In our modern, consumer-driven society every person loves a great bargain. One way to earn substantial savings from your purchases is via Income Tax Rebatess. Income Tax Rebatess are a strategy for marketing that retailers and manufacturers use to offer customers a partial refund for their purchases after they have created them. In this post, we'll go deeper into the realm of Income Tax Rebatess, exploring what they are, how they work, and how you can maximise your savings through these cost-effective incentives.

Get Latest Income Tax Rebates Below

Income Tax Rebates

Income Tax Rebates - Income Tax Rebates, Income Tax Rebates For Senior Citizens, Income Tax Rebates 2024, Income Tax Rebates For Salaried Employees, Income Tax Rebates And Reliefs, Income Tax Rebates For Ay 2022-23, For Tax Rebates, Income Tax Rebate On Home Loan, Income Tax Return, Income Tax Refund Status

Web 1 ITR 1 SAHAJ Applicable for Individual This return is applicable for a Resident other than Not Ordinarily Resident Individual having Total Income from any of the following

Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

A Income Tax Rebates, in its simplest definition, is a refund offered to a customer after they've bought a product or service. It's a very effective technique used by companies to attract customers, increase sales, and even promote certain products.

Types of Income Tax Rebates

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form

Web 22 f 233 vr 2023 nbsp 0183 32 Tax Rebates 22 February 2023 See changes from last year Tax Thresholds 22 February 2023 See changes from last year Last Updated

Cash Income Tax Rebates

Cash Income Tax Rebates are the most straightforward kind of Income Tax Rebates. Customers are offered a certain sum of money back when purchasing a product. These are typically for large-ticket items such as electronics and appliances.

Mail-In Income Tax Rebates

Mail-in Income Tax Rebates need customers to submit proof of purchase in order to receive their reimbursement. They're more involved, however they can yield huge savings.

Instant Income Tax Rebates

Instant Income Tax Rebates are credited at the point of sale, and can reduce the purchase price immediately. Customers don't have to wait until they can save through this kind of offer.

How Income Tax Rebates Work

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

Web 15 ao 251 t 2014 nbsp 0183 32 Details If you ve paid too much tax and want to claim back the over payment use form R38 You can also use this form to authorise a representative to get the

The Income Tax Rebates Process

It usually consists of a few steps:

-

Purchase the item: First purchase the product the way you normally do.

-

Fill out the Income Tax Rebates form: You'll have to provide some data, such as your name, address along with the purchase details, to receive your Income Tax Rebates.

-

Send in the Income Tax Rebates: Depending on the kind of Income Tax Rebates there may be a requirement to mail in a form or send it via the internet.

-

Wait for the company's approval: They will scrutinize your submission to confirm that it complies with the guidelines and conditions of the Income Tax Rebates.

-

Accept your Income Tax Rebates After approval, the amount you receive will be whether by check, prepaid card, or a different option specified by the offer.

Pros and Cons of Income Tax Rebates

Advantages

-

Cost savings The use of Income Tax Rebates can greatly lower the cost you pay for the product.

-

Promotional Deals The aim is to encourage customers to test new products or brands.

-

Help to Increase Sales: Income Tax Rebates can boost the company's sales as well as market share.

Disadvantages

-

Complexity Reward mail-ins in particular is a time-consuming process and slow-going.

-

Days of expiration A lot of Income Tax Rebates have deadlines for submission.

-

Risk of Not Being Paid: Some customers may not be able to receive their Income Tax Rebates if they don't observe the rules precisely.

Download Income Tax Rebates

FAQs

1. Are Income Tax Rebates the same as discounts? No, Income Tax Rebates involve only a partial reimbursement following the purchase, whereas discounts reduce the cost of purchase at time of sale.

2. Can I make use of multiple Income Tax Rebates on the same product This is dependent on conditions that apply to the Income Tax Rebates incentives and the specific product's ability to qualify. Some companies may allow it, while others won't.

3. What is the time frame to get a Income Tax Rebates? The time frame varies, but it can take anywhere from a couple of weeks to a couple of months to receive your Income Tax Rebates.

4. Do I have to pay taxes in relation to Income Tax Rebates the amount? most cases, Income Tax Rebates amounts are not considered to be taxable income.

5. Do I have confidence in Income Tax Rebates deals from lesser-known brands Consider doing some research and verify that the brand offering the Income Tax Rebates is trustworthy prior to making the purchase.

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

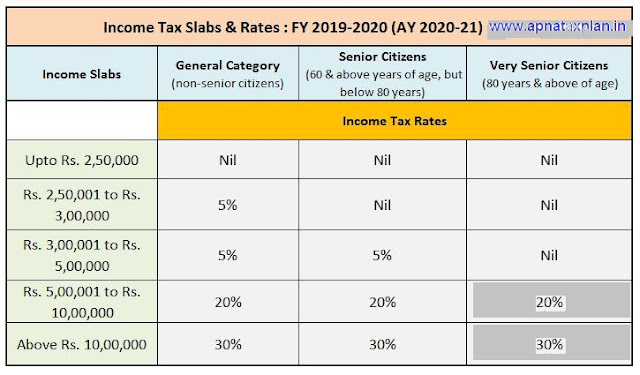

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Check more sample of Income Tax Rebates below

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

Income Tax Rebate U s 87 A Increased By 500 From FY 2019 20

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Tax Rebate On Income Upto 5 Lakh Under Section 87A

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-a...

Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

https://www.irs.gov/newsroom/recovery-rebate-credit

Web 20 d 233 c 2022 nbsp 0183 32 The first and second rounds of Economic Impact Payments were advance payments of the 2020 Recovery Rebate Credit claimed on a 2020 tax return They were

Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Web 20 d 233 c 2022 nbsp 0183 32 The first and second rounds of Economic Impact Payments were advance payments of the 2020 Recovery Rebate Credit claimed on a 2020 tax return They were

Income Tax Rebate U s 87 A Increased By 500 From FY 2019 20

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Tax Rebate On Income Upto 5 Lakh Under Section 87A

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

Tax Tables 2021 Learngross

Tax Tables 2021 Learngross

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained