In today's world of consumerism everybody loves a good deal. One way to make substantial savings in your purchase is through Irs Form 4506 T For Clean Vehicle Rebates. Irs Form 4506 T For Clean Vehicle Rebates are an effective marketing tactic used by manufacturers and retailers to provide customers with a portion of a refund for their purchases after they've taken them. In this article, we will dive into the world Irs Form 4506 T For Clean Vehicle Rebates, examining what they are as well as how they work and how you can maximise your savings through these efficient incentives.

Get Latest Irs Form 4506 T For Clean Vehicle Rebate Below

Irs Form 4506 T For Clean Vehicle Rebate

Irs Form 4506 T For Clean Vehicle Rebate -

Verkko 12 huhtik 2023 nbsp 0183 32 80 000 for vans sport utility vehicles and pickup trucks 55 000 for other vehicles The purchase of a new clean vehicle between 2009 and 2022 may

You may qualify for a clean vehicle tax credit up to 7 500 if you buy a new qualified plug in electric vehicle or fuel cell electric vehicle New requirements effective April 18 If you take possession of a new clean vehicle on or after April 18 2023 it must meet critical mineral and battery component requirements to qualify N 228 yt 228 lis 228 228

A Irs Form 4506 T For Clean Vehicle Rebate, in its simplest form, is a refund given to a client when they purchase a product or service. It's an effective method for businesses to entice customers, boost sales, or promote a specific product.

