In this modern-day world of consumers people love a good bargain. One way to gain significant savings in your purchase is through Hst Rebate Form For Charitiess. Hst Rebate Form For Charitiess are a method of marketing that retailers and manufacturers use to offer consumers a partial payment on their purchases, after they've purchased them. In this article, we'll dive into the world Hst Rebate Form For Charitiess. We will explore the nature of them as well as how they work and ways you can increase your savings by taking advantage of these cost-effective incentives.

Get Latest Hst Rebate Form For Charities Below

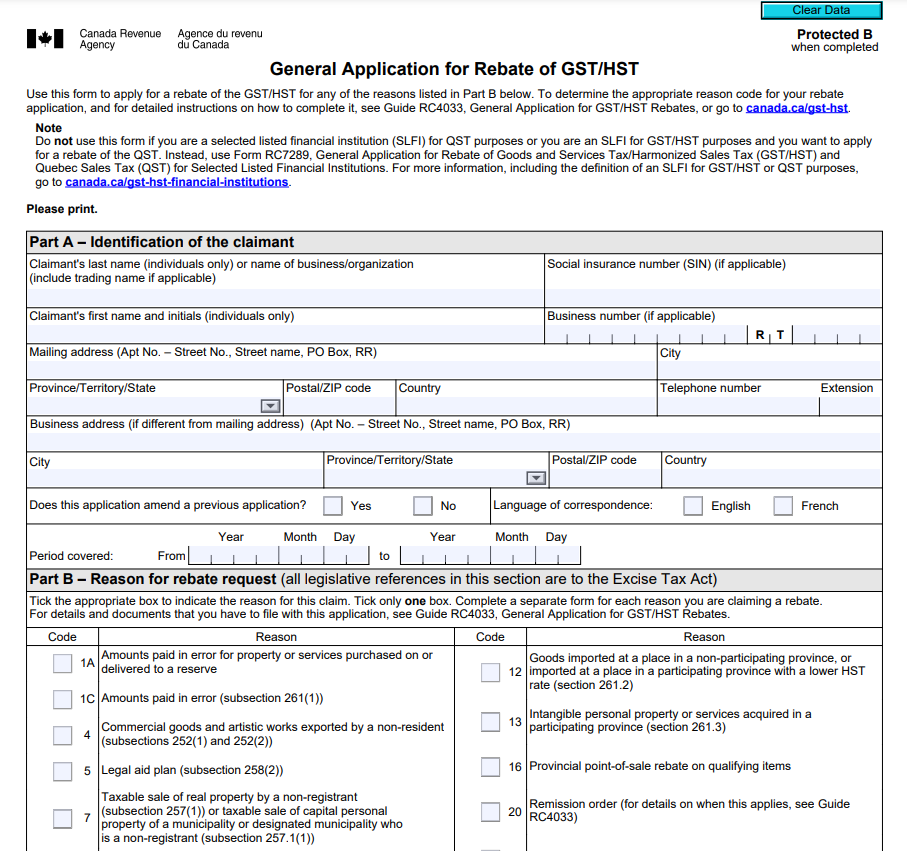

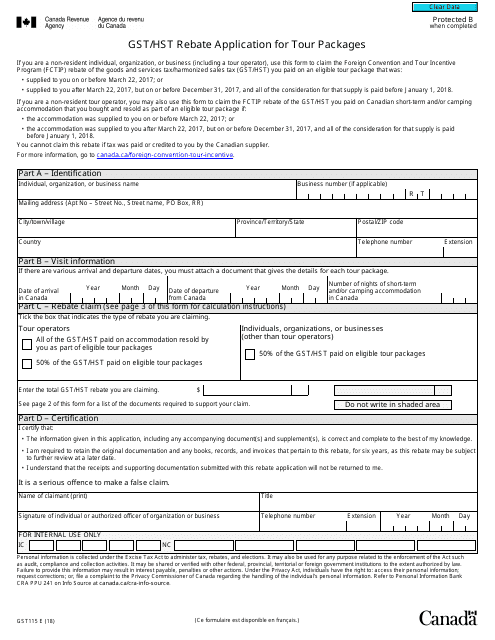

Hst Rebate Form For Charities

Hst Rebate Form For Charities -

Web The HST applies in the participating provinces at the following rates 13 in Ontario and 15 in New Brunswick Newfoundland and Labrador Nova Scotia and Prince Edward

Web A charity is entitled to claim a public service bodies rebate to recover a percentage of the GST HST paid or payable on eligible purchases and expenses for which it cannot claim

A Hst Rebate Form For Charities or Hst Rebate Form For Charities, in its most basic version, is an ad-hoc payment to a consumer who has purchased a particular product or service. It's a powerful instrument used by companies to attract clients, increase sales and to promote certain products.

