In today's consumer-driven world, everyone loves a good deal. One way to gain significant savings when you shop is with Irs Rebate Recovery Credit Forms. They are a form of marketing used by manufacturers and retailers to offer consumers a partial return on their purchases once they've purchased them. In this article, we'll investigate the world of Irs Rebate Recovery Credit Forms. We will explore what they are and how they function, and the best way to increase your savings using these low-cost incentives.

Get Latest Irs Rebate Recovery Credit Form Below

Irs Rebate Recovery Credit Form

Irs Rebate Recovery Credit Form - Irs Recovery Rebate Credit Form, Irs Forms 2021 Recovery Rebate Credit Worksheet, What Is The Irs Recovery Rebate Credit

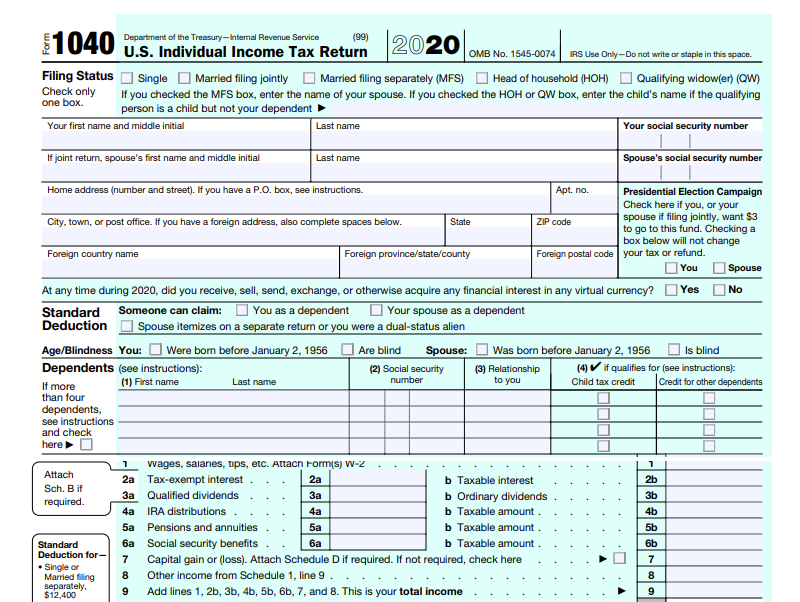

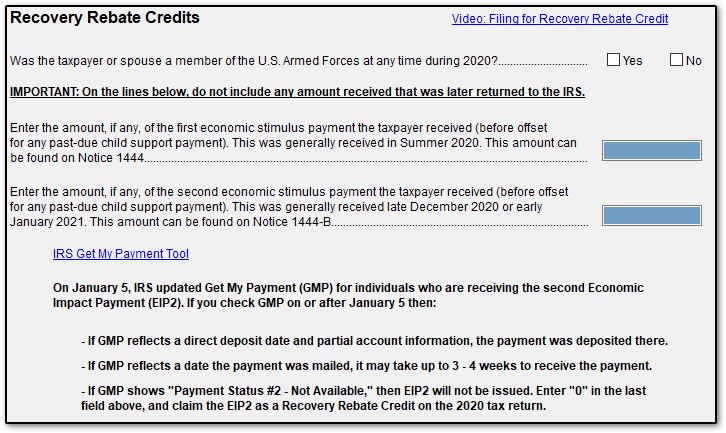

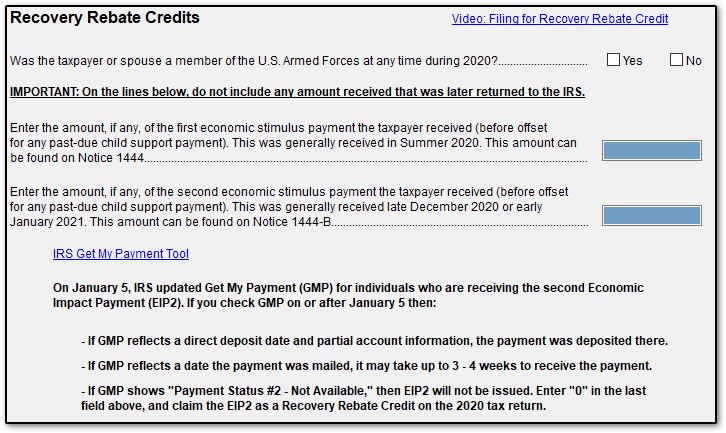

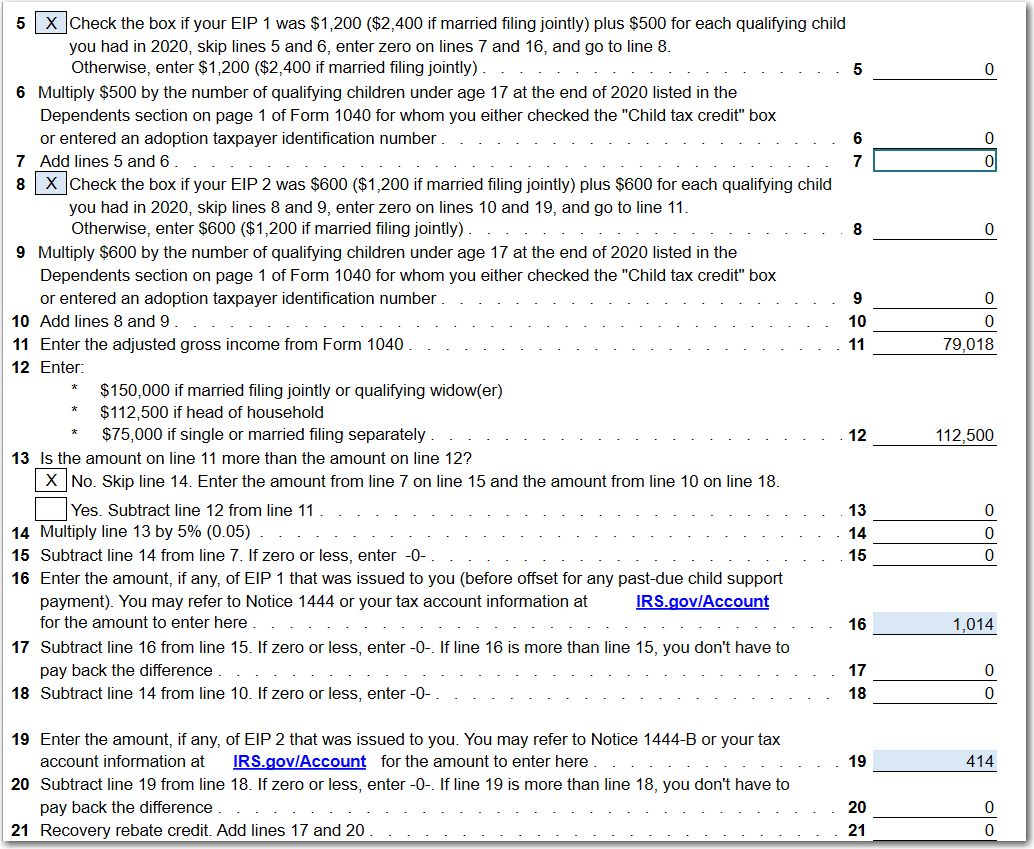

You received 600 plus 600 for each qualifying child you had in 2020 or You re filing a joint return for 2020 and together you and your spouse received 1 200 plus 600 for

