In this day and age of consuming we all love a good bargain. One option to obtain substantial savings for your purchases is through How Do You Report Turf Rebate Income On Form 1040as. How Do You Report Turf Rebate Income On Form 1040as are an effective marketing tactic used by manufacturers and retailers to provide customers with a portion of a refund for their purchases after they've created them. In this article, we will explore the world of How Do You Report Turf Rebate Income On Form 1040as. We'll explore the nature of them their purpose, how they function and the best way to increase your savings with these cost-effective incentives.

Get Latest How Do You Report Turf Rebate Income On Form 1040a Below

How Do You Report Turf Rebate Income On Form 1040a

How Do You Report Turf Rebate Income On Form 1040a -

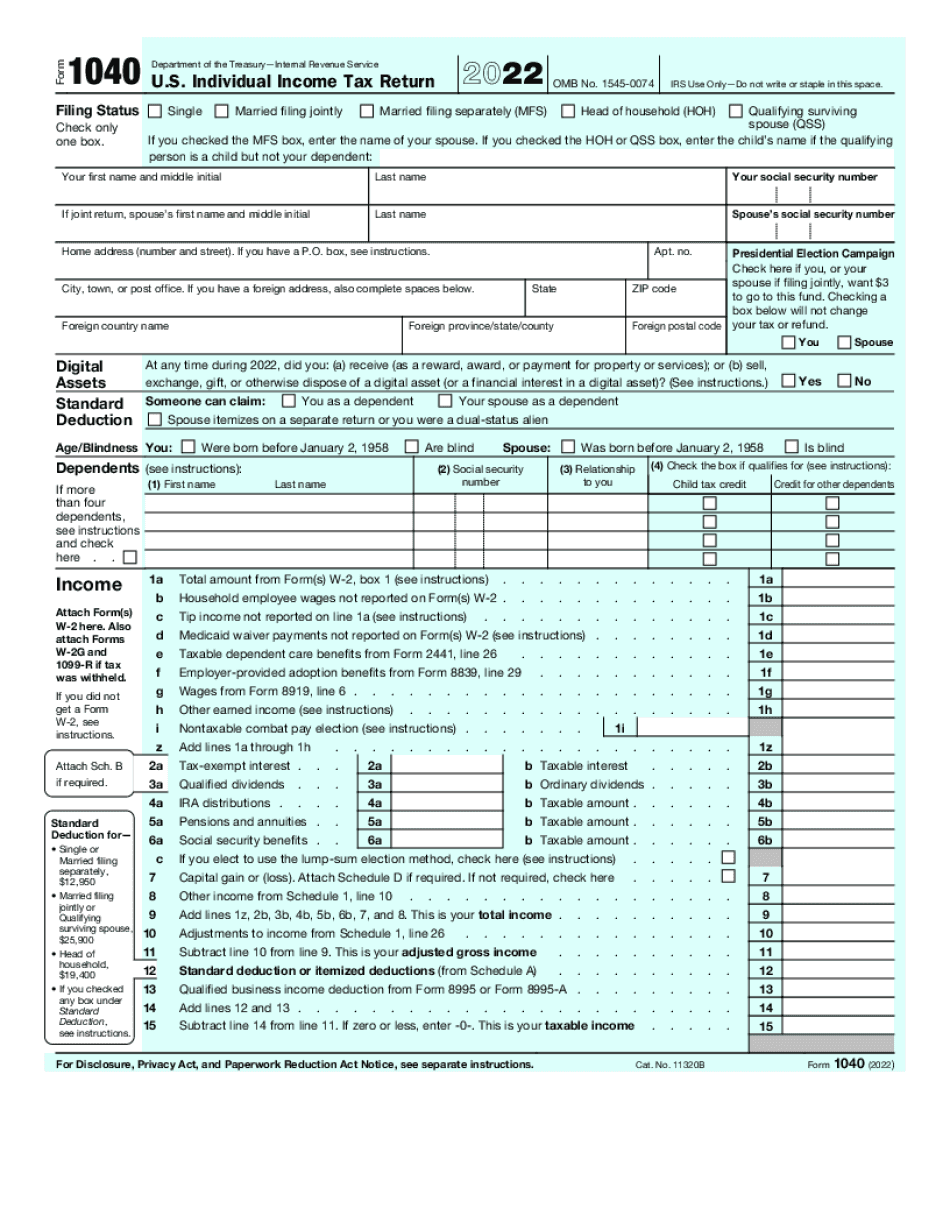

January 31 2023 If you don t receive it by early February use Tax Topic 154 to find out what to do Even if you don t get a Form W 2 you must still report your earnings If you lose your Form W 2 or it is incorrect ask

A turf replacement rebate is taxable on my federal return but not state CA How do I get into the state return to show it as an adjustment to misc income When

A How Do You Report Turf Rebate Income On Form 1040a is, in its most basic version, is an ad-hoc reimbursement to a buyer after they've bought a product or service. It's an effective way employed by companies to draw customers, boost sales, and market specific products.

