In this day and age of consuming we all love a good bargain. One method to get significant savings on your purchases is by using Irs Energy Rebate Forms. Irs Energy Rebate Forms are a method of marketing that retailers and manufacturers use to provide customers with a portion of a refund on their purchases after they've placed them. In this article, we'll go deeper into the realm of Irs Energy Rebate Forms, exploring the nature of them as well as how they work and how to maximize your savings through these cost-effective incentives.

Get Latest Irs Energy Rebate Form Below

Irs Energy Rebate Form

Irs Energy Rebate Form - Irs Energy Tax Credit Form, Irs Energy Tax Credit 2022 Form, What Tax Form For Energy Credit, Are Energy Rebates Taxable, Who Is Eligible For Energy Rebate, Can I Claim Energy Tax Credit

Web 6 Okt 2023 nbsp 0183 32 Clean Vehicle Credits Determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit Find more information on

Web 17 Feb 2023 nbsp 0183 32 Page Last Reviewed or Updated 17 Feb 2023 Information about Form 5695 Residential Energy Credits including recent updates related forms and

A Irs Energy Rebate Form at its most basic version, is an ad-hoc refund given to a client when they purchase a product or service. It's an effective way for businesses to entice customers, increase sales, and even promote certain products.

Types of Irs Energy Rebate Form

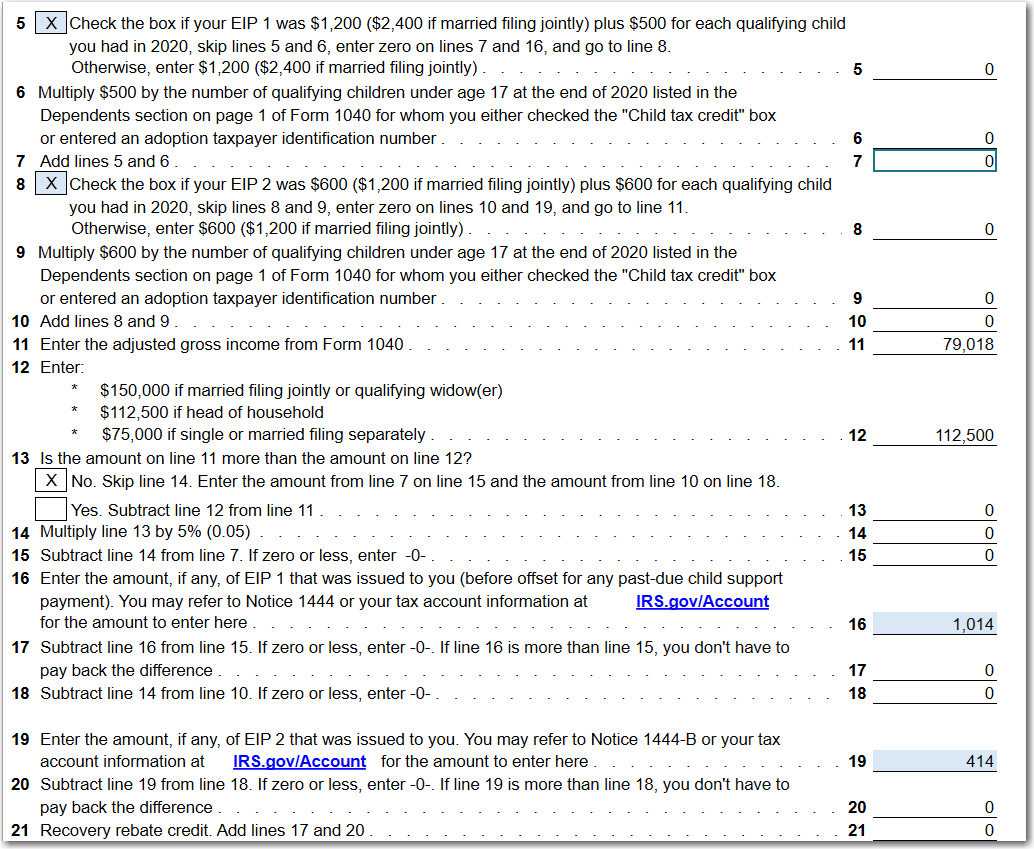

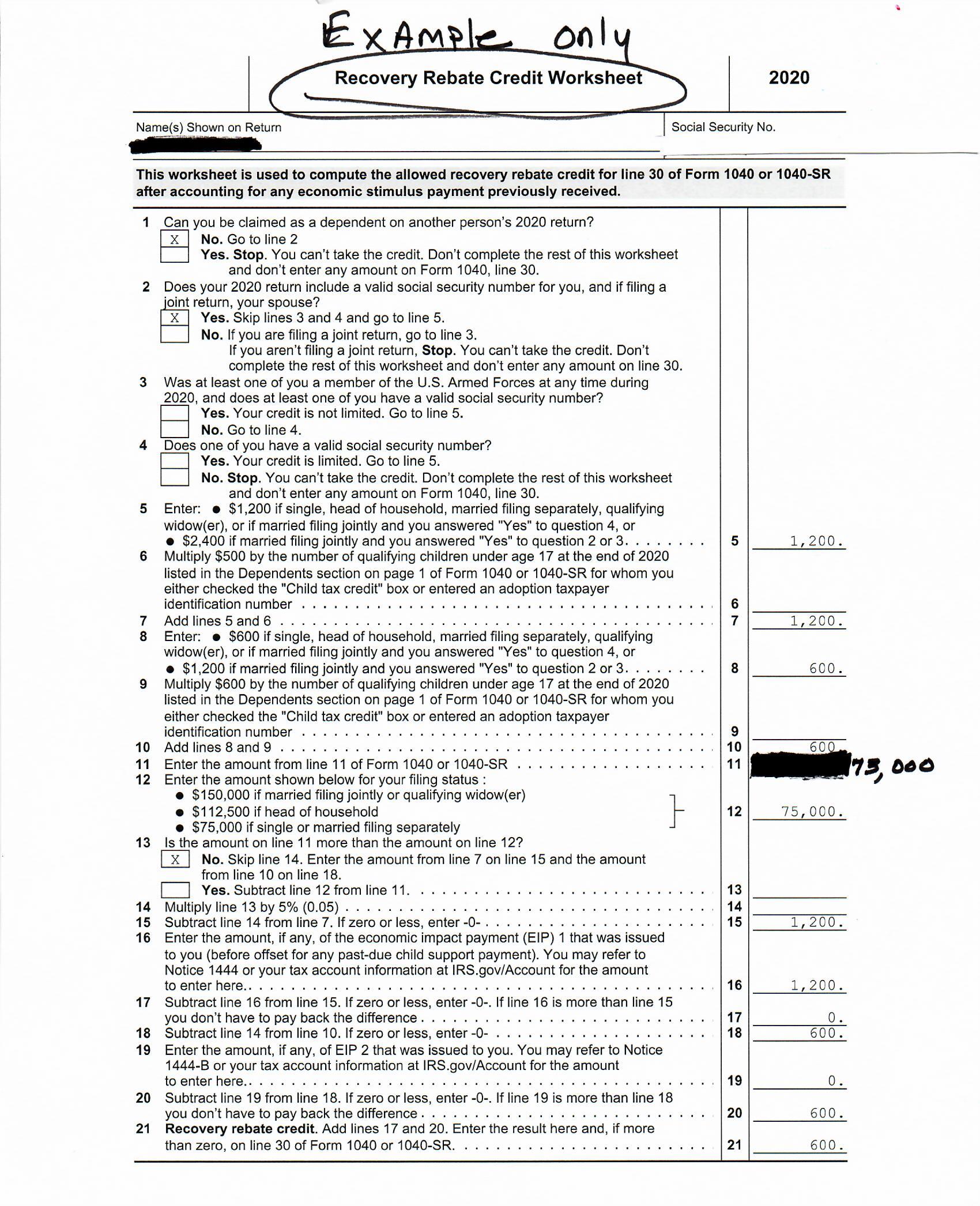

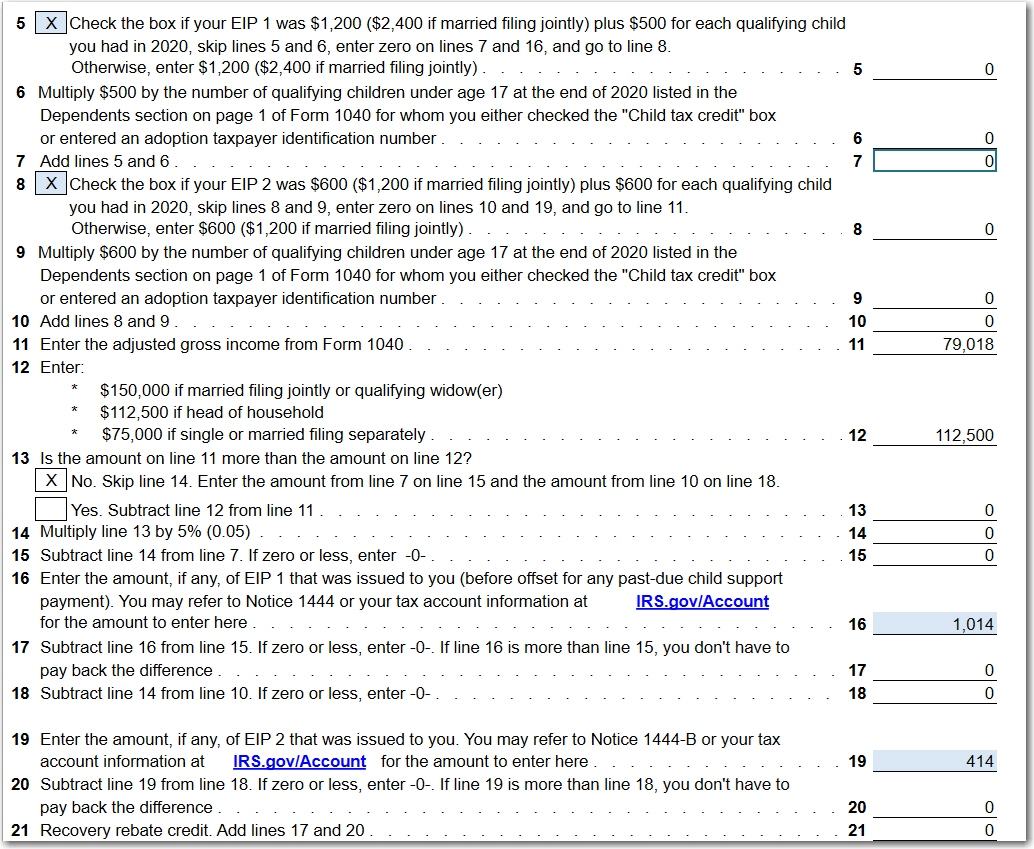

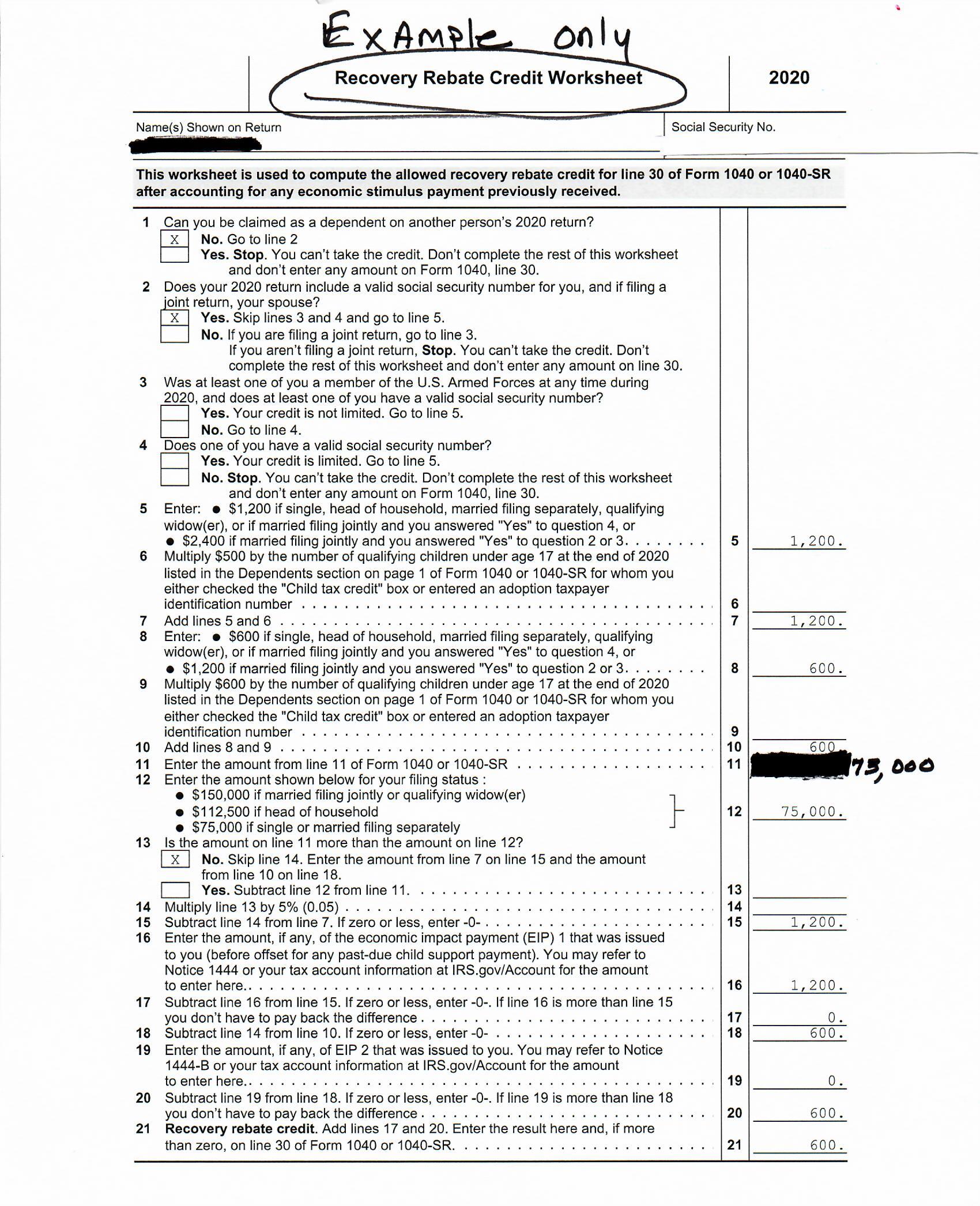

2022 Irs Recovery Rebate Credit Worksheet Rebate2022

2022 Irs Recovery Rebate Credit Worksheet Rebate2022

Web File Form 5695 Residential Energy Credits Part II with your tax return You must claim the credit for the tax year when the improvement is installed not purchased How to Claim

Web 27 Apr 2021 nbsp 0183 32 In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the

Cash Irs Energy Rebate Form

Cash Irs Energy Rebate Form is the most basic type of Irs Energy Rebate Form. The customer receives a particular amount of money after buying a product. These are often used for large-ticket items such as electronics and appliances.

Mail-In Irs Energy Rebate Form

Mail-in Irs Energy Rebate Form require that customers send in the proof of purchase to be eligible for their reimbursement. They're longer-lasting, however they offer significant savings.

Instant Irs Energy Rebate Form

Instant Irs Energy Rebate Form are credited at the place of purchase, reducing prices immediately. Customers don't need to wait long for savings with this type.