Types of Irs Form 4506 T For Clean Vehicle Rebate

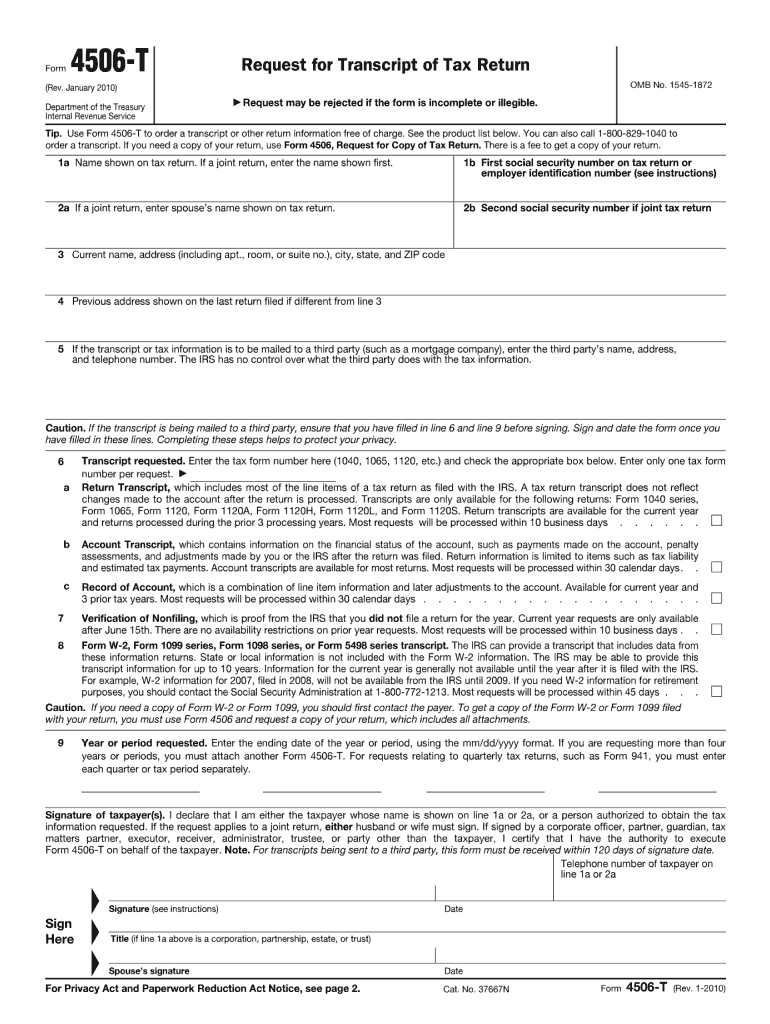

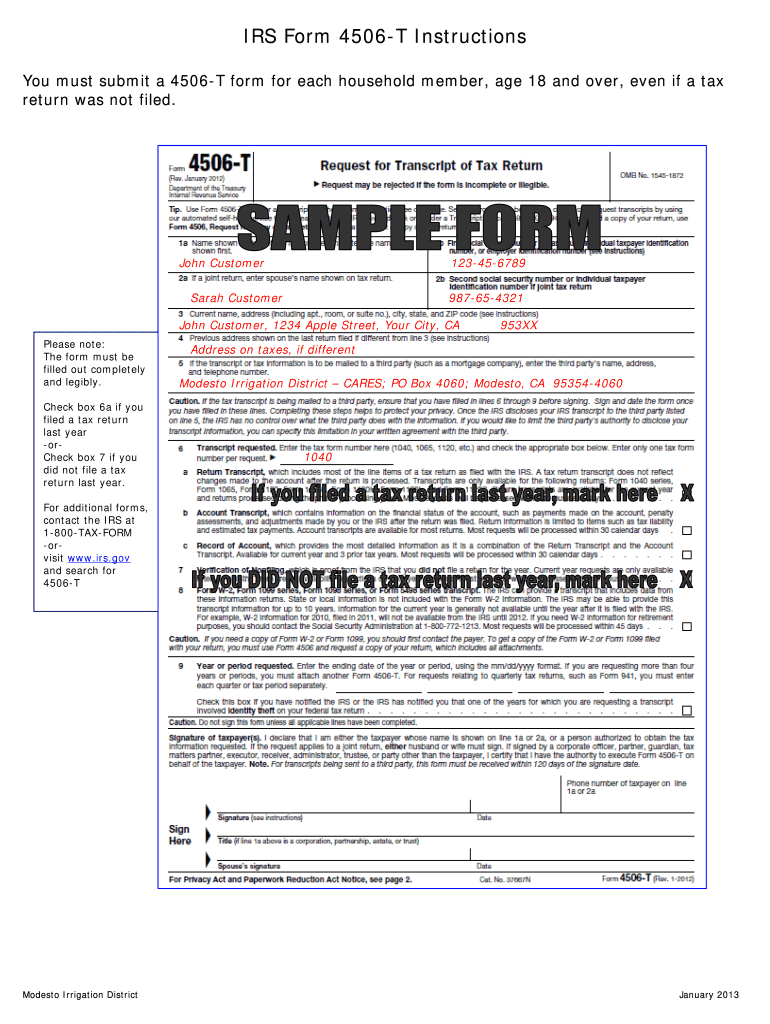

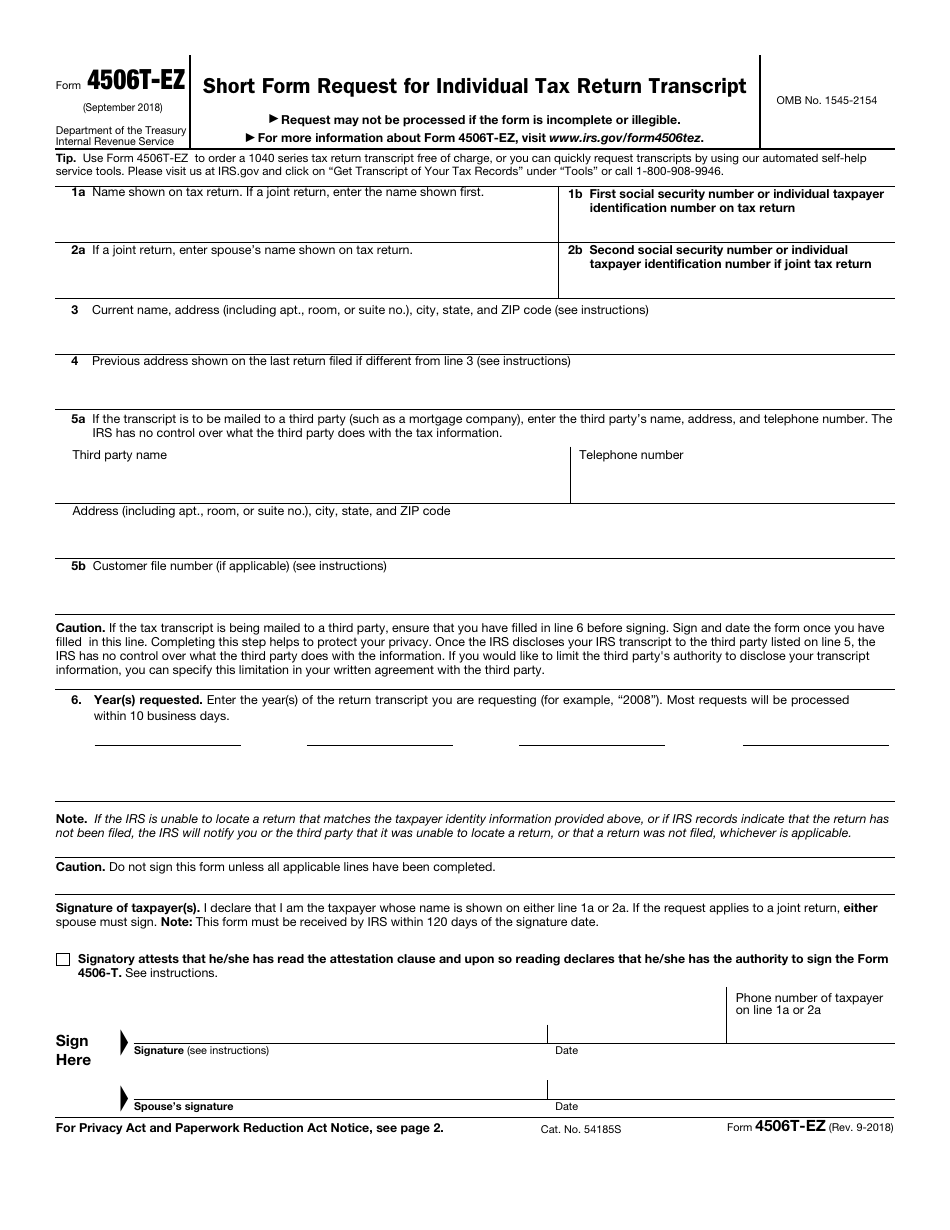

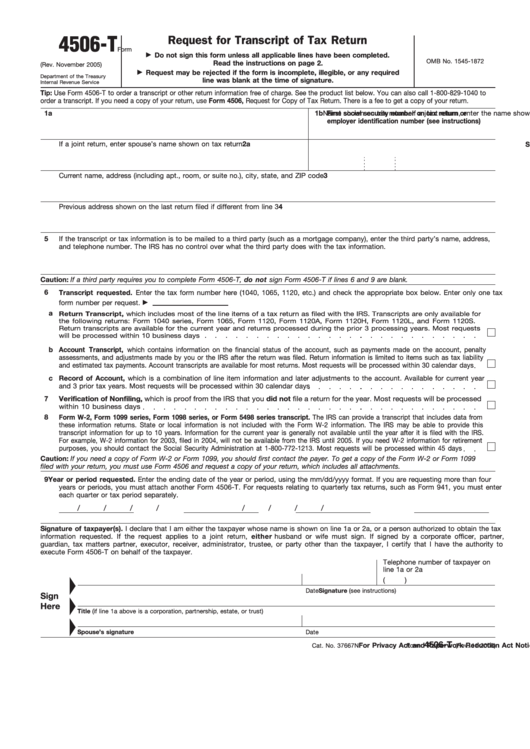

2010 Form IRS 4506 T Fill Online Printable Fillable Blank PdfFiller

2010 Form IRS 4506 T Fill Online Printable Fillable Blank PdfFiller