Types of Hst Rebate Form For Charities

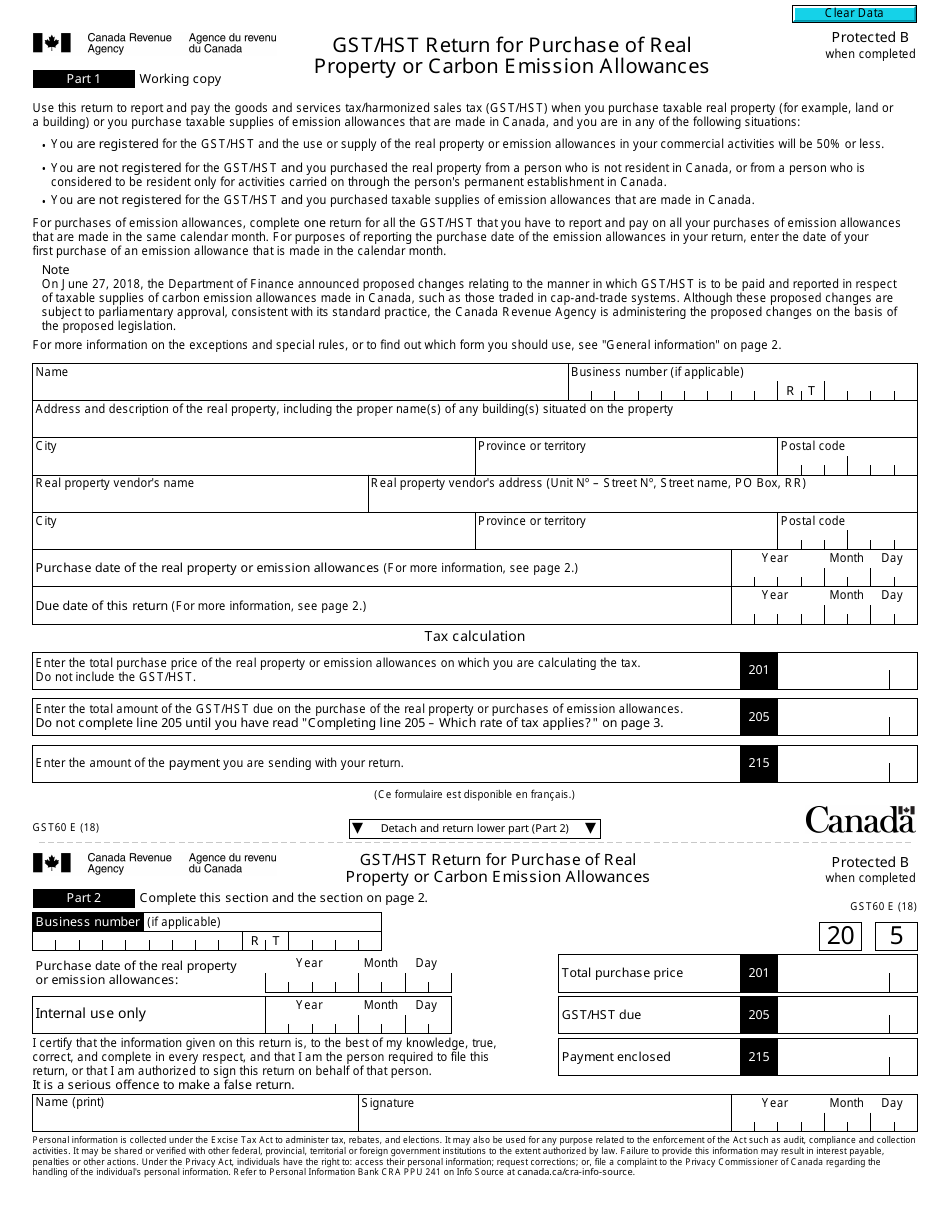

GST HST Rebate Form Asset Services Inc

GST HST Rebate Form Asset Services Inc

Web 1 avr 2019 nbsp 0183 32 For charities the majority of property and services supplied are exempt from GST HST Charities Specific Exemptions Supplies of used or donated goods Provision of new goods in exchange for

Web Charities and public institutions resident in a participating province can claim a rebate of the provincial part of the HST paid on goods and services exported outside Canada on Form

Cash Hst Rebate Form For Charities

Cash Hst Rebate Form For Charities are the simplest type of Hst Rebate Form For Charities. Clients receive a predetermined amount of money in return for buying a product. These are usually used for big-ticket items, like electronics and appliances.

Mail-In Hst Rebate Form For Charities

Mail-in Hst Rebate Form For Charities need customers to present documents of purchase to claim the money. They're a bit more involved, but offer substantial savings.

Instant Hst Rebate Form For Charities

Instant Hst Rebate Form For Charities are applied at the place of purchase, reducing the purchase price immediately. Customers don't have to wait for their savings by using this method.