Types of How Do You Report Turf Rebate Income On Form 1040a

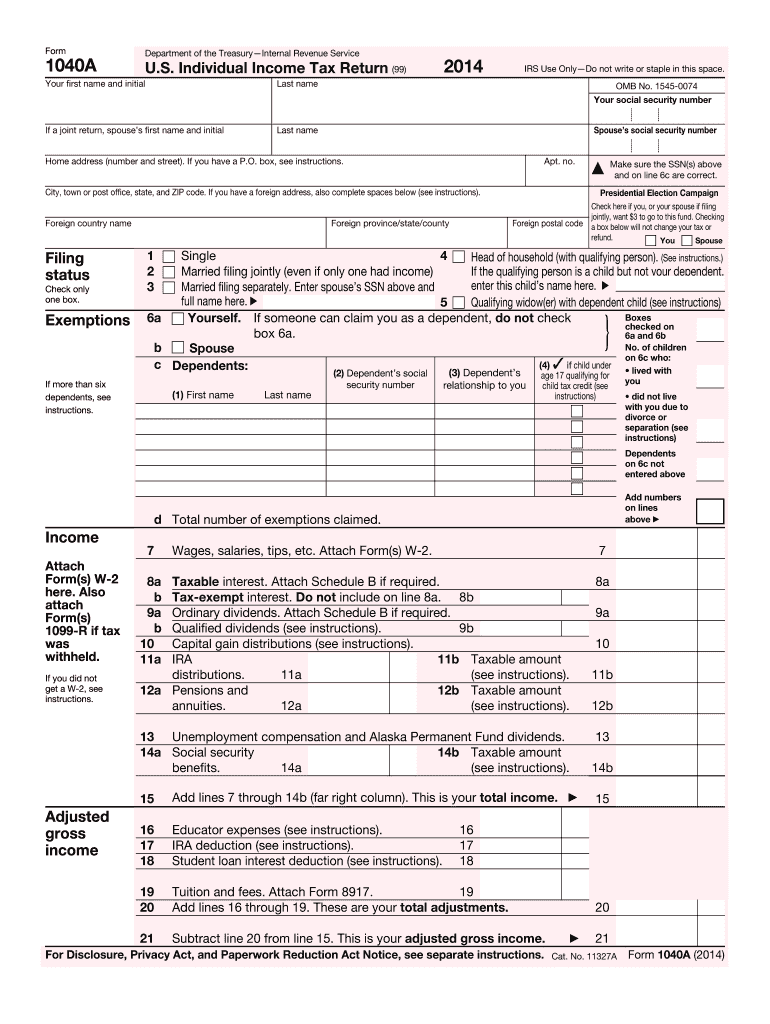

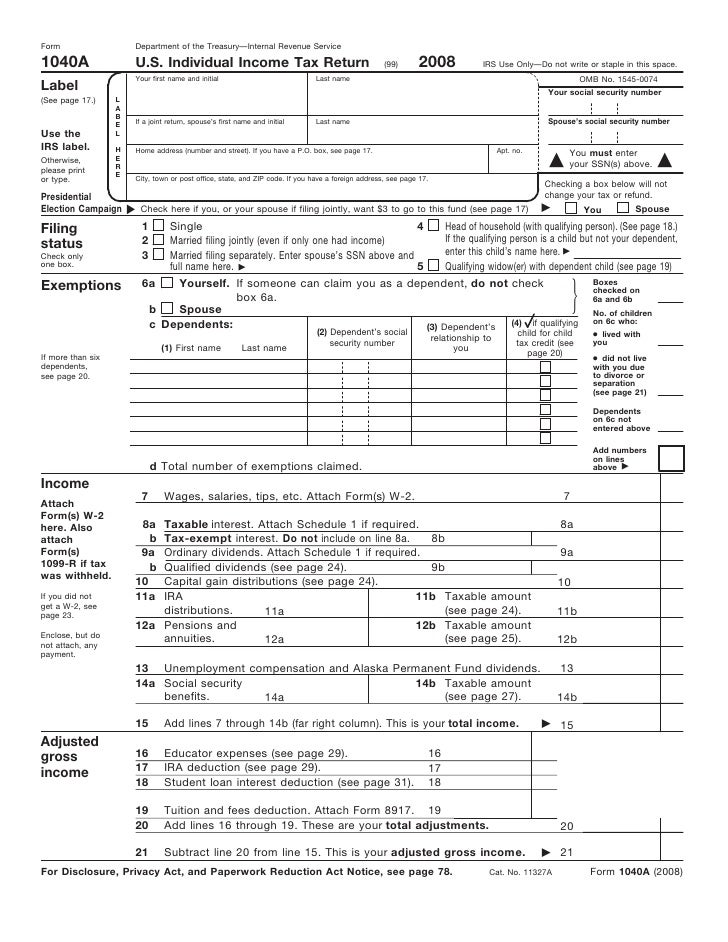

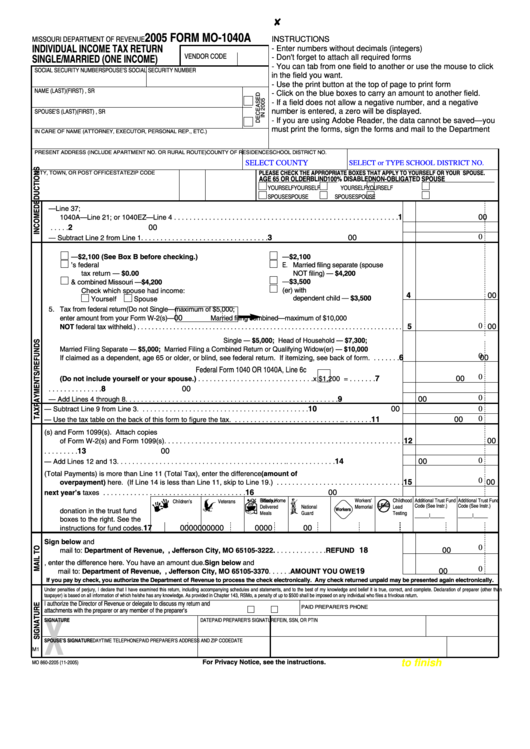

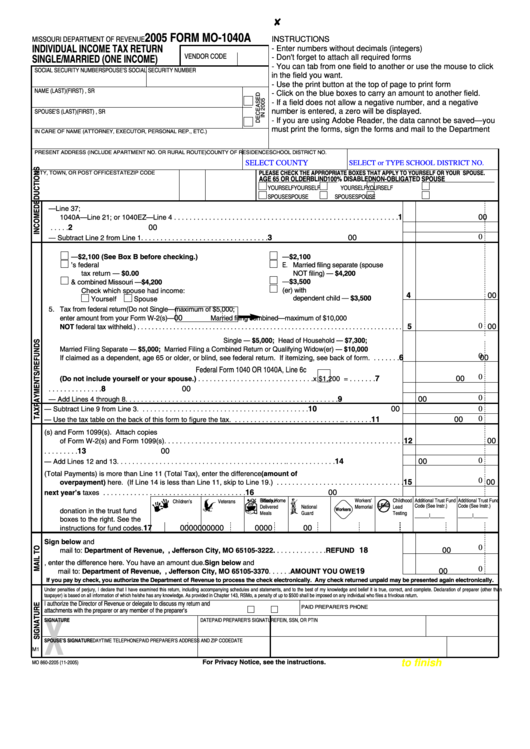