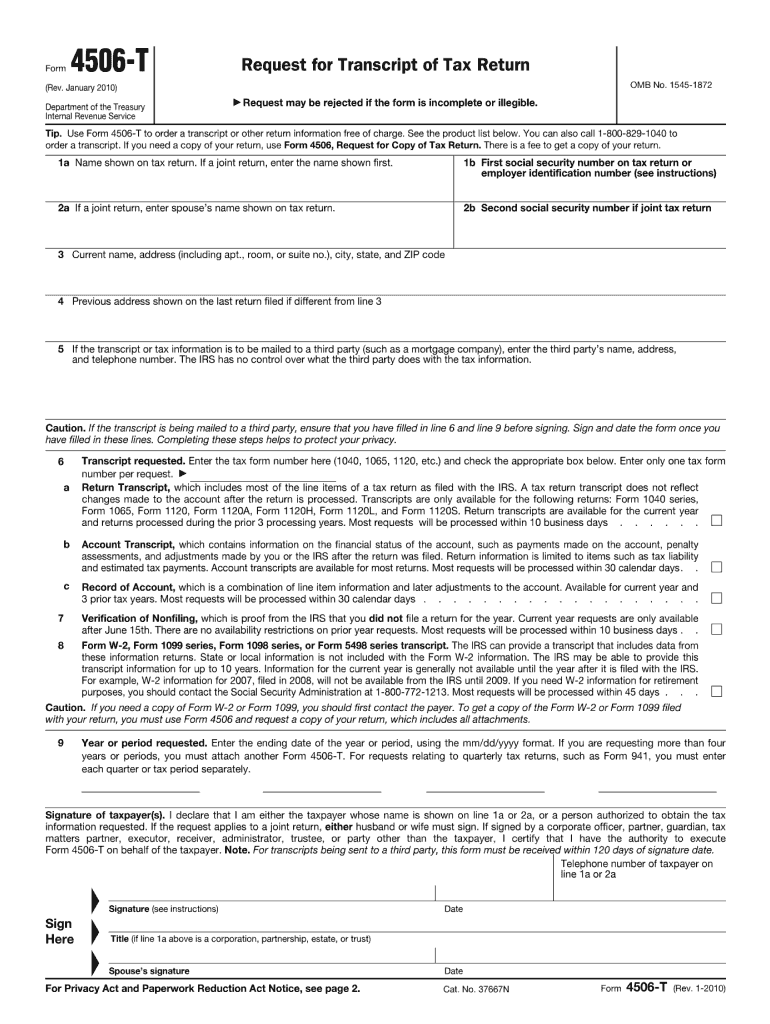

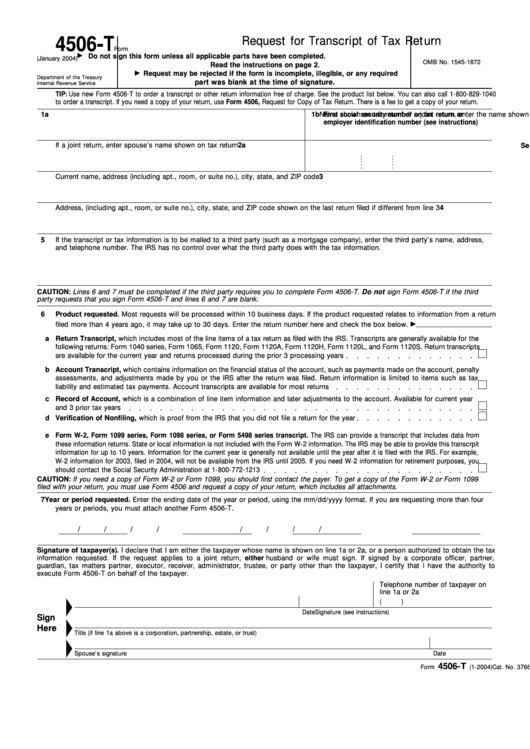

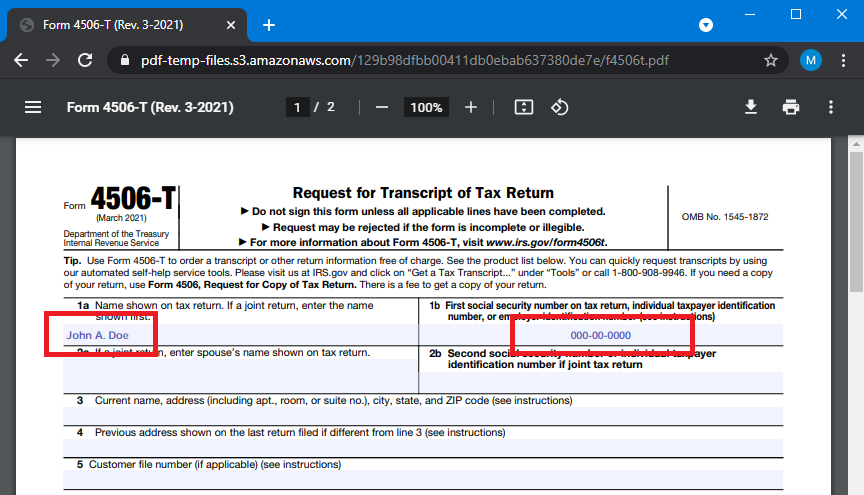

Verkko Use Form 4506 T to order a transcript or other return information free of charge See the product list below You can quickly request transcripts by using our automated self

