In today's consumer-driven world we all love a good bargain. One way to earn significant savings in your purchase is through Inland Revenue Donations Rebate Forms. They are a form of marketing that retailers and manufacturers use to offer customers a partial reimbursement on their purchases following the time they've created them. In this post, we'll take a look at the world that is Inland Revenue Donations Rebate Forms, looking at what they are and how they function, and how you can maximise your savings with these cost-effective incentives.

Get Latest Inland Revenue Donations Rebate Form Below

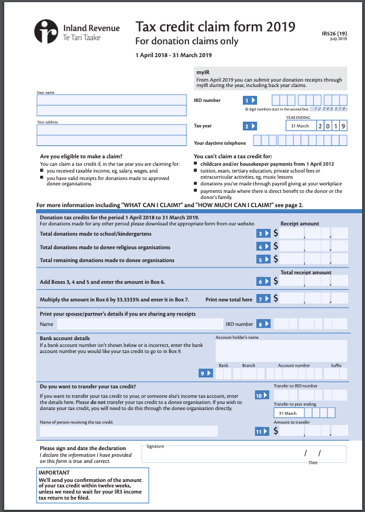

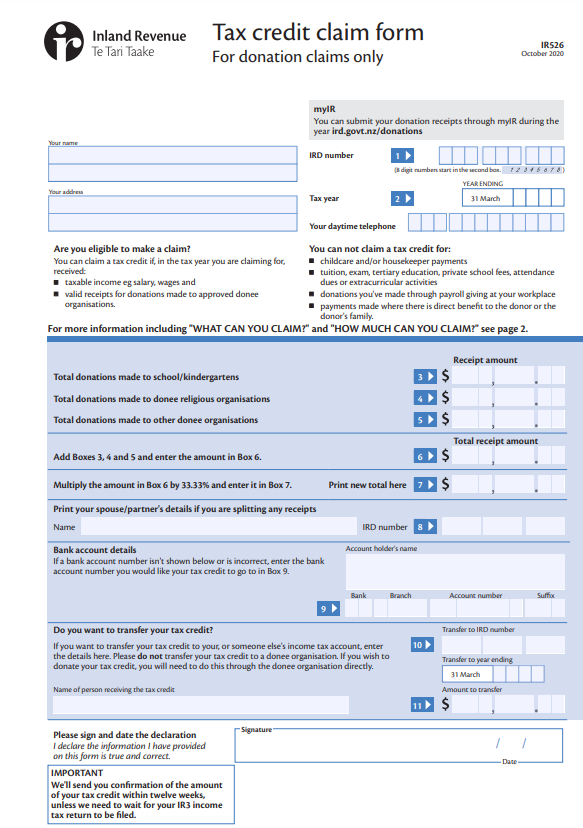

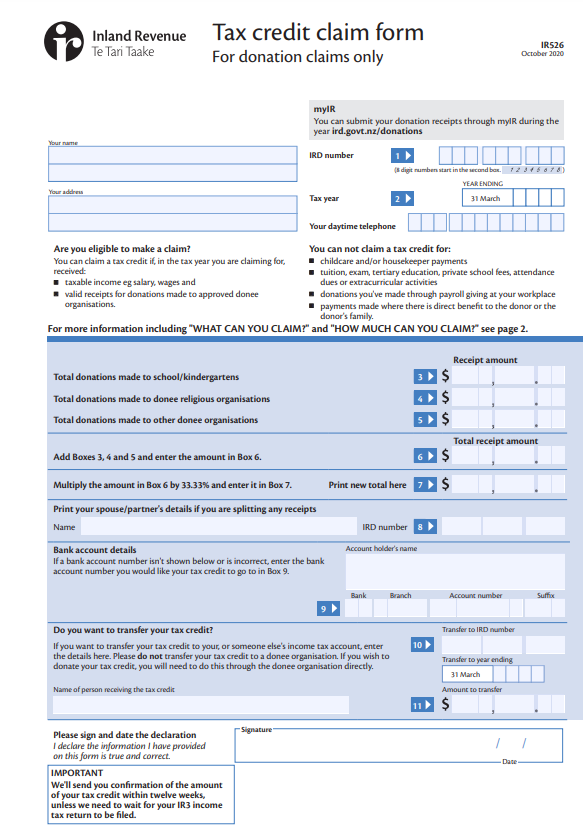

Inland Revenue Donations Rebate Form

Inland Revenue Donations Rebate Form - Inland Revenue Donations Rebate Form 2022, Hmrc Tax Relief For Charitable Donations, Can You Claim Tax Back On Donations, How To Get Tax Back On Donations, How To Get Tax Credit For Donations

