In our current world of high-end consumer goods everybody loves a good deal. One way to score significant savings on your purchases is through Income Tax Rebate Form 10es. Income Tax Rebate Form 10es can be a way of marketing used by manufacturers and retailers to offer customers a reimbursement on their purchases following the time they've made them. In this article, we will dive into the world Income Tax Rebate Form 10es and explore the nature of them and how they function, as well as ways to maximize your savings through these efficient incentives.

Get Latest Income Tax Rebate Form 10e Below

Income Tax Rebate Form 10e

Income Tax Rebate Form 10e - Income Tax Return Form 10e, Income Tax Relief 10e Form, What Is 10e Form In Income Tax

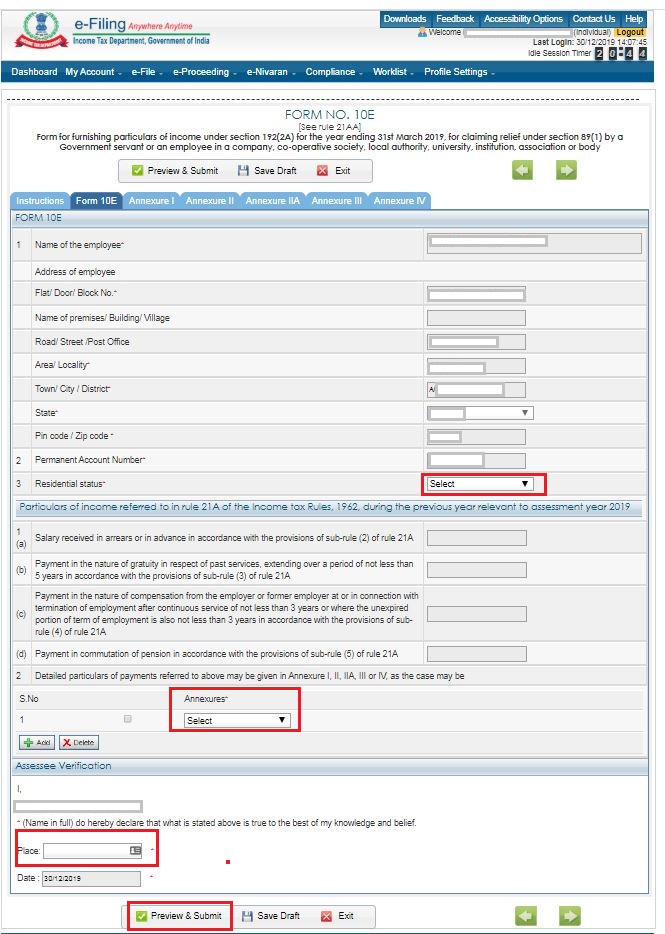

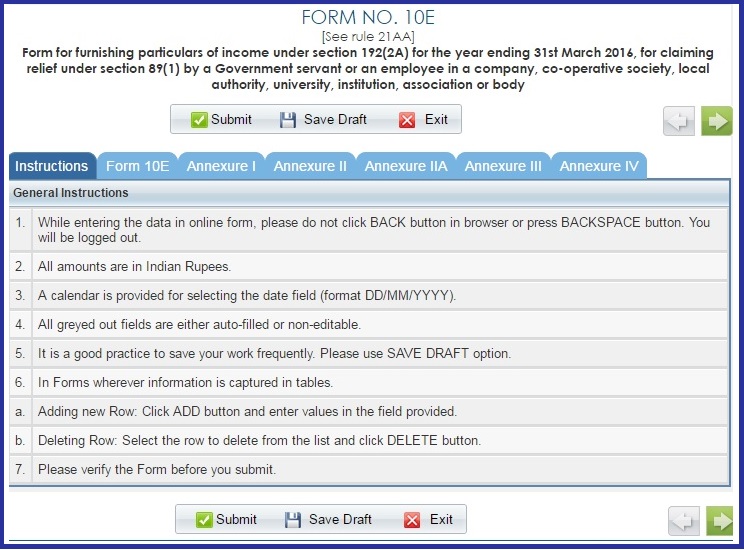

