In today's consumer-driven world, everyone loves a good bargain. One way to make significant savings on your purchases is through Income Tax Hra Rebate Forms. Income Tax Hra Rebate Forms are a strategy for marketing that retailers and manufacturers use to offer consumers a partial return on their purchases once they have purchased them. In this article, we will explore the world of Income Tax Hra Rebate Forms, examining the nature of them, how they work, as well as ways to maximize the savings you can make by using these cost-effective incentives.

Get Latest Income Tax Hra Rebate Form Below

Income Tax Hra Rebate Form

Income Tax Hra Rebate Form -

Web 9 f 233 vr 2023 nbsp 0183 32 House Rent Allowance HRA is paid by an employer to employees as a part of their salary to meet the accommodation expenses Salaried individuals who live in

Web 22 sept 2022 nbsp 0183 32 5 Tax Benefits of HRA HRA deduction under Section 10 13A of the ITA has the following benefits The biggest advantage of the HRA rebate is that it reduces

A Income Tax Hra Rebate Form in its simplest version, is an ad-hoc return to the customer when they purchase a product or service. It's an effective way used by businesses to attract customers, increase sales, and also to advertise certain products.

Types of Income Tax Hra Rebate Form

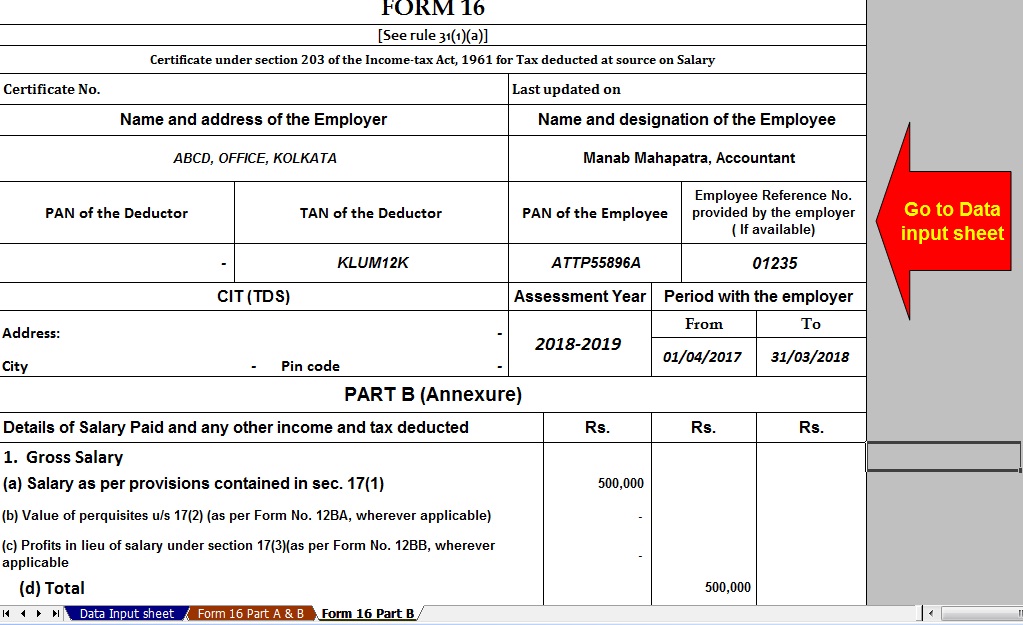

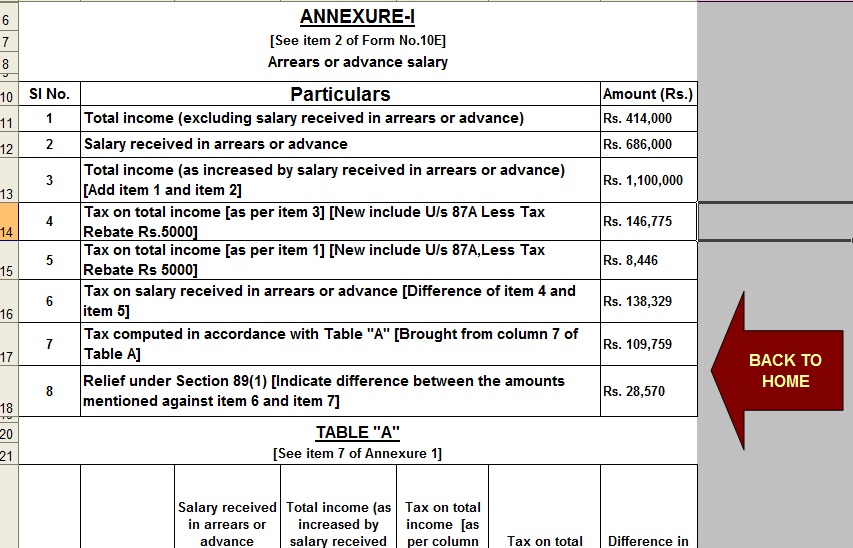

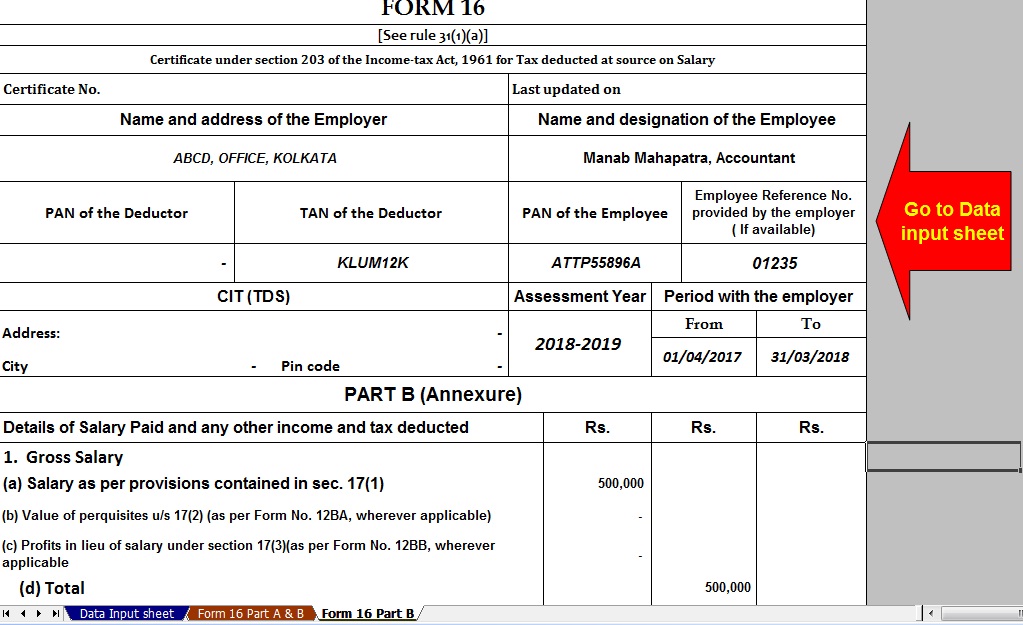

Download Automated Tax Computed Sheet HRA Calculation Arrears

Download Automated Tax Computed Sheet HRA Calculation Arrears

Web 28 juil 2019 nbsp 0183 32 Form 16 is the official TDS certificate issued by an employer to its employees It contains the details of the TDS Tax deducted at

Web Conditions to be satisfied for claiming HRA deduction This deduction is allowed only when an employee actually pay rent for his residence purpose If no rent is paid for any period

Cash Income Tax Hra Rebate Form

Cash Income Tax Hra Rebate Form are by far the easiest type of Income Tax Hra Rebate Form. The customer receives a particular amount of money in return for purchasing a item. These are often used for expensive items such as electronics or appliances.

Mail-In Income Tax Hra Rebate Form

Mail-in Income Tax Hra Rebate Form need customers to send in proof of purchase in order to receive their cash back. They're somewhat more involved, but can result in huge savings.

Instant Income Tax Hra Rebate Form

Instant Income Tax Hra Rebate Form will be applied at point of sale. They reduce the cost of purchase immediately. Customers don't need to wait long for savings through this kind of offer.

