In the modern world of consumerization every person loves a great bargain. One option to obtain significant savings for your purchases is through Gst Rebatess. Gst Rebatess are marketing strategies employed by retailers and manufacturers to provide customers with a partial refund for their purchases after they've bought them. In this post, we'll take a look at the world that is Gst Rebatess, looking at what they are about, how they work, and how to maximize the value of these incentives.

Get Latest Gst Rebates Below

Gst Rebates

Gst Rebates -

The GST rebate is issued four times a year the 2023 payment dates are Jan 5 April 5 July 5 2023 and Oct 5 The Canada Revenue Agency has said some Canadians may be eligible for the July GST

Canada Canada Millions of Canadians will see GST credits double starting Friday Here s who qualifies The one time payment was announced by the federal government in September and is intended

A Gst Rebates as it is understood in its simplest definition, is a refund to a purchaser when they purchase a product or service. It's a powerful method that businesses use to draw customers, increase sales, and to promote certain products.

Types of Gst Rebates

Are GST Rebates Taxable Top 10 Reasons To Claim A GST Rebate

Are GST Rebates Taxable Top 10 Reasons To Claim A GST Rebate

The CRA will keep all future GST HST credit payments or tax refunds until the balance is repaid The CRA will also apply your GST HST credit to amounts owing for tax balances or amounts owing to other federal provincial or territorial government programs

