In our current world of high-end consumer goods, everyone loves a good deal. One method of gaining substantial savings on your purchases can be achieved through Gst Rebate Forms New Home Constructions. They are a form of marketing that retailers and manufacturers use for offering customers a percentage return on their purchases once they've bought them. In this post, we'll take a look at the world that is Gst Rebate Forms New Home Constructions, exploring what they are their purpose, how they function and how you can make the most of your savings via these cost-effective incentives.

Get Latest Gst Rebate Forms New Home Construction Below

Gst Rebate Forms New Home Construction

Gst Rebate Forms New Home Construction - Gst Rebate Forms For New Home Construction, What Is Gst Rebate On New Home, Is There A Gst Rebate On New Houses

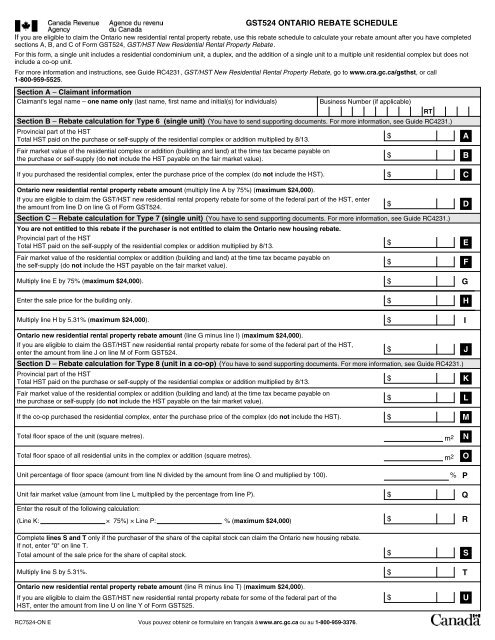

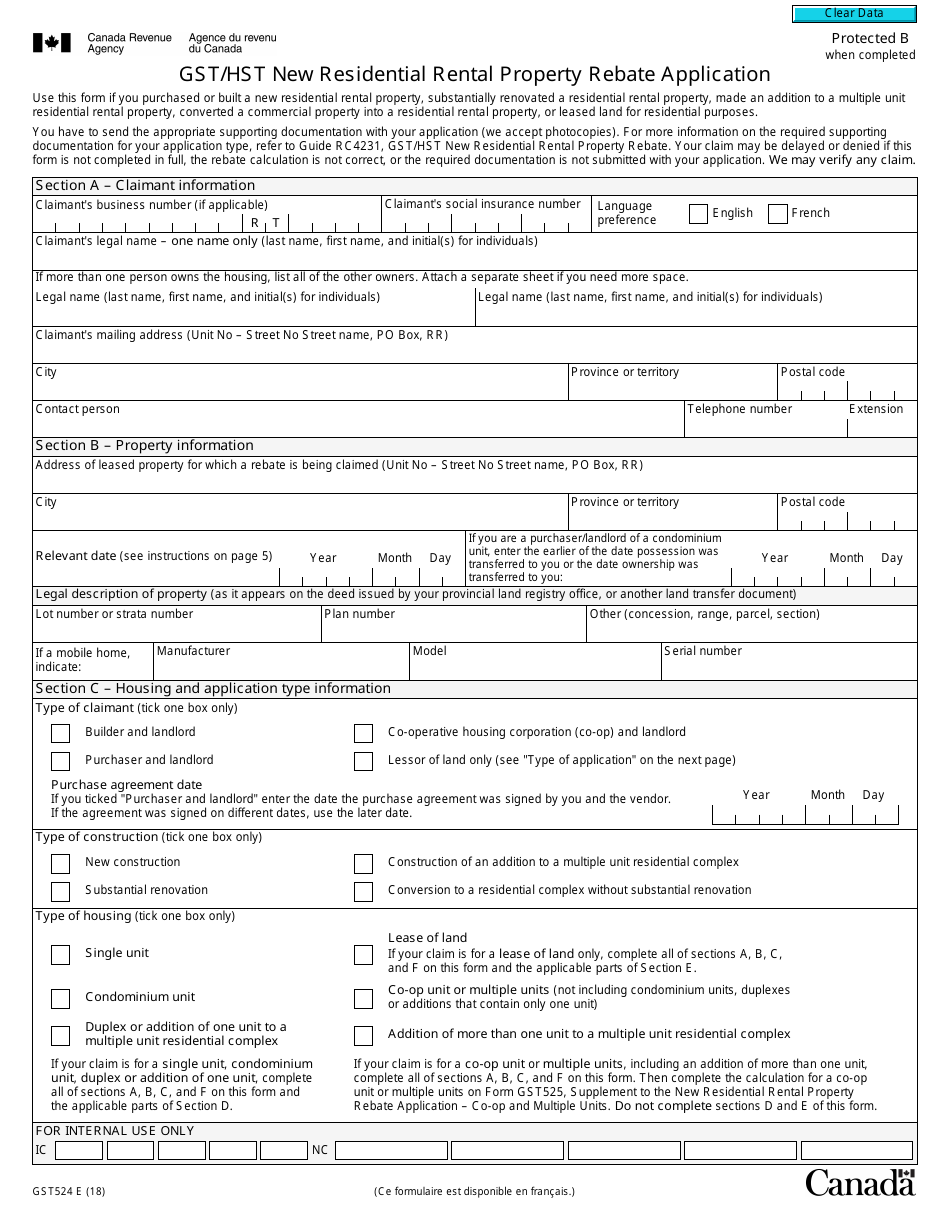

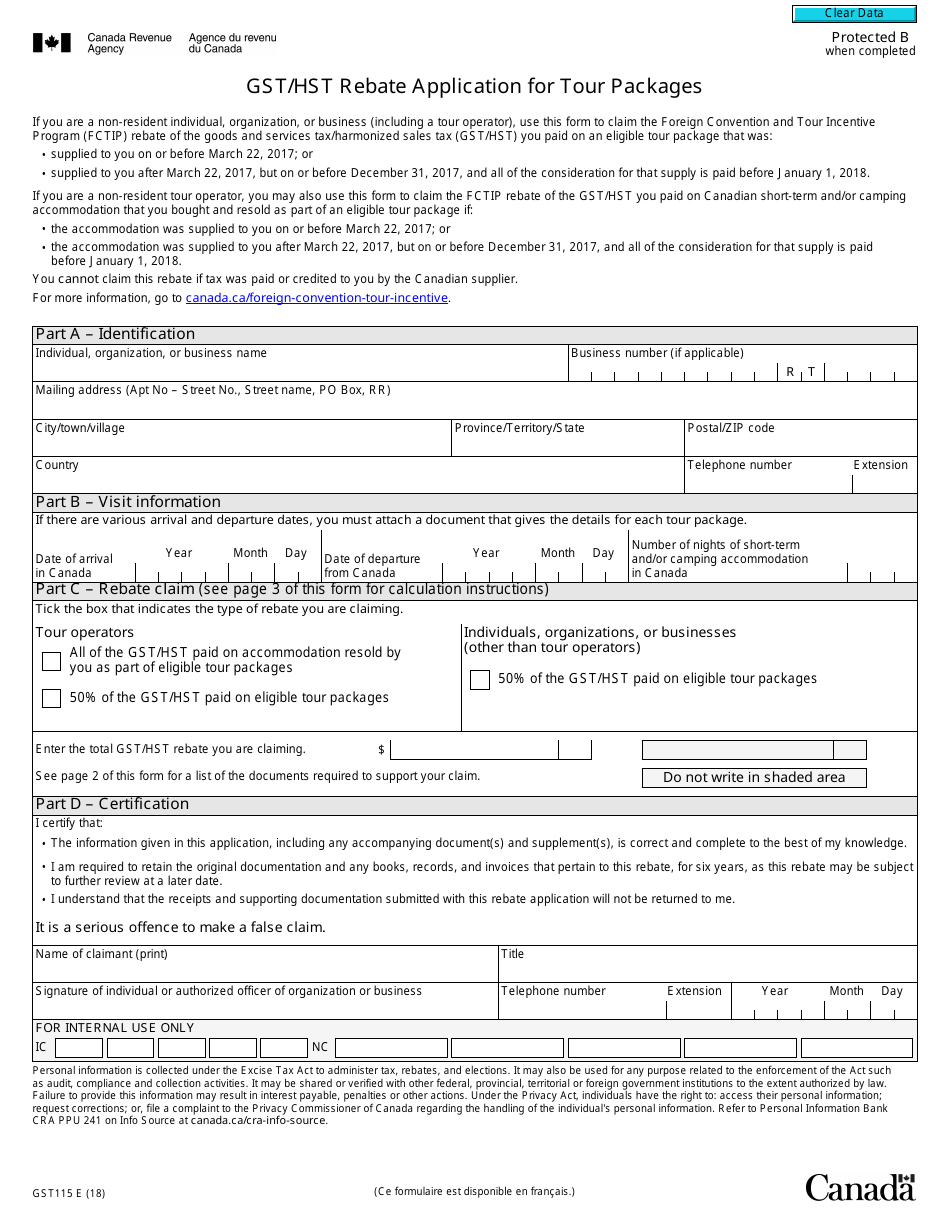

Web To apply for a tax rebate you or a co owner must use the form below best suited to your situation GST QST New Housing Rebate Application for a New Home Purchased from a Builder FP 2190 AC V GST QST New

