In the modern world of consumerization everybody loves a good deal. One way to earn significant savings on your purchases is by using Hmrc Tool Tax Rebate Forms. They are a form of marketing employed by retailers and manufacturers in order to offer customers a small discount on purchases they made after they have completed them. In this post, we'll investigate the world of Hmrc Tool Tax Rebate Forms, examining what they are as well as how they work and ways you can increase your savings via these cost-effective incentives.

Get Latest Hmrc Tool Tax Rebate Form Below

Hmrc Tool Tax Rebate Form

Hmrc Tool Tax Rebate Form - Hmrc Tool Tax Rebate Form, Hmrc Tax Rebate Number, What Is Hmrc Tax Rebate, Hmrc Tax Rebate Number Free, Hmrc Tax Rebate Address, Hmrc Tax Rebate Helpline

Web A tool tax rebate can be claimed back online or by post using either a P87 form or a self assessment tax return The value of your claim in any one tax year directly effects what

Web 3 mars 2016 nbsp 0183 32 You must claim tax relief by post if you re claiming either on behalf of someone else for more than 5 jobs You ll need to submit a claim by post using HMRC s

A Hmrc Tool Tax Rebate Form in its most basic definition, is a return to the customer after they have purchased a product or service. It is a powerful tool for businesses to entice customers, increase sales or promote a specific product.