Web You can click the inventory of charitable establishment plus trusts of a public character which are released from tax under section 88 of the Inland Revenue Government to

Web donations you ve made through payroll giving at your workplace payments made where there is direct benefit to the donor or the donor s family IRD number Tax year Your

A Inland Revenue Donations Rebate Form the simplest description, is a payment to a consumer after they've bought a product or service. It's a highly effective tool employed by companies to attract buyers, increase sales and to promote certain products.

Types of Inland Revenue Donations Rebate Form

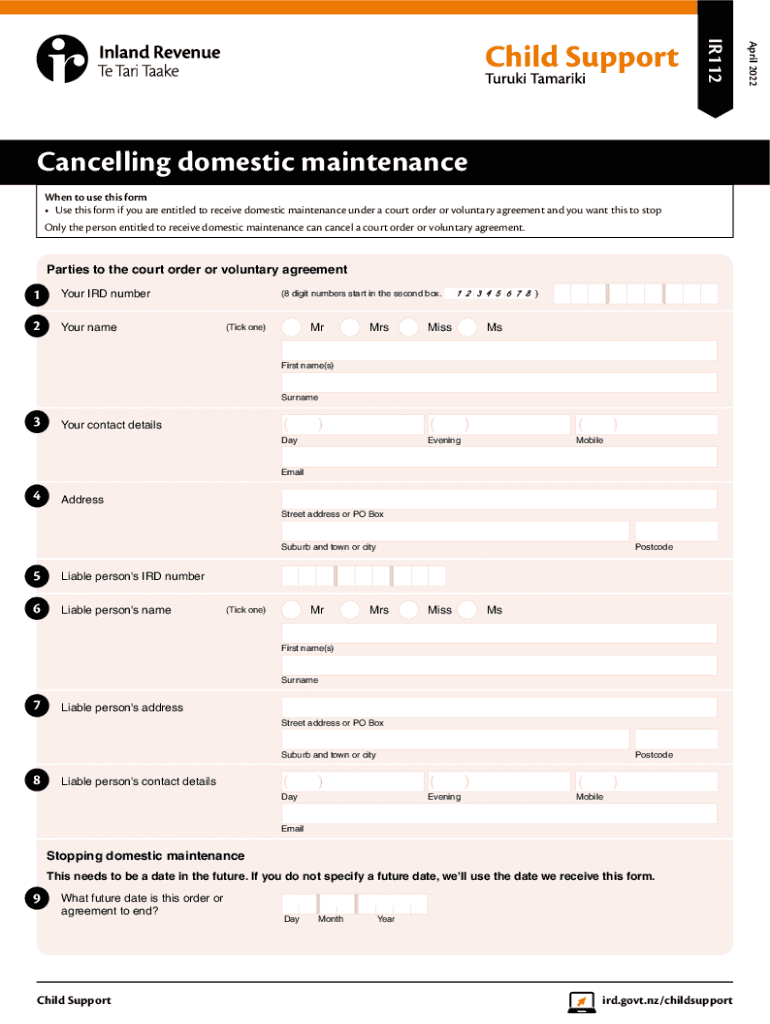

FORM 500 CTR Inland Revenue Division Fill Out Sign Online DocHub

FORM 500 CTR Inland Revenue Division Fill Out Sign Online DocHub

Web Si vous 234 tes un particulier faire un don 224 une association reconnue d utilit 233 publique ouvre droit 224 une r 233 duction d imp 244 t sur le revenu de 66 du montant de votre don dans la