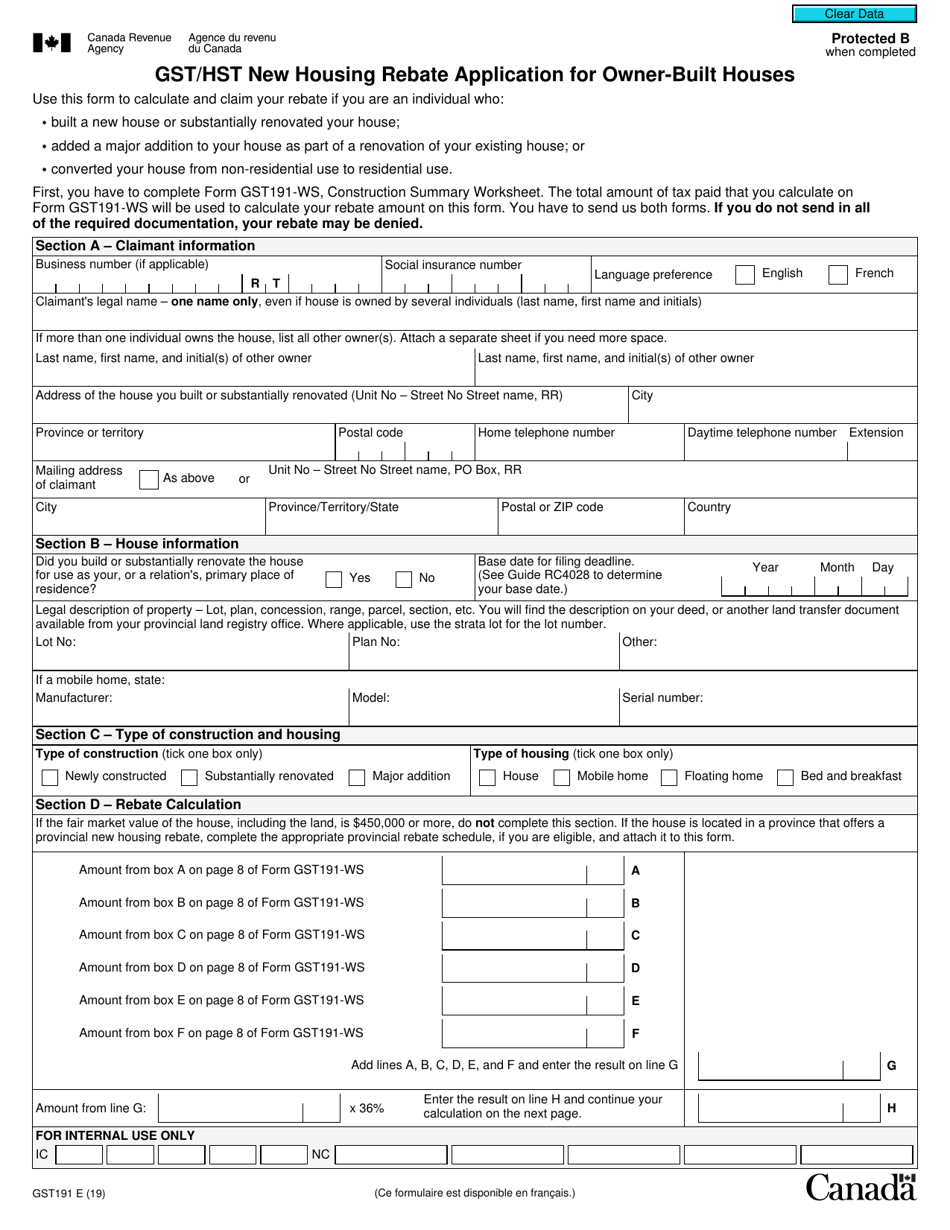

Web 9 sept 2022 nbsp 0183 32 Application form to claim the GST HST new housing rebate if you built a new house or substantially renovated or added a major addition to your house

A Gst Rebate Forms New Home Construction is, in its most basic definition, is a refund that a client receives after having purchased a item or service. This is a potent tool employed by companies to draw customers, increase sales and also to advertise certain products.