How Income Tax Hra Rebate Form Work

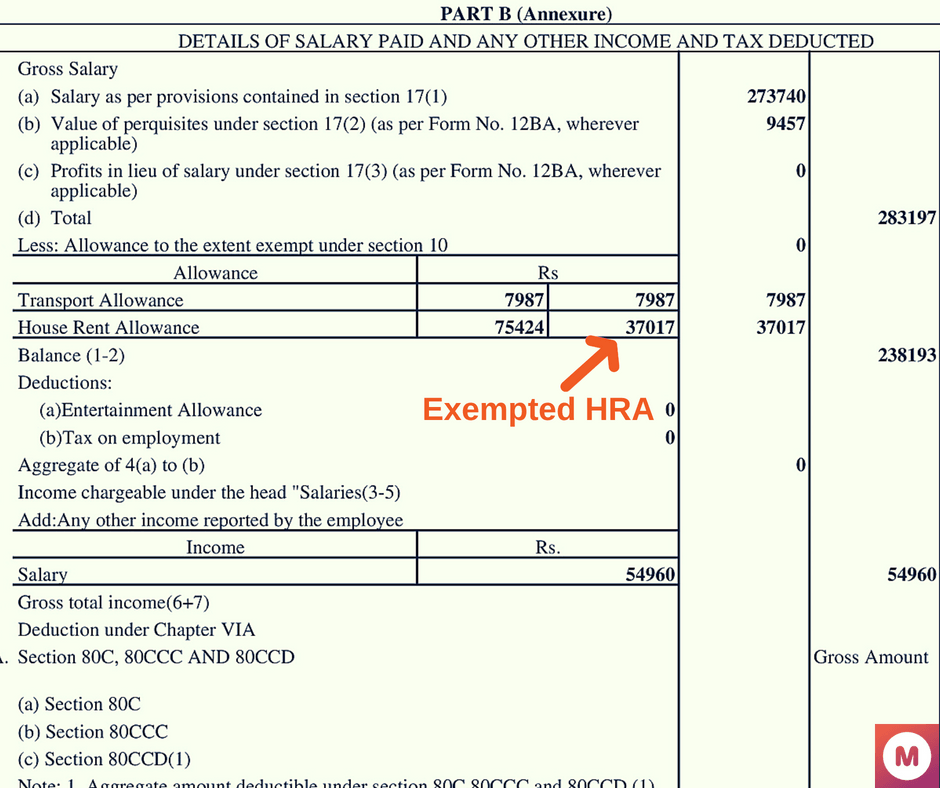

House Rent Allowance HRA Deduction Calculation AY 2019 20 Meteorio

House Rent Allowance HRA Deduction Calculation AY 2019 20 Meteorio

Web 10 f 233 vr 2023 nbsp 0183 32 HRA exemption limits The HRA exemption a salaried person is eligible to receive is the lowest of the following amounts according to Rule 2A of Income Tax

The Income Tax Hra Rebate Form Process

The process typically involves a couple of steps that are easy to follow:

-

Buy the product: Firstly then, you buy the item the way you normally do.

-

Fill in your Income Tax Hra Rebate Form forms: The Income Tax Hra Rebate Form form will have to fill in some information including your address, name, and the purchase details, in order in order to submit your Income Tax Hra Rebate Form.

-

To submit the Income Tax Hra Rebate Form If you want to submit the Income Tax Hra Rebate Form, based on the type of Income Tax Hra Rebate Form there may be a requirement to submit a claim form to the bank or send it via the internet.

-

Wait until the company approves: The company is going to review your entry to verify that it is compliant with the reimbursement's terms and condition.

-

Take advantage of your Income Tax Hra Rebate Form When it's approved you'll get your refund, either by check, prepaid card, or by another method specified by the offer.

Pros and Cons of Income Tax Hra Rebate Form

Advantages

-

Cost savings The use of Income Tax Hra Rebate Form can greatly lower the cost you pay for a product.

-

Promotional Offers: They encourage customers to try new items or brands.

-

Increase Sales The benefits of a Income Tax Hra Rebate Form can improve the company's sales as well as market share.

Disadvantages

-

Complexity Reward mail-ins in particular they can be time-consuming and take a long time to complete.

-

Day of Expiration Many Income Tax Hra Rebate Form impose certain deadlines for submitting.