How Hst Rebate Form For Charities Work

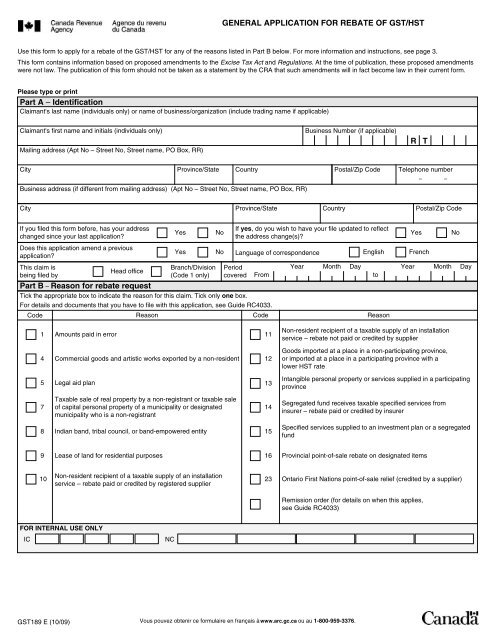

Gst Fillable Form Printable Forms Free Online

Gst Fillable Form Printable Forms Free Online

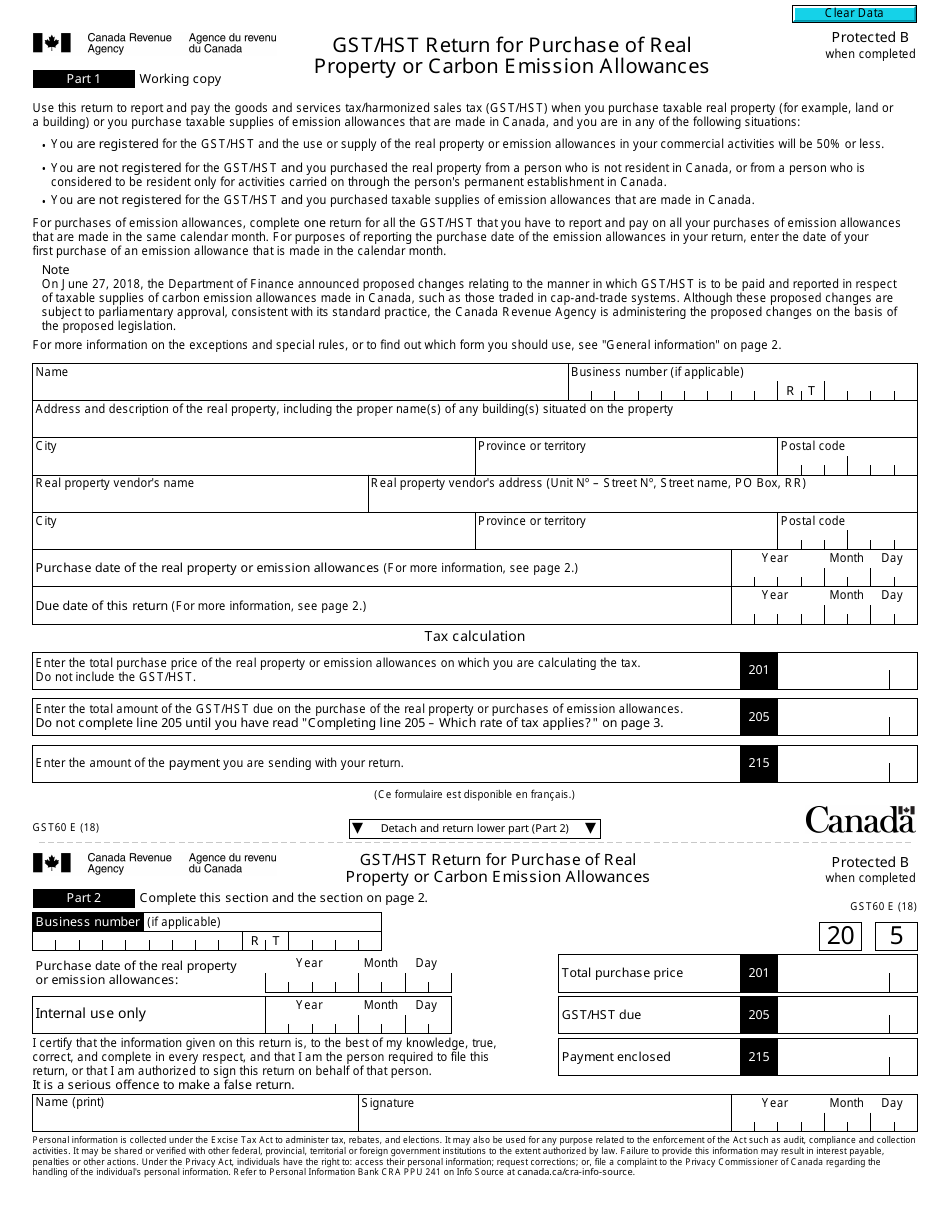

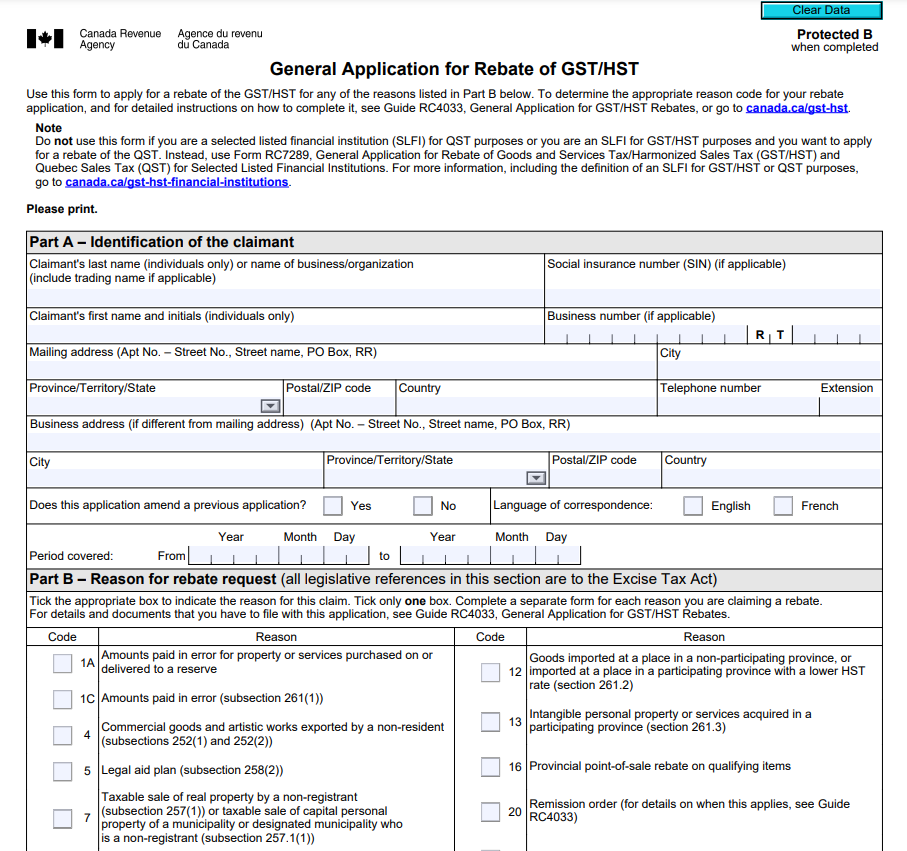

Web file a general application for rebate of GST HST see page 6 This guide is not for you if you are a diplomat or a foreign representative claiming a rebate for the GST HST you paid

The Hst Rebate Form For Charities Process

The process typically involves a few simple steps:

-

You purchase the item: First you buy the product like you would normally.

-

Fill in this Hst Rebate Form For Charities form: You'll have to give some specific information like your name, address and information about the purchase to be eligible for a Hst Rebate Form For Charities.