Types of Hmrc Tool Tax Rebate Form

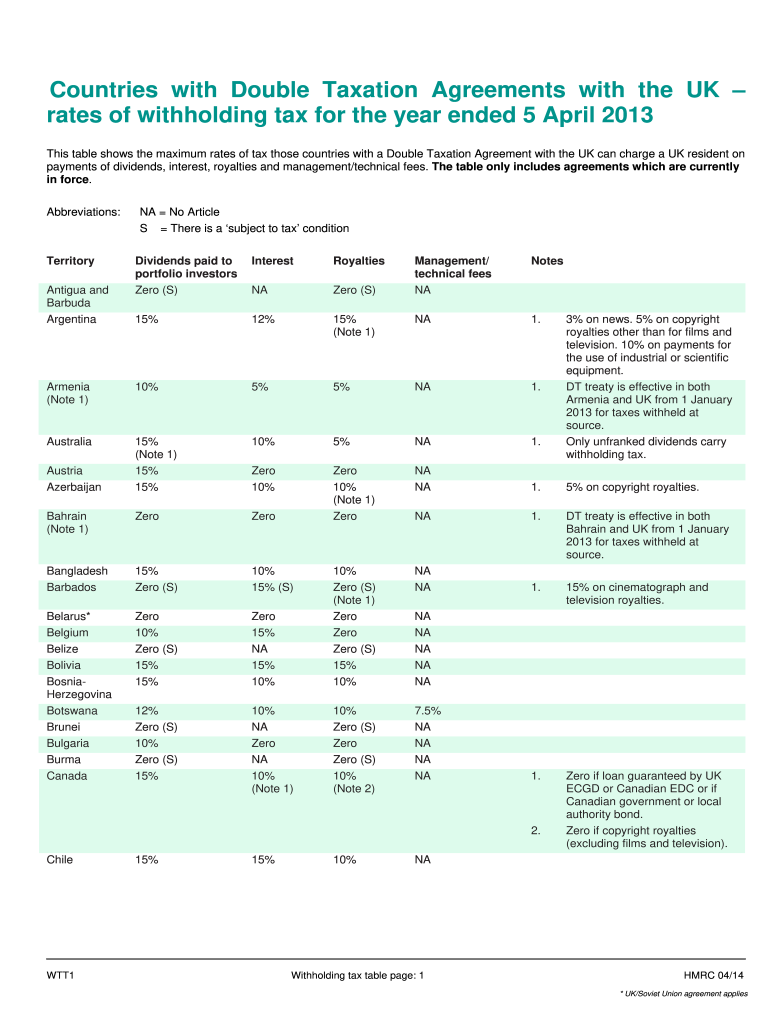

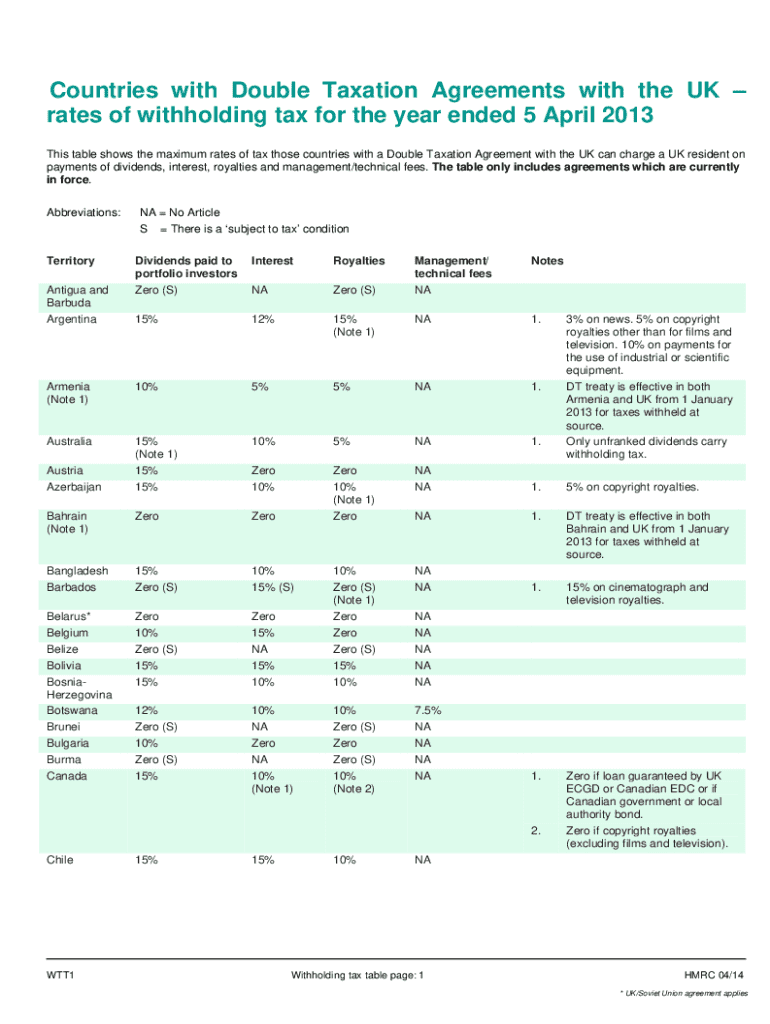

Hmrc Wtt1 Form Fill Out Sign Online DocHub

Hmrc Wtt1 Form Fill Out Sign Online DocHub

Web 1 janv 2014 nbsp 0183 32 HMRC forms HM Revenue and Customs HMRC forms and associated guides notes helpsheets and supplementary pages From HM Revenue amp Customs

Web Yes You cannot get a tax rebate that is superior in value to the amount of tax you paid A tax rebate is simply the repayment of overpaid tax How far back can I claim tax relief for my tools You can claim back tax relief for

Cash Hmrc Tool Tax Rebate Form

Cash Hmrc Tool Tax Rebate Form are a simple kind of Hmrc Tool Tax Rebate Form. Customers receive a certain amount of money in return for buying a product. They are typically used to purchase the most expensive products like electronics or appliances.

Mail-In Hmrc Tool Tax Rebate Form

Mail-in Hmrc Tool Tax Rebate Form require that customers present evidence of purchase to get the money. They're a little more complicated, but they can provide substantial savings.

Instant Hmrc Tool Tax Rebate Form

Instant Hmrc Tool Tax Rebate Form can be applied at the point of sale and reduce prices immediately. Customers don't need to wait around for savings through this kind of offer.