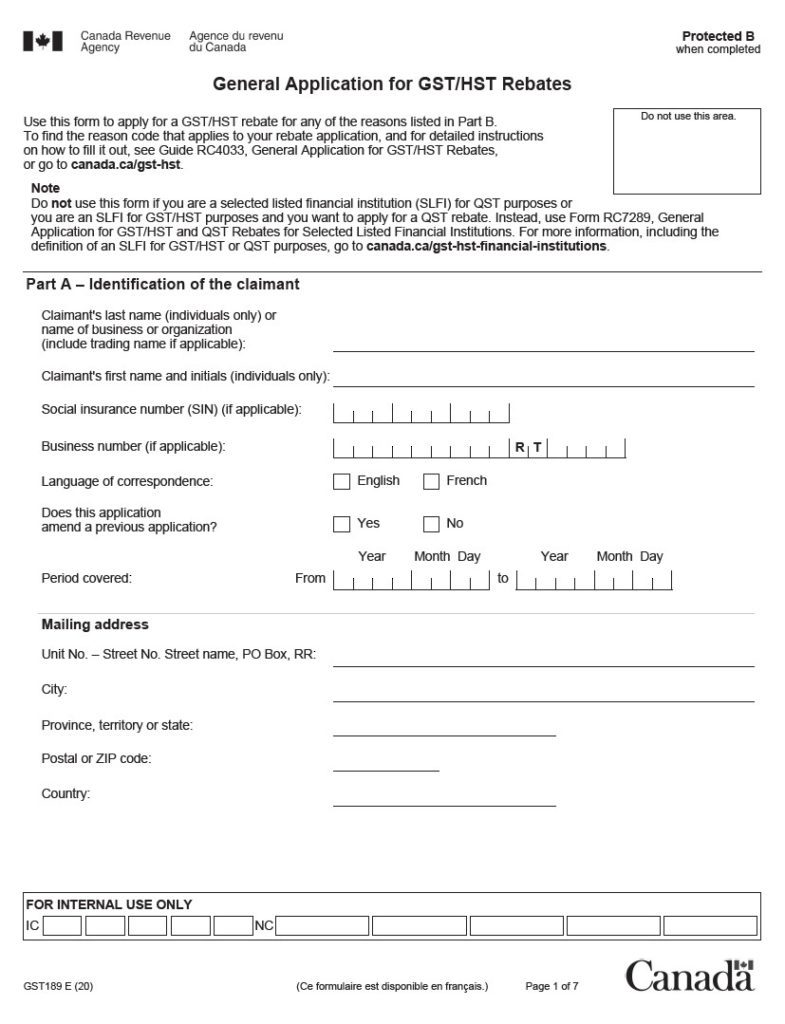

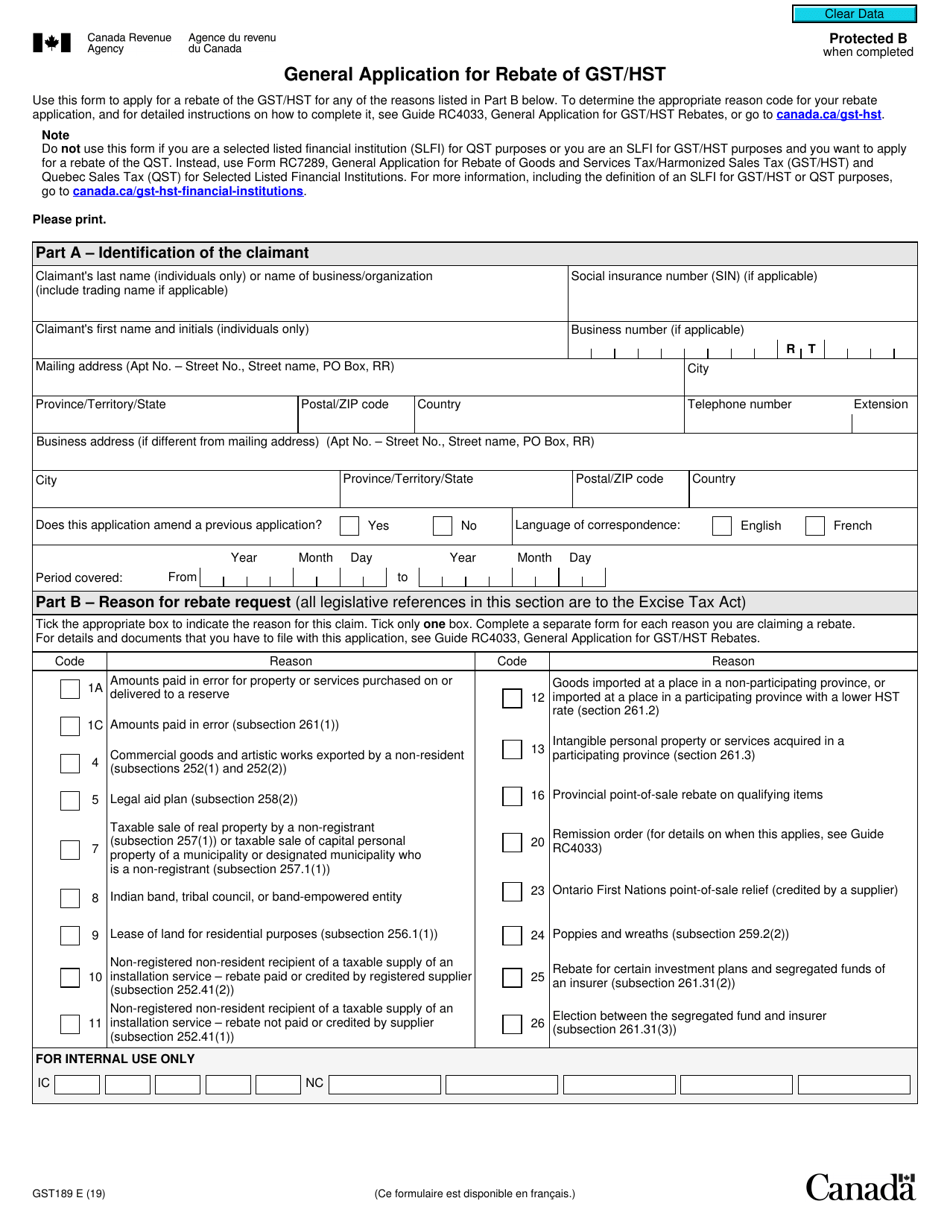

How to claim the GST HST rebate To claim your rebate use Form GST189 General Application for GST HST Rebate You can only use one reason code per rebate application If you are eligible to claim a rebate under more than one code use a separate rebate application for each reason code

Cash Gst Rebates

Cash Gst Rebates are the most straightforward type of Gst Rebates. The customer receives a particular amount of money after purchasing a item. This is often for big-ticket items, like electronics and appliances.

Mail-In Gst Rebates

Mail-in Gst Rebates need customers to provide the proof of purchase to be eligible for their money back. They're more complicated, but they can provide huge savings.

Instant Gst Rebates

Instant Gst Rebates will be applied at moment of sale, cutting the price of purchases immediately. Customers don't have to wait for their savings in this manner.

