In today's consumer-driven world everyone is looking for a great bargain. One option to obtain substantial savings from your purchases is via Inflation Reduction Act Rebatess. Inflation Reduction Act Rebatess are a marketing strategy used by manufacturers and retailers to offer customers a payment on their purchases, after they've placed them. In this article, we will dive into the world Inflation Reduction Act Rebatess. We'll explore the nature of them as well as how they work and ways you can increase your savings with these cost-effective incentives.

Get Latest Inflation Reduction Act Rebates Below

Inflation Reduction Act Rebates

Inflation Reduction Act Rebates - Inflation Reduction Act Rebates, Inflation Reduction Act Rebates 2023, Inflation Reduction Act Rebates California, Inflation Reduction Act Rebates For Heat Pumps, Inflation Reduction Act Rebates How To Apply, Inflation Reduction Act Rebates Colorado, Inflation Reduction Act Rebates Wisconsin, Inflation Reduction Act Rebates And Tax Credits, Inflation Reduction Act Rebates Minnesota, Inflation Reduction Act Rebates Ohio

Web 4 ao 251 t 2023 nbsp 0183 32 ICE Policy Fellows Steve Lee and Duncan Symonds unpack the legislation and its implications for infrastructure

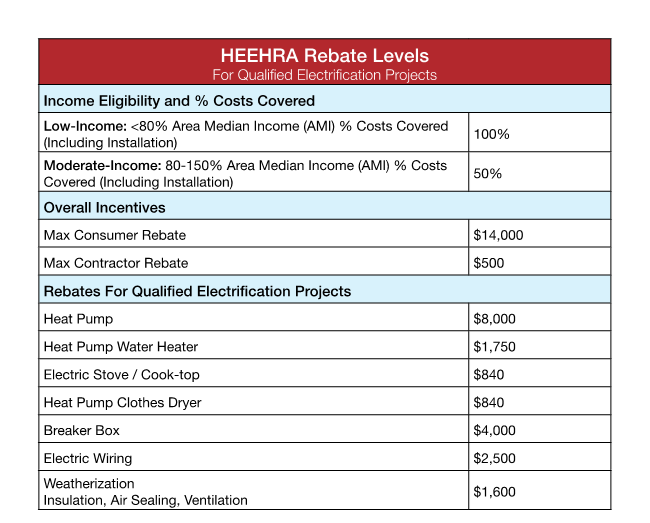

Web 13 ao 251 t 2022 nbsp 0183 32 The rebates are double up to 4 000 and 8 000 respectively for lower income households Their income must be 80 or less of an area s median

A Inflation Reduction Act Rebates or Inflation Reduction Act Rebates, in its most basic form, is a partial reimbursement to a buyer after they've bought a product or service. It's a powerful method utilized by businesses to attract customers, boost sales, and advertise specific products.

Types of Inflation Reduction Act Rebates

Chuck Schumer On Twitter Here s The Truth Of How The Inflation

Chuck Schumer On Twitter Here s The Truth Of How The Inflation

Web Il y a 1 jour nbsp 0183 32 President Biden s landmark climate bill the Inflation Reduction Act takes aim at this issue by allocating 8 8 billion to home energy efficiency rebates primarily for at

Web 29 ao 251 t 2023 nbsp 0183 32 The price negotiation program established by Democrats as part of the Inflation Reduction Act is projected to save the government tens of billions of dollars in

Cash Inflation Reduction Act Rebates

Cash Inflation Reduction Act Rebates are the most straightforward type of Inflation Reduction Act Rebates. Customers receive a specified sum of money back when buying a product. These are typically applied to the most expensive products like electronics or appliances.

Mail-In Inflation Reduction Act Rebates

Customers who want to receive mail-in Inflation Reduction Act Rebates must provide evidence of purchase to get their cash back. They are a bit longer-lasting, however they offer substantial savings.

Instant Inflation Reduction Act Rebates

Instant Inflation Reduction Act Rebates are applied at the point of sale and reduce prices immediately. Customers don't have to wait long for savings in this manner.

How Inflation Reduction Act Rebates Work

What S In The Inflation Reduction Act And What S Next For Its

What S In The Inflation Reduction Act And What S Next For Its

Web The Inflation Reduction Act will expand these opportunities bringing an estimated 8 3 billion of investment in large scale clean power generation and storage

The Inflation Reduction Act Rebates Process

The procedure typically consists of a number of easy steps:

-

When you buy the product you buy the product just like you normally would.

-

Complete the Inflation Reduction Act Rebates form: You'll have submit some information, such as your name, address and information about the purchase to make a claim for your Inflation Reduction Act Rebates.

-

Complete the Inflation Reduction Act Rebates The Inflation Reduction Act Rebates must be submitted in accordance with the kind of Inflation Reduction Act Rebates you could be required to mail a Inflation Reduction Act Rebates form in or send it via the internet.

-

Wait for approval: The company will look over your submission to make sure that it's in accordance with the Inflation Reduction Act Rebates's terms and conditions.

-

You will receive your Inflation Reduction Act Rebates Once it's approved, you'll receive your money back, through a check, or a prepaid card, or through another method specified by the offer.

Pros and Cons of Inflation Reduction Act Rebates

Advantages

-

Cost savings Rewards can drastically reduce the price you pay for an item.

-

Promotional Offers: They encourage customers to try new items or brands.

-

Improve Sales Inflation Reduction Act Rebates can help boost an organization's sales and market share.