How Irs Energy Rebate Form Work

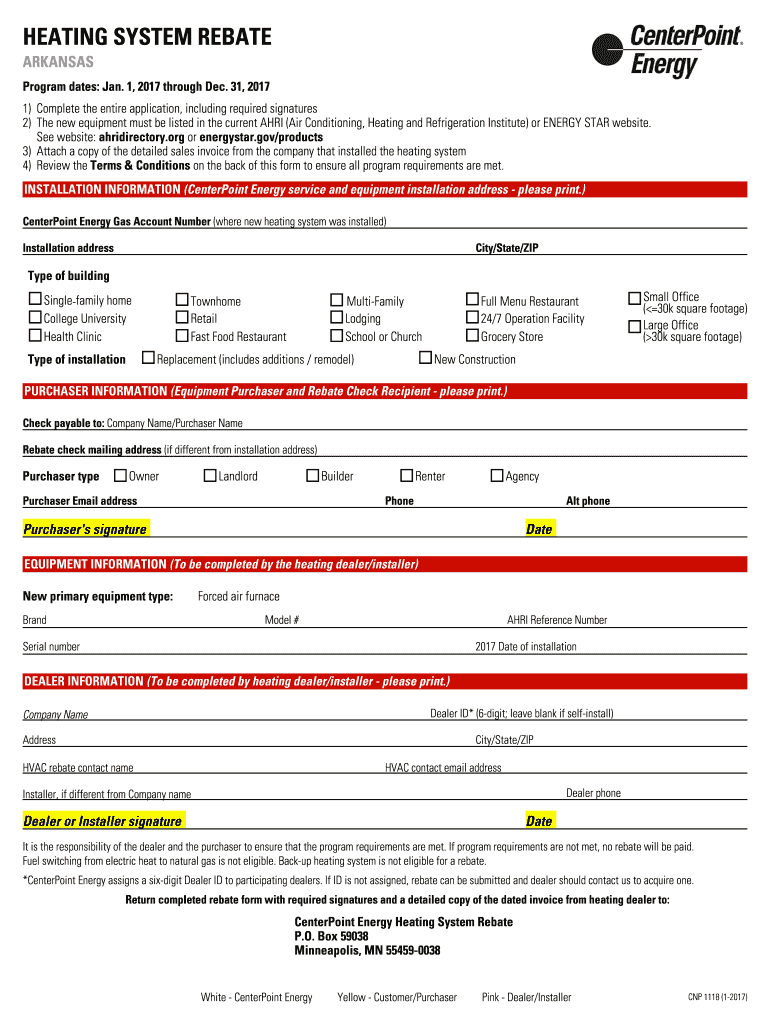

Center Point Rebates 2019 Fill Out And Sign Printable PDF Template

Center Point Rebates 2019 Fill Out And Sign Printable PDF Template

Web Here s the worksheet you ll need to apply the tax credits when you file your tax return IRS Form 5695 Residential Energy Credits If you have questions contact your tax preparer

The Irs Energy Rebate Form Process

The procedure typically consists of a few steps:

-

You purchase the item: First make sure you purchase the product like you normally do.

-

Complete the Irs Energy Rebate Form form: You'll have to supply some details, such as your name, address, and purchase details in order to claim your Irs Energy Rebate Form.

-

Complete the Irs Energy Rebate Form In accordance with the type of Irs Energy Rebate Form, you may need to fill out a form and mail it in or upload it online.

-

Wait for the company's approval: They will review your request to make sure that it's in accordance with the requirements of the Irs Energy Rebate Form.

-

Get your Irs Energy Rebate Form Once you've received your approval, you'll receive your cash back in the form of a check, prepaid card, or through another option that's specified in the offer.

Pros and Cons of Irs Energy Rebate Form

Advantages

-

Cost Savings Rewards can drastically reduce the price you pay for products.

-

Promotional Deals These promotions encourage consumers to try new products or brands.

