In this modern-day world of consumers people love a good bargain. One way to score substantial savings on your purchases is through Hmrc Tax Rebate Form R40s. They are a form of marketing employed by retailers and manufacturers to provide customers with a portion of a refund on their purchases after they have made them. In this post, we'll delve into the world of Hmrc Tax Rebate Form R40s. We'll discuss the nature of them about, how they work, and ways to maximize your savings through these efficient incentives.

Get Latest Hmrc Tax Rebate Form R40 Below

Hmrc Tax Rebate Form R40

Hmrc Tax Rebate Form R40 - Hmrc Tax Refund Form R40 Ppi, Hmrc Tax Refund Form R40, Hmrc Tax Refund Form R40 Ppi Pdf, How Do I Get A Tax Form R40, How To Complete Hmrc Form R40, Hmrc Tax Rebate Number, Hmrc Tax Rebate How Long Does It Take

Web 3 avr 2023 nbsp 0183 32 As we are in 2023 24 you can make a claim going back to the 2019 20 tax year It is possible to use the form to claim a repayment of tax relating to the current tax year known as an interim claim if you know

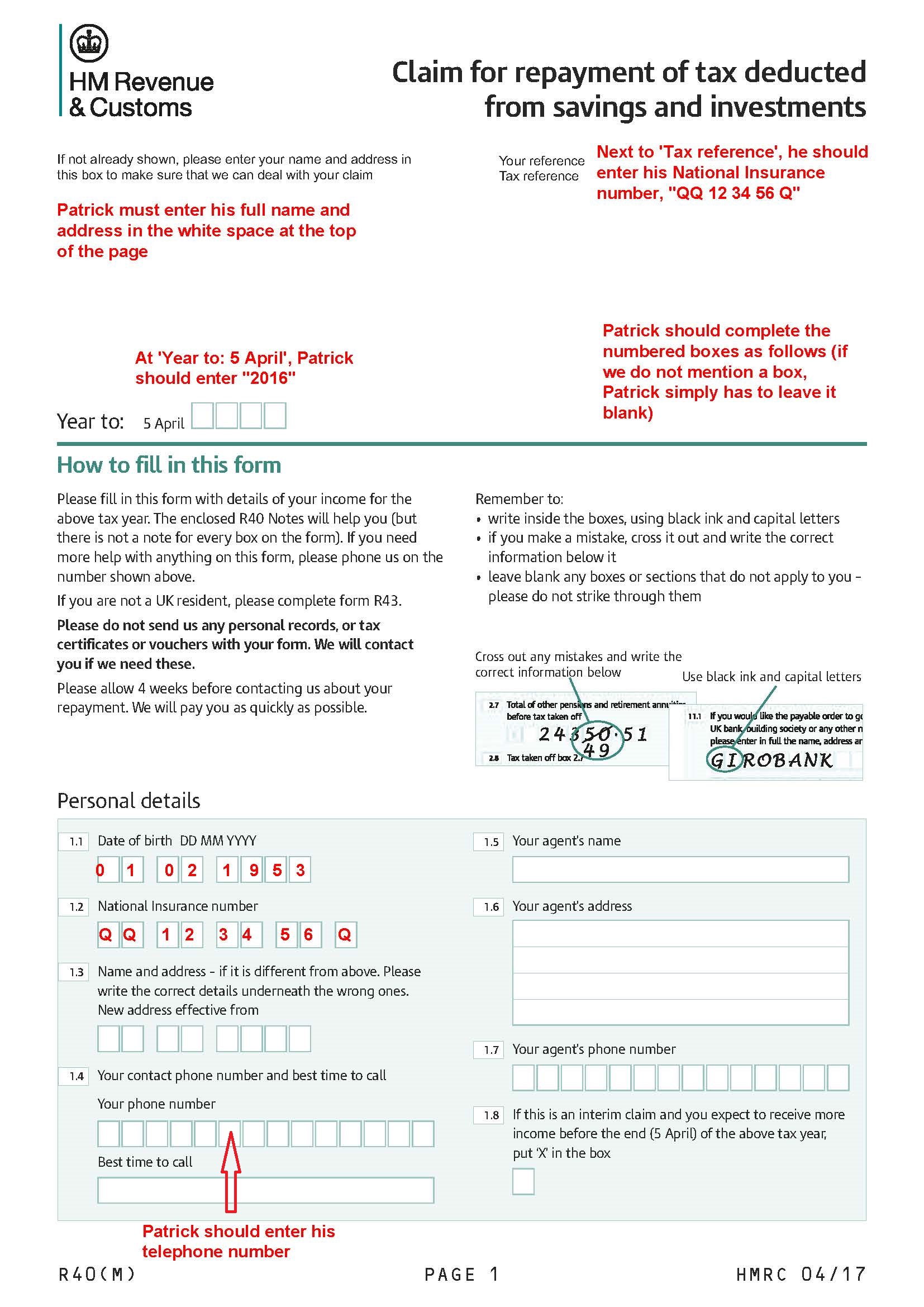

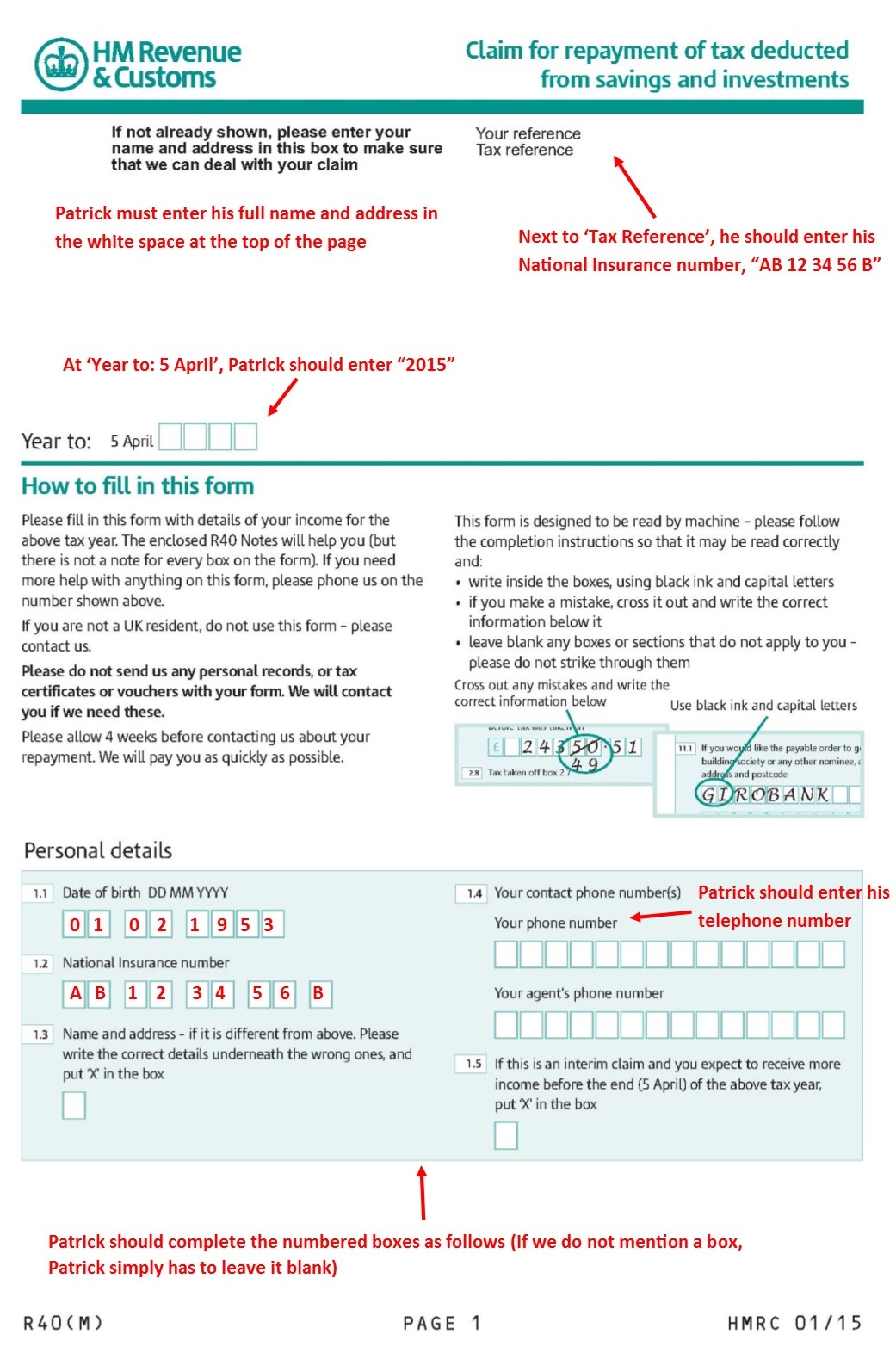

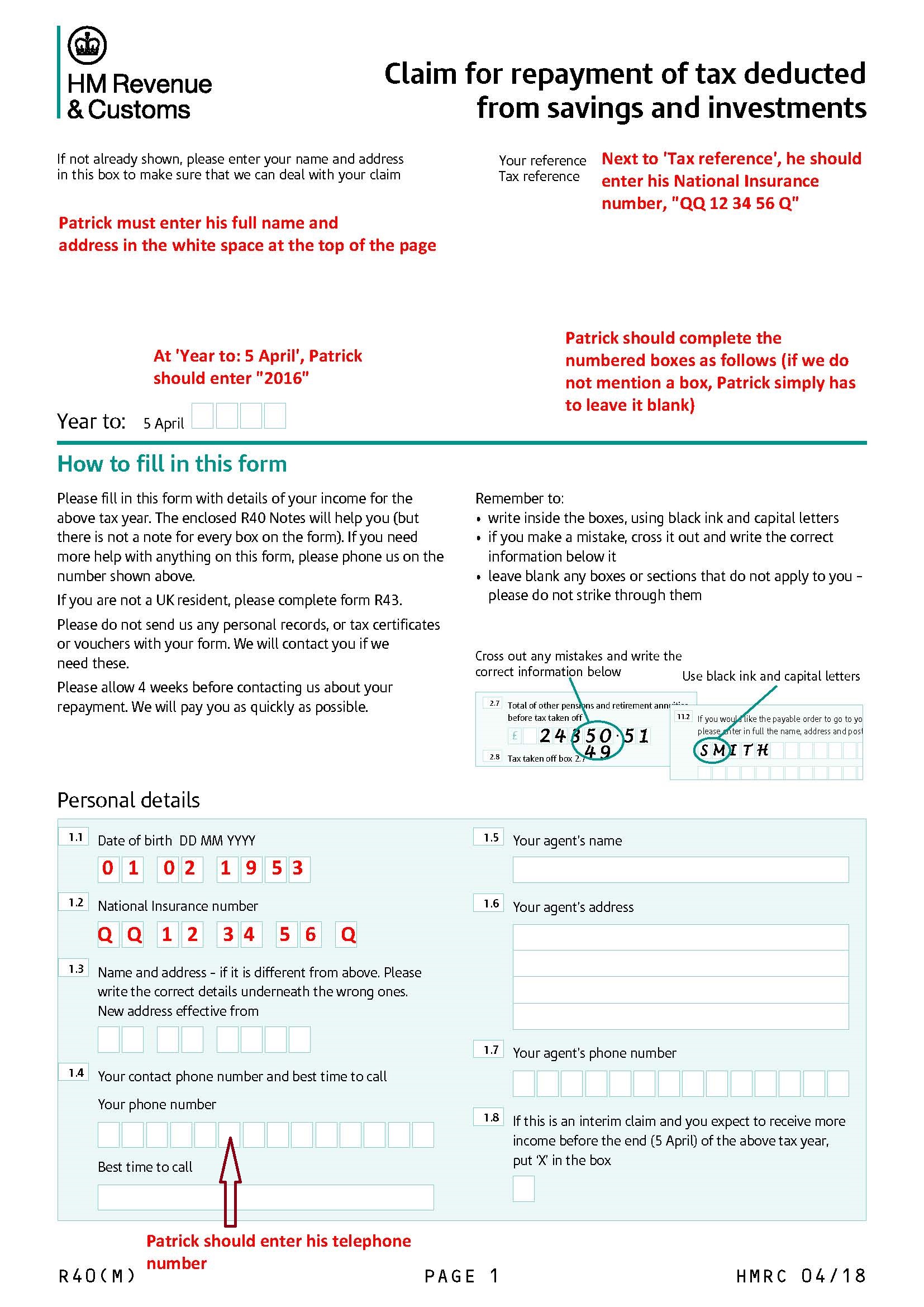

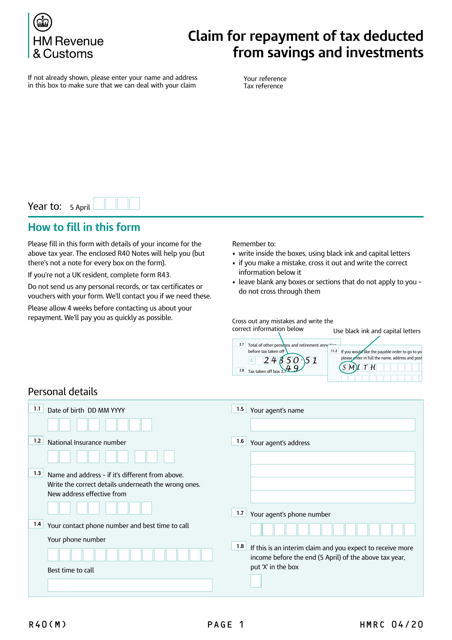

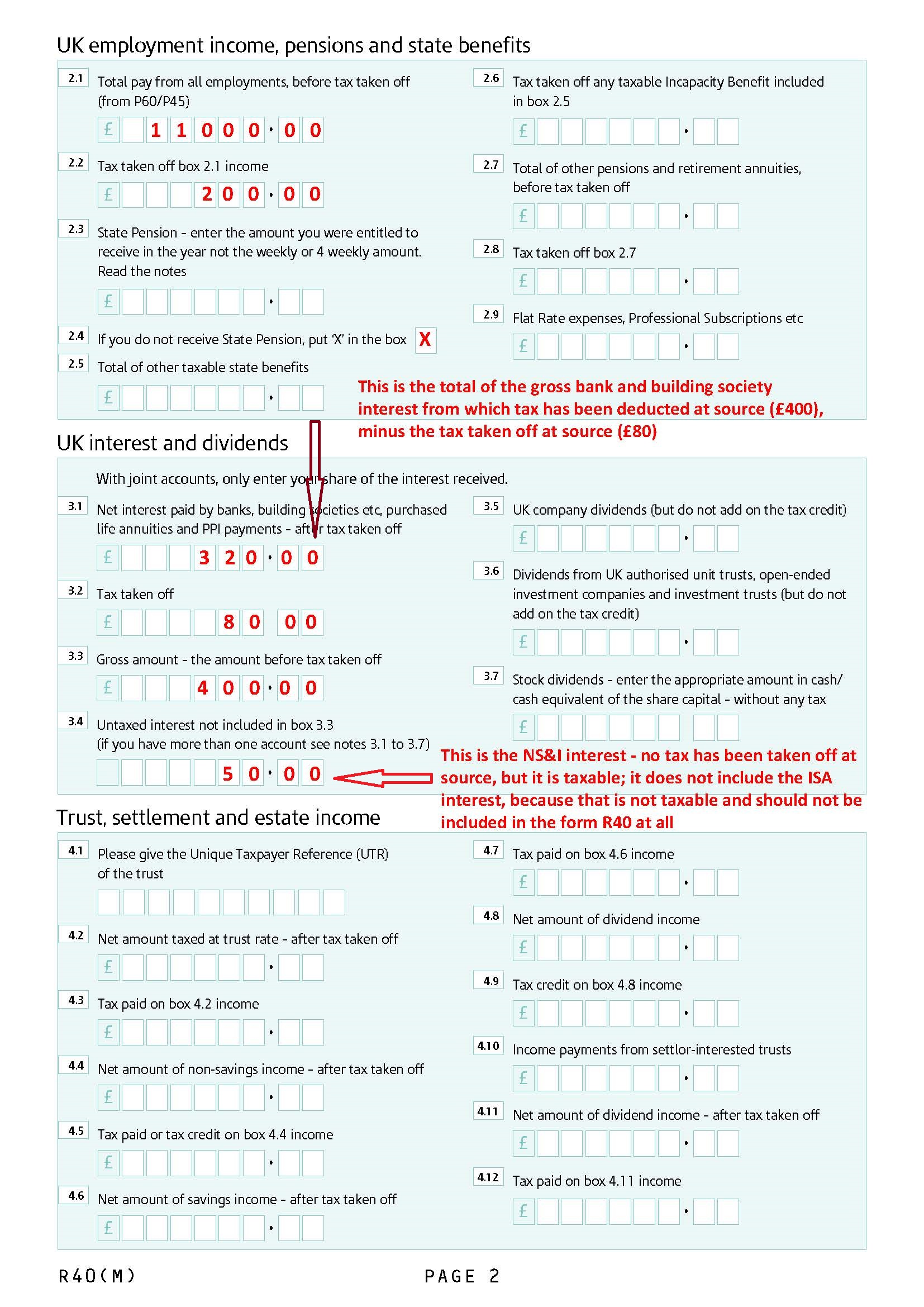

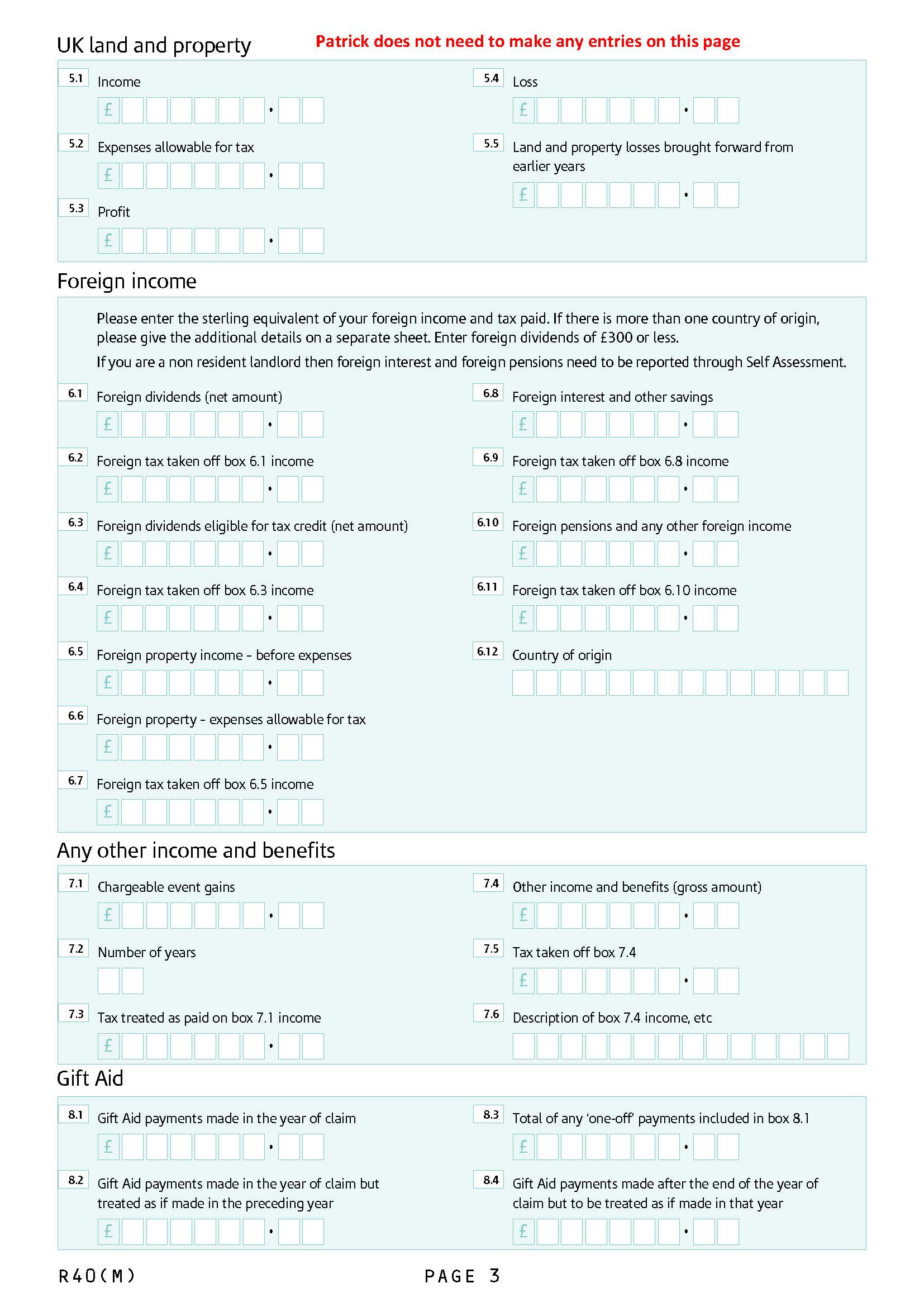

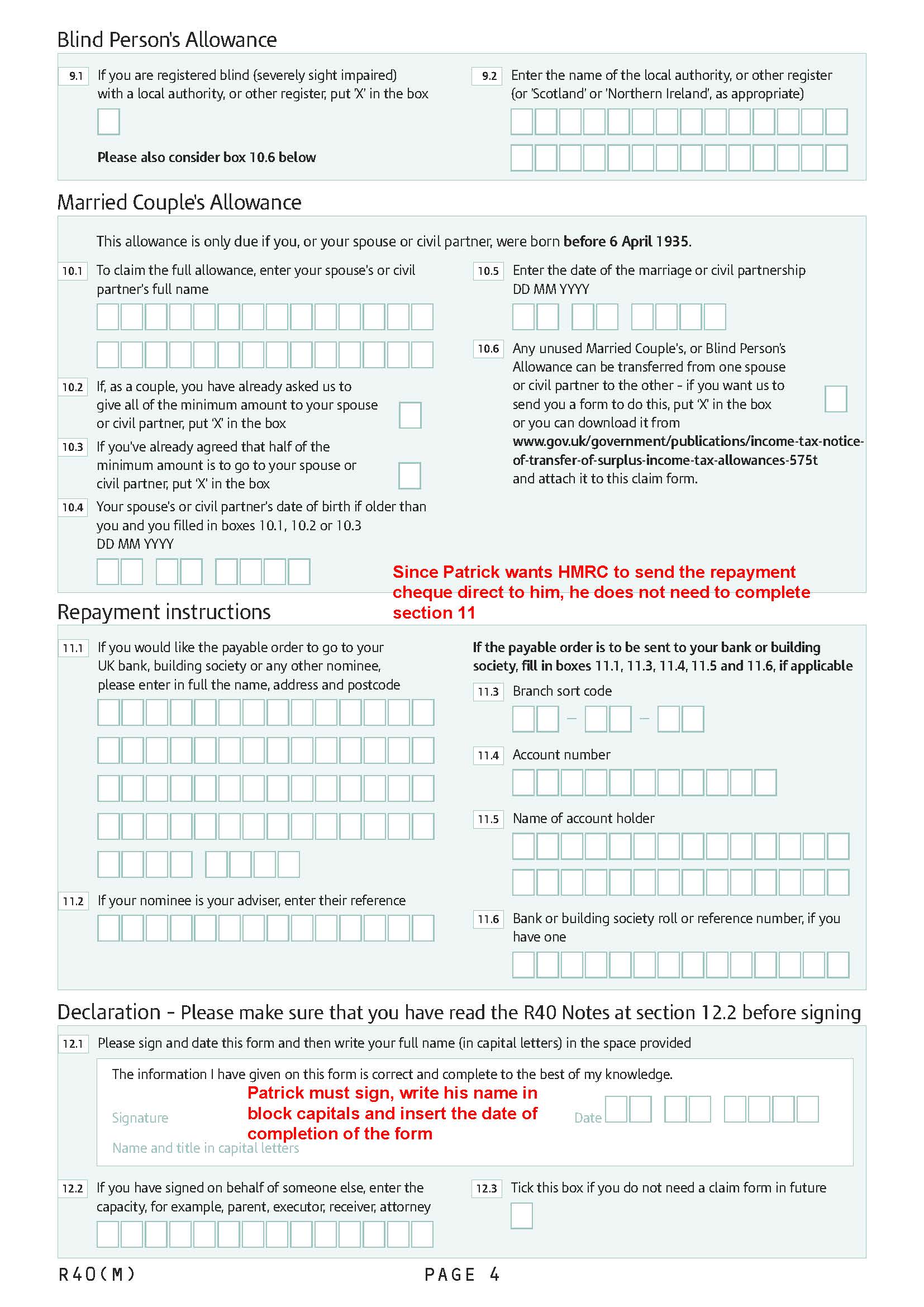

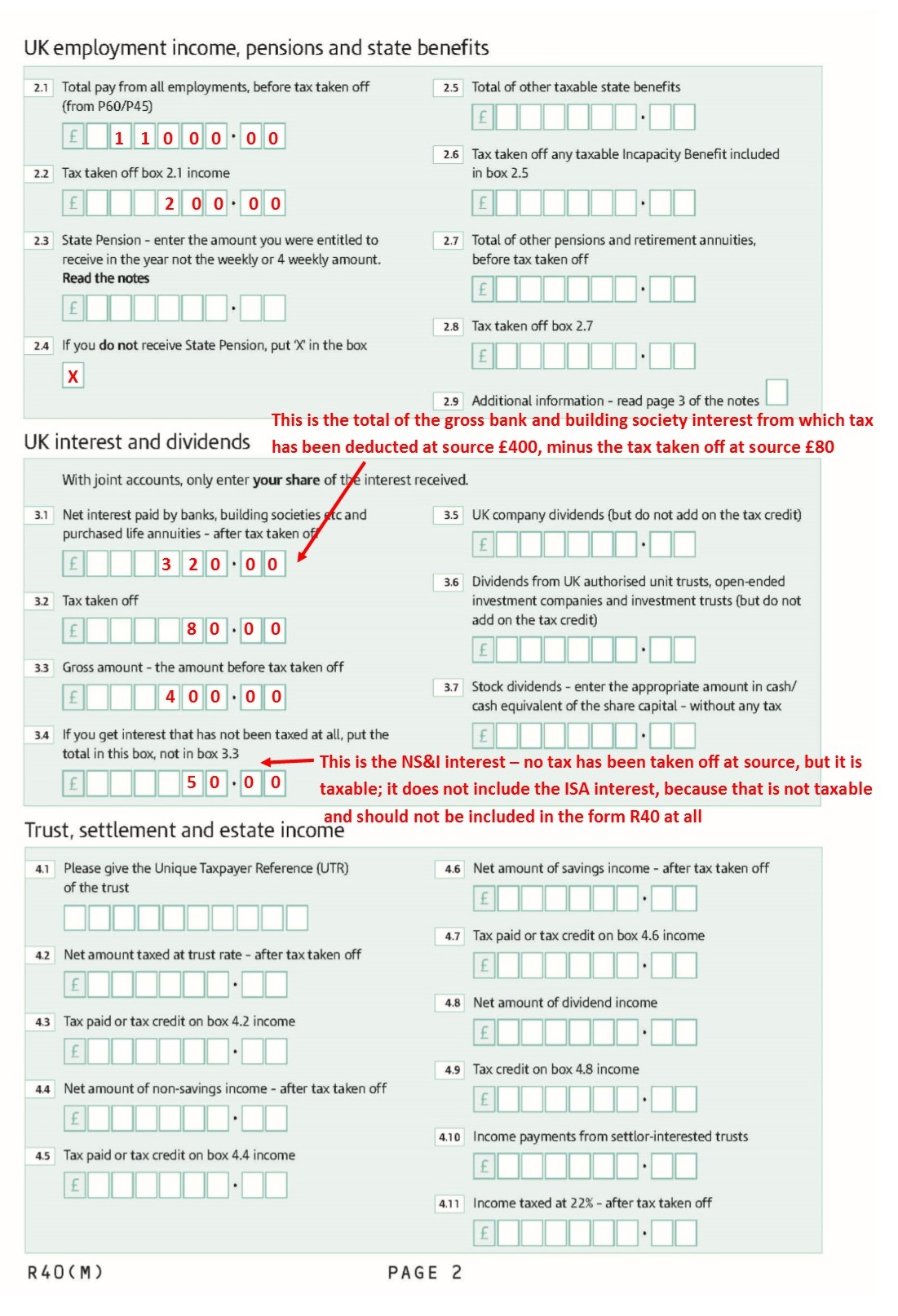

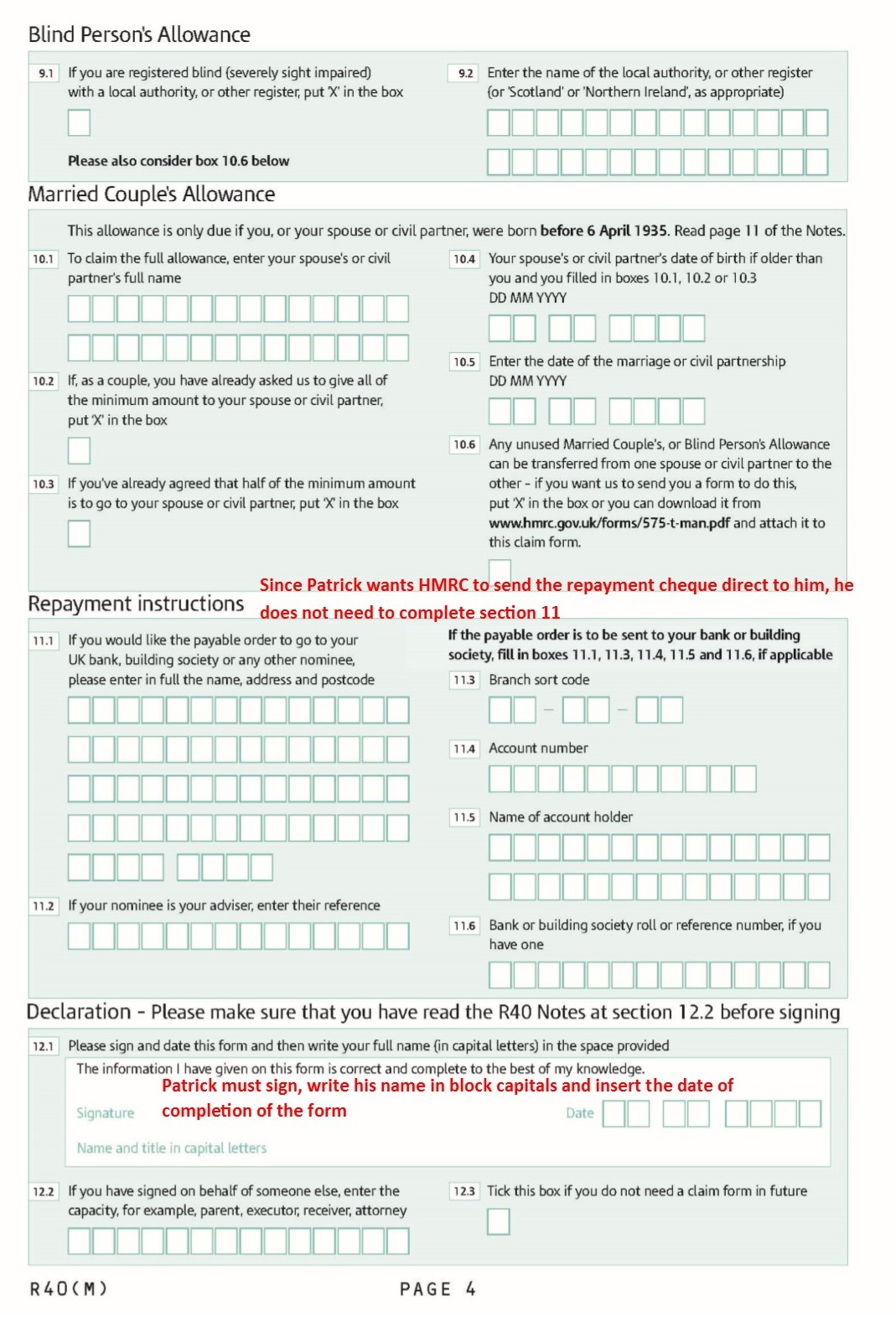

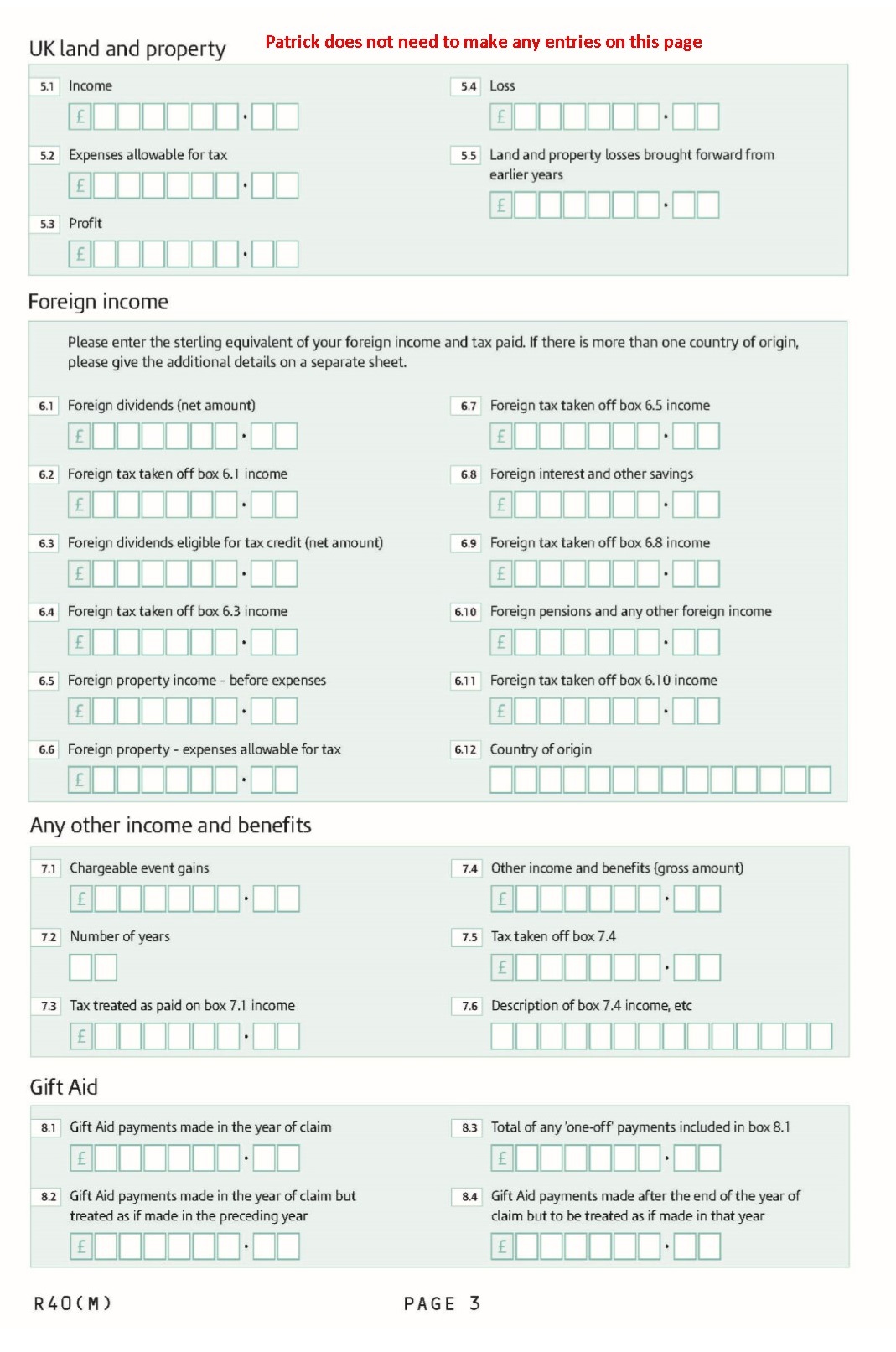

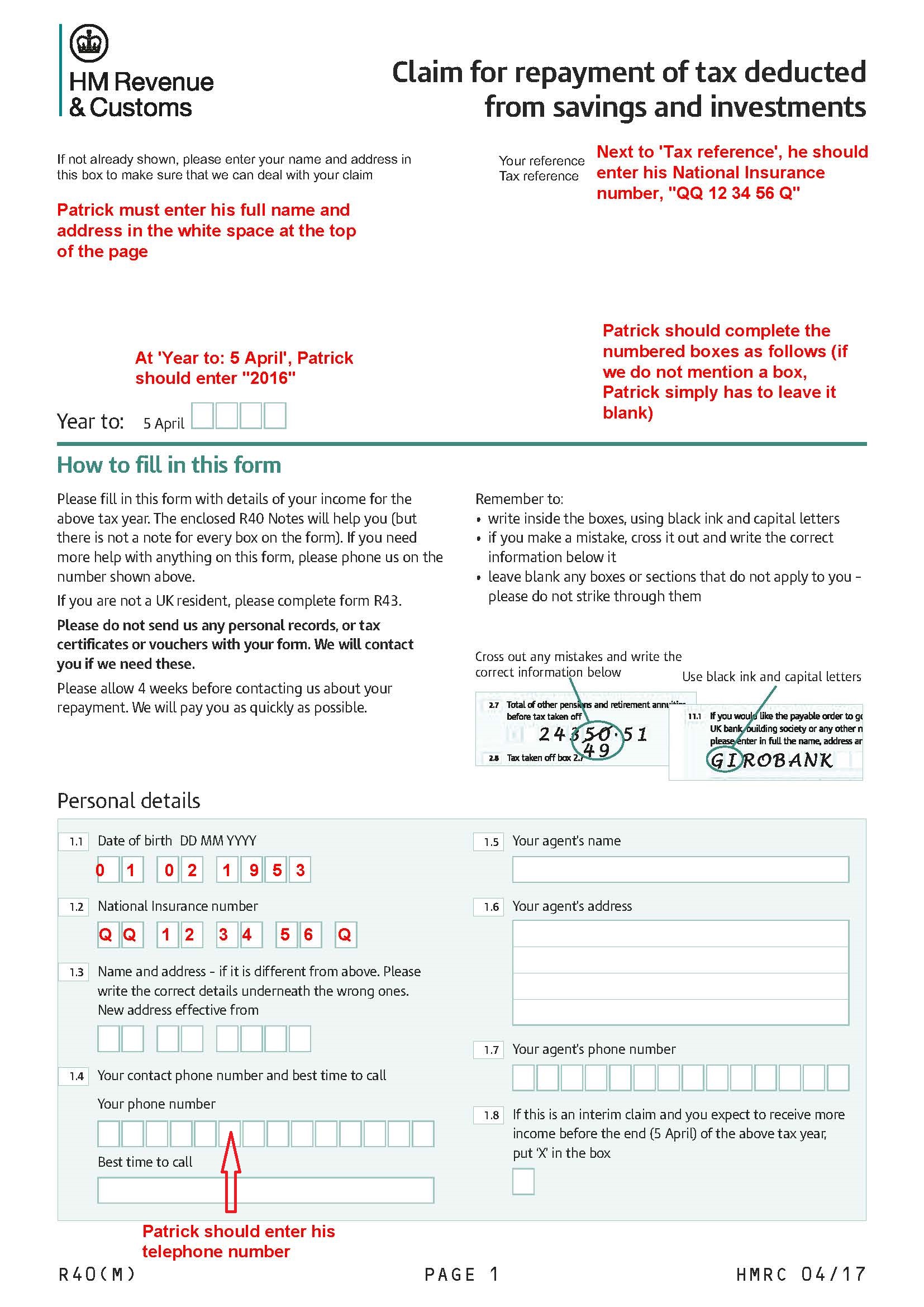

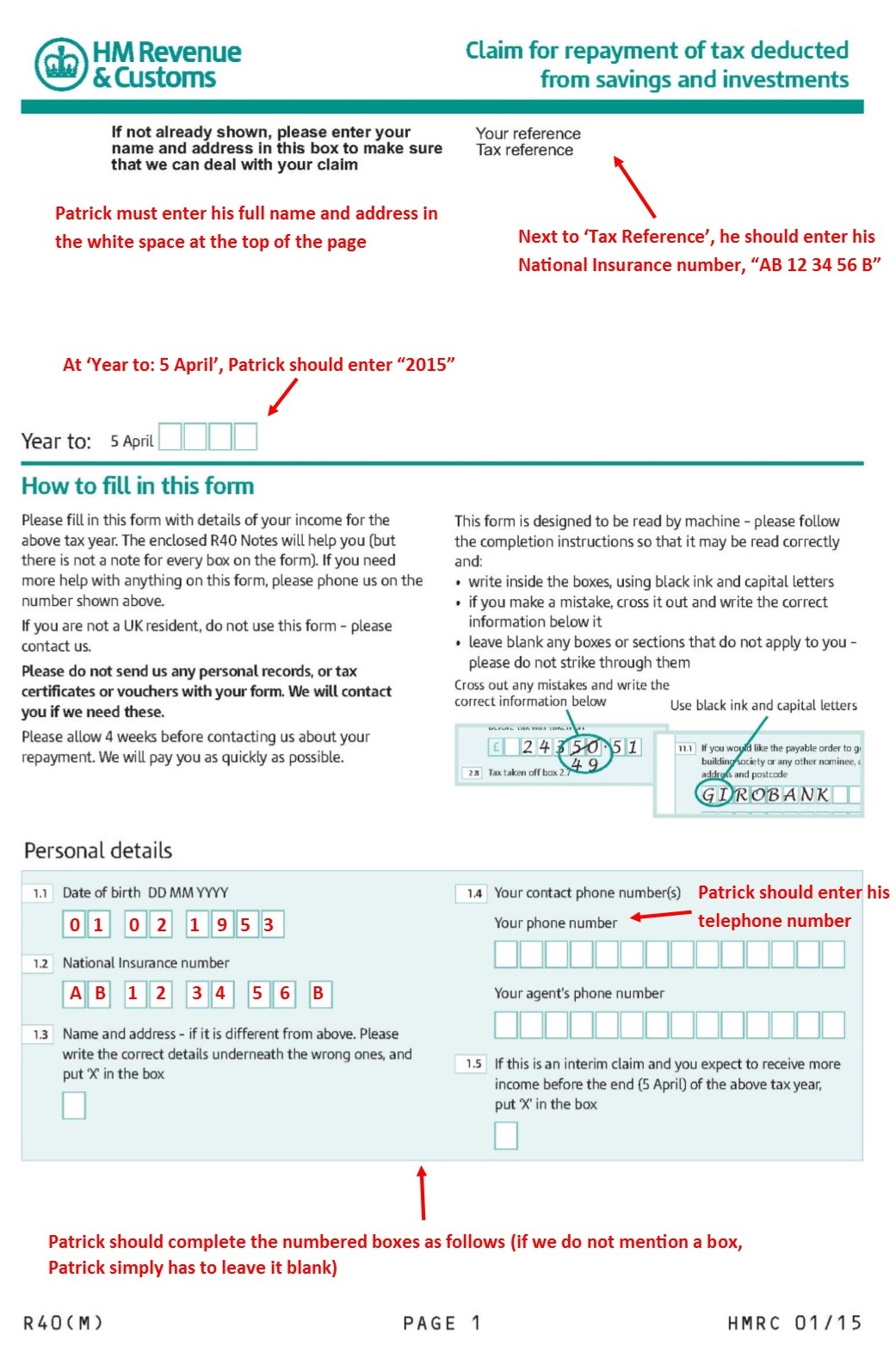

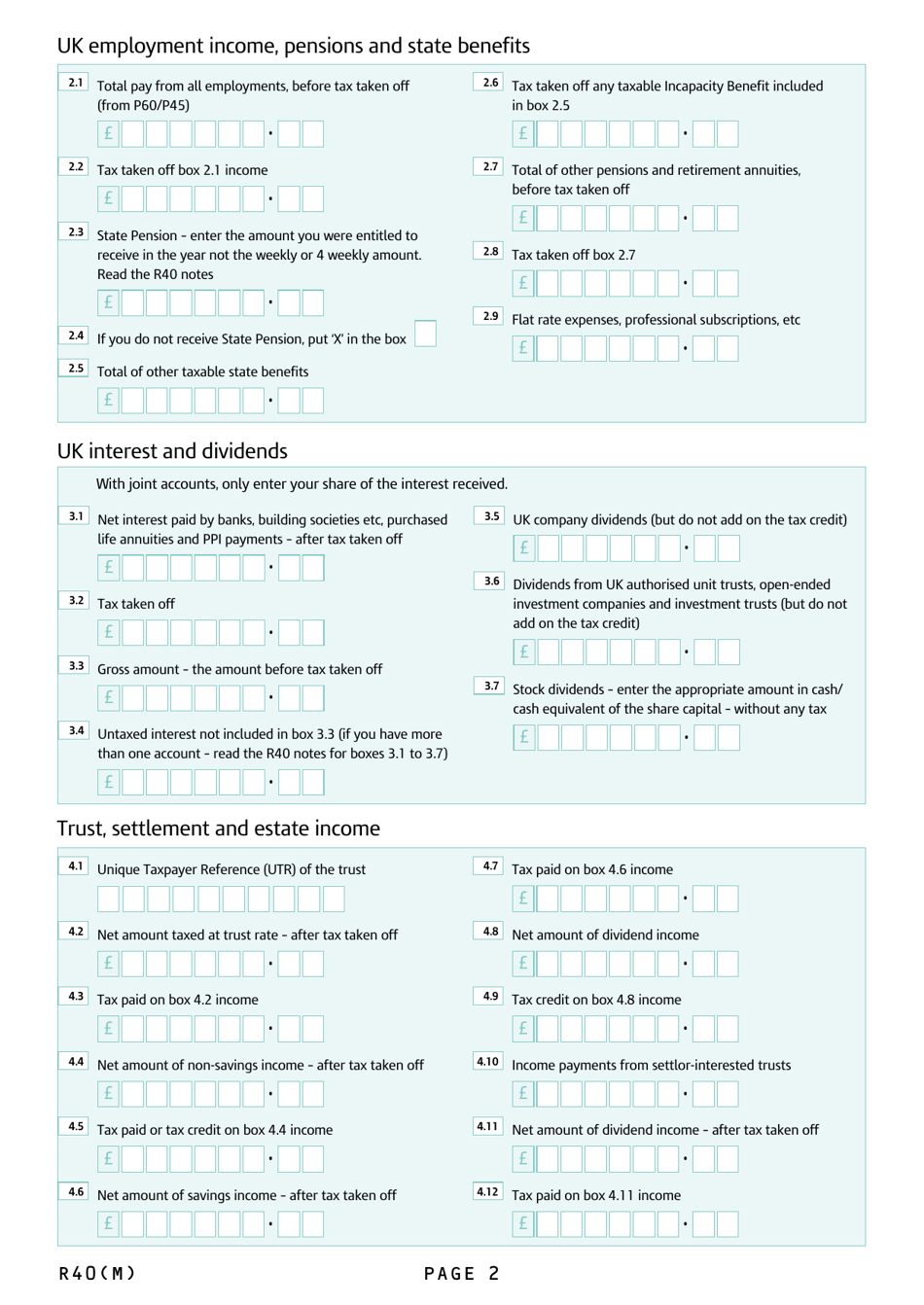