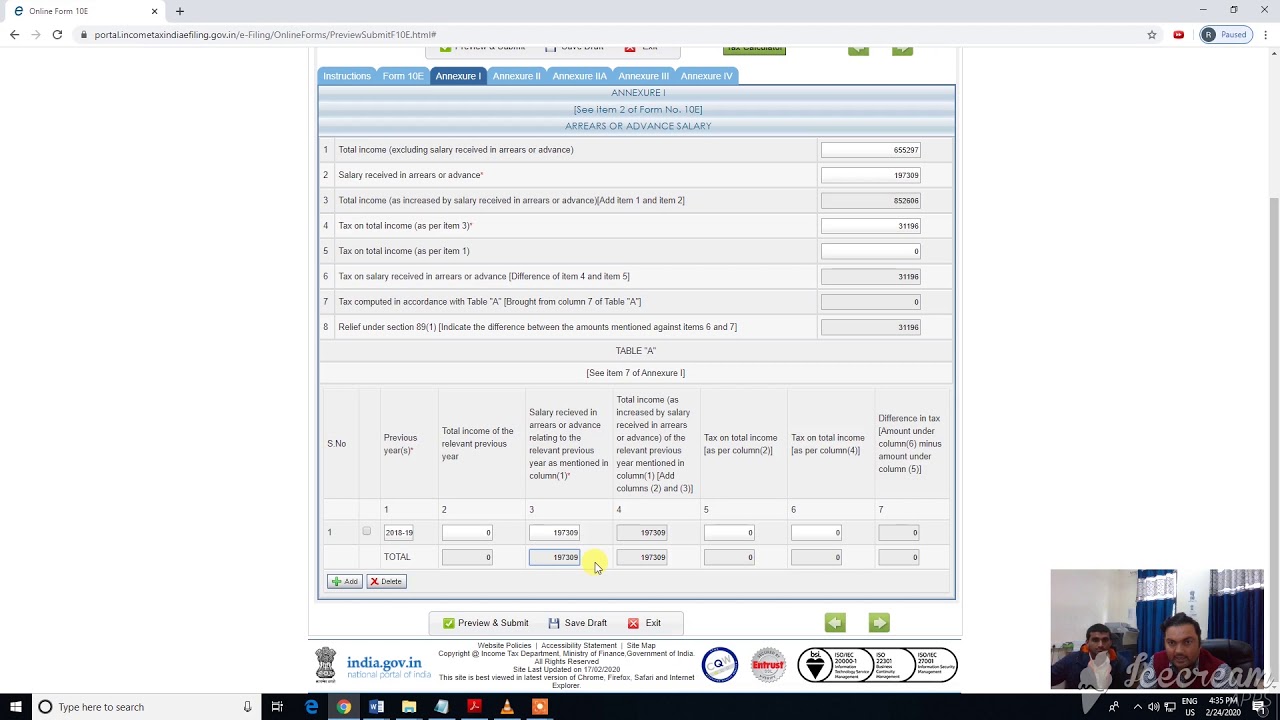

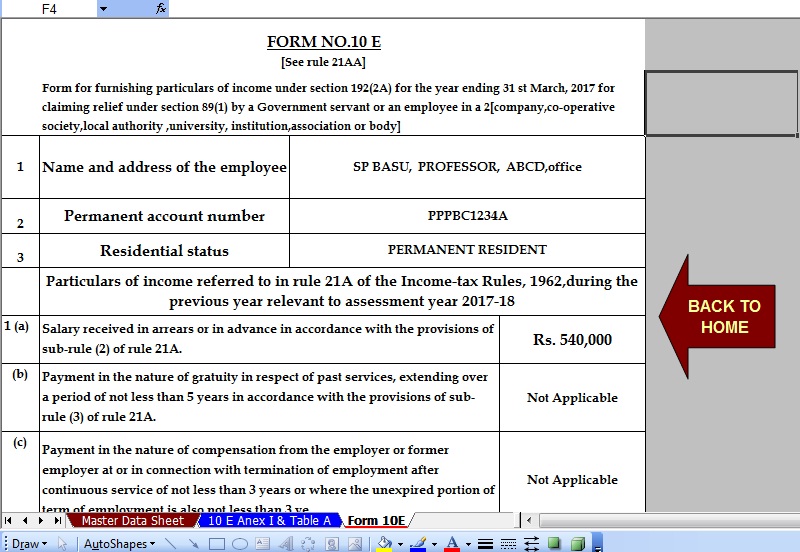

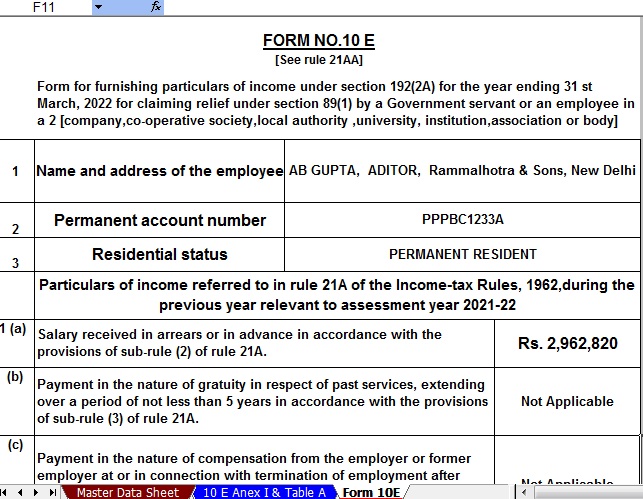

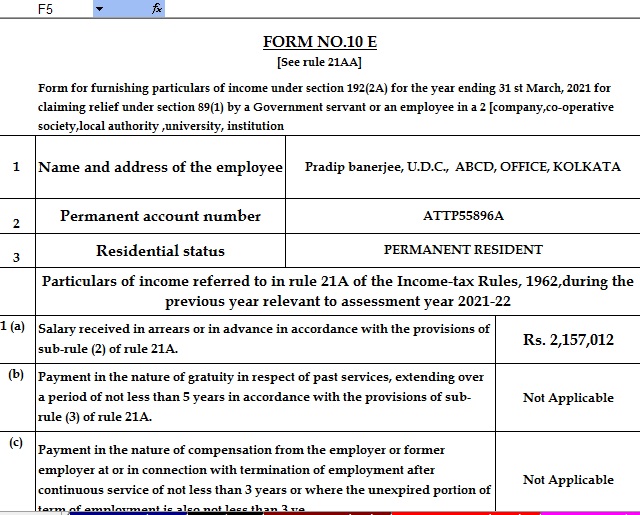

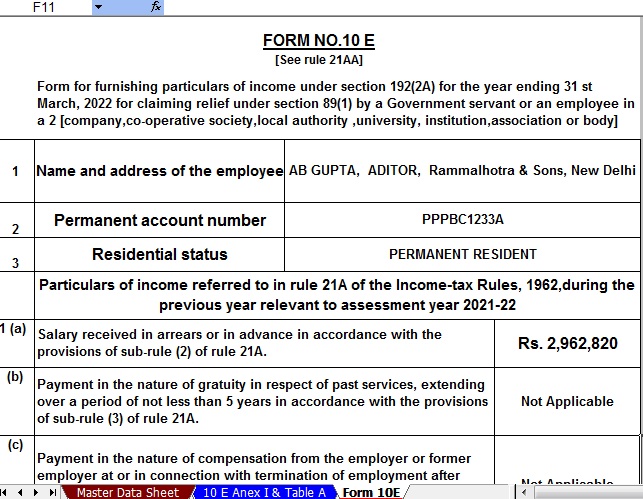

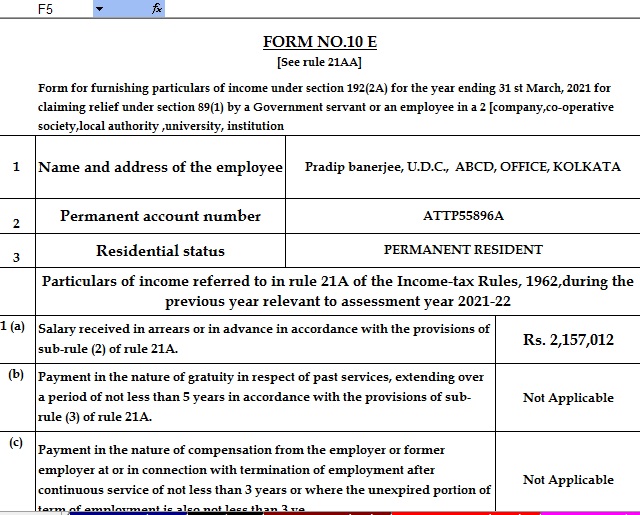

Web FORM NO 10E See rule 21AA Form for furnishing particulars of income under section 192 2A for the year ending 31st March for claiming relief under section 89 1 by a