Types of Gst Rebate Forms New Home Construction

Gst Hst New Housing Rebate Application For Owner Built Houses

Gst Hst New Housing Rebate Application For Owner Built Houses

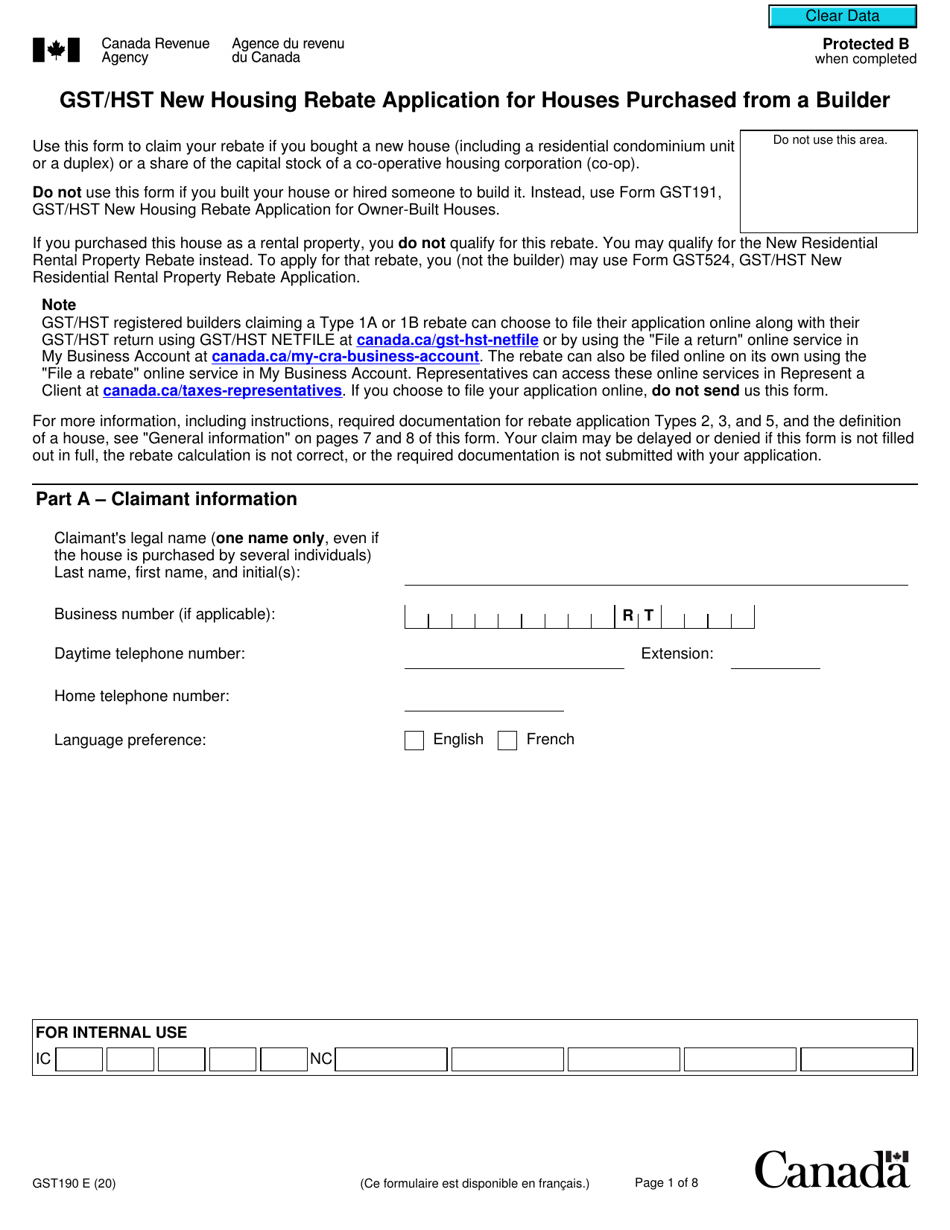

Web 3 juin 2022 nbsp 0183 32 Which form will I need to apply for the GST HST New Housing Rebate There are two types of rebates available with differing rates rebates for owner built houses

Web 20 mai 2021 nbsp 0183 32 Form GST191 WS is for those undergoing substantial renovations or who have an owner built home Our experts will guide you through how to fill out the form Skip to content 647 281 5399 email

Cash Gst Rebate Forms New Home Construction

Cash Gst Rebate Forms New Home Construction are probably the most simple type of Gst Rebate Forms New Home Construction. Customers are offered a certain sum of money back when buying a product. These are often used for expensive items such as electronics or appliances.

Mail-In Gst Rebate Forms New Home Construction

Mail-in Gst Rebate Forms New Home Construction require consumers to present the proof of purchase to be eligible for the refund. They're a bit more involved but offer substantial savings.

Instant Gst Rebate Forms New Home Construction

Instant Gst Rebate Forms New Home Construction will be applied at moment of sale, cutting the purchase cost immediately. Customers don't need to wait for their savings when they purchase this type of Gst Rebate Forms New Home Construction.

How Gst Rebate Forms New Home Construction Work

Guide Rc4231 Gst Hst New Residential Rental Property Rebate Property

Guide Rc4231 Gst Hst New Residential Rental Property Rebate Property