-

Make sure you submit the Hst Rebate Form For Charities: Depending on the type of Hst Rebate Form For Charities, you may need to send in a form, or send it via the internet.

-

Wait for approval: The business will review your submission to make sure it is in line with the requirements of the Hst Rebate Form For Charities.

-

Take advantage of your Hst Rebate Form For Charities After being approved, the amount you receive will be in the form of a check, prepaid card, or other procedure specified by the deal.

Pros and Cons of Hst Rebate Form For Charities

Advantages

-

Cost savings Hst Rebate Form For Charities could significantly reduce the cost for a product.

-

Promotional Offers These promotions encourage consumers to try out new products or brands.

-

Boost Sales The benefits of a Hst Rebate Form For Charities can improve the sales of a business and increase its market share.

Disadvantages

-

Complexity mail-in Hst Rebate Form For Charities in particular is a time-consuming process and tedious.

-

Expiration Dates Some Hst Rebate Form For Charities have strict time limits for submission.

-

Risk of not receiving payment Some customers might have their Hst Rebate Form For Charities delayed if they do not adhere to the guidelines precisely.

Download Hst Rebate Form For Charities

Download Hst Rebate Form For Charities

FAQs

1. Are Hst Rebate Form For Charities the same as discounts? No, the Hst Rebate Form For Charities will be a partial refund upon purchase, while discounts lower your purchase cost at time of sale.

2. Can I get multiple Hst Rebate Form For Charities on the same product? It depends on the conditions and conditions of Hst Rebate Form For Charities offer and also the item's ability to qualify. Certain companies might permit the use of multiple Hst Rebate Form For Charities, whereas other won't.

3. How long will it take to get the Hst Rebate Form For Charities? The period differs, but could last from a few weeks until a couple of months before you get your Hst Rebate Form For Charities.

4. Do I need to pay taxes in relation to Hst Rebate Form For Charities amounts? In the majority of situations, Hst Rebate Form For Charities amounts are not considered to be taxable income.

5. Can I trust Hst Rebate Form For Charities deals from lesser-known brands Consider doing some research and ensure that the business offering the Hst Rebate Form For Charities is trustworthy prior to making any purchase.