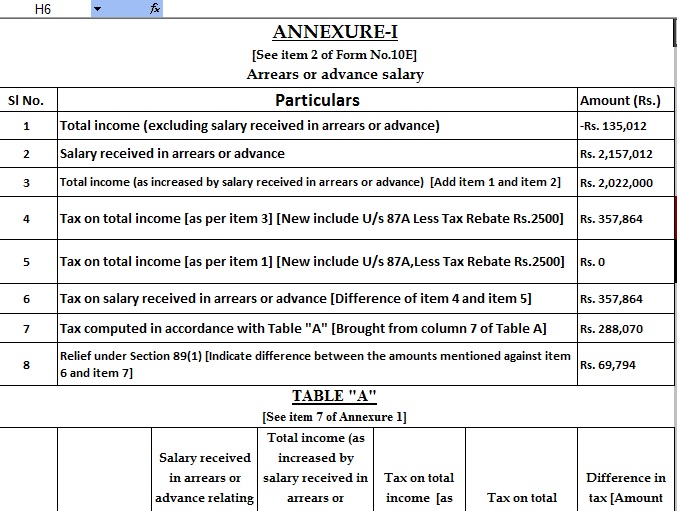

Web What is Form 10E In case of receipt in arrears or advance of any sum in the nature of salary relief u s 89 can be claimed In order to claim such relief the assessee has to file

A Income Tax Rebate Form 10e, in its simplest type, is a refund that a client receives after they've bought a product or service. It's a highly effective tool that companies use to attract customers, boost sales, and market specific products.