Web Any appendices to your return forms 2044 2044SPE 2047 etc can also be filled out and filed online If you have no changes to make to your pre filled return you can validate it with three clicks

Cash Inland Revenue Donations Rebate Form

Cash Inland Revenue Donations Rebate Form are a simple type of Inland Revenue Donations Rebate Form. Customers receive a specified amount of money in return for purchasing a item. These are typically for products that are expensive, such as electronics or appliances.

Mail-In Inland Revenue Donations Rebate Form

Mail-in Inland Revenue Donations Rebate Form require consumers to present the proof of purchase to be eligible for their cash back. They're a bit more involved, however they can yield huge savings.

Instant Inland Revenue Donations Rebate Form

Instant Inland Revenue Donations Rebate Form will be applied at point of sale. They reduce prices immediately. Customers don't need to wait for their savings when they purchase this type of Inland Revenue Donations Rebate Form.

How Inland Revenue Donations Rebate Form Work

New Zealand Inland Revenue Form Fill Out And Sign Printable PDF

New Zealand Inland Revenue Form Fill Out And Sign Printable PDF

Web At year end if a person has submitted donation receipts during the year and Inland Revenue considers the person is entitled to the donation tax credit the refund will be

The Inland Revenue Donations Rebate Form Process

The process generally involves a few steps:

-

When you buy the product then, you buy the item the way you normally do.

-

Fill out the Inland Revenue Donations Rebate Form questionnaire: you'll have to give some specific information, such as your address, name, and purchase details in order to claim your Inland Revenue Donations Rebate Form.

-

You must submit the Inland Revenue Donations Rebate Form It is dependent on the kind of Inland Revenue Donations Rebate Form, you may need to fill out a paper form or send it via the internet.

-

Wait for the company's approval: They will examine your application and ensure that it's compliant with guidelines and conditions of the Inland Revenue Donations Rebate Form.

-

Pay your Inland Revenue Donations Rebate Form After you've been approved, you'll receive the refund in the form of a check, prepaid card, or other method specified by the offer.

Pros and Cons of Inland Revenue Donations Rebate Form

Advantages

-

Cost savings Inland Revenue Donations Rebate Form are a great way to cut the price you pay for the product.

-

Promotional Offers Incentivize customers in trying new products or brands.

-

Enhance Sales Inland Revenue Donations Rebate Form can help boost companies' sales and market share.

Disadvantages

-

Complexity Mail-in Inland Revenue Donations Rebate Form in particular could be cumbersome and long-winded.

-

Day of Expiration Many Inland Revenue Donations Rebate Form impose specific deadlines for submission.

-

Risk of not receiving payment Some customers might not receive their refunds if they don't observe the rules precisely.

Download Inland Revenue Donations Rebate Form

Download Inland Revenue Donations Rebate Form

FAQs

1. Are Inland Revenue Donations Rebate Form the same as discounts? No, Inland Revenue Donations Rebate Form require partial reimbursement after purchase, whereas discounts cut costs at point of sale.

2. Are there any Inland Revenue Donations Rebate Form that I can use for the same product It's dependent on the terms and conditions of Inland Revenue Donations Rebate Form offers and the product's suitability. Some companies may allow it, but others won't.

3. How long does it take to get the Inland Revenue Donations Rebate Form? The amount of time differs, but it can last from a few weeks until a few months to get your Inland Revenue Donations Rebate Form.

4. Do I have to pay tax for Inland Revenue Donations Rebate Form montants? the majority of circumstances, Inland Revenue Donations Rebate Form amounts are not considered to be taxable income.