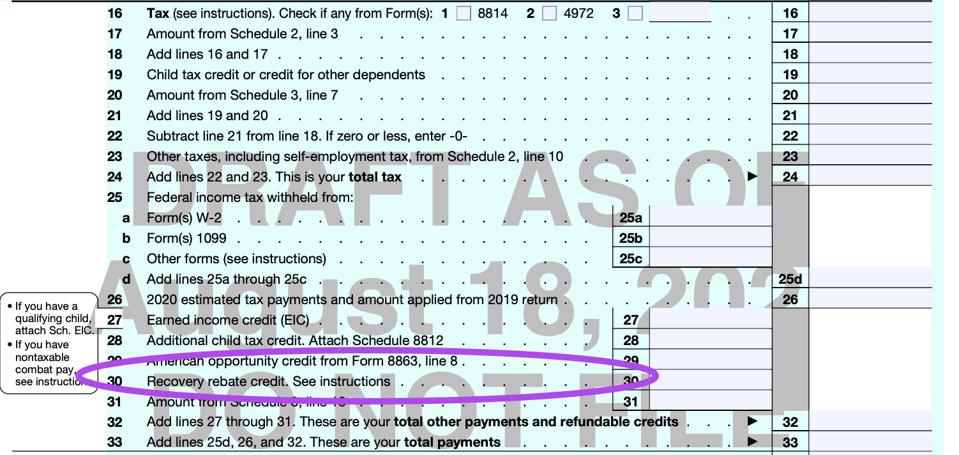

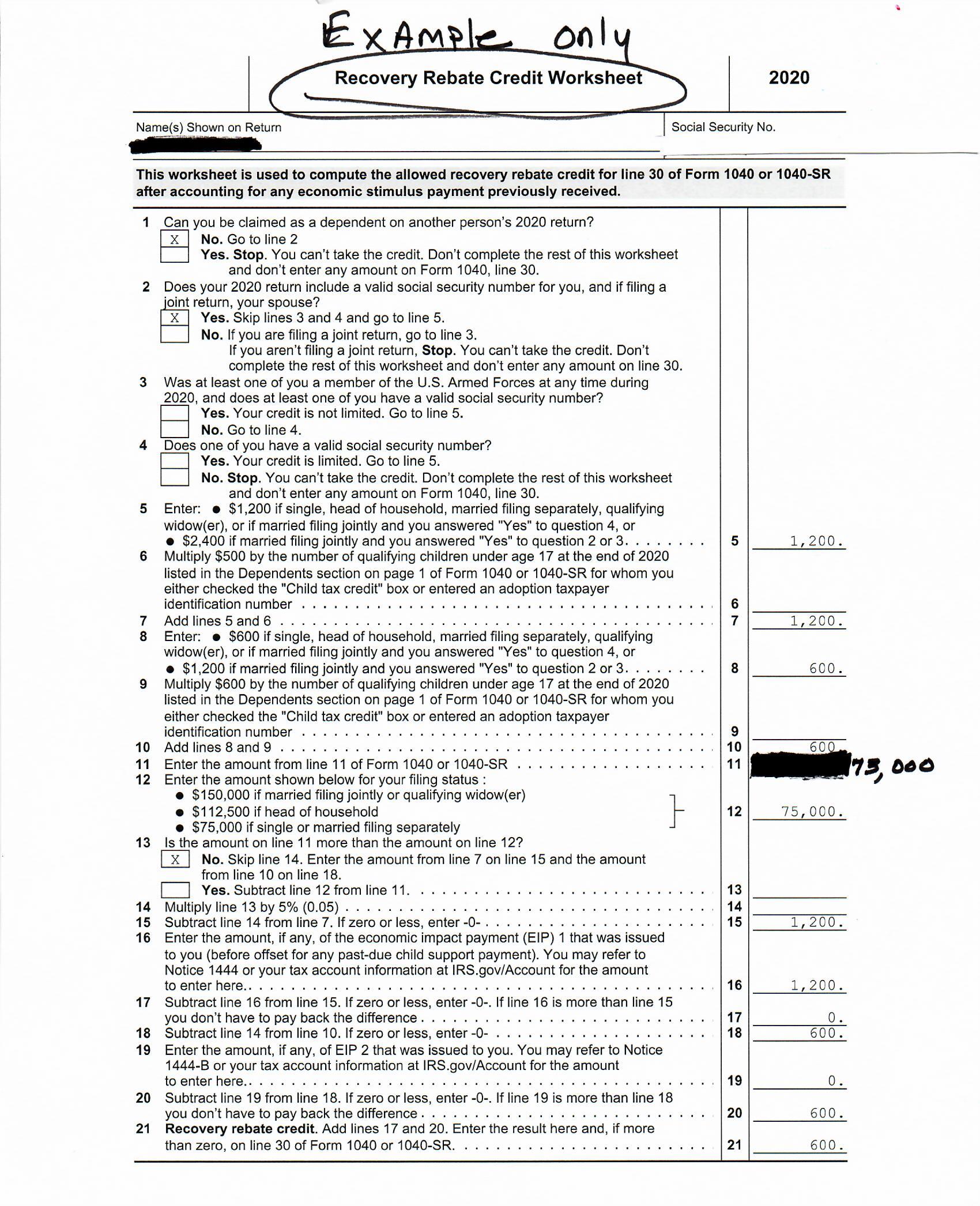

The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit Your

A Irs Rebate Recovery Credit Form is, in its most basic definition, is a refund offered to a customer who has purchased a particular product or service. It's a powerful method used by companies to attract customers, increase sales, and to promote certain products.