How Gst Rebates Work

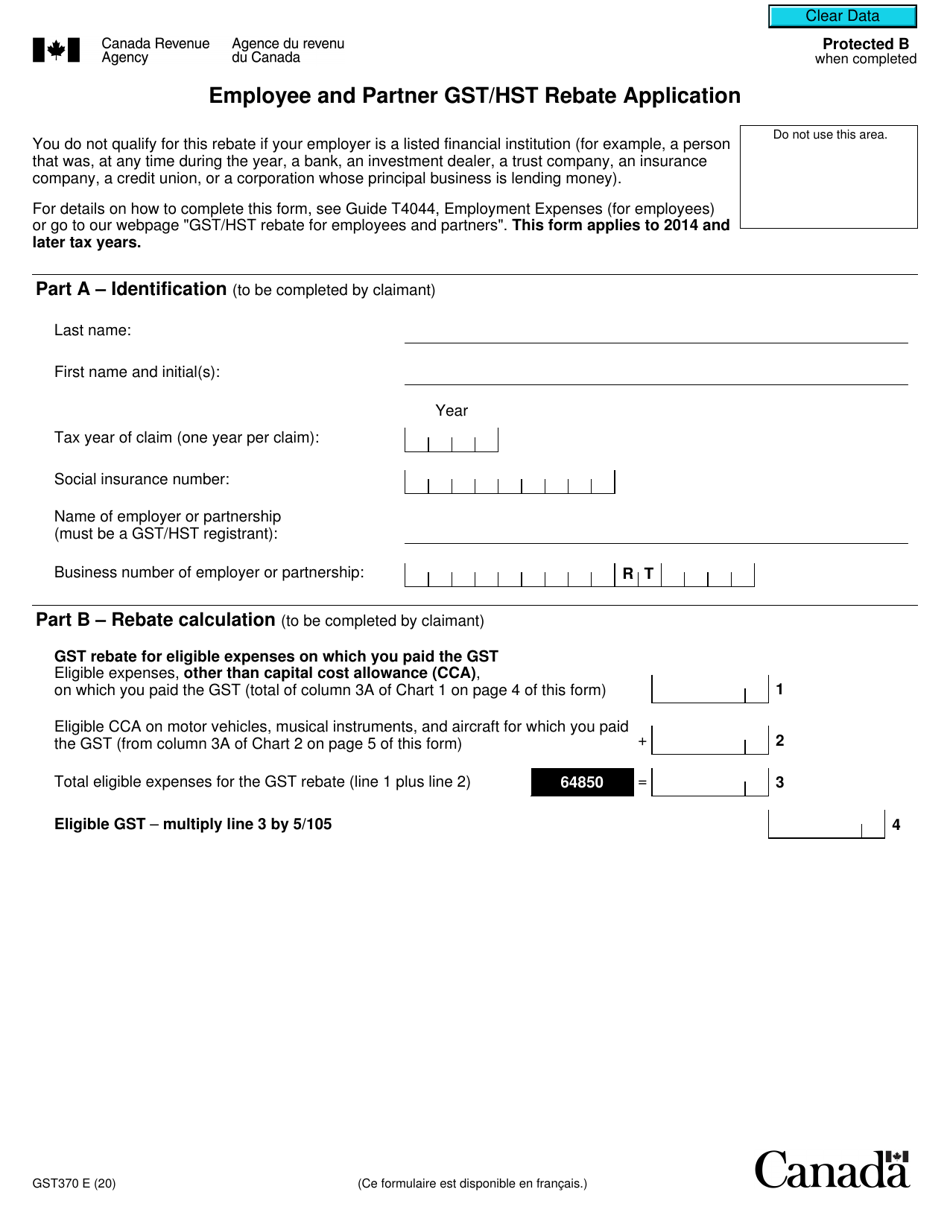

Form GST370 Download Fillable PDF Or Fill Online Employee And Partner

Form GST370 Download Fillable PDF Or Fill Online Employee And Partner

The goods and services tax GST French Taxe sur les produits et services is a value added tax introduced in Canada on January 1 1991 by the government of Prime Minister Brian Mulroney subject to certain public sector body rebates Tax exempt items include long term residential rents health and dental care educational services day

The Gst Rebates Process

It usually consists of a few steps:

-

Buy the product: Firstly you purchase the item like you normally do.

-

Fill in this Gst Rebates request form. You'll need to provide some data including your address, name, and purchase information, to receive your Gst Rebates.

-

To submit the Gst Rebates In accordance with the type of Gst Rebates you may have to mail in a form or make it available online.

-

Wait for approval: The company will review your request to make sure that it's in accordance with the terms and conditions of the Gst Rebates.

-

You will receive your Gst Rebates Once it's approved, you'll be able to receive your reimbursement, whether via check, credit card or through a different procedure specified by the deal.

Pros and Cons of Gst Rebates

Advantages

-

Cost Savings: Gst Rebates can significantly decrease the price for products.

-

Promotional Offers They encourage customers to experiment with new products, or brands.

-

Enhance Sales: Gst Rebates can boost a company's sales and market share.

Disadvantages

-

Complexity Pay-in Gst Rebates via mail, particularly, can be cumbersome and tedious.

-

Days of expiration A lot of Gst Rebates have extremely strict deadlines to submit.

-

Risk of not receiving payment Certain customers could not receive Gst Rebates if they don't adhere to the rules precisely.