Verkko 29 jouluk 2022 nbsp 0183 32 The Inflation Reduction Act of 2022 IRA makes several changes to the new clean vehicle credit for qualified plug in electric drive motor vehicles including

Cash Irs Form 4506 T For Clean Vehicle Rebate

Cash Irs Form 4506 T For Clean Vehicle Rebate are the most basic kind of Irs Form 4506 T For Clean Vehicle Rebate. Customers get a set amount back in cash after purchasing a particular item. This is often for expensive items such as electronics or appliances.

Mail-In Irs Form 4506 T For Clean Vehicle Rebate

Mail-in Irs Form 4506 T For Clean Vehicle Rebate require customers to present an evidence of purchase for their reimbursement. They're a little more involved but offer substantial savings.

Instant Irs Form 4506 T For Clean Vehicle Rebate

Instant Irs Form 4506 T For Clean Vehicle Rebate can be applied at the moment of sale, cutting the cost of purchase immediately. Customers don't have to wait for their savings with this type.

How Irs Form 4506 T For Clean Vehicle Rebate Work

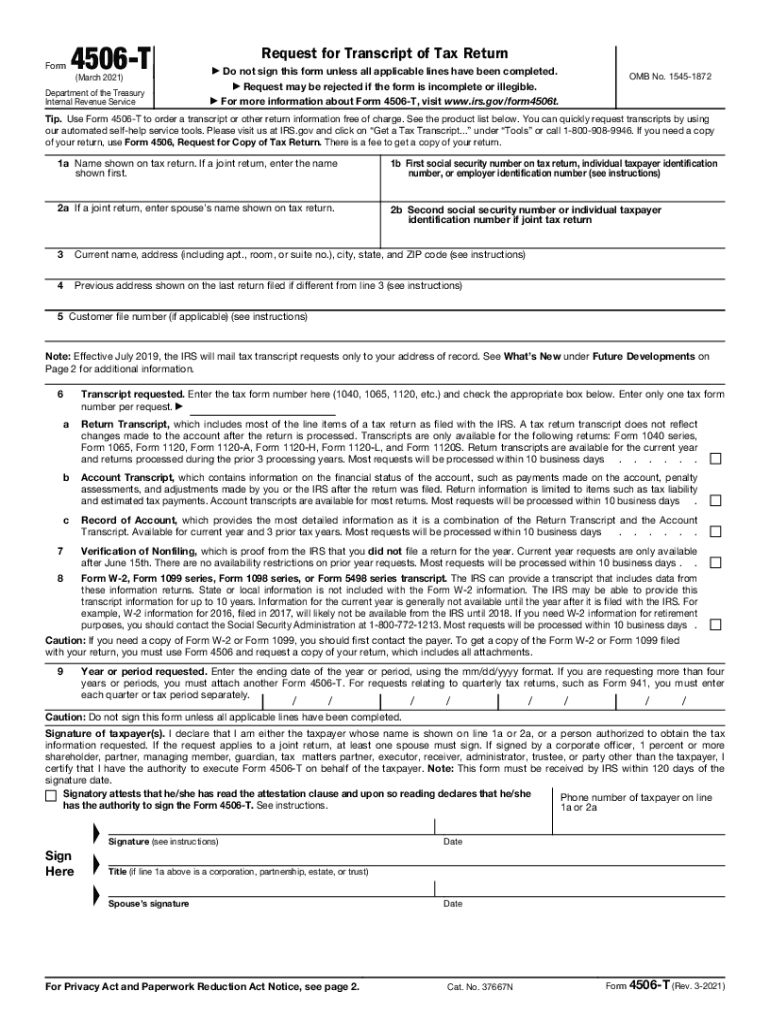

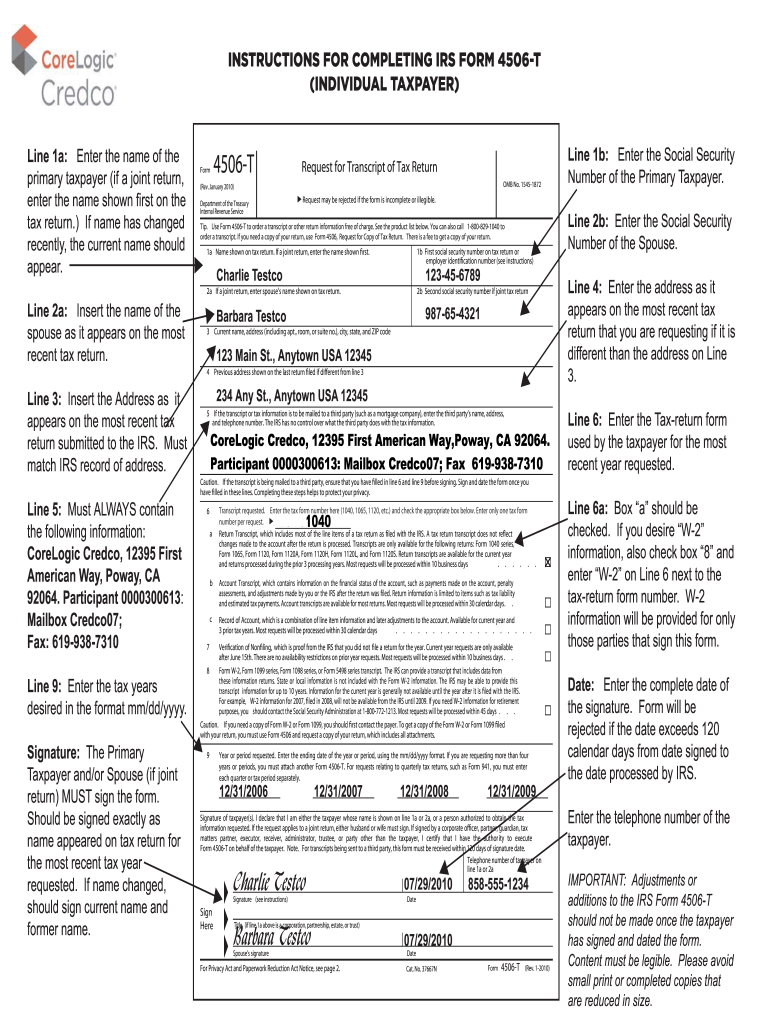

4506 T Fill Out Sign Online DocHub

4506 T Fill Out Sign Online DocHub

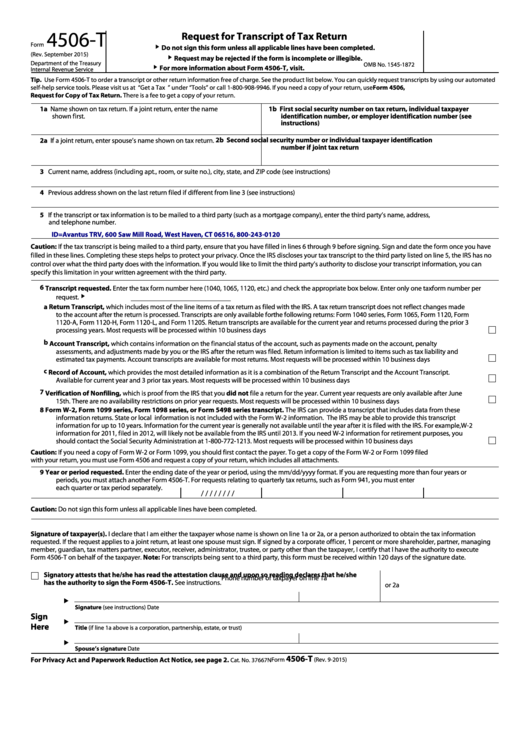

Verkko Standard rebate applicants selected for income verification must submit IRS Form 4506 C Request for Transcript of Tax Return as proof of income Increased Rebate

The Irs Form 4506 T For Clean Vehicle Rebate Process

It usually consists of a few easy steps:

-

Then, you purchase the product you buy the product just like you normally would.

-

Fill out the Irs Form 4506 T For Clean Vehicle Rebate request form. You'll need to supply some details like your name, address, and information about the purchase in order to receive your Irs Form 4506 T For Clean Vehicle Rebate.

-

Submit the Irs Form 4506 T For Clean Vehicle Rebate According to the type of Irs Form 4506 T For Clean Vehicle Rebate you could be required to fill out a form and mail it in or send it via the internet.

-