How Hmrc Tool Tax Rebate Form Work

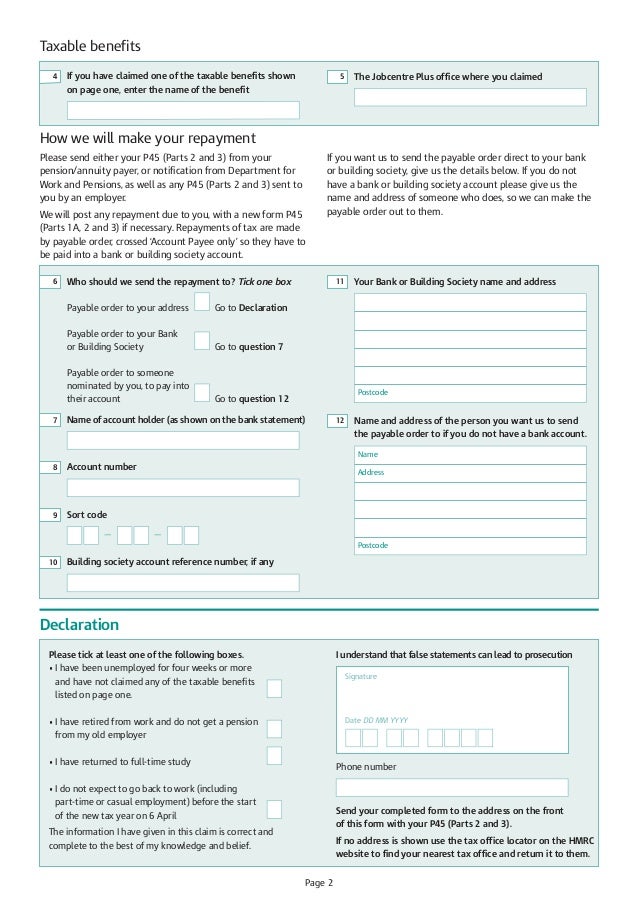

2013 2022 Form UK HMRC P85 Fill Online Printable Fillable Blank

2013 2022 Form UK HMRC P85 Fill Online Printable Fillable Blank

Web 28 f 233 vr 2023 nbsp 0183 32 The tool tax rebate can be applied for by using the P87 tax form if you are in employment This form allows you to claim back on certain expenses accrued through your job This form is available to fill

The Hmrc Tool Tax Rebate Form Process

The process typically comprises a few simple steps

-

You purchase the item: First then, you buy the item exactly as you would normally.

-

Fill in the Hmrc Tool Tax Rebate Form paper: You'll need provide certain information like your address, name, along with the purchase details, in order to receive your Hmrc Tool Tax Rebate Form.

-

To submit the Hmrc Tool Tax Rebate Form In accordance with the nature of Hmrc Tool Tax Rebate Form the recipient may be required to submit a form by mail or submit it online.

-

Wait for approval: The company will scrutinize your submission to ensure it meets the terms and conditions of the Hmrc Tool Tax Rebate Form.

-

Enjoy your Hmrc Tool Tax Rebate Form If it is approved, you'll be able to receive your reimbursement, whether by check, prepaid card, or a different option as per the terms of the offer.

Pros and Cons of Hmrc Tool Tax Rebate Form

Advantages

-

Cost savings Hmrc Tool Tax Rebate Form can dramatically reduce the cost for an item.

-

Promotional Deals: They encourage customers to try out new products or brands.

-

Help to Increase Sales Hmrc Tool Tax Rebate Form can increase the sales of a business and increase its market share.

Disadvantages

-

Complexity mail-in Hmrc Tool Tax Rebate Form in particular are often time-consuming and take a long time to complete.

-

End Dates Many Hmrc Tool Tax Rebate Form are subject to strict time limits for submission.

-

Risk of not receiving payment Certain customers could have their Hmrc Tool Tax Rebate Form delayed if they don't follow the rules precisely.

Download Hmrc Tool Tax Rebate Form

Download Hmrc Tool Tax Rebate Form

FAQs

1. Are Hmrc Tool Tax Rebate Form similar to discounts? No, Hmrc Tool Tax Rebate Form require only a partial reimbursement following the purchase, whereas discounts cut the price of the purchase at the time of sale.

2. Can I use multiple Hmrc Tool Tax Rebate Form on the same product This is dependent on terms on the Hmrc Tool Tax Rebate Form promotions and on the products suitability. Certain businesses may allow it, and some don't.