5. Do I have confidence in Inland Revenue Donations Rebate Form offers from lesser-known brands It is essential to investigate and ensure that the brand providing the Inland Revenue Donations Rebate Form is reputable prior making an investment.

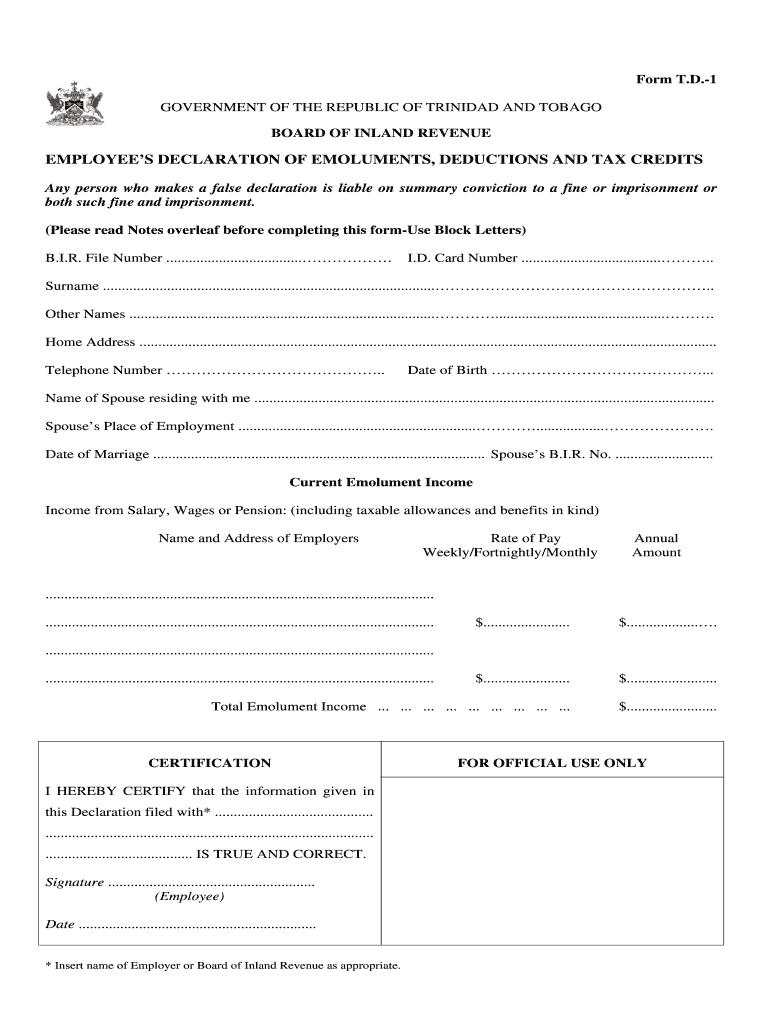

Board Of Inland Revenue Trinidad Td1 Forms Fill Out Sign Online DocHub

Explore Our Printable Furniture Donation Receipt Template Receipt

Check more sample of Inland Revenue Donations Rebate Form below

Donate Your Tax Return To UNICEF NZ

Supplier Rebate Agreement Template

Home Depot 11 Rebate Match Form Printable Rebate Form

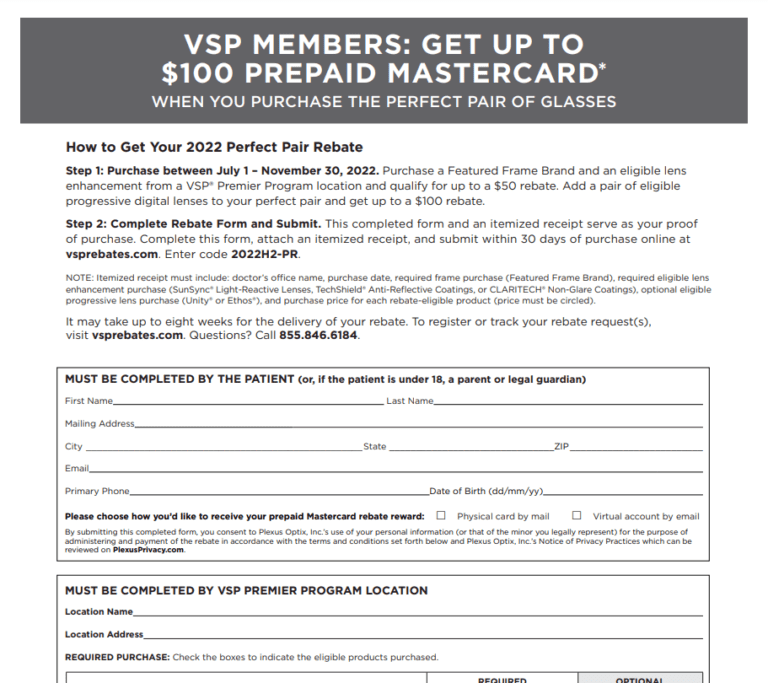

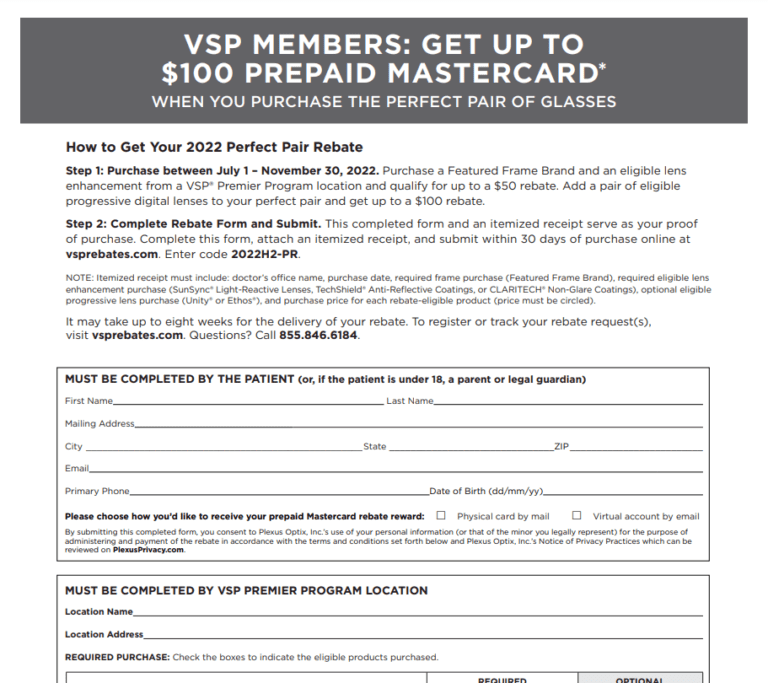

Vsp Rebate Forms Printable Rebate Form

Free Printable Menards Coupons 2020 Semashow

Fill Free Fillable Inland Revenue Department New Zealand PDF Forms

https://www.ird.govt.nz/-/media/project/ir/home/documents/fo…

Web donations you ve made through payroll giving at your workplace payments made where there is direct benefit to the donor or the donor s family IRD number Tax year Your

https://www.revenue.ie/.../charitable-donations/index.aspx

Web 1 ao 251 t 2023 nbsp 0183 32 The 112 32 is a Pay As You Earn PAYE tax refund now donated to the charity Any further PAYE tax refunds available to claim by you for the year of the

Web donations you ve made through payroll giving at your workplace payments made where there is direct benefit to the donor or the donor s family IRD number Tax year Your

Web 1 ao 251 t 2023 nbsp 0183 32 The 112 32 is a Pay As You Earn PAYE tax refund now donated to the charity Any further PAYE tax refunds available to claim by you for the year of the