Wait for approval: The business will scrutinize your submission to make sure it is in line with the guidelines and conditions of the Irs Form 4506 T For Clean Vehicle Rebate.

-

Accept your Irs Form 4506 T For Clean Vehicle Rebate: Once approved, you'll get your refund, either by check, prepaid card or through a different method specified by the offer.

Pros and Cons of Irs Form 4506 T For Clean Vehicle Rebate

Advantages

-

Cost savings Irs Form 4506 T For Clean Vehicle Rebate are a great way to decrease the price for products.

-

Promotional Deals These promotions encourage consumers to try new products and brands.

-

Accelerate Sales: Irs Form 4506 T For Clean Vehicle Rebate can boost sales for a company and also increase market share.

Disadvantages

-

Complexity Pay-in Irs Form 4506 T For Clean Vehicle Rebate via mail, particularly the case of HTML0, can be a hassle and take a long time to complete.

-

Extension Dates: Many Irs Form 4506 T For Clean Vehicle Rebate have deadlines for submission.

-

Risque of Non-Payment Certain customers could lose their Irs Form 4506 T For Clean Vehicle Rebate in the event that they don't adhere to the requirements exactly.

Download Irs Form 4506 T For Clean Vehicle Rebate

Download Irs Form 4506 T For Clean Vehicle Rebate

FAQs

1. Are Irs Form 4506 T For Clean Vehicle Rebate similar to discounts? No, the Irs Form 4506 T For Clean Vehicle Rebate will be one-third of the amount refunded following purchase, whereas discounts cut the cost of purchase at point of sale.

2. Can I make use of multiple Irs Form 4506 T For Clean Vehicle Rebate on the same product It's contingent upon the conditions that apply to the Irs Form 4506 T For Clean Vehicle Rebate provides and the particular product's potential eligibility. Certain companies may permit this, whereas others will not.

3. How long will it take to get a Irs Form 4506 T For Clean Vehicle Rebate? The period will vary, but it may be from several weeks to couple of months for you to receive your Irs Form 4506 T For Clean Vehicle Rebate.