3. How long will it take to receive an Hmrc Tool Tax Rebate Form? The period can vary, but typically it will take anywhere from a few weeks to a couple of months before you get your Hmrc Tool Tax Rebate Form.

4. Do I have to pay taxes in relation to Hmrc Tool Tax Rebate Form amount? most cases, Hmrc Tool Tax Rebate Form amounts are not considered taxable income.

5. Do I have confidence in Hmrc Tool Tax Rebate Form deals from lesser-known brands it is crucial to conduct research to ensure that the name offering the Hmrc Tool Tax Rebate Form is reliable prior to making the purchase.

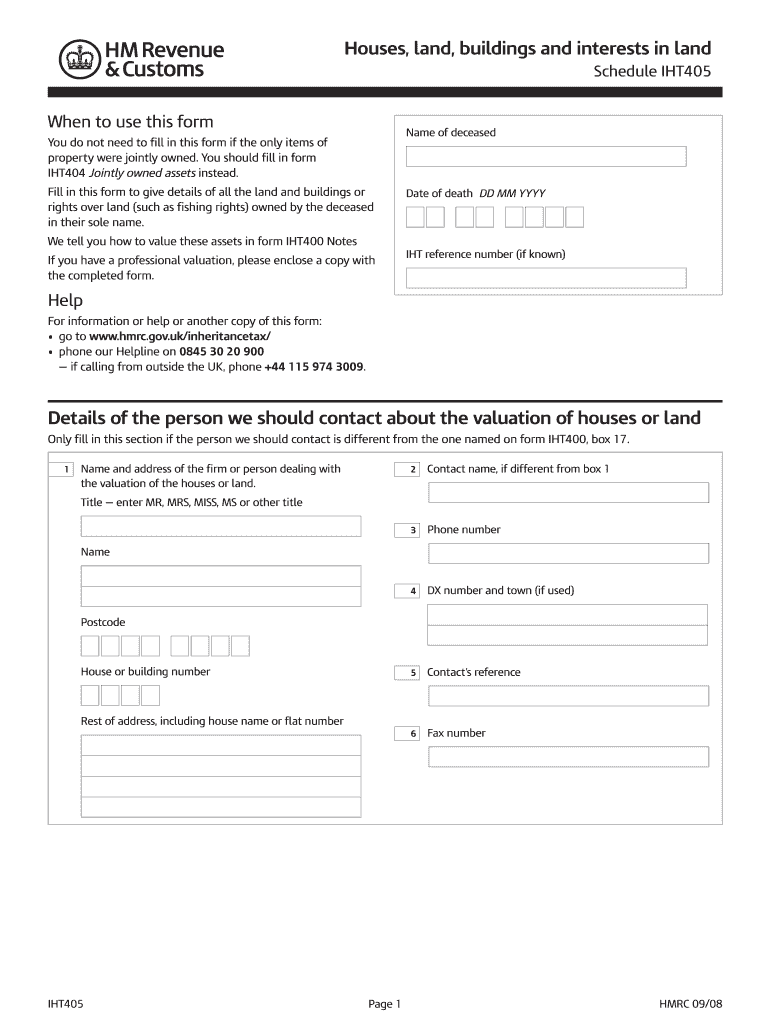

2008 Form UK HMRC IHT405 Fill Online Printable Fillable Blank

2012 Form UK HMRC CA3916 Fill Online Printable Fillable Blank

Check more sample of Hmrc Tool Tax Rebate Form below

It s Not A Tax Rebate It s An HMRC Phishing Scam IT Governance Blog

PSA HMRC Will Not E mail Or Call You About Tax Rebates CasualUK

Cash Declaration HM Revenue Customs Hmrc Gov Fill Out Sign

UK HMRC P46 2005 Fill And Sign Printable Template Online US Legal Forms

