In today's world of consumerism we all love a good bargain. One of the ways to enjoy substantial savings from your purchases is via Irish Tax Rebatess. Irish Tax Rebatess are marketing strategies that retailers and manufacturers use to provide customers with a portion of a payment on their purchases, after they have placed them. In this article, we'll investigate the world of Irish Tax Rebatess. We'll explore the nature of them and how they operate, and how you can maximise your savings by taking advantage of these cost-effective incentives.

Get Latest Irish Tax Rebates Below

Irish Tax Rebates

Irish Tax Rebates -

Web A Rent Tax Credit has been introduced for the years 2022 2025 If you rented private accommodation in 2022 or are currently renting in 2023 you can now claim this tax relief This new tax credit will be worth up to 500

Web Starting work emergency tax claiming a refund calculating your tax understanding entitlements pensions being tax compliant Personal tax credits reliefs and exemptions Understand your tax entitlements and

A Irish Tax Rebates in its most basic description, is a payment to a consumer following the purchase of a product or service. It's an effective way for businesses to entice clients, increase sales as well as promote particular products.

Types of Irish Tax Rebates

Irish Tax Rebates 40 Point Tax Check YouTube

Irish Tax Rebates 40 Point Tax Check YouTube

Web 31 mars 2022 nbsp 0183 32 If you worked in Ireland for part of the year and have now gone to live abroad you may be due a refund of tax To claim a refund you need to log into PAYE

Web Get in touch Want to know more Contact us using the details below check our FAQs or get in touch for a chat 059 8634794 info irishtaxrebates ie 1 Leinster Street Athy Co Kildare

Cash Irish Tax Rebates

Cash Irish Tax Rebates are the simplest kind of Irish Tax Rebates. Customers receive a specified amount of money back after buying a product. This is often for the most expensive products like electronics or appliances.

Mail-In Irish Tax Rebates

Mail-in Irish Tax Rebates are based on the requirement that customers present proof of purchase to receive the money. They're more involved, but offer huge savings.

Instant Irish Tax Rebates

Instant Irish Tax Rebates are credited at the points of sale. This reduces the price instantly. Customers do not have to wait for savings in this manner.

How Irish Tax Rebates Work

5 Reason To Apply With 100 Confidence To Irish Tax Rebates

5 Reason To Apply With 100 Confidence To Irish Tax Rebates

Web In order to securely send us your bank details and receive your rebate in the quickest way possible please Log In and submit your IBAN details User Name is your email address

The Irish Tax Rebates Process

The process typically involves a handful of simple steps:

-

Then, you purchase the product you purchase the product exactly as you would normally.

-

Fill out the Irish Tax Rebates application: In order to claim your Irish Tax Rebates, you'll need to give some specific information like your name, address and purchase details, in order to get your Irish Tax Rebates.

-

You must submit the Irish Tax Rebates It is dependent on the nature of Irish Tax Rebates you may have to mail in a form or send it via the internet.

-

Wait until the company approves: The company will look over your submission to confirm that it complies with the requirements of the Irish Tax Rebates.

-

Receive your Irish Tax Rebates Once it's approved, you'll receive a refund whether by check, prepaid card, or by another method that is specified in the offer.

Pros and Cons of Irish Tax Rebates

Advantages

-

Cost Savings Rewards can drastically reduce the price you pay for a product.

-

Promotional Deals These deals encourage customers to try new products or brands.

-

Increase Sales Irish Tax Rebates are a great way to boost the sales of a business and increase its market share.

Disadvantages

-

Complexity Mail-in Irish Tax Rebates in particular they can be time-consuming and tedious.

-

Days of expiration Most Irish Tax Rebates come with extremely strict deadlines to submit.

-

Risk of Non-Payment Customers may not receive their Irish Tax Rebates if they don't follow the rules exactly.

Download Irish Tax Rebates

FAQs

1. Are Irish Tax Rebates the same as discounts? No, Irish Tax Rebates offer some form of refund following the purchase, while discounts reduce the cost of purchase at point of sale.

2. Are there multiple Irish Tax Rebates I can get on the same item The answer is dependent on the terms of the Irish Tax Rebates is offered as well as the merchandise's eligibility. Certain companies might permit it, while other companies won't.

3. How long does it take to get an Irish Tax Rebates? The duration differs, but it can take anywhere from a few weeks to a couple of months to receive your Irish Tax Rebates.

4. Do I have to pay taxes regarding Irish Tax Rebates sums? the majority of cases, Irish Tax Rebates amounts are not considered to be taxable income.