Download Gst Rebates

FAQs

1. Are Gst Rebates similar to discounts? Not at all, Gst Rebates provide a partial refund upon purchase, whereas discounts decrease their price at moment of sale.

2. Are there multiple Gst Rebates I can get on the same item? It depends on the terms and conditions of Gst Rebates offers and the product's quality and eligibility. Some companies will allow it, while others won't.

3. How long does it take to get an Gst Rebates? The timing varies, but it can be anywhere from a few weeks up to a couple of months before you get your Gst Rebates.

4. Do I have to pay taxes with respect to Gst Rebates the amount? the majority of circumstances, Gst Rebates amounts are not considered to be taxable income.

5. Can I trust Gst Rebates offers from brands that aren't well-known It is essential to investigate and confirm that the company offering the Gst Rebates is reliable prior to making purchases.

Do You Qualify For A GST Rebate YouTube

GST New Housing Printable Rebate Form

Check more sample of Gst Rebates below

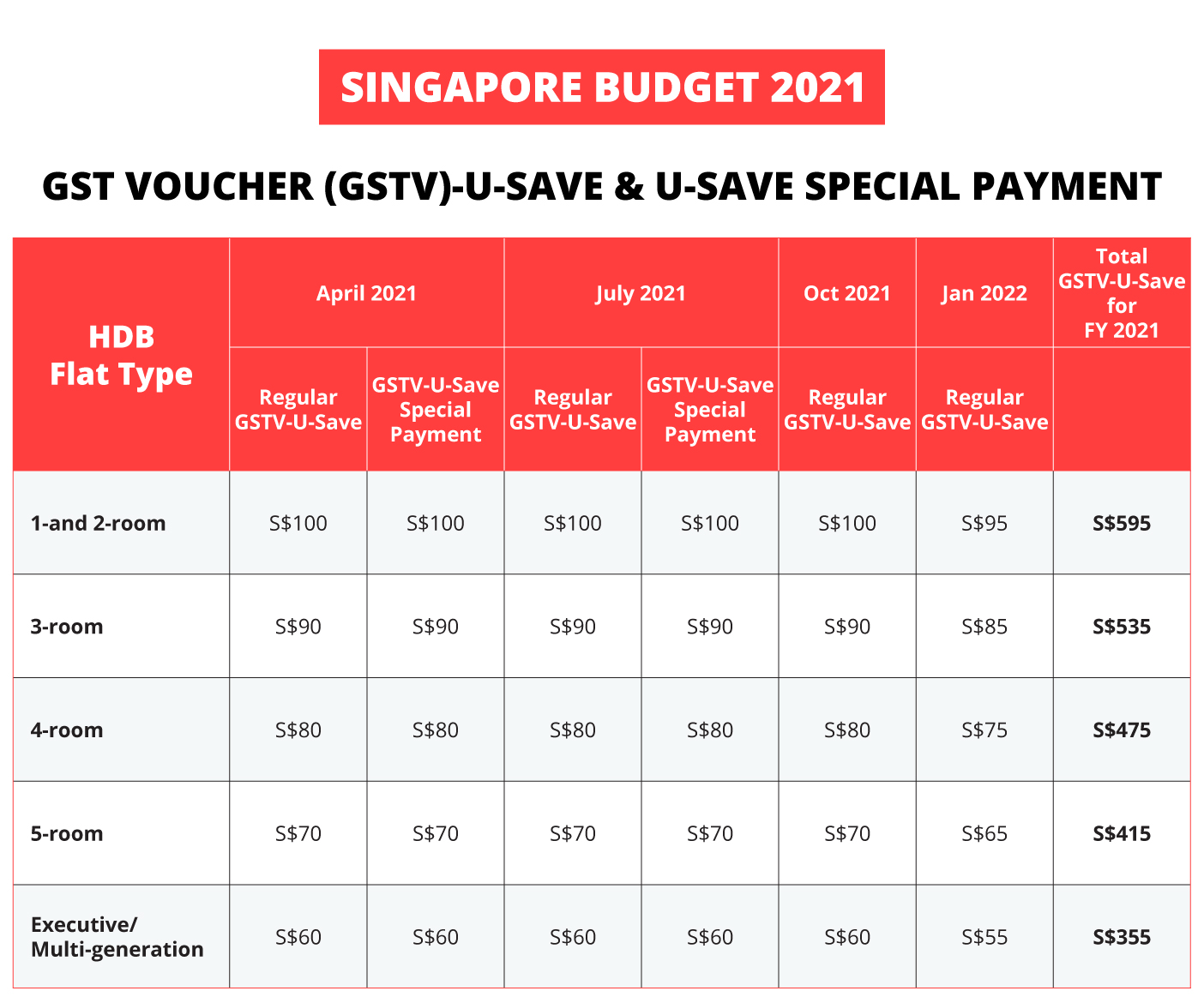

Budget 2021 More Help For Pandemic hit Singaporeans DBS Singapore

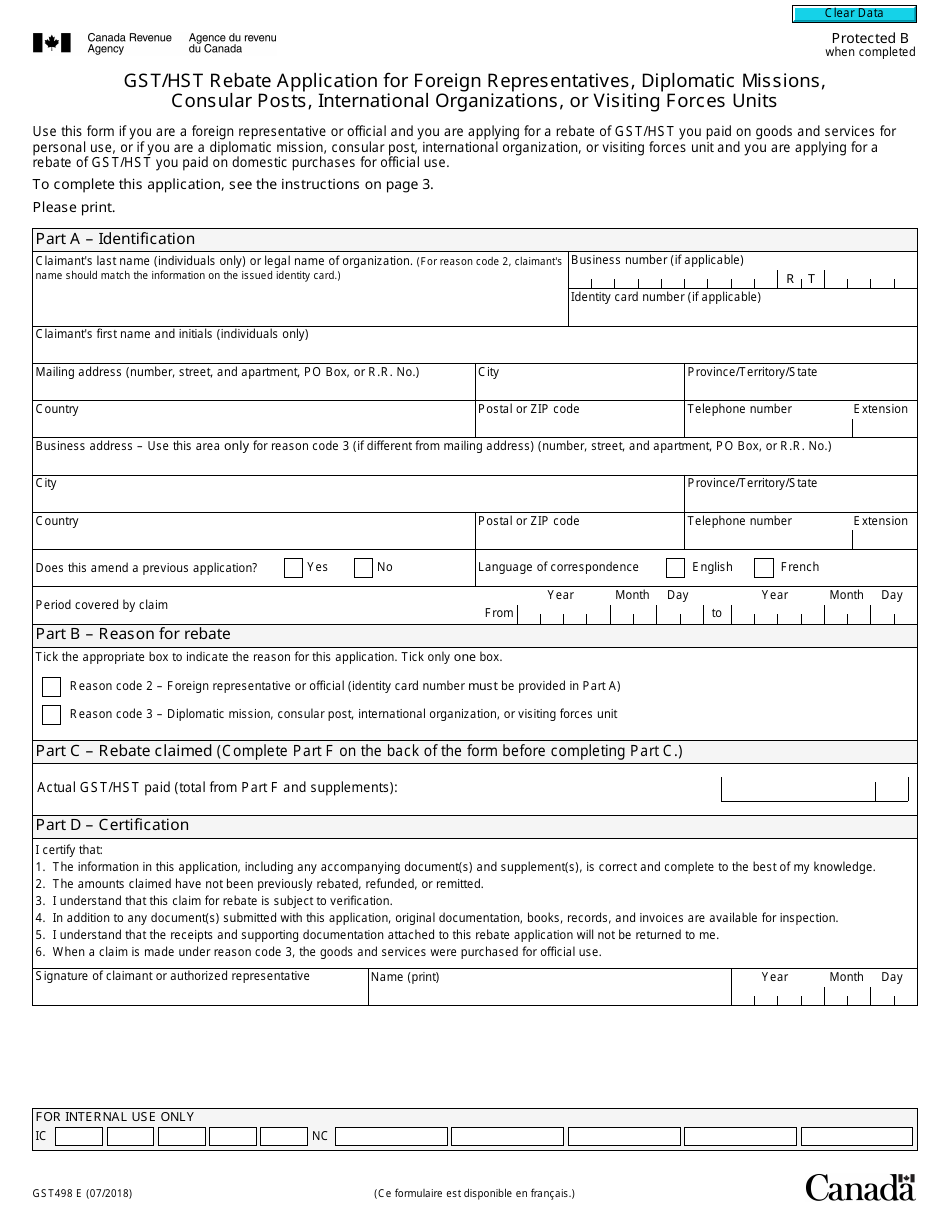

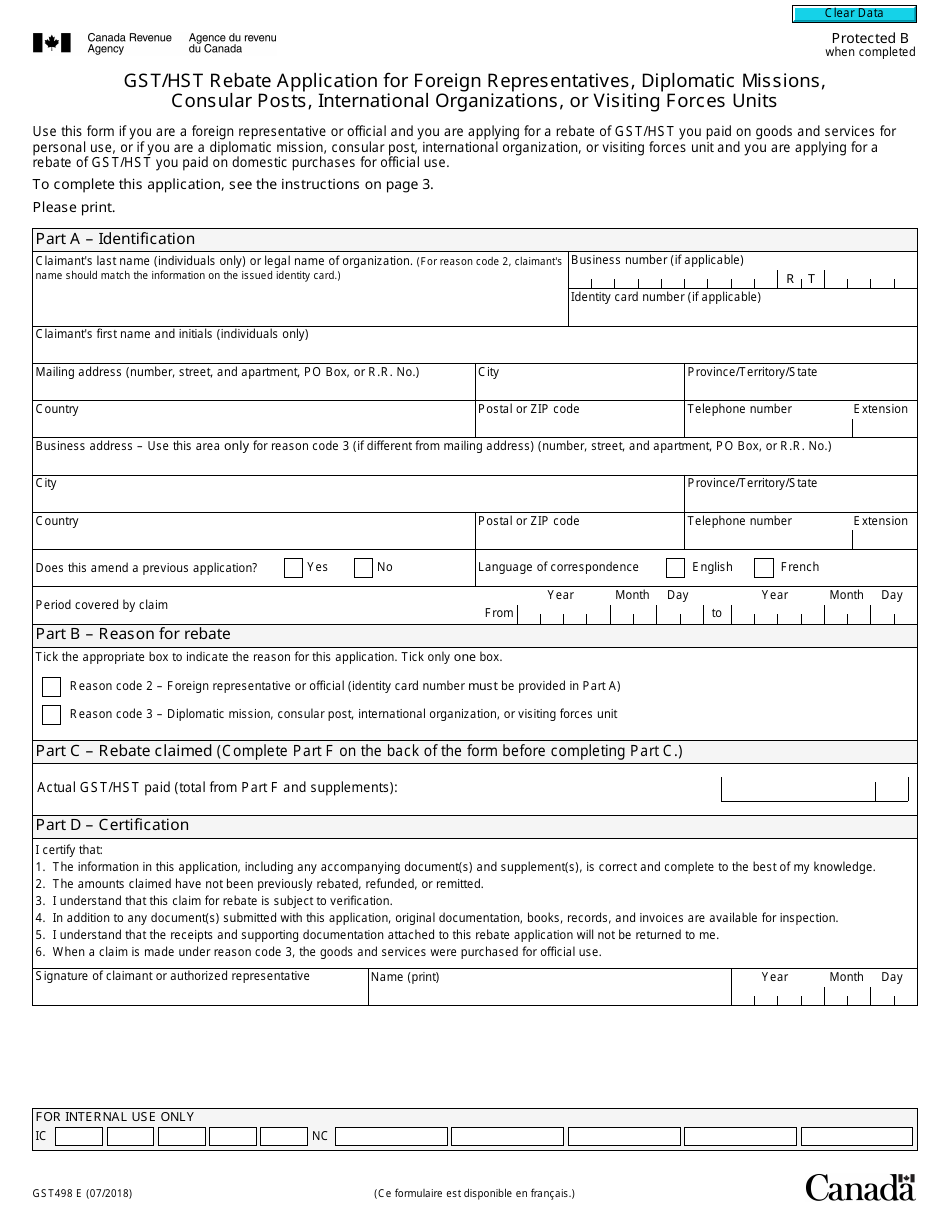

Form GST498 Download Fillable PDF Or Fill Online Gst Hst Rebate