Web How to fill in this form Please fill in this form with details of your income for the above tax year The enclosed R40 Notes will help you but there s not a note for every box on the

A Hmrc Tax Rebate Form R40 in its simplest model, refers to a partial return to the customer after having purchased a item or service. It's an effective way employed by companies to attract customers, increase sales as well as promote particular products.

Types of Hmrc Tax Rebate Form R40

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

Web 19 nov 2014 nbsp 0183 32 1 March 2018 Form Claim a tax refund if you re a non resident merchant seafarer 22 April 2020 Form Claim an Income Tax refund 15 August 2014 Form Claim

Web 6 juin 2023 nbsp 0183 32 Work out the tax year you re claiming for for example the current tax year and the last 4 tax years Check what UK income you have like UK property UK

Cash Hmrc Tax Rebate Form R40

Cash Hmrc Tax Rebate Form R40 are by far the easiest kind of Hmrc Tax Rebate Form R40. Customers receive a specific amount of money in return for purchasing a item. These are often used for expensive items such as electronics or appliances.

Mail-In Hmrc Tax Rebate Form R40

Mail-in Hmrc Tax Rebate Form R40 require the customer to submit an evidence of purchase for the money. They're more involved, but offer huge savings.

Instant Hmrc Tax Rebate Form R40

Instant Hmrc Tax Rebate Form R40 are credited at the point of sale. They reduce the purchase cost immediately. Customers don't have to wait until they can save with this type.

How Hmrc Tax Rebate Form R40 Work

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