Vsp Rebate Forms Printable Rebate Form

Supplier Rebate Agreement Template

Free Printable Menards Coupons 2020 Semashow

Fill Free Fillable Inland Revenue Department New Zealand PDF Forms

Fill Free Fillable Inland Revenue Department New Zealand PDF Forms

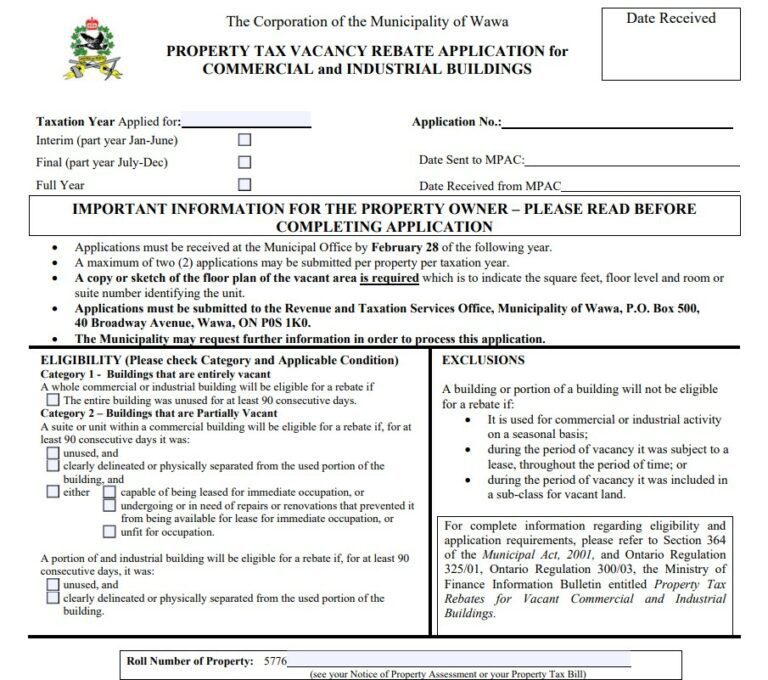

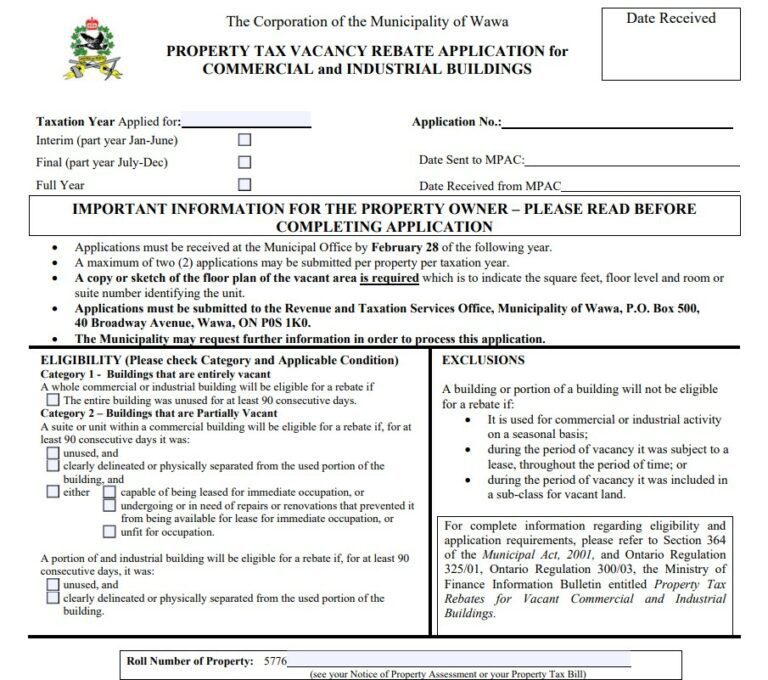

Wawa Revenue 2023 Printable Rebate Form

Wawa Revenue 2023 Printable Rebate Form

P55 Tax Rebate Form Business Printable Rebate Form