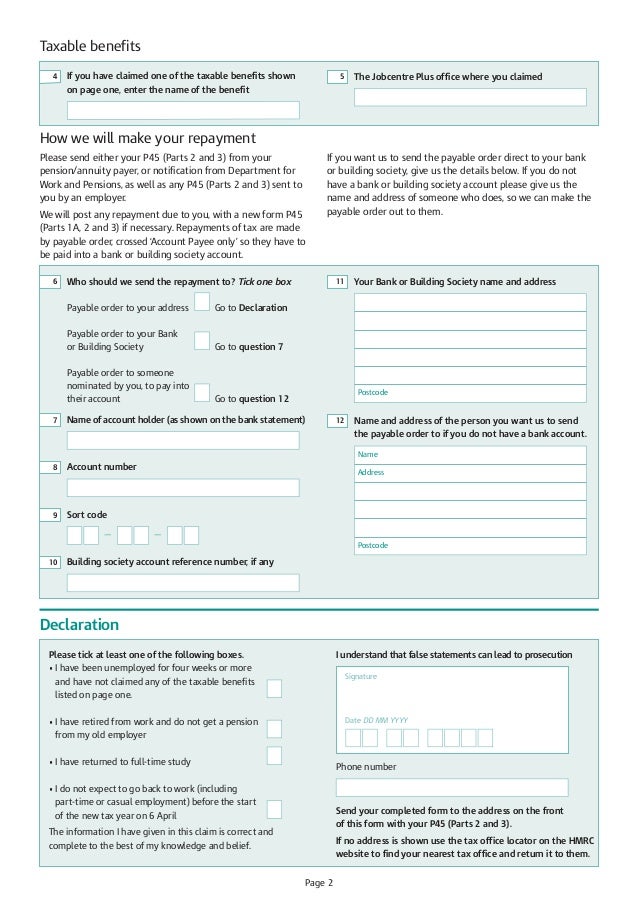

P50

2011 Form UK HMRC P87 Fill Online Printable Fillable Blank PDFfiller

https://www.gov.uk/guidance/claim-income-tax-relief-for-your...

Web 3 mars 2016 nbsp 0183 32 You must claim tax relief by post if you re claiming either on behalf of someone else for more than 5 jobs You ll need to submit a claim by post using HMRC s

https://www.gov.uk/guidance/hmrc-tools-and-calculators

Web 8 sept 2023 nbsp 0183 32 Tool What it does Get a tax credits claim form Find out if you qualify for tax credits Tax credits calculator Estimate of how much in tax credits you could get in total

Web 3 mars 2016 nbsp 0183 32 You must claim tax relief by post if you re claiming either on behalf of someone else for more than 5 jobs You ll need to submit a claim by post using HMRC s

Web 8 sept 2023 nbsp 0183 32 Tool What it does Get a tax credits claim form Find out if you qualify for tax credits Tax credits calculator Estimate of how much in tax credits you could get in total