Web Eligibility for the GST HST new residential rental property rebate You may be eligible for the GST HST new residential rental property NRRP rebate if you are in one of the

The Gst Rebate Forms New Home Construction Process

The process generally involves a few easy steps:

-

Purchase the item: First purchase the product like you would normally.

-

Fill in the Gst Rebate Forms New Home Construction paper: You'll have to provide some information including your name, address and purchase information, to receive your Gst Rebate Forms New Home Construction.

-

Complete the Gst Rebate Forms New Home Construction Based on the type of Gst Rebate Forms New Home Construction you may have to mail in a form or send it via the internet.

-

Wait for approval: The business will scrutinize your submission to ensure it meets the guidelines and conditions of the Gst Rebate Forms New Home Construction.

-

Accept your Gst Rebate Forms New Home Construction If it is approved, you'll get your refund, whether via check, credit card, or other option specified by the offer.

Pros and Cons of Gst Rebate Forms New Home Construction

Advantages

-

Cost Savings Gst Rebate Forms New Home Construction could significantly lower the cost you pay for the item.

-

Promotional Offers: They encourage customers to try new products or brands.

-

Improve Sales Gst Rebate Forms New Home Construction are a great way to boost the sales of a business and increase its market share.

Disadvantages

-

Complexity In particular, mail-in Gst Rebate Forms New Home Construction particularly is a time-consuming process and time-consuming.

-

Day of Expiration A lot of Gst Rebate Forms New Home Construction have extremely strict deadlines to submit.