Form 1040A Individual Income Tax Return Short Form

Form 1040A Individual Income Tax Return Short Form

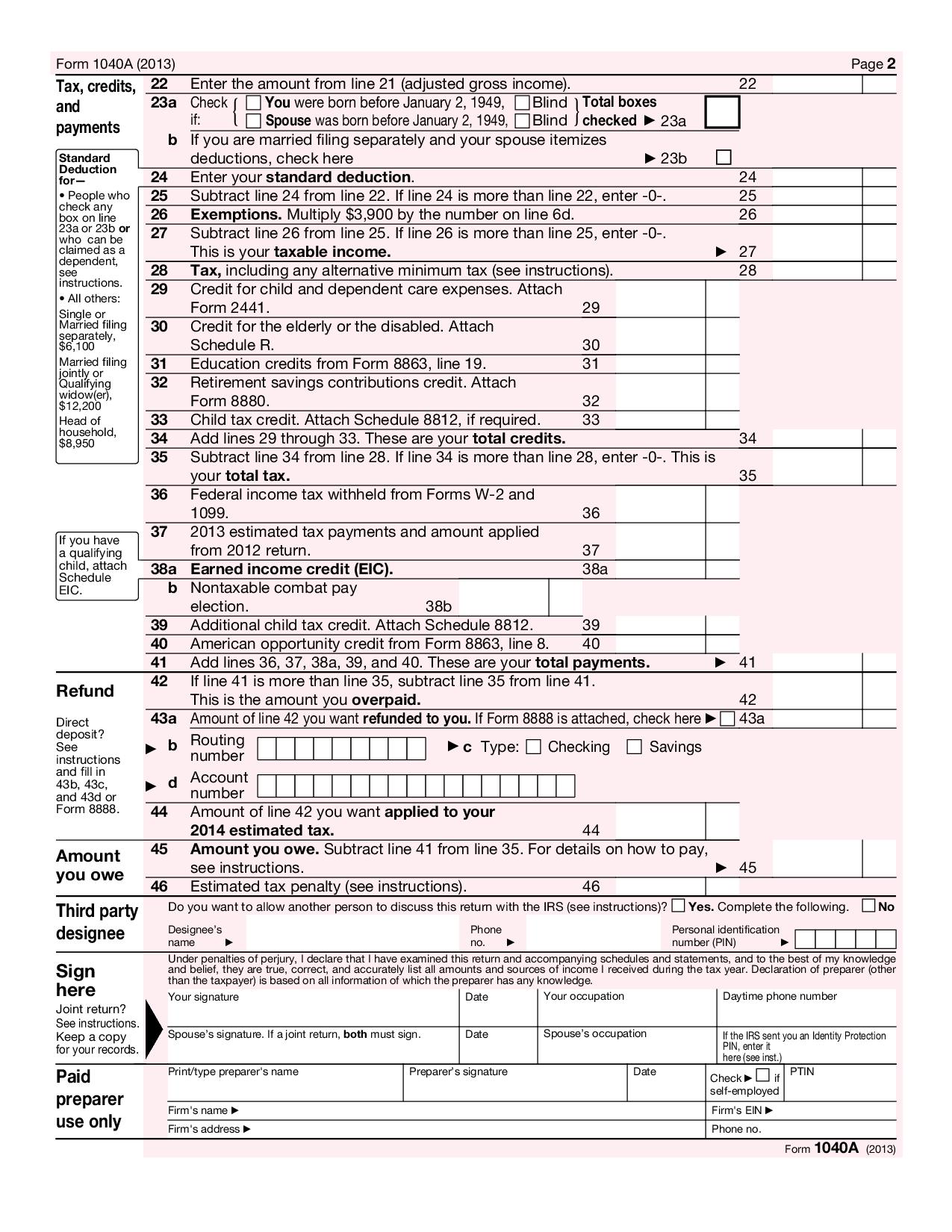

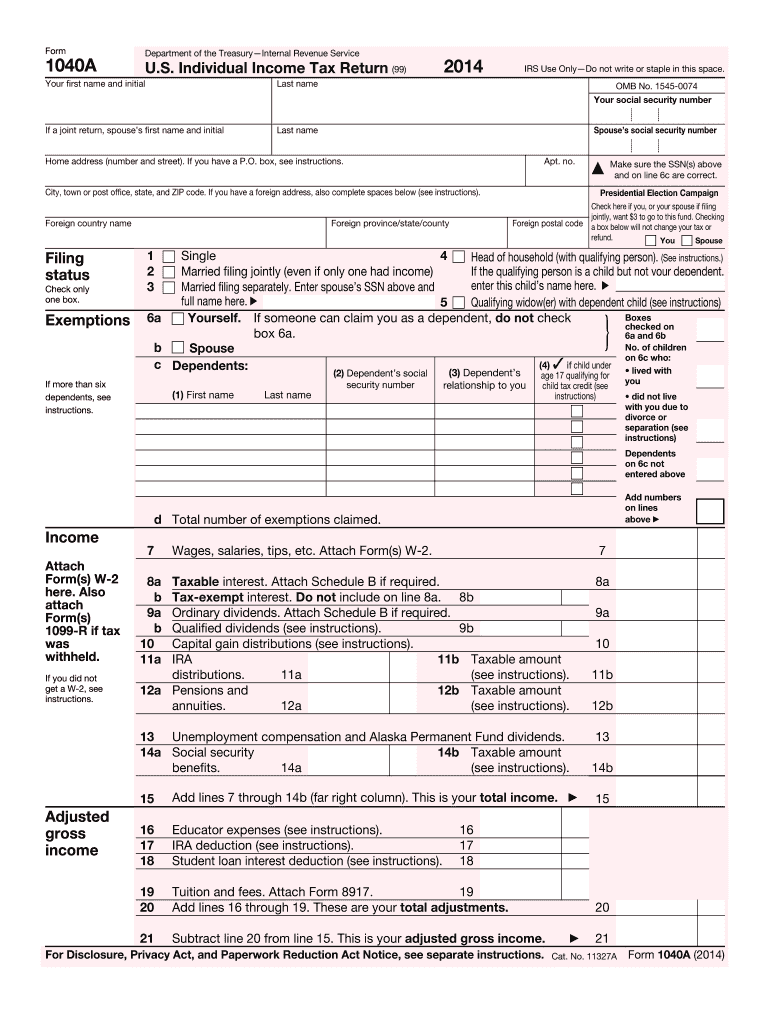

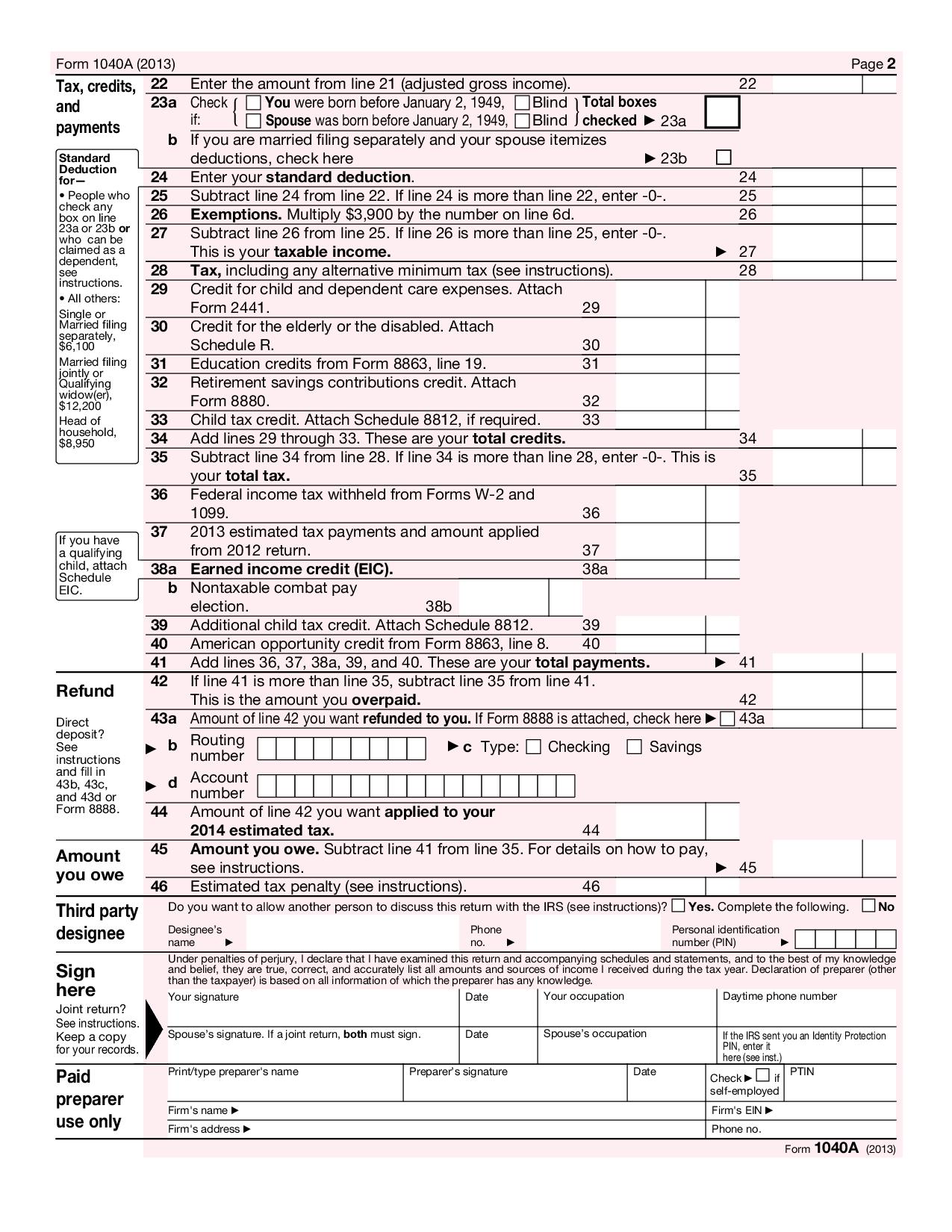

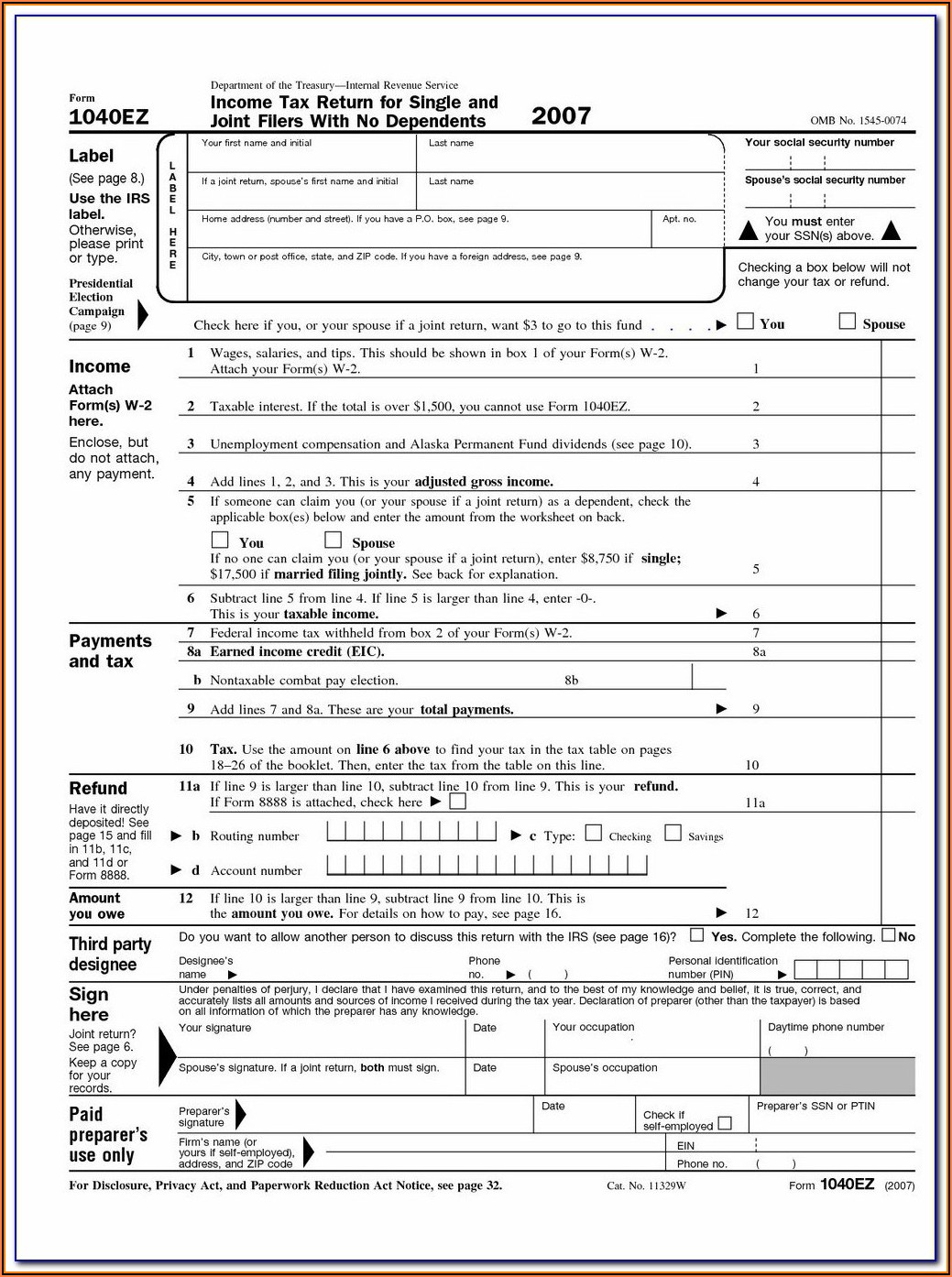

Reporting Tax and Tax Credit on Form 1040a The 1040a instructions tell you if you are eligible to file using this form or if you need to file Form 1040 including IRS Tax Forms 1040 Schedule A and

Form 1040A let you take more tax credits than 1040EZ but not as many as Form 1040 On 1040A you could claim if you were eligible credits for child and dependent care expenses for the elderly or

Cash How Do You Report Turf Rebate Income On Form 1040a

Cash How Do You Report Turf Rebate Income On Form 1040a are the simplest type of How Do You Report Turf Rebate Income On Form 1040a. Customers receive a specific amount of money back upon purchasing a item. These are usually used for products that are expensive, such as electronics or appliances.