-

Risk of Not Being Paid Customers may not receive Income Tax Hra Rebate Form if they do not follow the rules exactly.

Download Income Tax Hra Rebate Form

Download Income Tax Hra Rebate Form

FAQs

1. Are Income Tax Hra Rebate Form the same as discounts? No, the Income Tax Hra Rebate Form will be a partial refund after purchase, but discounts can reduce costs at moment of sale.

2. Are there any Income Tax Hra Rebate Form that I can use for the same product It's contingent upon the terms of the Income Tax Hra Rebate Form deals and product's admissibility. Certain businesses may allow it, but some will not.

3. What is the time frame to get an Income Tax Hra Rebate Form? The amount of time will differ, but can take anywhere from a few weeks to a couple of months for you to receive your Income Tax Hra Rebate Form.

4. Do I have to pay tax upon Income Tax Hra Rebate Form amounts? In the majority of instances, Income Tax Hra Rebate Form amounts are not considered to be taxable income.

5. Should I be able to trust Income Tax Hra Rebate Form offers from lesser-known brands it is crucial to conduct research and ensure that the brand which is providing the Income Tax Hra Rebate Form is credible prior to making an investment.

Download Automated Tax Computed Sheet HRA Calculation Arrears

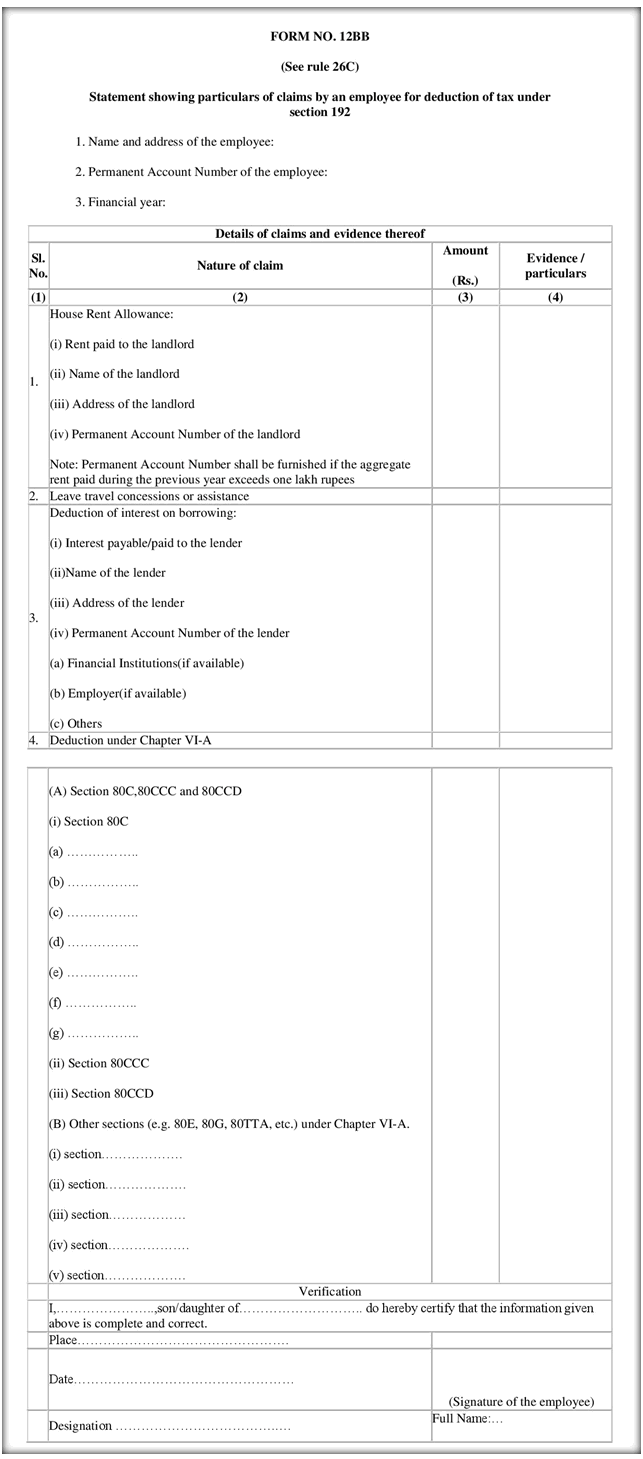