Types of Irs Rebate Recovery Credit Form

IRS CP 12R Recovery Rebate Credit Overpayment

IRS CP 12R Recovery Rebate Credit Overpayment

A10 The only way to get a Recovery Rebate Credit is to file a 2020 tax return even if you are otherwise not required to file a tax return The Recovery Rebate

2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form

Cash Irs Rebate Recovery Credit Form

Cash Irs Rebate Recovery Credit Form are a simple kind of Irs Rebate Recovery Credit Form. Customers receive a certain amount back in cash after buying a product. These are usually used for products that are expensive, such as electronics or appliances.

Mail-In Irs Rebate Recovery Credit Form

Mail-in Irs Rebate Recovery Credit Form require the customer to present proof of purchase in order to receive their cash back. They're a bit more involved but offer significant savings.

Instant Irs Rebate Recovery Credit Form

Instant Irs Rebate Recovery Credit Form are made at the moment of sale, cutting the purchase price immediately. Customers do not have to wait around for savings by using this method.

How Irs Rebate Recovery Credit Form Work

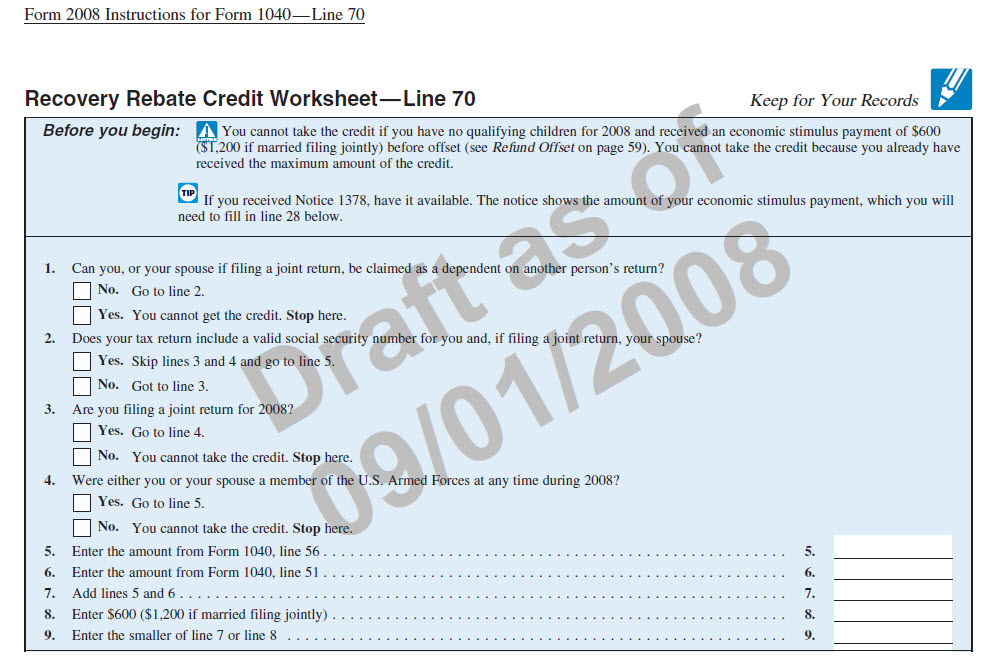

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

To claim a recovery rebate credit taxpayers will need to reconcile their economic impact payment with any recovery rebate credit amount for which they are

The Irs Rebate Recovery Credit Form Process

The process typically involves a handful of simple steps:

-

Buy the product: At first purchase the product like you normally do.

-

Complete this Irs Rebate Recovery Credit Form form: You'll need provide certain information like your name, address, and purchase details, to get your Irs Rebate Recovery Credit Form.