Disadvantages

-

Complexity Pay-in Inflation Reduction Act Rebates via mail, particularly the case of HTML0, can be a hassle and costly.

-

Deadlines for Expiration A majority of Inflation Reduction Act Rebates have very strict deadlines for filing.

-

A risk of not being paid Certain customers could lose their Inflation Reduction Act Rebates in the event that they don't observe the rules precisely.

Download Inflation Reduction Act Rebates

Download Inflation Reduction Act Rebates

FAQs

1. Are Inflation Reduction Act Rebates similar to discounts? No, Inflation Reduction Act Rebates are a partial refund after purchase, but discounts can reduce the purchase price at time of sale.

2. Do I have to use multiple Inflation Reduction Act Rebates on the same item? It depends on the terms of the Inflation Reduction Act Rebates offers and the product's suitability. Certain companies allow it, and some don't.

3. How long will it take to get the Inflation Reduction Act Rebates? The period is variable, however it can be anywhere from a few weeks up to a few months to get your Inflation Reduction Act Rebates.

4. Do I have to pay tax of Inflation Reduction Act Rebates values? the majority of circumstances, Inflation Reduction Act Rebates amounts are not considered taxable income.

5. Do I have confidence in Inflation Reduction Act Rebates deals from lesser-known brands? It's essential to research and ensure that the business giving the Inflation Reduction Act Rebates is legitimate prior to making purchases.

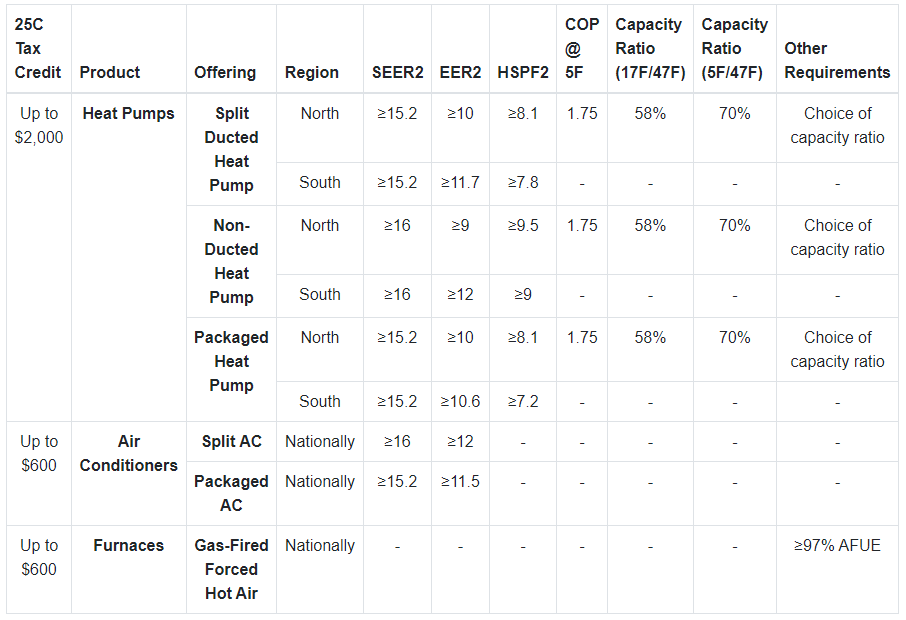

HVAC Rebates Inflation Reduction Act Get Up To 2 000 In Tax Credits

Inflation Reduction Act Electrical Plumbing Savings Blog

Check more sample of Inflation Reduction Act Rebates below

Inflation Reduction Act Explained Save Big On HVAC Systems

How Can I Use Inflation Reduction Act Rebates InflationReductionAct

Inflation Reduction Act Appliance Rebates Rebate2022

Here s How The Inflation Reduction Act s Rebates And Tax Credits For

Inflation Reduction Act Medicare Prestige Wealth Management Group

The Inflation Reduction Act And The New Tax Incentives Rebates For High

https://www.cnbc.com/2022/08/13/how-to-qualify-for-inflation-reduction...

Web 13 ao 251 t 2022 nbsp 0183 32 The rebates are double up to 4 000 and 8 000 respectively for lower income households Their income must be 80 or less of an area s median

https://www.cnbc.com/2022/09/03/inflation-re…

Web 3 sept 2022 nbsp 0183 32 The Inflation Reduction Act which President Biden signed into law Aug 16 offers tax credits and rebates to consumers who buy clean vehicles and appliances or take other steps to reduce their

Web 13 ao 251 t 2022 nbsp 0183 32 The rebates are double up to 4 000 and 8 000 respectively for lower income households Their income must be 80 or less of an area s median

Web 3 sept 2022 nbsp 0183 32 The Inflation Reduction Act which President Biden signed into law Aug 16 offers tax credits and rebates to consumers who buy clean vehicles and appliances or take other steps to reduce their

Here s How The Inflation Reduction Act s Rebates And Tax Credits For

How Can I Use Inflation Reduction Act Rebates InflationReductionAct

Inflation Reduction Act Medicare Prestige Wealth Management Group

The Inflation Reduction Act And The New Tax Incentives Rebates For High

Inflation Reduction Act Summary What It Means For New HVAC Systems

Rebates ABE Heating Cooling

Rebates ABE Heating Cooling

MSH PRESENTS HOW TO SAVE ENERGY WITH CREDITS REBATES FROM THE