-

increase sales Reward programs can boost companies' sales and market share.

Disadvantages

-

Complexity Pay-in Irs Energy Rebate Form via mail, in particular is a time-consuming process and time-consuming.

-

The Expiration Dates Most Irs Energy Rebate Form come with rigid deadlines to submit.

-

A risk of not being paid Some customers might not be able to receive their Irs Energy Rebate Form if they don't observe the rules exactly.

Download Irs Energy Rebate Form

Download Irs Energy Rebate Form

FAQs

1. Are Irs Energy Rebate Form equivalent to discounts? Not necessarily, as Irs Energy Rebate Form are a partial refund after purchase, whereas discounts decrease prices at time of sale.

2. Are there Irs Energy Rebate Form that can be used on the same product It's dependent on the conditions for the Irs Energy Rebate Form incentives and the specific product's quality and eligibility. Certain companies might allow this, whereas others will not.

3. What is the time frame to receive a Irs Energy Rebate Form? The length of time differs, but it can take a couple of weeks or a few months before you receive your Irs Energy Rebate Form.

4. Do I need to pay taxes for Irs Energy Rebate Form the amount? most instances, Irs Energy Rebate Form amounts are not considered taxable income.

5. Should I be able to trust Irs Energy Rebate Form deals from lesser-known brands It is essential to investigate and ensure that the brand which is providing the Irs Energy Rebate Form is reputable prior to making an acquisition.

Piedmont Natural Gas Rebate Form Fill Online Printable Fillable

Federal Solar Tax Credit Steps Down After 2019 Solar

.png)