-

Risk of Not Being Paid Customers may not be able to receive their Gst Rebate Forms New Home Construction if they don't comply with the rules exactly.

Download Gst Rebate Forms New Home Construction

Download Gst Rebate Forms New Home Construction

FAQs

1. Are Gst Rebate Forms New Home Construction similar to discounts? No, Gst Rebate Forms New Home Construction are one-third of the amount refunded following purchase, while discounts lower your purchase cost at point of sale.

2. Are multiple Gst Rebate Forms New Home Construction available on the same item It's contingent upon the terms of the Gst Rebate Forms New Home Construction offered and product's acceptance. Some companies may allow it, but others won't.

3. How long does it take to receive an Gst Rebate Forms New Home Construction? The length of time is variable, however it can be from several weeks to couple of months for you to receive your Gst Rebate Forms New Home Construction.

4. Do I have to pay taxes on Gst Rebate Forms New Home Construction sums? the majority of cases, Gst Rebate Forms New Home Construction amounts are not considered taxable income.

5. Should I be able to trust Gst Rebate Forms New Home Construction offers from lesser-known brands It's crucial to research and make sure that the company giving the Gst Rebate Forms New Home Construction is credible prior to making a purchase.

New Home HST GST Rebate By Nadene Milnes Issuu

Form GST524 Download Fillable PDF Or Fill Online Gst Hst New

Check more sample of Gst Rebate Forms New Home Construction below

Form GST190 Download Fillable PDF Or Fill Online Gst Hst New Housing

Gst Hst New Housing Rebate Application For Owner Built Houses

New Home HST GST Rebate By Nadene Milnes Issuu

Gst Hst New Housing Rebate Application For Owner Built Houses

Gst Return Working Copy Form Fill Out And Sign Printable PDF Template

Pin On Moving Buying Selling Home

https://www.canada.ca/.../services/forms-publications/forms/gst191.html

Web 9 sept 2022 nbsp 0183 32 Application form to claim the GST HST new housing rebate if you built a new house or substantially renovated or added a major addition to your house

https://www.canada.ca/.../19-3-4/rebate-owner-built-homes.html

Web A GST HST new housing rebate is provided for part of the tax paid by an individual who builds or substantially renovates his or her own primary place of residence or that of a

Web 9 sept 2022 nbsp 0183 32 Application form to claim the GST HST new housing rebate if you built a new house or substantially renovated or added a major addition to your house

Web A GST HST new housing rebate is provided for part of the tax paid by an individual who builds or substantially renovates his or her own primary place of residence or that of a

Gst Hst New Housing Rebate Application For Owner Built Houses

Gst Hst New Housing Rebate Application For Owner Built Houses

Gst Return Working Copy Form Fill Out And Sign Printable PDF Template

Pin On Moving Buying Selling Home

Gst Fillable Form Printable Forms Free Online

Gst Remittance Form Fill Online Printable Fillable Blank PdfFiller

Gst Remittance Form Fill Online Printable Fillable Blank PdfFiller

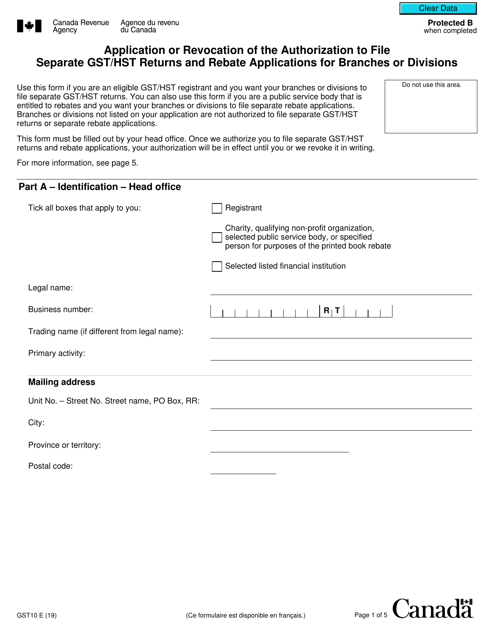

Form GST10 Download Fillable PDF Or Fill Online Application Or