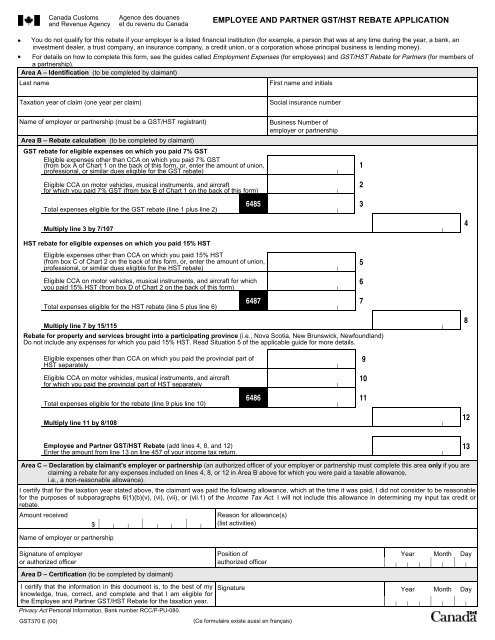

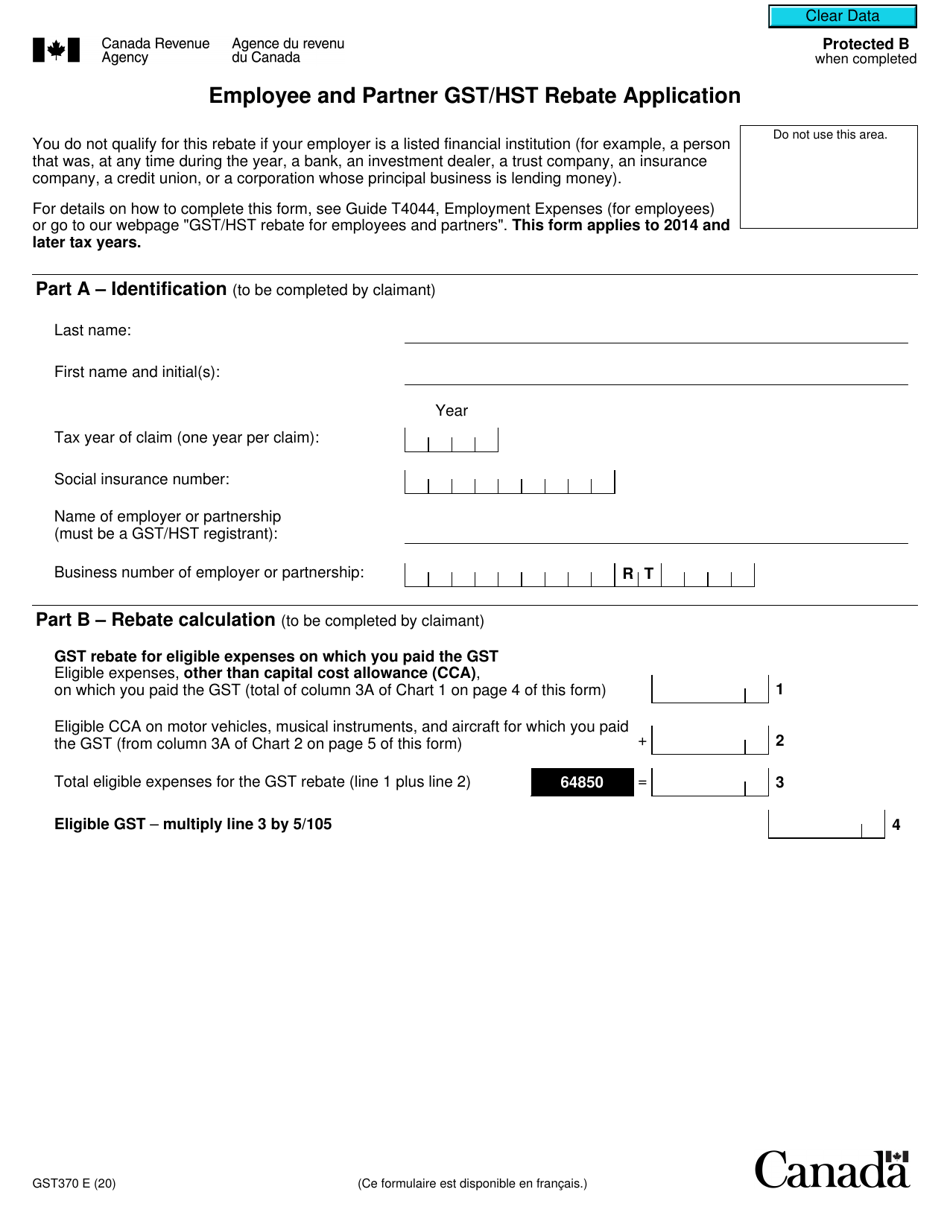

GST370 Employee And Partner GST HST Rebate Application

Hst Filing Form Fill Out Sign Online DocHub

Check more sample of Hst Rebate Form For Charities below

Hst Fillable Form Printable Forms Free Online

Fillable Gst34 Form Printable Forms Free Online

Form GST370 Download Fillable PDF Or Fill Online Employee And Partner

Gst Fillable Form Printable Forms Free Online