Mail-In How Do You Report Turf Rebate Income On Form 1040a

Mail-in How Do You Report Turf Rebate Income On Form 1040a require customers to provide the proof of purchase in order to receive the money. They're more involved but offer huge savings.

Instant How Do You Report Turf Rebate Income On Form 1040a

Instant How Do You Report Turf Rebate Income On Form 1040a are made at the points of sale. This reduces the purchase cost immediately. Customers do not have to wait around for savings when they purchase this type of How Do You Report Turf Rebate Income On Form 1040a.

How How Do You Report Turf Rebate Income On Form 1040a Work

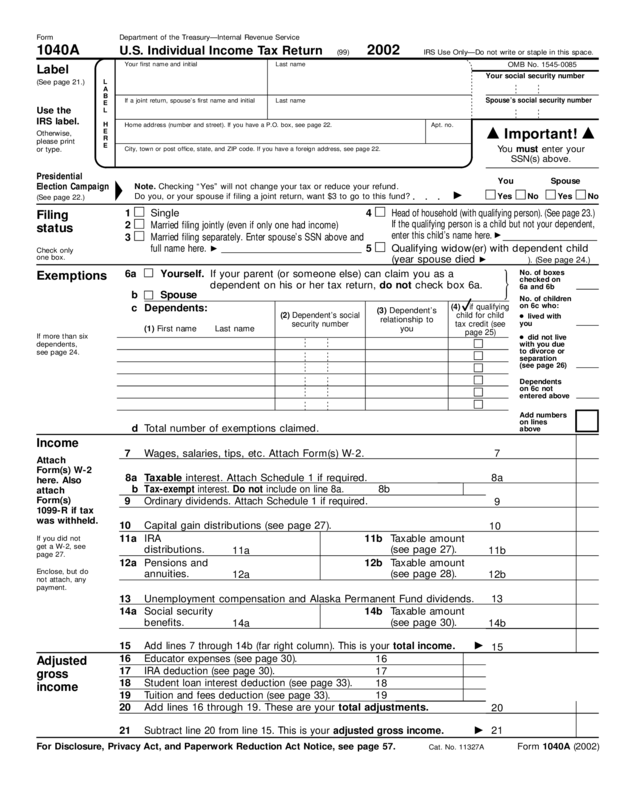

2002 Form 1040A Edit Fill Sign Online Handypdf

2002 Form 1040A Edit Fill Sign Online Handypdf

June 14 2017 H R Block The 1040A is a simpler version of Form 1040 You can use it if you meet the 1040A requirements which are less complex than those for a 1040 If

The How Do You Report Turf Rebate Income On Form 1040a Process

The process typically involves a few easy steps:

-

You purchase the item: First you purchase the item the way you normally do.

-

Fill out your How Do You Report Turf Rebate Income On Form 1040a application: In order to claim your How Do You Report Turf Rebate Income On Form 1040a, you'll have to provide some information like your name, address and details about your purchase, in order to receive your How Do You Report Turf Rebate Income On Form 1040a.

-

You must submit the How Do You Report Turf Rebate Income On Form 1040a: Depending on the kind of How Do You Report Turf Rebate Income On Form 1040a the recipient may be required to fill out a paper form or make it available online.

-

Wait for approval: The company will look over your submission to determine if it's in compliance with the terms and conditions of the How Do You Report Turf Rebate Income On Form 1040a.

-

You will receive your How Do You Report Turf Rebate Income On Form 1040a Once you've received your approval, you'll get your refund, either through check, prepaid card, or a different method as specified by the offer.

Pros and Cons of How Do You Report Turf Rebate Income On Form 1040a

Advantages

-

Cost savings How Do You Report Turf Rebate Income On Form 1040a could significantly cut the price you pay for the item.

-

Promotional Offers Incentivize customers in trying new products or brands.

-

Boost Sales How Do You Report Turf Rebate Income On Form 1040a can enhance the sales of a business and increase its market share.