UK HMRC P46 2005 Fill And Sign Printable Template Online US Legal Forms

PSA HMRC Will Not E mail Or Call You About Tax Rebates CasualUK

P50

2011 Form UK HMRC P87 Fill Online Printable Fillable Blank PDFfiller

UK HMRC Form HM4 2010 2021 Fill And Sign Printable Template Online

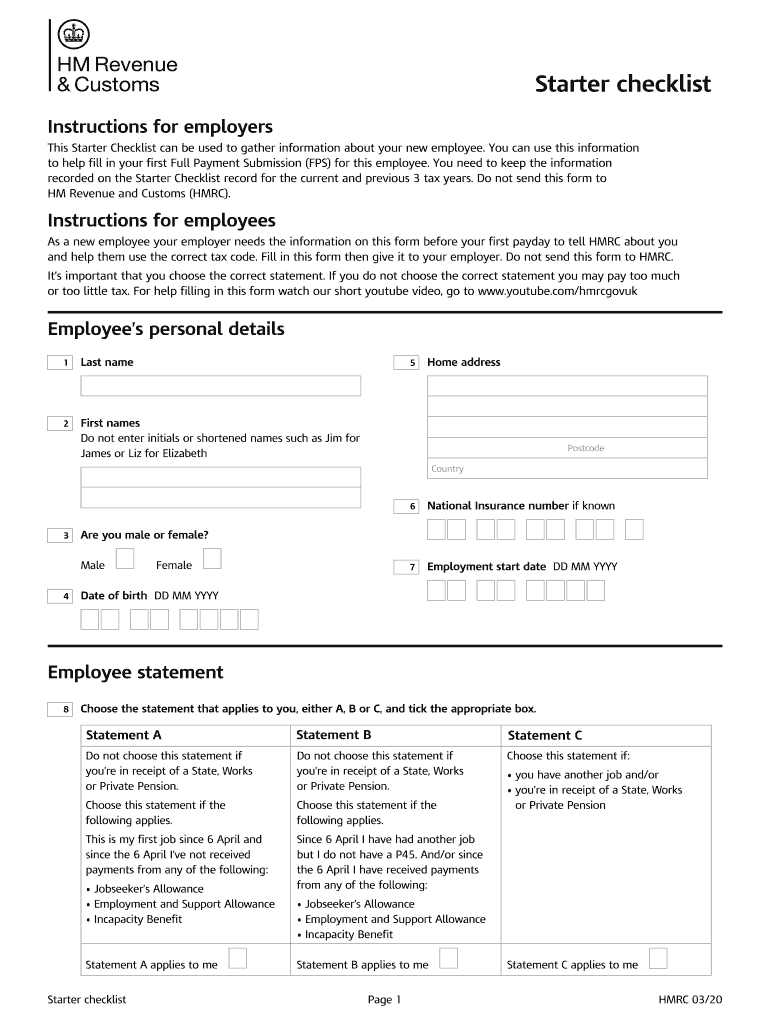

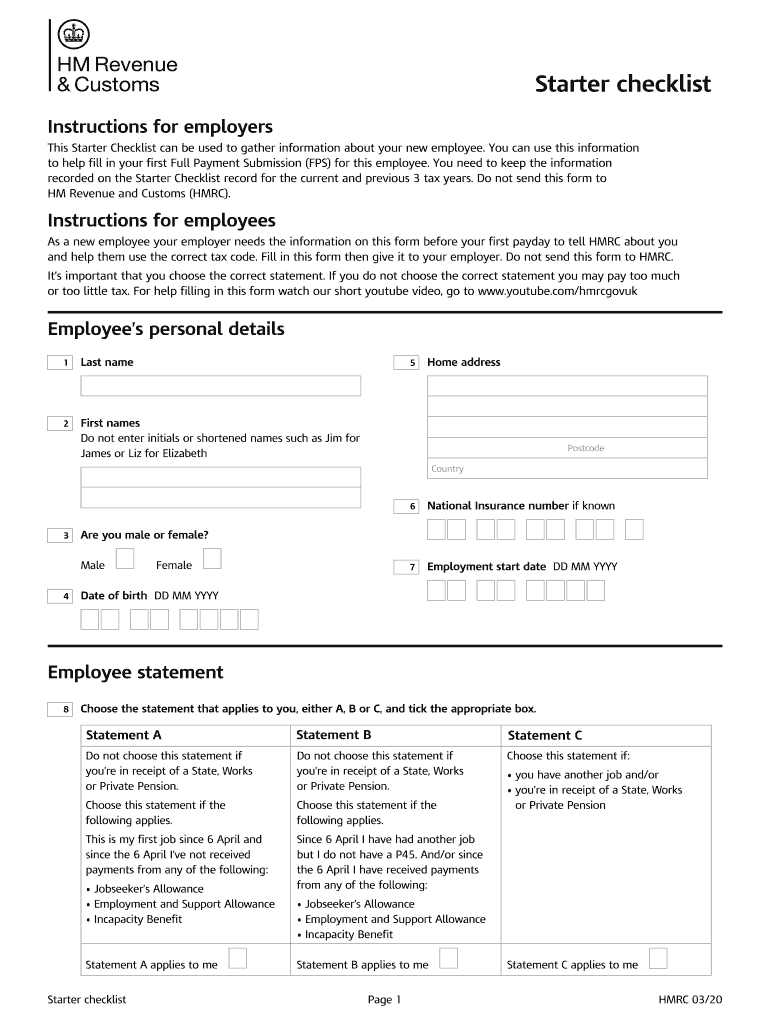

Hmrc Starter Checklist Fill Out And Sign Printable PDF Template SignNow

Hmrc Starter Checklist Fill Out And Sign Printable PDF Template SignNow

HMRC P60 FORM PDF