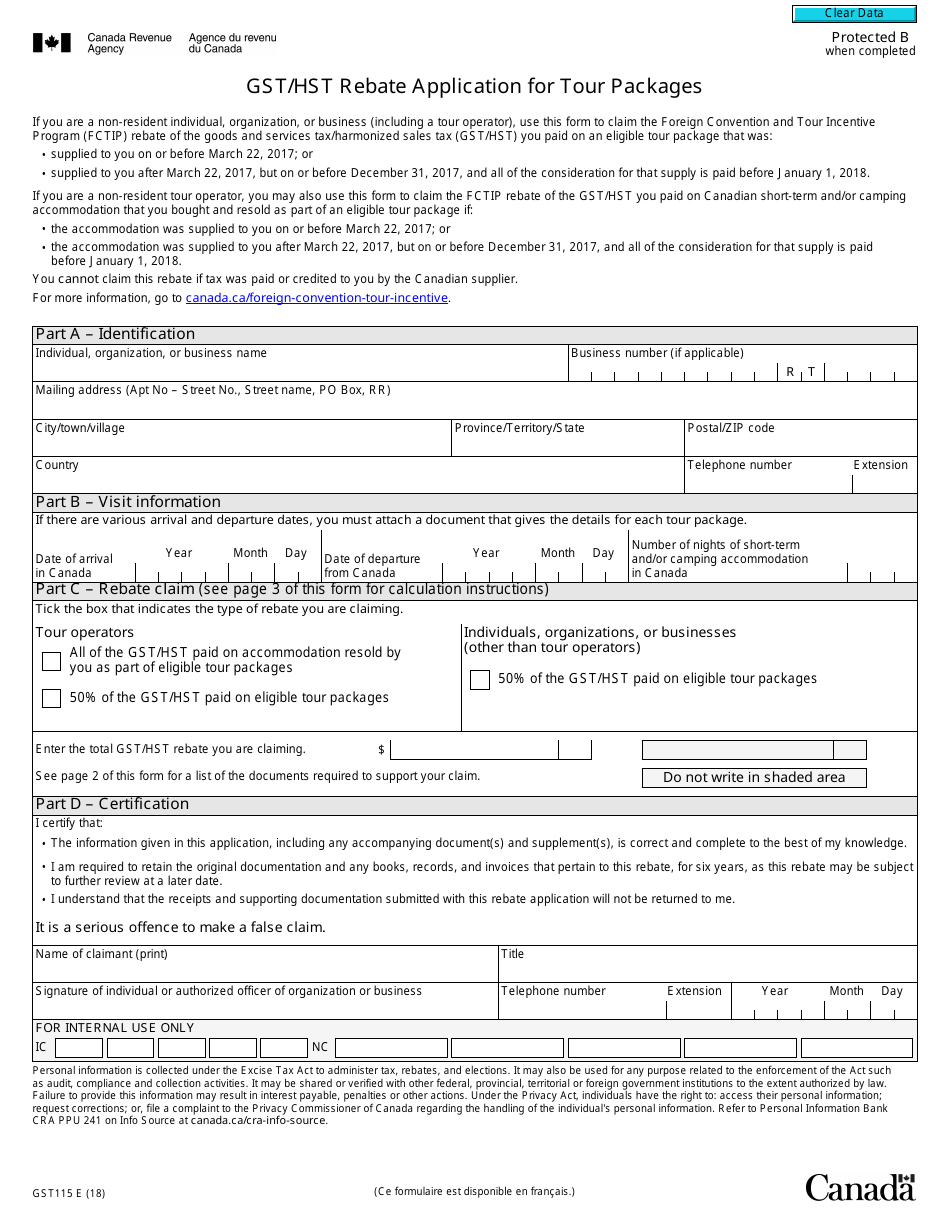

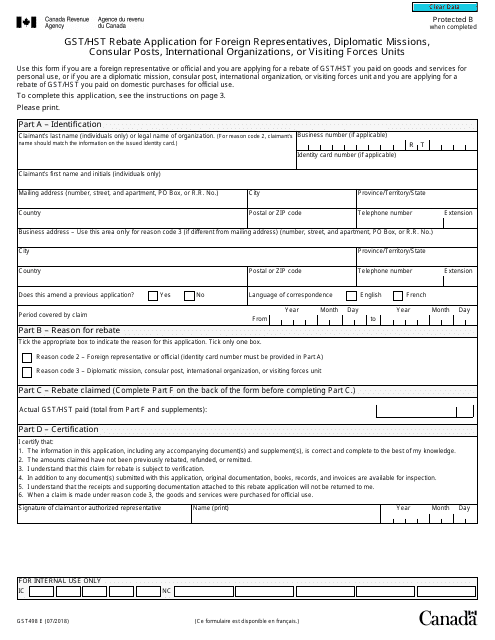

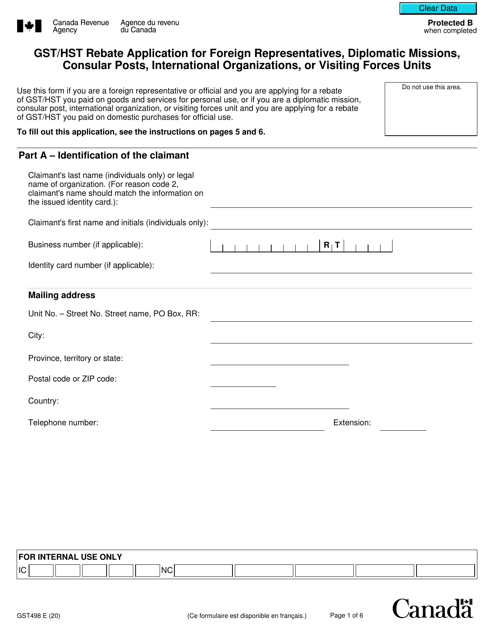

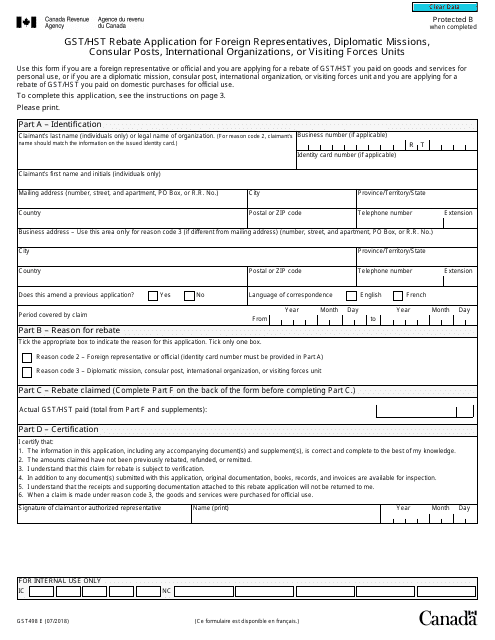

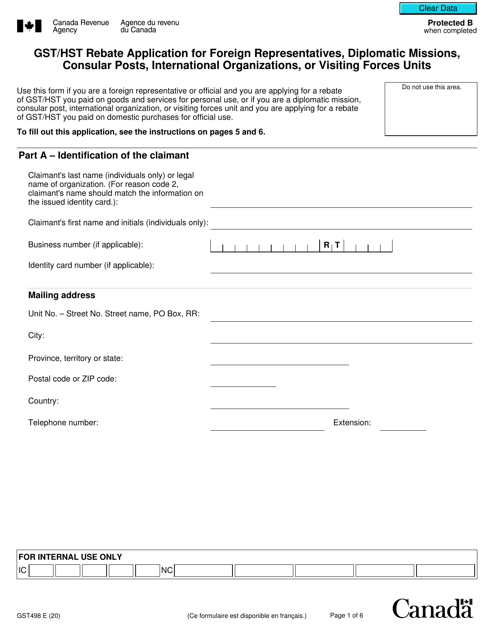

Form GST498 Download Fillable PDF Or Fill Online Gst Hst Rebate

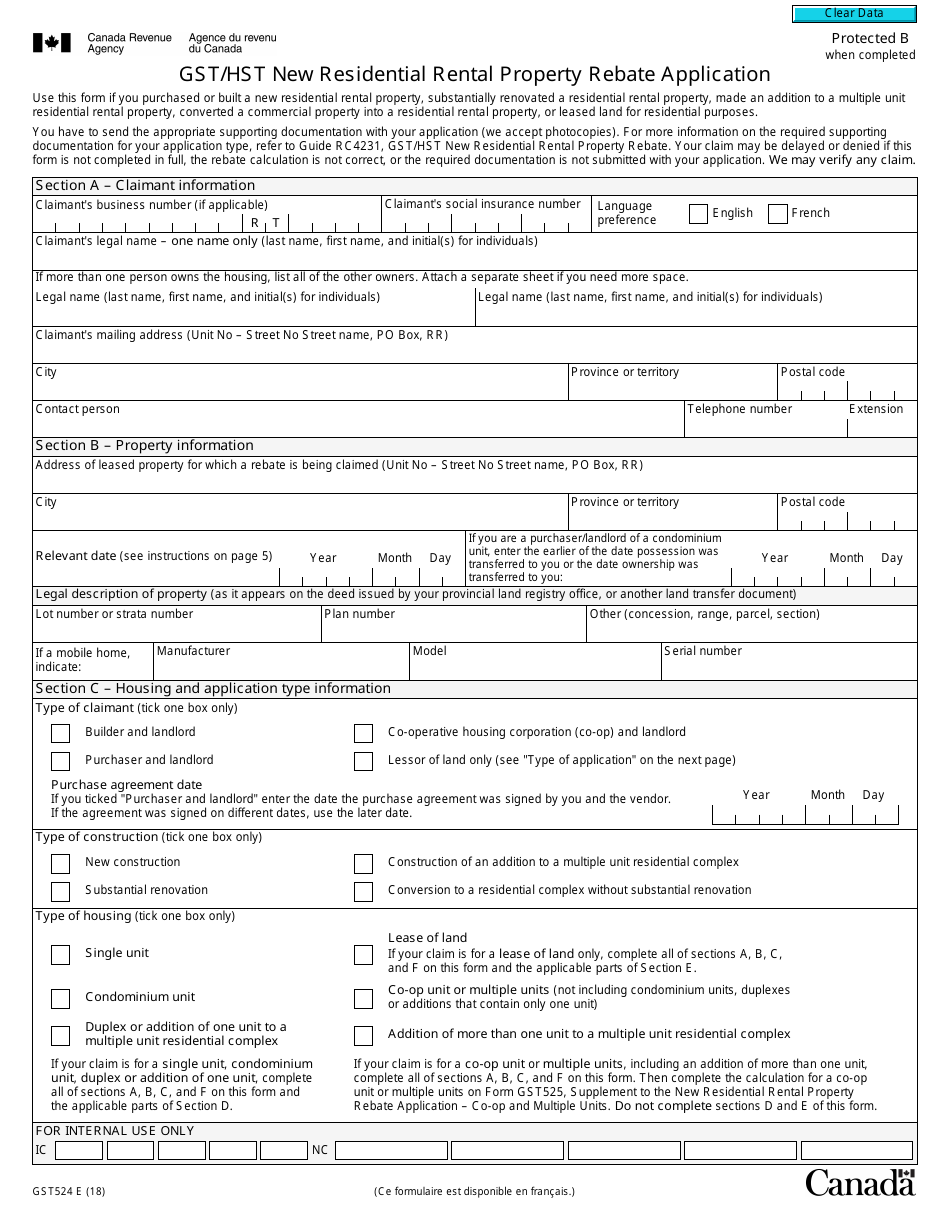

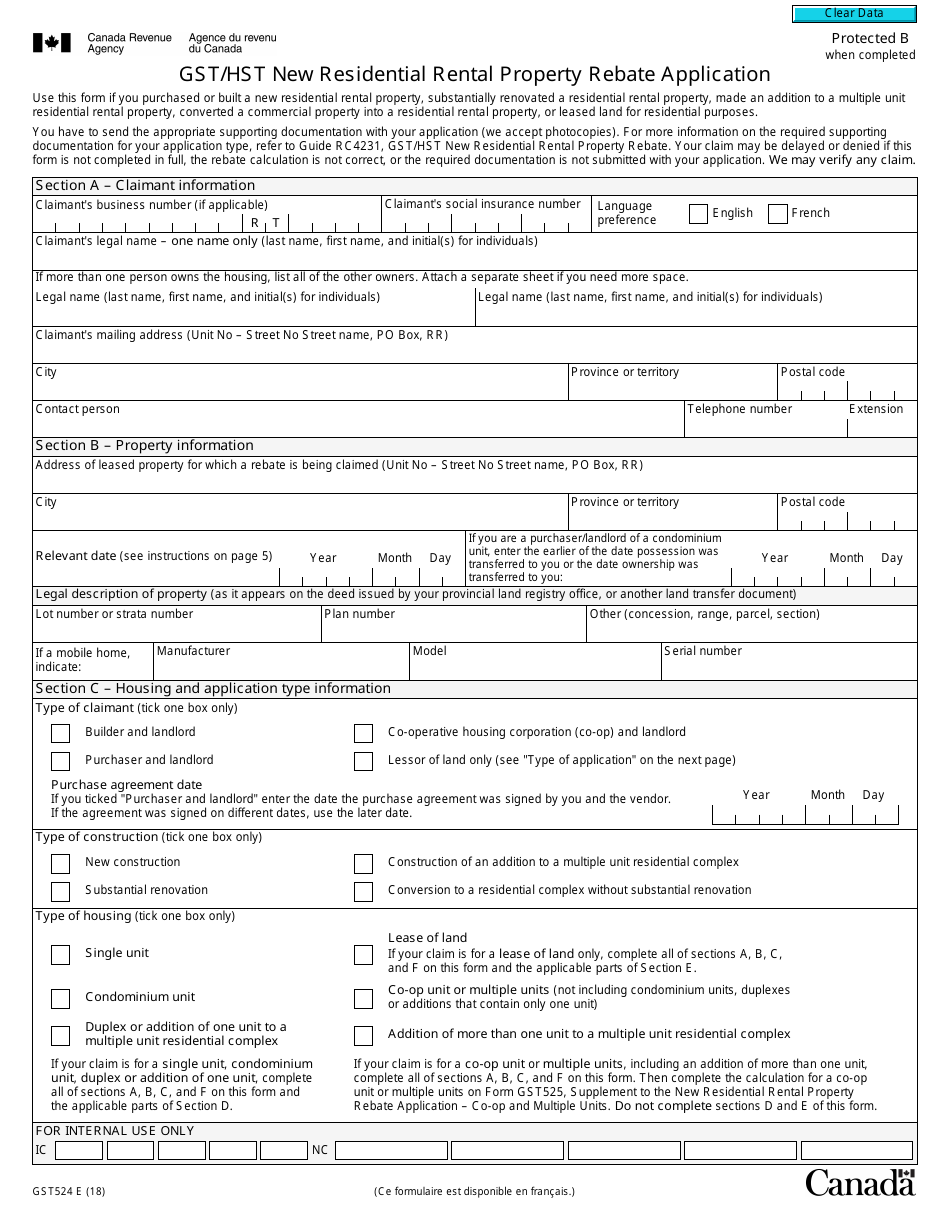

Form GST524 Download Fillable PDF Or Fill Online Gst Hst New

https://www.canada.ca/.../gi-066/a-charity-completes-gst-hst-return.html

Web A charity is entitled to claim a public service bodies rebate to recover a percentage of the GST HST paid or payable on eligible purchases and expenses for which it cannot claim

https://www.canada.ca/.../gi-067/basic-gst-hst-guidelines-charities.html

Web 1 juil 2010 nbsp 0183 32 A charity claiming a PSB rebate for the provincial part of the HST must complete and file Form RC7066 SCH Provincial Schedule GST HST Public Service