Web 0300 200 3610 from outside the UK phone 44 161 930 8331 or go to www hmrc gov uk Claim for repayment of tax deducted from savings and investments If not already shown

The Hmrc Tax Rebate Form R40 Process

It usually consists of a handful of simple steps:

-

Buy the product: At first you purchase the item like you normally do.

-

Fill out the Hmrc Tax Rebate Form R40 questionnaire: you'll have submit some information like your name, address, and purchase details, to be eligible for a Hmrc Tax Rebate Form R40.

-

To submit the Hmrc Tax Rebate Form R40 It is dependent on the nature of Hmrc Tax Rebate Form R40 you could be required to mail in a form or send it via the internet.

-

Wait for approval: The business will go through your application to make sure it is in line with the terms and conditions of the Hmrc Tax Rebate Form R40.

-

Get your Hmrc Tax Rebate Form R40 After being approved, the amount you receive will be whether by check, prepaid card, or by another option that's specified in the offer.

Pros and Cons of Hmrc Tax Rebate Form R40

Advantages

-

Cost savings Hmrc Tax Rebate Form R40 can dramatically reduce the cost for an item.

-

Promotional Offers These promotions encourage consumers to try new items or brands.

-

Help to Increase Sales The benefits of a Hmrc Tax Rebate Form R40 can improve the company's sales as well as market share.

Disadvantages

-

Complexity Pay-in Hmrc Tax Rebate Form R40 via mail, particularly may be lengthy and take a long time to complete.

-

Time Limits for Hmrc Tax Rebate Form R40 A majority of Hmrc Tax Rebate Form R40 have very strict deadlines for filing.

-

Risque of Non-Payment Customers may not receive their refunds if they don't comply with the rules precisely.

