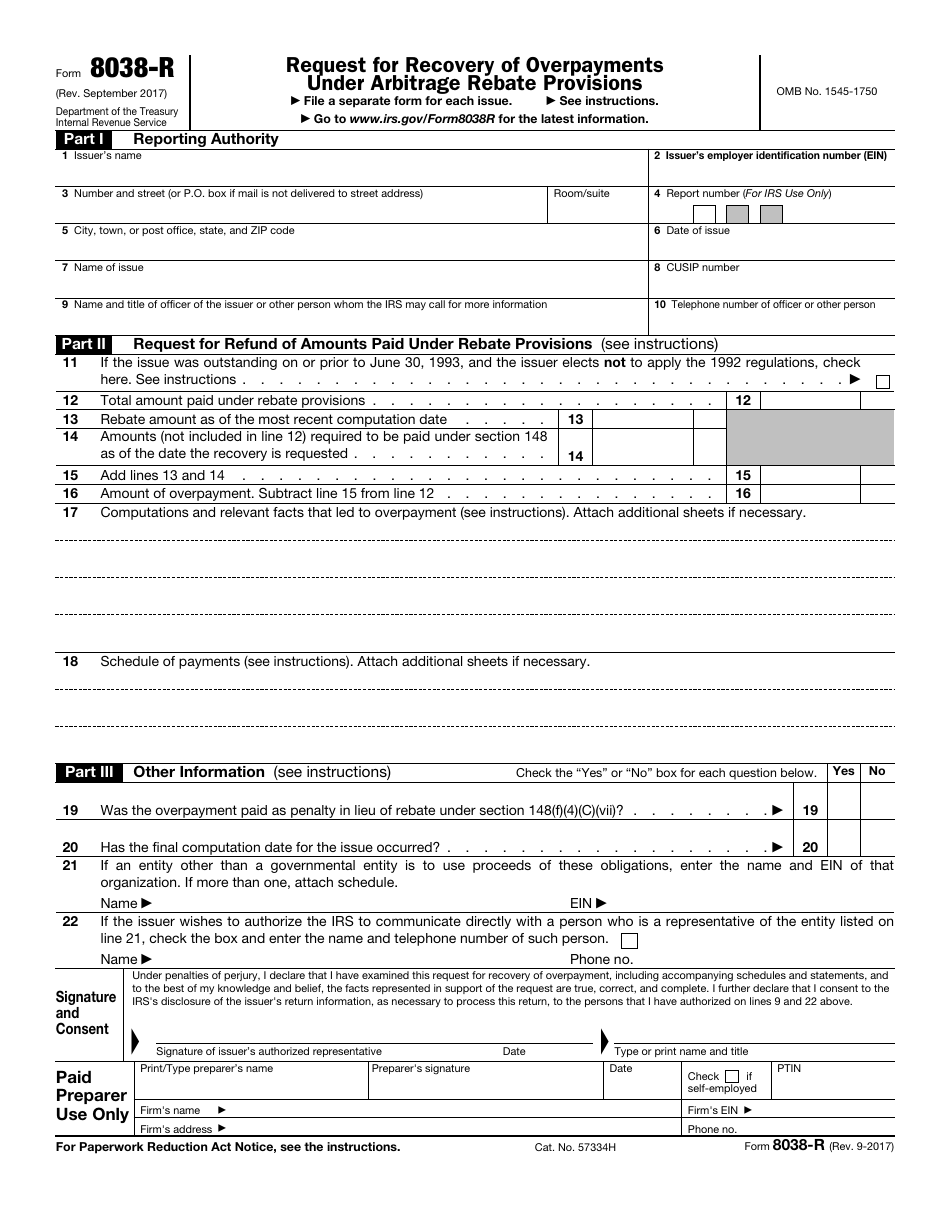

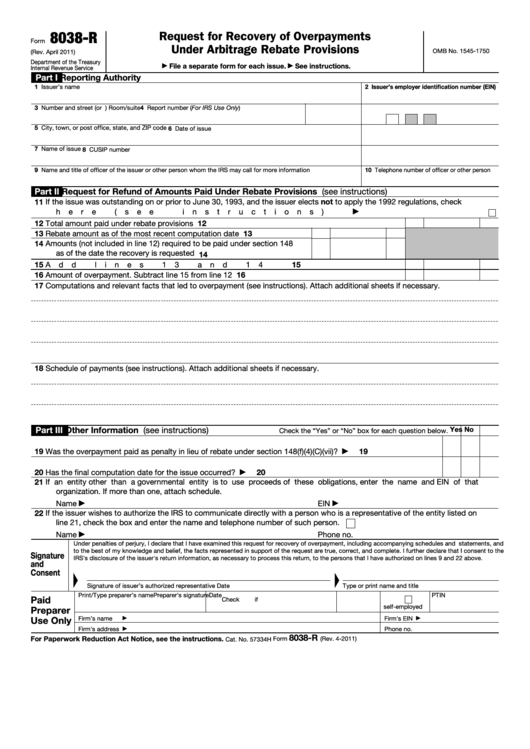

Form 8038 R Request For Recovery Of Overpayments Under Arbitrage

IRS Form 8038 R Download Fillable PDF Or Fill Online Request For

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

Fillable Form 8038 R Request For Recovery Of Overpayments Under

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 Jan 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-h...

Web 13 Jan 2022 nbsp 0183 32 Enter the amount on the Refundable Credits section of the Form 1040 X and include quot Recovery Rebate Credit quot in the Explanation of Changes section If you filed

Web 13 Jan 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and

Web 13 Jan 2022 nbsp 0183 32 Enter the amount on the Refundable Credits section of the Form 1040 X and include quot Recovery Rebate Credit quot in the Explanation of Changes section If you filed

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

Form 8038 R Request For Recovery Of Overpayments Under Arbitrage

Fillable Form 8038 R Request For Recovery Of Overpayments Under

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Free File 1040 Form 2021 Recovery Rebate

1040 EF Message 0006 Recovery Rebate Credit Drake20

1040 EF Message 0006 Recovery Rebate Credit Drake20

Who could Qualify For 2nd Stimulus