Types of Income Tax Rebate Form 10e

Form 10E Is Mandatory To Claim Section 89 Relief SAP Blogs

Form 10E Is Mandatory To Claim Section 89 Relief SAP Blogs

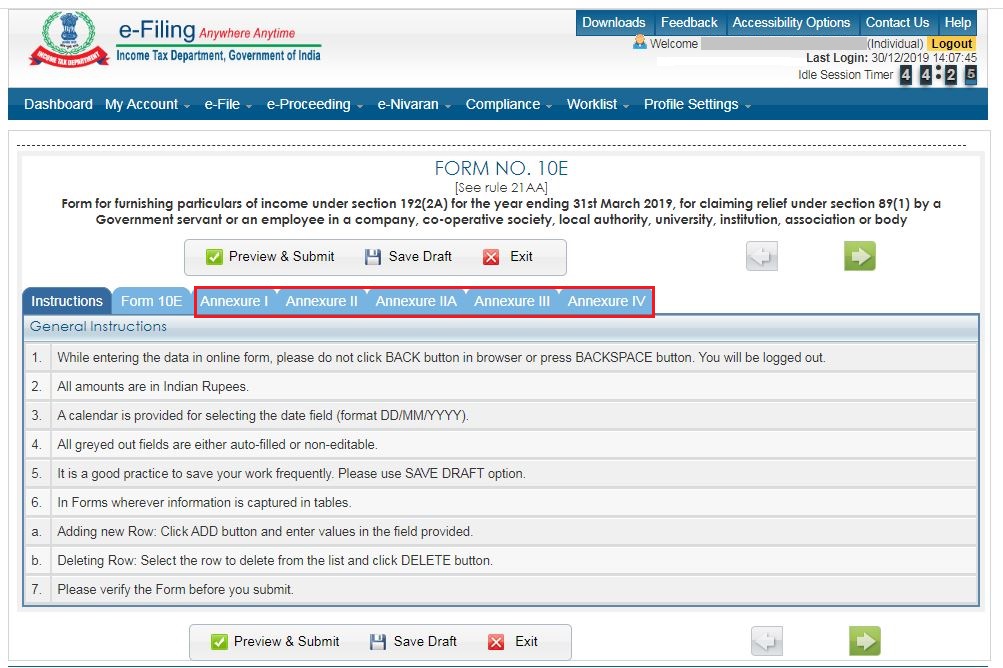

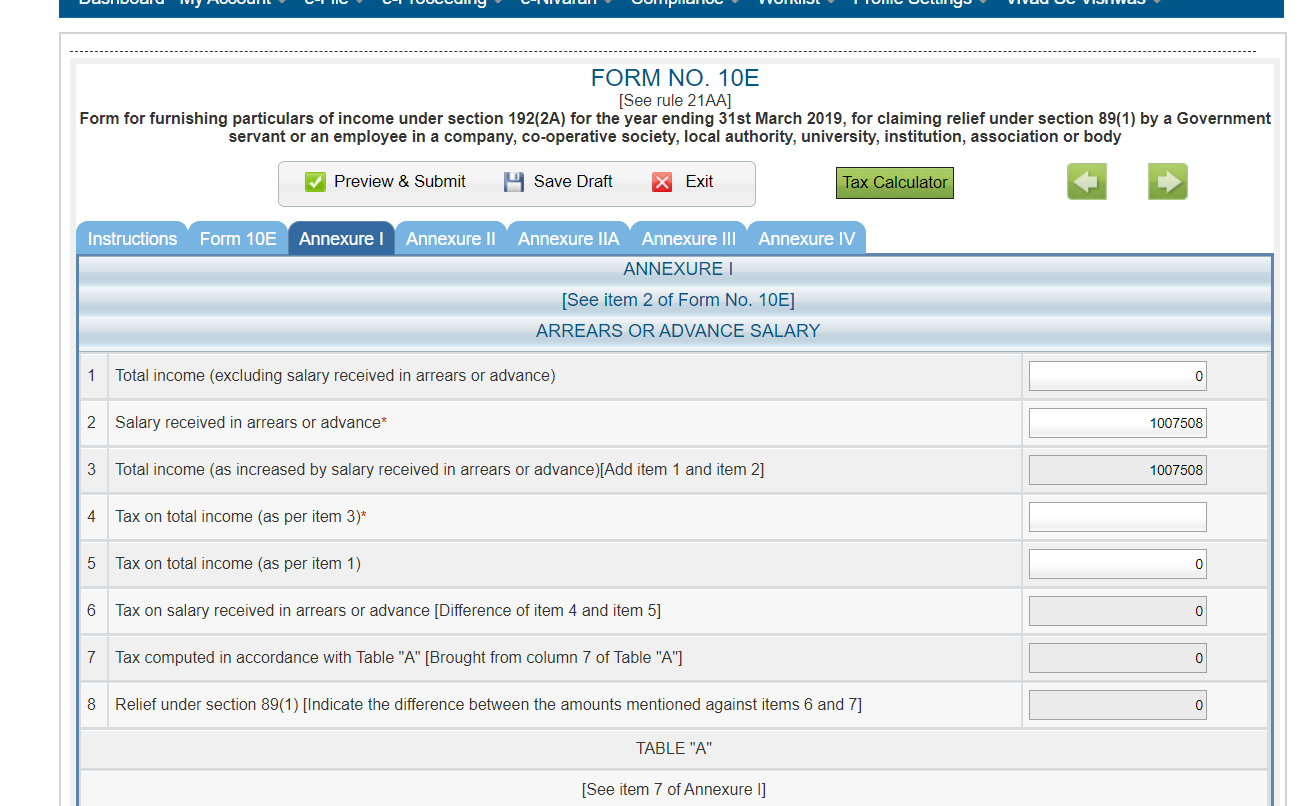

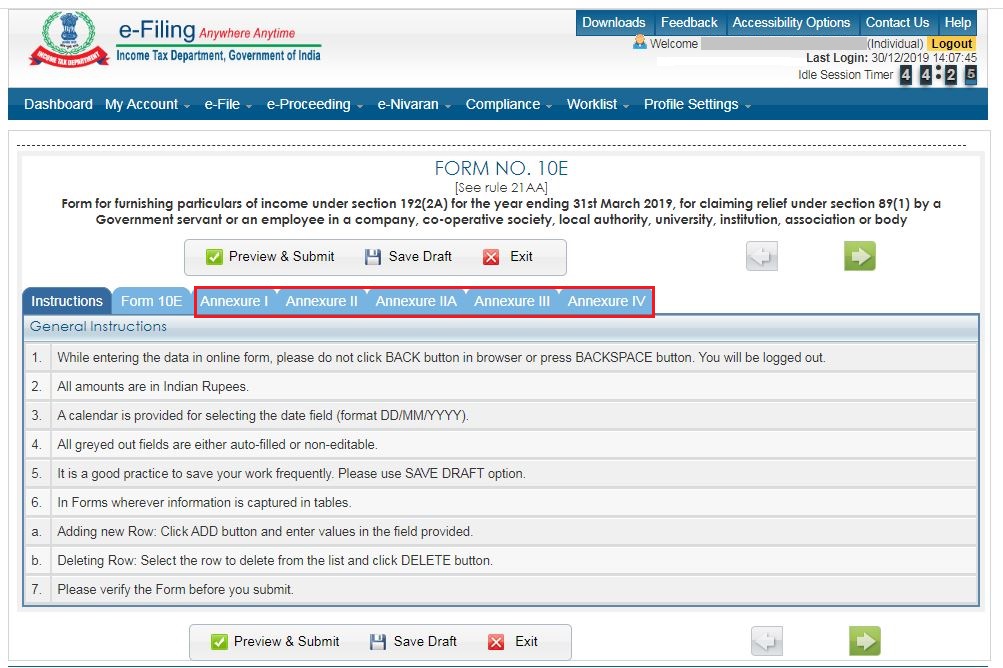

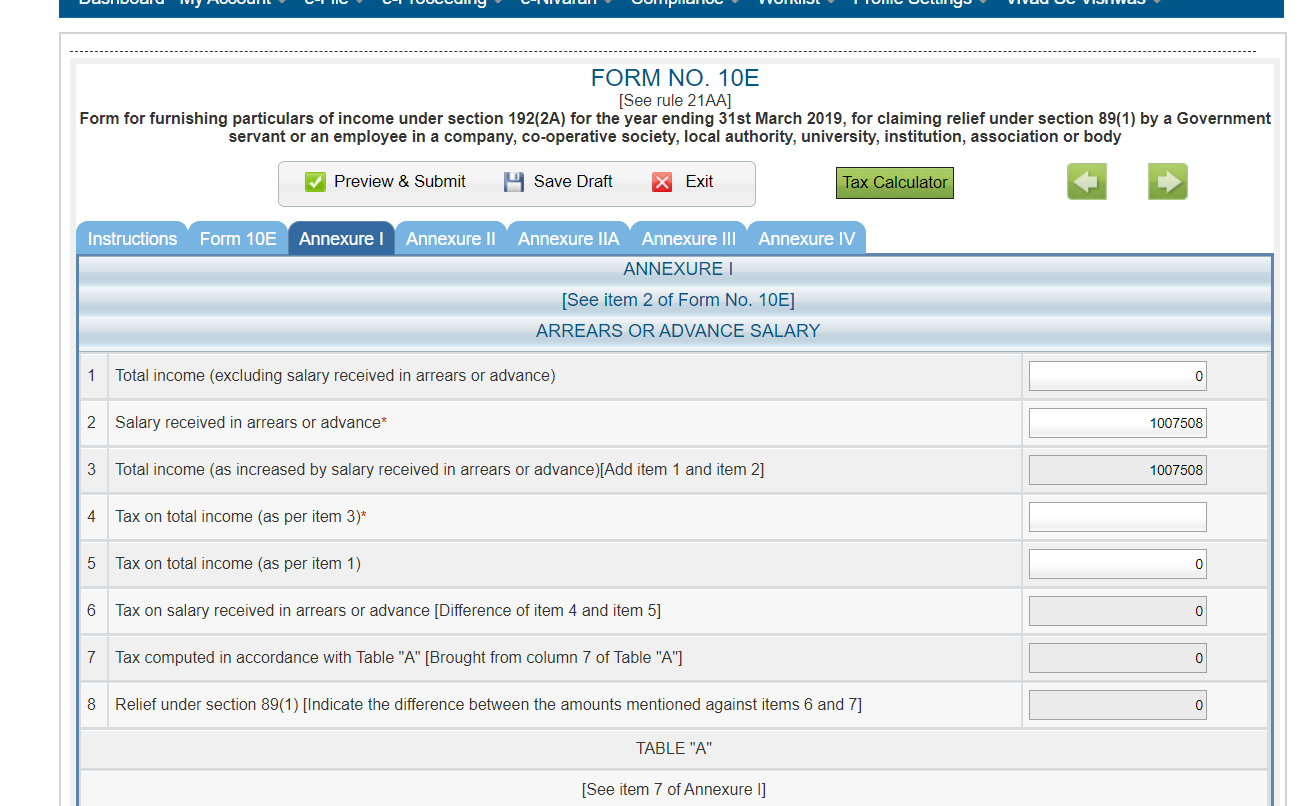

Web 11 janv 2023 nbsp 0183 32 The steps for filing online form No 10E are as under 1 Login to your income tax e filing account 2 Under efile menu go to Prepare and Submit Form Online Other than ITR 3 Select the AY and Form No

Web 17 juin 2023 nbsp 0183 32 FORM 10E If you are eligible to claim a relief on arrear income under Section 89 1 read with Rule 21A you would have to fill and file Form 10E The form is available on the website of the Income Tax