Download Hmrc Tax Rebate Form R40

Download Hmrc Tax Rebate Form R40

FAQs

1. Are Hmrc Tax Rebate Form R40 equivalent to discounts? No, Hmrc Tax Rebate Form R40 are one-third of the amount refunded following purchase, while discounts reduce their price at time of sale.

2. Can I get multiple Hmrc Tax Rebate Form R40 on the same product What is the best way to do it? It's contingent on conditions and conditions of Hmrc Tax Rebate Form R40 deals and product's eligibility. Certain companies may allow it, and some don't.

3. How long does it take to receive a Hmrc Tax Rebate Form R40? The time frame differs, but it can take a couple of weeks or a several months to receive a Hmrc Tax Rebate Form R40.

4. Do I have to pay taxes regarding Hmrc Tax Rebate Form R40 montants? the majority of instances, Hmrc Tax Rebate Form R40 amounts are not considered to be taxable income.

5. Do I have confidence in Hmrc Tax Rebate Form R40 deals from lesser-known brands it is crucial to conduct research and confirm that the company offering the Hmrc Tax Rebate Form R40 has a good reputation prior to making an purchase.

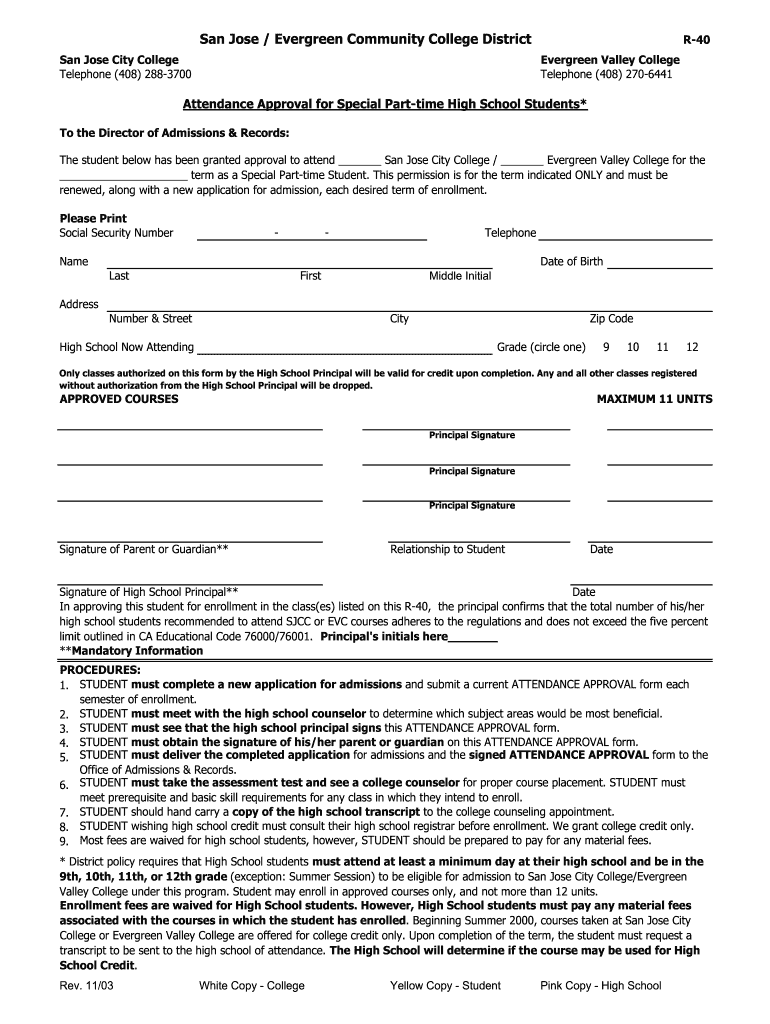

Form R40 Download Printable PDF Or Fill Online Claim For Repayment Of

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

Check more sample of Hmrc Tax Rebate Form R40 below

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

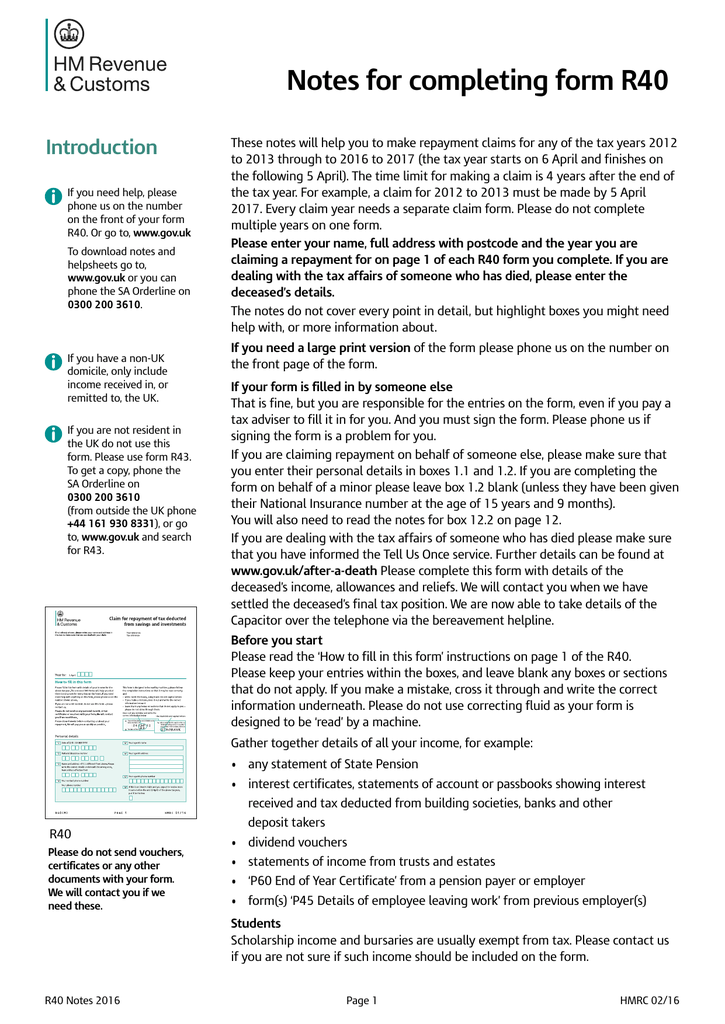

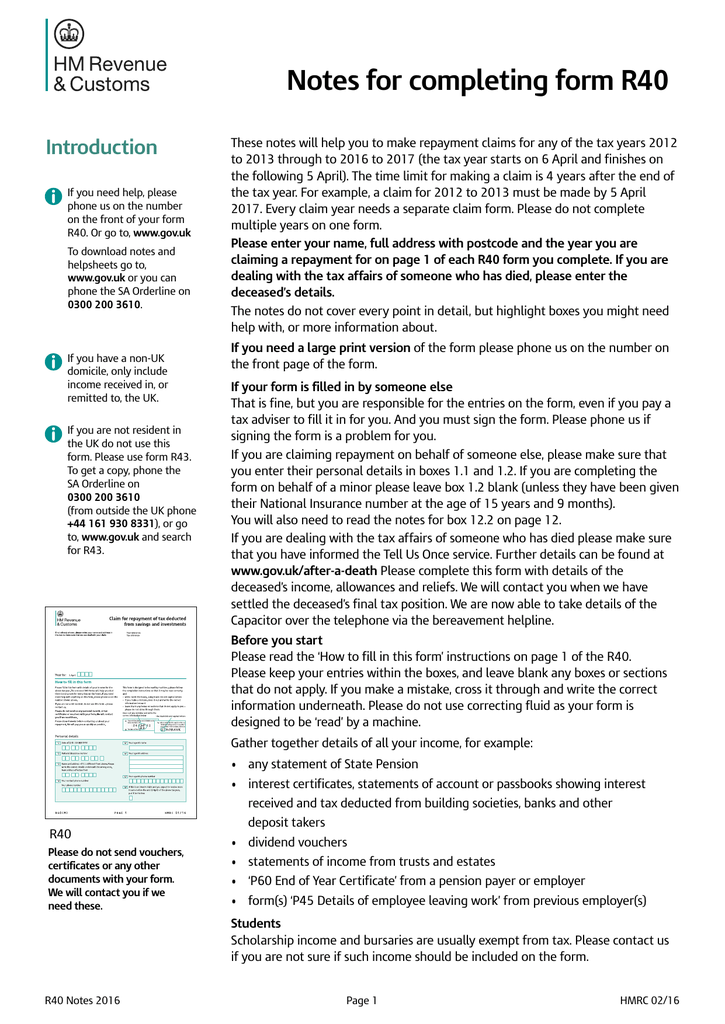

Notes For Completing Form R40

https://assets.publishing.service.gov.uk/.../file/1172652/R40…

Web How to fill in this form Please fill in this form with details of your income for the above tax year The enclosed R40 Notes will help you but there s not a note for every box on the