Check more sample of Irs Energy Rebate Form below

How Do I Claim The Recovery Rebate Credit On My Ta

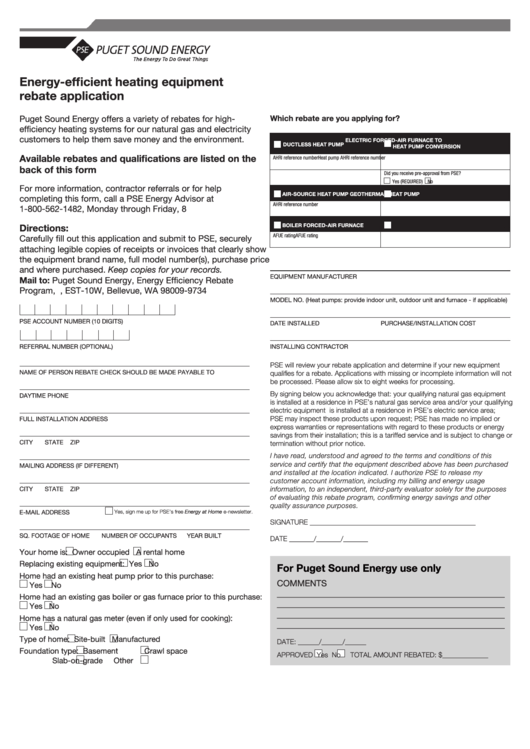

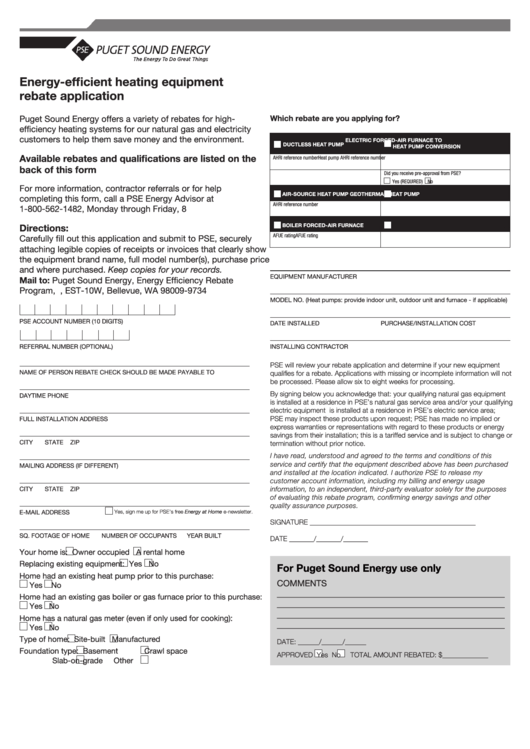

Energy Efficient Heating Equipment Rebate Application Pse Printable

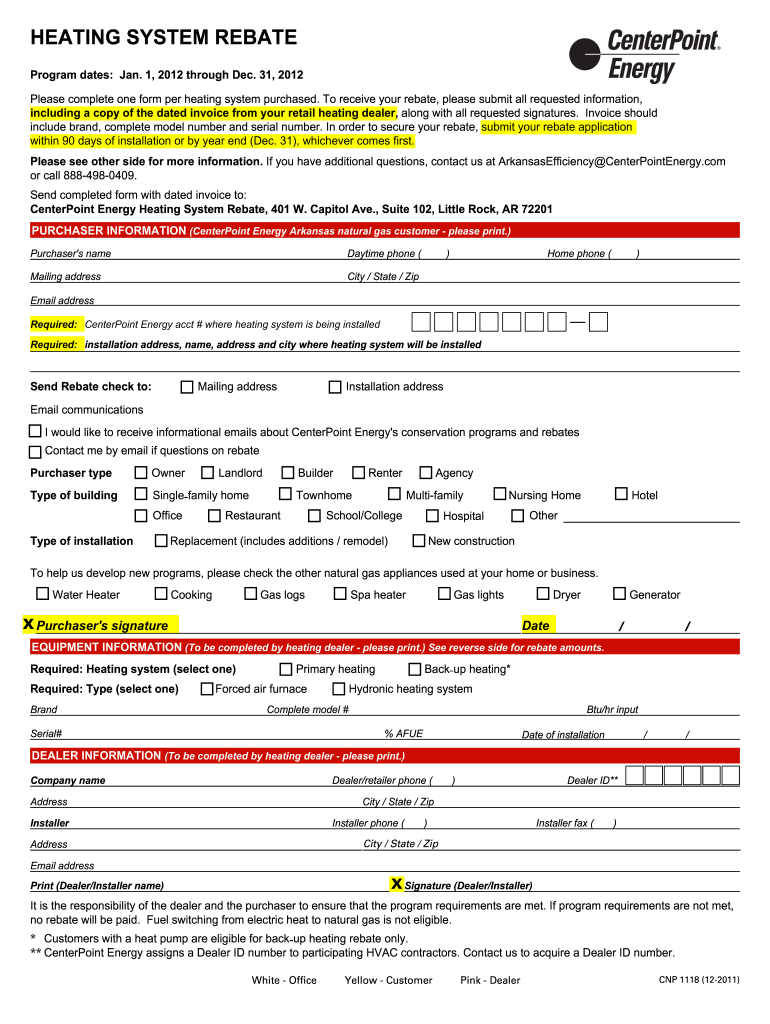

Centerpoint Energy Rebate Forms 2011 Fill Out Sign Online DocHub

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

Energy Efficient Home Improvement Tax Credit 2018 Home Improvement

Who could Qualify For 2nd Stimulus

https://www.irs.gov/forms-pubs/about-form-5695

Web 17 Feb 2023 nbsp 0183 32 Page Last Reviewed or Updated 17 Feb 2023 Information about Form 5695 Residential Energy Credits including recent updates related forms and

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Web Vor 2 Tagen nbsp 0183 32 If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses

Web 17 Feb 2023 nbsp 0183 32 Page Last Reviewed or Updated 17 Feb 2023 Information about Form 5695 Residential Energy Credits including recent updates related forms and

Web Vor 2 Tagen nbsp 0183 32 If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

Energy Efficient Heating Equipment Rebate Application Pse Printable

Energy Efficient Home Improvement Tax Credit 2018 Home Improvement

Who could Qualify For 2nd Stimulus

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

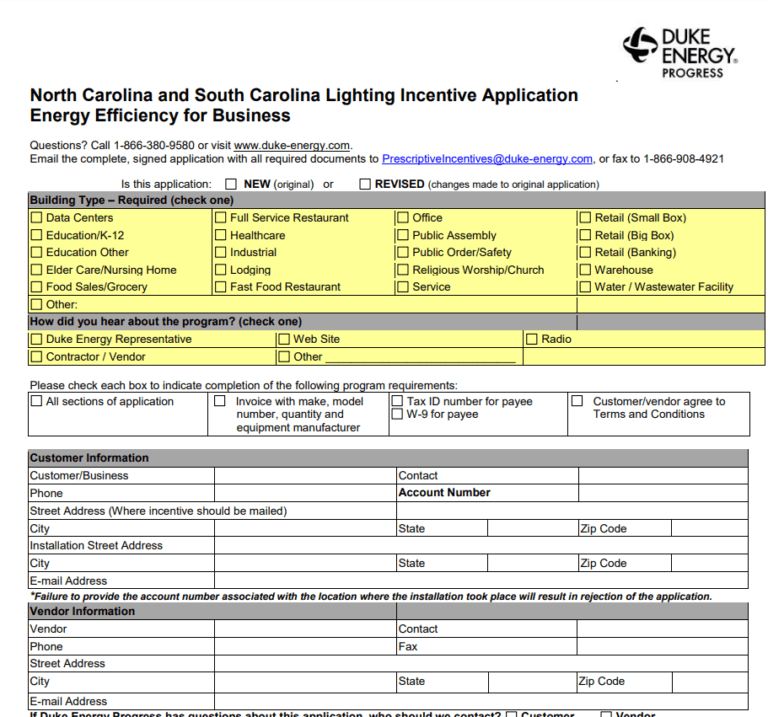

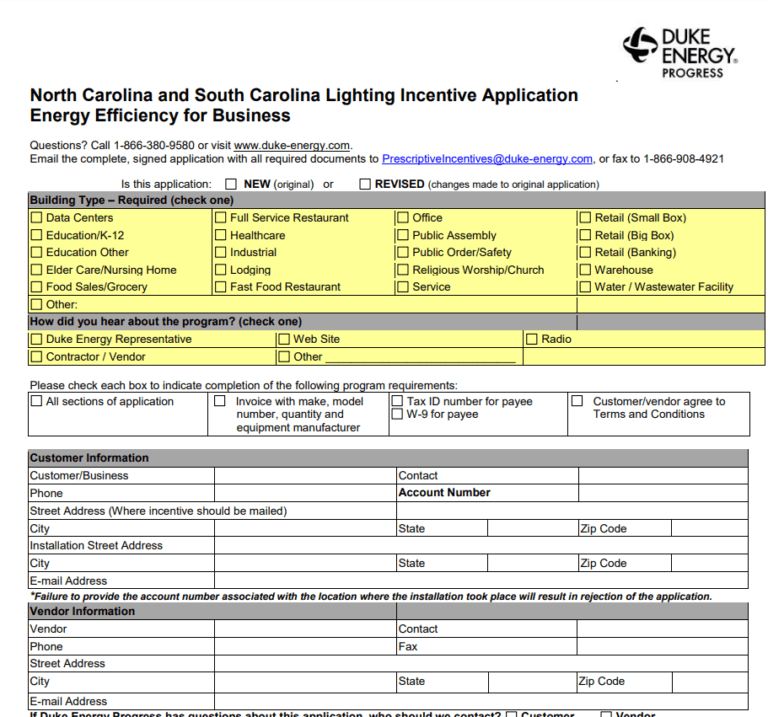

Duke Energy Window Rebate Form Printable Rebate Form

Duke Energy Window Rebate Form Printable Rebate Form

2022 Rent Rebate Form Fillable Printable PDF Forms Handypdf