4. Do I need to pay taxes when I receive Irs Form 4506 T For Clean Vehicle Rebate the amount? most cases, Irs Form 4506 T For Clean Vehicle Rebate amounts are not considered taxable income.

5. Can I trust Irs Form 4506 T For Clean Vehicle Rebate deals from lesser-known brands Consider doing some research and confirm that the brand that is offering the Irs Form 4506 T For Clean Vehicle Rebate has a good reputation prior to making an acquisition.

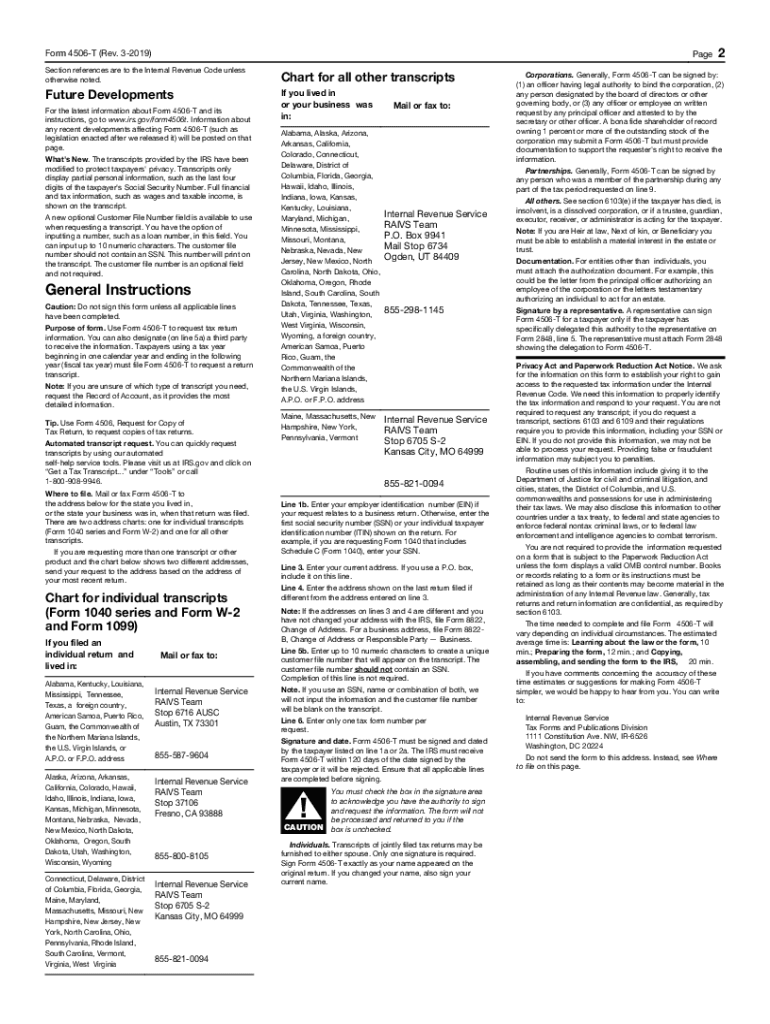

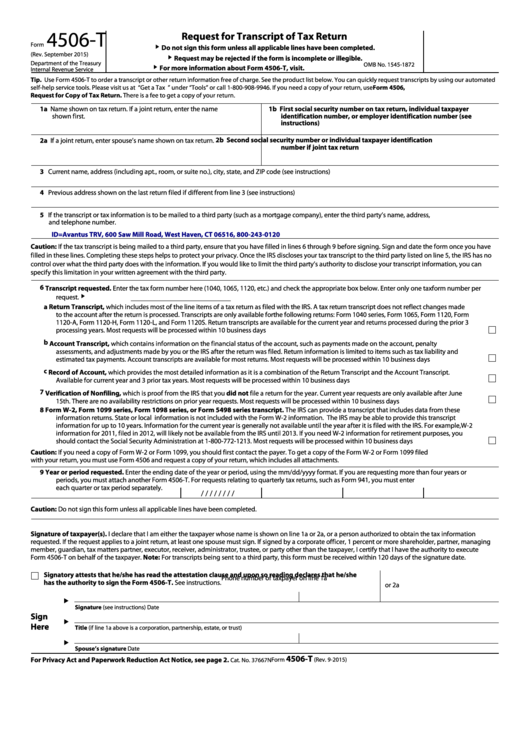

4506 T Form March 2019 Fill Out And Sign Printable PDF Template SignNow

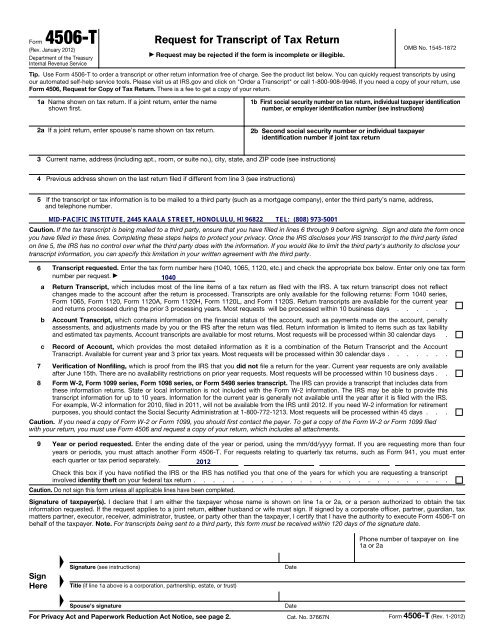

Printable 4506 T Form Portal Tutorials

Check more sample of Irs Form 4506 T For Clean Vehicle Rebate below

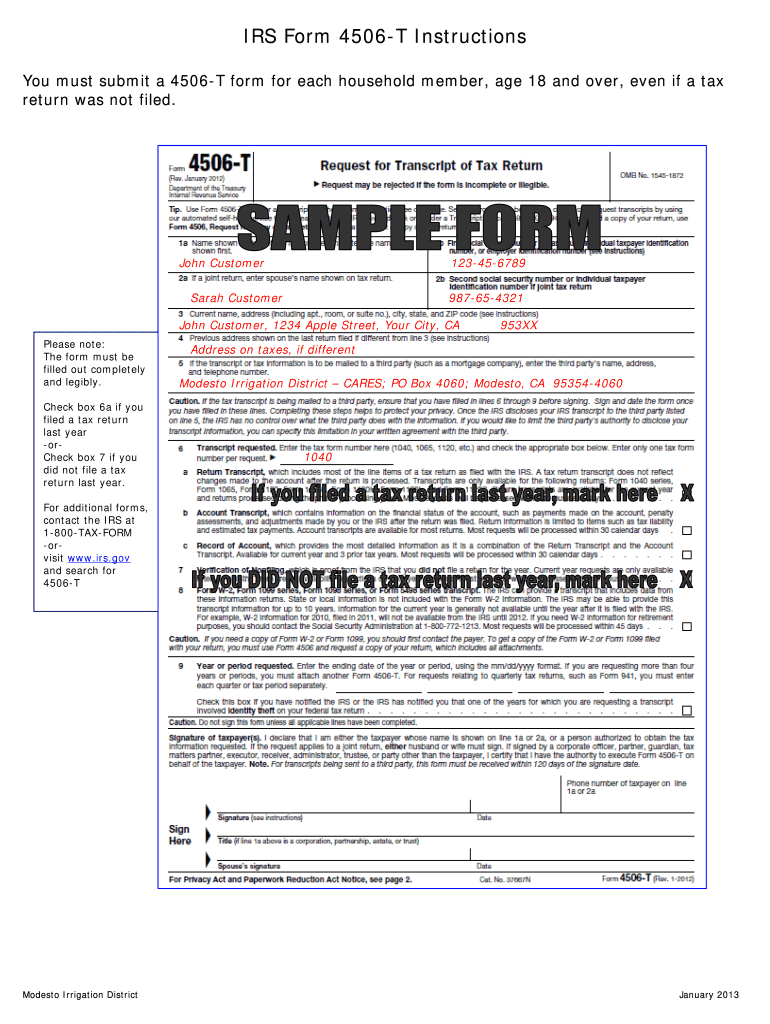

Form 4506 T Instructions Information About IRS Tax Form 4506 T

Form 4506t Fill Out And Sign Printable PDF Template SignNow

4506 T Form Fill Out And Sign Printable PDF Template SignNow