https://assets.publishing.service.gov.uk/.../R40_M__internet_…

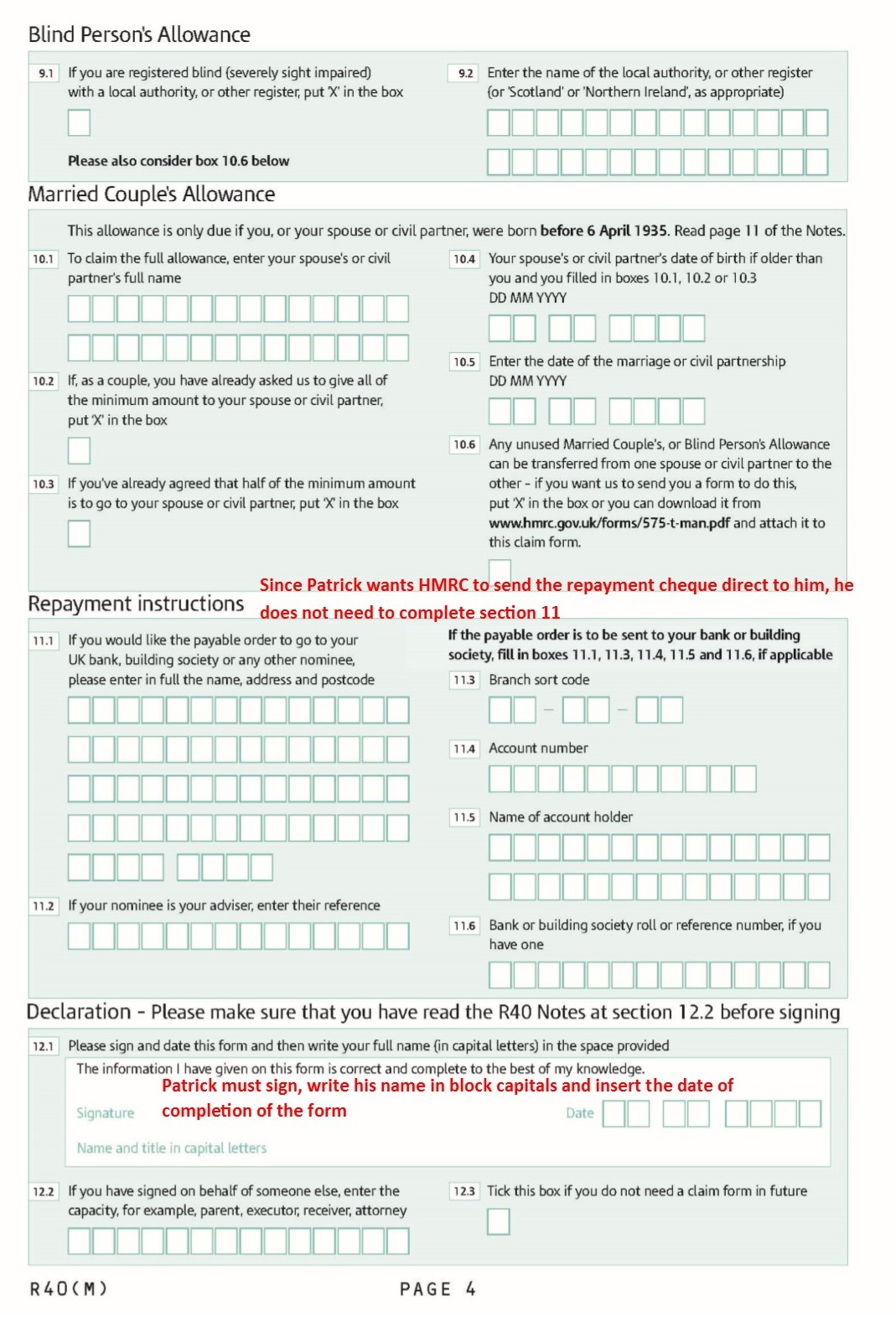

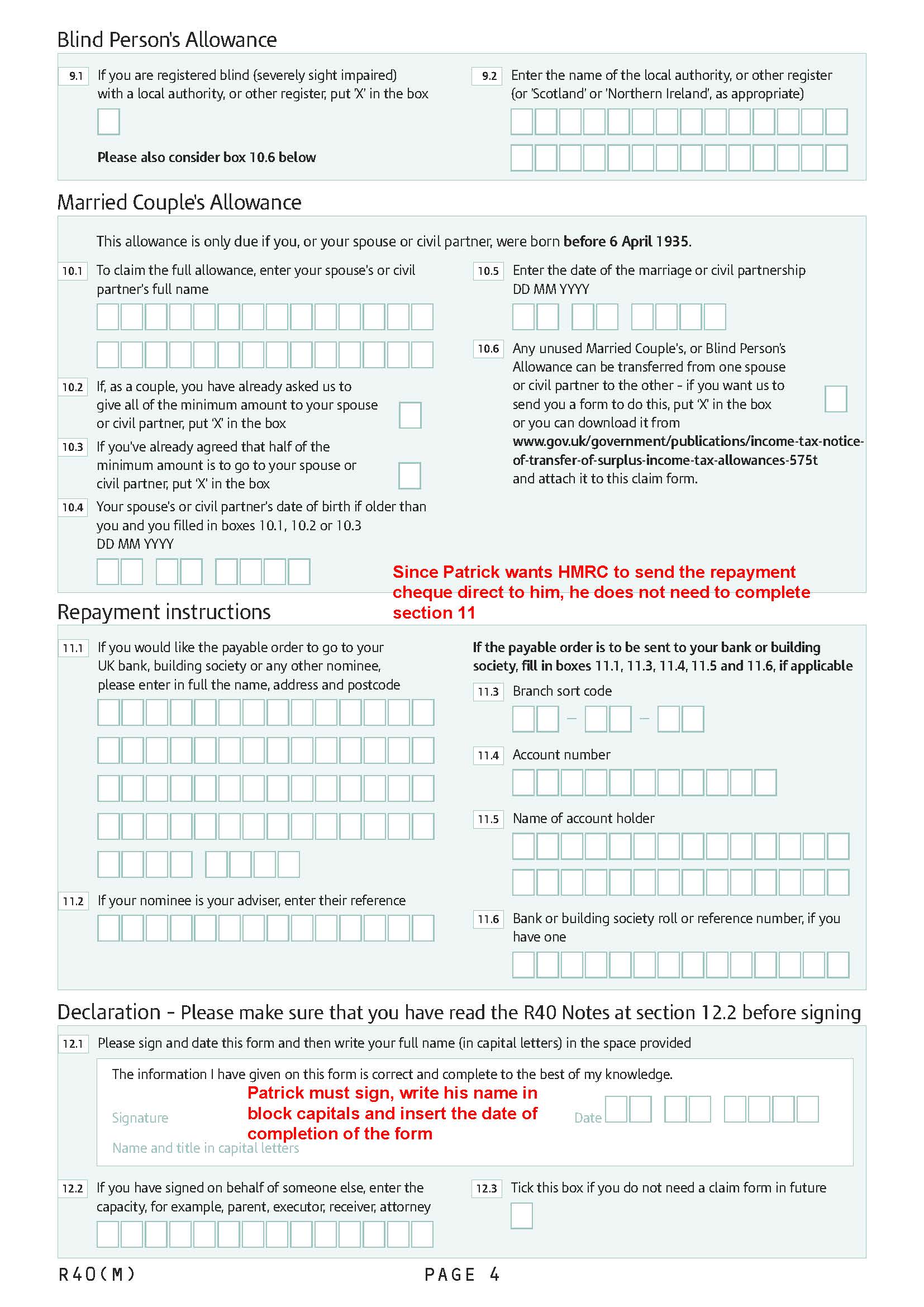

Web 163 2 8 ink and capital letters 11 1 If you would like the payable order to go building society or any other nominee address and postcode I R OB A N K to your bank enter their name

Web How to fill in this form Please fill in this form with details of your income for the above tax year The enclosed R40 Notes will help you but there s not a note for every box on the

Web 163 2 8 ink and capital letters 11 1 If you would like the payable order to go building society or any other nominee address and postcode I R OB A N K to your bank enter their name

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

R40 Claim For Repayment Of Tax Deducted From Savings And Investments

Notes For Completing Form R40

R40 Form Fill Online Printable Fillable Blank PDFfiller

R40 Notes Notes For Completing Form R40

R40 Notes Notes For Completing Form R40

Form R40 Download Printable PDF Or Fill Online Claim For Repayment Of