Cash Income Tax Rebate Form 10e

Cash Income Tax Rebate Form 10e are probably the most simple type of Income Tax Rebate Form 10e. Customers get a set amount of cash back after purchasing a item. They are typically used to purchase products that are expensive, such as electronics or appliances.

Mail-In Income Tax Rebate Form 10e

Mail-in Income Tax Rebate Form 10e require the customer to provide proof of purchase in order to receive the refund. They're a little longer-lasting, however they offer substantial savings.

Instant Income Tax Rebate Form 10e

Instant Income Tax Rebate Form 10e can be applied at the point of sale, which reduces the purchase cost immediately. Customers do not have to wait around for savings through this kind of offer.

How Income Tax Rebate Form 10e Work

Form 10E On Income Tax E filing Portal Learn By Quicko

Form 10E On Income Tax E filing Portal Learn By Quicko

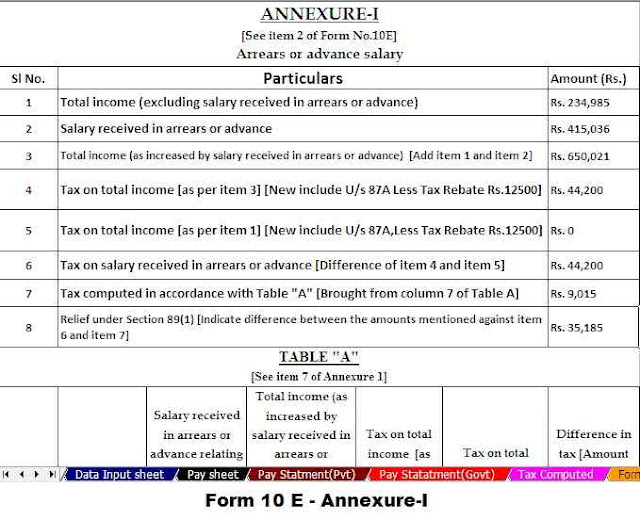

Web 8 f 233 vr 2023 nbsp 0183 32 Form 10E is a form to be submitted on Income Tax e filing portal to claim relief under Section 89 for any salary arrears or advance salary received during a financial year It gives relief to the taxpayer

The Income Tax Rebate Form 10e Process

The process typically involves a few steps:

-

Buy the product: At first then, you buy the item as you normally would.

-

Fill out the Income Tax Rebate Form 10e forms: The Income Tax Rebate Form 10e form will have to fill in some information like your name, address and information about the purchase to be eligible for a Income Tax Rebate Form 10e.