Form GST189 Download Fillable PDF Or Fill Online General Application

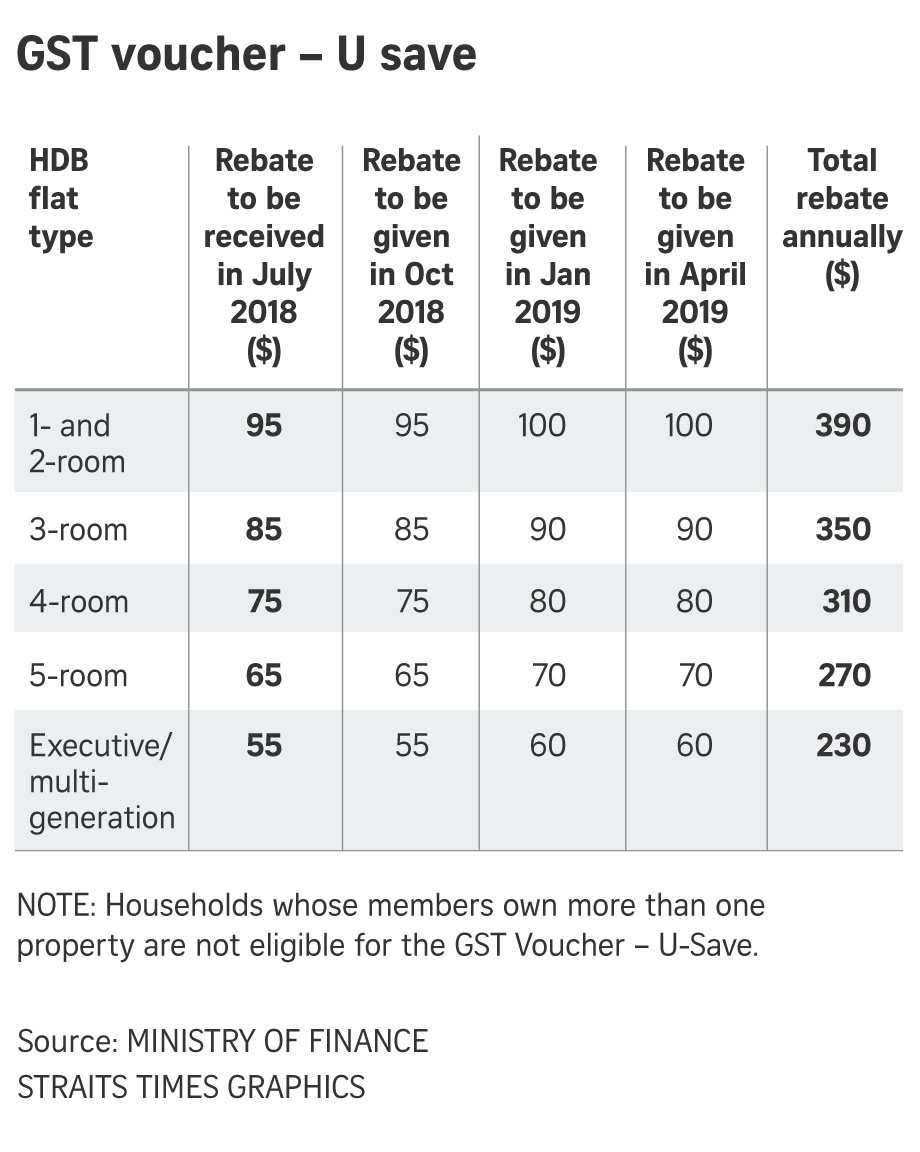

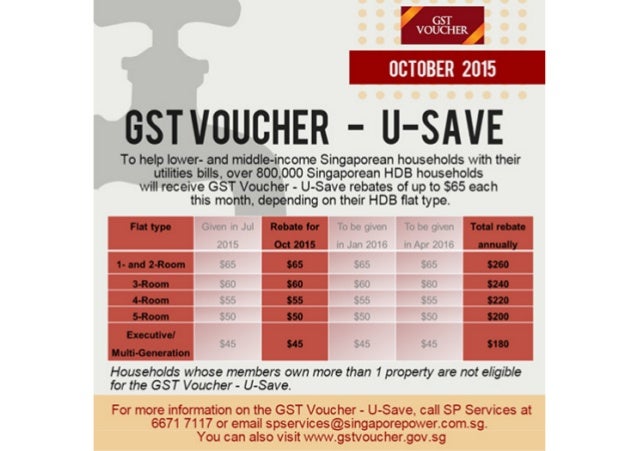

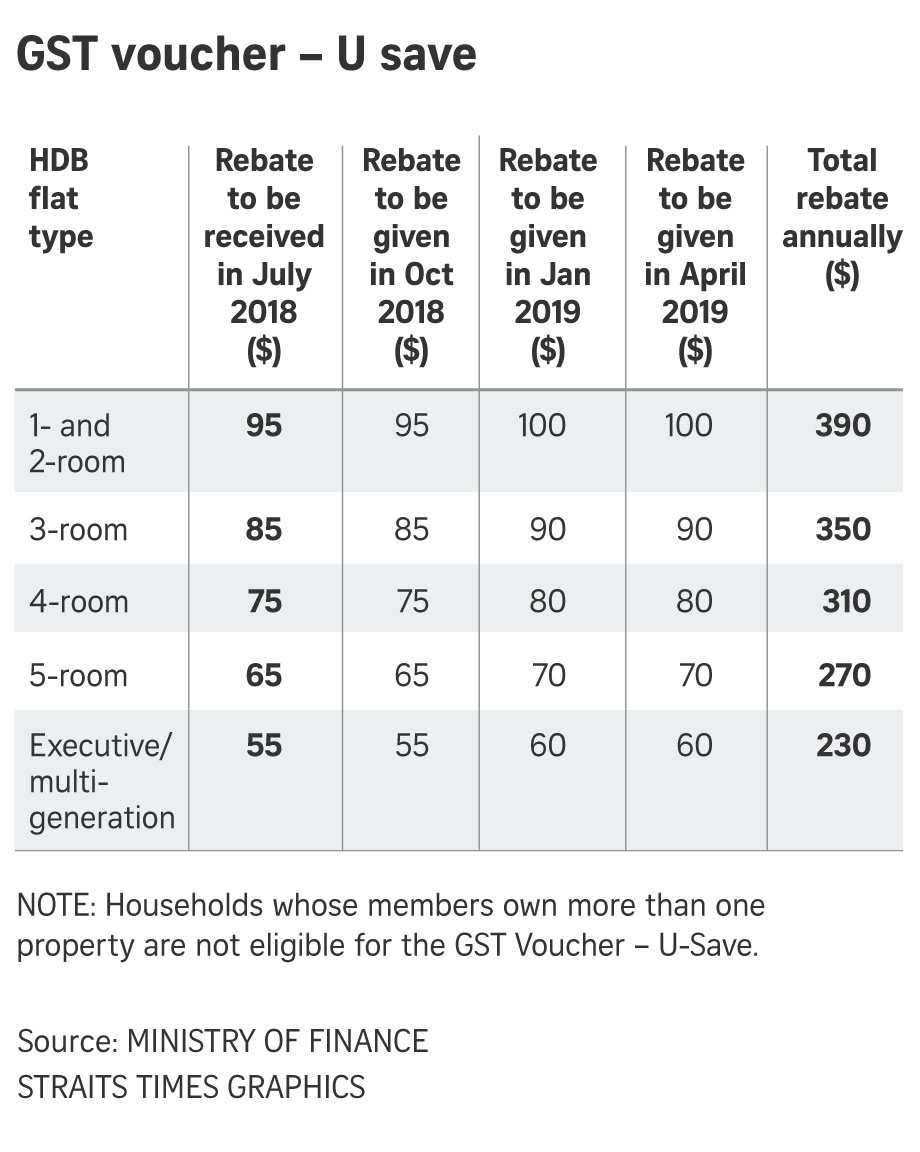

If Only Singaporeans Stopped To Think GST Voucher 2018 1 6 Million

Legislation To Temporarily Hike GST Rebate Likely To Pass This Week

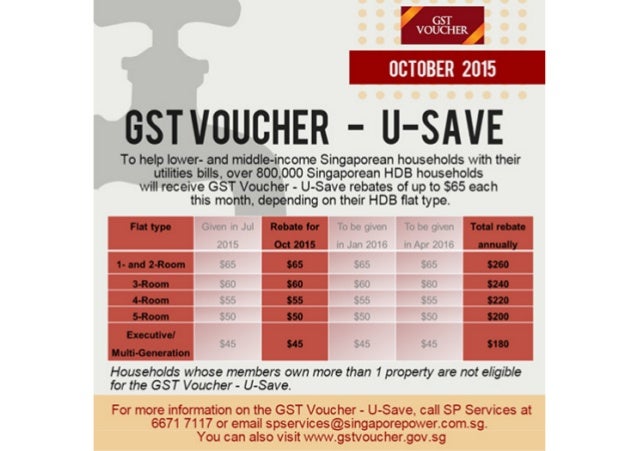

GST Voucher U save Rebates

https://www.thestar.com/news/canada/millions-of...

Canada Canada Millions of Canadians will see GST credits double starting Friday Here s who qualifies The one time payment was announced by the federal government in September and is intended

https://www.canada.ca/en/revenue-agency/campaigns/...

This one time payment will double the GST credit amount eligible individuals and families receive for a six month period Who can get the payment You will receive the additional one time GST credit payment if you were entitled to receive the GST credit in October 2022

Canada Canada Millions of Canadians will see GST credits double starting Friday Here s who qualifies The one time payment was announced by the federal government in September and is intended

This one time payment will double the GST credit amount eligible individuals and families receive for a six month period Who can get the payment You will receive the additional one time GST credit payment if you were entitled to receive the GST credit in October 2022

If Only Singaporeans Stopped To Think GST Voucher 2018 1 6 Million

Form GST498 Download Fillable PDF Or Fill Online Gst Hst Rebate

Legislation To Temporarily Hike GST Rebate Likely To Pass This Week

GST Voucher U save Rebates

Are GST Rebates Taxable Top 10 Reasons To Claim A GST Rebate

GST Rebates For Mobile Prepaid Top Up Reload Card Extended Until 31

GST Rebates For Mobile Prepaid Top Up Reload Card Extended Until 31

HDB Households To Get GST Voucher Rebate This Month To Offset Utilities