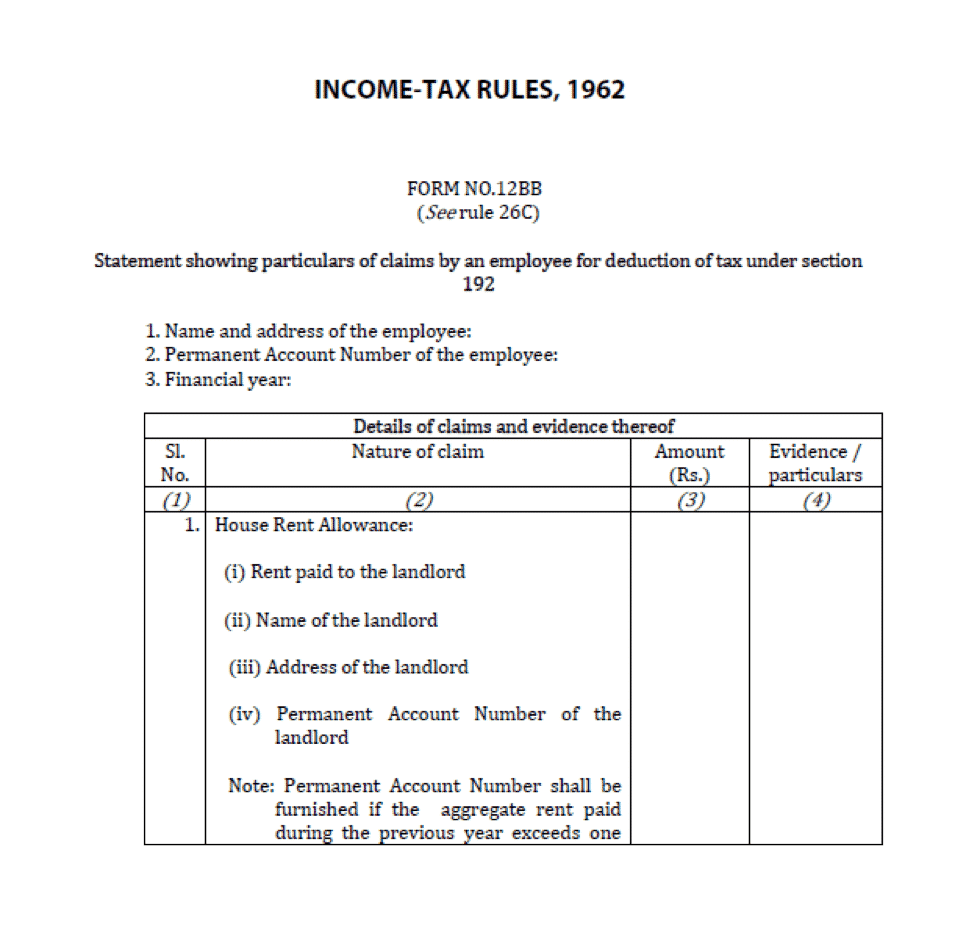

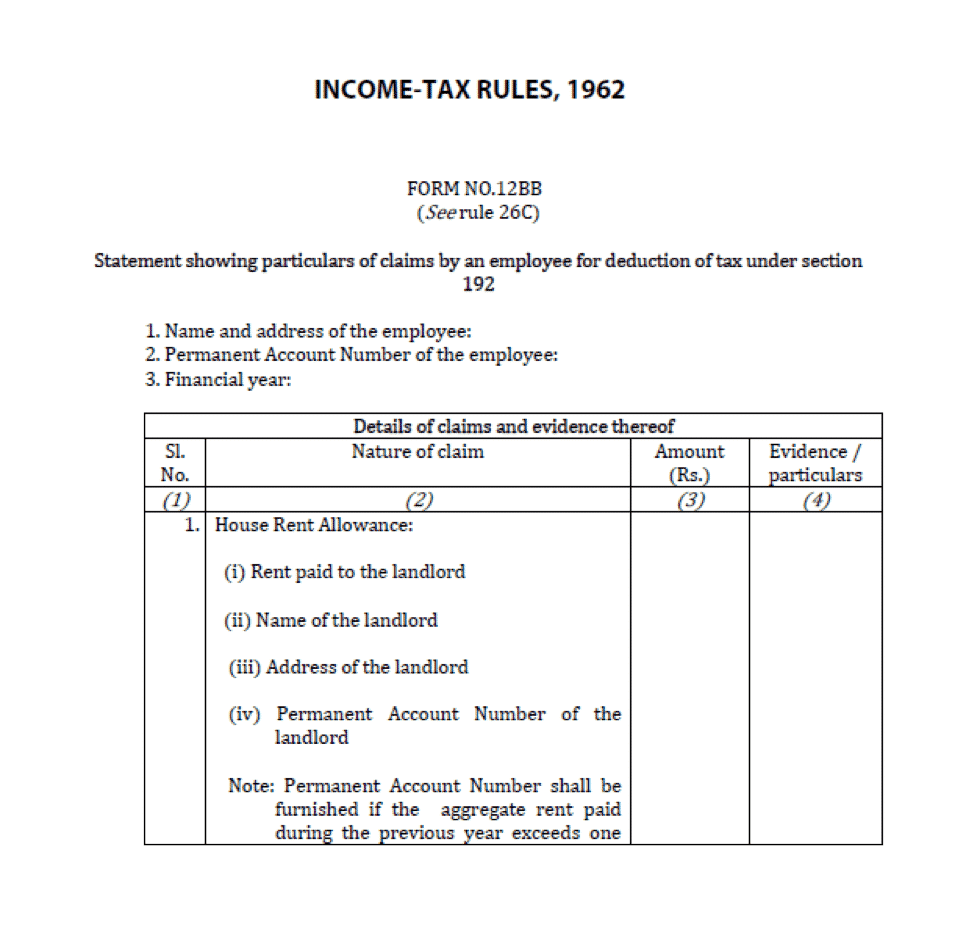

New Form 12BB For LTA HRA And Home Loan Interest Proofs To Be

Check more sample of Income Tax Hra Rebate Form below

HRA LTA Tax Deductions Can Be Claimed Using Form 12BB

How To Show HRA Not Accounted By The Employer In ITR

Exclusive Tax Receipt Template For Piano Lessons Great

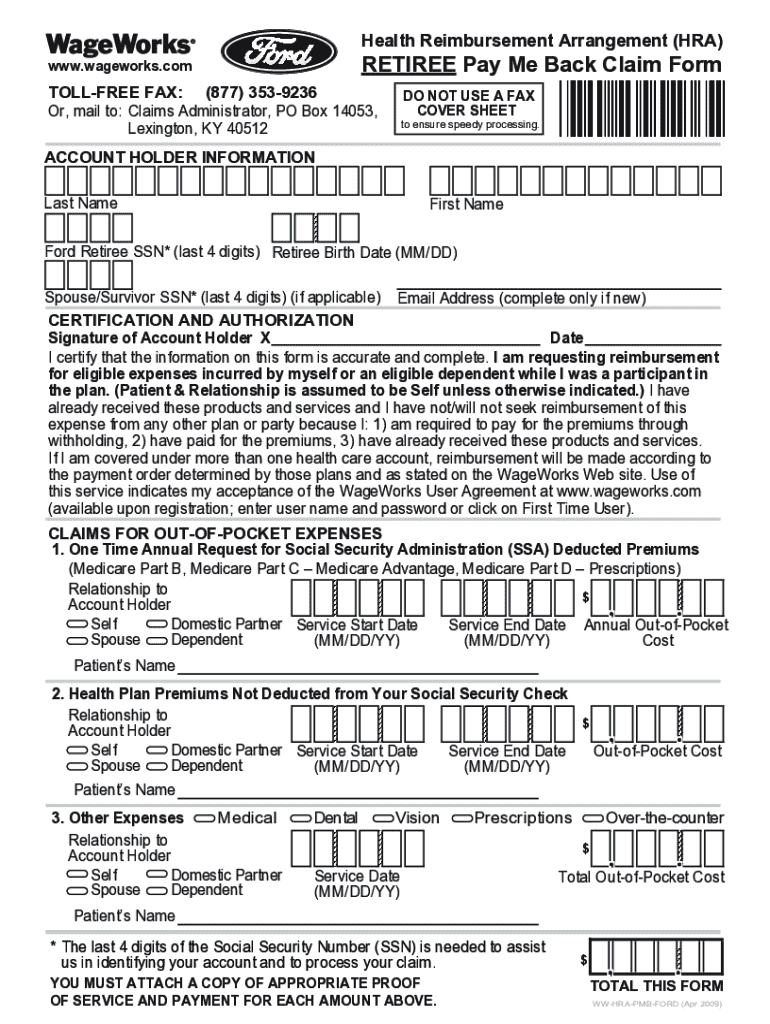

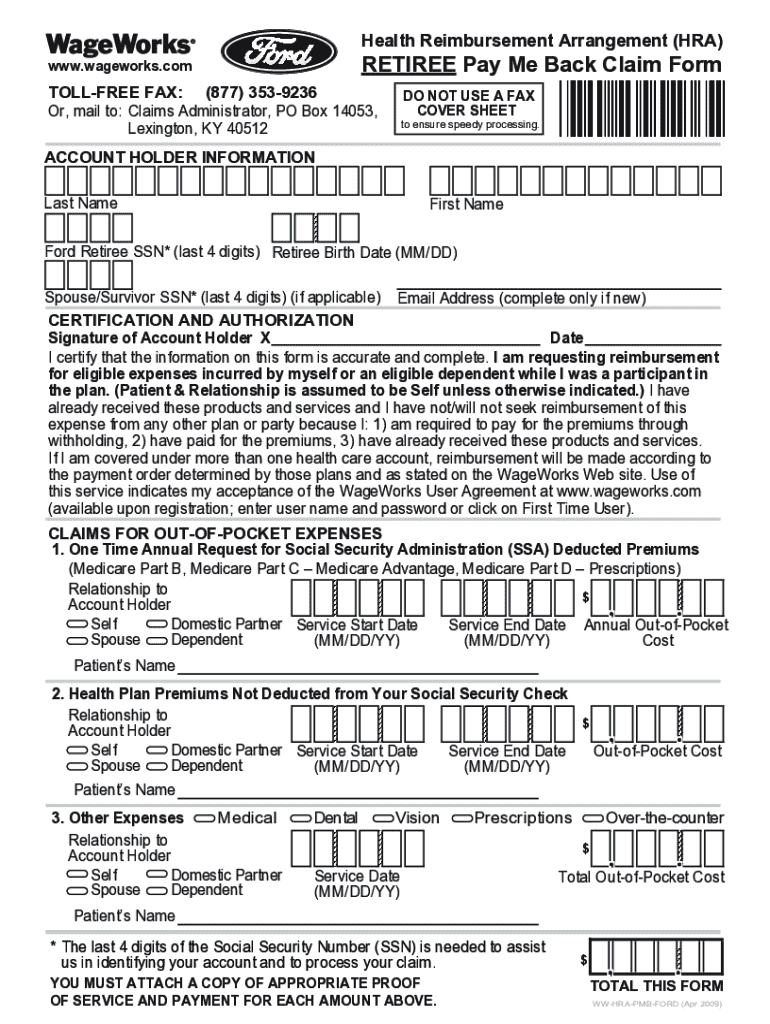

WW HRA PMB FORD 2009 2022 Fill And Sign Printable Template Online

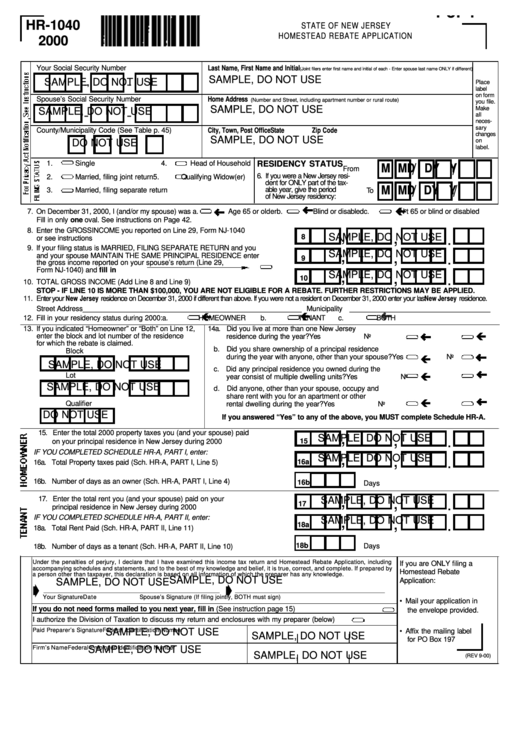

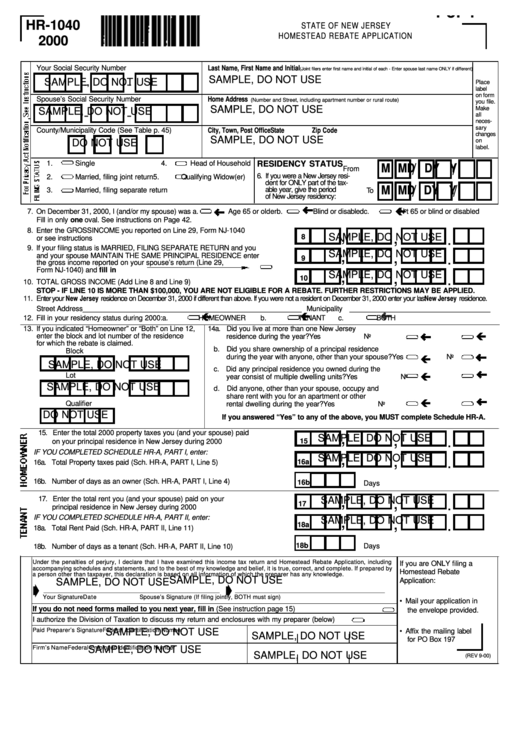

Form Hr 1040 Sample Homestead Rebate Application 2000 Printable Pdf