-

Submit the Income Tax Rebate Form 10e: Depending on the nature of Income Tax Rebate Form 10e you could be required to submit a form by mail or submit it online.

-

Wait for the company's approval: They will look over your submission to make sure that it's in accordance with the reimbursement's terms and condition.

-

Pay your Income Tax Rebate Form 10e Once you've received your approval, you'll receive your refund whether by check, prepaid card, or other option specified by the offer.

Pros and Cons of Income Tax Rebate Form 10e

Advantages

-

Cost Savings A Income Tax Rebate Form 10e can significantly cut the price you pay for the product.

-

Promotional Deals Incentivize customers to try new items or brands.

-

increase sales Income Tax Rebate Form 10e are a great way to boost a company's sales and market share.

Disadvantages

-

Complexity In particular, mail-in Income Tax Rebate Form 10e particularly is a time-consuming process and long-winded.

-

Day of Expiration Most Income Tax Rebate Form 10e come with the strictest deadlines for submission.

-

The risk of non-payment: Some customers may lose their Income Tax Rebate Form 10e in the event that they do not follow the rules precisely.

Download Income Tax Rebate Form 10e

Download Income Tax Rebate Form 10e

FAQs

1. Are Income Tax Rebate Form 10e the same as discounts? No, they are a partial refund after purchase, whereas discounts reduce prices at moment of sale.

2. Can I use multiple Income Tax Rebate Form 10e on the same item This depends on the conditions and conditions of Income Tax Rebate Form 10e offers and the product's qualification. Certain businesses may allow it, but others won't.

3. How long does it take to receive the Income Tax Rebate Form 10e? The period can vary, but typically it will take several weeks to a couple of months to receive your Income Tax Rebate Form 10e.

4. Do I need to pay taxes when I receive Income Tax Rebate Form 10e amounts? In the majority of circumstances, Income Tax Rebate Form 10e amounts are not considered to be taxable income.

5. Can I trust Income Tax Rebate Form 10e offers from brands that aren't well-known It's important to do your research and make sure that the company providing the Income Tax Rebate Form 10e has a good reputation prior to making any purchase.

INCOME TAX ARREARS REBATE FORM 10E U S 89 1 Edu Plus Official

Income Tax Form 10E YouTube

Check more sample of Income Tax Rebate Form 10e below

Income Tax Relief Income Tax Relief Form 10e

Download Automated Excel Based Income Tax Arrears Relief Calculator

DOWNLOAD AUTOMATED INCOME TAX 89 1 ARREARS RELIEF CALCULATOR WITH FORM

Form 10E On Income Tax E filing Portal Learn By Quicko

Salary Received In Arrears Or In Advance Don t Forget To File Form 10E

Download Auto Calculate Income Tax Arrears Relief Calculator U s 89 1

https://www.incometax.gov.in/.../statutory-forms/popular-form/form10e-faq

Web What is Form 10E In case of receipt in arrears or advance of any sum in the nature of salary relief u s 89 can be claimed In order to claim such relief the assessee has to file

https://cleartax.in/s/filing-form-10e-claim-relief-section-89-1

Web 3 avr 2017 nbsp 0183 32 How to File Form 10E Login to https incometaxindiaefiling gov in with your User ID and password along with the date of birth After you have logged in

Web What is Form 10E In case of receipt in arrears or advance of any sum in the nature of salary relief u s 89 can be claimed In order to claim such relief the assessee has to file

Web 3 avr 2017 nbsp 0183 32 How to File Form 10E Login to https incometaxindiaefiling gov in with your User ID and password along with the date of birth After you have logged in

Form 10E On Income Tax E filing Portal Learn By Quicko

Download Automated Excel Based Income Tax Arrears Relief Calculator

Salary Received In Arrears Or In Advance Don t Forget To File Form 10E

Download Auto Calculate Income Tax Arrears Relief Calculator U s 89 1

Taxexcel Automated Income Tax Preparation Software In Excel For The

Procedure To Claim Relief U s 89 1 Or How To Upload 10E Form

Procedure To Claim Relief U s 89 1 Or How To Upload 10E Form

FORM 10 E FORM 10 F Company Vakil