-

Make sure you submit the Irs Rebate Recovery Credit Form If you want to submit the Irs Rebate Recovery Credit Form, based on the nature of Irs Rebate Recovery Credit Form, you may need to mail a Irs Rebate Recovery Credit Form form in or send it via the internet.

-

Wait for approval: The company will look over your submission to ensure it meets the rules and regulations of the Irs Rebate Recovery Credit Form.

-

You will receive your Irs Rebate Recovery Credit Form Once it's approved, the amount you receive will be either by check, prepaid card, or through another method that is specified in the offer.

Pros and Cons of Irs Rebate Recovery Credit Form

Advantages

-

Cost savings Irs Rebate Recovery Credit Form could significantly reduce the price you pay for a product.

-

Promotional Offers Customers are enticed to experiment with new products, or brands.

-

Enhance Sales Irs Rebate Recovery Credit Form can help boost the sales of a company as well as its market share.

Disadvantages

-

Complexity The mail-in Irs Rebate Recovery Credit Form particularly is a time-consuming process and long-winded.

-

Time Limits for Irs Rebate Recovery Credit Form A majority of Irs Rebate Recovery Credit Form have certain deadlines for submitting.

-

Risque of Non-Payment Some customers might not be able to receive their Irs Rebate Recovery Credit Form if they don't observe the rules precisely.

Download Irs Rebate Recovery Credit Form

Download Irs Rebate Recovery Credit Form

FAQs

1. Are Irs Rebate Recovery Credit Form the same as discounts? Not necessarily, as Irs Rebate Recovery Credit Form are a partial refund after the purchase, but discounts can reduce their price at moment of sale.

2. Are there any Irs Rebate Recovery Credit Form that I can use for the same product It is contingent on the conditions in the Irs Rebate Recovery Credit Form incentives and the specific product's quality and eligibility. Certain companies allow it, and some don't.

3. How long will it take to receive the Irs Rebate Recovery Credit Form? The timing can vary, but typically it will be from several weeks to couple of months for you to receive your Irs Rebate Recovery Credit Form.

4. Do I need to pay tax regarding Irs Rebate Recovery Credit Form montants? the majority of situations, Irs Rebate Recovery Credit Form amounts are not considered to be taxable income.

5. Do I have confidence in Irs Rebate Recovery Credit Form offers from lesser-known brands it is crucial to conduct research and verify that the brand which is providing the Irs Rebate Recovery Credit Form is reputable before making any purchase.

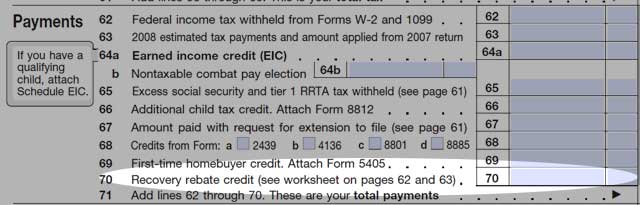

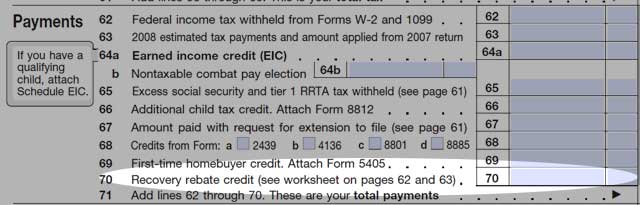

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Check more sample of Irs Rebate Recovery Credit Form below

Tax Time Guide Didn t Get Economic Impact Payments Check Eligibility

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

1040 EF Message 0006 Recovery Rebate Credit Drake20

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

Free File 1040 Form 2021 Recovery Rebate

https://www.irs.gov/newsroom/2021-recovery-rebate...

The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit Your

https://www.irs.gov/newsroom/2021-recovery-rebate...

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit Your

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

1040 EF Message 0006 Recovery Rebate Credit Drake20

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

Free File 1040 Form 2021 Recovery Rebate

Recovery Rebate Credit Worksheet ATX Line 30 COVID 19 ATX Community

Irs Form To Claim Recovery Rebate Credit Recovery Rebate

Irs Form To Claim Recovery Rebate Credit Recovery Rebate

Who could Qualify For 2nd Stimulus