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

https://www.etmoney.com/learn/saving-schemes/house-rent-allowance

Web 22 sept 2022 nbsp 0183 32 5 Tax Benefits of HRA HRA deduction under Section 10 13A of the ITA has the following benefits The biggest advantage of the HRA rebate is that it reduces

https://incometaxindia.gov.in/Pages/tools/house-rent-allowance...

Web DA forming part of salary Commission as of turnover achieved by the employee HRA Received Rent Paid Tick if residing in metro city Tick if Yes Exempted House Rent

Web 22 sept 2022 nbsp 0183 32 5 Tax Benefits of HRA HRA deduction under Section 10 13A of the ITA has the following benefits The biggest advantage of the HRA rebate is that it reduces

Web DA forming part of salary Commission as of turnover achieved by the employee HRA Received Rent Paid Tick if residing in metro city Tick if Yes Exempted House Rent

WW HRA PMB FORD 2009 2022 Fill And Sign Printable Template Online

How To Show HRA Not Accounted By The Employer In ITR

Form Hr 1040 Sample Homestead Rebate Application 2000 Printable Pdf

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

Supplier Rebate Agreement Template

A Very Simple Guide To Form 12BB Download Format PDF

A Very Simple Guide To Form 12BB Download Format PDF

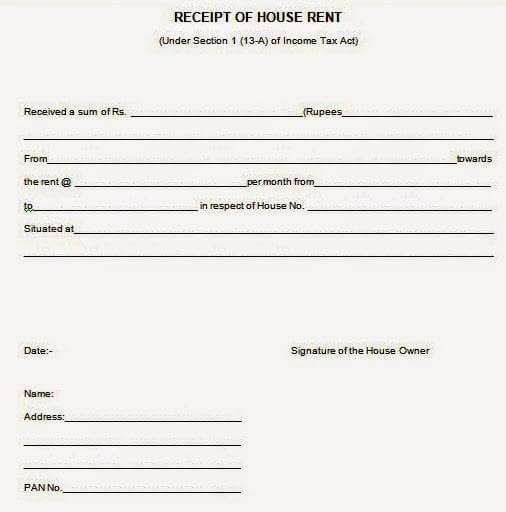

Guide On Rent Receipts How To Claim HRA Deduction Tax2win