Disadvantages

-

Complexity In particular, mail-in How Do You Report Turf Rebate Income On Form 1040a in particular is a time-consuming process and costly.

-

End Dates Some How Do You Report Turf Rebate Income On Form 1040a have rigid deadlines to submit.

-

Risque of Non-Payment Customers may not receive How Do You Report Turf Rebate Income On Form 1040a if they don't observe the rules precisely.

Download How Do You Report Turf Rebate Income On Form 1040a

Download How Do You Report Turf Rebate Income On Form 1040a

FAQs

1. Are How Do You Report Turf Rebate Income On Form 1040a the same as discounts? No, How Do You Report Turf Rebate Income On Form 1040a involve partial reimbursement after purchase, whereas discounts decrease the cost of purchase at time of sale.

2. Are there multiple How Do You Report Turf Rebate Income On Form 1040a I can get on the same item It's contingent upon the conditions and conditions of How Do You Report Turf Rebate Income On Form 1040a deals and product's quality and eligibility. Certain companies might allow this, whereas others will not.

3. How long does it take to get a How Do You Report Turf Rebate Income On Form 1040a? The period can vary, but typically it will range from several weeks to couple of months to receive your How Do You Report Turf Rebate Income On Form 1040a.

4. Do I have to pay tax for How Do You Report Turf Rebate Income On Form 1040a the amount? the majority of circumstances, How Do You Report Turf Rebate Income On Form 1040a amounts are not considered to be taxable income.

5. Can I trust How Do You Report Turf Rebate Income On Form 1040a offers from lesser-known brands Consider doing some research and ensure that the brand that is offering the How Do You Report Turf Rebate Income On Form 1040a is reputable prior to making any purchase.

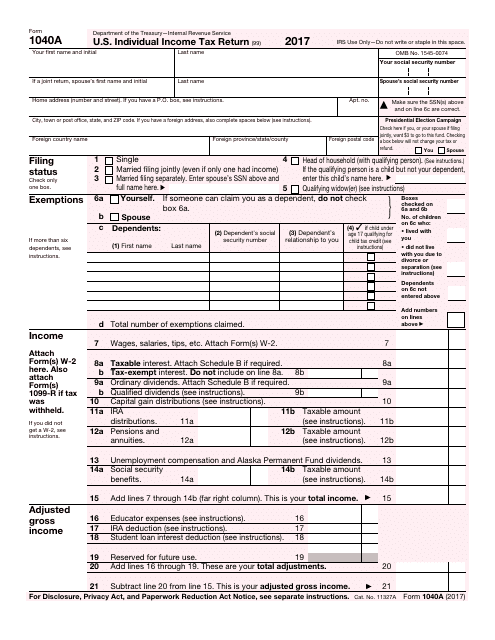

1040a Printable Form 2017 Universal Network

Understanding Taxes Simulation Completing A Tax Return Using Form

Check more sample of How Do You Report Turf Rebate Income On Form 1040a below

IRS Form 1040A Download Printable PDF 2017 U S Individual Income Tax

1040A U S Individual Income Tax Return

Federal Income Tax Form 1040a Instructions Universal Network

2012 Form MO MO 1040A Fill Online Printable Fillable Blank PdfFiller

Www irs govform 1040a Form Resume Examples MW9pBO7rVA

Free 1040A 2010 From Formville

https://ttlc.intuit.com/community/state-taxes/...

A turf replacement rebate is taxable on my federal return but not state CA How do I get into the state return to show it as an adjustment to misc income When

https://turfexplorer.com/is-turf-rebate-taxable

Turf rebates are considered taxable income because they are considered to be benefits by the IRS Many homeowners and businesses are surprised to learn that

A turf replacement rebate is taxable on my federal return but not state CA How do I get into the state return to show it as an adjustment to misc income When

Turf rebates are considered taxable income because they are considered to be benefits by the IRS Many homeowners and businesses are surprised to learn that

2012 Form MO MO 1040A Fill Online Printable Fillable Blank PdfFiller

1040A U S Individual Income Tax Return

Www irs govform 1040a Form Resume Examples MW9pBO7rVA

Free 1040A 2010 From Formville

Irs 1040a Forms 2017 Form Resume Examples MW9pa5MYAJ

Fillable Form Mo 1040a Missouri Individual Income Tax Return Single

Fillable Form Mo 1040a Missouri Individual Income Tax Return Single

Form 1040a 2023 PDF Fill Online Printable Fillable Blank