Free Printable 4506 T Form Printable Templates

Free Printable 4506 T Form Printable Templates

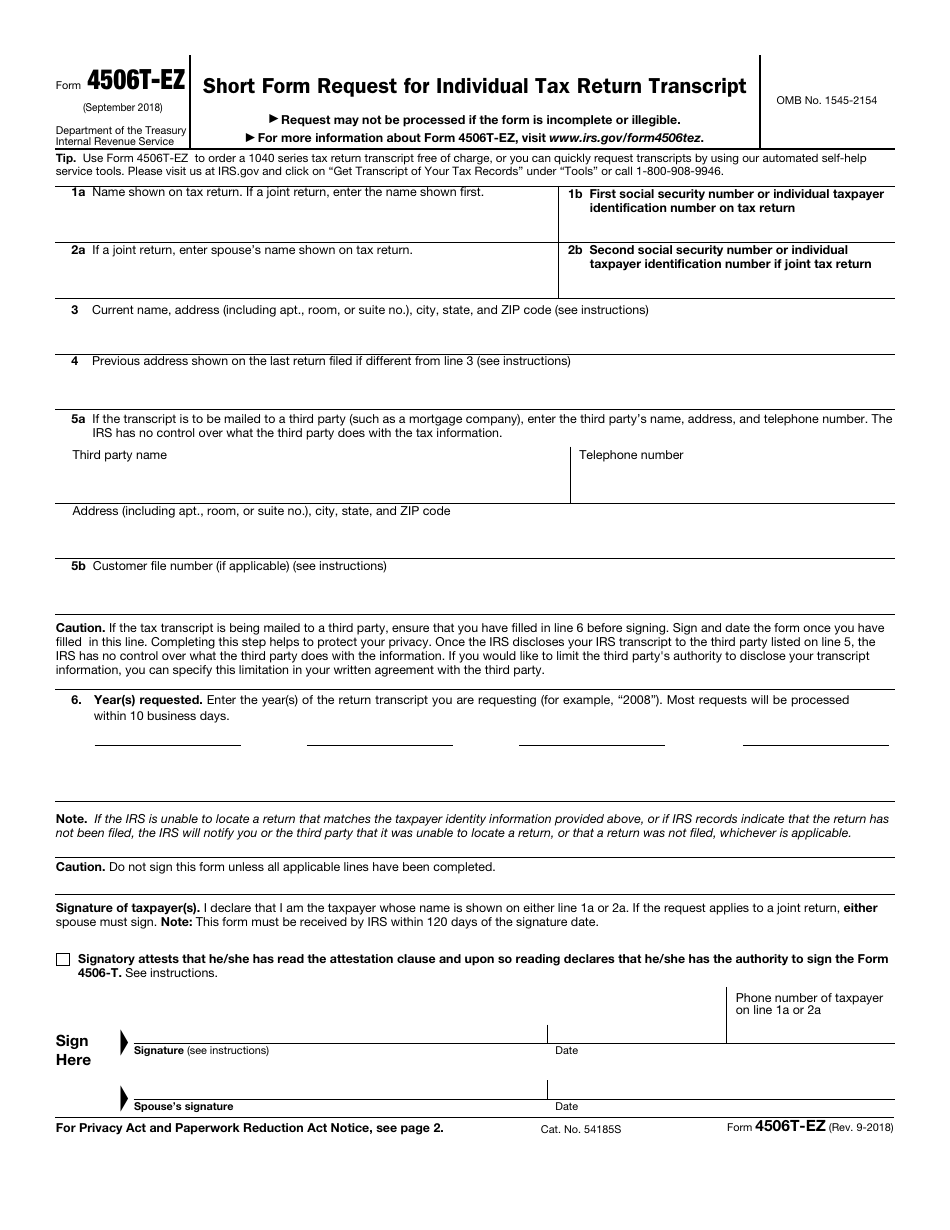

Irs Form 4506t Ez Download Fillable Pdf Or Fill Online Short Form

https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles...

You may qualify for a clean vehicle tax credit up to 7 500 if you buy a new qualified plug in electric vehicle or fuel cell electric vehicle New requirements effective April 18 If you take possession of a new clean vehicle on or after April 18 2023 it must meet critical mineral and battery component requirements to qualify N 228 yt 228 lis 228 228

https://www.irs.gov/credits-deductions/clean-vehicle-credit-seller-or...

Verkko You must submit required information about a qualifying clean vehicle sale to the IRS by January 15 of the year following the purchase The first reports are due to the IRS by