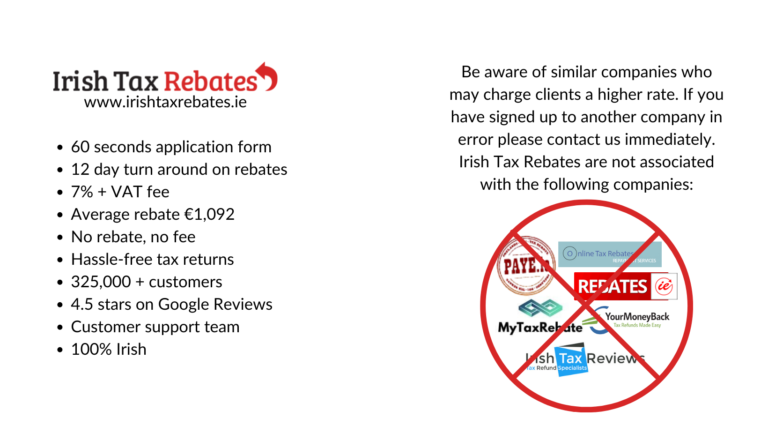

5. Should I be able to trust Irish Tax Rebates offers from lesser-known brands It is essential to investigate and ensure that the brand providing the Irish Tax Rebates is reputable prior making a purchase.

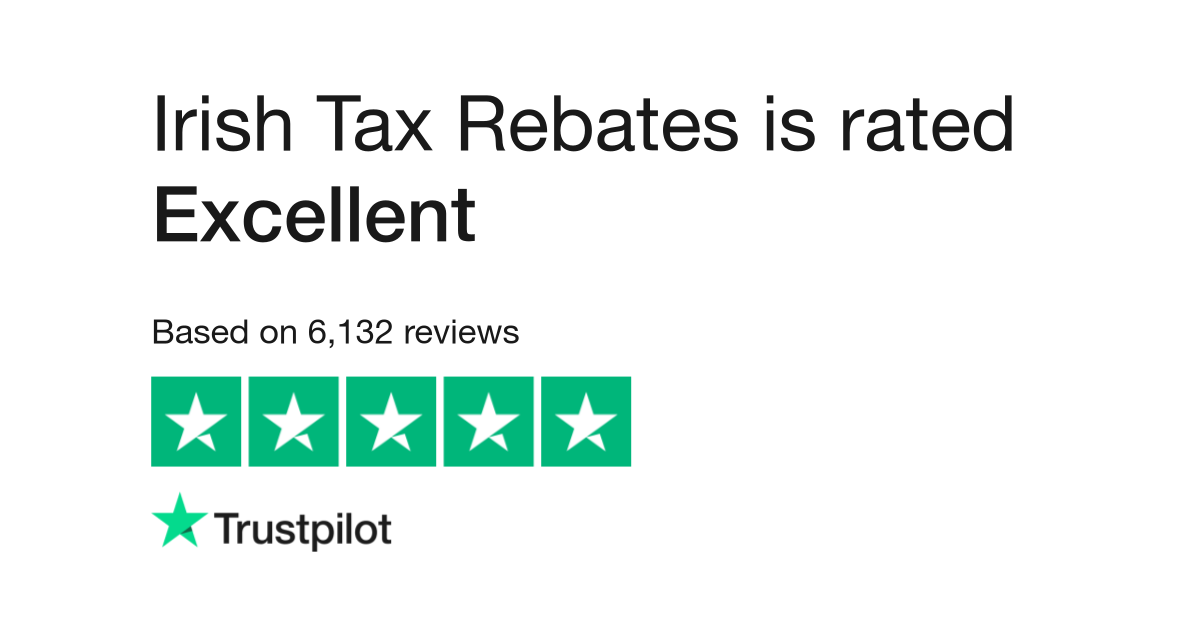

Irish Tax Rebates Reviews Read Customer Service Reviews Of

More Tax Credits More Rebates Education Magazine

Check more sample of Irish Tax Rebates below

Irish Tax Rebates We Do The Checking You Get The Cheque YouTube

Claiming Tax Back FAQ s Irish Tax Rebates

How To Claim Foreign Earning Deduction

More Tax Credits More Rebates Education Magazine

Irish Tax Tips Your Irish Tax Rebates Resource

The Universal Social Charge USC In 2017 Irish Tax Rebates

https://www.revenue.ie/en

Web Starting work emergency tax claiming a refund calculating your tax understanding entitlements pensions being tax compliant Personal tax credits reliefs and exemptions Understand your tax entitlements and

https://www.revenue.ie/en/personal-tax-credits-reliefs-and-exemptions

Web Rent Tax Credit Tax rates bands and reliefs Differences between tax credits reliefs and exemptions Real Time Credits Land and property Health and age Marital and civil

Web Starting work emergency tax claiming a refund calculating your tax understanding entitlements pensions being tax compliant Personal tax credits reliefs and exemptions Understand your tax entitlements and

Web Rent Tax Credit Tax rates bands and reliefs Differences between tax credits reliefs and exemptions Real Time Credits Land and property Health and age Marital and civil

More Tax Credits More Rebates Education Magazine

Claiming Tax Back FAQ s Irish Tax Rebates

Irish Tax Tips Your Irish Tax Rebates Resource

The Universal Social Charge USC In 2017 Irish Tax Rebates

Consult Tax Experts To Claim Tax Back Irish Tax Rebates

Employment Irish Tax Rebates

Employment Irish Tax Rebates

How To Claim Tax Back Online Revenue Refund Your Tax