Web A charity is entitled to claim a public service bodies rebate to recover a percentage of the GST HST paid or payable on eligible purchases and expenses for which it cannot claim

Web 1 juil 2010 nbsp 0183 32 A charity claiming a PSB rebate for the provincial part of the HST must complete and file Form RC7066 SCH Provincial Schedule GST HST Public Service

Gst Fillable Form Printable Forms Free Online

Fillable Gst34 Form Printable Forms Free Online

Form GST498 Download Fillable PDF Or Fill Online Gst Hst Rebate

Form GST524 Download Fillable PDF Or Fill Online Gst Hst New

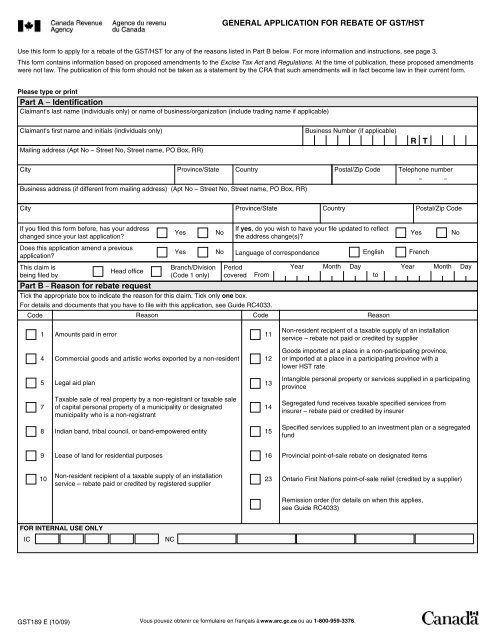

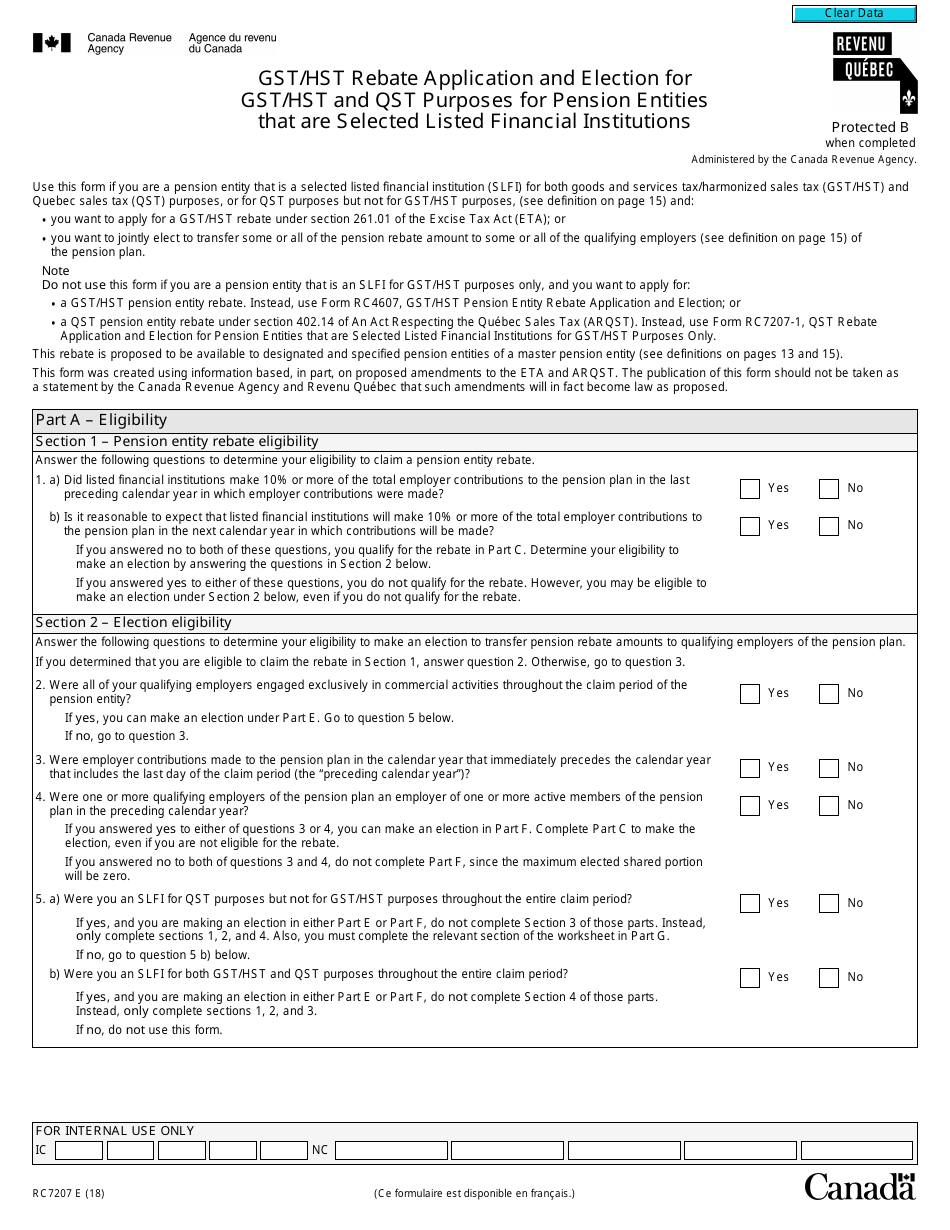

Form R7207 Download Fillable PDF Or Fill Online Gst Hst Rebate

Hst New Housing Rebate Ontario Forms Printable Rebate Form

Hst New Housing Rebate Ontario Forms Printable Rebate Form

Gst191 Fillable Form Printable Forms Free Online