You may qualify for a clean vehicle tax credit up to 7 500 if you buy a new qualified plug in electric vehicle or fuel cell electric vehicle New requirements effective April 18 If you take possession of a new clean vehicle on or after April 18 2023 it must meet critical mineral and battery component requirements to qualify N 228 yt 228 lis 228 228

Verkko You must submit required information about a qualifying clean vehicle sale to the IRS by January 15 of the year following the purchase The first reports are due to the IRS by

Free Printable 4506 T Form Printable Templates

Form 4506t Fill Out And Sign Printable PDF Template SignNow

Free Printable 4506 T Form Printable Templates

Irs Form 4506t Ez Download Fillable Pdf Or Fill Online Short Form

Form 4506 T Request For Transcript Of Tax Return Authorization To

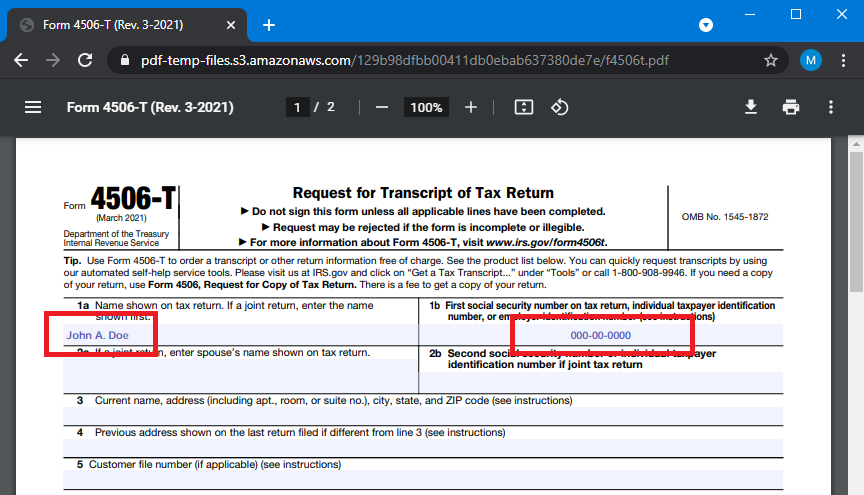

How To Fill In US Form 4506 T Correctly PDF co 2023

How To Fill In US Form 4506 T Correctly PDF co 2023

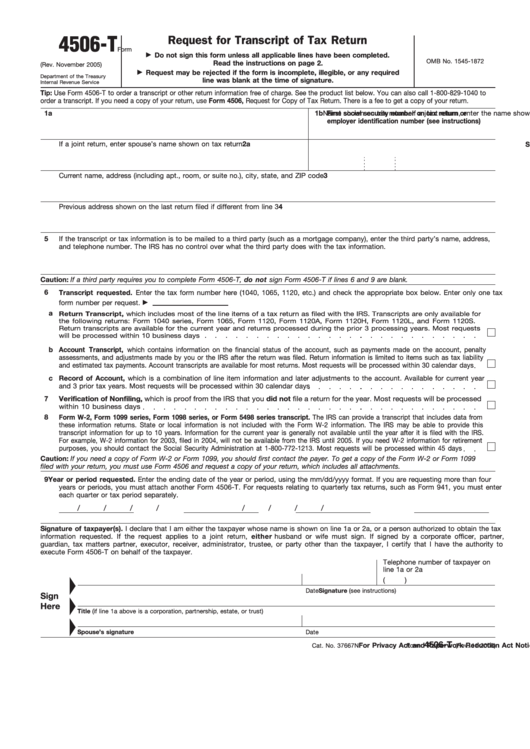

Form 4506 T Request For Transcript Of Tax Return 2015 Free Download